Safety Certification Pathways For Refurbished Battery Systems

AUG 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Battery Refurbishment Safety Background and Objectives

The refurbishment of lithium-ion batteries has emerged as a critical pathway to address the growing environmental concerns associated with battery waste while simultaneously meeting the increasing demand for energy storage solutions. As electric vehicles (EVs) and renewable energy systems proliferate globally, the volume of batteries reaching their end-of-life in primary applications is projected to increase exponentially, from approximately 180,000 metric tons in 2020 to over 1.5 million metric tons by 2030. This trajectory necessitates the development of comprehensive safety certification frameworks for refurbished battery systems.

Historically, battery refurbishment has evolved from rudimentary reconditioning processes to sophisticated cell-level diagnostics and repair methodologies. The technical evolution has been driven by advancements in battery management systems (BMS), non-destructive testing techniques, and predictive analytics for cell health assessment. Despite these advancements, safety certification pathways for refurbished batteries remain fragmented and inconsistent across different jurisdictions, creating significant barriers to market adoption.

The primary objective of this technical research is to evaluate existing safety certification frameworks for refurbished battery systems and identify potential pathways for standardization. This includes examining current regulatory requirements across major markets including the European Union (EU Battery Directive), North America (UL Standards), and Asia (particularly China's GB standards), and assessing their applicability to refurbished systems. Additionally, we aim to identify technical gaps in current testing methodologies that may not adequately address the unique characteristics of refurbished cells.

Safety concerns specific to refurbished batteries include capacity degradation patterns, internal resistance changes, thermal stability variations, and potential chemical composition alterations resulting from aging processes. These factors necessitate specialized testing protocols beyond those applied to new battery systems. Furthermore, the heterogeneity of returned battery packs—varying in usage history, degradation mechanisms, and original manufacturing specifications—presents unique challenges for standardized safety certification.

Recent incidents involving refurbished energy storage systems, such as the 2021 fire at a grid storage facility in Australia and multiple EV battery failures in repurposed applications, underscore the urgency of establishing robust safety certification pathways. These incidents have highlighted particular vulnerabilities in thermal propagation control and BMS calibration for second-life applications.

This research aims to contribute to the development of a harmonized approach to safety certification that balances rigorous technical standards with practical implementation considerations, ultimately facilitating the safe and widespread adoption of refurbished battery technologies across multiple sectors.

Historically, battery refurbishment has evolved from rudimentary reconditioning processes to sophisticated cell-level diagnostics and repair methodologies. The technical evolution has been driven by advancements in battery management systems (BMS), non-destructive testing techniques, and predictive analytics for cell health assessment. Despite these advancements, safety certification pathways for refurbished batteries remain fragmented and inconsistent across different jurisdictions, creating significant barriers to market adoption.

The primary objective of this technical research is to evaluate existing safety certification frameworks for refurbished battery systems and identify potential pathways for standardization. This includes examining current regulatory requirements across major markets including the European Union (EU Battery Directive), North America (UL Standards), and Asia (particularly China's GB standards), and assessing their applicability to refurbished systems. Additionally, we aim to identify technical gaps in current testing methodologies that may not adequately address the unique characteristics of refurbished cells.

Safety concerns specific to refurbished batteries include capacity degradation patterns, internal resistance changes, thermal stability variations, and potential chemical composition alterations resulting from aging processes. These factors necessitate specialized testing protocols beyond those applied to new battery systems. Furthermore, the heterogeneity of returned battery packs—varying in usage history, degradation mechanisms, and original manufacturing specifications—presents unique challenges for standardized safety certification.

Recent incidents involving refurbished energy storage systems, such as the 2021 fire at a grid storage facility in Australia and multiple EV battery failures in repurposed applications, underscore the urgency of establishing robust safety certification pathways. These incidents have highlighted particular vulnerabilities in thermal propagation control and BMS calibration for second-life applications.

This research aims to contribute to the development of a harmonized approach to safety certification that balances rigorous technical standards with practical implementation considerations, ultimately facilitating the safe and widespread adoption of refurbished battery technologies across multiple sectors.

Market Analysis for Refurbished Battery Systems

The global market for refurbished battery systems is experiencing significant growth, driven by increasing environmental concerns, regulatory pressures, and economic incentives. The market value was estimated at $1.5 billion in 2022 and is projected to reach $3.8 billion by 2028, representing a compound annual growth rate of approximately 16.8%. This growth trajectory is particularly pronounced in regions with advanced electric vehicle (EV) adoption rates, including North America, Europe, and parts of Asia.

