Economic Incentives And Market Mechanisms For SLB Adoption

AUG 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

SLB Background and Objectives

Sustainability-Linked Bonds (SLBs) represent a significant innovation in sustainable finance, emerging as a response to the growing demand for financial instruments that align economic returns with environmental and social outcomes. Unlike traditional green bonds that focus on funding specific projects, SLBs are performance-based instruments where the financial characteristics can vary depending on whether the issuer achieves predefined sustainability performance targets (SPTs). This structure creates a direct link between an organization's sustainability strategy and its financing costs.

The evolution of SLBs can be traced back to the broader development of Environmental, Social, and Governance (ESG) investing, which has gained substantial momentum over the past decade. The International Capital Market Association (ICMA) formalized SLBs in 2020 with the publication of the Sustainability-Linked Bond Principles, providing a framework for issuance and establishing market standards. Since then, the SLB market has experienced exponential growth, with global issuance increasing from approximately $8.9 billion in 2020 to over $90 billion by the end of 2022.

The primary objective of SLBs is to incentivize companies to improve their sustainability performance through market-based mechanisms. By tying financial outcomes to sustainability targets, SLBs create economic incentives for issuers to achieve meaningful environmental and social improvements. This approach addresses a critical gap in sustainable finance by focusing on company-wide transformation rather than isolated green projects.

From a market perspective, SLBs aim to expand the pool of sustainable investment opportunities by accommodating companies in transition-intensive sectors that may not have sufficient green projects to fund but are committed to improving their overall sustainability profile. This inclusivity is particularly important for hard-to-abate sectors such as heavy industry, transportation, and agriculture.

The technical objectives of SLB market mechanisms include developing robust frameworks for setting credible sustainability performance targets, establishing standardized verification processes, and creating pricing models that accurately reflect sustainability risk and performance. Additionally, there is a focus on enhancing transparency and accountability through comprehensive reporting requirements and third-party verification.

Looking forward, the SLB market is expected to continue its rapid growth trajectory, with innovations in structure, pricing mechanisms, and application across diverse sectors. The evolution of this market will likely be shaped by regulatory developments, investor demand for impact measurement, and the increasing sophistication of sustainability metrics and assessment methodologies.

The evolution of SLBs can be traced back to the broader development of Environmental, Social, and Governance (ESG) investing, which has gained substantial momentum over the past decade. The International Capital Market Association (ICMA) formalized SLBs in 2020 with the publication of the Sustainability-Linked Bond Principles, providing a framework for issuance and establishing market standards. Since then, the SLB market has experienced exponential growth, with global issuance increasing from approximately $8.9 billion in 2020 to over $90 billion by the end of 2022.

The primary objective of SLBs is to incentivize companies to improve their sustainability performance through market-based mechanisms. By tying financial outcomes to sustainability targets, SLBs create economic incentives for issuers to achieve meaningful environmental and social improvements. This approach addresses a critical gap in sustainable finance by focusing on company-wide transformation rather than isolated green projects.

From a market perspective, SLBs aim to expand the pool of sustainable investment opportunities by accommodating companies in transition-intensive sectors that may not have sufficient green projects to fund but are committed to improving their overall sustainability profile. This inclusivity is particularly important for hard-to-abate sectors such as heavy industry, transportation, and agriculture.

The technical objectives of SLB market mechanisms include developing robust frameworks for setting credible sustainability performance targets, establishing standardized verification processes, and creating pricing models that accurately reflect sustainability risk and performance. Additionally, there is a focus on enhancing transparency and accountability through comprehensive reporting requirements and third-party verification.

Looking forward, the SLB market is expected to continue its rapid growth trajectory, with innovations in structure, pricing mechanisms, and application across diverse sectors. The evolution of this market will likely be shaped by regulatory developments, investor demand for impact measurement, and the increasing sophistication of sustainability metrics and assessment methodologies.

