Retrofitting EV Pack Topologies For Stationary Use

AUG 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

EV Battery Repurposing Background and Objectives

The electric vehicle (EV) industry has witnessed exponential growth over the past decade, with global EV sales surpassing 10 million units in 2022. This surge has created a parallel challenge: what happens to EV batteries after they reach the end of their vehicular life? Typically, an EV battery is considered unsuitable for automotive applications when its capacity degrades to approximately 70-80% of its original capacity, usually after 8-10 years of service or 100,000-150,000 miles.

Despite this degradation, these batteries retain significant energy storage capabilities that can be repurposed for less demanding applications. The concept of retrofitting EV pack topologies for stationary use has emerged as a sustainable solution to extend the lifecycle of these valuable resources. This approach aligns with circular economy principles and addresses the growing concern about battery waste management.

The evolution of battery technology has been marked by significant improvements in energy density, charging speeds, and safety features. From the early lead-acid batteries to the current lithium-ion dominated market, and the emerging solid-state technologies, each generation has brought new possibilities for second-life applications. Understanding this technological progression is crucial for developing effective retrofitting strategies.

The primary objective of EV battery repurposing is to develop cost-effective and technically viable methods to transform automotive battery packs into stationary energy storage systems. This involves reconfiguring the battery management systems (BMS), thermal management systems, and electrical interfaces to suit stationary applications such as grid support, renewable energy integration, and backup power systems.

Technical goals include maximizing the remaining useful life of repurposed batteries, ensuring safety and reliability in second-life applications, and developing standardized processes for battery assessment, reconfiguration, and deployment. Additionally, there is a focus on creating scalable solutions that can address the anticipated influx of end-of-life EV batteries in the coming decades.

The environmental imperative for battery repurposing cannot be overstated. By 2030, an estimated 2 million metric tons of used EV batteries will be retired annually. Repurposing these batteries could reduce the demand for new raw materials, decrease the carbon footprint associated with battery production, and delay the need for recycling, which itself is an energy-intensive process.

Economic considerations also drive this field, as repurposed batteries can potentially provide energy storage solutions at 30-70% of the cost of new systems, creating new market opportunities and business models in the energy sector. The intersection of technological feasibility, environmental necessity, and economic viability makes EV battery repurposing a compelling area for research and development.

Despite this degradation, these batteries retain significant energy storage capabilities that can be repurposed for less demanding applications. The concept of retrofitting EV pack topologies for stationary use has emerged as a sustainable solution to extend the lifecycle of these valuable resources. This approach aligns with circular economy principles and addresses the growing concern about battery waste management.

The evolution of battery technology has been marked by significant improvements in energy density, charging speeds, and safety features. From the early lead-acid batteries to the current lithium-ion dominated market, and the emerging solid-state technologies, each generation has brought new possibilities for second-life applications. Understanding this technological progression is crucial for developing effective retrofitting strategies.

The primary objective of EV battery repurposing is to develop cost-effective and technically viable methods to transform automotive battery packs into stationary energy storage systems. This involves reconfiguring the battery management systems (BMS), thermal management systems, and electrical interfaces to suit stationary applications such as grid support, renewable energy integration, and backup power systems.

Technical goals include maximizing the remaining useful life of repurposed batteries, ensuring safety and reliability in second-life applications, and developing standardized processes for battery assessment, reconfiguration, and deployment. Additionally, there is a focus on creating scalable solutions that can address the anticipated influx of end-of-life EV batteries in the coming decades.

The environmental imperative for battery repurposing cannot be overstated. By 2030, an estimated 2 million metric tons of used EV batteries will be retired annually. Repurposing these batteries could reduce the demand for new raw materials, decrease the carbon footprint associated with battery production, and delay the need for recycling, which itself is an energy-intensive process.

Economic considerations also drive this field, as repurposed batteries can potentially provide energy storage solutions at 30-70% of the cost of new systems, creating new market opportunities and business models in the energy sector. The intersection of technological feasibility, environmental necessity, and economic viability makes EV battery repurposing a compelling area for research and development.

Second-Life Battery Market Analysis

The second-life battery market has experienced significant growth in recent years, driven by the increasing adoption of electric vehicles and the subsequent need to manage end-of-life EV batteries. As of 2023, the global second-life battery market is valued at approximately $2.3 billion, with projections indicating growth to reach $7.8 billion by 2030, representing a compound annual growth rate of 19.2%.

The market is primarily segmented into two major application areas: stationary energy storage systems and backup power solutions. Stationary energy storage represents the largest segment, accounting for nearly 65% of the total market share. This dominance is attributed to the growing integration of renewable energy sources into power grids, creating demand for large-scale energy storage solutions that can effectively balance supply and demand fluctuations.

Geographically, Asia Pacific leads the second-life battery market, with China, Japan, and South Korea collectively representing over 40% of the global market. This regional dominance stems from these countries' robust EV manufacturing ecosystems and progressive regulatory frameworks supporting battery recycling and repurposing. Europe follows closely, accounting for approximately 35% of the market, driven by stringent environmental regulations and ambitious renewable energy targets.

