mmWave's Competitive Edge in Developing Global Connectivity

SEP 22, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

mmWave Technology Background and Objectives

Millimeter wave (mmWave) technology represents a significant advancement in wireless communication, operating in the frequency spectrum between 30 GHz and 300 GHz. This technology has evolved from early radar applications in the mid-20th century to becoming a cornerstone of next-generation connectivity solutions. The progression of mmWave technology has been marked by continuous improvements in semiconductor fabrication, antenna design, and signal processing algorithms, enabling increasingly practical implementations.

The evolution of mmWave technology has accelerated dramatically in the past decade, driven by the exponential growth in global data consumption and the need for higher bandwidth communication channels. Traditional sub-6 GHz spectrum has become increasingly congested, pushing the industry toward higher frequency bands that offer substantially more available bandwidth. This transition represents a paradigm shift in wireless communication strategy, moving from spectrum efficiency to spectrum abundance as the primary approach to meeting capacity demands.

Current technical objectives for mmWave technology focus on overcoming its inherent physical limitations while maximizing its unique advantages. Primary goals include extending communication range beyond current limitations, improving penetration capabilities through various materials, reducing power consumption for mobile applications, and developing cost-effective manufacturing techniques for mass-market deployment. These objectives align with the broader industry goal of establishing ubiquitous high-capacity connectivity networks.

The competitive edge of mmWave in global connectivity stems from its unparalleled capacity advantages. With channel bandwidths potentially reaching several gigahertz—compared to tens or hundreds of megahertz in traditional cellular bands—mmWave technology enables multi-gigabit-per-second data rates that are essential for emerging applications such as augmented reality, autonomous vehicles, and industrial automation. This massive capacity increase represents the technology's most significant contribution to addressing the growing global digital divide.

Research and development trends indicate a convergence toward integrated solutions that combine mmWave with other complementary technologies. Hybrid network architectures leveraging both sub-6 GHz for coverage and mmWave for capacity are emerging as the dominant deployment model. Additionally, the integration of advanced beamforming techniques, machine learning algorithms for channel prediction, and edge computing capabilities are enhancing the practical viability of mmWave systems in diverse environmental conditions.

The trajectory of mmWave technology suggests it will play an increasingly central role in both terrestrial and non-terrestrial network infrastructures. As satellite constellations, high-altitude platform stations, and traditional cellular networks all incorporate mmWave capabilities, a new era of seamless global connectivity becomes possible, potentially transforming digital inclusion across previously underserved regions and creating new paradigms for communication service delivery.

The evolution of mmWave technology has accelerated dramatically in the past decade, driven by the exponential growth in global data consumption and the need for higher bandwidth communication channels. Traditional sub-6 GHz spectrum has become increasingly congested, pushing the industry toward higher frequency bands that offer substantially more available bandwidth. This transition represents a paradigm shift in wireless communication strategy, moving from spectrum efficiency to spectrum abundance as the primary approach to meeting capacity demands.

Current technical objectives for mmWave technology focus on overcoming its inherent physical limitations while maximizing its unique advantages. Primary goals include extending communication range beyond current limitations, improving penetration capabilities through various materials, reducing power consumption for mobile applications, and developing cost-effective manufacturing techniques for mass-market deployment. These objectives align with the broader industry goal of establishing ubiquitous high-capacity connectivity networks.

The competitive edge of mmWave in global connectivity stems from its unparalleled capacity advantages. With channel bandwidths potentially reaching several gigahertz—compared to tens or hundreds of megahertz in traditional cellular bands—mmWave technology enables multi-gigabit-per-second data rates that are essential for emerging applications such as augmented reality, autonomous vehicles, and industrial automation. This massive capacity increase represents the technology's most significant contribution to addressing the growing global digital divide.

