Expanding Utilities of mmWave in the Financial Sector

SEP 22, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

mmWave Technology Background and Objectives

Millimeter wave (mmWave) technology operates in the frequency range of 30 GHz to 300 GHz, with wavelengths between 1 and 10 millimeters. Initially developed for military and aerospace applications, mmWave has evolved significantly over the past decades. The technology gained substantial commercial traction with the advent of 5G telecommunications, where it enables high-bandwidth data transmission in dense urban environments.

In the financial sector, mmWave technology represents an emerging frontier with transformative potential. Traditional financial operations have relied on conventional security systems, data transmission protocols, and customer interaction models. However, the increasing digitization of financial services, coupled with growing security concerns and demands for frictionless customer experiences, has created a fertile ground for mmWave applications.

The evolution of mmWave technology has been marked by progressive improvements in miniaturization, power efficiency, and signal processing capabilities. Early mmWave systems were bulky, power-hungry, and limited in range. Modern implementations benefit from advanced semiconductor technologies, sophisticated antenna arrays, and enhanced signal processing algorithms, making them suitable for deployment in commercial and consumer settings.

The primary technical objective for mmWave in the financial sector is to leverage its unique properties—high bandwidth, directional transmission, and penetration limitations—to address specific industry challenges. These include enhancing physical security through advanced detection systems, enabling contactless high-speed data transfer for financial transactions, and supporting precise indoor positioning for personalized banking experiences.

Current research focuses on overcoming the inherent limitations of mmWave technology, particularly its susceptibility to atmospheric attenuation and limited penetration through solid materials. Innovations in beamforming, signal processing, and material science are progressively addressing these challenges, expanding the practical applications of mmWave in various financial contexts.

The convergence of mmWave technology with artificial intelligence and edge computing presents particularly promising avenues for financial applications. This integration enables real-time analysis of complex data patterns, enhancing fraud detection capabilities and enabling more sophisticated customer authentication protocols without compromising user experience.

Looking forward, the technical roadmap for mmWave in finance aims to achieve greater system integration, reduced power consumption, and enhanced reliability. The ultimate goal is to create seamless, secure, and efficient financial ecosystems where mmWave technology serves as a foundational element for next-generation banking infrastructure, payment systems, and customer engagement platforms.

In the financial sector, mmWave technology represents an emerging frontier with transformative potential. Traditional financial operations have relied on conventional security systems, data transmission protocols, and customer interaction models. However, the increasing digitization of financial services, coupled with growing security concerns and demands for frictionless customer experiences, has created a fertile ground for mmWave applications.

The evolution of mmWave technology has been marked by progressive improvements in miniaturization, power efficiency, and signal processing capabilities. Early mmWave systems were bulky, power-hungry, and limited in range. Modern implementations benefit from advanced semiconductor technologies, sophisticated antenna arrays, and enhanced signal processing algorithms, making them suitable for deployment in commercial and consumer settings.

The primary technical objective for mmWave in the financial sector is to leverage its unique properties—high bandwidth, directional transmission, and penetration limitations—to address specific industry challenges. These include enhancing physical security through advanced detection systems, enabling contactless high-speed data transfer for financial transactions, and supporting precise indoor positioning for personalized banking experiences.

Current research focuses on overcoming the inherent limitations of mmWave technology, particularly its susceptibility to atmospheric attenuation and limited penetration through solid materials. Innovations in beamforming, signal processing, and material science are progressively addressing these challenges, expanding the practical applications of mmWave in various financial contexts.

The convergence of mmWave technology with artificial intelligence and edge computing presents particularly promising avenues for financial applications. This integration enables real-time analysis of complex data patterns, enhancing fraud detection capabilities and enabling more sophisticated customer authentication protocols without compromising user experience.

Looking forward, the technical roadmap for mmWave in finance aims to achieve greater system integration, reduced power consumption, and enhanced reliability. The ultimate goal is to create seamless, secure, and efficient financial ecosystems where mmWave technology serves as a foundational element for next-generation banking infrastructure, payment systems, and customer engagement platforms.

