Conformal Coating Vs Dipping: Procedural Efficiency Analysis

SEP 17, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Conformal Coating and Dipping Technologies Background

Conformal coating and dipping technologies represent two primary methods for protecting electronic components and printed circuit boards (PCBs) from environmental factors such as moisture, dust, chemicals, and temperature fluctuations. These protection techniques emerged in the mid-20th century alongside the rapid development of the electronics industry, with significant advancements occurring during the 1960s and 1970s as electronic devices became increasingly miniaturized and deployed in harsh environments.

Conformal coating involves the application of a thin polymeric film that conforms to the contours of the PCB, providing a protective barrier without significantly adding weight or dimension to the assembly. The technology evolved from basic acrylic and epoxy formulations to include more sophisticated materials such as silicone, polyurethane, and parylene coatings, each offering specific performance characteristics suited to different operating environments.

Dipping technology, alternatively, involves the complete immersion of electronic components or assemblies into a protective material. This method dates back to early electronics manufacturing but has been refined over decades to accommodate increasingly complex circuit designs. Dipping typically provides thicker coverage compared to conformal coating, offering enhanced protection at the cost of added weight and dimensional changes.

The technological evolution of both methods has been driven by increasing demands for reliability in aerospace, automotive, medical, and consumer electronics applications. Modern conformal coating systems have incorporated precision application techniques including automated spray systems, selective coating robots, and vapor deposition processes that allow for highly controlled material application.

Industry standards such as IPC-CC-830, MIL-I-46058C, and IEC 60664 have emerged to govern the performance requirements and testing methodologies for protective coatings, establishing benchmarks for moisture resistance, dielectric strength, and thermal stability. These standards continue to evolve as electronic devices face new challenges in miniaturization and deployment in extreme environments.

Recent technological trends include the development of environmentally friendly coating formulations with reduced volatile organic compounds (VOCs), nano-enhanced materials offering superior protection characteristics, and smart coatings capable of self-healing or indicating breach of protection. The integration of these technologies with Industry 4.0 principles has led to highly automated, data-driven coating processes that optimize material usage and ensure consistent quality.

As electronics continue to permeate critical systems and harsh environments, the importance of effective protection technologies grows, driving ongoing innovation in both conformal coating and dipping methodologies to meet increasingly stringent performance requirements.

Conformal coating involves the application of a thin polymeric film that conforms to the contours of the PCB, providing a protective barrier without significantly adding weight or dimension to the assembly. The technology evolved from basic acrylic and epoxy formulations to include more sophisticated materials such as silicone, polyurethane, and parylene coatings, each offering specific performance characteristics suited to different operating environments.

Dipping technology, alternatively, involves the complete immersion of electronic components or assemblies into a protective material. This method dates back to early electronics manufacturing but has been refined over decades to accommodate increasingly complex circuit designs. Dipping typically provides thicker coverage compared to conformal coating, offering enhanced protection at the cost of added weight and dimensional changes.

The technological evolution of both methods has been driven by increasing demands for reliability in aerospace, automotive, medical, and consumer electronics applications. Modern conformal coating systems have incorporated precision application techniques including automated spray systems, selective coating robots, and vapor deposition processes that allow for highly controlled material application.

Industry standards such as IPC-CC-830, MIL-I-46058C, and IEC 60664 have emerged to govern the performance requirements and testing methodologies for protective coatings, establishing benchmarks for moisture resistance, dielectric strength, and thermal stability. These standards continue to evolve as electronic devices face new challenges in miniaturization and deployment in extreme environments.

Recent technological trends include the development of environmentally friendly coating formulations with reduced volatile organic compounds (VOCs), nano-enhanced materials offering superior protection characteristics, and smart coatings capable of self-healing or indicating breach of protection. The integration of these technologies with Industry 4.0 principles has led to highly automated, data-driven coating processes that optimize material usage and ensure consistent quality.

As electronics continue to permeate critical systems and harsh environments, the importance of effective protection technologies grows, driving ongoing innovation in both conformal coating and dipping methodologies to meet increasingly stringent performance requirements.

Market Demand Analysis for PCB Protection Methods

The global market for PCB protection methods has witnessed substantial growth in recent years, driven primarily by the increasing complexity of electronic devices and their deployment in harsh environments. The demand for reliable protection solutions like conformal coating and dipping processes has expanded across multiple industries, with the electronics manufacturing sector leading consumption patterns.

