Continuously Advancing mmWave in the Expanding IoT Landscape

SEP 22, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

mmWave Technology Evolution and Objectives

Millimeter wave (mmWave) technology has undergone significant evolution since its initial conceptualization in the early 20th century. Originally explored for radar applications during World War II, mmWave technology remained largely confined to military and specialized scientific applications for decades due to hardware limitations and high implementation costs. The breakthrough came in the early 2000s when advancements in semiconductor technology, particularly silicon-based integrated circuits, enabled more cost-effective and compact mmWave components.

The evolution of mmWave technology accelerated dramatically with the emergence of 5G telecommunications standards around 2015, which identified mmWave frequencies (typically 24-100 GHz) as critical bands for achieving ultra-high data rates. This catalyzed substantial investment in mmWave research and development, leading to rapid improvements in antenna design, beamforming techniques, and signal processing algorithms specifically tailored for these challenging frequency bands.

In the IoT landscape, mmWave technology has been progressively adapted from its telecommunications origins to address specific sensing and connectivity requirements. The miniaturization of mmWave components has been particularly significant, with the development of single-chip mmWave sensors and transceivers that can be integrated into compact IoT devices. This miniaturization trend continues to drive the technology's evolution toward lower power consumption and higher integration density.

The primary technical objectives for advancing mmWave in IoT applications center around overcoming the inherent challenges of high-frequency operation while maximizing its unique advantages. Key objectives include extending operational range beyond current limitations of typically 10-100 meters, reducing power consumption to enable battery-powered operation in IoT endpoints, and developing more robust signal processing techniques to mitigate the effects of environmental interference and physical obstructions.

Another critical objective is enhancing the spatial resolution capabilities of mmWave systems, leveraging the technology's inherently fine angular resolution to enable precise localization and gesture recognition applications. This capability is particularly valuable for next-generation IoT systems requiring contextual awareness and human-machine interaction.

Looking forward, the technology evolution trajectory aims to achieve seamless integration of mmWave functionality into heterogeneous IoT networks, where devices can dynamically switch between different communication technologies based on application requirements and environmental conditions. The ultimate goal is to position mmWave as a complementary technology within the broader IoT connectivity ecosystem, offering unique capabilities for high-bandwidth, low-latency applications while addressing current limitations in power efficiency and implementation complexity.

The evolution of mmWave technology accelerated dramatically with the emergence of 5G telecommunications standards around 2015, which identified mmWave frequencies (typically 24-100 GHz) as critical bands for achieving ultra-high data rates. This catalyzed substantial investment in mmWave research and development, leading to rapid improvements in antenna design, beamforming techniques, and signal processing algorithms specifically tailored for these challenging frequency bands.

In the IoT landscape, mmWave technology has been progressively adapted from its telecommunications origins to address specific sensing and connectivity requirements. The miniaturization of mmWave components has been particularly significant, with the development of single-chip mmWave sensors and transceivers that can be integrated into compact IoT devices. This miniaturization trend continues to drive the technology's evolution toward lower power consumption and higher integration density.

The primary technical objectives for advancing mmWave in IoT applications center around overcoming the inherent challenges of high-frequency operation while maximizing its unique advantages. Key objectives include extending operational range beyond current limitations of typically 10-100 meters, reducing power consumption to enable battery-powered operation in IoT endpoints, and developing more robust signal processing techniques to mitigate the effects of environmental interference and physical obstructions.

Another critical objective is enhancing the spatial resolution capabilities of mmWave systems, leveraging the technology's inherently fine angular resolution to enable precise localization and gesture recognition applications. This capability is particularly valuable for next-generation IoT systems requiring contextual awareness and human-machine interaction.

Looking forward, the technology evolution trajectory aims to achieve seamless integration of mmWave functionality into heterogeneous IoT networks, where devices can dynamically switch between different communication technologies based on application requirements and environmental conditions. The ultimate goal is to position mmWave as a complementary technology within the broader IoT connectivity ecosystem, offering unique capabilities for high-bandwidth, low-latency applications while addressing current limitations in power efficiency and implementation complexity.