Financial Sector Demand Analysis for mmWave Applications

The financial sector is experiencing a growing demand for advanced technological solutions that enhance security, efficiency, and customer experience. Millimeter wave (mmWave) technology, operating in the frequency range of 30-300 GHz, presents significant opportunities to address these demands. Market analysis indicates that financial institutions are increasingly investing in innovative technologies, with global IT spending in banking and financial services projected to reach $300 billion by 2025, growing at a CAGR of approximately 6.5%.

Security remains the paramount concern for financial institutions, driving demand for sophisticated authentication systems. mmWave technology offers unique capabilities for biometric authentication through its high-resolution imaging capabilities, which can detect minute vascular patterns beneath the skin surface. This contactless verification method addresses both security and hygiene concerns that have become increasingly important in post-pandemic operations.

Data transmission speed requirements continue to escalate as financial transactions become more complex and data-intensive. mmWave's wide bandwidth capabilities enable ultra-fast wireless data transmission reaching speeds of up to 10 Gbps, significantly outperforming conventional wireless technologies. This addresses the growing need for real-time transaction processing and high-frequency trading systems where milliseconds can translate to millions in profit or loss.

Branch transformation initiatives are creating demand for technologies that enhance customer experience while optimizing operational efficiency. Financial institutions are redesigning physical spaces to incorporate more technology-enabled services, with mmWave supporting applications such as queue management systems, personalized customer recognition, and intelligent space utilization through precise people counting and movement tracking.

Regulatory compliance requirements are becoming increasingly stringent, particularly regarding fraud prevention and anti-money laundering measures. mmWave-based systems can provide enhanced monitoring capabilities through non-intrusive scanning of customer behavior patterns and detection of suspicious activities, helping institutions meet these regulatory demands while maintaining customer privacy.

The COVID-19 pandemic has accelerated the adoption of contactless technologies across the financial sector. Market research indicates that 78% of consumers now prefer touchless payment options, creating opportunities for mmWave-enabled payment systems that can operate at greater distances than current NFC solutions while maintaining security integrity.

Emerging markets represent a significant growth opportunity, with financial inclusion initiatives driving demand for secure, accessible banking technologies. mmWave solutions can support the deployment of secure banking kiosks and mobile banking units in underserved areas, providing authentication and connectivity capabilities in regions with limited infrastructure.

Security remains the paramount concern for financial institutions, driving demand for sophisticated authentication systems. mmWave technology offers unique capabilities for biometric authentication through its high-resolution imaging capabilities, which can detect minute vascular patterns beneath the skin surface. This contactless verification method addresses both security and hygiene concerns that have become increasingly important in post-pandemic operations.

Data transmission speed requirements continue to escalate as financial transactions become more complex and data-intensive. mmWave's wide bandwidth capabilities enable ultra-fast wireless data transmission reaching speeds of up to 10 Gbps, significantly outperforming conventional wireless technologies. This addresses the growing need for real-time transaction processing and high-frequency trading systems where milliseconds can translate to millions in profit or loss.

Branch transformation initiatives are creating demand for technologies that enhance customer experience while optimizing operational efficiency. Financial institutions are redesigning physical spaces to incorporate more technology-enabled services, with mmWave supporting applications such as queue management systems, personalized customer recognition, and intelligent space utilization through precise people counting and movement tracking.

Regulatory compliance requirements are becoming increasingly stringent, particularly regarding fraud prevention and anti-money laundering measures. mmWave-based systems can provide enhanced monitoring capabilities through non-intrusive scanning of customer behavior patterns and detection of suspicious activities, helping institutions meet these regulatory demands while maintaining customer privacy.

The COVID-19 pandemic has accelerated the adoption of contactless technologies across the financial sector. Market research indicates that 78% of consumers now prefer touchless payment options, creating opportunities for mmWave-enabled payment systems that can operate at greater distances than current NFC solutions while maintaining security integrity.

