Comparison of EMI Shielding with Metallic vs Carbon-Based Materials

SEP 25, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

EMI Shielding Evolution and Objectives

Electromagnetic Interference (EMI) shielding has evolved significantly since the early days of electronic devices. The journey began in the mid-20th century when electronic equipment proliferation necessitated protection against electromagnetic radiation. Initially, metallic materials dominated the field due to their excellent electrical conductivity properties. Aluminum, copper, and steel were the primary materials used for EMI shielding applications, offering reliable protection through reflection mechanisms.

The technological landscape shifted dramatically in the 1980s and 1990s with the miniaturization of electronic devices and the emergence of portable electronics. This transition created new challenges for traditional metallic shields, which were often heavy, prone to corrosion, and difficult to integrate into complex geometries. These limitations prompted researchers to explore alternative materials with comparable shielding effectiveness but improved physical properties.

Carbon-based materials emerged as promising alternatives in the late 1990s, with significant research acceleration in the 2000s following the discovery of graphene and advanced carbon nanotube fabrication techniques. These materials offered unique advantages including lighter weight, flexibility, corrosion resistance, and the ability to be incorporated into polymers for multifunctional applications.

The current technological trajectory aims to develop hybrid solutions that combine the strengths of both metallic and carbon-based materials. Research objectives focus on creating shielding materials that provide superior electromagnetic interference protection across broader frequency ranges while addressing modern design constraints such as weight reduction, flexibility, and sustainability.

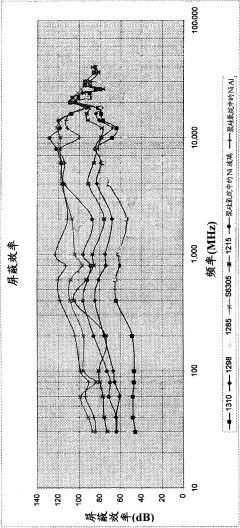

Key objectives in contemporary EMI shielding research include developing materials with shielding effectiveness exceeding 60-80 dB across frequencies from 30 MHz to 40 GHz, reducing shield thickness to accommodate miniaturized electronics, and creating environmentally sustainable solutions with reduced reliance on rare or toxic metals. Additionally, researchers aim to develop cost-effective manufacturing processes that enable mass production of advanced shielding materials.

The evolution of EMI shielding technology is increasingly driven by emerging applications in 5G communications, Internet of Things (IoT) devices, autonomous vehicles, and medical electronics. These applications present unique challenges due to their operation in diverse environments and frequency ranges, pushing the boundaries of traditional shielding approaches and necessitating innovative material solutions.

Future objectives include the development of "smart" shielding materials capable of adaptive responses to varying electromagnetic environments, integration of shielding functionality directly into structural components, and creation of transparent shields for display technologies. The field continues to evolve toward multifunctional materials that simultaneously address EMI shielding, thermal management, and mechanical performance requirements.

The technological landscape shifted dramatically in the 1980s and 1990s with the miniaturization of electronic devices and the emergence of portable electronics. This transition created new challenges for traditional metallic shields, which were often heavy, prone to corrosion, and difficult to integrate into complex geometries. These limitations prompted researchers to explore alternative materials with comparable shielding effectiveness but improved physical properties.

Carbon-based materials emerged as promising alternatives in the late 1990s, with significant research acceleration in the 2000s following the discovery of graphene and advanced carbon nanotube fabrication techniques. These materials offered unique advantages including lighter weight, flexibility, corrosion resistance, and the ability to be incorporated into polymers for multifunctional applications.

The current technological trajectory aims to develop hybrid solutions that combine the strengths of both metallic and carbon-based materials. Research objectives focus on creating shielding materials that provide superior electromagnetic interference protection across broader frequency ranges while addressing modern design constraints such as weight reduction, flexibility, and sustainability.

Key objectives in contemporary EMI shielding research include developing materials with shielding effectiveness exceeding 60-80 dB across frequencies from 30 MHz to 40 GHz, reducing shield thickness to accommodate miniaturized electronics, and creating environmentally sustainable solutions with reduced reliance on rare or toxic metals. Additionally, researchers aim to develop cost-effective manufacturing processes that enable mass production of advanced shielding materials.

