EMI Shielding Standards and Regulatory Compliance Analysis

SEP 25, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

EMI Shielding Evolution and Objectives

Electromagnetic Interference (EMI) shielding has evolved significantly since the early days of electronics, driven by the increasing complexity of electronic systems and the growing need to ensure their reliable operation in various environments. The journey of EMI shielding began in the mid-20th century with rudimentary metal enclosures designed to contain electromagnetic emissions from early computing and communication equipment. These initial solutions were primarily focused on preventing interference between adjacent electronic components rather than meeting specific regulatory standards.

The 1970s marked a turning point with the establishment of the first comprehensive EMI regulations by the Federal Communications Commission (FCC) in the United States, followed by similar initiatives in Europe and Asia. This regulatory framework catalyzed the development of more sophisticated shielding technologies and materials, transitioning from simple metal casings to specialized conductive coatings, gaskets, and composite materials engineered specifically for EMI attenuation.

The digital revolution of the 1980s and 1990s brought new challenges as clock speeds increased and electronic devices became more compact. Higher frequencies and greater device density necessitated innovations in shielding techniques, including the development of multi-layered shields capable of addressing a broader spectrum of electromagnetic frequencies. During this period, the focus expanded beyond merely containing emissions to also protecting sensitive components from external interference.

The wireless era introduced additional complexities, with the proliferation of RF devices operating across multiple frequency bands. Modern EMI shielding solutions now must address an unprecedented range of frequencies while conforming to increasingly stringent international standards. The miniaturization trend in electronics has further complicated shielding requirements, demanding solutions that are not only effective but also lightweight, thin, and compatible with automated manufacturing processes.

Today's EMI shielding objectives extend beyond basic compliance to encompass optimization for specific applications. In aerospace and defense, the primary goal is ensuring mission-critical systems operate reliably in electromagnetically hostile environments. For consumer electronics, objectives include maintaining signal integrity while meeting aesthetic and form factor requirements. In medical devices, EMI shielding aims to prevent interference that could compromise patient safety while adhering to biocompatibility standards.

Looking forward, the emergence of 5G networks, Internet of Things (IoT) devices, and autonomous systems presents new frontiers for EMI shielding technology. The objectives are evolving to address higher frequency ranges, support flexible and wearable electronics, and integrate with advanced manufacturing techniques such as 3D printing. Additionally, sustainability considerations are becoming increasingly important, driving research into recyclable and environmentally friendly shielding materials that maintain high performance standards.

The 1970s marked a turning point with the establishment of the first comprehensive EMI regulations by the Federal Communications Commission (FCC) in the United States, followed by similar initiatives in Europe and Asia. This regulatory framework catalyzed the development of more sophisticated shielding technologies and materials, transitioning from simple metal casings to specialized conductive coatings, gaskets, and composite materials engineered specifically for EMI attenuation.

The digital revolution of the 1980s and 1990s brought new challenges as clock speeds increased and electronic devices became more compact. Higher frequencies and greater device density necessitated innovations in shielding techniques, including the development of multi-layered shields capable of addressing a broader spectrum of electromagnetic frequencies. During this period, the focus expanded beyond merely containing emissions to also protecting sensitive components from external interference.

The wireless era introduced additional complexities, with the proliferation of RF devices operating across multiple frequency bands. Modern EMI shielding solutions now must address an unprecedented range of frequencies while conforming to increasingly stringent international standards. The miniaturization trend in electronics has further complicated shielding requirements, demanding solutions that are not only effective but also lightweight, thin, and compatible with automated manufacturing processes.

Today's EMI shielding objectives extend beyond basic compliance to encompass optimization for specific applications. In aerospace and defense, the primary goal is ensuring mission-critical systems operate reliably in electromagnetically hostile environments. For consumer electronics, objectives include maintaining signal integrity while meeting aesthetic and form factor requirements. In medical devices, EMI shielding aims to prevent interference that could compromise patient safety while adhering to biocompatibility standards.

Looking forward, the emergence of 5G networks, Internet of Things (IoT) devices, and autonomous systems presents new frontiers for EMI shielding technology. The objectives are evolving to address higher frequency ranges, support flexible and wearable electronics, and integrate with advanced manufacturing techniques such as 3D printing. Additionally, sustainability considerations are becoming increasingly important, driving research into recyclable and environmentally friendly shielding materials that maintain high performance standards.