Research and development trends indicate a convergence toward integrated solutions that combine mmWave with other complementary technologies. Hybrid network architectures leveraging both sub-6 GHz for coverage and mmWave for capacity are emerging as the dominant deployment model. Additionally, the integration of advanced beamforming techniques, machine learning algorithms for channel prediction, and edge computing capabilities are enhancing the practical viability of mmWave systems in diverse environmental conditions.

The trajectory of mmWave technology suggests it will play an increasingly central role in both terrestrial and non-terrestrial network infrastructures. As satellite constellations, high-altitude platform stations, and traditional cellular networks all incorporate mmWave capabilities, a new era of seamless global connectivity becomes possible, potentially transforming digital inclusion across previously underserved regions and creating new paradigms for communication service delivery.

Global Connectivity Market Demand Analysis

The global connectivity market is experiencing unprecedented growth, driven by increasing digitalization across industries and the rising demand for high-speed, reliable internet access worldwide. Current market analysis indicates that global internet penetration has reached approximately 65% of the world's population, leaving significant room for expansion, particularly in developing regions. The COVID-19 pandemic has further accelerated this demand, with remote work, telehealth, and online education becoming essential services rather than luxuries.

Millimeter wave (mmWave) technology is positioned to address critical connectivity gaps in both developed and emerging markets. In urban environments, the demand for high-bandwidth applications such as 4K/8K video streaming, augmented reality, and virtual reality experiences is creating network congestion that traditional connectivity solutions struggle to handle. Market research shows that data consumption per user continues to grow at 30-40% annually, necessitating new technological approaches.

Rural and remote connectivity represents another substantial market opportunity. Currently, approximately 3 billion people worldwide lack reliable internet access, representing not only a humanitarian challenge but also a significant untapped market. Traditional connectivity solutions face prohibitive deployment costs in these areas, creating an opening for innovative technologies like mmWave-based solutions that can provide high-capacity backhaul for rural networks.

The enterprise sector demonstrates particularly strong demand for mmWave connectivity solutions. Industries including manufacturing, healthcare, transportation, and retail are increasingly implementing IoT devices and data-intensive applications that require ultra-reliable, low-latency connections. The industrial IoT market alone is growing rapidly, with smart factories and automated production lines requiring connectivity solutions that can handle massive device density and real-time data processing.

Satellite-based internet services represent another expanding market segment where mmWave technology offers competitive advantages. Companies developing low Earth orbit (LEO) satellite constellations are actively seeking high-capacity ground station technologies, with mmWave offering ideal characteristics for these applications. The satellite internet market is projected to grow substantially over the next decade as these constellations achieve global coverage.

From a regional perspective, North America and East Asia currently lead in mmWave adoption, primarily for 5G network deployments. However, emerging markets in South Asia, Africa, and Latin America present significant growth opportunities as they seek to leapfrog traditional infrastructure limitations. Government initiatives promoting digital inclusion and smart city developments in these regions are creating favorable conditions for mmWave technology deployment.

Millimeter wave (mmWave) technology is positioned to address critical connectivity gaps in both developed and emerging markets. In urban environments, the demand for high-bandwidth applications such as 4K/8K video streaming, augmented reality, and virtual reality experiences is creating network congestion that traditional connectivity solutions struggle to handle. Market research shows that data consumption per user continues to grow at 30-40% annually, necessitating new technological approaches.

Rural and remote connectivity represents another substantial market opportunity. Currently, approximately 3 billion people worldwide lack reliable internet access, representing not only a humanitarian challenge but also a significant untapped market. Traditional connectivity solutions face prohibitive deployment costs in these areas, creating an opening for innovative technologies like mmWave-based solutions that can provide high-capacity backhaul for rural networks.

The enterprise sector demonstrates particularly strong demand for mmWave connectivity solutions. Industries including manufacturing, healthcare, transportation, and retail are increasingly implementing IoT devices and data-intensive applications that require ultra-reliable, low-latency connections. The industrial IoT market alone is growing rapidly, with smart factories and automated production lines requiring connectivity solutions that can handle massive device density and real-time data processing.