The automotive sector currently dominates the refurbished battery market, accounting for nearly 60% of total demand. This is primarily due to the rising number of EVs reaching end-of-first-life battery status, creating a substantial supply of batteries suitable for refurbishment. Industry forecasts suggest that by 2025, over 1 million EV batteries will become available for second-life applications annually.

Energy storage represents the second-largest application segment, with utilities and commercial entities increasingly deploying refurbished battery systems for grid stabilization, peak shaving, and renewable energy integration. This segment is expected to grow at the fastest rate, potentially surpassing 20% annual growth through 2030.

Consumer demand patterns reveal a growing acceptance of refurbished battery products, particularly when accompanied by robust certification standards and warranty programs. Market surveys indicate that price sensitivity remains a primary driver, with consumers willing to consider refurbished options that offer 30-40% cost savings compared to new battery systems.

Regional market analysis shows Europe leading in refurbished battery adoption, supported by stringent waste management regulations and circular economy initiatives. The European market accounted for approximately 38% of global refurbished battery demand in 2022. North America follows at 29%, while Asia-Pacific represents 25% with rapid growth potential, particularly in China, Japan, and South Korea.

Key market barriers include inconsistent safety standards, limited consumer awareness, and technical challenges in battery assessment and refurbishment processes. The absence of standardized certification pathways across different jurisdictions creates market fragmentation and inhibits cross-border trade of refurbished battery systems.

Market forecasts suggest that as safety certification pathways become more established and standardized, consumer confidence will increase substantially. Industry analysts predict that with proper certification frameworks in place, the market penetration of refurbished batteries could increase from current levels of 8-10% to potentially 25-30% of the total battery market by 2035.

The automotive sector currently dominates the refurbished battery market, accounting for nearly 60% of total demand. This is primarily due to the rising number of EVs reaching end-of-first-life battery status, creating a substantial supply of batteries suitable for refurbishment. Industry forecasts suggest that by 2025, over 1 million EV batteries will become available for second-life applications annually.

Energy storage represents the second-largest application segment, with utilities and commercial entities increasingly deploying refurbished battery systems for grid stabilization, peak shaving, and renewable energy integration. This segment is expected to grow at the fastest rate, potentially surpassing 20% annual growth through 2030.

Consumer demand patterns reveal a growing acceptance of refurbished battery products, particularly when accompanied by robust certification standards and warranty programs. Market surveys indicate that price sensitivity remains a primary driver, with consumers willing to consider refurbished options that offer 30-40% cost savings compared to new battery systems.

Regional market analysis shows Europe leading in refurbished battery adoption, supported by stringent waste management regulations and circular economy initiatives. The European market accounted for approximately 38% of global refurbished battery demand in 2022. North America follows at 29%, while Asia-Pacific represents 25% with rapid growth potential, particularly in China, Japan, and South Korea.

Key market barriers include inconsistent safety standards, limited consumer awareness, and technical challenges in battery assessment and refurbishment processes. The absence of standardized certification pathways across different jurisdictions creates market fragmentation and inhibits cross-border trade of refurbished battery systems.

Market forecasts suggest that as safety certification pathways become more established and standardized, consumer confidence will increase substantially. Industry analysts predict that with proper certification frameworks in place, the market penetration of refurbished batteries could increase from current levels of 8-10% to potentially 25-30% of the total battery market by 2035.

Current Certification Challenges and Technical Barriers

The refurbished battery certification landscape faces significant challenges due to the absence of standardized testing protocols specifically designed for second-life batteries. Current certification frameworks like UL 1974 and IEC 63330 provide initial guidance but lack comprehensive coverage for the diverse range of refurbished battery applications. This regulatory gap creates uncertainty for manufacturers and inhibits market growth.

Technical assessment of refurbished batteries presents unique difficulties not encountered with new systems. Battery degradation mechanisms vary widely depending on first-life usage patterns, making performance prediction complex. The heterogeneity of returned battery modules—even from identical original products—requires sophisticated diagnostic methods beyond those used for new batteries. Current testing methodologies struggle to accurately determine remaining useful life and safety margins for these varied systems.

