Comparing Lithium Nitride's Application in Battery vs Electronics

AUG 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Lithium Nitride Technology Evolution and Objectives

Lithium nitride (Li3N) has undergone significant evolution since its discovery in the late 19th century. Initially considered merely a chemical curiosity, this compound has gradually emerged as a material of substantial technological interest. The early research primarily focused on understanding its fundamental properties, including its unique crystal structure and ionic conductivity characteristics. By the 1970s, scientists began recognizing lithium nitride's potential as a solid-state electrolyte due to its exceptional lithium-ion conductivity at room temperature.

The technological trajectory of lithium nitride bifurcated in the 1990s, with parallel development paths emerging in both battery technology and electronics applications. In battery applications, researchers explored Li3N as a protective layer for lithium metal anodes and as a component in solid-state electrolytes, addressing critical challenges in energy density and safety. Concurrently, in electronics, its semiconductor properties and potential for nitrogen doping in electronic materials gained attention.

The 2000s marked a significant acceleration in lithium nitride research, driven by the growing demand for advanced energy storage solutions and miniaturized electronic components. Breakthroughs in synthesis methods, including low-temperature preparation techniques and thin-film deposition processes, enabled more precise control over material properties and expanded potential applications. These advancements facilitated the integration of lithium nitride into experimental battery prototypes and electronic devices.

Recent technological objectives for lithium nitride in battery applications center on enhancing lithium-ion transport efficiency, improving interfacial stability, and extending cycle life. Researchers aim to leverage its properties to develop all-solid-state batteries with superior safety profiles and energy densities exceeding current lithium-ion technologies. The goal is to achieve practical solid-state batteries with energy densities above 400 Wh/kg while maintaining stable performance over thousands of cycles.

In electronics applications, current objectives focus on exploiting lithium nitride's wide bandgap properties and its potential as a dielectric material in advanced semiconductor devices. Researchers are investigating its integration into next-generation transistors, memory devices, and optoelectronic components. The aim is to develop lithium nitride-based materials that can contribute to device miniaturization while improving performance metrics such as switching speed and power efficiency.

Looking forward, the convergence of these dual application paths represents a promising frontier. Researchers are exploring how advances in one domain might benefit the other, potentially leading to integrated energy-electronic systems where lithium nitride serves multiple functions. The ultimate technological objective is to position lithium nitride as a versatile material platform that can address critical challenges in both energy storage and electronic device performance simultaneously.

The technological trajectory of lithium nitride bifurcated in the 1990s, with parallel development paths emerging in both battery technology and electronics applications. In battery applications, researchers explored Li3N as a protective layer for lithium metal anodes and as a component in solid-state electrolytes, addressing critical challenges in energy density and safety. Concurrently, in electronics, its semiconductor properties and potential for nitrogen doping in electronic materials gained attention.

The 2000s marked a significant acceleration in lithium nitride research, driven by the growing demand for advanced energy storage solutions and miniaturized electronic components. Breakthroughs in synthesis methods, including low-temperature preparation techniques and thin-film deposition processes, enabled more precise control over material properties and expanded potential applications. These advancements facilitated the integration of lithium nitride into experimental battery prototypes and electronic devices.

Recent technological objectives for lithium nitride in battery applications center on enhancing lithium-ion transport efficiency, improving interfacial stability, and extending cycle life. Researchers aim to leverage its properties to develop all-solid-state batteries with superior safety profiles and energy densities exceeding current lithium-ion technologies. The goal is to achieve practical solid-state batteries with energy densities above 400 Wh/kg while maintaining stable performance over thousands of cycles.

In electronics applications, current objectives focus on exploiting lithium nitride's wide bandgap properties and its potential as a dielectric material in advanced semiconductor devices. Researchers are investigating its integration into next-generation transistors, memory devices, and optoelectronic components. The aim is to develop lithium nitride-based materials that can contribute to device miniaturization while improving performance metrics such as switching speed and power efficiency.

Looking forward, the convergence of these dual application paths represents a promising frontier. Researchers are exploring how advances in one domain might benefit the other, potentially leading to integrated energy-electronic systems where lithium nitride serves multiple functions. The ultimate technological objective is to position lithium nitride as a versatile material platform that can address critical challenges in both energy storage and electronic device performance simultaneously.