Emerging markets represent a significant growth opportunity, with financial inclusion initiatives driving demand for secure, accessible banking technologies. mmWave solutions can support the deployment of secure banking kiosks and mobile banking units in underserved areas, providing authentication and connectivity capabilities in regions with limited infrastructure.

Current mmWave Implementation Challenges in Finance

Despite the promising potential of mmWave technology in financial applications, several significant implementation challenges currently hinder its widespread adoption in the sector. The high-frequency nature of mmWave signals (typically 30-300 GHz) creates inherent physical limitations that financial institutions must overcome when deploying these systems.

Signal propagation presents a primary obstacle, as mmWave signals experience substantial attenuation when encountering physical barriers. In financial environments such as trading floors, bank branches, and data centers, the presence of walls, furniture, and even human bodies can significantly degrade signal quality. This characteristic necessitates careful planning of transmitter placement and often requires multiple access points to ensure comprehensive coverage.

Hardware costs remain prohibitively high for many financial institutions considering mmWave implementation. The specialized components required for mmWave systems—including high-precision antennas, phase arrays, and signal processing units—demand significant capital investment. This cost barrier particularly affects smaller financial entities and creates an adoption divide within the industry.

Security concerns represent another critical challenge. While mmWave's limited propagation range inherently enhances security by reducing signal leakage, financial institutions require additional safeguards given the sensitive nature of financial data. Implementing robust encryption and authentication protocols specifically optimized for mmWave's high-bandwidth characteristics adds complexity to system design and deployment.

Regulatory compliance further complicates mmWave adoption in finance. Different countries maintain varying regulations regarding spectrum allocation and power limitations for mmWave frequencies. Financial institutions operating globally must navigate this complex regulatory landscape, often necessitating different technical approaches across jurisdictions.

Integration with legacy systems poses substantial technical difficulties. Many financial institutions operate on established infrastructure that wasn't designed with mmWave compatibility in mind. Creating seamless interfaces between new mmWave systems and existing financial networks requires extensive engineering efforts and careful transition planning.

Power consumption represents an often-overlooked challenge. Current mmWave systems typically require significant energy to operate effectively, particularly for beamforming and signal processing functions. This energy requirement conflicts with financial institutions' growing focus on sustainability and operational cost reduction.

Talent acquisition presents a final significant hurdle. The specialized knowledge required to design, implement, and maintain mmWave systems in financial contexts remains scarce. Financial institutions must compete with telecommunications and technology sectors for this limited talent pool, often at premium compensation rates.

Signal propagation presents a primary obstacle, as mmWave signals experience substantial attenuation when encountering physical barriers. In financial environments such as trading floors, bank branches, and data centers, the presence of walls, furniture, and even human bodies can significantly degrade signal quality. This characteristic necessitates careful planning of transmitter placement and often requires multiple access points to ensure comprehensive coverage.

Hardware costs remain prohibitively high for many financial institutions considering mmWave implementation. The specialized components required for mmWave systems—including high-precision antennas, phase arrays, and signal processing units—demand significant capital investment. This cost barrier particularly affects smaller financial entities and creates an adoption divide within the industry.

Security concerns represent another critical challenge. While mmWave's limited propagation range inherently enhances security by reducing signal leakage, financial institutions require additional safeguards given the sensitive nature of financial data. Implementing robust encryption and authentication protocols specifically optimized for mmWave's high-bandwidth characteristics adds complexity to system design and deployment.

Regulatory compliance further complicates mmWave adoption in finance. Different countries maintain varying regulations regarding spectrum allocation and power limitations for mmWave frequencies. Financial institutions operating globally must navigate this complex regulatory landscape, often necessitating different technical approaches across jurisdictions.

Integration with legacy systems poses substantial technical difficulties. Many financial institutions operate on established infrastructure that wasn't designed with mmWave compatibility in mind. Creating seamless interfaces between new mmWave systems and existing financial networks requires extensive engineering efforts and careful transition planning.