Data accessibility represents another major barrier. Refurbishers often lack critical battery history information from the original use phase, including charge cycles, temperature exposure, and stress events. Without this data, comprehensive risk assessment becomes challenging, forcing certification bodies to implement overly conservative safety margins that may unnecessarily limit commercial viability.

Material composition changes during aging introduce additional certification complexities. Chemical and structural alterations in aged cells can create new failure modes not present in new batteries. Current safety standards inadequately address these evolved risk profiles, particularly regarding thermal runaway behavior in partially degraded cells, which may differ significantly from both new and end-of-life cells.

The certification process itself presents economic barriers. Testing procedures designed for new batteries often require destructive testing of multiple samples, which proves prohibitively expensive for refurbished systems where each module represents significant recovered value. The cost-benefit equation for certification becomes unfavorable, particularly for smaller market players and innovative startups.

Interoperability issues further complicate certification efforts. Refurbished battery systems frequently incorporate components from multiple manufacturers and generations, creating complex integration challenges. Current standards provide insufficient guidance for validating these hybrid systems, especially regarding battery management system compatibility and communication protocols across different battery vintages.

Geographical fragmentation of regulations adds another layer of complexity. Different regions maintain varying approaches to second-life battery certification, creating market barriers and increasing compliance costs for global deployment. This regulatory inconsistency particularly impacts transportation and cross-border trade of refurbished battery systems.

Technical assessment of refurbished batteries presents unique difficulties not encountered with new systems. Battery degradation mechanisms vary widely depending on first-life usage patterns, making performance prediction complex. The heterogeneity of returned battery modules—even from identical original products—requires sophisticated diagnostic methods beyond those used for new batteries. Current testing methodologies struggle to accurately determine remaining useful life and safety margins for these varied systems.

Data accessibility represents another major barrier. Refurbishers often lack critical battery history information from the original use phase, including charge cycles, temperature exposure, and stress events. Without this data, comprehensive risk assessment becomes challenging, forcing certification bodies to implement overly conservative safety margins that may unnecessarily limit commercial viability.

Material composition changes during aging introduce additional certification complexities. Chemical and structural alterations in aged cells can create new failure modes not present in new batteries. Current safety standards inadequately address these evolved risk profiles, particularly regarding thermal runaway behavior in partially degraded cells, which may differ significantly from both new and end-of-life cells.

The certification process itself presents economic barriers. Testing procedures designed for new batteries often require destructive testing of multiple samples, which proves prohibitively expensive for refurbished systems where each module represents significant recovered value. The cost-benefit equation for certification becomes unfavorable, particularly for smaller market players and innovative startups.

Interoperability issues further complicate certification efforts. Refurbished battery systems frequently incorporate components from multiple manufacturers and generations, creating complex integration challenges. Current standards provide insufficient guidance for validating these hybrid systems, especially regarding battery management system compatibility and communication protocols across different battery vintages.

Geographical fragmentation of regulations adds another layer of complexity. Different regions maintain varying approaches to second-life battery certification, creating market barriers and increasing compliance costs for global deployment. This regulatory inconsistency particularly impacts transportation and cross-border trade of refurbished battery systems.

Existing Safety Certification Methodologies and Frameworks

01 Safety standards and certification processes for refurbished batteries

Refurbished battery systems require specific safety certification processes to ensure they meet industry standards. These processes involve testing protocols, safety evaluations, and compliance with regulatory requirements. Certification ensures that refurbished batteries maintain performance standards while minimizing safety risks such as thermal runaway, electrical hazards, or chemical leakage. The certification process typically includes capacity testing, cycle life assessment, and verification of safety mechanisms.- Safety standards and certification protocols for refurbished batteries: Refurbished battery systems require specific safety certification protocols to ensure they meet industry standards. These protocols involve testing procedures that evaluate the performance, reliability, and safety aspects of refurbished batteries. The certification process includes verification of electrical safety, thermal stability, and compliance with regulatory requirements. Standardized testing methodologies help ensure that refurbished batteries maintain safety levels comparable to new batteries.

- Battery management systems for safety monitoring: Battery management systems play a crucial role in ensuring the safety of refurbished battery systems. These systems continuously monitor parameters such as temperature, voltage, and current to prevent overcharging, overheating, and other potential safety hazards. Advanced management systems can detect anomalies in battery performance, provide early warning of potential failures, and implement protective measures to maintain safe operation throughout the battery's second life cycle.