Key market drivers include the widening price gap between new and repurposed batteries, with second-life batteries typically costing 30-50% less than new equivalents while still retaining 70-80% of their original capacity. Additionally, regulatory pressures for sustainable battery lifecycle management, particularly in the EU with its Battery Directive, are compelling automotive manufacturers to develop comprehensive end-of-life strategies for EV batteries.

Consumer electronics and telecommunications sectors are emerging as significant secondary markets, collectively representing about 20% of current applications but expected to grow to 30% by 2028. These sectors value the cost advantages of repurposed batteries for less demanding applications where energy density is not a critical factor.

Market challenges include the lack of standardization in battery designs across manufacturers, creating technical complexities in repurposing processes. Additionally, quality assurance concerns and warranty limitations present barriers to wider adoption, as end-users require confidence in the reliability and performance of second-life batteries.

The competitive landscape features both established players and innovative startups. Traditional battery manufacturers like LG Energy Solution and CATL are developing proprietary second-life programs, while specialized firms such as B2U Storage Solutions and Connected Energy focus exclusively on battery repurposing technologies and services.

The market is primarily segmented into two major application areas: stationary energy storage systems and backup power solutions. Stationary energy storage represents the largest segment, accounting for nearly 65% of the total market share. This dominance is attributed to the growing integration of renewable energy sources into power grids, creating demand for large-scale energy storage solutions that can effectively balance supply and demand fluctuations.

Geographically, Asia Pacific leads the second-life battery market, with China, Japan, and South Korea collectively representing over 40% of the global market. This regional dominance stems from these countries' robust EV manufacturing ecosystems and progressive regulatory frameworks supporting battery recycling and repurposing. Europe follows closely, accounting for approximately 35% of the market, driven by stringent environmental regulations and ambitious renewable energy targets.

Key market drivers include the widening price gap between new and repurposed batteries, with second-life batteries typically costing 30-50% less than new equivalents while still retaining 70-80% of their original capacity. Additionally, regulatory pressures for sustainable battery lifecycle management, particularly in the EU with its Battery Directive, are compelling automotive manufacturers to develop comprehensive end-of-life strategies for EV batteries.

Consumer electronics and telecommunications sectors are emerging as significant secondary markets, collectively representing about 20% of current applications but expected to grow to 30% by 2028. These sectors value the cost advantages of repurposed batteries for less demanding applications where energy density is not a critical factor.

Market challenges include the lack of standardization in battery designs across manufacturers, creating technical complexities in repurposing processes. Additionally, quality assurance concerns and warranty limitations present barriers to wider adoption, as end-users require confidence in the reliability and performance of second-life batteries.

The competitive landscape features both established players and innovative startups. Traditional battery manufacturers like LG Energy Solution and CATL are developing proprietary second-life programs, while specialized firms such as B2U Storage Solutions and Connected Energy focus exclusively on battery repurposing technologies and services.

Technical Barriers in EV Pack Retrofitting

Retrofitting electric vehicle (EV) battery packs for stationary energy storage applications faces several significant technical barriers that must be addressed to ensure safety, efficiency, and economic viability. These challenges stem from the fundamental differences between automotive and stationary use requirements, as well as the complex nature of repurposing sophisticated battery systems.

The primary technical barrier is the battery management system (BMS) reconfiguration. EV battery packs utilize proprietary BMS designed specifically for vehicle applications, with algorithms optimized for dynamic charging and discharging patterns, thermal management during acceleration and regenerative braking, and vehicle-specific safety protocols. Retrofitting requires either reverse engineering the existing BMS or developing a completely new system compatible with stationary applications, both of which present significant technical challenges.

Thermal management represents another critical barrier. EV packs are designed with cooling systems optimized for the spatial constraints and airflow patterns of vehicles. Stationary applications have different thermal profiles and cooling requirements, necessitating substantial redesign of thermal management systems. Without proper thermal control, repurposed batteries may experience accelerated degradation or, in extreme cases, thermal runaway events.

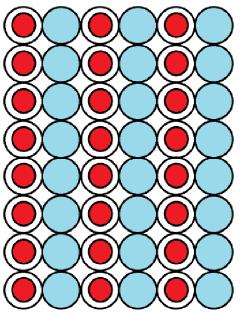

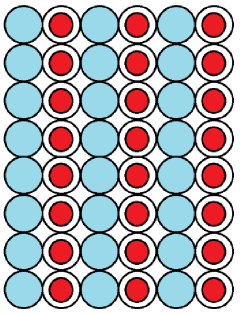

Cell balancing presents a complex challenge in retrofitted systems. After years of automotive use, individual cells within a pack develop varying states of health and capacity. These imbalances, while manageable in automotive applications, become more problematic in stationary systems where long-duration energy storage is often required. Advanced cell balancing techniques must be implemented to prevent underperforming cells from limiting overall system performance.

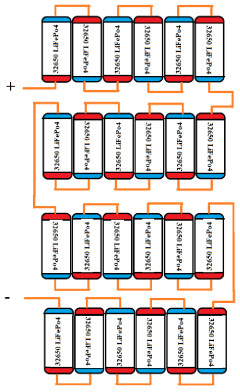

Voltage and current requirements differ significantly between automotive and stationary applications. EV packs typically operate at high voltages (400-800V) optimized for drivetrain efficiency, while many stationary applications require different voltage configurations. Reconfiguring the pack topology to match these requirements often necessitates breaking down modules and reconnecting cells in new configurations, a process that introduces technical complexity and safety risks.