The evolution of EMI shielding technology is increasingly driven by emerging applications in 5G communications, Internet of Things (IoT) devices, autonomous vehicles, and medical electronics. These applications present unique challenges due to their operation in diverse environments and frequency ranges, pushing the boundaries of traditional shielding approaches and necessitating innovative material solutions.

Future objectives include the development of "smart" shielding materials capable of adaptive responses to varying electromagnetic environments, integration of shielding functionality directly into structural components, and creation of transparent shields for display technologies. The field continues to evolve toward multifunctional materials that simultaneously address EMI shielding, thermal management, and mechanical performance requirements.

Market Demand Analysis for Advanced Shielding Solutions

The global market for EMI shielding solutions is experiencing robust growth, driven primarily by the proliferation of electronic devices across various sectors. Current market valuations indicate that the EMI shielding market reached approximately 6.2 billion USD in 2022, with projections suggesting a compound annual growth rate (CAGR) of 5.8% through 2030. This growth trajectory is particularly evident in regions with high technological adoption rates, such as North America, Europe, and the Asia-Pacific.

Consumer electronics represent the largest application segment, accounting for nearly 35% of the total market share. The increasing integration of wireless technologies, miniaturization of electronic components, and higher operating frequencies in smartphones, tablets, and wearable devices have intensified the need for effective EMI shielding solutions. Manufacturers are facing mounting pressure to develop products that not only meet regulatory compliance but also address consumer demands for smaller, lighter devices without performance compromise.

The automotive industry emerges as the fastest-growing segment, with a projected CAGR exceeding 7% over the next five years. This surge is attributed to the rapid electrification of vehicles and the integration of advanced driver-assistance systems (ADAS). Electric vehicles (EVs) contain significantly more electronic components than traditional combustion engine vehicles, creating complex electromagnetic environments that require sophisticated shielding solutions to ensure proper functionality and safety.

Healthcare and medical devices constitute another critical market segment, valued at approximately 800 million USD in 2022. The increasing adoption of wireless medical devices, telemedicine platforms, and electronic implants has created stringent requirements for EMI shielding to prevent interference with critical life-supporting equipment. Regulatory bodies worldwide have established strict standards for medical device electromagnetic compatibility, further driving demand for advanced shielding solutions.

The aerospace and defense sectors continue to demand high-performance shielding materials capable of withstanding extreme conditions while providing superior protection against electromagnetic interference. These applications typically require customized solutions with specific performance characteristics, creating a premium segment within the market.

A notable shift in market demand is the growing preference for lightweight, environmentally friendly shielding solutions. Traditional metallic shields, while effective, add significant weight to electronic devices and present end-of-life disposal challenges. This has accelerated research and development into carbon-based alternatives, including graphene, carbon nanotubes, and carbon fiber composites, which offer comparable shielding effectiveness with reduced weight and environmental impact.

Consumer electronics represent the largest application segment, accounting for nearly 35% of the total market share. The increasing integration of wireless technologies, miniaturization of electronic components, and higher operating frequencies in smartphones, tablets, and wearable devices have intensified the need for effective EMI shielding solutions. Manufacturers are facing mounting pressure to develop products that not only meet regulatory compliance but also address consumer demands for smaller, lighter devices without performance compromise.

The automotive industry emerges as the fastest-growing segment, with a projected CAGR exceeding 7% over the next five years. This surge is attributed to the rapid electrification of vehicles and the integration of advanced driver-assistance systems (ADAS). Electric vehicles (EVs) contain significantly more electronic components than traditional combustion engine vehicles, creating complex electromagnetic environments that require sophisticated shielding solutions to ensure proper functionality and safety.

Healthcare and medical devices constitute another critical market segment, valued at approximately 800 million USD in 2022. The increasing adoption of wireless medical devices, telemedicine platforms, and electronic implants has created stringent requirements for EMI shielding to prevent interference with critical life-supporting equipment. Regulatory bodies worldwide have established strict standards for medical device electromagnetic compatibility, further driving demand for advanced shielding solutions.