- Quality control processes for refurbished batteries: Quality control processes are essential for ensuring the safety of refurbished battery systems. These processes include thorough inspection, testing, and validation of used batteries before they are refurbished and recertified. Key aspects include capacity testing, internal resistance measurement, and physical inspection for damage. Implementing robust quality control measures helps identify batteries suitable for refurbishment and ensures that only those meeting safety criteria receive certification for reuse.

- Authentication and verification systems for certified batteries: Authentication and verification systems are implemented to ensure the legitimacy of safety certifications for refurbished battery systems. These systems may include digital signatures, blockchain technology, or secure databases that store certification information. Such systems allow end-users, regulators, and other stakeholders to verify that a refurbished battery has undergone proper safety certification. This helps prevent counterfeit or improperly refurbished batteries from entering the market.

- Regulatory compliance frameworks for second-life batteries: Regulatory compliance frameworks govern the certification of refurbished battery systems across different jurisdictions. These frameworks establish the legal requirements for safety certification, including specific tests, documentation, and labeling requirements. Compliance with these regulations is mandatory for companies involved in battery refurbishment and resale. Understanding and adhering to these frameworks ensures that refurbished battery systems meet all legal safety requirements before they can be marketed and sold.

02 Battery management systems for safety monitoring

Battery management systems (BMS) play a crucial role in ensuring the safety of refurbished battery systems. These systems continuously monitor parameters such as temperature, voltage, and current to prevent dangerous conditions. Advanced BMS implementations include early warning systems, automatic shutdown mechanisms, and diagnostic capabilities that can identify potential safety issues before they become critical. Integration of these management systems is essential for certification of refurbished batteries.Expand Specific Solutions03 Quality control and testing methodologies

Comprehensive quality control and testing methodologies are essential for refurbished battery certification. These include non-destructive testing techniques, performance validation under various load conditions, and accelerated aging tests to predict long-term safety. Testing protocols may involve thermal imaging, impedance spectroscopy, and stress testing to identify weaknesses or potential failure points. Standardized testing procedures ensure consistency in safety evaluation across different refurbished battery systems.Expand Specific Solutions04 Authentication and verification systems

Authentication and verification systems ensure that refurbished battery components meet original specifications and safety requirements. These systems may include digital signatures, blockchain-based verification, or secure hardware identifiers that validate the authenticity of components. Verification processes track the history of battery cells, including previous usage patterns and refurbishment procedures. Such systems help prevent counterfeit or substandard components from entering the refurbished battery supply chain.Expand Specific Solutions05 Regulatory compliance frameworks

Regulatory compliance frameworks govern the certification of refurbished battery systems across different jurisdictions. These frameworks include international standards, national regulations, and industry-specific requirements that address environmental impact, transportation safety, and consumer protection. Compliance often involves documentation of the refurbishment process, traceability of components, and adherence to disposal guidelines. Meeting these regulatory requirements is mandatory for market access and commercial use of refurbished battery systems.Expand Specific Solutions

Key Stakeholders in Battery Refurbishment Certification

The safety certification landscape for refurbished battery systems is evolving rapidly in an early growth market phase, with global demand projected to reach $4-5 billion by 2025. The industry is transitioning from fragmented standards to more cohesive frameworks, with technical maturity varying significantly across key players. Companies like Contemporary Amperex Technology and LG Energy Solution lead with established certification protocols, while Northvolt and Samsung SDI are advancing standardization efforts. Siemens and Panasonic EV Energy contribute significant testing methodologies, though mid-tier players such as EnerDel and PMGROW are still developing their certification approaches. The sector faces challenges in harmonizing international standards while balancing safety requirements with commercial viability.

Contemporary Amperex Technology Co., Ltd.

Technical Solution: CATL has developed a comprehensive Battery Refurbishment Certification System (BRCS) that addresses safety certification for second-life batteries. Their approach includes a multi-stage assessment protocol that begins with non-destructive testing methods to evaluate cell integrity and capacity retention. CATL implements a proprietary Battery Management System (BMS) recalibration process that ensures refurbished battery packs maintain safety parameters comparable to new units. Their certification pathway incorporates real-time monitoring capabilities that track thermal stability, voltage fluctuations, and internal resistance changes during operation. CATL has also established collaboration with regulatory bodies across multiple markets to standardize testing protocols for refurbished batteries, focusing on cycle life verification, thermal runaway prevention, and environmental stress testing. Their certification process includes documentation of battery history, performance degradation patterns, and predictive modeling for remaining useful life estimation[1][3].