Satellite-based internet services represent another expanding market segment where mmWave technology offers competitive advantages. Companies developing low Earth orbit (LEO) satellite constellations are actively seeking high-capacity ground station technologies, with mmWave offering ideal characteristics for these applications. The satellite internet market is projected to grow substantially over the next decade as these constellations achieve global coverage.

From a regional perspective, North America and East Asia currently lead in mmWave adoption, primarily for 5G network deployments. However, emerging markets in South Asia, Africa, and Latin America present significant growth opportunities as they seek to leapfrog traditional infrastructure limitations. Government initiatives promoting digital inclusion and smart city developments in these regions are creating favorable conditions for mmWave technology deployment.

mmWave Current Status and Technical Challenges

Millimeter wave (mmWave) technology has emerged as a critical component in the global connectivity landscape, with significant advancements achieved across various regions. Currently, the United States, China, South Korea, and Japan lead in mmWave research and deployment, with European nations following closely behind. Commercial implementations have primarily focused on 5G networks, with carriers in these regions deploying mmWave in dense urban environments to address capacity challenges.

The current technical maturity of mmWave varies significantly across applications. While fixed wireless access has demonstrated commercial viability, mobile mmWave connectivity still faces substantial implementation challenges. Industry testing indicates that mmWave can deliver multi-gigabit speeds in ideal conditions, but real-world performance often falls short of theoretical maximums due to environmental factors.

A primary technical challenge for mmWave deployment is its limited propagation characteristics. The high-frequency signals (typically 24-100 GHz) suffer from severe attenuation when encountering physical obstacles, resulting in significantly reduced coverage compared to sub-6 GHz frequencies. Signal penetration through building materials is particularly problematic, with studies showing signal loss of 20-40 dB through common construction materials.

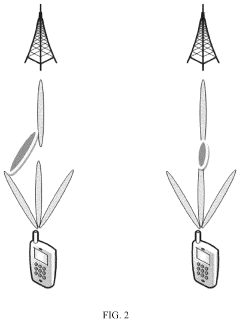

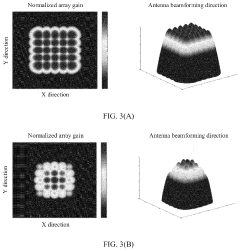

Beam management represents another critical challenge. The directional nature of mmWave transmissions requires sophisticated beamforming techniques and precise alignment between transmitters and receivers. Current solutions employ massive MIMO antenna arrays with hundreds of elements, but maintaining optimal beam alignment for mobile users remains technically demanding and energy-intensive.

Power consumption issues further constrain mmWave applications, especially in mobile devices. The complex signal processing required for beamforming and the higher power needed for signal amplification at these frequencies result in substantial energy demands. Current mmWave chipsets consume 2-3 times more power than their sub-6 GHz counterparts, creating thermal management challenges in compact devices.

Device integration presents additional hurdles, as mmWave components require careful placement to avoid interference and body blockage effects. Manufacturers must balance antenna performance with industrial design considerations, often resulting in compromised solutions.

Network densification requirements also pose economic challenges. The limited coverage radius of mmWave cells (typically 100-200 meters) necessitates significantly more base stations compared to traditional cellular networks. This increases both capital expenditure and operational costs, making widespread deployment economically challenging outside of high-traffic areas.

Weather susceptibility remains a concern, with rain attenuation reaching 10-30 dB/km at mmWave frequencies. This creates reliability issues in regions with frequent precipitation, requiring sophisticated network planning and redundancy mechanisms to maintain service quality.

The current technical maturity of mmWave varies significantly across applications. While fixed wireless access has demonstrated commercial viability, mobile mmWave connectivity still faces substantial implementation challenges. Industry testing indicates that mmWave can deliver multi-gigabit speeds in ideal conditions, but real-world performance often falls short of theoretical maximums due to environmental factors.