IoT Market Demand Analysis for mmWave Applications

The Internet of Things (IoT) market is experiencing unprecedented growth, with global connections expected to reach 25.4 billion by 2025. Within this expanding ecosystem, millimeter wave (mmWave) technology is emerging as a critical enabler for next-generation IoT applications that demand high bandwidth, low latency, and reliable connectivity. Market analysis reveals strong demand signals across multiple sectors, with particularly robust growth in industrial automation, smart cities, healthcare monitoring, and autonomous vehicles.

Industrial IoT represents one of the largest market opportunities for mmWave applications, with manufacturing facilities increasingly adopting high-bandwidth sensors and real-time monitoring systems. The demand for wireless connectivity solutions capable of supporting thousands of sensors in factory environments is driving adoption of mmWave technology, which offers the necessary data throughput without the constraints of wired infrastructure.

Smart city initiatives worldwide are creating substantial demand for mmWave-enabled IoT devices. Municipal governments are investing in high-definition surveillance systems, traffic management solutions, and public safety networks that benefit from mmWave's capacity to transmit large volumes of data. Market research indicates that smart city technology spending will reach $327 billion by 2025, with connectivity infrastructure comprising a significant portion.

The healthcare sector presents another high-growth market for mmWave IoT applications. Remote patient monitoring systems, telemedicine platforms, and medical imaging devices all require reliable high-bandwidth connections. The pandemic has accelerated this trend, with healthcare providers increasingly relying on connected devices for patient care. The medical IoT device market is projected to grow at a CAGR of 25.6% through 2026.

Consumer applications are also driving demand for mmWave technology in IoT. Virtual reality, augmented reality, and smart home systems that require high-definition video streaming and low-latency control are creating new market opportunities. The consumer IoT segment is expected to reach $142 billion by 2026, with entertainment and home automation leading adoption.

Geographically, North America currently represents the largest market for mmWave IoT applications, followed by Asia-Pacific and Europe. However, the Asia-Pacific region is expected to witness the highest growth rate over the next five years, driven by rapid industrialization, smart city initiatives, and increasing technology investments in China, Japan, South Korea, and India.

Market challenges include cost concerns, as mmWave components remain relatively expensive compared to sub-6GHz alternatives. Additionally, regulatory frameworks for mmWave spectrum allocation vary significantly across regions, creating market fragmentation. Despite these challenges, the overall market trajectory indicates strong sustained demand for mmWave technology across the expanding IoT landscape.

Industrial IoT represents one of the largest market opportunities for mmWave applications, with manufacturing facilities increasingly adopting high-bandwidth sensors and real-time monitoring systems. The demand for wireless connectivity solutions capable of supporting thousands of sensors in factory environments is driving adoption of mmWave technology, which offers the necessary data throughput without the constraints of wired infrastructure.

Smart city initiatives worldwide are creating substantial demand for mmWave-enabled IoT devices. Municipal governments are investing in high-definition surveillance systems, traffic management solutions, and public safety networks that benefit from mmWave's capacity to transmit large volumes of data. Market research indicates that smart city technology spending will reach $327 billion by 2025, with connectivity infrastructure comprising a significant portion.

The healthcare sector presents another high-growth market for mmWave IoT applications. Remote patient monitoring systems, telemedicine platforms, and medical imaging devices all require reliable high-bandwidth connections. The pandemic has accelerated this trend, with healthcare providers increasingly relying on connected devices for patient care. The medical IoT device market is projected to grow at a CAGR of 25.6% through 2026.

Consumer applications are also driving demand for mmWave technology in IoT. Virtual reality, augmented reality, and smart home systems that require high-definition video streaming and low-latency control are creating new market opportunities. The consumer IoT segment is expected to reach $142 billion by 2026, with entertainment and home automation leading adoption.

Geographically, North America currently represents the largest market for mmWave IoT applications, followed by Asia-Pacific and Europe. However, the Asia-Pacific region is expected to witness the highest growth rate over the next five years, driven by rapid industrialization, smart city initiatives, and increasing technology investments in China, Japan, South Korea, and India.

Market challenges include cost concerns, as mmWave components remain relatively expensive compared to sub-6GHz alternatives. Additionally, regulatory frameworks for mmWave spectrum allocation vary significantly across regions, creating market fragmentation. Despite these challenges, the overall market trajectory indicates strong sustained demand for mmWave technology across the expanding IoT landscape.