Safety certification presents a regulatory barrier. EV battery packs are certified for automotive use under specific standards, but repurposed packs must meet different safety standards for stationary energy storage. This often requires extensive redesign of safety systems, including thermal runaway prevention, fire suppression, and electrical isolation.

Diagnostic capabilities represent a final significant barrier. EV battery packs contain sophisticated diagnostic systems designed for vehicle integration. When repurposed, these systems often become inoperable or provide limited functionality. Developing new diagnostic capabilities that can accurately assess the health and performance of aged cells in their new application context requires substantial technical innovation.

The primary technical barrier is the battery management system (BMS) reconfiguration. EV battery packs utilize proprietary BMS designed specifically for vehicle applications, with algorithms optimized for dynamic charging and discharging patterns, thermal management during acceleration and regenerative braking, and vehicle-specific safety protocols. Retrofitting requires either reverse engineering the existing BMS or developing a completely new system compatible with stationary applications, both of which present significant technical challenges.

Thermal management represents another critical barrier. EV packs are designed with cooling systems optimized for the spatial constraints and airflow patterns of vehicles. Stationary applications have different thermal profiles and cooling requirements, necessitating substantial redesign of thermal management systems. Without proper thermal control, repurposed batteries may experience accelerated degradation or, in extreme cases, thermal runaway events.

Cell balancing presents a complex challenge in retrofitted systems. After years of automotive use, individual cells within a pack develop varying states of health and capacity. These imbalances, while manageable in automotive applications, become more problematic in stationary systems where long-duration energy storage is often required. Advanced cell balancing techniques must be implemented to prevent underperforming cells from limiting overall system performance.

Voltage and current requirements differ significantly between automotive and stationary applications. EV packs typically operate at high voltages (400-800V) optimized for drivetrain efficiency, while many stationary applications require different voltage configurations. Reconfiguring the pack topology to match these requirements often necessitates breaking down modules and reconnecting cells in new configurations, a process that introduces technical complexity and safety risks.

Safety certification presents a regulatory barrier. EV battery packs are certified for automotive use under specific standards, but repurposed packs must meet different safety standards for stationary energy storage. This often requires extensive redesign of safety systems, including thermal runaway prevention, fire suppression, and electrical isolation.

Diagnostic capabilities represent a final significant barrier. EV battery packs contain sophisticated diagnostic systems designed for vehicle integration. When repurposed, these systems often become inoperable or provide limited functionality. Developing new diagnostic capabilities that can accurately assess the health and performance of aged cells in their new application context requires substantial technical innovation.

Current Retrofitting Methodologies

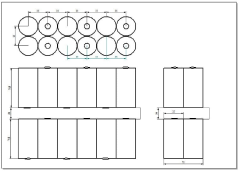

01 Modular battery pack architectures for retrofitting

Modular battery pack designs allow for easier retrofitting of electric vehicles by providing flexible configurations that can adapt to different vehicle platforms. These architectures feature standardized battery modules that can be arranged in various topologies to fit existing vehicle spaces. The modular approach enables upgrading conventional vehicles to electric powertrains without extensive structural modifications, allowing for scalable energy capacity based on vehicle requirements.- Modular Battery Pack Architectures for Retrofitting: Modular battery pack designs allow for easier retrofitting of electric vehicles by enabling flexible configuration and installation. These architectures feature standardized battery modules that can be arranged in various topologies to fit different vehicle platforms. The modular approach facilitates replacement of individual components without requiring complete system overhaul, making it ideal for converting conventional vehicles to electric powertrains. This design philosophy supports scalable energy capacity and simplified maintenance procedures for retrofitted vehicles.

- Battery Management Systems for Retrofitted EV Packs: Specialized battery management systems (BMS) are essential for retrofitted EV battery packs to ensure safe and efficient operation. These systems monitor cell voltages, temperatures, and state of charge across different pack topologies. For retrofitted applications, the BMS must be adaptable to various battery configurations and capable of interfacing with both original and new vehicle systems. Advanced BMS designs include thermal management features, balancing algorithms, and diagnostic capabilities specifically optimized for retrofitted battery pack topologies.

- Thermal Management Solutions for Retrofitted Battery Packs: Effective thermal management is critical for retrofitted EV battery packs to maintain optimal performance and longevity. Solutions include liquid cooling systems, air cooling channels, and phase-change materials integrated into the battery pack structure. Retrofitted thermal management systems must adapt to the spatial constraints of existing vehicle platforms while providing sufficient cooling capacity. These systems are designed to maintain uniform temperature distribution across different battery pack topologies, preventing hotspots and thermal runaway in converted vehicles.

- Structural Integration Methods for EV Battery Retrofits: Innovative structural integration methods enable effective retrofitting of battery packs into existing vehicle platforms. These approaches include floor-mounted configurations, distributed battery arrays, and custom mounting frames that utilize available space without compromising vehicle integrity. Advanced integration techniques consider crash safety, weight distribution, and accessibility for maintenance. Some solutions incorporate the battery pack as a structural element to enhance vehicle rigidity while minimizing modifications to the original chassis design.

