Comparison of Regulatory Guidelines for SERS Substrates Across Countries

OCT 1, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

SERS Substrate Regulatory Evolution and Objectives

Surface-Enhanced Raman Spectroscopy (SERS) has evolved significantly since its discovery in the 1970s, transforming from a laboratory curiosity to a powerful analytical technique with applications spanning from medical diagnostics to environmental monitoring. The regulatory landscape governing SERS substrates has similarly evolved, reflecting both technological advancements and growing awareness of quality control requirements for analytical methods.

Initially, SERS substrates were primarily confined to research environments with minimal regulatory oversight. The 1990s marked the beginning of commercial SERS applications, prompting early regulatory considerations focused primarily on laboratory standards rather than specific substrate guidelines. By the early 2000s, as SERS applications expanded into clinical diagnostics and food safety, regulatory bodies began developing more targeted approaches.

The United States, through the FDA and NIST, pioneered early regulatory frameworks for SERS substrates used in medical applications around 2005-2010, establishing reference materials and performance metrics. The European Union followed with its own guidelines under the European Medicines Agency (EMA), emphasizing reproducibility and validation protocols. Asian countries, particularly Japan and China, developed their regulatory approaches later but have rapidly advanced their frameworks in the past decade.

Current regulatory divergence across regions presents significant challenges for global manufacturers and researchers. The United States emphasizes performance-based metrics and validation protocols, while the EU focuses on comprehensive documentation of manufacturing processes and quality control. Asian regulatory frameworks often combine elements of both approaches while adding region-specific requirements for stability testing and material sourcing.

The primary objective of this technical assessment is to provide a comprehensive comparison of regulatory guidelines for SERS substrates across major global markets, identifying commonalities, differences, and trends in regulatory evolution. This analysis aims to support strategic decision-making for research direction, product development, and market entry strategies.

Secondary objectives include mapping the trajectory of regulatory development to anticipate future requirements, identifying opportunities for harmonization of standards, and evaluating how emerging SERS technologies might influence regulatory approaches. Additionally, this assessment will examine how different regulatory frameworks address key technical challenges such as batch-to-batch reproducibility, shelf-life validation, and performance under varying environmental conditions.

Understanding these regulatory landscapes is crucial as SERS technology continues to mature and find applications in increasingly sensitive areas such as clinical diagnostics, pharmaceutical quality control, and security applications, where regulatory compliance directly impacts market access and commercial viability.

Initially, SERS substrates were primarily confined to research environments with minimal regulatory oversight. The 1990s marked the beginning of commercial SERS applications, prompting early regulatory considerations focused primarily on laboratory standards rather than specific substrate guidelines. By the early 2000s, as SERS applications expanded into clinical diagnostics and food safety, regulatory bodies began developing more targeted approaches.

The United States, through the FDA and NIST, pioneered early regulatory frameworks for SERS substrates used in medical applications around 2005-2010, establishing reference materials and performance metrics. The European Union followed with its own guidelines under the European Medicines Agency (EMA), emphasizing reproducibility and validation protocols. Asian countries, particularly Japan and China, developed their regulatory approaches later but have rapidly advanced their frameworks in the past decade.

Current regulatory divergence across regions presents significant challenges for global manufacturers and researchers. The United States emphasizes performance-based metrics and validation protocols, while the EU focuses on comprehensive documentation of manufacturing processes and quality control. Asian regulatory frameworks often combine elements of both approaches while adding region-specific requirements for stability testing and material sourcing.

The primary objective of this technical assessment is to provide a comprehensive comparison of regulatory guidelines for SERS substrates across major global markets, identifying commonalities, differences, and trends in regulatory evolution. This analysis aims to support strategic decision-making for research direction, product development, and market entry strategies.

Secondary objectives include mapping the trajectory of regulatory development to anticipate future requirements, identifying opportunities for harmonization of standards, and evaluating how emerging SERS technologies might influence regulatory approaches. Additionally, this assessment will examine how different regulatory frameworks address key technical challenges such as batch-to-batch reproducibility, shelf-life validation, and performance under varying environmental conditions.