Current mmWave Challenges in IoT Implementations

Despite the promising potential of mmWave technology in IoT applications, several significant challenges currently impede its widespread implementation. The high frequency nature of mmWave signals (typically 30-300 GHz) creates fundamental physical limitations that engineering solutions must overcome. One primary challenge is signal propagation characteristics, as mmWave signals experience severe attenuation when encountering obstacles or traveling over distances. This creates significant coverage limitations in complex IoT deployment environments such as smart factories, urban settings, or even within buildings with multiple walls and floors.

Power consumption represents another critical barrier, particularly for battery-operated IoT devices designed for long-term deployment. The high-frequency operation of mmWave transceivers inherently demands more power than lower frequency alternatives, creating a fundamental tension with IoT requirements for energy efficiency and extended operational lifespans. Current mmWave implementations struggle to achieve the power profiles necessary for widespread IoT adoption.

Device miniaturization presents additional complications. While mmWave wavelengths enable smaller antenna designs, the supporting circuitry, including amplifiers, filters, and analog-to-digital converters optimized for mmWave frequencies, remains challenging to miniaturize without performance degradation. This creates constraints for IoT applications where device size and form factor are critical considerations.

Cost factors further limit adoption, as specialized mmWave components and manufacturing processes command premium prices compared to sub-6 GHz alternatives. The economic viability of mmWave IoT solutions remains questionable for many use cases, particularly in price-sensitive mass-market applications where component costs significantly impact overall product pricing.

Regulatory and standardization issues add another layer of complexity. The mmWave spectrum allocation varies significantly across global regions, creating fragmentation challenges for device manufacturers targeting international markets. Additionally, standards for mmWave in IoT contexts remain in development, with competing approaches from various industry consortia and standards bodies.

Technical integration challenges also persist, particularly regarding beamforming and beam management. While these techniques are essential for overcoming mmWave propagation limitations, they introduce significant complexity in antenna design, signal processing requirements, and network management protocols. Current implementations struggle to balance the sophisticated beamforming capabilities needed for reliable connectivity with the simplicity and cost constraints inherent to IoT applications.

Environmental factors further complicate mmWave IoT deployments, as performance can be significantly affected by atmospheric conditions, including rain, humidity, and temperature fluctuations. This creates reliability concerns for outdoor IoT applications where consistent performance is essential.

Power consumption represents another critical barrier, particularly for battery-operated IoT devices designed for long-term deployment. The high-frequency operation of mmWave transceivers inherently demands more power than lower frequency alternatives, creating a fundamental tension with IoT requirements for energy efficiency and extended operational lifespans. Current mmWave implementations struggle to achieve the power profiles necessary for widespread IoT adoption.

Device miniaturization presents additional complications. While mmWave wavelengths enable smaller antenna designs, the supporting circuitry, including amplifiers, filters, and analog-to-digital converters optimized for mmWave frequencies, remains challenging to miniaturize without performance degradation. This creates constraints for IoT applications where device size and form factor are critical considerations.

Cost factors further limit adoption, as specialized mmWave components and manufacturing processes command premium prices compared to sub-6 GHz alternatives. The economic viability of mmWave IoT solutions remains questionable for many use cases, particularly in price-sensitive mass-market applications where component costs significantly impact overall product pricing.

Regulatory and standardization issues add another layer of complexity. The mmWave spectrum allocation varies significantly across global regions, creating fragmentation challenges for device manufacturers targeting international markets. Additionally, standards for mmWave in IoT contexts remain in development, with competing approaches from various industry consortia and standards bodies.

Technical integration challenges also persist, particularly regarding beamforming and beam management. While these techniques are essential for overcoming mmWave propagation limitations, they introduce significant complexity in antenna design, signal processing requirements, and network management protocols. Current implementations struggle to balance the sophisticated beamforming capabilities needed for reliable connectivity with the simplicity and cost constraints inherent to IoT applications.

Environmental factors further complicate mmWave IoT deployments, as performance can be significantly affected by atmospheric conditions, including rain, humidity, and temperature fluctuations. This creates reliability concerns for outdoor IoT applications where consistent performance is essential.