Market Demand Analysis for SLBs

The Sustainability-Linked Bond (SLB) market has experienced remarkable growth since the introduction of the ICMA Sustainability-Linked Bond Principles in 2020. Market demand for SLBs has been driven primarily by investors seeking financial instruments that align with environmental, social, and governance (ESG) objectives while maintaining traditional bond characteristics. According to recent market data, global SLB issuance reached $118.8 billion in 2022, representing a significant increase from previous years despite challenging market conditions.

Institutional investors, particularly pension funds, insurance companies, and asset managers with ESG mandates, constitute the primary demand source for SLBs. These investors are increasingly required to allocate portions of their portfolios to sustainable investments due to regulatory pressures and stakeholder expectations. The EU Sustainable Finance Disclosure Regulation (SFDR) and similar frameworks worldwide have accelerated this trend by requiring greater transparency in sustainable investment practices.

Corporate issuers across various sectors have responded to this demand by incorporating SLBs into their financing strategies. Initially dominated by European entities, the market has expanded geographically with significant growth in North America and emerging Asian markets. Energy, utilities, and industrial sectors lead issuance volumes, reflecting the carbon-intensive nature of these industries and their need to demonstrate credible transition strategies.

Market research indicates that investor appetite for SLBs continues to grow, with 73% of institutional investors planning to increase their allocation to sustainability-linked debt instruments over the next three years. This demand is supported by the flexibility SLBs offer compared to green bonds, as they are not restricted to specific projects but tied to entity-wide sustainability performance.

Pricing dynamics reveal an emerging "greenium" (green premium) for well-structured SLBs, with evidence suggesting that bonds with ambitious, science-based targets and meaningful step-up mechanisms command better pricing. However, market participants increasingly scrutinize the ambition level of sustainability performance targets (SPTs) and the materiality of financial penalties for missed targets.

Regulatory developments are expected to further shape market demand, with taxonomies and disclosure requirements becoming more standardized globally. The EU Taxonomy and forthcoming regulations on sustainability reporting will likely increase demand for SLBs that align with recognized frameworks and demonstrate measurable impact.

Despite positive growth trends, challenges remain in market development, including concerns about "sustainability-washing," standardization of key performance indicators (KPIs), and verification methodologies. Addressing these challenges will be crucial for maintaining investor confidence and ensuring continued market expansion.

Institutional investors, particularly pension funds, insurance companies, and asset managers with ESG mandates, constitute the primary demand source for SLBs. These investors are increasingly required to allocate portions of their portfolios to sustainable investments due to regulatory pressures and stakeholder expectations. The EU Sustainable Finance Disclosure Regulation (SFDR) and similar frameworks worldwide have accelerated this trend by requiring greater transparency in sustainable investment practices.

Corporate issuers across various sectors have responded to this demand by incorporating SLBs into their financing strategies. Initially dominated by European entities, the market has expanded geographically with significant growth in North America and emerging Asian markets. Energy, utilities, and industrial sectors lead issuance volumes, reflecting the carbon-intensive nature of these industries and their need to demonstrate credible transition strategies.

Market research indicates that investor appetite for SLBs continues to grow, with 73% of institutional investors planning to increase their allocation to sustainability-linked debt instruments over the next three years. This demand is supported by the flexibility SLBs offer compared to green bonds, as they are not restricted to specific projects but tied to entity-wide sustainability performance.

Pricing dynamics reveal an emerging "greenium" (green premium) for well-structured SLBs, with evidence suggesting that bonds with ambitious, science-based targets and meaningful step-up mechanisms command better pricing. However, market participants increasingly scrutinize the ambition level of sustainability performance targets (SPTs) and the materiality of financial penalties for missed targets.

Regulatory developments are expected to further shape market demand, with taxonomies and disclosure requirements becoming more standardized globally. The EU Taxonomy and forthcoming regulations on sustainability reporting will likely increase demand for SLBs that align with recognized frameworks and demonstrate measurable impact.