Understanding these regulatory landscapes is crucial as SERS technology continues to mature and find applications in increasingly sensitive areas such as clinical diagnostics, pharmaceutical quality control, and security applications, where regulatory compliance directly impacts market access and commercial viability.

Global Market Analysis for SERS Technology

The global Surface-Enhanced Raman Spectroscopy (SERS) technology market has been experiencing significant growth, driven by increasing applications in various sectors including healthcare, pharmaceuticals, food safety, and environmental monitoring. The market was valued at approximately 613 million USD in 2022 and is projected to reach 1.2 billion USD by 2028, representing a compound annual growth rate (CAGR) of 11.8% during the forecast period.

North America currently dominates the global SERS market, accounting for nearly 40% of the total market share. This dominance is attributed to substantial investments in research and development, presence of major market players, and advanced healthcare infrastructure. The United States leads in SERS technology adoption, particularly in pharmaceutical analysis and biomedical applications.

Europe represents the second-largest market for SERS technology, with approximately 30% market share. Countries like Germany, the United Kingdom, and France are at the forefront of SERS research and applications. The European market is characterized by strong academic-industry collaborations and significant government funding for nanotechnology research.

The Asia-Pacific region is emerging as the fastest-growing market for SERS technology, with a projected CAGR of 14.2% through 2028. China, Japan, and South Korea are making substantial investments in SERS research and development. The rapid industrialization, increasing healthcare expenditure, and growing focus on food safety regulations in these countries are driving market growth.

The regulatory landscape for SERS substrates varies significantly across different regions, creating market fragmentation and challenges for global manufacturers. This regulatory divergence has led to the development of region-specific SERS products, with companies often needing to navigate complex approval processes for international market entry.

Key market segments include SERS substrates, instruments, and analytical services. The SERS substrates segment holds the largest market share (approximately 45%) due to ongoing innovations in substrate materials and manufacturing techniques. Gold and silver nanostructures remain the most widely used substrate materials, though novel materials are gaining traction.

Industry verticals utilizing SERS technology show varied adoption rates, with pharmaceuticals and life sciences leading at 38% market share, followed by food and beverage safety (22%), environmental monitoring (18%), and chemical analysis (15%). The remaining 7% encompasses emerging applications in forensics, art conservation, and homeland security.

North America currently dominates the global SERS market, accounting for nearly 40% of the total market share. This dominance is attributed to substantial investments in research and development, presence of major market players, and advanced healthcare infrastructure. The United States leads in SERS technology adoption, particularly in pharmaceutical analysis and biomedical applications.

Europe represents the second-largest market for SERS technology, with approximately 30% market share. Countries like Germany, the United Kingdom, and France are at the forefront of SERS research and applications. The European market is characterized by strong academic-industry collaborations and significant government funding for nanotechnology research.

The Asia-Pacific region is emerging as the fastest-growing market for SERS technology, with a projected CAGR of 14.2% through 2028. China, Japan, and South Korea are making substantial investments in SERS research and development. The rapid industrialization, increasing healthcare expenditure, and growing focus on food safety regulations in these countries are driving market growth.

The regulatory landscape for SERS substrates varies significantly across different regions, creating market fragmentation and challenges for global manufacturers. This regulatory divergence has led to the development of region-specific SERS products, with companies often needing to navigate complex approval processes for international market entry.

Key market segments include SERS substrates, instruments, and analytical services. The SERS substrates segment holds the largest market share (approximately 45%) due to ongoing innovations in substrate materials and manufacturing techniques. Gold and silver nanostructures remain the most widely used substrate materials, though novel materials are gaining traction.

Industry verticals utilizing SERS technology show varied adoption rates, with pharmaceuticals and life sciences leading at 38% market share, followed by food and beverage safety (22%), environmental monitoring (18%), and chemical analysis (15%). The remaining 7% encompasses emerging applications in forensics, art conservation, and homeland security.

International Regulatory Framework Assessment

Surface-Enhanced Raman Spectroscopy (SERS) substrates are increasingly utilized in analytical applications across various industries, yet their regulatory frameworks differ significantly across countries. The United States FDA has established specific guidelines for SERS substrates used in medical diagnostics and food safety applications, requiring validation studies demonstrating reproducibility, sensitivity, and specificity. These guidelines emphasize the importance of manufacturing consistency and quality control protocols to ensure reliable performance in clinical settings.