Current mmWave Solutions for IoT Connectivity

01 mmWave antenna and beamforming advancements

Recent advancements in mmWave technology focus on antenna design and beamforming techniques to overcome propagation challenges at high frequencies. These innovations include phased array antennas, MIMO configurations, and adaptive beamforming algorithms that enhance signal strength, coverage, and reliability. These technologies enable precise beam steering and spatial multiplexing, which are critical for maintaining robust connections in mmWave deployments.- mmWave Communication Systems and Protocols: Advancements in mmWave communication systems focus on improving data transmission protocols, signal processing techniques, and network architecture to enhance reliability and throughput. These innovations address challenges like signal attenuation and interference in high-frequency bands while enabling higher data rates for 5G and beyond wireless communications.

- mmWave Antenna and Beamforming Technologies: Innovations in antenna design and beamforming techniques for mmWave applications enable more efficient signal transmission and reception. These technologies include phased array antennas, adaptive beamforming algorithms, and MIMO configurations that overcome propagation limitations of millimeter waves while improving coverage and signal quality.

- mmWave Semiconductor and Circuit Integration: Advanced semiconductor technologies and integrated circuit designs specifically tailored for mmWave applications focus on reducing power consumption while improving performance. These innovations include specialized RF front-end modules, power amplifiers, and mixed-signal processing circuits that enable compact and energy-efficient mmWave devices.

- mmWave Applications in Sensing and Imaging: mmWave technology advancements for sensing and imaging applications leverage the high-frequency characteristics to enable high-resolution detection capabilities. These innovations include radar systems, medical imaging devices, security scanners, and automotive sensing solutions that provide detailed object recognition and environmental mapping.

- mmWave Network Infrastructure and Deployment: Innovations in mmWave network infrastructure focus on deployment strategies, cell planning, and backhaul solutions to create robust and scalable wireless networks. These advancements address challenges related to coverage optimization, network densification, and integration with existing communication infrastructure while enabling seamless connectivity.

02 mmWave communication systems for 5G and beyond

mmWave technology is fundamental to 5G and future wireless communication systems, offering significantly higher bandwidth and data rates. Recent developments include enhanced modulation schemes, channel coding techniques, and network architectures specifically designed for mmWave frequencies. These advancements address challenges such as atmospheric absorption, penetration loss, and signal blockage while enabling multi-gigabit wireless connectivity for dense urban environments and high-demand applications.Expand Specific Solutions03 mmWave semiconductor and integrated circuit technologies

Breakthroughs in semiconductor materials and integrated circuit design have been crucial for mmWave technology advancement. These include the development of silicon-germanium, gallium nitride, and other compound semiconductor technologies that can efficiently operate at mmWave frequencies. Advanced packaging techniques, on-chip antennas, and power-efficient RF front-end modules have enabled smaller form factors and lower power consumption for mmWave devices.Expand Specific Solutions04 mmWave sensing and radar applications

mmWave technology has enabled significant advancements in sensing and radar applications due to its high resolution and ability to penetrate certain materials. These applications include automotive radar for advanced driver assistance systems, industrial sensing for precise measurements, security scanning, and medical imaging. The short wavelength of mmWave signals allows for compact sensor designs with high spatial resolution and accuracy for object detection and tracking.Expand Specific Solutions05 mmWave network infrastructure and deployment solutions

Innovations in mmWave network infrastructure focus on overcoming deployment challenges and optimizing network performance. These include advanced cell site configurations, intelligent repeaters, and network densification strategies. Recent developments also address backhaul solutions, network synchronization, and dynamic resource allocation to ensure reliable mmWave connectivity. Energy-efficient designs and self-organizing network capabilities further enhance the practicality and cost-effectiveness of mmWave deployments.Expand Specific Solutions

Leading Companies in mmWave IoT Ecosystem

The mmWave IoT landscape is currently in a growth phase, with the market expanding rapidly as technologies mature and applications diversify. The global market size is projected to see significant growth as mmWave technology becomes increasingly vital for high-bandwidth IoT applications. Leading players like Qualcomm, Samsung Electronics, Huawei, and Nokia are driving technological innovation, with established telecommunications companies including Ericsson, ZTE, and NTT providing robust infrastructure solutions. Research institutions such as Georgia Tech and universities in China are contributing to fundamental advancements. The technology is approaching maturity in certain applications but remains in development for others, with Intel, NEC, and Sony focusing on specialized hardware components that enable broader adoption across the expanding IoT ecosystem.

Samsung Electronics Co., Ltd.