Current market analysis indicates that the PCB protection market reached approximately $2.8 billion in 2022, with projections suggesting a compound annual growth rate of 5.7% through 2028. This growth trajectory is supported by the rapid expansion of consumer electronics, automotive electronics, aerospace applications, and industrial control systems that require enhanced protection against environmental factors.

Consumer demand for smaller, more durable electronic devices has significantly influenced the market dynamics for PCB protection methods. As devices become more compact, traditional protection methods face challenges in providing adequate coverage without affecting performance. This has created a distinct market segment focused on precision application technologies that can deliver consistent protection while maintaining miniaturization trends.

The automotive industry represents one of the fastest-growing segments for PCB protection solutions, with an estimated market value of $580 million in 2022. The increasing integration of electronic components in vehicles, particularly in electric and autonomous vehicles, has heightened the need for reliable protection against vibration, temperature fluctuations, and chemical exposure. This sector's demand is particularly focused on solutions that offer procedural efficiency while maintaining high reliability standards.

Regional analysis reveals that Asia-Pacific dominates the market with approximately 45% share, followed by North America and Europe. China, Japan, South Korea, and Taiwan collectively account for over 60% of the Asia-Pacific market, reflecting the concentration of electronics manufacturing in these regions. However, emerging markets in Southeast Asia and India are showing accelerated growth rates as electronics manufacturing continues to expand geographically.

The market is also experiencing a shift toward environmentally friendly protection solutions, with water-based and solvent-free formulations gaining traction. This trend is particularly evident in European markets, where regulatory pressures have accelerated the adoption of sustainable protection methods. Approximately 35% of new product developments in the PCB protection space now emphasize environmental compliance as a key selling point.

Customer feedback indicates growing interest in protection methods that offer procedural efficiency without compromising quality. Manufacturing facilities are increasingly evaluating the total cost of ownership, including application time, curing requirements, and rework capabilities, when selecting between conformal coating and dipping processes.

Current market analysis indicates that the PCB protection market reached approximately $2.8 billion in 2022, with projections suggesting a compound annual growth rate of 5.7% through 2028. This growth trajectory is supported by the rapid expansion of consumer electronics, automotive electronics, aerospace applications, and industrial control systems that require enhanced protection against environmental factors.

Consumer demand for smaller, more durable electronic devices has significantly influenced the market dynamics for PCB protection methods. As devices become more compact, traditional protection methods face challenges in providing adequate coverage without affecting performance. This has created a distinct market segment focused on precision application technologies that can deliver consistent protection while maintaining miniaturization trends.

The automotive industry represents one of the fastest-growing segments for PCB protection solutions, with an estimated market value of $580 million in 2022. The increasing integration of electronic components in vehicles, particularly in electric and autonomous vehicles, has heightened the need for reliable protection against vibration, temperature fluctuations, and chemical exposure. This sector's demand is particularly focused on solutions that offer procedural efficiency while maintaining high reliability standards.

Regional analysis reveals that Asia-Pacific dominates the market with approximately 45% share, followed by North America and Europe. China, Japan, South Korea, and Taiwan collectively account for over 60% of the Asia-Pacific market, reflecting the concentration of electronics manufacturing in these regions. However, emerging markets in Southeast Asia and India are showing accelerated growth rates as electronics manufacturing continues to expand geographically.

The market is also experiencing a shift toward environmentally friendly protection solutions, with water-based and solvent-free formulations gaining traction. This trend is particularly evident in European markets, where regulatory pressures have accelerated the adoption of sustainable protection methods. Approximately 35% of new product developments in the PCB protection space now emphasize environmental compliance as a key selling point.

Customer feedback indicates growing interest in protection methods that offer procedural efficiency without compromising quality. Manufacturing facilities are increasingly evaluating the total cost of ownership, including application time, curing requirements, and rework capabilities, when selecting between conformal coating and dipping processes.

Current State and Technical Challenges in Coating Processes

The global protective coating industry has witnessed significant technological advancements in recent years, with conformal coating and dipping emerging as two predominant methods for protecting electronic components. Currently, these processes are implemented across various manufacturing sectors, with electronics, automotive, and aerospace industries being the primary adopters. The market size for protective coatings reached approximately $14.5 billion in 2022, with projections indicating growth to $19.7 billion by 2027, representing a CAGR of 6.3%.