Power consumption represents an often-overlooked challenge. Current mmWave systems typically require significant energy to operate effectively, particularly for beamforming and signal processing functions. This energy requirement conflicts with financial institutions' growing focus on sustainability and operational cost reduction.

Talent acquisition presents a final significant hurdle. The specialized knowledge required to design, implement, and maintain mmWave systems in financial contexts remains scarce. Financial institutions must compete with telecommunications and technology sectors for this limited talent pool, often at premium compensation rates.

Existing mmWave Solutions for Financial Services

01 mmWave Communication Systems and Protocols

Millimeter wave (mmWave) technology enables high-speed wireless communication by utilizing frequency bands between 30 GHz and 300 GHz. These systems implement specialized protocols for efficient data transmission, beamforming techniques to overcome signal attenuation, and advanced modulation schemes to maximize bandwidth utilization. The technology supports multi-gigabit data rates essential for 5G networks and beyond, addressing challenges like atmospheric absorption and limited propagation distance through innovative signal processing algorithms.- mmWave Communication Systems and Protocols: Millimeter wave (mmWave) technology enables high-speed wireless communication by utilizing frequency bands between 30 GHz and 300 GHz. These systems implement specialized protocols for efficient data transmission, beamforming techniques to overcome signal attenuation, and advanced modulation schemes. The technology supports multi-gigabit data rates essential for 5G networks and beyond, addressing challenges like atmospheric absorption and limited propagation distance through innovative signal processing algorithms.

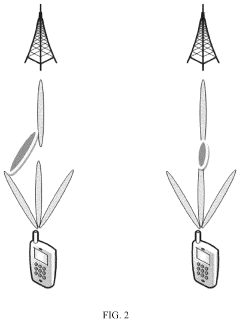

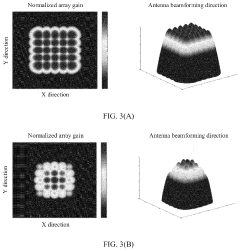

- mmWave Antenna Design and Beamforming: Advanced antenna designs are crucial for mmWave technology implementation, featuring phased array configurations that enable precise beamforming and beam steering capabilities. These antenna systems incorporate multiple radiating elements to form highly directional beams, compensating for the high path loss characteristic of mmWave frequencies. Innovations include compact antenna arrays, metamaterial-based designs, and integrated circuit solutions that minimize size while maximizing performance for mobile devices and base stations.

- mmWave Applications in Radar and Sensing: Millimeter wave technology enables high-resolution radar and sensing applications due to its short wavelength characteristics. These systems provide precise object detection, imaging, and distance measurement capabilities used in automotive radar, security screening, and industrial monitoring. The technology offers advantages in spatial resolution, penetration of certain materials, and operation in adverse weather conditions, making it valuable for autonomous vehicles, gesture recognition systems, and medical imaging devices.

- mmWave Semiconductor and Circuit Technologies: Specialized semiconductor technologies and integrated circuit designs are developed to operate efficiently at mmWave frequencies. These include silicon-germanium, gallium nitride, and CMOS processes optimized for high-frequency operation with low noise figures. Advanced circuit topologies address challenges like power consumption, thermal management, and signal integrity at these frequencies. Innovations focus on miniaturization, integration of multiple functions, and improved energy efficiency for practical mmWave system implementation.

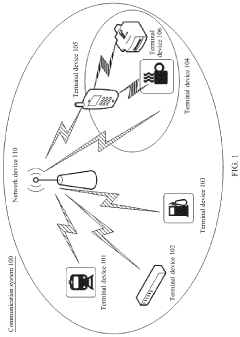

- mmWave Network Infrastructure and Deployment: The deployment of mmWave technology in network infrastructure requires specialized equipment and planning methodologies to overcome propagation limitations. Solutions include dense small cell deployments, intelligent repeater systems, and hybrid network architectures that combine mmWave with sub-6 GHz technologies. Network planning tools incorporate detailed propagation models, building penetration characteristics, and environmental factors to optimize coverage. Innovations focus on cost-effective deployment strategies, energy efficiency, and seamless integration with existing network infrastructure.

