Role of Patents in SERS Substrate Technology Advancement

OCT 1, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

SERS Substrate Technology Background and Objectives

Surface-Enhanced Raman Spectroscopy (SERS) has evolved significantly since its discovery in the 1970s, transforming from an interesting scientific phenomenon to a powerful analytical technique with diverse applications. The technology leverages the interaction between light and molecules adsorbed on specially designed metallic surfaces, resulting in signal enhancements of up to 10^14 times compared to conventional Raman spectroscopy. This remarkable enhancement enables detection capabilities at single-molecule levels, positioning SERS as a revolutionary tool in analytical chemistry, biosensing, and medical diagnostics.

The development of SERS substrate technology has been characterized by continuous innovation driven by both academic research and industrial applications. Early substrates consisted primarily of roughened metal surfaces, while contemporary solutions incorporate sophisticated nanofabrication techniques to create precisely engineered structures. This evolution has been significantly shaped by patent activities, which have both protected intellectual property and stimulated further technological advancement through disclosure requirements.

Patents in SERS substrate technology serve multiple crucial functions in the innovation ecosystem. They provide temporary monopoly rights to inventors, incentivizing investment in research and development while simultaneously creating a structured framework for knowledge dissemination. The patent literature constitutes a valuable repository of technical information, revealing design principles, fabrication methods, and application strategies that might otherwise remain proprietary secrets.

The primary objective of this technical research report is to comprehensively analyze how patent activities have influenced the trajectory of SERS substrate technology development. We aim to identify key technological milestones documented in patents, examine how patent strategies have evolved over time, and assess the relationship between patent activities and commercial success in this field. Additionally, we seek to understand how patents have facilitated or hindered technology transfer between academic institutions and industry partners.

Current trends indicate an acceleration in SERS substrate patent filings globally, with particular growth in applications related to point-of-care diagnostics, environmental monitoring, and food safety testing. The geographical distribution of patent activities has also shifted, with significant increases in filings from China and South Korea complementing the traditionally strong patent portfolios from the United States, Europe, and Japan.

Looking forward, this report will explore how emerging patent landscapes might shape future SERS substrate innovations, particularly in areas such as flexible substrates, mass-producible designs, and substrate standardization. Understanding these patent dynamics is essential for strategic planning in both research institutions and commercial enterprises seeking to navigate this rapidly evolving technological domain.

The development of SERS substrate technology has been characterized by continuous innovation driven by both academic research and industrial applications. Early substrates consisted primarily of roughened metal surfaces, while contemporary solutions incorporate sophisticated nanofabrication techniques to create precisely engineered structures. This evolution has been significantly shaped by patent activities, which have both protected intellectual property and stimulated further technological advancement through disclosure requirements.

Patents in SERS substrate technology serve multiple crucial functions in the innovation ecosystem. They provide temporary monopoly rights to inventors, incentivizing investment in research and development while simultaneously creating a structured framework for knowledge dissemination. The patent literature constitutes a valuable repository of technical information, revealing design principles, fabrication methods, and application strategies that might otherwise remain proprietary secrets.

The primary objective of this technical research report is to comprehensively analyze how patent activities have influenced the trajectory of SERS substrate technology development. We aim to identify key technological milestones documented in patents, examine how patent strategies have evolved over time, and assess the relationship between patent activities and commercial success in this field. Additionally, we seek to understand how patents have facilitated or hindered technology transfer between academic institutions and industry partners.

Current trends indicate an acceleration in SERS substrate patent filings globally, with particular growth in applications related to point-of-care diagnostics, environmental monitoring, and food safety testing. The geographical distribution of patent activities has also shifted, with significant increases in filings from China and South Korea complementing the traditionally strong patent portfolios from the United States, Europe, and Japan.

Looking forward, this report will explore how emerging patent landscapes might shape future SERS substrate innovations, particularly in areas such as flexible substrates, mass-producible designs, and substrate standardization. Understanding these patent dynamics is essential for strategic planning in both research institutions and commercial enterprises seeking to navigate this rapidly evolving technological domain.