The aerospace and defense sectors continue to demand high-performance shielding materials capable of withstanding extreme conditions while providing superior protection against electromagnetic interference. These applications typically require customized solutions with specific performance characteristics, creating a premium segment within the market.

A notable shift in market demand is the growing preference for lightweight, environmentally friendly shielding solutions. Traditional metallic shields, while effective, add significant weight to electronic devices and present end-of-life disposal challenges. This has accelerated research and development into carbon-based alternatives, including graphene, carbon nanotubes, and carbon fiber composites, which offer comparable shielding effectiveness with reduced weight and environmental impact.

Current State and Challenges in EMI Shielding Technologies

The global electromagnetic interference (EMI) shielding market has witnessed significant growth in recent years, driven by the proliferation of electronic devices and increasing concerns about electromagnetic compatibility. Currently, metallic materials dominate the EMI shielding landscape, with aluminum, copper, and nickel being the most widely utilized options due to their excellent electrical conductivity and established manufacturing processes. These traditional metallic shields typically achieve shielding effectiveness of 60-120 dB across a wide frequency range.

However, metallic EMI shields face several critical challenges. Weight constraints have become increasingly problematic, particularly in aerospace, automotive, and portable electronics applications where every gram matters. Traditional metal shields can add substantial weight to systems, compromising overall performance and efficiency. Additionally, corrosion susceptibility remains a significant concern, especially in harsh environments, leading to degradation of shielding performance over time.

Carbon-based materials have emerged as promising alternatives, with graphene, carbon nanotubes (CNTs), and carbon fiber composites showing remarkable potential. These materials offer comparable shielding effectiveness (typically 30-90 dB) while providing significant weight reduction—often 40-60% lighter than equivalent metallic solutions. Recent advancements in carbon nanotube fabrication have achieved shielding effectiveness exceeding 80 dB at frequencies above 8 GHz, approaching the performance of traditional metals.

Geographically, North America and Asia-Pacific lead in EMI shielding technology development. The United States maintains strong research capabilities in advanced carbon-based materials, while China has rapidly expanded its manufacturing capacity for both traditional and emerging shielding solutions. Japan continues to excel in miniaturized shielding technologies for consumer electronics, while European research institutions focus heavily on environmentally sustainable shielding materials.

A significant technical challenge facing both material categories is achieving consistent performance across ultra-wide frequency bands (1 MHz to 100 GHz), particularly as 5G and future wireless technologies expand into higher frequency ranges. Integration complexity also remains problematic, with designers struggling to incorporate effective shielding without compromising device functionality or manufacturing efficiency.

Cost factors continue to constrain widespread adoption of carbon-based solutions, with current manufacturing expenses typically 2-5 times higher than conventional metallic options. Scalability challenges persist in producing high-quality carbon-based materials with consistent properties at industrial volumes, though recent manufacturing innovations have begun to narrow this gap.

However, metallic EMI shields face several critical challenges. Weight constraints have become increasingly problematic, particularly in aerospace, automotive, and portable electronics applications where every gram matters. Traditional metal shields can add substantial weight to systems, compromising overall performance and efficiency. Additionally, corrosion susceptibility remains a significant concern, especially in harsh environments, leading to degradation of shielding performance over time.

Carbon-based materials have emerged as promising alternatives, with graphene, carbon nanotubes (CNTs), and carbon fiber composites showing remarkable potential. These materials offer comparable shielding effectiveness (typically 30-90 dB) while providing significant weight reduction—often 40-60% lighter than equivalent metallic solutions. Recent advancements in carbon nanotube fabrication have achieved shielding effectiveness exceeding 80 dB at frequencies above 8 GHz, approaching the performance of traditional metals.