Despite positive growth trends, challenges remain in market development, including concerns about "sustainability-washing," standardization of key performance indicators (KPIs), and verification methodologies. Addressing these challenges will be crucial for maintaining investor confidence and ensuring continued market expansion.

Current State and Challenges in SLB Implementation

The implementation of Sustainable Linked Bonds (SLBs) has gained significant traction in global financial markets since their introduction in 2019. Currently, SLBs represent approximately 11% of the sustainable debt market, with issuance volumes reaching $108.8 billion in 2022. Despite this growth, several critical challenges impede wider adoption and effectiveness of these financial instruments.

Market fragmentation presents a substantial barrier, with inconsistent standards and practices across different regions and sectors. This fragmentation creates difficulties in comparing SLB performance and establishing benchmark metrics, ultimately reducing investor confidence. The European market leads in SLB adoption, while Asian and North American markets lag significantly, creating geographical imbalances in implementation.

Measurement and verification challenges constitute another major obstacle. Many issuers struggle to establish robust, transparent mechanisms for tracking and reporting progress against sustainability performance targets (SPTs). The lack of standardized methodologies for measuring environmental and social impacts complicates the verification process, raising concerns about the credibility of reported outcomes and the potential for greenwashing.

Pricing mechanisms for SLBs remain underdeveloped, with inconsistent approaches to determining appropriate step-up penalties for missed targets. Current market data indicates that the average coupon step-up ranges between 15-50 basis points, which many critics argue is insufficient to drive meaningful corporate behavior change. This inadequate financial incentive structure undermines the fundamental purpose of SLBs as instruments for promoting sustainability transitions.

Regulatory frameworks governing SLBs vary widely across jurisdictions, creating compliance challenges for issuers operating in multiple markets. The absence of harmonized global standards increases transaction costs and creates regulatory uncertainty. While the EU has made progress through its Sustainable Finance Disclosure Regulation (SFDR) and taxonomy, many regions lack comprehensive regulatory guidance specific to SLBs.

Technical capacity constraints further limit SLB implementation, particularly in emerging markets. Many potential issuers lack the expertise and infrastructure necessary for setting ambitious yet achievable sustainability targets, implementing effective monitoring systems, and managing the complex reporting requirements associated with SLBs. This capacity gap disproportionately affects smaller companies and issuers in developing economies.

Market liquidity for SLBs remains lower than for conventional bonds, with wider bid-ask spreads and more limited secondary market trading. This liquidity constraint increases transaction costs and reduces the attractiveness of SLBs to certain investor classes, particularly those with shorter investment horizons or stricter liquidity requirements.

Market fragmentation presents a substantial barrier, with inconsistent standards and practices across different regions and sectors. This fragmentation creates difficulties in comparing SLB performance and establishing benchmark metrics, ultimately reducing investor confidence. The European market leads in SLB adoption, while Asian and North American markets lag significantly, creating geographical imbalances in implementation.

Measurement and verification challenges constitute another major obstacle. Many issuers struggle to establish robust, transparent mechanisms for tracking and reporting progress against sustainability performance targets (SPTs). The lack of standardized methodologies for measuring environmental and social impacts complicates the verification process, raising concerns about the credibility of reported outcomes and the potential for greenwashing.

Pricing mechanisms for SLBs remain underdeveloped, with inconsistent approaches to determining appropriate step-up penalties for missed targets. Current market data indicates that the average coupon step-up ranges between 15-50 basis points, which many critics argue is insufficient to drive meaningful corporate behavior change. This inadequate financial incentive structure undermines the fundamental purpose of SLBs as instruments for promoting sustainability transitions.

Regulatory frameworks governing SLBs vary widely across jurisdictions, creating compliance challenges for issuers operating in multiple markets. The absence of harmonized global standards increases transaction costs and creates regulatory uncertainty. While the EU has made progress through its Sustainable Finance Disclosure Regulation (SFDR) and taxonomy, many regions lack comprehensive regulatory guidance specific to SLBs.