Market Demand for EMI Protection Solutions

The global market for EMI protection solutions has witnessed substantial growth in recent years, driven primarily by the proliferation of electronic devices across various sectors. The increasing density of electronic components in modern devices has created a significant demand for effective EMI shielding solutions to ensure proper functionality and regulatory compliance.

The telecommunications sector represents one of the largest markets for EMI protection, with the ongoing deployment of 5G infrastructure creating unprecedented demand for advanced shielding materials and techniques. As 5G networks operate at higher frequencies, they require more sophisticated EMI protection solutions to maintain signal integrity and prevent interference. This segment alone is projected to grow at a compound annual growth rate of 6.8% through 2027.

Consumer electronics constitute another major market driver, with smartphones, tablets, laptops, and wearable devices requiring comprehensive EMI protection. The trend toward miniaturization and increased functionality in these devices has intensified the need for effective shielding solutions that do not compromise design aesthetics or add significant weight. Market research indicates that consumer electronics manufacturers are increasingly prioritizing EMI protection during the design phase rather than as an afterthought.

The automotive industry represents a rapidly expanding market for EMI protection, particularly with the accelerating adoption of electric vehicles and autonomous driving technologies. Modern vehicles contain numerous electronic control units, sensors, and communication systems that must operate reliably in close proximity. The automotive EMI shielding market is expected to grow significantly as vehicle electrification continues to advance.

Healthcare and medical devices form another critical segment, where EMI protection is essential for ensuring the reliability and safety of life-critical equipment. Regulatory requirements in this sector are particularly stringent, driving demand for high-performance shielding solutions that can meet medical-grade standards.

Industrial automation and aerospace/defense sectors also contribute substantially to market demand, with requirements for robust EMI protection in harsh operating environments. These sectors typically demand customized solutions that can withstand extreme conditions while maintaining shielding effectiveness.

Geographically, North America and Asia-Pacific lead the market for EMI protection solutions, with Europe following closely. The Asia-Pacific region, particularly China, Japan, and South Korea, is expected to witness the highest growth rate due to the concentration of electronics manufacturing and increasing adoption of advanced technologies.

The telecommunications sector represents one of the largest markets for EMI protection, with the ongoing deployment of 5G infrastructure creating unprecedented demand for advanced shielding materials and techniques. As 5G networks operate at higher frequencies, they require more sophisticated EMI protection solutions to maintain signal integrity and prevent interference. This segment alone is projected to grow at a compound annual growth rate of 6.8% through 2027.

Consumer electronics constitute another major market driver, with smartphones, tablets, laptops, and wearable devices requiring comprehensive EMI protection. The trend toward miniaturization and increased functionality in these devices has intensified the need for effective shielding solutions that do not compromise design aesthetics or add significant weight. Market research indicates that consumer electronics manufacturers are increasingly prioritizing EMI protection during the design phase rather than as an afterthought.

The automotive industry represents a rapidly expanding market for EMI protection, particularly with the accelerating adoption of electric vehicles and autonomous driving technologies. Modern vehicles contain numerous electronic control units, sensors, and communication systems that must operate reliably in close proximity. The automotive EMI shielding market is expected to grow significantly as vehicle electrification continues to advance.

Healthcare and medical devices form another critical segment, where EMI protection is essential for ensuring the reliability and safety of life-critical equipment. Regulatory requirements in this sector are particularly stringent, driving demand for high-performance shielding solutions that can meet medical-grade standards.

Industrial automation and aerospace/defense sectors also contribute substantially to market demand, with requirements for robust EMI protection in harsh operating environments. These sectors typically demand customized solutions that can withstand extreme conditions while maintaining shielding effectiveness.

Geographically, North America and Asia-Pacific lead the market for EMI protection solutions, with Europe following closely. The Asia-Pacific region, particularly China, Japan, and South Korea, is expected to witness the highest growth rate due to the concentration of electronics manufacturing and increasing adoption of advanced technologies.

Global EMI Shielding Technical Landscape

The electromagnetic interference (EMI) shielding landscape has evolved significantly over the past decades, driven by the proliferation of electronic devices and increasingly stringent regulatory requirements. Currently, the global EMI shielding market is valued at approximately $6.8 billion and is projected to reach $9.2 billion by 2026, with a compound annual growth rate (CAGR) of 5.8%.