Market Analysis for SERS-Based Applications

The SERS (Surface-Enhanced Raman Spectroscopy) technology market has witnessed significant growth in recent years, driven by increasing applications across multiple industries. The global SERS market was valued at approximately $103 million in 2020 and is projected to reach $257 million by 2025, representing a compound annual growth rate (CAGR) of 20.1%. This robust growth trajectory underscores the expanding commercial potential of SERS-based applications.

Healthcare and life sciences currently dominate the SERS application landscape, accounting for nearly 45% of the market share. The ability of SERS to provide highly sensitive molecular detection has proven invaluable for biomarker identification, drug discovery, and disease diagnosis. Particularly noteworthy is the growing adoption of SERS in point-of-care diagnostics, where rapid and accurate detection capabilities address critical healthcare needs.

The pharmaceutical industry represents another significant market segment, utilizing SERS technology for drug development, quality control, and counterfeit detection. This sector is expected to grow at a CAGR of 22.3% through 2025, fueled by increasing regulatory requirements for pharmaceutical authentication and quality assurance.

Environmental monitoring applications of SERS have gained substantial traction, with a market share of approximately 15%. The technology's capability to detect trace contaminants in water, soil, and air has positioned it as a valuable tool for environmental regulatory compliance and public safety monitoring. This segment is projected to expand significantly as environmental regulations become more stringent globally.

Food safety represents an emerging application area with considerable growth potential. SERS-based detection of pesticides, antibiotics, and foodborne pathogens addresses critical concerns in the food supply chain. Market analysts predict this segment will grow at a CAGR of 25.7% over the next five years, outpacing the overall SERS market growth.

Geographically, North America leads the SERS market with approximately 38% share, followed by Europe (29%) and Asia-Pacific (24%). However, the Asia-Pacific region is experiencing the fastest growth rate, driven by increasing R&D investments in China, Japan, and South Korea, along with expanding industrial applications.

The competitive landscape features both established analytical instrument manufacturers and specialized SERS technology providers. Key market players are increasingly focusing on developing application-specific SERS substrate solutions to address unique industry requirements, indicating a shift toward market specialization rather than generic technology offerings.

Healthcare and life sciences currently dominate the SERS application landscape, accounting for nearly 45% of the market share. The ability of SERS to provide highly sensitive molecular detection has proven invaluable for biomarker identification, drug discovery, and disease diagnosis. Particularly noteworthy is the growing adoption of SERS in point-of-care diagnostics, where rapid and accurate detection capabilities address critical healthcare needs.

The pharmaceutical industry represents another significant market segment, utilizing SERS technology for drug development, quality control, and counterfeit detection. This sector is expected to grow at a CAGR of 22.3% through 2025, fueled by increasing regulatory requirements for pharmaceutical authentication and quality assurance.

Environmental monitoring applications of SERS have gained substantial traction, with a market share of approximately 15%. The technology's capability to detect trace contaminants in water, soil, and air has positioned it as a valuable tool for environmental regulatory compliance and public safety monitoring. This segment is projected to expand significantly as environmental regulations become more stringent globally.

Food safety represents an emerging application area with considerable growth potential. SERS-based detection of pesticides, antibiotics, and foodborne pathogens addresses critical concerns in the food supply chain. Market analysts predict this segment will grow at a CAGR of 25.7% over the next five years, outpacing the overall SERS market growth.

Geographically, North America leads the SERS market with approximately 38% share, followed by Europe (29%) and Asia-Pacific (24%). However, the Asia-Pacific region is experiencing the fastest growth rate, driven by increasing R&D investments in China, Japan, and South Korea, along with expanding industrial applications.

The competitive landscape features both established analytical instrument manufacturers and specialized SERS technology providers. Key market players are increasingly focusing on developing application-specific SERS substrate solutions to address unique industry requirements, indicating a shift toward market specialization rather than generic technology offerings.

Global SERS Substrate Development Status and Challenges

Surface-Enhanced Raman Spectroscopy (SERS) substrate technology has witnessed significant global development over the past two decades, yet faces persistent challenges that impede its widespread commercial adoption. Currently, research institutions and companies across North America, Europe, and Asia are actively engaged in advancing SERS substrate technologies, with notable concentrations in the United States, China, and several European countries including Germany and the United Kingdom.