Technical capacity constraints further limit SLB implementation, particularly in emerging markets. Many potential issuers lack the expertise and infrastructure necessary for setting ambitious yet achievable sustainability targets, implementing effective monitoring systems, and managing the complex reporting requirements associated with SLBs. This capacity gap disproportionately affects smaller companies and issuers in developing economies.

Market liquidity for SLBs remains lower than for conventional bonds, with wider bid-ask spreads and more limited secondary market trading. This liquidity constraint increases transaction costs and reduces the attractiveness of SLBs to certain investor classes, particularly those with shorter investment horizons or stricter liquidity requirements.

Current Economic Incentive Mechanisms for SLBs

01 Sustainability-Linked Bond Structures and Mechanisms

Sustainability-Linked Bonds (SLBs) are structured with specific mechanisms that tie financial returns to sustainability performance targets. These bonds incorporate step-up/step-down coupon rates that adjust based on whether predefined environmental, social, and governance (ESG) targets are met. This creates direct economic incentives for issuers to improve their sustainability performance, as missing targets results in higher interest payments, while achieving them can lead to more favorable financing terms.- Sustainability-Linked Bond Structures and Mechanisms: Sustainability-Linked Bonds (SLBs) are structured with specific mechanisms that tie financial returns to sustainability performance targets. These bonds incorporate predefined key performance indicators (KPIs) and sustainability performance targets (SPTs) that, when achieved, can result in financial benefits for issuers such as reduced coupon rates. The bond structure typically includes step-up or step-down features in interest rates based on whether environmental or social targets are met within specified timeframes, creating direct economic incentives for sustainable practices.

- Market-Based Incentives and Pricing Mechanisms: Economic incentives in SLBs are driven by market-based pricing mechanisms that reward sustainability performance. Investors may accept lower yields for bonds with strong sustainability credentials, creating a 'greenium' effect where sustainable issuers benefit from lower capital costs. The market mechanisms include preferential pricing for achieving targets, penalties for missing targets, and transparency requirements that allow market participants to properly value sustainability performance. These mechanisms help align financial interests with environmental and social outcomes.

- Risk Management and Verification Systems: SLBs incorporate sophisticated risk management and verification systems to ensure the credibility of sustainability claims. Third-party verification processes validate whether issuers have met their sustainability targets, reducing information asymmetry and greenwashing risks. These systems include regular auditing, reporting frameworks, and compliance mechanisms that provide assurance to investors about the achievement of sustainability goals. The verification infrastructure is crucial for maintaining market integrity and investor confidence in the SLB market.

- Regulatory Frameworks and Standardization: The development of regulatory frameworks and standardization efforts supports the growth of the SLB market by establishing consistent guidelines for issuers and investors. These frameworks define acceptable sustainability performance indicators, reporting requirements, and disclosure standards. Standardization helps reduce transaction costs, improves market liquidity, and enhances comparability across different SLB offerings. Regulatory support also includes tax incentives and preferential treatment for qualifying sustainable investments, further strengthening economic incentives.

- Technology-Enabled Monitoring and Trading Platforms: Advanced technological solutions are emerging to support the SLB market through improved monitoring capabilities and specialized trading platforms. These technologies include blockchain-based verification systems, AI-powered sustainability analytics, and digital platforms that facilitate transparent tracking of sustainability performance. Such innovations reduce monitoring costs, enhance data reliability, and enable real-time assessment of sustainability metrics. Technology-enabled platforms also improve market efficiency by connecting SLB issuers with interested investors and providing tools for impact measurement.