Conformal coating technology has evolved from simple acrylic-based solutions to advanced multi-functional coatings incorporating nanotechnology. Modern conformal coating systems utilize automated spray, selective coating robots, and plasma-enhanced deposition techniques. These systems achieve thickness ranges of 25-250 micrometers with increasingly precise application control. However, challenges persist in achieving uniform coverage on complex geometries and high-density component arrangements, particularly as electronic devices continue to miniaturize.

Dipping processes, while traditionally simpler, have also undergone significant refinement. Current dipping technologies employ precision-controlled immersion and withdrawal rates, often with automated systems that can adjust parameters in real-time based on component characteristics. These systems typically achieve coating thicknesses of 50-500 micrometers, though with less precision than selective coating methods.

A significant technical challenge facing both methodologies is the environmental impact of traditional coating materials. VOC emissions from solvent-based coatings face increasingly stringent regulations globally. The industry is transitioning toward water-based and UV-curable alternatives, though these often present trade-offs in performance characteristics such as moisture resistance and thermal stability.

Process efficiency remains a critical challenge, particularly in high-volume manufacturing environments. Conformal coating typically requires longer curing times (30 minutes to 24 hours depending on material), while dipping processes face challenges in controlling material waste and maintaining consistent viscosity in large-scale operations. Current research focuses on reducing cycle times through advanced curing technologies such as UV-LED systems and infrared heating.

Quality control represents another significant challenge, with inspection methods still largely reliant on visual techniques and spot testing. Advanced automated optical inspection (AOI) systems are being integrated into production lines, but their effectiveness varies with coating type and substrate complexity. The development of real-time monitoring systems using spectroscopic techniques shows promise but remains in early adoption phases.

Geographical distribution of coating technology development shows concentration in East Asia (particularly Japan, South Korea, and Taiwan) for electronics applications, while North America and Europe lead in aerospace and military-grade coating innovations. This regional specialization creates both challenges and opportunities for technology transfer and standardization across global supply chains.

Conformal coating technology has evolved from simple acrylic-based solutions to advanced multi-functional coatings incorporating nanotechnology. Modern conformal coating systems utilize automated spray, selective coating robots, and plasma-enhanced deposition techniques. These systems achieve thickness ranges of 25-250 micrometers with increasingly precise application control. However, challenges persist in achieving uniform coverage on complex geometries and high-density component arrangements, particularly as electronic devices continue to miniaturize.

Dipping processes, while traditionally simpler, have also undergone significant refinement. Current dipping technologies employ precision-controlled immersion and withdrawal rates, often with automated systems that can adjust parameters in real-time based on component characteristics. These systems typically achieve coating thicknesses of 50-500 micrometers, though with less precision than selective coating methods.

A significant technical challenge facing both methodologies is the environmental impact of traditional coating materials. VOC emissions from solvent-based coatings face increasingly stringent regulations globally. The industry is transitioning toward water-based and UV-curable alternatives, though these often present trade-offs in performance characteristics such as moisture resistance and thermal stability.

Process efficiency remains a critical challenge, particularly in high-volume manufacturing environments. Conformal coating typically requires longer curing times (30 minutes to 24 hours depending on material), while dipping processes face challenges in controlling material waste and maintaining consistent viscosity in large-scale operations. Current research focuses on reducing cycle times through advanced curing technologies such as UV-LED systems and infrared heating.

Quality control represents another significant challenge, with inspection methods still largely reliant on visual techniques and spot testing. Advanced automated optical inspection (AOI) systems are being integrated into production lines, but their effectiveness varies with coating type and substrate complexity. The development of real-time monitoring systems using spectroscopic techniques shows promise but remains in early adoption phases.

Geographical distribution of coating technology development shows concentration in East Asia (particularly Japan, South Korea, and Taiwan) for electronics applications, while North America and Europe lead in aerospace and military-grade coating innovations. This regional specialization creates both challenges and opportunities for technology transfer and standardization across global supply chains.