- Power Electronics and Interface Systems for Battery Pack Retrofits: Specialized power electronics and interface systems are developed to connect retrofitted battery packs with existing vehicle components. These systems include DC-DC converters, inverters, and control units designed to manage power flow between the battery pack and drivetrain. Interface solutions accommodate various battery topologies while ensuring compatibility with both original vehicle systems and new electric components. Advanced power management algorithms optimize energy efficiency and performance across different operating conditions specific to retrofitted electric vehicles.

02 Battery management systems for retrofitted packs

Specialized battery management systems (BMS) are essential for retrofitted EV battery packs to ensure safe and efficient operation. These systems monitor cell voltages, temperatures, and state of charge across different pack topologies. Advanced BMS designs include thermal management features and communication protocols that can integrate with existing vehicle systems. They provide critical protection functions such as overcharge prevention and cell balancing tailored for retrofitted applications.Expand Specific Solutions03 Conversion kits for ICE to EV retrofitting

Comprehensive conversion kits enable the transformation of internal combustion engine vehicles to electric vehicles through standardized battery pack retrofitting solutions. These kits include mounting hardware, electrical interfaces, and cooling systems designed to integrate battery packs into existing vehicle chassis. The conversion systems often feature adaptable battery topologies that can be configured to utilize available space in different vehicle models while maintaining proper weight distribution and safety requirements.Expand Specific Solutions04 Thermal management solutions for retrofitted battery packs

Specialized thermal management systems are designed for retrofitted EV battery packs to ensure optimal performance and longevity. These systems include innovative cooling channels, heat exchangers, and thermal interface materials that can be adapted to various pack topologies. Advanced thermal solutions address the unique challenges of retrofitted installations where original vehicle cooling systems may be inadequate for battery thermal requirements, helping to maintain cell temperature uniformity across different pack configurations.Expand Specific Solutions05 Structural integration methods for battery retrofitting

Novel structural integration methods enable secure mounting of battery packs in retrofitted vehicles while maintaining structural integrity and crash safety. These approaches include reinforced mounting frames, load distribution systems, and vibration isolation techniques specifically designed for aftermarket battery installations. The integration methods accommodate various battery topologies while addressing challenges such as weight distribution, center of gravity optimization, and protection against road debris and collision impacts.Expand Specific Solutions

Key Industry Players in Battery Repurposing

The EV battery retrofitting for stationary use market is in its early growth phase, characterized by increasing interest as the industry seeks sustainable second-life applications for retired EV batteries. The global market is projected to expand significantly, driven by grid storage demands and renewable energy integration. Technologically, the field shows varying maturity levels, with established players like Siemens, Mitsubishi, and State Grid Corporation of China leading with comprehensive solutions, while innovative approaches emerge from specialized companies like Ample and 3Ti Energy Hubs. Research institutions including Shanghai Jiao Tong University and Toyota Research Institute are advancing technical capabilities, while automotive manufacturers such as Ford and Changan Automobile are exploring integration pathways to extend battery value chains beyond vehicle lifecycles.

State Grid Corp. of China

Technical Solution: State Grid Corporation of China has developed an advanced retrofitting system for converting EV battery packs into large-scale grid-connected energy storage assets. Their approach focuses on integrating heterogeneous battery packs from various vehicle manufacturers into unified storage arrays through a standardized interface architecture. The technology includes a hierarchical battery management system that can communicate with and control the original vehicle BMS while adding grid-specific functionalities. State Grid's solution incorporates AI-driven predictive analytics to optimize the performance of repurposed batteries based on their degradation patterns and remaining capacity. Their retrofitting process involves a comprehensive cell-level assessment followed by reconfiguration into optimal series-parallel arrangements that balance performance and longevity. The system features adaptive power electronics that can accommodate various battery chemistries and voltage ranges, making it versatile for different EV battery types. State Grid has implemented this technology in several pilot projects across China, demonstrating the ability to integrate hundreds of retired EV battery packs into multi-megawatt grid storage installations that provide peak shaving, frequency regulation, and renewable energy integration services.

Strengths: Unparalleled access to grid infrastructure for deployment; extensive experience with large-scale energy storage integration; strong government backing for circular economy initiatives involving battery reuse. Weaknesses: Solutions may be optimized for Chinese regulatory environment and grid specifications; potential challenges in adapting the technology for international markets with different standards; heavy focus on utility-scale applications may limit applicability for smaller distributed storage needs.

Mitsubishi Motors Corp.

Technical Solution: Mitsubishi Motors has pioneered a retrofitting system for their EV battery packs that focuses on bi-directional power capabilities for stationary applications. Their technology enables seamless integration of used Outlander PHEV and i-MiEV battery packs into home and commercial energy storage systems. The retrofitting process involves reconfiguring the battery modules with a proprietary adapter system that maintains the original battery management architecture while adding new control interfaces for stationary use cases. Mitsubishi's approach includes a comprehensive battery health assessment protocol that categorizes cells based on remaining capacity and performance characteristics, allowing for strategic grouping of similar-condition modules. Their V2X (Vehicle-to-Everything) technology has been adapted to create a standardized interface for second-life batteries, enabling them to provide grid services such as peak shaving, frequency regulation, and backup power. The system incorporates advanced thermal management modifications that optimize the cooling requirements for the less demanding but more constant duty cycles of stationary storage.