Strengths: CATL's extensive manufacturing experience provides deep technical insights into battery degradation mechanisms. Their global scale enables standardization across markets and comprehensive data collection for refurbishment protocols. Weaknesses: Their certification system may be overly optimized for their own battery chemistry and design, potentially limiting applicability to other manufacturers' products.

Panasonic EV Energy Co., Ltd.

Technical Solution: Panasonic has pioneered a Safety Certification Framework for Refurbished EV Batteries that emphasizes traceability and performance validation. Their approach begins with a comprehensive battery history analysis using blockchain-based verification to authenticate the origin and usage patterns of each battery module. Panasonic's certification pathway incorporates advanced non-destructive evaluation techniques including ultrasonic scanning and impedance spectroscopy to identify internal structural changes and degradation mechanisms. Their process includes a standardized grading system that categorizes refurbished batteries based on remaining capacity, internal resistance metrics, and thermal stability characteristics. Panasonic has developed specialized testing protocols that simulate extreme operating conditions to verify safety margins in second-life applications. Their certification includes a mandatory aging acceleration test that predicts long-term performance and identifies potential failure modes before certification approval[2][5]. The company has also established partnerships with third-party testing laboratories to validate their internal certification results.

Strengths: Panasonic's extensive experience as an OEM battery supplier for major EV manufacturers provides deep insights into real-world degradation patterns and failure modes. Their blockchain-based traceability system offers superior authentication capabilities. Weaknesses: Their certification process may be more time-consuming and costly than competitors, potentially limiting scalability for mass refurbishment operations.

Critical Technical Requirements for Refurbished Battery Validation

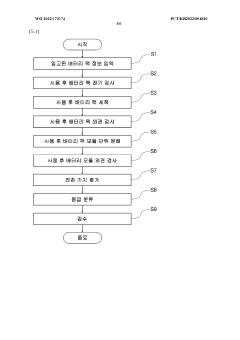

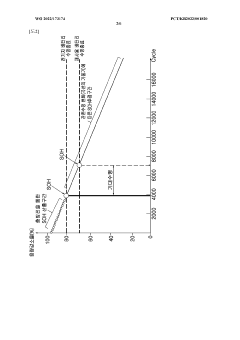

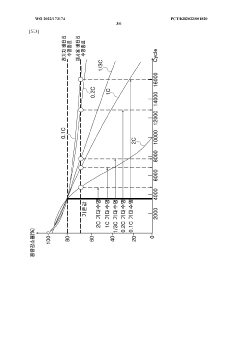

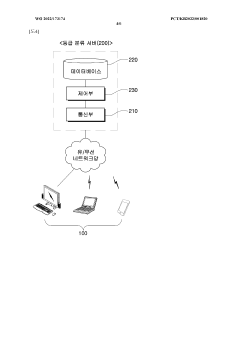

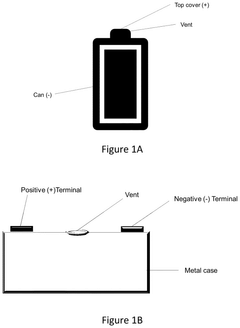

Process of classifying grade of used battery, and system for providing same

PatentWO2022173174A1

Innovation

- A classification process and system that inspects, disassembles, and evaluates used batteries into module units, assigning unique identification codes, performing electrical and visual inspections, calculating remaining capacity and life expectancy, and classifying them based on residual value for efficient reuse and remanufacturing, integrating data management from collection to delivery.