Comparative Analysis of Current Protection Solutions

01 Automated dipping systems for conformal coating

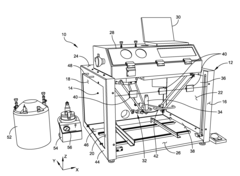

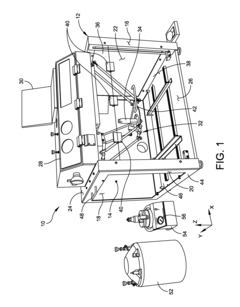

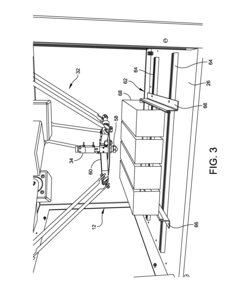

Automated systems can significantly improve the efficiency of conformal coating processes by providing precise control over dipping parameters such as immersion speed, dwell time, and withdrawal rate. These systems often include programmable controllers that ensure consistent coating thickness and coverage across multiple components, reducing manual handling and human error. Automated dipping equipment may incorporate features like temperature control, viscosity monitoring, and multi-axis positioning to optimize coating quality and throughput.- Automated dipping systems for conformal coating: Automated systems can significantly improve the efficiency of conformal coating processes through controlled dipping mechanisms. These systems typically include programmable dipping parameters such as immersion speed, dwell time, and withdrawal rate to ensure consistent coating thickness and quality. Automation reduces human error, increases throughput, and provides better repeatability compared to manual dipping operations.

- Specialized coating formulations for improved coverage: Advanced coating formulations can enhance procedural efficiency by optimizing viscosity, surface tension, and curing properties. These specialized formulations are designed to provide uniform coverage, reduce bubble formation, and minimize dripping or pooling during the dipping process. Some formulations include additives that improve flow characteristics and adhesion to various substrate materials, resulting in more efficient coating operations and reduced material waste.

- Temperature and environmental control techniques: Controlling the temperature and environmental conditions during the conformal coating process significantly impacts efficiency and quality. Maintaining optimal temperature ranges for both the coating material and the substrate ensures proper viscosity and flow characteristics. Humidity control prevents moisture-related defects, while clean room environments minimize contamination. These controlled conditions lead to faster processing times, reduced defect rates, and improved overall coating performance.

- Multi-stage dipping processes for complex geometries: Multi-stage dipping techniques have been developed to efficiently coat components with complex geometries. These processes involve sequential dipping at different angles or depths to ensure complete coverage of difficult-to-reach areas. Some approaches incorporate rotation or articulation of components during dipping to eliminate shadowing effects. This methodical approach improves coating uniformity on intricate parts while minimizing the need for manual touch-up operations.

- Post-dipping handling and curing optimization: Efficient post-dipping handling and curing procedures are critical for maximizing throughput in conformal coating operations. Optimized draining positions prevent pooling and ensure uniform coating thickness. Advanced curing technologies, including UV, thermal, and moisture-cure systems, can significantly reduce curing times. Automated handling systems that control the movement of coated components during draining and curing further enhance process efficiency while minimizing human contact that could damage the wet coating.

02 Specialized coating formulations for improved efficiency

Advanced conformal coating formulations can enhance procedural efficiency through properties like faster curing times, improved adhesion, and optimized viscosity profiles. These specialized formulations may include modified polymers, solvent systems tailored for specific application methods, and additives that control flow characteristics during the dipping process. Some formulations are designed to provide uniform coverage even on complex geometries, reducing the need for multiple coating cycles and minimizing material waste.Expand Specific Solutions03 Process optimization techniques for dipping operations

Various techniques can be employed to optimize dipping procedures, including controlled withdrawal rates to prevent coating defects, precise temperature management to maintain optimal viscosity, and specialized fixturing to ensure proper component orientation. Process optimization may also involve pre-treatment steps to enhance coating adhesion, post-dip drainage control to minimize excess material accumulation, and environmental controls to manage humidity and particulate contamination. These techniques collectively contribute to higher throughput, reduced material consumption, and improved coating quality.Expand Specific Solutions04 Equipment design innovations for conformal coating

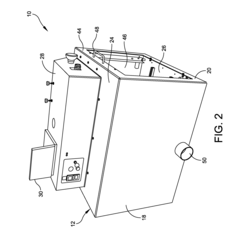

Innovative equipment designs can significantly enhance conformal coating efficiency through features like multi-zone dipping tanks, integrated curing systems, and modular fixturing solutions. Advanced equipment may incorporate real-time monitoring capabilities, automated cleaning cycles to prevent contamination, and quick-change components to reduce setup times between production runs. Some designs focus on minimizing material waste through precise metering, reclamation systems, and optimized tank geometries that reduce drag-out losses.Expand Specific Solutions05 Quality control and monitoring systems for coating processes