Geographically, North America and Asia-Pacific lead in EMI shielding technology development. The United States maintains strong research capabilities in advanced carbon-based materials, while China has rapidly expanded its manufacturing capacity for both traditional and emerging shielding solutions. Japan continues to excel in miniaturized shielding technologies for consumer electronics, while European research institutions focus heavily on environmentally sustainable shielding materials.

A significant technical challenge facing both material categories is achieving consistent performance across ultra-wide frequency bands (1 MHz to 100 GHz), particularly as 5G and future wireless technologies expand into higher frequency ranges. Integration complexity also remains problematic, with designers struggling to incorporate effective shielding without compromising device functionality or manufacturing efficiency.

Cost factors continue to constrain widespread adoption of carbon-based solutions, with current manufacturing expenses typically 2-5 times higher than conventional metallic options. Scalability challenges persist in producing high-quality carbon-based materials with consistent properties at industrial volumes, though recent manufacturing innovations have begun to narrow this gap.

Comparative Analysis of Metallic vs Carbon-Based Solutions

01 Metallic EMI shielding materials and structures

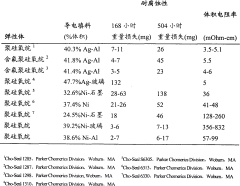

Metallic materials such as aluminum, copper, and steel are commonly used for EMI shielding due to their high electrical conductivity. These materials can be formed into various structures including foils, meshes, and coatings to provide effective electromagnetic interference protection. The shielding effectiveness of metallic materials depends on factors such as thickness, conductivity, and permeability. These materials are often used in electronic enclosures, cables, and connectors to prevent electromagnetic radiation from entering or exiting sensitive equipment.- Metal-based EMI shielding materials: Metal-based materials are widely used for EMI shielding due to their excellent electrical conductivity. These materials include metal foils, meshes, coatings, and composites that can effectively block electromagnetic interference. The high conductivity of metals like copper, aluminum, and nickel allows them to reflect and absorb electromagnetic waves, providing superior shielding effectiveness. These materials can be applied as coatings, incorporated into polymers, or used as standalone shields in electronic devices.

- Carbon-based EMI shielding materials: Carbon-based materials such as graphene, carbon nanotubes, carbon black, and carbon fiber offer effective EMI shielding solutions with the advantages of lightweight and flexibility. These materials provide shielding through absorption and reflection mechanisms. Carbon-based shields can be incorporated into polymers or applied as coatings to create composite materials with enhanced EMI shielding effectiveness while maintaining lower weight compared to traditional metal shields.

- Hybrid and composite EMI shielding materials: Hybrid shielding materials combine metallic and carbon-based components to achieve enhanced EMI shielding effectiveness. These composites leverage the complementary properties of different materials, such as the high conductivity of metals and the lightweight nature of carbon materials. Polymer matrices filled with conductive particles create flexible shields that can be molded into complex shapes. These hybrid materials often demonstrate synergistic effects, providing superior shielding across broader frequency ranges than single-material solutions.

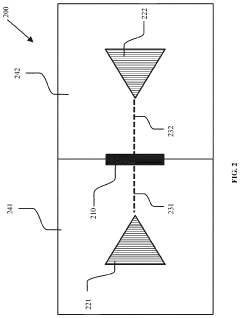

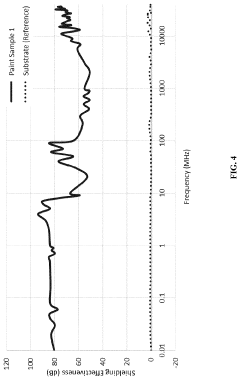

- EMI shielding effectiveness measurement techniques: Various techniques and methodologies are employed to measure and evaluate the effectiveness of EMI shielding materials. These include network analyzer measurements, shielded room testing, and specialized test fixtures that can quantify attenuation across different frequency ranges. Testing standards help ensure consistent evaluation of shielding effectiveness, typically measured in decibels (dB). Advanced measurement systems can characterize both reflection and absorption components of shielding, providing comprehensive performance data for material development and selection.