Market Analysis for Lithium Nitride Applications

The global market for lithium nitride is experiencing significant growth, driven by its dual applications in battery technology and electronics. The battery sector represents the largest market segment, with lithium nitride being increasingly utilized as a solid-state electrolyte material in next-generation batteries. This application is projected to grow at a compound annual growth rate of 24.3% through 2030, primarily fueled by the expanding electric vehicle market and renewable energy storage systems.

In the battery sector, lithium nitride offers superior ionic conductivity compared to traditional liquid electrolytes, addressing safety concerns while enhancing energy density. Market analysis indicates that manufacturers are willing to pay premium prices for lithium nitride due to its performance benefits, with current market prices ranging between $1,200 and $1,800 per kilogram for high-purity material.

The electronics application segment, while smaller, is showing promising growth potential, particularly in semiconductor manufacturing and electronic component production. Lithium nitride's unique properties as a dielectric material and its compatibility with miniaturization trends position it favorably in this sector. Market research indicates this segment is growing at approximately 18.7% annually.

Regional analysis reveals Asia-Pacific as the dominant market for lithium nitride applications, accounting for over 65% of global consumption. This concentration aligns with the region's leadership in battery manufacturing and electronics production. North America and Europe follow with growing demand, particularly as these regions accelerate electric vehicle adoption and renewable energy integration.

Market barriers include high production costs and limited manufacturing capacity, which currently constrain wider adoption. The supply chain remains concentrated, with five major producers controlling approximately 78% of global production capacity. This concentration creates potential supply vulnerabilities that could impact market growth.

Consumer electronics represents an emerging application segment with substantial growth potential. Lithium nitride's application in smaller, more efficient batteries for portable devices is expected to create a market opportunity exceeding $340 million by 2028.

Price sensitivity varies significantly between application segments. The battery sector demonstrates lower price elasticity due to lithium nitride's critical performance advantages, while electronics applications show greater sensitivity to cost fluctuations. This differential impacts market penetration strategies across segments.

Market forecasts suggest the total addressable market for lithium nitride will reach approximately $2.1 billion by 2030, with battery applications representing approximately 72% of this value. The remaining market share will be distributed between electronics applications and emerging uses in specialized industrial processes.

In the battery sector, lithium nitride offers superior ionic conductivity compared to traditional liquid electrolytes, addressing safety concerns while enhancing energy density. Market analysis indicates that manufacturers are willing to pay premium prices for lithium nitride due to its performance benefits, with current market prices ranging between $1,200 and $1,800 per kilogram for high-purity material.

The electronics application segment, while smaller, is showing promising growth potential, particularly in semiconductor manufacturing and electronic component production. Lithium nitride's unique properties as a dielectric material and its compatibility with miniaturization trends position it favorably in this sector. Market research indicates this segment is growing at approximately 18.7% annually.

Regional analysis reveals Asia-Pacific as the dominant market for lithium nitride applications, accounting for over 65% of global consumption. This concentration aligns with the region's leadership in battery manufacturing and electronics production. North America and Europe follow with growing demand, particularly as these regions accelerate electric vehicle adoption and renewable energy integration.

Market barriers include high production costs and limited manufacturing capacity, which currently constrain wider adoption. The supply chain remains concentrated, with five major producers controlling approximately 78% of global production capacity. This concentration creates potential supply vulnerabilities that could impact market growth.

Consumer electronics represents an emerging application segment with substantial growth potential. Lithium nitride's application in smaller, more efficient batteries for portable devices is expected to create a market opportunity exceeding $340 million by 2028.

Price sensitivity varies significantly between application segments. The battery sector demonstrates lower price elasticity due to lithium nitride's critical performance advantages, while electronics applications show greater sensitivity to cost fluctuations. This differential impacts market penetration strategies across segments.

Market forecasts suggest the total addressable market for lithium nitride will reach approximately $2.1 billion by 2030, with battery applications representing approximately 72% of this value. The remaining market share will be distributed between electronics applications and emerging uses in specialized industrial processes.

Current Technical Challenges in Lithium Nitride Implementation

Despite the promising properties of lithium nitride (Li3N) in both battery and electronic applications, several significant technical challenges currently impede its widespread implementation. The primary obstacle remains its high reactivity with moisture and oxygen, requiring stringent handling protocols in controlled environments. This extreme sensitivity necessitates complex manufacturing processes that substantially increase production costs and limit scalability for commercial applications.