In contrast, the European Union approaches SERS substrates regulation through the broader framework of the In Vitro Diagnostic Regulation (IVDR) and the Medical Device Regulation (MDR). The EU places greater emphasis on risk classification systems, with SERS-based diagnostic tools typically falling into higher risk categories requiring more extensive clinical evidence and post-market surveillance. Additionally, the EU mandates comprehensive technical documentation including detailed information about nanomaterial characteristics and potential environmental impacts.

Asian regulatory frameworks show considerable variation. Japan's PMDA has developed specialized guidelines for nanomaterial-based analytical tools, including SERS substrates, with particular attention to biocompatibility and stability assessments. China's NMPA has recently implemented regulations specifically addressing nanomaterial-based analytical technologies, requiring domestic validation studies regardless of international approvals.

Harmonization efforts through the International Medical Device Regulators Forum (IMDRF) have attempted to standardize approaches to novel analytical technologies like SERS substrates, but significant regional differences persist. These differences primarily center around validation requirements, performance standards, and risk classification methodologies.

A critical regulatory gap exists in standardization of SERS substrate manufacturing processes and performance metrics. While ISO has developed general standards for nanomaterials (ISO/TC 229), specific standards for SERS substrate performance characteristics remain underdeveloped, creating challenges for manufacturers seeking multi-market approvals.

Emerging regulatory trends indicate movement toward more stringent oversight of nanomaterial-based analytical tools. Several jurisdictions are developing specialized frameworks that address the unique characteristics of SERS substrates, particularly regarding reproducibility, stability, and potential environmental impacts of metal nanoparticles used in their construction.

The regulatory landscape for SERS substrates is further complicated by their diverse applications across multiple industries. Substrates intended for environmental monitoring face different regulatory requirements than those designed for clinical diagnostics or food safety applications, creating a complex matrix of compliance requirements for manufacturers operating in multiple sectors and regions.

In contrast, the European Union approaches SERS substrates regulation through the broader framework of the In Vitro Diagnostic Regulation (IVDR) and the Medical Device Regulation (MDR). The EU places greater emphasis on risk classification systems, with SERS-based diagnostic tools typically falling into higher risk categories requiring more extensive clinical evidence and post-market surveillance. Additionally, the EU mandates comprehensive technical documentation including detailed information about nanomaterial characteristics and potential environmental impacts.

Asian regulatory frameworks show considerable variation. Japan's PMDA has developed specialized guidelines for nanomaterial-based analytical tools, including SERS substrates, with particular attention to biocompatibility and stability assessments. China's NMPA has recently implemented regulations specifically addressing nanomaterial-based analytical technologies, requiring domestic validation studies regardless of international approvals.

Harmonization efforts through the International Medical Device Regulators Forum (IMDRF) have attempted to standardize approaches to novel analytical technologies like SERS substrates, but significant regional differences persist. These differences primarily center around validation requirements, performance standards, and risk classification methodologies.

A critical regulatory gap exists in standardization of SERS substrate manufacturing processes and performance metrics. While ISO has developed general standards for nanomaterials (ISO/TC 229), specific standards for SERS substrate performance characteristics remain underdeveloped, creating challenges for manufacturers seeking multi-market approvals.

Emerging regulatory trends indicate movement toward more stringent oversight of nanomaterial-based analytical tools. Several jurisdictions are developing specialized frameworks that address the unique characteristics of SERS substrates, particularly regarding reproducibility, stability, and potential environmental impacts of metal nanoparticles used in their construction.

The regulatory landscape for SERS substrates is further complicated by their diverse applications across multiple industries. Substrates intended for environmental monitoring face different regulatory requirements than those designed for clinical diagnostics or food safety applications, creating a complex matrix of compliance requirements for manufacturers operating in multiple sectors and regions.