02 mmWave Antenna Design and Beamforming

Advanced antenna designs are crucial for mmWave technology implementation, featuring phased array architectures that enable precise beamforming capabilities. These antennas incorporate multiple radiating elements arranged in specific configurations to achieve directional gain and overcome the high path loss characteristic of mmWave frequencies. Adaptive beamforming techniques dynamically adjust signal phase and amplitude across antenna elements to track mobile users and maintain optimal connections despite environmental changes, significantly improving coverage and link reliability in mmWave deployments.Expand Specific Solutions03 mmWave Semiconductor and Circuit Technologies

Specialized semiconductor technologies and integrated circuit designs are developed specifically for mmWave applications, addressing the unique challenges of high-frequency operation. These include silicon-germanium (SiGe), gallium arsenide (GaAs), and complementary metal-oxide-semiconductor (CMOS) processes optimized for mmWave performance. Advanced circuit topologies incorporate low-noise amplifiers, power amplifiers, mixers, and frequency synthesizers capable of operating efficiently at extremely high frequencies while managing thermal issues and minimizing power consumption.Expand Specific Solutions04 mmWave Applications in Sensing and Imaging

Millimeter wave technology enables high-resolution sensing and imaging applications across various industries. The short wavelength characteristics allow for precise object detection, material penetration, and high-definition imaging capabilities. These properties make mmWave technology suitable for automotive radar systems, security screening, medical imaging, industrial quality control, and environmental monitoring. The non-ionizing nature of mmWaves, combined with their ability to penetrate certain materials while reflecting off others, creates unique opportunities for contactless sensing applications.Expand Specific Solutions05 mmWave Network Infrastructure and Deployment

The implementation of mmWave technology in network infrastructure requires specialized equipment and deployment strategies to overcome propagation limitations. This includes dense small cell architectures, distributed antenna systems, and integrated access and backhaul solutions. Network planning tools incorporate detailed 3D mapping and ray-tracing algorithms to optimize cell placement and coverage. Advanced resource allocation mechanisms dynamically manage spectrum usage, while edge computing capabilities are integrated to reduce latency and enhance service delivery in mmWave networks.Expand Specific Solutions

Key Financial Technology Players Adopting mmWave

The mmWave technology in the financial sector is in an early growth phase, with market size expanding as applications evolve beyond traditional telecommunications. The competitive landscape features established tech giants like Intel, IBM, Samsung, and Huawei developing specialized financial applications, alongside telecommunications leaders such as Nokia and T-Mobile providing infrastructure support. Research institutions including Peking University and IIT Madras are advancing fundamental technologies, while specialized firms like Vubiq focus on niche applications. Technical maturity varies significantly, with companies like MediaTek, TSMC, and Qualcomm leading in semiconductor implementation, while financial-specific applications remain in development stages as the industry explores secure transactions, fraud detection, and contactless payment innovations.

Intel Corp.

Technical Solution: Intel has developed a comprehensive mmWave solution for financial institutions called "Intel Financial Wireless Security" that operates across multiple mmWave bands (28GHz, 39GHz, and 60GHz). Their technology integrates with Intel's processor security features to create an end-to-end secure communication environment specifically designed for financial applications. Intel's mmWave implementation includes specialized hardware security modules that perform real-time encryption of financial data with negligible latency overhead (under 0.5ms). Their system features adaptive beamforming technology that automatically adjusts to maintain optimal security and performance even in dynamic financial environments like trading floors. Intel has also developed custom mmWave chipsets optimized for financial applications that include dedicated security processing cores and tamper-detection circuitry. The solution incorporates Intel's SGX (Software Guard Extensions) technology to create secure enclaves for financial data processing that remain protected even if the broader system is compromised. Field testing in major financial institutions has demonstrated throughput exceeding 15Gbps with consistent sub-millisecond latency, critical for algorithmic trading applications.