Geographically, North America dominates the EMI shielding market with approximately 35% market share, followed by Europe (28%), Asia-Pacific (25%), and the rest of the world (12%). The Asia-Pacific region, particularly China, South Korea, and Taiwan, is experiencing the fastest growth due to the rapid expansion of electronics manufacturing and increasing adoption of 5G technology.

The technological landscape is characterized by a shift from traditional metallic shields to advanced composite materials and conductive coatings. Metallic shields, primarily aluminum and copper, still account for about 40% of the market, while conductive polymers and carbon-based solutions represent approximately 30%. Emerging technologies such as graphene-based shields and nano-materials constitute around 15% of the market, with specialized solutions making up the remainder.

Key technological trends include miniaturization of shielding solutions to accommodate smaller electronic devices, development of multi-functional materials that provide both EMI shielding and thermal management, and increased focus on environmentally sustainable shielding materials that comply with RoHS and REACH regulations.

The regulatory framework governing EMI shielding is complex and varies by region. In the United States, the Federal Communications Commission (FCC) establishes EMI standards under 47 CFR Part 15, while the European Union enforces the Electromagnetic Compatibility (EMC) Directive 2014/30/EU. Asian countries typically follow either FCC guidelines or adopt standards from the International Electrotechnical Commission (IEC).

Industry-specific standards further complicate the landscape, with automotive (ISO 11452), aerospace (DO-160), medical devices (IEC 60601-1-2), and telecommunications (ETSI EN 301 489) each having unique requirements. This regulatory diversity creates significant challenges for global manufacturers seeking to develop universally compliant products.

Recent technological advancements include the development of transparent EMI shielding solutions for displays and touchscreens, flexible shielding materials for wearable electronics, and selective shielding techniques that block specific frequency ranges while allowing others to pass through. These innovations are primarily driven by the growing demand for 5G devices, electric vehicles, and IoT applications, all of which present unique EMI challenges.

Geographically, North America dominates the EMI shielding market with approximately 35% market share, followed by Europe (28%), Asia-Pacific (25%), and the rest of the world (12%). The Asia-Pacific region, particularly China, South Korea, and Taiwan, is experiencing the fastest growth due to the rapid expansion of electronics manufacturing and increasing adoption of 5G technology.

The technological landscape is characterized by a shift from traditional metallic shields to advanced composite materials and conductive coatings. Metallic shields, primarily aluminum and copper, still account for about 40% of the market, while conductive polymers and carbon-based solutions represent approximately 30%. Emerging technologies such as graphene-based shields and nano-materials constitute around 15% of the market, with specialized solutions making up the remainder.

Key technological trends include miniaturization of shielding solutions to accommodate smaller electronic devices, development of multi-functional materials that provide both EMI shielding and thermal management, and increased focus on environmentally sustainable shielding materials that comply with RoHS and REACH regulations.

The regulatory framework governing EMI shielding is complex and varies by region. In the United States, the Federal Communications Commission (FCC) establishes EMI standards under 47 CFR Part 15, while the European Union enforces the Electromagnetic Compatibility (EMC) Directive 2014/30/EU. Asian countries typically follow either FCC guidelines or adopt standards from the International Electrotechnical Commission (IEC).

Industry-specific standards further complicate the landscape, with automotive (ISO 11452), aerospace (DO-160), medical devices (IEC 60601-1-2), and telecommunications (ETSI EN 301 489) each having unique requirements. This regulatory diversity creates significant challenges for global manufacturers seeking to develop universally compliant products.

Recent technological advancements include the development of transparent EMI shielding solutions for displays and touchscreens, flexible shielding materials for wearable electronics, and selective shielding techniques that block specific frequency ranges while allowing others to pass through. These innovations are primarily driven by the growing demand for 5G devices, electric vehicles, and IoT applications, all of which present unique EMI challenges.