A primary technical challenge for mmWave deployment is its limited propagation characteristics. The high-frequency signals (typically 24-100 GHz) suffer from severe attenuation when encountering physical obstacles, resulting in significantly reduced coverage compared to sub-6 GHz frequencies. Signal penetration through building materials is particularly problematic, with studies showing signal loss of 20-40 dB through common construction materials.

Beam management represents another critical challenge. The directional nature of mmWave transmissions requires sophisticated beamforming techniques and precise alignment between transmitters and receivers. Current solutions employ massive MIMO antenna arrays with hundreds of elements, but maintaining optimal beam alignment for mobile users remains technically demanding and energy-intensive.

Power consumption issues further constrain mmWave applications, especially in mobile devices. The complex signal processing required for beamforming and the higher power needed for signal amplification at these frequencies result in substantial energy demands. Current mmWave chipsets consume 2-3 times more power than their sub-6 GHz counterparts, creating thermal management challenges in compact devices.

Device integration presents additional hurdles, as mmWave components require careful placement to avoid interference and body blockage effects. Manufacturers must balance antenna performance with industrial design considerations, often resulting in compromised solutions.

Network densification requirements also pose economic challenges. The limited coverage radius of mmWave cells (typically 100-200 meters) necessitates significantly more base stations compared to traditional cellular networks. This increases both capital expenditure and operational costs, making widespread deployment economically challenging outside of high-traffic areas.

Weather susceptibility remains a concern, with rain attenuation reaching 10-30 dB/km at mmWave frequencies. This creates reliability issues in regions with frequent precipitation, requiring sophisticated network planning and redundancy mechanisms to maintain service quality.

Current mmWave Deployment Solutions

01 Enhanced Communication and Data Transfer Capabilities

mmWave technology offers significant advantages in communication speed and data transfer rates, providing a competitive edge in applications requiring high bandwidth. The technology enables faster wireless communication, reduced latency, and improved data throughput, which is particularly valuable in 5G networks, IoT devices, and high-speed data transmission systems. These capabilities allow for more efficient information exchange and support advanced applications like real-time analytics and high-definition content streaming.- Enhanced Communication and Data Transfer Capabilities: mmWave technology offers significant advantages in communication speed and data transfer rates due to its high frequency spectrum. This technology enables faster wireless connections, reduced latency, and increased bandwidth capacity, providing a competitive edge in applications requiring real-time data processing and high-speed connectivity. The implementation of mmWave in communication systems allows for more efficient spectrum utilization and supports advanced features like beamforming for targeted signal transmission.

- Advanced Sensing and Imaging Applications: mmWave technology provides superior sensing and imaging capabilities due to its shorter wavelengths, enabling high-resolution detection and imaging. This offers competitive advantages in various fields including security scanning, automotive radar systems, and medical imaging. The technology allows for precise object detection, tracking, and classification even in challenging environmental conditions, making it valuable for autonomous vehicles, industrial automation, and surveillance systems.

- Integration with AI and Machine Learning: The combination of mmWave technology with artificial intelligence and machine learning algorithms creates powerful solutions with significant competitive advantages. This integration enables intelligent signal processing, adaptive beamforming, and predictive analytics that can optimize system performance in real-time. Enhanced data analysis capabilities allow for more accurate pattern recognition, anomaly detection, and automated decision-making in various applications including smart cities, industrial IoT, and next-generation wireless networks.

- Market Positioning and Business Strategy: Companies leveraging mmWave technology can gain competitive edge through strategic market positioning and innovative business models. Early adoption and patent portfolio development in mmWave technology can establish market leadership and create barriers to entry for competitors. Strategic partnerships, licensing agreements, and ecosystem development around mmWave solutions can further strengthen competitive positioning and create new revenue streams in emerging markets like 5G/6G telecommunications, smart infrastructure, and advanced manufacturing.

- Gaming and Entertainment Applications: mmWave technology offers competitive advantages in gaming and entertainment industries through enhanced user experiences and new interaction modalities. The high bandwidth and low latency characteristics enable more immersive virtual and augmented reality experiences, precise motion tracking, and wireless high-definition content streaming. These capabilities create opportunities for innovative gaming platforms, interactive entertainment systems, and location-based experiences that can differentiate products in competitive markets.