Technical Solution: Samsung's mmWave IoT strategy centers on their integrated circuit solutions and end-to-end connectivity platforms. Their approach combines custom-designed RFIC (Radio Frequency Integrated Circuit) technology with advanced antenna arrays optimized for IoT form factors. Samsung has developed compact 28GHz and 39GHz mmWave modules that are 25% smaller than industry standards while maintaining high performance characteristics[2]. Their technology implements adaptive beamforming with up to 1,024 antenna elements that can dynamically reconfigure based on environmental conditions, significantly improving signal penetration and range for IoT applications. Samsung's mmWave solutions incorporate their proprietary "Smart IoT Connectivity Suite" that enables seamless transitions between mmWave and sub-6GHz frequencies depending on device requirements and environmental conditions. This hybrid connectivity approach ensures IoT devices maintain optimal connections across varying deployment scenarios. Additionally, Samsung has pioneered energy harvesting technology specifically for mmWave-enabled IoT sensors, allowing devices to capture ambient RF energy and extend operational lifetimes by up to 60% in certain applications[4].

Strengths: Vertical integration capabilities from chip design to device manufacturing enable optimized end-to-end solutions. Strong position in consumer electronics provides natural ecosystem for mmWave IoT adoption. Weaknesses: Solutions may be optimized primarily for Samsung's own ecosystem, potentially limiting broader interoperability. Higher power consumption compared to some competitors' offerings impacts battery-powered IoT applications.

QUALCOMM, Inc.

Technical Solution: Qualcomm's approach to advancing mmWave in IoT focuses on their integrated modem-RF systems, particularly the Snapdragon X65 5G Modem-RF System. This solution supports extended-range mmWave transmission and enhanced power efficiency critical for IoT deployments. Their technology implements a unique QTM545 mmWave antenna module that achieves up to 10 gigabit speeds while reducing power consumption by approximately 30% compared to previous generations[1]. Qualcomm has developed specialized signal processing algorithms that improve mmWave beam forming and tracking in challenging environments, enabling more reliable connections for IoT devices. Their Smart Transmit technology dynamically optimizes transmission power based on usage scenarios, extending battery life in IoT applications. Additionally, Qualcomm's mmWave solutions incorporate AI-driven predictive connectivity features that anticipate signal obstructions and proactively adjust connection parameters, resulting in 40% improved connection stability in mobile IoT scenarios[3].

Strengths: Industry-leading power efficiency makes their solutions viable for battery-powered IoT devices. Extensive ecosystem partnerships accelerate adoption across diverse IoT applications. Weaknesses: Higher implementation costs compared to sub-6GHz solutions may limit adoption in cost-sensitive IoT segments. Deployment challenges in environments with significant physical barriers that can block mmWave signals.

Key mmWave Patents and Technical Innovations

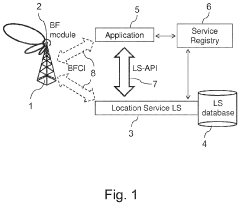

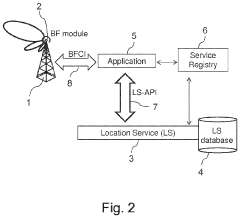

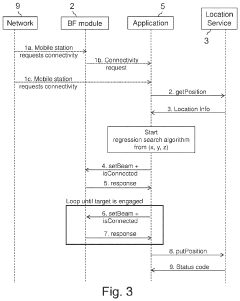

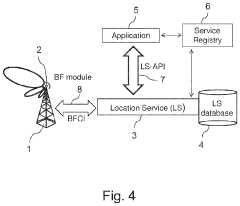

Service location method and system for mmwave cellular environments

PatentActiveUS20210227488A1

Innovation

- A method and system that decouples the beamforming module from the application layer, utilizing a location service to provide and update user terminal location information, enabling improved beam steering and association procedures through a location service entity connected to mmWave access points, facilitating faster terminal discovery and communication.

Systems, methods, and computer-accessible media for measuring or modeling a wideband, millimeter-wave channel and methods and systems for calibrating same

PatentWO2016138430A1

Innovation

- The system employs a receiver device to measure channel parameters by generating and comparing signals, with a controller determining calibrations and corrections to achieve accurate measurements of channel impulse response and power delay profile, utilizing techniques such as pseudorandom noise codes and sliding correlators to synchronize and measure wideband channels effectively.