The global landscape reveals varying approaches to SERS substrate development. North American research primarily focuses on novel nanofabrication techniques and high-sensitivity applications in biomedical diagnostics. European institutions emphasize reproducibility and standardization protocols, while Asian research centers, particularly in China and South Korea, have made remarkable progress in cost-effective manufacturing methods and flexible substrate designs.

Despite these advancements, several critical challenges persist across the global SERS community. Reproducibility remains the foremost technical hurdle, as many substrate fabrication methods produce inconsistent enhancement factors between batches. This variability significantly limits quantitative analysis applications and hampers industrial adoption. The enhancement factor stability over time presents another major challenge, with many substrates exhibiting performance degradation during storage or under operational conditions.

Cost-effectiveness represents a substantial barrier to commercialization, particularly for high-precision nanofabricated substrates that require sophisticated equipment and controlled environments. While some low-cost alternatives have emerged, they typically sacrifice performance or reproducibility, creating an unresolved tension between accessibility and reliability.

Scalability challenges further complicate the industrial implementation of SERS technology. Many laboratory-developed substrates demonstrate excellent performance at small scales but encounter significant difficulties when scaled to production volumes. The translation of patented technologies from research settings to manufacturing environments often reveals unforeseen complications in maintaining consistent quality across larger production batches.

Regulatory considerations vary significantly across regions, creating additional complexity for global commercialization efforts. The lack of standardized testing protocols and performance metrics makes cross-comparison between different substrate technologies particularly challenging, hindering informed decision-making by potential industrial adopters.

Patent landscapes reveal geographical disparities in innovation focus, with U.S. patents predominantly addressing novel nanomaterial compositions, while Chinese patents emphasize manufacturing process improvements. This divergence creates opportunities for strategic collaboration but also potential barriers in technology transfer and implementation across markets.

The global landscape reveals varying approaches to SERS substrate development. North American research primarily focuses on novel nanofabrication techniques and high-sensitivity applications in biomedical diagnostics. European institutions emphasize reproducibility and standardization protocols, while Asian research centers, particularly in China and South Korea, have made remarkable progress in cost-effective manufacturing methods and flexible substrate designs.

Despite these advancements, several critical challenges persist across the global SERS community. Reproducibility remains the foremost technical hurdle, as many substrate fabrication methods produce inconsistent enhancement factors between batches. This variability significantly limits quantitative analysis applications and hampers industrial adoption. The enhancement factor stability over time presents another major challenge, with many substrates exhibiting performance degradation during storage or under operational conditions.

Cost-effectiveness represents a substantial barrier to commercialization, particularly for high-precision nanofabricated substrates that require sophisticated equipment and controlled environments. While some low-cost alternatives have emerged, they typically sacrifice performance or reproducibility, creating an unresolved tension between accessibility and reliability.

Scalability challenges further complicate the industrial implementation of SERS technology. Many laboratory-developed substrates demonstrate excellent performance at small scales but encounter significant difficulties when scaled to production volumes. The translation of patented technologies from research settings to manufacturing environments often reveals unforeseen complications in maintaining consistent quality across larger production batches.

Regulatory considerations vary significantly across regions, creating additional complexity for global commercialization efforts. The lack of standardized testing protocols and performance metrics makes cross-comparison between different substrate technologies particularly challenging, hindering informed decision-making by potential industrial adopters.

Patent landscapes reveal geographical disparities in innovation focus, with U.S. patents predominantly addressing novel nanomaterial compositions, while Chinese patents emphasize manufacturing process improvements. This divergence creates opportunities for strategic collaboration but also potential barriers in technology transfer and implementation across markets.