Strengths: Extensive experience with bi-directional charging technology gives them an advantage in grid-interactive applications; established battery supply chain from their EV production; proven V2X technology that can be adapted for stationary use. Weaknesses: Limited EV model range means less diverse battery inventory for second-life applications; retrofitting approach may be optimized primarily for their own battery designs rather than industry-wide solutions.

Critical Patents in EV Battery Repurposing

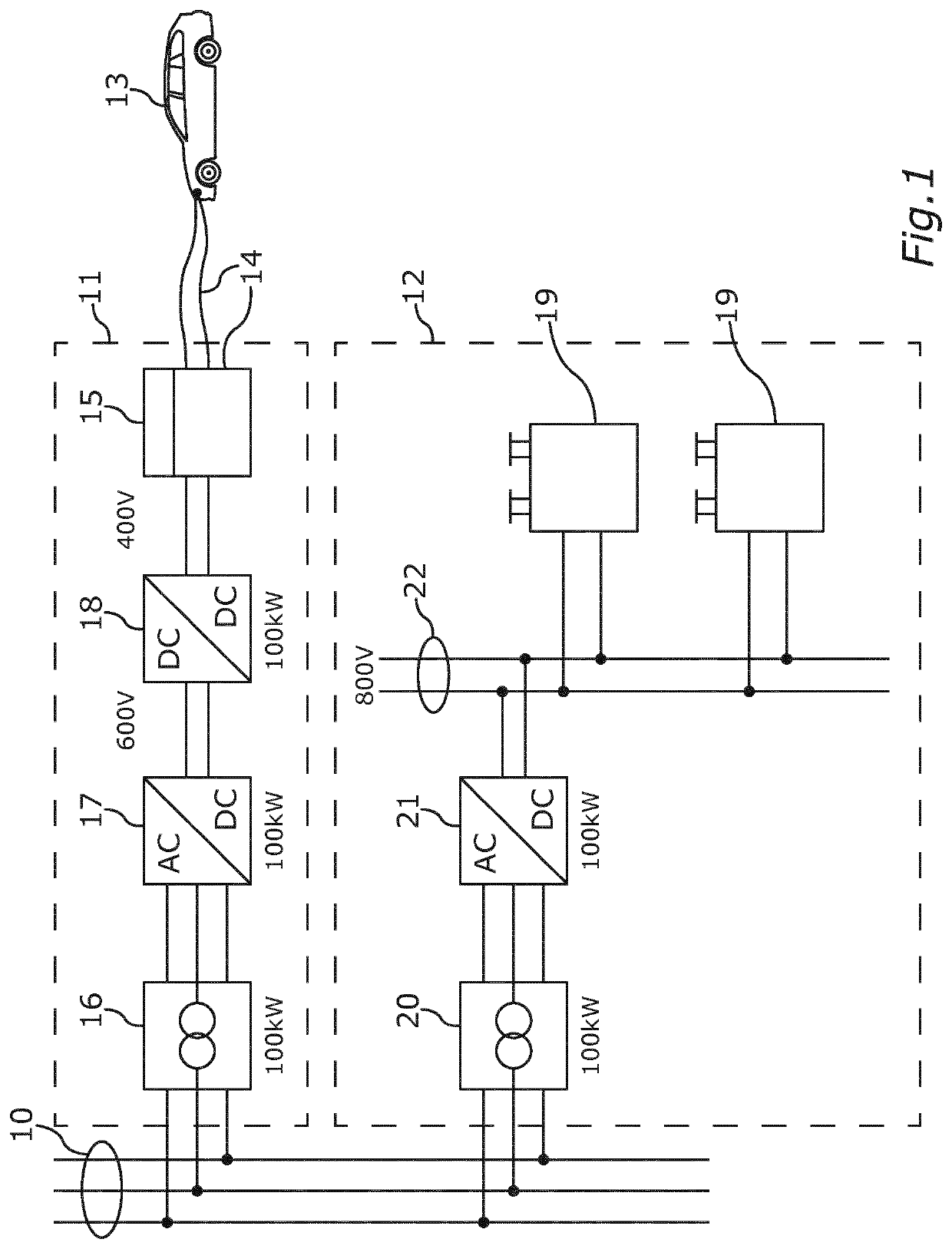

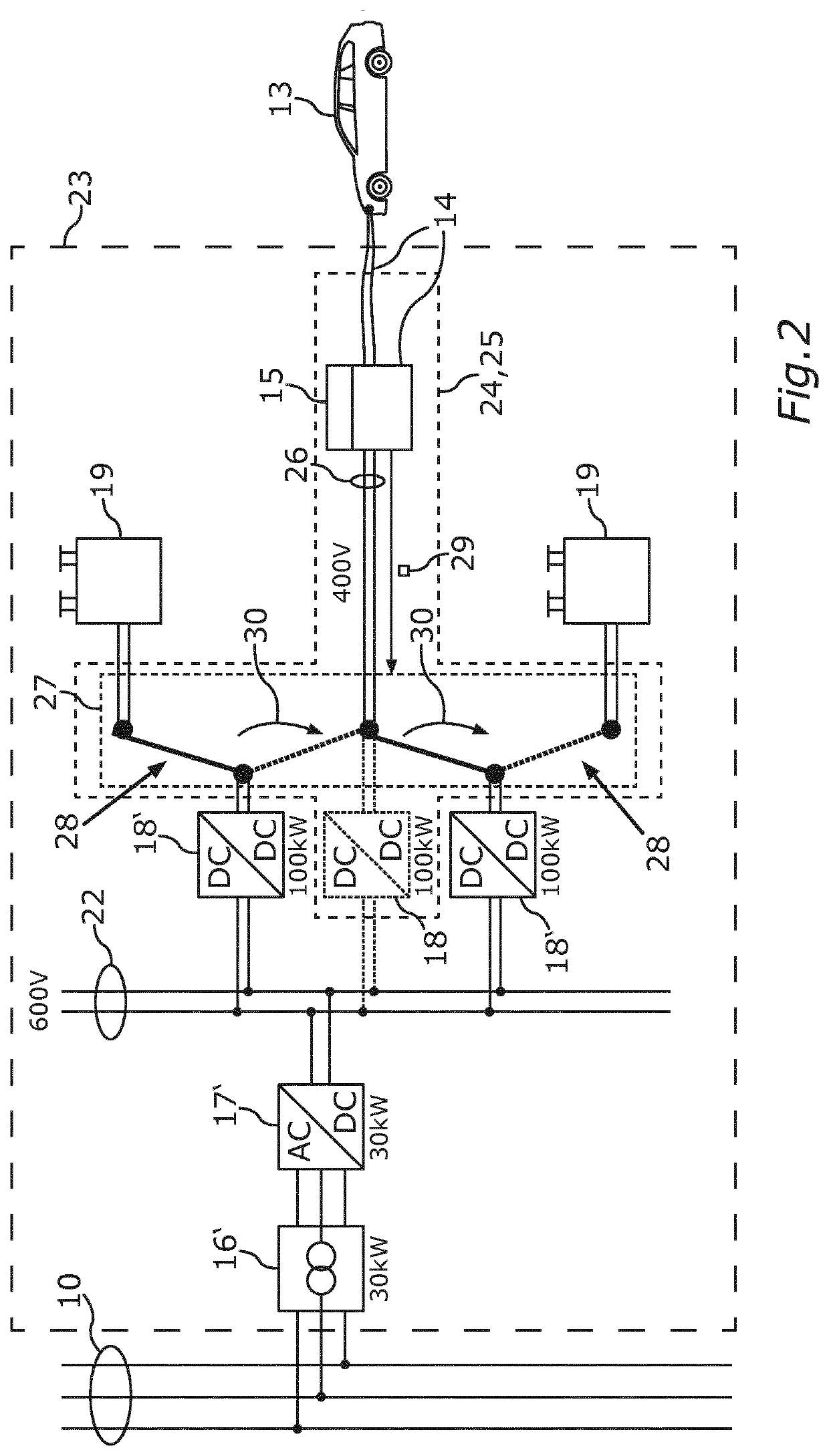

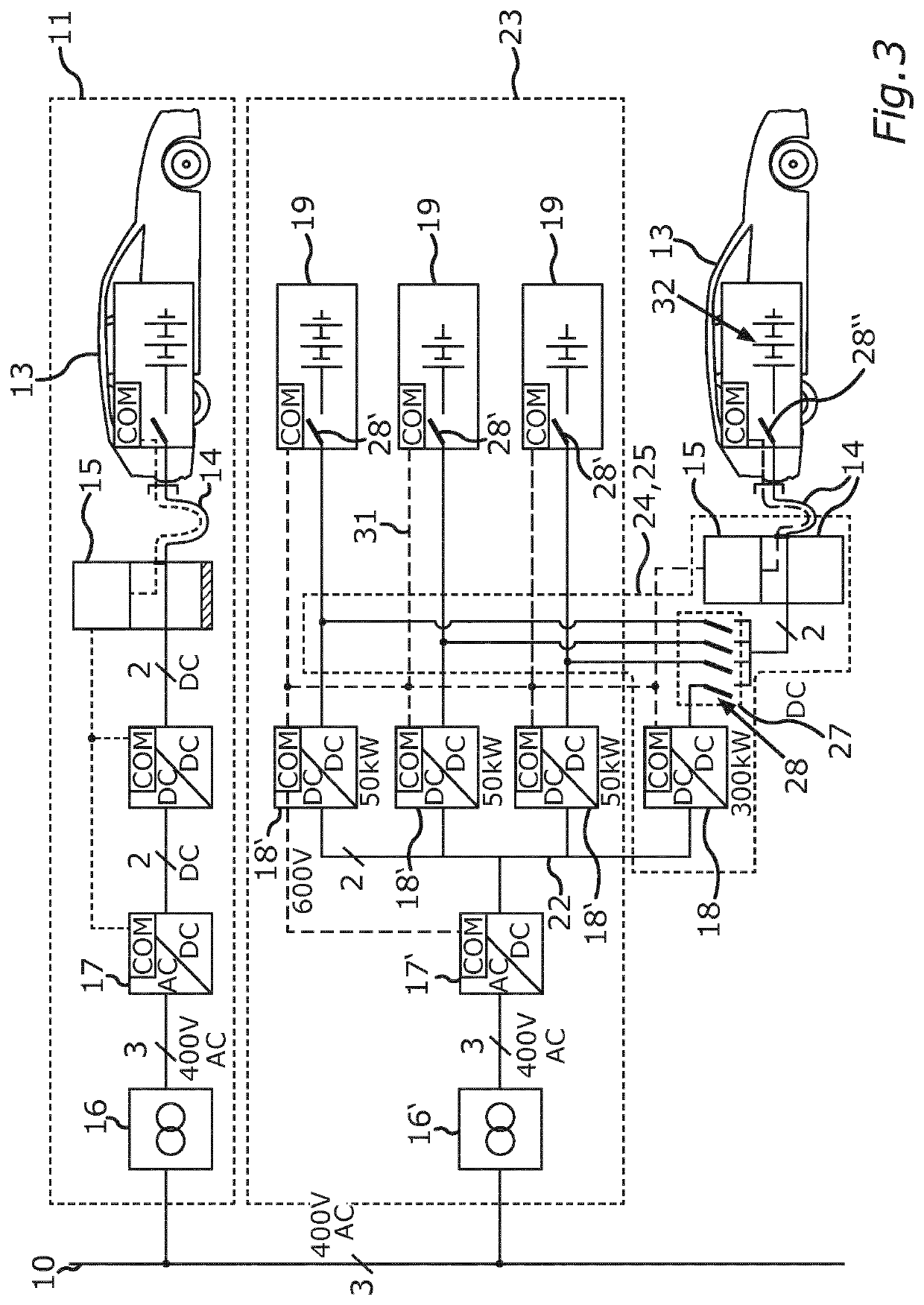

Stationary Storage Device for Temporarily Storing Electric Energy in an Electric Supply Grid, Operating Method, and Retrofitting Module for the Stationary Storage Device

PatentActiveUS20200001730A1

Innovation

- A stationary storage device with a bidirectionally operated AC-DC converter and a DC bus connected to the supply grid via a DC-DC converter, allowing for continuous energy exchange with the grid and reducing the need for additional AC-DC converters by using a DC-based charging process, along with a switching device to optimize energy distribution across multiple storage units.

Serpentine topology for energy storage in electric vehicles

PatentPendingIN202341017831A

Innovation

- A novel topology featuring a stacked arrangement of Lithium ferro phosphate cells in series and parallel combinations, with composite supports for secure assembly, allowing for natural airflow and improved mechanical robustness, specifically designed for electric rickshaw batteries with 72 V, 48 Ah rating.