02 Advanced Sensing and Imaging Applications

mmWave technology provides superior sensing and imaging capabilities due to its short wavelength characteristics. This enables high-resolution imaging, precise object detection, and accurate distance measurement, creating competitive advantages in security systems, automotive radar, medical imaging, and industrial inspection. The technology can penetrate certain materials while providing detailed scans, making it valuable for non-destructive testing and surveillance applications where traditional technologies fall short.Expand Specific Solutions03 Integration with AI and Machine Learning

The combination of mmWave technology with artificial intelligence and machine learning algorithms creates powerful competitive advantages. This integration enables intelligent signal processing, adaptive beam steering, predictive maintenance, and automated decision-making systems. Companies leveraging this combination can offer smarter devices, more efficient network management, and innovative solutions for complex problems in various industries, from telecommunications to healthcare and autonomous vehicles.Expand Specific Solutions04 Market Positioning and Business Strategy

Organizations can gain competitive edge through strategic implementation of mmWave technology in their business models. This includes developing proprietary mmWave solutions, securing key patents, forming strategic partnerships, and creating new revenue streams based on mmWave capabilities. Companies that effectively position themselves as mmWave technology leaders can differentiate their offerings, command premium pricing, and capture emerging market opportunities before competitors.Expand Specific Solutions05 Miniaturization and Integration Solutions

Advancements in mmWave component miniaturization and system integration provide significant competitive advantages. These innovations enable smaller device footprints, reduced power consumption, and more efficient thermal management. Companies developing compact mmWave modules, integrated antenna arrays, and system-on-chip solutions can offer more portable, energy-efficient, and cost-effective products across various applications, from consumer electronics to industrial equipment and defense systems.Expand Specific Solutions

Key Industry Players in mmWave Ecosystem

The mmWave connectivity market is currently in a growth phase, with major players positioning themselves for dominance in this transformative technology. The global market is expanding rapidly as 5G deployment accelerates, with projections indicating substantial growth over the next five years. From a technological maturity perspective, companies like Huawei, Samsung, Nokia, and Ericsson lead in infrastructure development, while Intel, MediaTek, and Qualcomm focus on chipset solutions. Research institutions including University of Electronic Science & Technology of China and Electronics & Telecommunications Research Institute are advancing fundamental technologies. The competitive landscape shows telecommunications giants collaborating with semiconductor companies to overcome mmWave's technical challenges of limited range and penetration, with significant investment in antenna array technologies and beamforming solutions to enhance performance in diverse deployment scenarios.

Intel Corp.

Technical Solution: Intel has developed a comprehensive mmWave technology portfolio centered around their Intel XMM 8160 5G modem and subsequent generations, which support mmWave bands from 24 GHz to 40 GHz. Their approach integrates advanced RF front-end modules with specialized digital signal processing capabilities to enable efficient mmWave communications. Intel's mmWave solutions feature their proprietary CMOS-based phased array antennas that implement dynamic beamforming to overcome propagation challenges while maintaining power efficiency. Their technology incorporates sophisticated beam tracking algorithms that continuously adjust signal direction to maintain connectivity with moving devices. Intel has demonstrated mmWave implementations achieving multi-gigabit throughput in both fixed and mobile scenarios, with their latest solutions supporting theoretical peak speeds up to 7.5 Gbps in optimal conditions. Their mmWave platform includes specialized hardware accelerators for beam management functions, reducing processing overhead and power consumption. Intel's approach also emphasizes software-defined networking capabilities that allow for flexible deployment across diverse use cases, from dense urban environments to enterprise campuses and industrial settings.

Strengths: Strong system-on-chip integration capabilities; extensive experience in RF design and digital signal processing; broad ecosystem partnerships across device manufacturers and network operators. Weaknesses: Less direct deployment experience compared to traditional telecom equipment vendors; higher power consumption requirements in early implementations; complex integration requirements with radio access network infrastructure.