Integrated quality control systems can improve procedural efficiency by providing real-time feedback on coating parameters and detecting defects early in the process. These systems may employ vision inspection, thickness measurement, and automated testing to verify coating integrity without manual intervention. Advanced monitoring capabilities can track process variables like viscosity changes, contamination levels, and curing profiles, enabling predictive maintenance and continuous process improvement. Some systems incorporate data analytics to identify optimization opportunities and maintain consistent coating quality across production batches.Expand Specific Solutions

Key Industry Players in Conformal Coating and Dipping

The conformal coating versus dipping technology landscape is currently in a growth phase, with the market expected to expand significantly due to increasing demand for electronic component protection across automotive, aerospace, and consumer electronics sectors. The global conformal coating market demonstrates moderate maturity, with established players like Nordson Corp. and HzO, Inc. leading innovation in precision application technologies. Emerging companies such as Semblant Ltd. are advancing nano-coating solutions, while traditional manufacturers like 3M Innovative Properties Co. maintain strong market positions. Texas Instruments and Honeywell represent major end-users driving requirements for these technologies. The competitive dynamics show a clear trend toward automated, environmentally-friendly coating processes that optimize material usage and production efficiency while meeting increasingly stringent reliability standards for electronic protection.

Nordson Corp.

Technical Solution: Nordson has developed advanced selective conformal coating systems that utilize precision atomized spray technology with multi-axis robotic control. Their approach integrates automated optical inspection (AOI) systems that verify coating coverage and thickness in real-time, ensuring quality control during the application process. Their Film-Coater series employs patented flow control technology that maintains consistent material viscosity through temperature regulation, resulting in uniform coating thickness across complex PCB topographies. Nordson's systems can achieve coating thicknesses between 25-250 microns with ±5% tolerance across the board surface[1]. Their automated path planning software optimizes nozzle movement to reduce material waste by up to 30% compared to traditional methods while maintaining complete coverage of critical components.

Strengths: Precise selective application reduces material waste and masking requirements; integrated quality control systems ensure consistent coverage; high throughput with multi-axis robotics. Weaknesses: Higher initial capital investment compared to dipping systems; requires more complex programming for new board designs; maintenance of precision spray nozzles adds operational complexity.

3M Innovative Properties Co.

Technical Solution: 3M has pioneered a hybrid conformal coating approach that combines the benefits of both spray and dipping methods. Their Novec Electronic Grade Coatings utilize fluorinated compounds with low surface tension (typically 12-15 dynes/cm compared to water's 72 dynes/cm) that enable exceptional penetration into tight spaces when applied via their modified dipping process[2]. The technology incorporates a controlled withdrawal system that maintains precise extraction speeds (0.8-1.2 mm/second) to ensure uniform coating thickness. 3M's solution features rapid drying capabilities, with their latest formulations achieving tack-free status in under 60 seconds at room temperature. Their coatings provide excellent moisture protection with water vapor transmission rates below 2 g/m²/day, while maintaining dielectric strength exceeding 7 kV/mil. The process is complemented by UV-traceable additives that enable automated inspection systems to verify complete coverage.

Strengths: Excellent penetration into high-density board areas; environmentally friendly formulations with low VOCs; rapid processing times reduce production bottlenecks. Weaknesses: Higher material costs compared to conventional acrylics; requires specialized equipment for optimal application; some formulations may need additional curing steps for maximum performance.

Technical Innovations in Application Methodologies

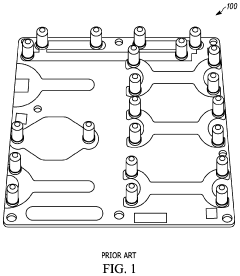

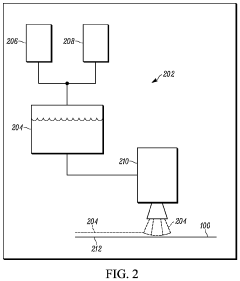

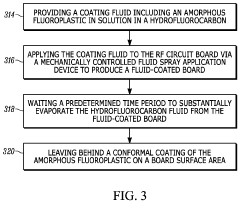

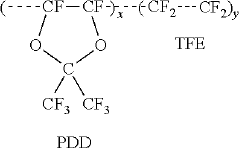

Method of conformal coating

PatentActiveUS10485108B1

Innovation

- A method using a mechanically controlled fluid spray application of an amorphous fluorinated polymer dissolved in a fluorinated solvent, such as Teflon™ AF in Vertrel™ XF, to apply a thin, conformal coating to RF circuit boards, which evaporates, leaving behind a protective layer that adheres without degrading RF performance.