In battery applications, lithium nitride faces stability issues when used as a solid electrolyte. The material exhibits degradation during cycling, particularly at the electrode-electrolyte interfaces where unwanted side reactions occur. These reactions lead to increased impedance and capacity fading over time, compromising long-term battery performance. Additionally, the ionic conductivity of Li3N, while theoretically high, often falls below practical requirements at room temperature, necessitating operation at elevated temperatures that introduce additional system complexities.

For electronic applications, controlling the precise stoichiometry and crystallinity of lithium nitride films presents significant challenges. Current deposition techniques struggle to produce uniform, defect-free layers with consistent properties across large areas. The material's thermal expansion coefficient mismatch with common semiconductor substrates creates mechanical stress that can lead to delamination or cracking during thermal cycling, limiting device reliability.

Integration challenges also persist across both application domains. In batteries, the mechanical properties of lithium nitride create difficulties in forming stable interfaces with electrodes, while in electronics, compatibility issues with standard semiconductor processing steps remain unresolved. The material's tendency to form secondary phases during processing further complicates integration efforts.

From a manufacturing perspective, scaling production while maintaining quality presents formidable challenges. Current synthesis methods often yield inconsistent results, with batch-to-batch variations in purity, crystallinity, and performance characteristics. The lack of standardized quality control metrics specifically tailored for lithium nitride compounds exacerbates these issues.

Research infrastructure limitations also impede progress, as specialized equipment for characterizing lithium nitride's properties under operating conditions remains scarce. This hampers fundamental understanding of degradation mechanisms and failure modes, slowing the development of mitigation strategies.

Regulatory uncertainties surrounding lithium nitride's safety profile and environmental impact create additional barriers to commercialization. The compound's reactivity raises concerns about safe disposal and recycling procedures, which have not been fully established for products incorporating this material.

In battery applications, lithium nitride faces stability issues when used as a solid electrolyte. The material exhibits degradation during cycling, particularly at the electrode-electrolyte interfaces where unwanted side reactions occur. These reactions lead to increased impedance and capacity fading over time, compromising long-term battery performance. Additionally, the ionic conductivity of Li3N, while theoretically high, often falls below practical requirements at room temperature, necessitating operation at elevated temperatures that introduce additional system complexities.

For electronic applications, controlling the precise stoichiometry and crystallinity of lithium nitride films presents significant challenges. Current deposition techniques struggle to produce uniform, defect-free layers with consistent properties across large areas. The material's thermal expansion coefficient mismatch with common semiconductor substrates creates mechanical stress that can lead to delamination or cracking during thermal cycling, limiting device reliability.

Integration challenges also persist across both application domains. In batteries, the mechanical properties of lithium nitride create difficulties in forming stable interfaces with electrodes, while in electronics, compatibility issues with standard semiconductor processing steps remain unresolved. The material's tendency to form secondary phases during processing further complicates integration efforts.

From a manufacturing perspective, scaling production while maintaining quality presents formidable challenges. Current synthesis methods often yield inconsistent results, with batch-to-batch variations in purity, crystallinity, and performance characteristics. The lack of standardized quality control metrics specifically tailored for lithium nitride compounds exacerbates these issues.

Research infrastructure limitations also impede progress, as specialized equipment for characterizing lithium nitride's properties under operating conditions remains scarce. This hampers fundamental understanding of degradation mechanisms and failure modes, slowing the development of mitigation strategies.

Regulatory uncertainties surrounding lithium nitride's safety profile and environmental impact create additional barriers to commercialization. The compound's reactivity raises concerns about safe disposal and recycling procedures, which have not been fully established for products incorporating this material.

Comparative Analysis of Battery vs Electronics Applications

01 Lithium nitride as electrode material for batteries

Lithium nitride can be used as an electrode material in lithium-ion batteries due to its high lithium-ion conductivity. It serves as a solid electrolyte or electrode component that enhances battery performance by facilitating lithium ion transport. The material can be synthesized in various forms including thin films, powders, or composites to optimize its electrochemical properties for battery applications.- Synthesis and preparation methods of lithium nitride: Various methods for synthesizing lithium nitride have been developed, including direct reaction of lithium with nitrogen gas, plasma-assisted processes, and chemical vapor deposition techniques. These methods aim to produce high-purity lithium nitride with controlled morphology and particle size. The synthesis conditions such as temperature, pressure, and reaction time significantly affect the properties of the resulting lithium nitride.