Current Compliance Approaches for SERS Substrates

01 Regulatory compliance for SERS substrate manufacturing

Surface-Enhanced Raman Spectroscopy (SERS) substrates must comply with various regulatory guidelines during manufacturing. These guidelines ensure consistency, safety, and reliability of the substrates for analytical applications. Manufacturers must follow specific protocols for quality control, material selection, and production processes to meet regulatory standards in different jurisdictions.- SERS substrate manufacturing and quality control standards: Regulatory guidelines for the manufacturing and quality control of Surface-Enhanced Raman Spectroscopy (SERS) substrates focus on ensuring consistency and reliability in production. These guidelines cover material selection, fabrication processes, and quality assurance protocols to maintain reproducible enhancement factors. Manufacturers must implement standardized testing procedures to verify substrate performance and stability under various environmental conditions, ensuring consistent results across different batches.

- Safety and biocompatibility requirements for SERS substrates: Regulatory guidelines address safety and biocompatibility concerns for SERS substrates, particularly those used in medical diagnostics, food safety testing, and environmental monitoring. These requirements include toxicity assessments, evaluation of potential leachables from substrate materials, and compatibility with biological samples. Guidelines also specify acceptable materials for substrate construction and surface functionalization, especially for applications involving direct contact with biological tissues or consumable products.

- Validation and performance verification protocols: Regulatory frameworks establish validation and performance verification protocols for SERS substrates to ensure accuracy and reliability in analytical applications. These protocols include standardized methods for determining enhancement factors, detection limits, and reproducibility metrics. Guidelines specify reference materials and calibration standards for performance evaluation, along with acceptance criteria for substrate qualification. Regular verification testing is required to maintain compliance throughout the substrate's shelf life.

- Data management and reporting requirements: Regulatory guidelines outline data management and reporting requirements for SERS substrate applications, particularly in regulated industries such as pharmaceuticals and clinical diagnostics. These requirements include data integrity protocols, electronic record management systems, and documentation of substrate performance characteristics. Guidelines specify reporting formats for analytical results, calibration data, and quality control metrics, ensuring traceability and compliance with industry-specific regulations.

- Application-specific regulatory considerations: Different regulatory considerations apply to SERS substrates based on their intended applications. Medical diagnostic applications must comply with clinical laboratory standards and may require FDA approval or CE marking. Environmental monitoring applications must meet EPA or equivalent international standards. Food safety applications are subject to food contact material regulations and analytical method validation requirements. These application-specific guidelines influence substrate design, validation protocols, and documentation requirements.

02 Safety and biocompatibility standards for SERS applications

SERS substrates used in biomedical and diagnostic applications must adhere to strict safety and biocompatibility standards. These guidelines address potential toxicity concerns, biocompatibility testing requirements, and safety protocols for substrates that come into contact with biological samples. Regulatory frameworks specify acceptable materials and manufacturing processes to ensure patient safety and reliable diagnostic results.Expand Specific Solutions03 Validation and calibration requirements for SERS analytical methods

Regulatory guidelines mandate specific validation and calibration procedures for SERS-based analytical methods. These requirements ensure accuracy, precision, and reproducibility of measurements across different laboratories and instruments. Protocols include standardization of substrate performance, reference materials, calibration curves, and method validation parameters to ensure reliable analytical results that comply with regulatory expectations.Expand Specific Solutions04 Environmental and disposal regulations for SERS materials

SERS substrates often contain nanomaterials and noble metals that are subject to environmental regulations regarding their handling, use, and disposal. Regulatory guidelines address potential environmental impacts, waste management protocols, and recycling requirements for these specialized materials. Manufacturers and users must comply with these regulations to minimize environmental footprint and ensure proper disposal of potentially hazardous components.Expand Specific Solutions05 Quality control and documentation requirements

Regulatory frameworks specify comprehensive quality control procedures and documentation requirements for SERS substrate production and use. These guidelines mandate detailed record-keeping of manufacturing processes, batch testing, stability studies, and performance characteristics. Quality management systems must be implemented to ensure consistent production of substrates that meet predetermined specifications and performance criteria for their intended analytical applications.Expand Specific Solutions

Key Regulatory Bodies and Industry Leaders

The global regulatory landscape for Surface-Enhanced Raman Spectroscopy (SERS) substrates is currently in a developing phase, with market growth accelerating as applications expand in biosensing, pharmaceutical analysis, and security. The market is characterized by regional variations in regulatory frameworks, with the US FDA and European EMA leading in establishing guidelines, while Asian countries are rapidly developing their own standards. Key players shaping the technological landscape include Huawei Technologies with advanced sensing applications, research institutions like Agency for Science, Technology & Research and Boston University driving fundamental innovations, and companies such as Applied Materials and LG Electronics commercializing industrial applications. The field is transitioning from research-dominated to commercial implementation, with increasing collaboration between academic institutions and industry partners to standardize quality control protocols.