Conformal coating apparatus and related method

PatentInactiveUS20120171383A1

Innovation

- A conformal coating apparatus featuring a movement mechanism with a delta robot configuration, utilizing three actuators and linkages to provide x-axis, y-axis, and z-axis movement, along with rotational capabilities, allowing for precise and automated control of the dispensing head to deposit materials accurately and efficiently on substrates.

Environmental Impact and Regulatory Compliance

The environmental impact of electronic manufacturing processes has become increasingly scrutinized as regulatory frameworks evolve globally. When comparing conformal coating and dipping technologies, several environmental considerations emerge that significantly influence process selection and implementation strategies.

Conformal coating typically utilizes spray or atomization techniques that can release volatile organic compounds (VOCs) into the atmosphere. Modern water-based and UV-curable coating formulations have reduced VOC emissions by 40-65% compared to traditional solvent-based systems, yet still require proper ventilation and filtration systems. These systems represent additional capital investment ranging from $10,000 to $50,000 depending on facility size and throughput requirements.

Dipping processes generally demonstrate lower atmospheric emissions during application but may generate greater volumes of hazardous waste through contaminated dipping baths that require periodic replacement. The average dipping operation produces approximately 15-20% more liquid waste by volume than equivalent conformal coating operations, necessitating comprehensive waste management protocols.

Regulatory compliance frameworks vary significantly by region, with the European Union's Restriction of Hazardous Substances (RoHS) and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) directives imposing the most stringent requirements. Both processes must adhere to these standards, though conformal coating manufacturers have developed more extensive environmentally-compliant product portfolios, with approximately 78% of commercial formulations now meeting global green standards.

Energy consumption profiles differ substantially between technologies. Automated conformal coating systems typically consume 2.5-3.2 kWh per production hour, while comparable dipping operations require 1.8-2.4 kWh. However, when factoring in curing requirements, the energy advantage of dipping diminishes as both processes require similar thermal or UV curing energy inputs.

Water usage represents another critical environmental factor. Dipping processes consume approximately 2.3-3.1 gallons of water per 100 electronic assemblies processed, primarily for cleaning and bath maintenance. Conformal coating operations typically use 1.5-2.2 gallons per 100 units, representing a 30-40% reduction in water consumption.

Carbon footprint assessments indicate that modern conformal coating operations generate approximately 0.8-1.2 kg CO2 equivalent per square meter of protected surface area, while dipping processes generate 1.0-1.4 kg CO2 equivalent. This difference primarily stems from transportation impacts of higher volume materials required for dipping operations and waste disposal considerations.

Conformal coating typically utilizes spray or atomization techniques that can release volatile organic compounds (VOCs) into the atmosphere. Modern water-based and UV-curable coating formulations have reduced VOC emissions by 40-65% compared to traditional solvent-based systems, yet still require proper ventilation and filtration systems. These systems represent additional capital investment ranging from $10,000 to $50,000 depending on facility size and throughput requirements.

Dipping processes generally demonstrate lower atmospheric emissions during application but may generate greater volumes of hazardous waste through contaminated dipping baths that require periodic replacement. The average dipping operation produces approximately 15-20% more liquid waste by volume than equivalent conformal coating operations, necessitating comprehensive waste management protocols.

Regulatory compliance frameworks vary significantly by region, with the European Union's Restriction of Hazardous Substances (RoHS) and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) directives imposing the most stringent requirements. Both processes must adhere to these standards, though conformal coating manufacturers have developed more extensive environmentally-compliant product portfolios, with approximately 78% of commercial formulations now meeting global green standards.

Energy consumption profiles differ substantially between technologies. Automated conformal coating systems typically consume 2.5-3.2 kWh per production hour, while comparable dipping operations require 1.8-2.4 kWh. However, when factoring in curing requirements, the energy advantage of dipping diminishes as both processes require similar thermal or UV curing energy inputs.