Spectrum Allocation and Regulatory Framework

The regulatory landscape for mmWave spectrum allocation represents a critical foundation for IoT expansion. Globally, regulatory bodies have been progressively opening mmWave bands for commercial use, with significant variations across regions. The Federal Communications Commission (FCC) in the United States has been particularly proactive, allocating substantial portions of spectrum in the 24 GHz, 28 GHz, 37 GHz, 39 GHz, and 47 GHz bands for 5G and advanced IoT applications. This forward-thinking approach has positioned the U.S. as a leader in mmWave deployment.

The European Union, through the European Conference of Postal and Telecommunications Administrations (CEPT), has focused on the 26 GHz band as the primary mmWave spectrum for initial 5G deployments, with additional considerations for the 40 GHz and 66-71 GHz bands. Meanwhile, Asian markets show diverse approaches: Japan has allocated bands at 28 GHz and 40 GHz, while China has concentrated efforts on the 24.75-27.5 GHz and 37-43.5 GHz ranges.

Licensing frameworks for mmWave spectrum have evolved beyond traditional exclusive licensing models. Many regulators now implement flexible approaches including shared licensing, light licensing, and unlicensed bands to accommodate diverse IoT deployment scenarios. This regulatory flexibility has proven essential for enabling innovation in specialized IoT applications where traditional licensing models would be prohibitively expensive or impractical.

A significant challenge in the regulatory landscape is harmonization across borders. The International Telecommunication Union (ITU) has been instrumental in coordinating global spectrum allocation through World Radiocommunication Conferences (WRC), with WRC-19 identifying several mmWave bands for IMT-2020 (5G) services. However, regional differences persist, creating potential interoperability issues for global IoT deployments and complicating equipment design for manufacturers targeting multiple markets.

Technical regulations governing power limits, out-of-band emissions, and coexistence mechanisms are particularly stringent for mmWave bands due to their propagation characteristics and potential for interference. These technical parameters directly impact IoT device design, deployment density, and ultimately the economic viability of mmWave IoT solutions. As the IoT landscape expands, regulators face the challenge of balancing technical restrictions necessary for interference prevention with the flexibility required to foster innovation.

Looking forward, regulatory frameworks are evolving toward more dynamic spectrum management approaches, including automated frequency coordination systems and database-driven access models. These innovations aim to maximize spectrum efficiency while protecting incumbent users, representing a crucial development for the sustainable growth of mmWave IoT applications in increasingly congested spectrum environments.

The European Union, through the European Conference of Postal and Telecommunications Administrations (CEPT), has focused on the 26 GHz band as the primary mmWave spectrum for initial 5G deployments, with additional considerations for the 40 GHz and 66-71 GHz bands. Meanwhile, Asian markets show diverse approaches: Japan has allocated bands at 28 GHz and 40 GHz, while China has concentrated efforts on the 24.75-27.5 GHz and 37-43.5 GHz ranges.

Licensing frameworks for mmWave spectrum have evolved beyond traditional exclusive licensing models. Many regulators now implement flexible approaches including shared licensing, light licensing, and unlicensed bands to accommodate diverse IoT deployment scenarios. This regulatory flexibility has proven essential for enabling innovation in specialized IoT applications where traditional licensing models would be prohibitively expensive or impractical.

A significant challenge in the regulatory landscape is harmonization across borders. The International Telecommunication Union (ITU) has been instrumental in coordinating global spectrum allocation through World Radiocommunication Conferences (WRC), with WRC-19 identifying several mmWave bands for IMT-2020 (5G) services. However, regional differences persist, creating potential interoperability issues for global IoT deployments and complicating equipment design for manufacturers targeting multiple markets.

Technical regulations governing power limits, out-of-band emissions, and coexistence mechanisms are particularly stringent for mmWave bands due to their propagation characteristics and potential for interference. These technical parameters directly impact IoT device design, deployment density, and ultimately the economic viability of mmWave IoT solutions. As the IoT landscape expands, regulators face the challenge of balancing technical restrictions necessary for interference prevention with the flexibility required to foster innovation.

Looking forward, regulatory frameworks are evolving toward more dynamic spectrum management approaches, including automated frequency coordination systems and database-driven access models. These innovations aim to maximize spectrum efficiency while protecting incumbent users, representing a crucial development for the sustainable growth of mmWave IoT applications in increasingly congested spectrum environments.