Current EMI Shielding Implementation Methods

01 EMI Shielding Standards for Electronic Devices

Electronic devices must comply with specific EMI shielding standards to prevent electromagnetic interference. These standards define the acceptable levels of electromagnetic emissions and immunity requirements for various electronic equipment. Proper shielding techniques, such as conductive enclosures and gaskets, are implemented to ensure devices meet these regulatory requirements and operate without causing interference to other equipment.- EMI Shielding Standards for Electronic Devices: Electronic devices must comply with specific EMI shielding standards to prevent electromagnetic interference. These standards define the acceptable levels of electromagnetic emissions and immunity requirements for various electronic products. Proper shielding materials and design techniques are essential to meet these regulatory requirements and ensure that devices do not interfere with other equipment or suffer from external interference.

- Regulatory Compliance Testing and Certification: EMI shielding products must undergo rigorous testing and certification processes to verify compliance with international standards. This includes testing for emission levels, absorption capabilities, and overall shielding effectiveness. Certification bodies evaluate products against standards such as FCC, CE, MIL-STD, and ISO requirements. Manufacturers must maintain documentation of compliance testing and regularly update certifications as standards evolve.

- Materials and Technologies for EMI Compliance: Various materials and technologies are employed to achieve EMI shielding compliance, including conductive coatings, metal enclosures, gaskets, and specialized fabrics. The selection of appropriate shielding materials depends on the frequency range, required attenuation levels, and environmental conditions. Advanced composite materials combining multiple shielding mechanisms can provide superior performance across broader frequency ranges while meeting regulatory requirements.

- EMI Compliance Management Systems: Organizations implement EMI compliance management systems to track, document, and ensure adherence to relevant standards and regulations. These systems include databases of applicable standards, testing protocols, compliance documentation, and certification records. Automated tools help monitor regulatory changes, schedule testing, and maintain compliance throughout product lifecycles, reducing the risk of non-compliance penalties and market access barriers.

- International EMI Shielding Regulatory Frameworks: EMI shielding compliance involves navigating complex international regulatory frameworks that vary by region and industry. Different countries and regions maintain their own standards and certification requirements, though many are harmonized with international standards. Companies operating globally must understand and comply with multiple regulatory regimes, including FCC regulations in the US, CE marking requirements in Europe, and country-specific standards in Asia and other regions.

02 Regulatory Compliance Testing and Certification

EMI shielding products and systems must undergo rigorous testing and certification processes to ensure compliance with international and regional standards. These processes involve measuring electromagnetic emissions and immunity levels under standardized test conditions. Certification marks from regulatory bodies are required before products can be marketed in specific regions, with different requirements for various industries such as consumer electronics, automotive, and medical devices.Expand Specific Solutions03 Global EMI Compliance Management Systems

Organizations implement comprehensive compliance management systems to track and ensure adherence to EMI shielding regulations across different markets. These systems help manage the complex landscape of international standards, documentation requirements, and certification processes. They often include databases of regulatory requirements, automated compliance checking tools, and workflow management for certification applications and renewals.Expand Specific Solutions04 EMI Shielding Materials and Technologies for Compliance

Advanced materials and technologies are developed specifically to meet EMI shielding regulatory requirements. These include conductive polymers, metal-infused composites, specialized coatings, and innovative design approaches. The selection of appropriate shielding materials depends on the specific compliance standards applicable to the product category, operating environment, and performance requirements.Expand Specific Solutions05 EMI Compliance Documentation and Reporting

Proper documentation and reporting are essential aspects of EMI shielding regulatory compliance. This includes maintaining technical files with test reports, compliance declarations, risk assessments, and design documentation. Automated systems help organizations generate required compliance reports, track regulatory changes, and maintain up-to-date documentation for audits and market surveillance authorities.Expand Specific Solutions

Leading EMI Compliance Solution Providers

The EMI Shielding Standards and Regulatory Compliance landscape is currently in a mature growth phase, with a global market valued at approximately $6.5 billion and projected to expand at a CAGR of 5-7% through 2028. Leading players like Laird Technologies and 3M have established strong positions through comprehensive shielding solutions that meet stringent international standards including IEC, FCC, and MIL-STD requirements. Technology maturity varies across sectors, with companies like Parker-Hannifin and TE Connectivity focusing on advanced composite materials for aerospace applications, while consumer electronics leaders such as Apple, Huawei, and Intel drive innovation in miniaturized shielding solutions. Emerging players like Nanotech Energy are disrupting the market with graphene-based EMI shielding technologies that offer superior performance characteristics while meeting evolving regulatory frameworks across global markets.

Laird Technologies, Inc.