Strengths: Deep integration with Intel's broader security architecture; hardware-level security features specifically designed for financial applications; excellent performance metrics for latency-sensitive financial operations. Weaknesses: Requires Intel hardware components for full security feature implementation; higher power consumption compared to some competing solutions; complex deployment requiring specialized expertise.

Huawei Technologies Co., Ltd.

Technical Solution: Huawei has developed comprehensive mmWave solutions specifically tailored for financial sector applications. Their technology leverages 60GHz and 77GHz frequency bands to enable secure, high-speed wireless communications within financial institutions. Huawei's mmWave technology for financial applications includes specialized beamforming techniques that create highly directional transmission paths, significantly enhancing security by reducing signal interception risks. Their system incorporates advanced encryption protocols specifically designed for financial data transmission, with end-to-end latency under 1ms, critical for high-frequency trading applications. Huawei has also implemented specialized mmWave small cells optimized for dense indoor financial environments like trading floors, providing multi-gigabit connectivity while minimizing interference. Their solution includes AI-powered network management tools that continuously monitor for security threats and optimize performance based on financial transaction patterns and peak usage times.

Strengths: Superior security features specifically designed for financial data; ultra-low latency ideal for trading applications; high bandwidth capacity for data-intensive financial operations. Weaknesses: Higher implementation costs compared to traditional wireless solutions; limited penetration through physical barriers requiring more access points; potential regulatory challenges in certain markets due to security concerns.

Core mmWave Innovations for Financial Applications

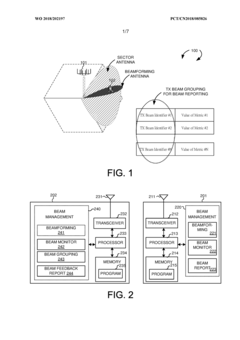

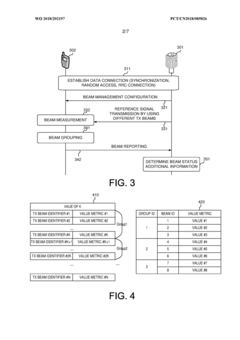

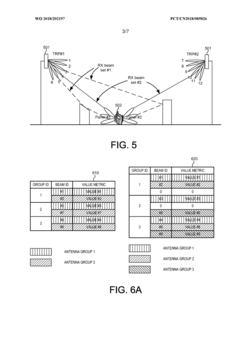

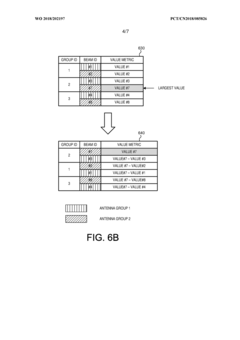

Method for beam management for wireless communication system with beamforming

PatentWO2018202197A1

Innovation

- Utilization of the underutilized mmWave frequency spectrum (3G-300GHz) for next generation broadband cellular communication networks, offering bandwidth 200 times greater than conventional cellular systems.

- Implementation of miniaturized antenna systems in small areas due to the very small wavelengths of mmWave spectrum, enabling high beamforming gains through electrically steerable arrays.

- Application of analog beamforming as a suitable candidate for mmWave wireless systems, allowing for different spatial resolutions through various beamformers.

Beam Alignment Method and Related Device

PatentPendingUS20240230816A1

Innovation

- A beam alignment method that involves receiving multiple beams, determining the optimal receive beam based on RSRP, calculating the required rotation angle and direction to align the peak direction beam with the transmit beam, and adjusting the terminal device's location to form an optimal beam pair, thereby increasing transmit or receive gain and improving coverage and mobility.

Security and Privacy Considerations for mmWave Financial Systems

As millimeter wave (mmWave) technology expands into financial applications, security and privacy considerations become paramount. Financial institutions must address the unique vulnerabilities associated with mmWave implementations while leveraging the technology's inherent security advantages. The high-frequency nature of mmWave signals (30-300 GHz) provides some natural security benefits through limited signal propagation and high directionality, making eavesdropping more difficult compared to traditional wireless technologies.