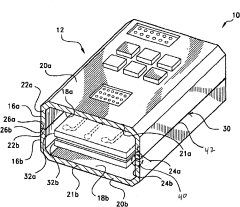

- Application-specific EMI shielding solutions: EMI shielding materials are tailored for specific applications based on requirements such as frequency range, environmental conditions, and physical constraints. Solutions include specialized coatings for electronic enclosures, flexible shields for wearable devices, and high-performance materials for aerospace and military applications. The selection of shielding materials considers factors such as weight, thickness, durability, and cost-effectiveness. Emerging applications in 5G communications, automotive electronics, and medical devices drive the development of innovative shielding solutions with optimized performance characteristics.

02 Carbon-based EMI shielding materials

Carbon-based materials including carbon fiber, graphene, carbon nanotubes, and carbon black are increasingly used for EMI shielding applications. These materials offer advantages such as lightweight properties, flexibility, and corrosion resistance compared to traditional metallic shields. Carbon-based composites can be engineered to achieve specific shielding effectiveness across different frequency ranges. The incorporation of carbon materials into polymers creates conductive composites that can be molded into complex shapes while maintaining good EMI shielding properties.Expand Specific Solutions03 Hybrid and composite EMI shielding materials

Hybrid shielding materials combine metallic and carbon-based components to leverage the advantages of both material types. These composites often feature metal particles or fibers embedded in carbon-based matrices or polymer substrates with multiple conductive fillers. The synergistic effect between different materials can enhance overall shielding effectiveness across broader frequency ranges. These hybrid materials can be tailored for specific applications by adjusting the composition and structure to optimize properties such as weight, flexibility, and shielding performance.Expand Specific Solutions04 EMI shielding effectiveness measurement and testing methods

Various techniques and equipment are used to measure and evaluate the shielding effectiveness of EMI materials. These include network analyzers, shielded rooms, and specialized test fixtures that comply with standards such as IEEE-299, MIL-STD-461, and ASTM D4935. Shielding effectiveness is typically measured in decibels (dB) across different frequency ranges, with higher values indicating better performance. Testing methods may evaluate parameters such as reflection loss, absorption loss, and multiple reflections to comprehensively assess shielding capabilities under different electromagnetic conditions.Expand Specific Solutions05 Application-specific EMI shielding solutions

EMI shielding materials and designs are often customized for specific applications such as electronic devices, medical equipment, automotive systems, and aerospace components. These solutions may incorporate features like gaskets, vents, windows, and selective shielding to balance electromagnetic protection with other requirements such as thermal management, weight constraints, and cost considerations. Advanced manufacturing techniques including 3D printing, spray coating, and vacuum metallization enable the production of complex shielding structures that conform to intricate geometries while maintaining effective EMI protection.Expand Specific Solutions

Key Industry Players in EMI Shielding Market

The EMI shielding market is currently in a growth phase, with increasing demand driven by the proliferation of electronic devices and wireless technologies. The global market size is projected to reach significant value as industries seek effective solutions for electromagnetic interference protection. Technologically, there is a clear transition occurring from traditional metallic shielding materials toward carbon-based alternatives. Companies like Nanotech Energy, Laird Technologies, and Graphenest are leading innovation in graphene-based EMI shielding solutions, offering lighter weight and comparable or superior performance to conventional metal shields. Meanwhile, established players such as 3M, Parker-Hannifin, and Kyocera continue to develop hybrid solutions. Research institutions including Drexel University, Tohoku University, and KIST are advancing fundamental understanding of shielding mechanisms, particularly in nanomaterial applications, indicating the field's technological maturity is still evolving.

Nanotech Energy, Inc.

Technical Solution: Nanotech Energy has developed revolutionary graphene-based EMI shielding materials that represent a significant advancement over traditional metallic shields. Their proprietary manufacturing process creates highly conductive, flexible graphene sheets with exceptional EMI shielding properties. The company's Graphene EMI Shielding Film achieves shielding effectiveness of 40-60 dB across frequencies from 30 MHz to 40 GHz[3], comparable to much thicker metallic shields. A key innovation is their graphene-polymer composite technology that allows for tunable conductivity and shielding performance based on graphene concentration and dispersion methods. Nanotech Energy's graphene-based shields are approximately 75% lighter than equivalent metallic shields while offering superior corrosion resistance and flexibility. Their multilayer graphene structures incorporate specialized dielectric layers between conductive graphene sheets, creating multiple reflection and absorption mechanisms that enhance overall shielding performance. The company has also developed graphene-based EMI shielding paints and coatings that can be applied to complex geometries, providing effective shielding solutions for components that are difficult to shield with traditional methods.