Technical Solution: Laird Technologies has developed comprehensive EMI shielding solutions that comply with international standards including FCC Part 15, CISPR 22, and MIL-STD-461. Their approach integrates multiple shielding technologies including board-level shields (BLS), fabric-over-foam gaskets, and fingerstock contacts. Their ECCOSORB® microwave absorbing materials are specifically designed to address EMI issues in high-frequency applications (1-40 GHz range)[1]. Laird's compliance strategy involves a multi-layered defense system that combines conductive elastomers, metalized fabrics, and specialized coatings to achieve attenuation levels exceeding 80dB across a wide frequency spectrum[3]. They've also pioneered automated testing protocols that verify shielding effectiveness according to IEEE-STD-299 and EN 50147-1 standards, ensuring consistent regulatory compliance across global markets.

Strengths: Comprehensive portfolio covering multiple shielding technologies allows for customized solutions across diverse applications. Their global testing facilities enable rapid compliance verification for different regional standards. Weaknesses: Their high-performance solutions often come at premium price points compared to competitors, and some of their more advanced materials require specialized handling during installation.

3M Innovative Properties Co.

Technical Solution: 3M has developed a sophisticated EMI shielding technology portfolio that addresses regulatory compliance through multiple approaches. Their Electrically Conductive Adhesive Transfer Tapes (ECATTs) provide both bonding and EMI shielding in a single application, meeting IEC 61000-4-2 standards for electrostatic discharge protection[2]. 3M's unique approach includes their Dual Metallized Copper/Nickel fabric tapes that offer >85dB shielding effectiveness across 30MHz-10GHz frequency ranges, complying with FCC Part 15 and CISPR 22 requirements[4]. Their compliance strategy incorporates specialized EMI absorbing materials that convert electromagnetic energy into heat rather than reflecting it, addressing both conducted and radiated emissions standards. 3M has also pioneered lightweight aluminum foil-based solutions with proprietary adhesive systems that maintain grounding continuity while meeting UL 746C environmental standards and RoHS compliance requirements.

Strengths: Extensive materials science expertise allows for innovative adhesive-based solutions that simplify manufacturing processes. Their global regulatory knowledge ensures products meet standards across multiple jurisdictions. Weaknesses: Some solutions require precise application techniques to achieve specified performance levels, and their premium materials can increase overall product costs compared to basic shielding options.