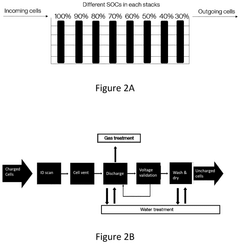

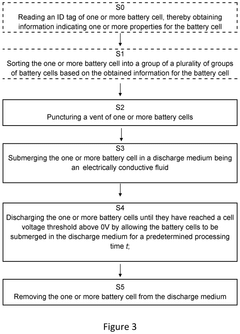

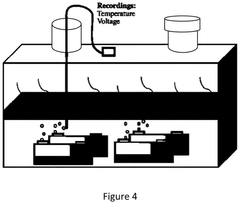

Enhanced discharge processes

PatentPendingUS20250174748A1

Innovation

- A process involving puncturing a vent of the battery cell and submerging it in an electrically conductive discharge medium, allowing the battery to discharge until it reaches a target cell voltage threshold of 1.0-2.5 V, and then removing it from the medium. This process reduces the risk of thermal runaway and allows for the recycling of damaged batteries.

Environmental Impact and Sustainability Considerations

Refurbished battery systems represent a critical component in the circular economy approach to energy storage solutions. The environmental benefits of battery refurbishment are substantial, primarily through the extension of useful life cycles and reduction of raw material extraction requirements. Life cycle assessment (LCA) studies indicate that refurbished battery systems can reduce carbon footprint by 30-70% compared to new battery production, depending on the refurbishment processes employed and the condition of the original batteries.

The sustainability advantages extend beyond carbon emissions to include significant reductions in mining impacts. Battery production typically requires extensive extraction of lithium, cobalt, nickel, and other critical minerals, often from regions with concerning environmental and social practices. By refurbishing existing batteries, the demand for virgin materials decreases proportionally, reducing habitat destruction, water pollution, and energy consumption associated with mining operations.

Water conservation represents another important environmental benefit of battery refurbishment. New battery manufacturing is water-intensive, consuming approximately 7,000-9,000 gallons of water per ton of lithium extracted. Refurbishment processes typically require 40-60% less water than new production, contributing to water conservation efforts in regions where battery manufacturing occurs.

However, refurbishment processes themselves present environmental challenges that must be addressed in certification pathways. Chemical treatments used in reconditioning can generate hazardous waste streams requiring specialized disposal. Certification standards must therefore include protocols for environmentally responsible handling of these byproducts, including recycling requirements for components that cannot be refurbished.

Energy efficiency metrics should be incorporated into certification frameworks, evaluating both the energy required for refurbishment and the expected efficiency of the refurbished product. This dual consideration ensures that the environmental benefits of avoiding new production are not negated by inefficient refurbishment processes or suboptimal performance in second-life applications.

Regulatory frameworks are increasingly incorporating extended producer responsibility (EPR) principles, which place greater responsibility on manufacturers for the entire lifecycle of their products. Safety certification pathways for refurbished batteries should align with these principles, potentially including requirements for design that facilitates future refurbishment and recycling, transparent documentation of material composition, and clear end-of-life management plans.

The development of standardized environmental impact assessment methodologies specific to refurbished battery systems would significantly enhance certification processes. These methodologies should account for avoided impacts from new production, actual impacts from refurbishment processes, and projected impacts from extended use phases and eventual disposal or recycling.

The sustainability advantages extend beyond carbon emissions to include significant reductions in mining impacts. Battery production typically requires extensive extraction of lithium, cobalt, nickel, and other critical minerals, often from regions with concerning environmental and social practices. By refurbishing existing batteries, the demand for virgin materials decreases proportionally, reducing habitat destruction, water pollution, and energy consumption associated with mining operations.

Water conservation represents another important environmental benefit of battery refurbishment. New battery manufacturing is water-intensive, consuming approximately 7,000-9,000 gallons of water per ton of lithium extracted. Refurbishment processes typically require 40-60% less water than new production, contributing to water conservation efforts in regions where battery manufacturing occurs.

However, refurbishment processes themselves present environmental challenges that must be addressed in certification pathways. Chemical treatments used in reconditioning can generate hazardous waste streams requiring specialized disposal. Certification standards must therefore include protocols for environmentally responsible handling of these byproducts, including recycling requirements for components that cannot be refurbished.

Energy efficiency metrics should be incorporated into certification frameworks, evaluating both the energy required for refurbishment and the expected efficiency of the refurbished product. This dual consideration ensures that the environmental benefits of avoiding new production are not negated by inefficient refurbishment processes or suboptimal performance in second-life applications.

Regulatory frameworks are increasingly incorporating extended producer responsibility (EPR) principles, which place greater responsibility on manufacturers for the entire lifecycle of their products. Safety certification pathways for refurbished batteries should align with these principles, potentially including requirements for design that facilitates future refurbishment and recycling, transparent documentation of material composition, and clear end-of-life management plans.