Physical layer security represents a significant advantage in mmWave financial systems. The narrow beamforming capabilities create spatially secure communication channels that are difficult to intercept without physical presence in the direct signal path. This characteristic is particularly valuable for sensitive financial transactions occurring at ATMs, payment terminals, and banking facilities where proximity-based authentication can be implemented with reduced risk of remote interception.

Despite these advantages, mmWave financial systems face several security challenges. Side-channel attacks remain possible through reflection and scattering of signals, potentially allowing sophisticated adversaries to reconstruct sensitive information. Additionally, the increased deployment of mmWave sensors for biometric authentication in financial settings introduces new privacy concerns regarding the collection and processing of highly personal biometric data.

Data protection frameworks must evolve to address mmWave-specific vulnerabilities. Financial institutions implementing mmWave technologies should adopt comprehensive encryption protocols specifically designed for high-bandwidth, low-latency communications. This includes implementing post-quantum cryptographic algorithms that can withstand future computational threats while maintaining the performance benefits of mmWave systems.

Regulatory compliance presents another critical consideration. Financial organizations must navigate varying international standards for wireless communications security while adhering to financial data protection regulations such as GDPR, CCPA, and industry-specific frameworks like PCI DSS. The integration of mmWave technology into existing compliance frameworks requires careful assessment and documentation of security controls.

Identity management within mmWave financial ecosystems demands robust authentication mechanisms. Multi-factor authentication combining mmWave-based proximity detection with traditional security measures can significantly enhance protection against unauthorized access. The development of tamper-evident mmWave hardware modules specifically designed for financial applications will further strengthen the security posture of these systems.

Future security research must focus on developing mmWave-specific threat models and corresponding countermeasures. This includes investigating potential vulnerabilities in beam management protocols, exploring jamming resistance techniques, and establishing industry standards for secure mmWave implementations in financial contexts. Collaborative efforts between financial institutions, technology providers, and regulatory bodies will be essential to establish comprehensive security frameworks that enable the safe expansion of mmWave utilities across the financial sector.

Physical layer security represents a significant advantage in mmWave financial systems. The narrow beamforming capabilities create spatially secure communication channels that are difficult to intercept without physical presence in the direct signal path. This characteristic is particularly valuable for sensitive financial transactions occurring at ATMs, payment terminals, and banking facilities where proximity-based authentication can be implemented with reduced risk of remote interception.

Despite these advantages, mmWave financial systems face several security challenges. Side-channel attacks remain possible through reflection and scattering of signals, potentially allowing sophisticated adversaries to reconstruct sensitive information. Additionally, the increased deployment of mmWave sensors for biometric authentication in financial settings introduces new privacy concerns regarding the collection and processing of highly personal biometric data.

Data protection frameworks must evolve to address mmWave-specific vulnerabilities. Financial institutions implementing mmWave technologies should adopt comprehensive encryption protocols specifically designed for high-bandwidth, low-latency communications. This includes implementing post-quantum cryptographic algorithms that can withstand future computational threats while maintaining the performance benefits of mmWave systems.

Regulatory compliance presents another critical consideration. Financial organizations must navigate varying international standards for wireless communications security while adhering to financial data protection regulations such as GDPR, CCPA, and industry-specific frameworks like PCI DSS. The integration of mmWave technology into existing compliance frameworks requires careful assessment and documentation of security controls.

Identity management within mmWave financial ecosystems demands robust authentication mechanisms. Multi-factor authentication combining mmWave-based proximity detection with traditional security measures can significantly enhance protection against unauthorized access. The development of tamper-evident mmWave hardware modules specifically designed for financial applications will further strengthen the security posture of these systems.

Future security research must focus on developing mmWave-specific threat models and corresponding countermeasures. This includes investigating potential vulnerabilities in beam management protocols, exploring jamming resistance techniques, and establishing industry standards for secure mmWave implementations in financial contexts. Collaborative efforts between financial institutions, technology providers, and regulatory bodies will be essential to establish comprehensive security frameworks that enable the safe expansion of mmWave utilities across the financial sector.