Key EMI Mitigation Technologies Analysis

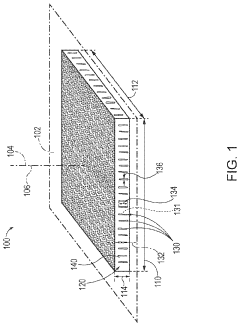

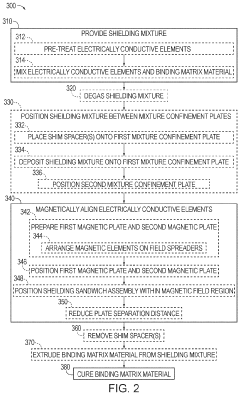

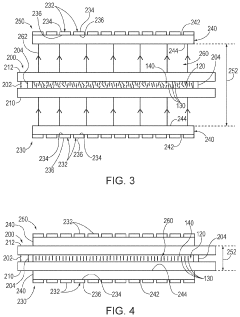

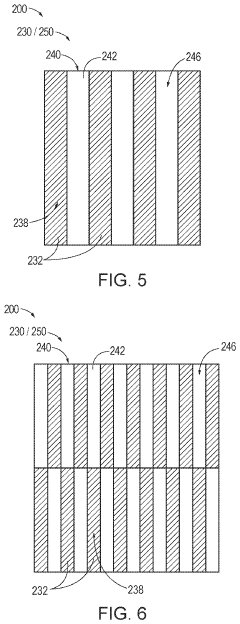

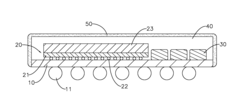

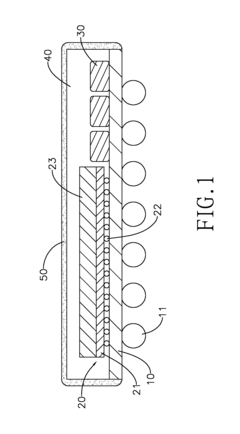

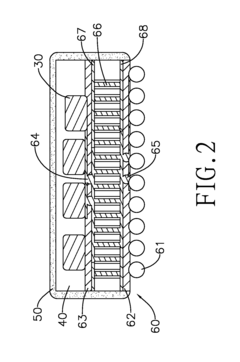

Electromagnetic interference shielding panels and associated methods

PatentActiveUS10856455B1

Innovation

- The development of EMI shielding panels comprising a binding matrix material with electrically conductive elements aligned parallel to a shielding axis, formed by magnetically aligning conductive elements within the matrix before curing, allowing for flexible and efficient attenuation of electromagnetic waves.

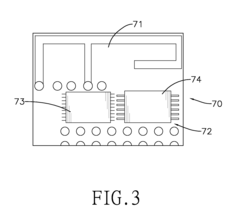

Electromagnetic interference shielding material, electromagnetic interference shielding device, method for making the electromagnetic interference shielding device, electromagnetic interference shielding package module and appliance

PatentInactiveUS20150085462A1

Innovation

- A mixture comprising 70 wt % to 98 wt % of dendritic copper filler, flaky copper filler, resin binder, and diluent is used to create an adjustable EMI shielding material that can be applied via screen printing or spraying, hardened at 120-160°C, providing effective shielding with adjustable thickness and low cost.

Regulatory Framework Across Industries

The regulatory landscape for EMI shielding spans multiple industries, each governed by distinct standards and compliance requirements. In the telecommunications sector, the International Telecommunication Union (ITU) establishes global standards, while regional bodies like the Federal Communications Commission (FCC) in the United States and the European Telecommunications Standards Institute (ETSI) in Europe enforce specific requirements for electromagnetic compatibility.

For medical devices, the regulatory framework is particularly stringent due to potential health implications. The FDA in the US requires compliance with IEC 60601-1-2 for medical electrical equipment, focusing on electromagnetic disturbances that could compromise device functionality and patient safety. Similarly, the EU Medical Device Regulation (MDR) mandates EMC testing as part of the conformity assessment process.

The automotive industry operates under standards such as CISPR 25 and ISO 11452, addressing both vehicle-level emissions and component-level susceptibility. As electric vehicles gain prominence, these regulations continue to evolve, with increased focus on high-voltage systems and charging infrastructure compatibility.

Aerospace and defense sectors follow MIL-STD-461 in the US and equivalent standards internationally, with particularly rigorous requirements for mission-critical systems. These standards address both conducted and radiated emissions across broad frequency ranges, with specialized testing protocols for airborne, ground, and naval applications.

Consumer electronics fall under broader EMC directives like FCC Part 15 in the US and the EMC Directive 2014/30/EU in Europe. These regulations establish limits for both intentional and unintentional radiators, with compliance verification through laboratory testing and documentation.

Industrial equipment manufacturers must navigate IEC 61000 series standards, which address electromagnetic compatibility in industrial environments characterized by high electromagnetic noise floors and potential interference sources. These standards include immunity requirements against power surges, electrostatic discharge, and radiated fields.

Cross-industry harmonization efforts are underway through organizations like the International Electrotechnical Commission (IEC) and the International Organization for Standardization (ISO), aiming to streamline compliance processes while maintaining protection against electromagnetic interference. This harmonization is particularly important for products deployed across multiple sectors or geographic regions.

For medical devices, the regulatory framework is particularly stringent due to potential health implications. The FDA in the US requires compliance with IEC 60601-1-2 for medical electrical equipment, focusing on electromagnetic disturbances that could compromise device functionality and patient safety. Similarly, the EU Medical Device Regulation (MDR) mandates EMC testing as part of the conformity assessment process.

The automotive industry operates under standards such as CISPR 25 and ISO 11452, addressing both vehicle-level emissions and component-level susceptibility. As electric vehicles gain prominence, these regulations continue to evolve, with increased focus on high-voltage systems and charging infrastructure compatibility.

Aerospace and defense sectors follow MIL-STD-461 in the US and equivalent standards internationally, with particularly rigorous requirements for mission-critical systems. These standards address both conducted and radiated emissions across broad frequency ranges, with specialized testing protocols for airborne, ground, and naval applications.