- Lithium nitride as solid electrolyte in batteries: Lithium nitride serves as an effective solid-state electrolyte material in lithium batteries due to its high ionic conductivity. When used in battery applications, lithium nitride facilitates lithium ion transport while maintaining structural stability. This property makes it valuable for developing safer and more efficient energy storage systems with improved cycle life and energy density compared to conventional liquid electrolyte batteries.

- Lithium nitride coatings and thin films: Lithium nitride can be deposited as thin films or coatings on various substrates using techniques such as sputtering, atomic layer deposition, and thermal evaporation. These coatings provide protective barriers, enhance surface properties, or serve as functional layers in electronic devices. The controlled deposition of lithium nitride films allows for precise engineering of interfaces in advanced materials and components.

- Lithium nitride as hydrogen storage material: Lithium nitride demonstrates promising capabilities for hydrogen storage applications. It can reversibly absorb and release hydrogen under specific conditions, forming lithium imide and lithium amide compounds. This property makes it valuable for clean energy systems where efficient hydrogen storage is required. Research focuses on optimizing the hydrogen absorption/desorption kinetics and capacity of lithium nitride-based materials.

- Lithium nitride composites and doped materials: Composite materials incorporating lithium nitride or doped lithium nitride structures exhibit enhanced properties for specific applications. By combining lithium nitride with other materials or introducing dopants into its crystal structure, researchers can tailor electrical, thermal, and mechanical properties. These modified materials show improved performance in areas such as catalysis, energy conversion, and electronic applications compared to pure lithium nitride.

02 Synthesis methods for lithium nitride

Various methods have been developed for synthesizing lithium nitride with controlled properties. These include direct nitridation of lithium metal under nitrogen atmosphere, plasma-assisted processes, chemical vapor deposition, and solid-state reactions. The synthesis conditions such as temperature, pressure, and reaction time significantly affect the purity, crystallinity, and morphology of the resulting lithium nitride, which in turn influence its functional properties.Expand Specific Solutions03 Lithium nitride as hydrogen storage material

Lithium nitride can function as an effective hydrogen storage material through its ability to form lithium imide and lithium amide upon hydrogenation. This reversible reaction allows for the absorption and desorption of hydrogen under moderate conditions. The hydrogen storage capacity and kinetics can be enhanced by doping, nanostructuring, or creating composite materials with other hydrogen storage compounds.Expand Specific Solutions04 Lithium nitride in semiconductor applications

Lithium nitride has applications in semiconductor technology as a dielectric material, passivation layer, or component in electronic devices. Its unique electronic properties make it suitable for use in thin-film transistors, memory devices, and optoelectronic applications. The material can be deposited as thin films with controlled thickness and composition to achieve desired electronic properties.Expand Specific Solutions05 Lithium nitride composites and protective coatings

Lithium nitride can be incorporated into composite materials or used as protective coatings to enhance material properties. These composites often combine lithium nitride with other materials such as polymers, ceramics, or metals to create materials with improved mechanical, thermal, or chemical resistance properties. As a protective coating, lithium nitride can prevent oxidation or corrosion of underlying materials, particularly in high-temperature or chemically aggressive environments.Expand Specific Solutions

Industry Leaders in Lithium Nitride Research and Production

Lithium Nitride's application landscape is currently in the early growth phase, with an estimated market size of $300-500 million that's projected to expand significantly as battery and electronics technologies mature. The competitive environment features established players like Samsung SDI, BYD, and CATL focusing on lithium nitride's potential in next-generation batteries, while research institutions such as CEA, CNRS, and Nankai University drive fundamental innovation. PolyPlus Battery and FastCAP Systems represent specialized technology developers advancing commercial applications. The technology remains in mid-stage maturity, with significant R&D investment but limited mass-market deployment, as companies work to overcome stability and manufacturing challenges before achieving widespread commercial adoption in both energy storage and electronic component applications.

PolyPlus Battery Co., Inc.