Samsung Electronics Co., Ltd.

Technical Solution: Samsung has developed an extensive mmWave technology portfolio focused on enhancing global connectivity through high-bandwidth, low-latency communications. Their approach centers on advanced 28 GHz and 39 GHz mmWave solutions that integrate with their end-to-end 5G infrastructure. Samsung's mmWave technology incorporates proprietary beamforming techniques using compact antenna arrays that dynamically adjust signal direction to overcome the limited propagation characteristics of mmWave frequencies. Their solutions feature specialized RF integrated circuits (RFICs) that enable efficient power management while maintaining signal integrity across challenging environments. Samsung has demonstrated mmWave connectivity achieving multi-gigabit speeds in both fixed wireless access (FWA) and mobile scenarios, with their latest implementations supporting speeds up to 8.5 Gbps in optimal conditions. Their mmWave small cell architecture enables dense urban deployments with minimal visual impact, while their virtualized RAN approach allows for flexible network scaling and management across diverse deployment scenarios.

Strengths: Vertical integration capabilities from chipsets to network infrastructure; strong commercial deployment experience in key markets like the US and South Korea; comprehensive device ecosystem supporting mmWave. Weaknesses: Higher deployment costs compared to sub-6 GHz solutions; limited penetration through physical obstacles requiring denser network deployments; more complex installation and optimization requirements.

Core mmWave Patents and Technical Innovations

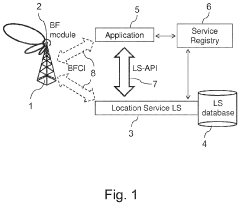

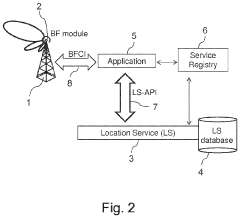

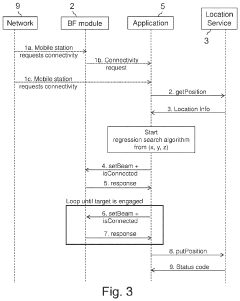

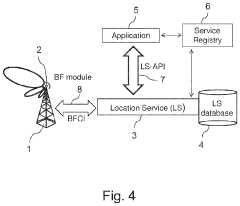

Service location method and system for mmwave cellular environments

PatentActiveUS20210227488A1

Innovation

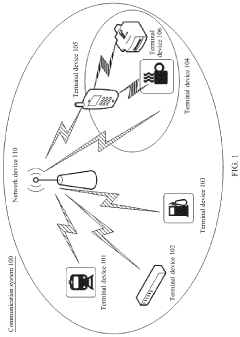

- A method and system that decouples the beamforming module from the application layer, utilizing a location service to provide and update user terminal location information, enabling improved beam steering and association procedures through a location service entity connected to mmWave access points, facilitating faster terminal discovery and communication.

Beam Alignment Method and Related Device

PatentPendingUS20240230816A1

Innovation

- A beam alignment method that involves receiving multiple beams, determining the optimal receive beam based on RSRP, calculating the required rotation angle and direction to align the peak direction beam with the transmit beam, and adjusting the terminal device's location to form an optimal beam pair, thereby increasing transmit or receive gain and improving coverage and mobility.

Spectrum Allocation and Regulatory Framework

The regulatory landscape for millimeter wave (mmWave) spectrum represents a critical foundation for the technology's global deployment. Currently, international bodies such as the International Telecommunication Union (ITU) have designated several mmWave bands for 5G and future connectivity solutions, primarily in the 24-86 GHz range. The World Radiocommunication Conference (WRC) has played a pivotal role in harmonizing these allocations across regions, with the WRC-19 identifying specific bands including 24.25-27.5 GHz, 37-43.5 GHz, and 66-71 GHz for IMT services.