Strengths: Industry-leading expertise in graphene-based materials; lightweight solutions ideal for mobile and aerospace applications; excellent flexibility allowing application on complex surfaces; superior corrosion resistance compared to metallic shields. Weaknesses: Higher production costs compared to conventional materials; manufacturing scalability challenges for some specialized graphene formulations; relatively new technology with limited long-term performance data.

Henkel IP & Holding GmbH

Technical Solution: Henkel has developed a comprehensive portfolio of EMI shielding solutions that strategically utilize both metallic and carbon-based materials. Their LOCTITE® ABLESTIK EMI shielding adhesives incorporate silver-coated carbon fibers in proprietary polymer matrices, creating electrically conductive bonds that simultaneously provide structural integrity and EMI protection. Henkel's two-phase approach to EMI shielding combines metallic coatings for high-frequency protection with carbon-loaded composites for lower frequency shielding, optimizing performance across the electromagnetic spectrum. The company has pioneered sprayable EMI shielding coatings that utilize copper particles and carbon nanotubes in water-based formulations, achieving shielding effectiveness of 60-80 dB while reducing environmental impact compared to solvent-based alternatives[4]. Their BERGQUIST® gap fillers incorporate specialized carbon materials that provide both thermal management and EMI shielding in a single material, addressing the growing need for multifunctional materials in compact electronic designs. Henkel has also developed selective metallization processes for plastic enclosures that create effective EMI shields while minimizing material usage and weight.

Strengths: Extensive formulation expertise allowing customization for specific application requirements; global manufacturing and technical support infrastructure; strong integration capabilities with existing electronic assembly processes; comprehensive testing facilities for performance validation. Weaknesses: Some specialized solutions require specific processing parameters that may limit manufacturing flexibility; higher cost compared to basic shielding materials; potential for galvanic corrosion in certain metallic formulations when exposed to harsh environments.

Critical Patents and Research in Shielding Materials

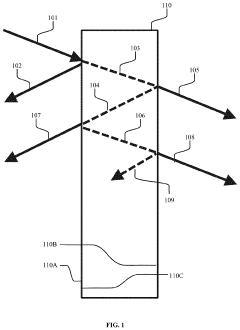

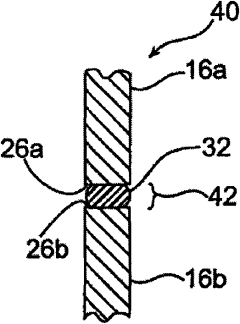

Metallic based electromagnetic interference shielding materials, devices, and methods of manufacture thereof

PatentPendingUS20230413500A1

Innovation

- The development of EMI shielding materials incorporating a metal-based conductive additive, such as metallic nanomaterials, combined with a carbon-based additive like graphene, which forms a conductive network for enhanced conductivity and mechanical properties, applied as a coating on substrates with a binder and solvent, allowing for flexible and corrosion-resistant shielding.

EMI shielding materials

PatentInactiveCN102171284A

Innovation

- Nickel-glass and nickel-aluminum fillers are used as conductive fillers, and by mixing with elastomer polymer components, a corrosion-resistant EMI shielding material is formed, providing improved EMI shielding efficiency and corrosion resistance.

Environmental Impact and Sustainability Considerations

The environmental impact of EMI shielding materials represents a critical consideration in modern electronics design, particularly as sustainability becomes increasingly prioritized across industries. Traditional metallic shielding materials, while effective, present significant environmental challenges throughout their lifecycle. Mining operations for metals like copper, aluminum, and nickel cause substantial habitat disruption, soil erosion, and water contamination. The energy-intensive refining processes contribute heavily to carbon emissions, with aluminum production being especially problematic due to its electricity requirements.