Regulatory Compliance for mmWave in Financial Institutions

The implementation of mmWave technology in financial institutions necessitates careful navigation of complex regulatory frameworks across different jurisdictions. Financial institutions must comply with regulations from multiple authorities, including telecommunications regulators (FCC in the US, ETSI in Europe), financial oversight bodies (SEC, FINRA, FSA), and data protection agencies (GDPR in Europe, CCPA in California).

Primary regulatory considerations for mmWave deployment include spectrum allocation compliance, where financial institutions must ensure their mmWave systems operate within legally designated frequency bands. This often requires obtaining appropriate licenses and adhering to power output limitations to prevent interference with other services utilizing similar frequencies.

Security and privacy regulations present another significant compliance challenge. Financial institutions implementing mmWave technology for customer identification, transaction processing, or surveillance must ensure these applications comply with data protection laws. This includes implementing robust encryption for data transmitted via mmWave channels and establishing clear data retention policies that align with regulatory requirements.

Physical deployment regulations also impact mmWave implementation in financial settings. Installation of mmWave equipment in branch locations must comply with building codes, electromagnetic emission standards, and accessibility requirements. Some jurisdictions may require environmental impact assessments before permitting installation of new transmission equipment.

Financial-specific regulations add another layer of complexity. Anti-money laundering (AML) and Know Your Customer (KYC) regulations must be considered when implementing mmWave-based identification systems. Any biometric data collected through mmWave scanning must meet stringent regulatory standards for storage and processing.

Cross-border operations present unique challenges, as financial institutions must navigate varying regulatory requirements across different countries. This often necessitates customized compliance approaches for each jurisdiction where mmWave technology is deployed.

To ensure ongoing compliance, financial institutions should implement comprehensive regulatory monitoring systems. These should track evolving regulations affecting mmWave technology across all relevant jurisdictions. Regular compliance audits and risk assessments are essential to identify potential regulatory gaps before they result in penalties or operational disruptions.

Engagement with regulatory bodies through industry associations can help shape future regulations. As mmWave applications in finance represent a relatively new technological frontier, proactive participation in regulatory discussions can help ensure that emerging frameworks accommodate legitimate business needs while protecting consumer interests.

Primary regulatory considerations for mmWave deployment include spectrum allocation compliance, where financial institutions must ensure their mmWave systems operate within legally designated frequency bands. This often requires obtaining appropriate licenses and adhering to power output limitations to prevent interference with other services utilizing similar frequencies.

Security and privacy regulations present another significant compliance challenge. Financial institutions implementing mmWave technology for customer identification, transaction processing, or surveillance must ensure these applications comply with data protection laws. This includes implementing robust encryption for data transmitted via mmWave channels and establishing clear data retention policies that align with regulatory requirements.

Physical deployment regulations also impact mmWave implementation in financial settings. Installation of mmWave equipment in branch locations must comply with building codes, electromagnetic emission standards, and accessibility requirements. Some jurisdictions may require environmental impact assessments before permitting installation of new transmission equipment.

Financial-specific regulations add another layer of complexity. Anti-money laundering (AML) and Know Your Customer (KYC) regulations must be considered when implementing mmWave-based identification systems. Any biometric data collected through mmWave scanning must meet stringent regulatory standards for storage and processing.

Cross-border operations present unique challenges, as financial institutions must navigate varying regulatory requirements across different countries. This often necessitates customized compliance approaches for each jurisdiction where mmWave technology is deployed.

To ensure ongoing compliance, financial institutions should implement comprehensive regulatory monitoring systems. These should track evolving regulations affecting mmWave technology across all relevant jurisdictions. Regular compliance audits and risk assessments are essential to identify potential regulatory gaps before they result in penalties or operational disruptions.

Engagement with regulatory bodies through industry associations can help shape future regulations. As mmWave applications in finance represent a relatively new technological frontier, proactive participation in regulatory discussions can help ensure that emerging frameworks accommodate legitimate business needs while protecting consumer interests.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!