Regional regulatory approaches demonstrate significant variation in mmWave implementation strategies. The United States, through the Federal Communications Commission (FCC), has taken an aggressive approach by auctioning substantial portions of the 24 GHz, 28 GHz, and 39 GHz bands, establishing itself as an early leader in mmWave deployment. The European Union, via its Electronic Communications Committee (ECC), has focused on the 26 GHz band as its primary mmWave resource, while implementing more stringent technical conditions to protect adjacent services.

Asia-Pacific regulators have adopted diverse approaches, with Japan and South Korea prioritizing rapid mmWave allocation to support their technology industries, while China has focused more heavily on mid-band spectrum before gradually expanding into mmWave territory. Emerging markets face unique challenges in spectrum allocation, often balancing the need for technological advancement against limited resources and competing priorities.

Licensing frameworks for mmWave spectrum have evolved beyond traditional exclusive nationwide licenses. Many regulators now implement flexible models including regional licensing, shared access frameworks, and light licensing regimes. These approaches recognize mmWave's propagation characteristics and the need for dense, localized deployments rather than broad coverage networks.

Technical coexistence requirements present significant regulatory challenges, as mmWave bands often neighbor sensitive services including satellite operations, scientific research, and earth observation systems. Regulators have implemented various protection mechanisms including guard bands, power limitations, and geographic exclusion zones to mitigate interference risks.

The economic valuation of mmWave spectrum differs substantially from traditional mobile bands, reflecting both its abundant availability and deployment challenges. Auction results have shown lower per-MHz valuations compared to sub-6 GHz spectrum, though pricing varies significantly based on market conditions, license terms, and deployment requirements.

Future regulatory trends indicate movement toward more dynamic spectrum management approaches, including automated coordination systems, database-driven access, and potentially AI-powered interference management. These innovations aim to maximize the utility of mmWave resources while protecting incumbent services and enabling rapid deployment of next-generation connectivity solutions.

Regional regulatory approaches demonstrate significant variation in mmWave implementation strategies. The United States, through the Federal Communications Commission (FCC), has taken an aggressive approach by auctioning substantial portions of the 24 GHz, 28 GHz, and 39 GHz bands, establishing itself as an early leader in mmWave deployment. The European Union, via its Electronic Communications Committee (ECC), has focused on the 26 GHz band as its primary mmWave resource, while implementing more stringent technical conditions to protect adjacent services.

Asia-Pacific regulators have adopted diverse approaches, with Japan and South Korea prioritizing rapid mmWave allocation to support their technology industries, while China has focused more heavily on mid-band spectrum before gradually expanding into mmWave territory. Emerging markets face unique challenges in spectrum allocation, often balancing the need for technological advancement against limited resources and competing priorities.

Licensing frameworks for mmWave spectrum have evolved beyond traditional exclusive nationwide licenses. Many regulators now implement flexible models including regional licensing, shared access frameworks, and light licensing regimes. These approaches recognize mmWave's propagation characteristics and the need for dense, localized deployments rather than broad coverage networks.

Technical coexistence requirements present significant regulatory challenges, as mmWave bands often neighbor sensitive services including satellite operations, scientific research, and earth observation systems. Regulators have implemented various protection mechanisms including guard bands, power limitations, and geographic exclusion zones to mitigate interference risks.

The economic valuation of mmWave spectrum differs substantially from traditional mobile bands, reflecting both its abundant availability and deployment challenges. Auction results have shown lower per-MHz valuations compared to sub-6 GHz spectrum, though pricing varies significantly based on market conditions, license terms, and deployment requirements.

Future regulatory trends indicate movement toward more dynamic spectrum management approaches, including automated coordination systems, database-driven access, and potentially AI-powered interference management. These innovations aim to maximize the utility of mmWave resources while protecting incumbent services and enabling rapid deployment of next-generation connectivity solutions.