Leading Companies and Research Institutions in SERS Field

The SERS substrate technology landscape is currently in a growth phase, characterized by increasing patent activity from both academic institutions and industry players. The market is expanding rapidly, driven by applications in biosensing, chemical detection, and medical diagnostics, with projections suggesting a compound annual growth rate of 10-15%. Technologically, the field shows varying maturity levels, with companies like Intel, Micron Technology, and HP Development leading commercial development through substantial patent portfolios focused on manufacturing scalability. Academic institutions including Drexel University, Rice University, and Nanjing University are advancing fundamental research in novel substrate designs. Research organizations like Agency for Science, Technology & Research and Council of Scientific & Industrial Research are bridging the gap between academic innovation and industrial application, creating a competitive ecosystem where intellectual property protection through patents is increasingly critical for market positioning.

Penn State Research Foundation

Technical Solution: Penn State has developed and patented innovative SERS substrate technologies focusing on both fundamental enhancement mechanisms and practical applications. Their researchers have pioneered the development of hierarchical nanostructured surfaces that combine multiple length scales to create "hot spots" with exceptionally high enhancement factors (10^8-10^9). One significant patented approach involves the controlled assembly of silver nanocubes with precise interparticle spacing to optimize electromagnetic field enhancement while maintaining reproducibility. Penn State has also patented novel fabrication methods using nanosphere lithography combined with directional metal deposition to create highly ordered arrays of 3D nanostructures with tunable plasmonic properties. Their patent portfolio includes specialized surface chemistries for selective molecular capture, particularly for environmental contaminant detection and food safety applications. Additionally, Penn State researchers have developed and patented SERS substrates integrated with microfluidic platforms that enable automated sample processing and multiplexed detection capabilities, significantly expanding the practical utility of SERS technology for real-world analytical challenges.

Strengths: Strong interdisciplinary approach combining materials science, chemistry, and engineering expertise to develop comprehensive SERS solutions. Particular strength in environmental monitoring applications and integration with sample processing systems. Weaknesses: As an academic institution, may face challenges in scaling manufacturing processes for commercial production compared to industrial entities.

Corning, Inc.

Technical Solution: Corning has developed advanced SERS substrate technologies utilizing their expertise in glass and ceramic materials. Their approach involves creating highly ordered nanostructured surfaces with precise control over feature size and spacing to optimize SERS enhancement factors. Corning's patented technology includes silver and gold nanoparticle-embedded glass substrates with controlled interparticle spacing that creates consistent "hot spots" for molecular detection. Their manufacturing process employs proprietary nanofabrication techniques that enable mass production of uniform SERS substrates with enhancement factors exceeding 10^6. Corning has also developed specialized surface chemistry modifications to improve target molecule adsorption while maintaining long shelf-life stability. Their patents cover both the physical substrate architecture and the chemical functionalization methods, creating a comprehensive IP portfolio that addresses both sensitivity and reproducibility challenges in SERS technology.

Strengths: Leverages Corning's extensive materials science expertise and manufacturing capabilities to produce highly uniform SERS substrates at scale. Their established position in specialty materials provides advantages in quality control and distribution. Weaknesses: Their solutions may be more expensive than academic alternatives and potentially less customizable for specialized research applications.

Key Patent Analysis for SERS Substrate Innovations

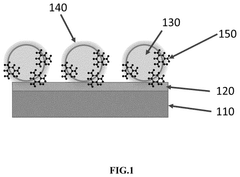

Surface enhanced raman spectroscopy (SERS) substrates exhibiting uniform high enhancement and stability

PatentWO2006137885A2

Innovation

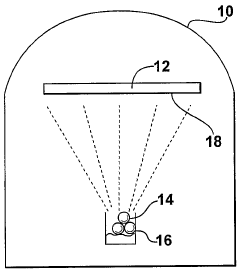

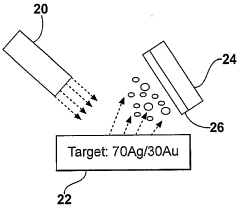

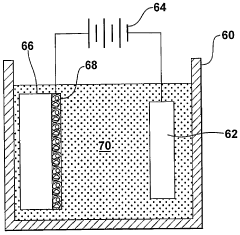

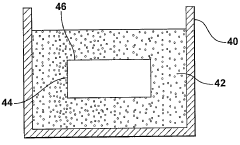

- The development of porous metal substrates, such as gold-silver alloy films that are acid-etched or electrochemically roughened, providing uniform and high enhancement factors, with methods like sputter deposition and electrochemical processes to create substrates with controlled pore sizes and surface roughness.