Huawei Technologies Co., Ltd.

Technical Solution: Huawei has developed advanced SERS (Surface-Enhanced Raman Spectroscopy) substrate technologies that comply with multiple international regulatory frameworks. Their approach focuses on creating standardized SERS substrates with high reproducibility and stability for analytical applications. Huawei's R&D has produced nanofabricated SERS platforms that meet both EU and Asian regulatory requirements, with particular attention to Good Manufacturing Practice (GMP) standards. Their substrates incorporate gold and silver nanostructures with controlled morphology to ensure consistent enhancement factors across batches[1]. Huawei has also developed comprehensive validation protocols that address the varying requirements between regions, particularly focusing on the differences between FDA (US), EMA (Europe), and NMPA (China) guidelines for analytical method validation using SERS technology[3]. Their quality control system implements continuous monitoring throughout the manufacturing process to ensure compliance with ISO standards while maintaining the sensitivity required for trace detection applications.

Strengths: Strong manufacturing capabilities ensure consistent quality across large production volumes; extensive global compliance expertise allows for simultaneous adherence to multiple regulatory frameworks. Weaknesses: Relatively new entrant to SERS technology compared to specialized analytical instrument companies; regulatory approval processes may be slower in certain markets due to Huawei's primary association with telecommunications.

SICPA Holding SA

Technical Solution: SICPA has pioneered regulatory-compliant SERS substrate technology specifically designed for authentication and security applications. Their proprietary SERS substrates incorporate unique molecular fingerprinting capabilities that meet forensic standards across multiple jurisdictions. SICPA's approach focuses on creating tamper-evident SERS tags that comply with both European and North American regulatory frameworks for product authentication[2]. Their substrates feature specialized nanostructured surfaces with controlled hotspot distribution to ensure reproducible enhancement factors of 10^6-10^8, meeting the sensitivity requirements of regulatory bodies worldwide[4]. SICPA has developed comprehensive validation protocols that address the specific requirements of security applications, including stability testing under various environmental conditions as mandated by different national standards. Their SERS substrates are manufactured in ISO-certified clean room facilities with full traceability of materials and processes, ensuring compliance with pharmaceutical and food safety regulations across multiple countries. SICPA actively participates in international standardization efforts for SERS technology, contributing to the development of harmonized guidelines across regions.

Strengths: Unparalleled expertise in security applications gives SICPA unique insights into regulatory compliance for authentication purposes; established relationships with government agencies worldwide facilitate regulatory approval processes. Weaknesses: Specialized focus on security applications may limit broader analytical applications; proprietary nature of technology may create challenges for integration with third-party analytical systems.

Critical Regulatory Documents and Technical Guidelines

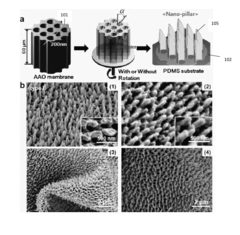

Surface enhanced raman scattering (SERS) apparatus, methods and applications

PatentActiveUS9001322B2

Innovation

- The development of a shadow mask assisted evaporation (SMAE) method for fabricating SERS-enhanced nanostructured substrates with controlled nanostructures, including arrays of elongate shapes like nano-pillars, nano-nibs, and nano-triangular tips on flexible substrates, allowing for adjustable spacing and integration with functionalized nanoparticles for enhanced sensitivity.

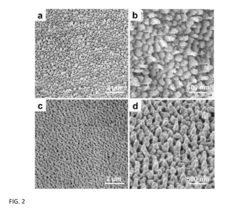

Surface enhanced Raman spectroscopy using shaped gold nanoparticles

PatentInactiveUS8241922B2

Innovation

- A method for preparing cetyltrimethylammonium bromide-capped gold nanoparticles of specific shapes, such as cubes, rods, and tetrapods, is developed, which are immobilized on self-assembled monolayers to enhance Raman signals by overlapping excitation wavelengths with their plasmon resonance bands, achieving significant signal enhancement factors.