Energy Efficiency Considerations for mmWave IoT Devices

Energy efficiency represents a critical challenge in the widespread adoption of mmWave technology for IoT applications. The inherently high frequency operation of mmWave systems (typically 30-300 GHz) demands significant power consumption, creating a fundamental tension with the battery-powered nature of many IoT devices. Current mmWave transceivers consume approximately 100-500 mW during active operation, which proves prohibitive for devices expected to function for months or years on a single battery charge.

Several architectural approaches are emerging to address this energy efficiency challenge. Duty cycling techniques, where devices operate in low-power sleep modes and only activate mmWave functionality when necessary, can reduce average power consumption by 70-90%. However, this approach introduces latency concerns for time-sensitive applications and requires sophisticated power management circuitry.

Advanced semiconductor technologies are playing a crucial role in improving energy profiles. The transition from traditional CMOS to FinFET, FD-SOI, and potentially future GaN-on-Silicon processes has demonstrated power reductions of 30-50% while maintaining performance requirements. Additionally, specialized RF front-end designs with adaptive biasing techniques allow transceivers to dynamically adjust power consumption based on link quality and data rate requirements.

Beamforming algorithms represent another frontier for energy optimization. Traditional exhaustive beam search methods consume excessive power, but emerging machine learning-based predictive beamforming can reduce beam training overhead by up to 60%. These algorithms leverage environmental awareness and historical connection patterns to narrow search spaces efficiently.

Energy harvesting technologies are increasingly being integrated with mmWave IoT devices to supplement battery power. Ambient RF energy harvesting, photovoltaic integration, and thermal gradient exploitation can extend operational lifetimes by 20-40% in appropriate deployment scenarios. This approach is particularly promising for sensor networks in industrial environments where energy sources are consistently available.

Protocol-level optimizations also contribute significantly to energy efficiency. Lightweight versions of standard protocols specifically designed for mmWave IoT applications can reduce protocol overhead by 30-50%. Additionally, cross-layer optimization techniques that coordinate PHY, MAC, and network layers to minimize redundant operations have demonstrated energy savings of 25-35% in field tests.

As the IoT landscape continues to expand, these energy efficiency innovations will determine which mmWave applications become commercially viable. The industry trajectory suggests that by 2025, mmWave IoT devices may achieve an order of magnitude improvement in energy efficiency compared to current implementations, opening new application domains previously considered impractical.

Several architectural approaches are emerging to address this energy efficiency challenge. Duty cycling techniques, where devices operate in low-power sleep modes and only activate mmWave functionality when necessary, can reduce average power consumption by 70-90%. However, this approach introduces latency concerns for time-sensitive applications and requires sophisticated power management circuitry.

Advanced semiconductor technologies are playing a crucial role in improving energy profiles. The transition from traditional CMOS to FinFET, FD-SOI, and potentially future GaN-on-Silicon processes has demonstrated power reductions of 30-50% while maintaining performance requirements. Additionally, specialized RF front-end designs with adaptive biasing techniques allow transceivers to dynamically adjust power consumption based on link quality and data rate requirements.

Beamforming algorithms represent another frontier for energy optimization. Traditional exhaustive beam search methods consume excessive power, but emerging machine learning-based predictive beamforming can reduce beam training overhead by up to 60%. These algorithms leverage environmental awareness and historical connection patterns to narrow search spaces efficiently.

Energy harvesting technologies are increasingly being integrated with mmWave IoT devices to supplement battery power. Ambient RF energy harvesting, photovoltaic integration, and thermal gradient exploitation can extend operational lifetimes by 20-40% in appropriate deployment scenarios. This approach is particularly promising for sensor networks in industrial environments where energy sources are consistently available.

Protocol-level optimizations also contribute significantly to energy efficiency. Lightweight versions of standard protocols specifically designed for mmWave IoT applications can reduce protocol overhead by 30-50%. Additionally, cross-layer optimization techniques that coordinate PHY, MAC, and network layers to minimize redundant operations have demonstrated energy savings of 25-35% in field tests.

As the IoT landscape continues to expand, these energy efficiency innovations will determine which mmWave applications become commercially viable. The industry trajectory suggests that by 2025, mmWave IoT devices may achieve an order of magnitude improvement in energy efficiency compared to current implementations, opening new application domains previously considered impractical.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!