Infrastructure Requirements for mmWave Deployment

The deployment of millimeter wave (mmWave) technology for global connectivity requires substantial infrastructure investments and technical considerations. The high-frequency nature of mmWave signals (typically 24-100 GHz) necessitates a dense network of base stations due to limited propagation characteristics. These signals are highly susceptible to atmospheric absorption, rain fade, and physical obstructions, requiring line-of-sight transmission paths in most deployment scenarios.

Base station density represents a primary infrastructure challenge, with estimates suggesting that mmWave networks require 8-10 times more cell sites than traditional sub-6 GHz networks. This translates to significant capital expenditure for telecommunications providers, with industry analysts projecting infrastructure costs between $6-8 billion for nationwide mmWave coverage in medium-sized countries.

Advanced antenna systems form another critical infrastructure component. Massive MIMO (Multiple-Input Multiple-Output) arrays and beamforming technologies are essential to overcome propagation limitations. These systems typically require 64-256 antenna elements per base station, significantly increasing hardware complexity and power requirements compared to conventional cellular infrastructure.

Backhaul capacity presents an additional challenge, as mmWave's multi-gigabit throughput capabilities demand corresponding increases in backhaul network capacity. Fiber optic connectivity to base stations is optimal but expensive, while wireless backhaul solutions using E-band (70/80 GHz) or even higher frequencies are being explored as cost-effective alternatives in certain deployment scenarios.

Power infrastructure must also be enhanced, as mmWave base stations consume 1.5-3 times more energy than traditional cellular equipment due to complex signal processing requirements and active cooling needs. This necessitates robust power distribution networks and potentially on-site backup power systems to ensure reliability.

Edge computing facilities represent an emerging infrastructure requirement for mmWave networks. The ultra-low latency applications enabled by mmWave technology (such as autonomous vehicles and industrial automation) require distributed computing resources positioned closer to end users, necessitating mini data centers at strategic network locations.

Regulatory frameworks and spectrum allocation policies significantly impact infrastructure deployment. Countries with streamlined site acquisition processes and favorable small cell regulations have demonstrated 30-40% faster mmWave rollouts. Additionally, harmonized international spectrum allocation would enable economies of scale in equipment manufacturing, potentially reducing infrastructure costs by 15-20% according to industry estimates.

Base station density represents a primary infrastructure challenge, with estimates suggesting that mmWave networks require 8-10 times more cell sites than traditional sub-6 GHz networks. This translates to significant capital expenditure for telecommunications providers, with industry analysts projecting infrastructure costs between $6-8 billion for nationwide mmWave coverage in medium-sized countries.

Advanced antenna systems form another critical infrastructure component. Massive MIMO (Multiple-Input Multiple-Output) arrays and beamforming technologies are essential to overcome propagation limitations. These systems typically require 64-256 antenna elements per base station, significantly increasing hardware complexity and power requirements compared to conventional cellular infrastructure.

Backhaul capacity presents an additional challenge, as mmWave's multi-gigabit throughput capabilities demand corresponding increases in backhaul network capacity. Fiber optic connectivity to base stations is optimal but expensive, while wireless backhaul solutions using E-band (70/80 GHz) or even higher frequencies are being explored as cost-effective alternatives in certain deployment scenarios.

Power infrastructure must also be enhanced, as mmWave base stations consume 1.5-3 times more energy than traditional cellular equipment due to complex signal processing requirements and active cooling needs. This necessitates robust power distribution networks and potentially on-site backup power systems to ensure reliability.

Edge computing facilities represent an emerging infrastructure requirement for mmWave networks. The ultra-low latency applications enabled by mmWave technology (such as autonomous vehicles and industrial automation) require distributed computing resources positioned closer to end users, necessitating mini data centers at strategic network locations.

Regulatory frameworks and spectrum allocation policies significantly impact infrastructure deployment. Countries with streamlined site acquisition processes and favorable small cell regulations have demonstrated 30-40% faster mmWave rollouts. Additionally, harmonized international spectrum allocation would enable economies of scale in equipment manufacturing, potentially reducing infrastructure costs by 15-20% according to industry estimates.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!