02 Market-Based Incentives and Pricing Mechanisms

Economic incentives in SLBs are driven by market-based pricing mechanisms that reflect investor valuation of sustainability performance. These bonds typically feature a premium or discount pricing model based on achievement of key performance indicators (KPIs). The market mechanisms include preferential pricing for sustainability achievement, risk-adjusted returns that account for ESG factors, and liquidity benefits for issuers who demonstrate strong sustainability credentials, creating a financial ecosystem that rewards sustainable business practices.Expand Specific Solutions03 Technology-Enabled Verification and Reporting Systems

Advanced technological systems are employed to verify, track, and report sustainability performance in SLBs. These systems include blockchain-based verification platforms, AI-powered data analytics for measuring ESG metrics, and automated reporting tools that ensure transparency and credibility. The technology infrastructure enables real-time monitoring of sustainability targets, reducing information asymmetry between issuers and investors, and strengthening the integrity of the SLB market by providing reliable data for coupon adjustments.Expand Specific Solutions04 Regulatory Frameworks and Standardization

Regulatory frameworks and standardization efforts are crucial for the SLB market development. These include standardized principles for SLB issuance, regulatory guidelines for sustainability performance measurement, and compliance mechanisms that ensure the integrity of sustainability claims. The frameworks establish minimum requirements for target ambition, materiality of KPIs, and reporting frequency, creating a level playing field for market participants and enhancing investor confidence in the legitimacy of sustainability-linked financial instruments.Expand Specific Solutions05 Risk Management and Financial Innovation

SLBs incorporate innovative risk management approaches that align financial and sustainability objectives. These innovations include sustainability-linked derivatives, insurance products that hedge against sustainability performance risks, and hybrid financial structures that combine features of green bonds and SLBs. The risk management mechanisms help issuers and investors navigate the uncertainties associated with long-term sustainability commitments while fostering financial innovation that expands the market for sustainability-linked financial products.Expand Specific Solutions

Key Players in the SLB Ecosystem

The market for Sustainability-Linked Bond (SLB) adoption is in its early growth phase, characterized by increasing momentum as financial institutions and corporations seek environmentally responsible investment vehicles. The global SLB market has expanded rapidly, reaching approximately $100 billion in issuance volume, though still representing a fraction of the overall bond market. Technical maturity varies significantly across players, with financial institutions like IBM and Visa developing sophisticated frameworks, while energy companies including CATL, LG Energy Solution, and Sunwoda are pioneering sector-specific applications. Academic institutions such as MIT and Harvard are contributing research on incentive mechanism design, while technology companies like Microsoft and Samsung are exploring blockchain-based verification systems to enhance transparency and accountability in SLB performance tracking.

Contemporary Amperex Technology Co., Ltd.

Technical Solution: CATL has developed a comprehensive Second Life Battery (SLB) adoption framework that integrates economic incentives with market mechanisms. Their approach includes a battery health assessment system that accurately evaluates remaining capacity and performance metrics, enabling precise valuation of used batteries. CATL's Battery-as-a-Service (BaaS) model separates battery ownership from electric vehicle ownership, creating financial incentives for consumers while establishing a controlled pathway for battery recirculation. The company has implemented blockchain-based battery passport systems to track lifecycle data, enhancing transparency and trust in secondary markets. CATL also operates battery banks that aggregate used batteries for grid services, creating revenue streams that offset recycling costs and incentivize proper end-of-life management. Their cascading utilization strategy matches degraded batteries with appropriate second-life applications based on remaining performance characteristics.

Strengths: Comprehensive ecosystem approach that addresses multiple stakeholders; established infrastructure for battery assessment and repurposing; strong market position to influence standards. Weaknesses: High initial investment requirements; dependence on scale economies that may limit applicability in emerging markets; potential vulnerability to regulatory changes affecting battery ownership models.

LG Energy Solution Ltd.