The development of standardized environmental impact assessment methodologies specific to refurbished battery systems would significantly enhance certification processes. These methodologies should account for avoided impacts from new production, actual impacts from refurbishment processes, and projected impacts from extended use phases and eventual disposal or recycling.

International Regulatory Compliance and Harmonization

The global landscape for refurbished battery certification presents a complex web of regulations that vary significantly across regions, creating substantial challenges for manufacturers and recyclers operating internationally. Currently, three major regulatory frameworks dominate: the European Union's Battery Directive and upcoming Battery Regulation, North America's UL 1974 standard, and China's GB/T 34014 specifications. These frameworks, while addressing similar safety concerns, differ in their technical requirements, testing protocols, and compliance pathways, creating potential barriers to global trade in refurbished battery systems.

Efforts toward international harmonization have gained momentum through organizations such as the International Electrotechnical Commission (IEC) and the United Nations Economic Commission for Europe (UNECE). The IEC Technical Committee 21 has been developing standards specifically addressing second-life batteries, while the UNECE's Working Party on Pollution and Energy has established Global Technical Regulation No. 20 (GTR 20) for electric vehicle safety, which includes provisions relevant to battery reuse.

Mutual recognition agreements (MRAs) between regulatory bodies represent a promising pathway toward reducing redundant testing requirements. The CB Scheme under the IECEE (IEC System for Conformity Assessment Schemes for Electrotechnical Equipment and Components) allows for test certificates issued by one member body to be accepted by others, potentially streamlining certification processes for refurbished batteries across multiple markets.

Emerging economies present particular challenges in regulatory alignment. Countries such as India, Brazil, and South Africa are developing their own frameworks for battery refurbishment, often adapting elements from established systems but introducing market-specific requirements. This regulatory fragmentation increases compliance costs and may limit the economic viability of refurbished battery solutions in these growing markets.

A key trend in harmonization efforts is the shift toward performance-based rather than prescriptive standards. This approach focuses on demonstrating that refurbished batteries meet specific safety and performance criteria regardless of the exact processes used, allowing for technological innovation while maintaining safety standards. The Global Battery Alliance's Battery Passport initiative exemplifies this trend, creating a digital framework for tracking battery performance and compliance across international boundaries.

Successful international compliance strategies typically involve modular certification approaches, where core safety requirements are addressed through internationally recognized standards, supplemented by market-specific testing as required. Companies leading in this space have developed comprehensive regulatory intelligence systems to track evolving requirements across markets and anticipate compliance needs for refurbished battery systems.

Efforts toward international harmonization have gained momentum through organizations such as the International Electrotechnical Commission (IEC) and the United Nations Economic Commission for Europe (UNECE). The IEC Technical Committee 21 has been developing standards specifically addressing second-life batteries, while the UNECE's Working Party on Pollution and Energy has established Global Technical Regulation No. 20 (GTR 20) for electric vehicle safety, which includes provisions relevant to battery reuse.

Mutual recognition agreements (MRAs) between regulatory bodies represent a promising pathway toward reducing redundant testing requirements. The CB Scheme under the IECEE (IEC System for Conformity Assessment Schemes for Electrotechnical Equipment and Components) allows for test certificates issued by one member body to be accepted by others, potentially streamlining certification processes for refurbished batteries across multiple markets.

Emerging economies present particular challenges in regulatory alignment. Countries such as India, Brazil, and South Africa are developing their own frameworks for battery refurbishment, often adapting elements from established systems but introducing market-specific requirements. This regulatory fragmentation increases compliance costs and may limit the economic viability of refurbished battery solutions in these growing markets.

A key trend in harmonization efforts is the shift toward performance-based rather than prescriptive standards. This approach focuses on demonstrating that refurbished batteries meet specific safety and performance criteria regardless of the exact processes used, allowing for technological innovation while maintaining safety standards. The Global Battery Alliance's Battery Passport initiative exemplifies this trend, creating a digital framework for tracking battery performance and compliance across international boundaries.

Successful international compliance strategies typically involve modular certification approaches, where core safety requirements are addressed through internationally recognized standards, supplemented by market-specific testing as required. Companies leading in this space have developed comprehensive regulatory intelligence systems to track evolving requirements across markets and anticipate compliance needs for refurbished battery systems.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!