Water usage represents another critical environmental factor. Dipping processes consume approximately 2.3-3.1 gallons of water per 100 electronic assemblies processed, primarily for cleaning and bath maintenance. Conformal coating operations typically use 1.5-2.2 gallons per 100 units, representing a 30-40% reduction in water consumption.

Carbon footprint assessments indicate that modern conformal coating operations generate approximately 0.8-1.2 kg CO2 equivalent per square meter of protected surface area, while dipping processes generate 1.0-1.4 kg CO2 equivalent. This difference primarily stems from transportation impacts of higher volume materials required for dipping operations and waste disposal considerations.

Cost-Benefit Analysis of Implementation Strategies

When evaluating implementation strategies for conformal coating versus dipping processes, a comprehensive cost-benefit analysis reveals significant economic implications for manufacturing operations. Initial capital investment differs substantially between these two protection methods, with conformal coating systems typically requiring higher upfront costs for automated equipment, spray booths, and environmental control systems. Conversely, dipping setups generally demand lower initial investment, making them more accessible for smaller operations or companies with limited capital resources.

Operational expenses present another critical dimension for comparison. Conformal coating demonstrates superior material efficiency with precise application capabilities that minimize waste, particularly when utilizing selective coating equipment. This advantage becomes increasingly significant at higher production volumes where material costs accumulate substantially. Dipping processes, while requiring simpler equipment, often consume more protective material due to their immersive nature, potentially offsetting their lower initial investment advantage over extended production runs.

Labor costs vary considerably between these approaches. Conformal coating, especially in automated implementations, reduces direct labor requirements but necessitates skilled technicians for equipment maintenance and programming. Dipping operations typically demand more manual intervention and monitoring, translating to higher ongoing labor expenses but lower technical expertise requirements. This creates different cost structures depending on regional labor markets and available workforce skills.

Production throughput analysis reveals that automated conformal coating systems generally achieve higher units-per-hour rates compared to traditional dipping methods. This efficiency differential can substantially impact return on investment calculations, particularly for high-volume manufacturing environments where production speed directly affects revenue potential. The accelerated throughput may justify higher initial investments in conformal coating technology through faster capital recovery.

Quality-related costs represent another significant factor. Conformal coating's precision application typically results in fewer defects and rework requirements, reducing quality control expenses and material waste. Dipping processes, while providing excellent coverage in many applications, may introduce inconsistencies requiring additional inspection and remediation, particularly for complex component geometries with potential for trapped air or uneven material distribution.

Long-term maintenance considerations further differentiate these approaches. Conformal coating equipment demands regular maintenance and occasional specialized service, representing an ongoing cost center. Dipping systems generally require less sophisticated maintenance but may need more frequent material replacement and environmental monitoring, creating different long-term cost profiles that must be factored into implementation decisions.

Operational expenses present another critical dimension for comparison. Conformal coating demonstrates superior material efficiency with precise application capabilities that minimize waste, particularly when utilizing selective coating equipment. This advantage becomes increasingly significant at higher production volumes where material costs accumulate substantially. Dipping processes, while requiring simpler equipment, often consume more protective material due to their immersive nature, potentially offsetting their lower initial investment advantage over extended production runs.

Labor costs vary considerably between these approaches. Conformal coating, especially in automated implementations, reduces direct labor requirements but necessitates skilled technicians for equipment maintenance and programming. Dipping operations typically demand more manual intervention and monitoring, translating to higher ongoing labor expenses but lower technical expertise requirements. This creates different cost structures depending on regional labor markets and available workforce skills.

Production throughput analysis reveals that automated conformal coating systems generally achieve higher units-per-hour rates compared to traditional dipping methods. This efficiency differential can substantially impact return on investment calculations, particularly for high-volume manufacturing environments where production speed directly affects revenue potential. The accelerated throughput may justify higher initial investments in conformal coating technology through faster capital recovery.

Quality-related costs represent another significant factor. Conformal coating's precision application typically results in fewer defects and rework requirements, reducing quality control expenses and material waste. Dipping processes, while providing excellent coverage in many applications, may introduce inconsistencies requiring additional inspection and remediation, particularly for complex component geometries with potential for trapped air or uneven material distribution.

Long-term maintenance considerations further differentiate these approaches. Conformal coating equipment demands regular maintenance and occasional specialized service, representing an ongoing cost center. Dipping systems generally require less sophisticated maintenance but may need more frequent material replacement and environmental monitoring, creating different long-term cost profiles that must be factored into implementation decisions.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!