Technical Solution: LG Energy Solution has pioneered a multi-tiered economic incentive structure for SLB adoption centered around their "Battery Value Guarantee" program. This program offers initial EV purchasers predetermined buyback values for batteries after primary use, creating immediate economic incentives while securing battery return channels. Their technical approach includes advanced Battery Management Systems (BMS) that preserve detailed operational history, enabling more accurate second-life valuation and application matching. LG has established partnerships with utility companies to create demand-pull mechanisms, where grid operators provide upfront commitments to purchase second-life batteries meeting specific performance criteria. The company has also developed standardized battery module designs specifically engineered for easy disassembly and reconfiguration, reducing repurposing costs by approximately 30% compared to conventional designs. Their Value-Based Pricing model adjusts second-life battery prices according to remaining capacity, cycle life, and application suitability.

Strengths: Strong vertical integration from manufacturing through repurposing; established utility partnerships creating guaranteed demand; sophisticated battery health assessment capabilities. Weaknesses: Program complexity may limit adoption by smaller market participants; geographic limitations based on existing infrastructure; potential cannibalization of new battery sales if SLB market becomes too efficient.

Core Innovations in SLB Structuring

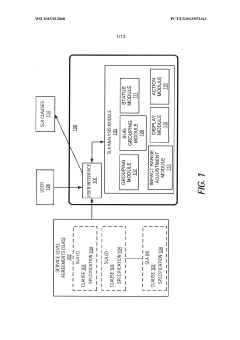

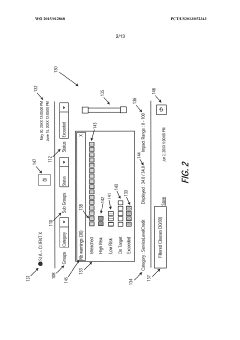

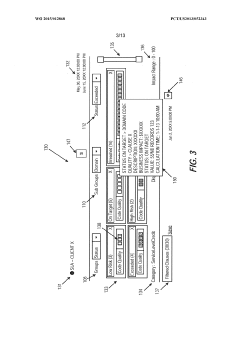

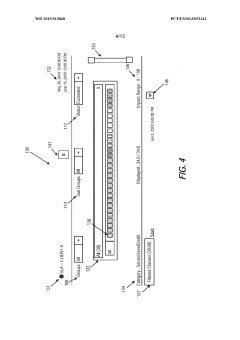

Service-level agreement analysis

PatentWO2015012868A1

Innovation

- A SLA analysis apparatus and method that uses grouping, sorting, and filtering to provide real-time visibility into SLA status and business impact, allowing users to select breached clauses and their estimated impact, with features like sliders and menu options to restrict analysis based on status and impact range, and a user interface for selecting priority and saving preferences.

Service level agreement management

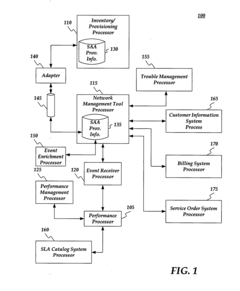

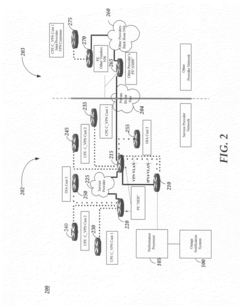

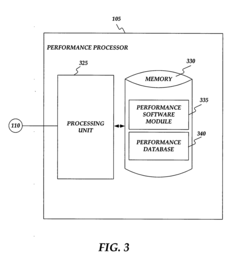

PatentInactiveUS20080046266A1

Innovation

- The implementation of a Multi-VPN (MVPN) system, combined with performance software and service provider probes, allows for network performance measurement and connectivity failure detection across any layer 2 access method, including within and outside the service provider's territory, without the need for dedicated equipment, using a single device to support multiple VPNs.

Regulatory Framework and Policy Support for SLBs

The regulatory landscape for Sustainability-Linked Bonds (SLBs) is rapidly evolving as governments and financial authorities recognize their potential in advancing sustainable development goals. At the international level, the International Capital Market Association (ICMA) has established the Sustainability-Linked Bond Principles (SLBP), providing a framework that emphasizes the importance of meaningful key performance indicators (KPIs), ambitious sustainability performance targets (SPTs), and regular reporting. These principles serve as the foundation for market standardization and integrity.