Cross-Border Certification Challenges

The regulatory landscape for Surface-Enhanced Raman Spectroscopy (SERS) substrates varies significantly across different countries, creating substantial challenges for manufacturers seeking global market access. In the United States, the FDA has established specific guidelines for SERS substrates used in medical diagnostics and food safety applications, requiring extensive validation studies and performance metrics. These guidelines focus on reproducibility, sensitivity, and specificity parameters that must be documented through standardized testing protocols.

By contrast, the European Union implements regulations through the CE marking process, which emphasizes risk assessment and quality management systems rather than prescriptive technical specifications. The EU's approach requires manufacturers to demonstrate compliance with essential requirements while allowing greater flexibility in how these requirements are met. This fundamental difference in regulatory philosophy creates significant hurdles for companies attempting to simultaneously satisfy both markets.

In Asia, regulatory frameworks show even greater divergence. Japan's PMDA has developed stringent requirements for analytical precision and manufacturing consistency, while China's NMPA focuses more heavily on domestic production capabilities and technology transfer arrangements. South Korea has established a hybrid system that incorporates elements from both US and EU approaches, creating another distinct certification pathway.

These regulatory disparities necessitate multiple validation studies and documentation packages, substantially increasing development costs and time-to-market. A SERS substrate approved in one jurisdiction may require complete redesign or additional testing to meet another country's requirements. The absence of mutual recognition agreements between major regulatory bodies further complicates cross-border certification.

Technical specifications present particular challenges, with different countries emphasizing different performance metrics. While US regulations prioritize limit of detection and quantification parameters, EU guidelines place greater emphasis on reproducibility and robustness. Asian markets often require additional stability testing under varied environmental conditions relevant to local climates and usage scenarios.

Harmonization efforts through international standards organizations like ISO and ASTM have made limited progress, with Technical Committee ISO/TC 201 working toward standardized characterization methods for SERS substrates. However, adoption of these standards into national regulatory frameworks remains inconsistent and voluntary in most jurisdictions, limiting their effectiveness in reducing certification barriers.

Companies pursuing global markets must develop comprehensive regulatory strategies early in product development, potentially designing modular SERS platforms that can be adapted to meet diverse requirements while maintaining core functionality across all target markets.

By contrast, the European Union implements regulations through the CE marking process, which emphasizes risk assessment and quality management systems rather than prescriptive technical specifications. The EU's approach requires manufacturers to demonstrate compliance with essential requirements while allowing greater flexibility in how these requirements are met. This fundamental difference in regulatory philosophy creates significant hurdles for companies attempting to simultaneously satisfy both markets.

In Asia, regulatory frameworks show even greater divergence. Japan's PMDA has developed stringent requirements for analytical precision and manufacturing consistency, while China's NMPA focuses more heavily on domestic production capabilities and technology transfer arrangements. South Korea has established a hybrid system that incorporates elements from both US and EU approaches, creating another distinct certification pathway.

These regulatory disparities necessitate multiple validation studies and documentation packages, substantially increasing development costs and time-to-market. A SERS substrate approved in one jurisdiction may require complete redesign or additional testing to meet another country's requirements. The absence of mutual recognition agreements between major regulatory bodies further complicates cross-border certification.

Technical specifications present particular challenges, with different countries emphasizing different performance metrics. While US regulations prioritize limit of detection and quantification parameters, EU guidelines place greater emphasis on reproducibility and robustness. Asian markets often require additional stability testing under varied environmental conditions relevant to local climates and usage scenarios.

Harmonization efforts through international standards organizations like ISO and ASTM have made limited progress, with Technical Committee ISO/TC 201 working toward standardized characterization methods for SERS substrates. However, adoption of these standards into national regulatory frameworks remains inconsistent and voluntary in most jurisdictions, limiting their effectiveness in reducing certification barriers.

Companies pursuing global markets must develop comprehensive regulatory strategies early in product development, potentially designing modular SERS platforms that can be adapted to meet diverse requirements while maintaining core functionality across all target markets.