Manufacturing metallic shields typically involves chemical treatments and plating processes that generate hazardous waste requiring specialized disposal. At end-of-life, while metals offer excellent recyclability theoretically, the composite nature of many shielding applications complicates recovery efforts, resulting in substantial metallic waste entering landfills despite their theoretical recyclability potential.

Carbon-based alternatives present a more nuanced environmental profile. Materials like carbon fiber, graphene, and carbon nanotubes offer reduced weight compared to metals, potentially decreasing transportation-related emissions in final products. However, production of these advanced carbon materials, particularly carbon nanotubes and graphene, currently involves energy-intensive processes and potentially hazardous chemicals, though manufacturing techniques continue to improve in efficiency.

The sustainability advantage of carbon-based materials lies primarily in their potential for bio-derived precursors. Research into cellulose-based carbon materials and lignin-derived carbon fibers demonstrates promising pathways toward renewable EMI shielding solutions. Additionally, carbon-based composites typically require less energy during processing compared to metal refining, though scale remains a limiting factor in realizing these benefits industry-wide.

End-of-life considerations for carbon-based materials present both challenges and opportunities. While carbon fiber composites have traditionally been difficult to recycle, recent technological advances in pyrolysis and solvolysis techniques show promise for material recovery. Graphene-based materials may offer advantages in biodegradability when appropriately functionalized, potentially reducing long-term environmental impact.

Life cycle assessment (LCA) studies comparing metallic and carbon-based shielding materials indicate that the environmental superiority depends heavily on specific application requirements, material formulation, and manufacturing processes. Carbon-based solutions generally demonstrate advantages in global warming potential and resource depletion categories, while metallic options may perform better in toxicity-related impact categories depending on the specific carbon materials and processing methods employed.

Manufacturing metallic shields typically involves chemical treatments and plating processes that generate hazardous waste requiring specialized disposal. At end-of-life, while metals offer excellent recyclability theoretically, the composite nature of many shielding applications complicates recovery efforts, resulting in substantial metallic waste entering landfills despite their theoretical recyclability potential.

Carbon-based alternatives present a more nuanced environmental profile. Materials like carbon fiber, graphene, and carbon nanotubes offer reduced weight compared to metals, potentially decreasing transportation-related emissions in final products. However, production of these advanced carbon materials, particularly carbon nanotubes and graphene, currently involves energy-intensive processes and potentially hazardous chemicals, though manufacturing techniques continue to improve in efficiency.

The sustainability advantage of carbon-based materials lies primarily in their potential for bio-derived precursors. Research into cellulose-based carbon materials and lignin-derived carbon fibers demonstrates promising pathways toward renewable EMI shielding solutions. Additionally, carbon-based composites typically require less energy during processing compared to metal refining, though scale remains a limiting factor in realizing these benefits industry-wide.

End-of-life considerations for carbon-based materials present both challenges and opportunities. While carbon fiber composites have traditionally been difficult to recycle, recent technological advances in pyrolysis and solvolysis techniques show promise for material recovery. Graphene-based materials may offer advantages in biodegradability when appropriately functionalized, potentially reducing long-term environmental impact.

Life cycle assessment (LCA) studies comparing metallic and carbon-based shielding materials indicate that the environmental superiority depends heavily on specific application requirements, material formulation, and manufacturing processes. Carbon-based solutions generally demonstrate advantages in global warming potential and resource depletion categories, while metallic options may perform better in toxicity-related impact categories depending on the specific carbon materials and processing methods employed.

Cost-Performance Analysis of Shielding Materials

When evaluating EMI shielding solutions, cost-performance analysis is critical for determining the most efficient material selection. Metallic materials, traditionally dominant in EMI shielding applications, offer excellent conductivity and shielding effectiveness but often come with higher costs, particularly for materials like silver and copper. These metals provide shielding effectiveness typically ranging from 60-120 dB, depending on thickness and frequency range.