Various jurisdictions have implemented supportive policy measures to accelerate SLB adoption. The European Union, through its Sustainable Finance Taxonomy and European Green Deal, has created a conducive environment for SLB issuance by establishing clear definitions of sustainable activities and promoting transparency. Similarly, Singapore's Monetary Authority has introduced grant schemes covering up to 100% of external review costs for SLB issuers, directly addressing transaction cost barriers.

Tax incentives represent another significant policy lever being deployed globally. Several countries offer preferential tax treatment for SLB issuers and investors, including tax credits, deductions on interest payments, and reduced capital gains taxes. These fiscal measures effectively lower the cost of capital for sustainability projects and enhance their financial attractiveness compared to conventional bonds.

Central banks are increasingly incorporating sustainability considerations into their monetary policy operations. Some have begun accepting SLBs as collateral at preferential rates or including them in asset purchase programs, providing liquidity support to this emerging market segment. These interventions send powerful signals about the legitimacy and importance of sustainability-linked financial instruments.

Regulatory bodies are also enhancing disclosure requirements related to sustainability performance and climate risks. The Task Force on Climate-related Financial Disclosures (TCFD) recommendations are being incorporated into mandatory reporting frameworks in multiple jurisdictions, creating greater transparency and accountability that benefit the SLB market by ensuring the credibility of sustainability claims.

Emerging policy innovations include "regulatory sandboxes" that allow for controlled experimentation with novel SLB structures before full-scale implementation. Additionally, some governments are exploring blended finance approaches, combining public and private capital to de-risk SLB investments in challenging sectors or regions where sustainability transitions face significant barriers.

The effectiveness of these regulatory frameworks varies considerably across regions, with more mature markets demonstrating greater policy coherence. As the SLB market continues to grow, policy harmonization efforts will be crucial to prevent fragmentation and reduce compliance burdens for issuers operating across multiple jurisdictions.

Various jurisdictions have implemented supportive policy measures to accelerate SLB adoption. The European Union, through its Sustainable Finance Taxonomy and European Green Deal, has created a conducive environment for SLB issuance by establishing clear definitions of sustainable activities and promoting transparency. Similarly, Singapore's Monetary Authority has introduced grant schemes covering up to 100% of external review costs for SLB issuers, directly addressing transaction cost barriers.

Tax incentives represent another significant policy lever being deployed globally. Several countries offer preferential tax treatment for SLB issuers and investors, including tax credits, deductions on interest payments, and reduced capital gains taxes. These fiscal measures effectively lower the cost of capital for sustainability projects and enhance their financial attractiveness compared to conventional bonds.

Central banks are increasingly incorporating sustainability considerations into their monetary policy operations. Some have begun accepting SLBs as collateral at preferential rates or including them in asset purchase programs, providing liquidity support to this emerging market segment. These interventions send powerful signals about the legitimacy and importance of sustainability-linked financial instruments.

Regulatory bodies are also enhancing disclosure requirements related to sustainability performance and climate risks. The Task Force on Climate-related Financial Disclosures (TCFD) recommendations are being incorporated into mandatory reporting frameworks in multiple jurisdictions, creating greater transparency and accountability that benefit the SLB market by ensuring the credibility of sustainability claims.

Emerging policy innovations include "regulatory sandboxes" that allow for controlled experimentation with novel SLB structures before full-scale implementation. Additionally, some governments are exploring blended finance approaches, combining public and private capital to de-risk SLB investments in challenging sectors or regions where sustainability transitions face significant barriers.

The effectiveness of these regulatory frameworks varies considerably across regions, with more mature markets demonstrating greater policy coherence. As the SLB market continues to grow, policy harmonization efforts will be crucial to prevent fragmentation and reduce compliance burdens for issuers operating across multiple jurisdictions.