Safety and Performance Standards for Second-Life Batteries

The evolution of safety and performance standards for second-life batteries represents a critical framework for the successful implementation of retrofitted EV pack topologies in stationary applications. Current standards such as IEC 62619 and UL 1973 provide baseline requirements for lithium-ion battery safety in industrial applications, but they were primarily developed for new battery systems rather than repurposed ones.

Regulatory bodies including IEEE, UL, and IEC have begun developing specialized standards that address the unique characteristics of second-life batteries. The IEEE 1881 working group specifically focuses on establishing testing protocols for evaluating the condition and performance of used EV batteries intended for secondary applications. These emerging standards emphasize rigorous assessment methodologies for determining remaining useful life and performance degradation patterns.

Safety considerations for second-life batteries in stationary applications require more stringent thermal management requirements compared to their original automotive applications. Standards now mandate enhanced fire suppression systems, thermal runaway containment, and isolation mechanisms specifically designed for the stationary environment where batteries may be housed in proximity to buildings or critical infrastructure.

Performance certification for second-life batteries introduces new metrics beyond those used for new batteries. These include cycle stability under partial state-of-charge operation, capacity retention predictability, and power capability under various environmental conditions. The standards increasingly recognize the importance of battery management system (BMS) recalibration for second-life applications, with specific requirements for data logging, state-of-health algorithms, and remote monitoring capabilities.

Grid integration standards such as IEEE 1547 and IEC 61850 have been expanded to include provisions for second-life battery systems, ensuring proper interconnection with existing power infrastructure. These standards address power quality, frequency regulation capabilities, and response times specific to repurposed battery systems with potentially variable performance characteristics.

Emerging certification pathways are being developed to streamline the qualification process for second-life batteries. These include accelerated testing protocols that can reliably predict long-term performance without requiring years of testing, and standardized reporting formats that enable comparison between different second-life battery offerings. The certification process increasingly incorporates traceability requirements, documenting the battery's complete history from original manufacture through its automotive service life and into its second-life application.