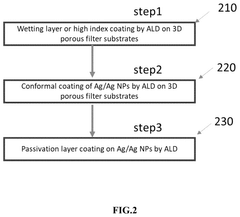

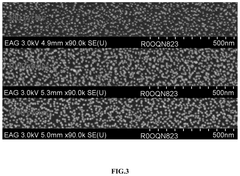

Methods for Fabricating Surface-enhanced Raman Spectroscopy Substrates

PatentInactiveUS20250027194A1

Innovation

- The use of Atomic Layer Deposition (ALD) to fabricate SERS substrates on cheap commercial 3D porous filter papers, enabling the creation of super-conformal, continuous coatings with high density of hotspots and enhanced sensitivity.

Patent Strategy for Competitive Advantage in SERS Market

Patents serve as critical strategic assets in the competitive SERS (Surface-Enhanced Raman Spectroscopy) substrate market, offering companies exclusive rights to their innovations while creating barriers to entry for competitors. Effective patent strategies begin with comprehensive IP landscape analysis, identifying white spaces for innovation and potential infringement risks. Companies leading the SERS market typically maintain robust patent portfolios covering fundamental substrate designs, fabrication methods, and application-specific optimizations.

Strategic patent filing approaches include creating "patent thickets" around core technologies, where multiple overlapping patents protect various aspects of a single innovation. This defensive strategy prevents competitors from easily designing around protected technologies. Geographic considerations are equally important, with strategic filing in key markets such as the United States, Europe, China, and Japan, where both SERS research activity and commercial opportunities are concentrated.

Cross-licensing agreements have emerged as valuable tools for companies to navigate the complex patent landscape, allowing access to complementary technologies while reducing litigation risks. These agreements are particularly important for smaller companies seeking to enter markets dominated by established players with extensive patent portfolios. Some market leaders strategically license non-core patents to generate revenue streams while maintaining exclusivity on their most critical innovations.

Patent quality, rather than quantity, increasingly determines competitive advantage in the SERS market. High-quality patents with broad, defensible claims covering commercially viable technologies provide stronger market protection than numerous narrow patents. Companies must balance the costs of obtaining and maintaining patents against their commercial potential, particularly for startups with limited resources.

Open innovation approaches are gaining traction, with some companies selectively publishing certain innovations to prevent competitors from patenting them, while aggressively protecting truly differentiating technologies. This strategic disclosure creates prior art that prevents others from obtaining exclusive rights while maintaining the company's freedom to operate.

Monitoring competitor patent activities provides crucial competitive intelligence, revealing technological directions and potential market entries. Advanced patent analytics tools enable companies to identify emerging trends and potential acquisition or licensing targets. Forward-looking companies are increasingly integrating patent strategy with broader business objectives, ensuring IP development aligns with product roadmaps and market opportunities in the rapidly evolving SERS substrate technology landscape.

Strategic patent filing approaches include creating "patent thickets" around core technologies, where multiple overlapping patents protect various aspects of a single innovation. This defensive strategy prevents competitors from easily designing around protected technologies. Geographic considerations are equally important, with strategic filing in key markets such as the United States, Europe, China, and Japan, where both SERS research activity and commercial opportunities are concentrated.

Cross-licensing agreements have emerged as valuable tools for companies to navigate the complex patent landscape, allowing access to complementary technologies while reducing litigation risks. These agreements are particularly important for smaller companies seeking to enter markets dominated by established players with extensive patent portfolios. Some market leaders strategically license non-core patents to generate revenue streams while maintaining exclusivity on their most critical innovations.

Patent quality, rather than quantity, increasingly determines competitive advantage in the SERS market. High-quality patents with broad, defensible claims covering commercially viable technologies provide stronger market protection than numerous narrow patents. Companies must balance the costs of obtaining and maintaining patents against their commercial potential, particularly for startups with limited resources.