Impact Assessment and Performance Metrics for SLBs

Measuring the effectiveness of Sustainability-Linked Bonds (SLBs) requires robust assessment frameworks and performance metrics. The impact assessment of SLBs must evaluate both financial returns and sustainability outcomes, creating a comprehensive picture of their dual-purpose nature. Key performance indicators (KPIs) serve as the foundation for this assessment, with their selection being critical to the credibility and effectiveness of the SLB structure.

Financial metrics for SLBs include traditional measures such as yield, coupon step-up/step-down values, and risk-adjusted returns. However, these must be complemented by sustainability performance metrics that quantify environmental, social, or governance improvements. The alignment of these metrics with recognized international standards, such as the UN Sustainable Development Goals or the Paris Agreement targets, enhances their comparability and credibility.

The quality of impact assessment depends significantly on data availability and verification methodologies. Third-party verification and assurance play crucial roles in validating reported outcomes and preventing greenwashing. Organizations like the Climate Bonds Initiative and Sustainalytics have developed specialized frameworks for assessing SLB performance, providing standardized approaches to measurement.

Temporal considerations are equally important in SLB assessment. Short-term versus long-term impact measurements may yield different conclusions about effectiveness. Many sustainability goals require extended timeframes to demonstrate meaningful change, necessitating assessment frameworks that account for this temporal dimension while still providing interim accountability measures.

Additionality represents another critical dimension of SLB assessment – determining whether the sustainability improvements would have occurred without the SLB mechanism. This requires counterfactual analysis and baseline establishment, which remain challenging but essential components of comprehensive impact evaluation.

Market perception metrics also matter significantly. Investor demand, pricing advantages compared to conventional bonds, and market liquidity serve as indicators of SLB effectiveness from a market mechanism perspective. The premium or discount at which SLBs trade relative to conventional bonds provides valuable insights into how the market values the sustainability component.

Emerging best practices include the development of materiality assessments to ensure selected KPIs address the most significant sustainability challenges relevant to the issuer's industry and operations. Additionally, the incorporation of science-based targets has strengthened the rigor of performance metrics, ensuring they align with global environmental necessities rather than merely representing incremental improvements.

Financial metrics for SLBs include traditional measures such as yield, coupon step-up/step-down values, and risk-adjusted returns. However, these must be complemented by sustainability performance metrics that quantify environmental, social, or governance improvements. The alignment of these metrics with recognized international standards, such as the UN Sustainable Development Goals or the Paris Agreement targets, enhances their comparability and credibility.

The quality of impact assessment depends significantly on data availability and verification methodologies. Third-party verification and assurance play crucial roles in validating reported outcomes and preventing greenwashing. Organizations like the Climate Bonds Initiative and Sustainalytics have developed specialized frameworks for assessing SLB performance, providing standardized approaches to measurement.

Temporal considerations are equally important in SLB assessment. Short-term versus long-term impact measurements may yield different conclusions about effectiveness. Many sustainability goals require extended timeframes to demonstrate meaningful change, necessitating assessment frameworks that account for this temporal dimension while still providing interim accountability measures.

Additionality represents another critical dimension of SLB assessment – determining whether the sustainability improvements would have occurred without the SLB mechanism. This requires counterfactual analysis and baseline establishment, which remain challenging but essential components of comprehensive impact evaluation.

Market perception metrics also matter significantly. Investor demand, pricing advantages compared to conventional bonds, and market liquidity serve as indicators of SLB effectiveness from a market mechanism perspective. The premium or discount at which SLBs trade relative to conventional bonds provides valuable insights into how the market values the sustainability component.

Emerging best practices include the development of materiality assessments to ensure selected KPIs address the most significant sustainability challenges relevant to the issuer's industry and operations. Additionally, the incorporation of science-based targets has strengthened the rigor of performance metrics, ensuring they align with global environmental necessities rather than merely representing incremental improvements.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!