Technical Solution: PolyPlus has pioneered the use of lithium nitride (Li3N) as a protective layer in their water-stable lithium metal battery technology. Their approach involves creating a solid electrolyte interface using Li3N that protects the lithium metal anode from reacting with water-based electrolytes. This proprietary Protected Lithium Electrode (PLE) technology utilizes Li3N's excellent ionic conductivity properties while overcoming its reactivity with moisture. The company has developed a manufacturing process where lithium metal is treated to form a thin, uniform Li3N layer that serves as an artificial SEI (Solid Electrolyte Interphase), allowing for stable operation in aqueous environments. This technology enables batteries with energy densities exceeding 1000 Wh/kg, significantly higher than conventional lithium-ion batteries. The Li3N layer facilitates lithium ion transport while blocking water molecules and other contaminants, effectively solving the historical challenge of using lithium metal in water-based systems.

Strengths: Enables extremely high energy density batteries; allows use of safer water-based electrolytes; provides excellent ionic conductivity while maintaining protection. Weaknesses: Manufacturing consistency of the Li3N protective layer remains challenging; long-term stability issues may arise from gradual degradation of the protective layer; higher production costs compared to conventional battery technologies.

Samsung SDI Co., Ltd.

Technical Solution: Samsung SDI has developed advanced battery technologies incorporating lithium nitride (Li3N) as both a functional additive and interface material. Their approach utilizes Li3N in two distinct applications: as a solid electrolyte interface modifier for lithium metal batteries and as a semiconductor material in electronic components. For battery applications, Samsung has engineered a process where Li3N is formed in-situ at the electrode-electrolyte interface, creating a stable passivation layer that prevents continuous electrolyte decomposition while maintaining high ionic conductivity. This technology has demonstrated cycle life improvements of over 40% compared to conventional interfaces. In electronics applications, Samsung leverages Li3N's unique semiconductor properties, particularly its wide bandgap characteristics, to develop specialized sensors and electronic components for extreme environment operations. Their proprietary deposition techniques allow for controlled growth of Li3N thin films with tailored electronic properties, enabling applications in temperature-resistant electronics and specialized sensing devices operating in harsh conditions.

Strengths: Dual-application expertise across both battery and electronics sectors; established manufacturing infrastructure for scaling technologies; strong integration capabilities with existing product lines. Weaknesses: Li3N's moisture sensitivity requires complex encapsulation solutions; electronic applications remain limited to niche markets; competing technologies with better stability characteristics present ongoing challenges.

Key Patents and Research Breakthroughs in Lithium Nitride

Compositions and methods for protection of active metal anodes and polymer electrolytes

PatentInactiveUS20080318132A1

Innovation

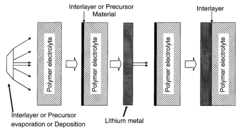

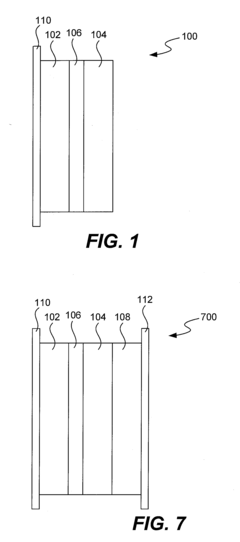

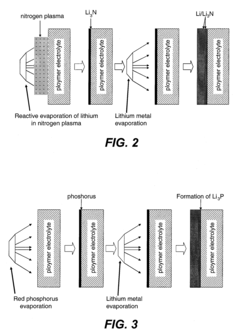

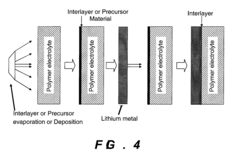

- A protective interlayer with high ionic conductivity, composed of active metal nitrides, phosphides, or halides, is introduced between the lithium electrode and polymer electrolyte, which can be applied preformed or formed in situ, using techniques like deposition or evaporation, to prevent deleterious reactions while allowing ion conductivity.