The cost structure for metallic shielding includes raw material expenses, manufacturing processes, and weight considerations. Silver, while offering superior conductivity (63.0 × 10^6 S/m), costs approximately $550-650 per kilogram. Copper provides good shielding performance (59.6 × 10^6 S/m conductivity) at a more moderate price point of $6-8 per kilogram. Aluminum represents the most economical metallic option at $1.5-2.5 per kilogram, though with reduced conductivity (37.8 × 10^6 S/m).

Carbon-based materials present a compelling alternative with different cost-performance characteristics. Carbon fiber composites typically cost $20-30 per kilogram, while graphene ranges from $100-200 per gram for high-quality sheets. Despite higher initial material costs for some carbon variants, these materials offer significant weight reduction (70-80% lighter than comparable metallic solutions), which translates to lower transportation costs and reduced structural support requirements.

Performance metrics reveal that carbon-based materials generally provide 40-80 dB shielding effectiveness, lower than metals but sufficient for many commercial applications. However, carbon materials excel in flexibility, corrosion resistance, and weight efficiency. Recent advancements in carbon nanotube and graphene technologies have improved shielding performance while manufacturing costs continue to decrease, narrowing the performance gap with metals.

Lifecycle cost analysis demonstrates that while metallic solutions may have lower initial implementation costs, carbon-based materials often present better long-term value due to durability, maintenance requirements, and recyclability. Metal shields typically require replacement every 5-7 years in corrosive environments, while carbon composites can last 10-15 years under similar conditions.

Market research indicates that industries with weight-critical applications (aerospace, portable electronics) increasingly favor carbon-based solutions despite higher initial costs. Conversely, stationary infrastructure and high-performance military applications continue to rely on metallic shielding where maximum shielding effectiveness is paramount regardless of weight considerations.

The cost-performance frontier is continuously evolving, with hybrid solutions combining metallic and carbon-based materials emerging as an optimal approach for specific applications, leveraging the strengths of both material categories while mitigating their respective limitations.

The cost structure for metallic shielding includes raw material expenses, manufacturing processes, and weight considerations. Silver, while offering superior conductivity (63.0 × 10^6 S/m), costs approximately $550-650 per kilogram. Copper provides good shielding performance (59.6 × 10^6 S/m conductivity) at a more moderate price point of $6-8 per kilogram. Aluminum represents the most economical metallic option at $1.5-2.5 per kilogram, though with reduced conductivity (37.8 × 10^6 S/m).

Carbon-based materials present a compelling alternative with different cost-performance characteristics. Carbon fiber composites typically cost $20-30 per kilogram, while graphene ranges from $100-200 per gram for high-quality sheets. Despite higher initial material costs for some carbon variants, these materials offer significant weight reduction (70-80% lighter than comparable metallic solutions), which translates to lower transportation costs and reduced structural support requirements.

Performance metrics reveal that carbon-based materials generally provide 40-80 dB shielding effectiveness, lower than metals but sufficient for many commercial applications. However, carbon materials excel in flexibility, corrosion resistance, and weight efficiency. Recent advancements in carbon nanotube and graphene technologies have improved shielding performance while manufacturing costs continue to decrease, narrowing the performance gap with metals.

Lifecycle cost analysis demonstrates that while metallic solutions may have lower initial implementation costs, carbon-based materials often present better long-term value due to durability, maintenance requirements, and recyclability. Metal shields typically require replacement every 5-7 years in corrosive environments, while carbon composites can last 10-15 years under similar conditions.

Market research indicates that industries with weight-critical applications (aerospace, portable electronics) increasingly favor carbon-based solutions despite higher initial costs. Conversely, stationary infrastructure and high-performance military applications continue to rely on metallic shielding where maximum shielding effectiveness is paramount regardless of weight considerations.

The cost-performance frontier is continuously evolving, with hybrid solutions combining metallic and carbon-based materials emerging as an optimal approach for specific applications, leveraging the strengths of both material categories while mitigating their respective limitations.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!