Consumer electronics fall under broader EMC directives like FCC Part 15 in the US and the EMC Directive 2014/30/EU in Europe. These regulations establish limits for both intentional and unintentional radiators, with compliance verification through laboratory testing and documentation.

Industrial equipment manufacturers must navigate IEC 61000 series standards, which address electromagnetic compatibility in industrial environments characterized by high electromagnetic noise floors and potential interference sources. These standards include immunity requirements against power surges, electrostatic discharge, and radiated fields.

Cross-industry harmonization efforts are underway through organizations like the International Electrotechnical Commission (IEC) and the International Organization for Standardization (ISO), aiming to streamline compliance processes while maintaining protection against electromagnetic interference. This harmonization is particularly important for products deployed across multiple sectors or geographic regions.

Testing Methodologies and Certification Processes

EMI shielding testing methodologies are structured around standardized procedures that ensure consistent and reliable evaluation of shielding effectiveness. The most widely adopted testing standard is MIL-STD-461, which provides comprehensive guidelines for measuring electromagnetic interference in military applications. This standard encompasses various test methods including RE102 for radiated emissions and RS103 for radiated susceptibility. For commercial applications, CISPR standards (particularly CISPR 22 and CISPR 24) establish testing protocols for information technology equipment, while IEC 61000 series addresses electromagnetic compatibility testing across diverse industrial sectors.

Testing procedures typically involve two primary measurement approaches: the shielded room method and the open field method. The shielded room method utilizes anechoic chambers to create controlled electromagnetic environments, eliminating external interference factors. This approach employs spectrum analyzers and network analyzers to measure shielding effectiveness across specified frequency ranges. Conversely, the open field method conducts measurements in real-world environments, providing practical insights into shielding performance under actual operating conditions.

The certification process for EMI shielding compliance follows a structured pathway beginning with pre-compliance testing, where manufacturers conduct internal evaluations to identify potential issues before formal assessment. This is followed by formal compliance testing at accredited laboratories, where products undergo rigorous examination against applicable standards. Testing laboratories must maintain ISO/IEC 17025 accreditation to ensure their competence in conducting EMI measurements.

Documentation requirements form a critical component of the certification process, including detailed test reports, technical construction files, and declarations of conformity. For products entering global markets, region-specific certifications become necessary, such as FCC certification for the United States, CE marking for European markets, and VCCI for Japan. The mutual recognition agreements between regulatory bodies in different regions can streamline this process, reducing redundant testing requirements.

Recent advancements in testing methodologies include the development of near-field scanning techniques, which enable precise identification of EMI leakage points during product development. Additionally, computational electromagnetic modeling is increasingly employed to predict shielding performance before physical prototyping, reducing development cycles and costs. These advanced techniques complement traditional testing methods, providing manufacturers with comprehensive tools to ensure regulatory compliance throughout the product development lifecycle.

Testing procedures typically involve two primary measurement approaches: the shielded room method and the open field method. The shielded room method utilizes anechoic chambers to create controlled electromagnetic environments, eliminating external interference factors. This approach employs spectrum analyzers and network analyzers to measure shielding effectiveness across specified frequency ranges. Conversely, the open field method conducts measurements in real-world environments, providing practical insights into shielding performance under actual operating conditions.

The certification process for EMI shielding compliance follows a structured pathway beginning with pre-compliance testing, where manufacturers conduct internal evaluations to identify potential issues before formal assessment. This is followed by formal compliance testing at accredited laboratories, where products undergo rigorous examination against applicable standards. Testing laboratories must maintain ISO/IEC 17025 accreditation to ensure their competence in conducting EMI measurements.

Documentation requirements form a critical component of the certification process, including detailed test reports, technical construction files, and declarations of conformity. For products entering global markets, region-specific certifications become necessary, such as FCC certification for the United States, CE marking for European markets, and VCCI for Japan. The mutual recognition agreements between regulatory bodies in different regions can streamline this process, reducing redundant testing requirements.

Recent advancements in testing methodologies include the development of near-field scanning techniques, which enable precise identification of EMI leakage points during product development. Additionally, computational electromagnetic modeling is increasingly employed to predict shielding performance before physical prototyping, reducing development cycles and costs. These advanced techniques complement traditional testing methods, providing manufacturers with comprehensive tools to ensure regulatory compliance throughout the product development lifecycle.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!