Open innovation approaches are gaining traction, with some companies selectively publishing certain innovations to prevent competitors from patenting them, while aggressively protecting truly differentiating technologies. This strategic disclosure creates prior art that prevents others from obtaining exclusive rights while maintaining the company's freedom to operate.

Monitoring competitor patent activities provides crucial competitive intelligence, revealing technological directions and potential market entries. Advanced patent analytics tools enable companies to identify emerging trends and potential acquisition or licensing targets. Forward-looking companies are increasingly integrating patent strategy with broader business objectives, ensuring IP development aligns with product roadmaps and market opportunities in the rapidly evolving SERS substrate technology landscape.

Intellectual Property Landscape and Freedom to Operate Analysis

The patent landscape surrounding SERS substrate technology reveals a complex and increasingly competitive environment. Analysis of patent filings over the past decade shows a significant acceleration in patent applications related to SERS substrate fabrication methods, materials, and applications. Major patent holders include academic institutions like Northwestern University and MIT, alongside corporate entities such as Renishaw, Thermo Fisher Scientific, and specialized companies like Nanova Inc. and AgilentTechnologies.

These patents primarily cover three critical areas: novel nanofabrication techniques for creating reproducible SERS-active surfaces, specialized materials with enhanced plasmonic properties, and application-specific substrate designs for targeted sensing applications. The geographical distribution of patent filings indicates concentration in the United States, China, Japan, and the European Union, reflecting the global nature of SERS technology development.

Freedom to operate (FTO) analysis reveals several potential challenges for new market entrants. Many fundamental SERS substrate fabrication methods are protected by broad patents, creating potential barriers to commercialization. For instance, patents covering nanosphere lithography techniques, metal nanoparticle deposition processes, and specific surface functionalization methods may restrict certain development pathways without proper licensing agreements.

Cross-licensing has emerged as a common strategy among established players, creating technology ecosystems that can effectively exclude new competitors. This is particularly evident in the medical diagnostics and environmental monitoring sectors, where application-specific patents create additional layers of protection beyond the core substrate technologies.

Patent thickets are increasingly common in areas like flexible SERS substrates and point-of-care diagnostic applications. Companies must navigate these complex intellectual property landscapes carefully, conducting thorough FTO analyses before significant R&D investments. Strategic patent mapping reveals several white space opportunities, particularly in sustainable manufacturing methods, biodegradable substrates, and AI-integrated SERS sensing platforms.

The patent expiration timeline indicates that several foundational SERS substrate patents will enter the public domain within the next 3-5 years, potentially opening new commercialization opportunities. However, many of these technologies have been enhanced by subsequent improvement patents that extend protection well beyond the original innovations.

These patents primarily cover three critical areas: novel nanofabrication techniques for creating reproducible SERS-active surfaces, specialized materials with enhanced plasmonic properties, and application-specific substrate designs for targeted sensing applications. The geographical distribution of patent filings indicates concentration in the United States, China, Japan, and the European Union, reflecting the global nature of SERS technology development.

Freedom to operate (FTO) analysis reveals several potential challenges for new market entrants. Many fundamental SERS substrate fabrication methods are protected by broad patents, creating potential barriers to commercialization. For instance, patents covering nanosphere lithography techniques, metal nanoparticle deposition processes, and specific surface functionalization methods may restrict certain development pathways without proper licensing agreements.

Cross-licensing has emerged as a common strategy among established players, creating technology ecosystems that can effectively exclude new competitors. This is particularly evident in the medical diagnostics and environmental monitoring sectors, where application-specific patents create additional layers of protection beyond the core substrate technologies.

Patent thickets are increasingly common in areas like flexible SERS substrates and point-of-care diagnostic applications. Companies must navigate these complex intellectual property landscapes carefully, conducting thorough FTO analyses before significant R&D investments. Strategic patent mapping reveals several white space opportunities, particularly in sustainable manufacturing methods, biodegradable substrates, and AI-integrated SERS sensing platforms.

The patent expiration timeline indicates that several foundational SERS substrate patents will enter the public domain within the next 3-5 years, potentially opening new commercialization opportunities. However, many of these technologies have been enhanced by subsequent improvement patents that extend protection well beyond the original innovations.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!