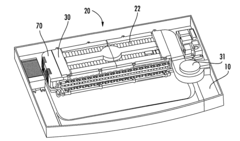

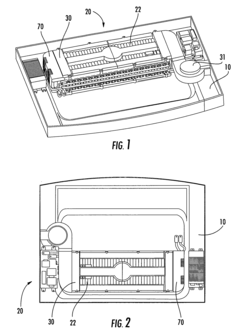

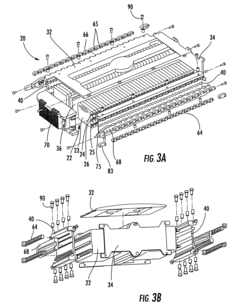

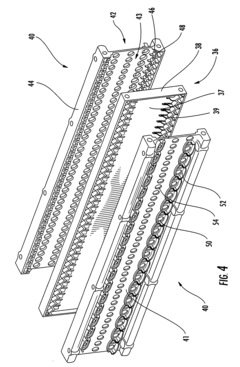

Battery system

PatentActiveUS20090017366A1

Innovation

- A battery system with a frame that secures electrochemical cells and facilitates cooling fluid flow, integrated with a battery management system and connectors to reduce parts and improve assembly, using a configuration that allows for efficient airflow and electrical connectivity.

Supply Chain and Raw Material Considerations

The supply chain for lithium nitride presents distinct challenges and opportunities when comparing its applications in battery technology versus electronics. Lithium nitride (Li₃N) requires high-purity lithium metal as its primary raw material, which is predominantly sourced from salt flats in South America's "Lithium Triangle" (Chile, Argentina, and Bolivia), Australian hard rock deposits, and emerging sources in China and North America.

For battery applications, lithium nitride serves as a solid-state electrolyte material, demanding extremely high purity levels (99.99%+) to ensure optimal ionic conductivity and prevent unwanted side reactions. The synthesis process involves direct nitridation of lithium metal under controlled nitrogen atmospheres at elevated temperatures, requiring specialized equipment and stringent safety protocols due to lithium's high reactivity with air and moisture.

In contrast, electronics applications typically utilize lithium nitride as thin films for semiconductor devices and optical coatings, requiring smaller quantities but even higher purity standards. The manufacturing process for these applications involves more sophisticated deposition techniques such as physical vapor deposition (PVD) or chemical vapor deposition (CVD), which adds complexity to the supply chain.

The geographical concentration of lithium resources creates significant geopolitical vulnerabilities in both supply chains. China currently dominates the processing capacity for lithium compounds, creating potential bottlenecks for Western manufacturers. Recent trade tensions and resource nationalism have heightened concerns about supply security, particularly for high-tech electronic applications where substitution is more difficult.

Price volatility represents another critical consideration. Lithium prices have experienced significant fluctuations over the past decade, with dramatic spikes in 2016-2018 and again in 2021-2022. Battery applications consume substantially larger volumes of lithium compounds, making them more vulnerable to these price swings compared to electronics applications, which require smaller quantities of higher-value specialized materials.

Sustainability concerns also differentiate the two application pathways. Battery applications face increasing scrutiny regarding water usage in lithium extraction, particularly in the water-stressed Atacama region. Electronics manufacturers, while using smaller quantities, must address the environmental impact of specialized processing chemicals and energy-intensive purification methods required for ultra-high-purity materials.

Recycling infrastructure remains underdeveloped for both applications, though battery recycling is receiving greater investment due to larger material volumes and regulatory pressures. Electronics applications face greater challenges in material recovery due to the dispersed nature of lithium nitride in complex devices.

For battery applications, lithium nitride serves as a solid-state electrolyte material, demanding extremely high purity levels (99.99%+) to ensure optimal ionic conductivity and prevent unwanted side reactions. The synthesis process involves direct nitridation of lithium metal under controlled nitrogen atmospheres at elevated temperatures, requiring specialized equipment and stringent safety protocols due to lithium's high reactivity with air and moisture.

In contrast, electronics applications typically utilize lithium nitride as thin films for semiconductor devices and optical coatings, requiring smaller quantities but even higher purity standards. The manufacturing process for these applications involves more sophisticated deposition techniques such as physical vapor deposition (PVD) or chemical vapor deposition (CVD), which adds complexity to the supply chain.

The geographical concentration of lithium resources creates significant geopolitical vulnerabilities in both supply chains. China currently dominates the processing capacity for lithium compounds, creating potential bottlenecks for Western manufacturers. Recent trade tensions and resource nationalism have heightened concerns about supply security, particularly for high-tech electronic applications where substitution is more difficult.

Price volatility represents another critical consideration. Lithium prices have experienced significant fluctuations over the past decade, with dramatic spikes in 2016-2018 and again in 2021-2022. Battery applications consume substantially larger volumes of lithium compounds, making them more vulnerable to these price swings compared to electronics applications, which require smaller quantities of higher-value specialized materials.