Regulatory bodies including IEEE, UL, and IEC have begun developing specialized standards that address the unique characteristics of second-life batteries. The IEEE 1881 working group specifically focuses on establishing testing protocols for evaluating the condition and performance of used EV batteries intended for secondary applications. These emerging standards emphasize rigorous assessment methodologies for determining remaining useful life and performance degradation patterns.

Safety considerations for second-life batteries in stationary applications require more stringent thermal management requirements compared to their original automotive applications. Standards now mandate enhanced fire suppression systems, thermal runaway containment, and isolation mechanisms specifically designed for the stationary environment where batteries may be housed in proximity to buildings or critical infrastructure.

Performance certification for second-life batteries introduces new metrics beyond those used for new batteries. These include cycle stability under partial state-of-charge operation, capacity retention predictability, and power capability under various environmental conditions. The standards increasingly recognize the importance of battery management system (BMS) recalibration for second-life applications, with specific requirements for data logging, state-of-health algorithms, and remote monitoring capabilities.

Grid integration standards such as IEEE 1547 and IEC 61850 have been expanded to include provisions for second-life battery systems, ensuring proper interconnection with existing power infrastructure. These standards address power quality, frequency regulation capabilities, and response times specific to repurposed battery systems with potentially variable performance characteristics.

Emerging certification pathways are being developed to streamline the qualification process for second-life batteries. These include accelerated testing protocols that can reliably predict long-term performance without requiring years of testing, and standardized reporting formats that enable comparison between different second-life battery offerings. The certification process increasingly incorporates traceability requirements, documenting the battery's complete history from original manufacture through its automotive service life and into its second-life application.

Economic Viability and ROI Analysis

The economic viability of retrofitting EV battery packs for stationary energy storage presents a compelling business case with significant ROI potential. Initial conversion costs typically range from $100-250 per kWh, substantially lower than the $400-600 per kWh for new stationary storage systems. This cost advantage creates an immediate value proposition, especially considering that repurposed EV batteries often retain 70-80% of their original capacity when deemed unsuitable for automotive applications.

Financial modeling indicates that retrofitted systems can achieve payback periods of 3-5 years in grid services applications, compared to 6-8 years for new battery systems. This accelerated ROI is particularly attractive for commercial and industrial customers seeking to reduce peak demand charges, which can constitute up to 70% of their electricity bills in some markets.

The economics improve further when considering the avoided costs of battery disposal and the environmental benefits of extended battery lifecycles. EV manufacturers can potentially realize an additional 15-25% return on their original battery investments through second-life applications, creating new revenue streams in their business models.

Market analysis reveals that the total addressable market for repurposed EV batteries could reach $4-5 billion by 2025 and potentially $15 billion by 2030, driven by the increasing availability of first-generation EV batteries reaching end-of-automotive-life. This represents a compound annual growth rate exceeding 40% over the next decade.

Sensitivity analysis shows that economic viability is highly dependent on several key factors: the purchase price of used EV batteries (currently $50-100/kWh), retrofitting costs, electricity market prices, and regulatory frameworks for energy storage. Regions with high electricity price volatility or capacity constraints show the most favorable economics, with potential internal rates of return exceeding 20%.

The value stacking approach—combining multiple revenue streams such as frequency regulation, peak shaving, and renewable energy time-shifting—significantly enhances ROI profiles. Modeling indicates that multi-use applications can increase returns by 30-50% compared to single-use cases, though this requires more sophisticated battery management systems and market participation strategies.

Long-term economic projections suggest that as retrofitting processes become standardized and scaled, conversion costs could decrease by 40-50% over the next five years, further improving the value proposition and expanding market opportunities for second-life battery applications.

Financial modeling indicates that retrofitted systems can achieve payback periods of 3-5 years in grid services applications, compared to 6-8 years for new battery systems. This accelerated ROI is particularly attractive for commercial and industrial customers seeking to reduce peak demand charges, which can constitute up to 70% of their electricity bills in some markets.

The economics improve further when considering the avoided costs of battery disposal and the environmental benefits of extended battery lifecycles. EV manufacturers can potentially realize an additional 15-25% return on their original battery investments through second-life applications, creating new revenue streams in their business models.

Market analysis reveals that the total addressable market for repurposed EV batteries could reach $4-5 billion by 2025 and potentially $15 billion by 2030, driven by the increasing availability of first-generation EV batteries reaching end-of-automotive-life. This represents a compound annual growth rate exceeding 40% over the next decade.

Sensitivity analysis shows that economic viability is highly dependent on several key factors: the purchase price of used EV batteries (currently $50-100/kWh), retrofitting costs, electricity market prices, and regulatory frameworks for energy storage. Regions with high electricity price volatility or capacity constraints show the most favorable economics, with potential internal rates of return exceeding 20%.

The value stacking approach—combining multiple revenue streams such as frequency regulation, peak shaving, and renewable energy time-shifting—significantly enhances ROI profiles. Modeling indicates that multi-use applications can increase returns by 30-50% compared to single-use cases, though this requires more sophisticated battery management systems and market participation strategies.

Long-term economic projections suggest that as retrofitting processes become standardized and scaled, conversion costs could decrease by 40-50% over the next five years, further improving the value proposition and expanding market opportunities for second-life battery applications.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!