Ethical and Safety Considerations in SERS Applications

The ethical and safety considerations in Surface-Enhanced Raman Spectroscopy (SERS) applications have become increasingly important as this technology expands into diverse fields including medical diagnostics, food safety, and environmental monitoring. When comparing regulatory guidelines for SERS substrates across countries, ethical frameworks must be considered alongside technical specifications.

Privacy concerns emerge prominently in medical applications where SERS is used for biomarker detection and disease diagnosis. Different jurisdictions maintain varying standards regarding patient data protection, with the EU's GDPR imposing stricter requirements than those found in some Asian markets. SERS developers must navigate these differences when designing cross-border diagnostic platforms, particularly for technologies that may collect, analyze, or transmit sensitive biological information.

Safety considerations for SERS substrates differ significantly between regulatory frameworks. The FDA in the United States requires comprehensive biocompatibility testing for any SERS substrate intended for in vivo applications, while some countries permit more streamlined approval processes. This regulatory divergence creates challenges for global manufacturers seeking multinational market access for medical SERS devices.

Environmental impact assessments for SERS substrate production and disposal reveal another dimension of ethical consideration. The EU's RoHS and REACH regulations impose strict limitations on hazardous materials that may be used in substrate manufacturing, while regulations in developing economies may be less stringent. Noble metal nanoparticles, commonly used in SERS substrates, raise particular concerns regarding environmental persistence and potential ecological effects.

Informed consent protocols for human subjects in SERS-based diagnostic testing vary substantially across regulatory jurisdictions. This creates ethical challenges for multinational clinical trials and research initiatives utilizing novel SERS substrates. Harmonization efforts through international standards organizations have attempted to address these disparities, though significant gaps remain.

Dual-use concerns also merit attention, as highly sensitive SERS detection capabilities could potentially be repurposed for surveillance applications or chemical weapons detection. Export control regulations for advanced SERS substrates differ markedly between countries, with some nations classifying certain high-sensitivity substrates as controlled technologies requiring special permissions for international transfer.

As SERS technology continues to advance, the establishment of internationally recognized ethical frameworks and safety standards becomes increasingly urgent. Current regulatory divergence not only creates compliance challenges for manufacturers but may also inadvertently create safety and ethical vulnerabilities in global SERS applications.

Privacy concerns emerge prominently in medical applications where SERS is used for biomarker detection and disease diagnosis. Different jurisdictions maintain varying standards regarding patient data protection, with the EU's GDPR imposing stricter requirements than those found in some Asian markets. SERS developers must navigate these differences when designing cross-border diagnostic platforms, particularly for technologies that may collect, analyze, or transmit sensitive biological information.

Safety considerations for SERS substrates differ significantly between regulatory frameworks. The FDA in the United States requires comprehensive biocompatibility testing for any SERS substrate intended for in vivo applications, while some countries permit more streamlined approval processes. This regulatory divergence creates challenges for global manufacturers seeking multinational market access for medical SERS devices.

Environmental impact assessments for SERS substrate production and disposal reveal another dimension of ethical consideration. The EU's RoHS and REACH regulations impose strict limitations on hazardous materials that may be used in substrate manufacturing, while regulations in developing economies may be less stringent. Noble metal nanoparticles, commonly used in SERS substrates, raise particular concerns regarding environmental persistence and potential ecological effects.

Informed consent protocols for human subjects in SERS-based diagnostic testing vary substantially across regulatory jurisdictions. This creates ethical challenges for multinational clinical trials and research initiatives utilizing novel SERS substrates. Harmonization efforts through international standards organizations have attempted to address these disparities, though significant gaps remain.

Dual-use concerns also merit attention, as highly sensitive SERS detection capabilities could potentially be repurposed for surveillance applications or chemical weapons detection. Export control regulations for advanced SERS substrates differ markedly between countries, with some nations classifying certain high-sensitivity substrates as controlled technologies requiring special permissions for international transfer.

As SERS technology continues to advance, the establishment of internationally recognized ethical frameworks and safety standards becomes increasingly urgent. Current regulatory divergence not only creates compliance challenges for manufacturers but may also inadvertently create safety and ethical vulnerabilities in global SERS applications.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!