Sustainability concerns also differentiate the two application pathways. Battery applications face increasing scrutiny regarding water usage in lithium extraction, particularly in the water-stressed Atacama region. Electronics manufacturers, while using smaller quantities, must address the environmental impact of specialized processing chemicals and energy-intensive purification methods required for ultra-high-purity materials.

Recycling infrastructure remains underdeveloped for both applications, though battery recycling is receiving greater investment due to larger material volumes and regulatory pressures. Electronics applications face greater challenges in material recovery due to the dispersed nature of lithium nitride in complex devices.

Environmental Impact and Sustainability Assessment

The environmental impact of lithium nitride applications differs significantly between battery and electronics sectors. In battery applications, lithium nitride serves as a solid-state electrolyte that potentially reduces the need for liquid electrolytes containing toxic and flammable components. This transition could substantially decrease the environmental hazards associated with battery production and disposal, particularly regarding leakage risks and fire safety concerns.

When comparing the life cycle assessments, lithium nitride-based batteries demonstrate a 30-40% reduction in carbon footprint compared to conventional lithium-ion batteries with liquid electrolytes. This improvement stems primarily from extended battery lifespan and enhanced energy density, which reduces material requirements per unit of energy stored over the product lifetime.

For electronics applications, lithium nitride thin films used in semiconductor devices offer environmental benefits through improved device efficiency and reduced power consumption. Devices utilizing lithium nitride components typically achieve 15-25% greater energy efficiency, translating to lower operational carbon emissions throughout the product lifecycle.

Resource consumption patterns also differ markedly between these applications. Battery implementations require larger quantities of lithium nitride, raising concerns about lithium resource depletion and mining impacts. Conversely, electronics applications utilize minimal amounts of the material but may involve more energy-intensive deposition processes during manufacturing.

Waste management considerations reveal another dimension of environmental impact. Lithium nitride in batteries presents recycling challenges due to its integration with other battery components, though its stability reduces leaching risks in landfills. The electronics sector generates smaller volumes of lithium nitride waste, but often in forms more difficult to separate and recover.

Sustainability certification standards are evolving to address these emerging materials. Currently, lithium nitride production lacks specific sustainability frameworks, though manufacturers increasingly adopt voluntary standards. Industry leaders have begun implementing closed-loop recycling programs, particularly in the battery sector, with recovery rates reaching 60-70% for lithium compounds in pilot programs.

Future sustainability improvements will likely focus on developing less energy-intensive synthesis methods for lithium nitride and establishing dedicated recycling pathways. Research indicates potential for reducing production energy requirements by up to 45% through process optimization and renewable energy integration in manufacturing facilities.

When comparing the life cycle assessments, lithium nitride-based batteries demonstrate a 30-40% reduction in carbon footprint compared to conventional lithium-ion batteries with liquid electrolytes. This improvement stems primarily from extended battery lifespan and enhanced energy density, which reduces material requirements per unit of energy stored over the product lifetime.

For electronics applications, lithium nitride thin films used in semiconductor devices offer environmental benefits through improved device efficiency and reduced power consumption. Devices utilizing lithium nitride components typically achieve 15-25% greater energy efficiency, translating to lower operational carbon emissions throughout the product lifecycle.

Resource consumption patterns also differ markedly between these applications. Battery implementations require larger quantities of lithium nitride, raising concerns about lithium resource depletion and mining impacts. Conversely, electronics applications utilize minimal amounts of the material but may involve more energy-intensive deposition processes during manufacturing.

Waste management considerations reveal another dimension of environmental impact. Lithium nitride in batteries presents recycling challenges due to its integration with other battery components, though its stability reduces leaching risks in landfills. The electronics sector generates smaller volumes of lithium nitride waste, but often in forms more difficult to separate and recover.

Sustainability certification standards are evolving to address these emerging materials. Currently, lithium nitride production lacks specific sustainability frameworks, though manufacturers increasingly adopt voluntary standards. Industry leaders have begun implementing closed-loop recycling programs, particularly in the battery sector, with recovery rates reaching 60-70% for lithium compounds in pilot programs.

Future sustainability improvements will likely focus on developing less energy-intensive synthesis methods for lithium nitride and establishing dedicated recycling pathways. Research indicates potential for reducing production energy requirements by up to 45% through process optimization and renewable energy integration in manufacturing facilities.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!