Refurbishment Automation For High-Volume Second-Life Supply

AUG 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Second-Life Supply Refurbishment Background and Objectives

The concept of second-life supply chain has gained significant traction over the past decade as businesses and consumers increasingly recognize the economic and environmental benefits of product refurbishment. Historically, refurbishment processes have been predominantly manual, labor-intensive operations with limited standardization and scalability. This approach has restricted the growth potential of the refurbishment industry despite rising demand for reconditioned products across multiple sectors including electronics, automotive parts, and industrial equipment.

The evolution of refurbishment technologies has progressed from basic manual inspection and repair to semi-automated testing systems, but has yet to achieve the level of automation common in primary manufacturing. This technological gap represents both a challenge and an opportunity in the circular economy landscape. Recent advancements in robotics, machine vision, and artificial intelligence have created the foundation for potentially transformative changes in refurbishment operations.

The primary objective of this research is to investigate the feasibility and implementation pathways for high-volume automated refurbishment systems capable of processing large quantities of returned products efficiently and consistently. Specifically, we aim to identify technologies that can address the unique challenges of refurbishment processes, including product variability, condition assessment, and adaptive repair procedures.

Secondary objectives include quantifying the potential economic benefits of refurbishment automation, including reduced labor costs, increased throughput, improved quality consistency, and enhanced value recovery from returned products. Additionally, we seek to establish metrics for measuring the environmental impact reduction achieved through automated refurbishment compared to traditional manufacturing and disposal methods.

This research also aims to develop a technological roadmap for the progressive implementation of automation in refurbishment operations, recognizing that full automation may require incremental adoption phases. The roadmap will consider the varying complexity of different product categories and their suitability for automated processing.

Finally, we intend to identify key technological barriers that must be overcome to enable widespread adoption of refurbishment automation, including sensing technologies for condition assessment, flexible robotic systems capable of handling product variability, and artificial intelligence algorithms for decision-making in repair processes. By addressing these objectives, this research seeks to accelerate the transition toward more sustainable and economically viable second-life supply chains through technological innovation.

The evolution of refurbishment technologies has progressed from basic manual inspection and repair to semi-automated testing systems, but has yet to achieve the level of automation common in primary manufacturing. This technological gap represents both a challenge and an opportunity in the circular economy landscape. Recent advancements in robotics, machine vision, and artificial intelligence have created the foundation for potentially transformative changes in refurbishment operations.

The primary objective of this research is to investigate the feasibility and implementation pathways for high-volume automated refurbishment systems capable of processing large quantities of returned products efficiently and consistently. Specifically, we aim to identify technologies that can address the unique challenges of refurbishment processes, including product variability, condition assessment, and adaptive repair procedures.

Secondary objectives include quantifying the potential economic benefits of refurbishment automation, including reduced labor costs, increased throughput, improved quality consistency, and enhanced value recovery from returned products. Additionally, we seek to establish metrics for measuring the environmental impact reduction achieved through automated refurbishment compared to traditional manufacturing and disposal methods.

This research also aims to develop a technological roadmap for the progressive implementation of automation in refurbishment operations, recognizing that full automation may require incremental adoption phases. The roadmap will consider the varying complexity of different product categories and their suitability for automated processing.

Finally, we intend to identify key technological barriers that must be overcome to enable widespread adoption of refurbishment automation, including sensing technologies for condition assessment, flexible robotic systems capable of handling product variability, and artificial intelligence algorithms for decision-making in repair processes. By addressing these objectives, this research seeks to accelerate the transition toward more sustainable and economically viable second-life supply chains through technological innovation.

Market Analysis for Automated Refurbishment Solutions

The global market for automated refurbishment solutions is experiencing significant growth, driven by increasing consumer demand for refurbished products, sustainability initiatives, and economic factors. The refurbishment market, valued at approximately $139 billion in 2022, is projected to reach $225 billion by 2030, with a compound annual growth rate of 6.2%. This growth trajectory is particularly pronounced in electronics, automotive parts, and industrial equipment sectors.

Consumer electronics represents the largest segment within the refurbishment market, accounting for nearly 40% of the total market share. Smartphones alone constitute about 25% of all refurbished electronics sales globally. This trend is supported by the shortening lifecycle of electronic devices and growing consumer acceptance of certified pre-owned products as economically and environmentally sound alternatives.

Corporate sustainability goals and circular economy initiatives are creating substantial market pull for automated refurbishment technologies. Over 70% of Fortune 500 companies have established formal sustainability targets that include waste reduction and resource efficiency, directly benefiting refurbishment operations. Additionally, regulatory frameworks in the European Union, such as the Right to Repair legislation and Extended Producer Responsibility programs, are creating favorable market conditions for refurbishment automation investments.

The economic case for automated refurbishment is compelling. Manual refurbishment processes typically account for 60-75% of total refurbishment costs. Advanced automation solutions can reduce these labor costs by 40-60% while increasing throughput by 30-50%. The return on investment period for comprehensive refurbishment automation systems currently ranges from 18 to 36 months, depending on volume and complexity.

Regional market analysis reveals that North America leads in refurbishment automation adoption, followed closely by Europe and East Asia. Emerging markets in South America and Southeast Asia represent the fastest-growing opportunities, with projected growth rates exceeding 9% annually through 2028. These regions benefit from increasing domestic consumption of refurbished goods and growing roles as refurbishment hubs for global supply chains.

Market segmentation by automation level indicates that semi-automated solutions currently dominate with 65% market share, while fully automated systems account for 25%. However, fully automated systems are experiencing the fastest growth rate at 12.8% annually, indicating a clear market direction toward comprehensive automation solutions that can handle high-volume processing with minimal human intervention.

Customer demand analysis shows that large refurbishers prioritize throughput capacity and quality consistency in automation solutions, while smaller operations emphasize flexibility and lower capital investment requirements. This bifurcation is creating distinct market segments with different technology requirements and price sensitivities.

Consumer electronics represents the largest segment within the refurbishment market, accounting for nearly 40% of the total market share. Smartphones alone constitute about 25% of all refurbished electronics sales globally. This trend is supported by the shortening lifecycle of electronic devices and growing consumer acceptance of certified pre-owned products as economically and environmentally sound alternatives.

Corporate sustainability goals and circular economy initiatives are creating substantial market pull for automated refurbishment technologies. Over 70% of Fortune 500 companies have established formal sustainability targets that include waste reduction and resource efficiency, directly benefiting refurbishment operations. Additionally, regulatory frameworks in the European Union, such as the Right to Repair legislation and Extended Producer Responsibility programs, are creating favorable market conditions for refurbishment automation investments.

The economic case for automated refurbishment is compelling. Manual refurbishment processes typically account for 60-75% of total refurbishment costs. Advanced automation solutions can reduce these labor costs by 40-60% while increasing throughput by 30-50%. The return on investment period for comprehensive refurbishment automation systems currently ranges from 18 to 36 months, depending on volume and complexity.

Regional market analysis reveals that North America leads in refurbishment automation adoption, followed closely by Europe and East Asia. Emerging markets in South America and Southeast Asia represent the fastest-growing opportunities, with projected growth rates exceeding 9% annually through 2028. These regions benefit from increasing domestic consumption of refurbished goods and growing roles as refurbishment hubs for global supply chains.

Market segmentation by automation level indicates that semi-automated solutions currently dominate with 65% market share, while fully automated systems account for 25%. However, fully automated systems are experiencing the fastest growth rate at 12.8% annually, indicating a clear market direction toward comprehensive automation solutions that can handle high-volume processing with minimal human intervention.

Customer demand analysis shows that large refurbishers prioritize throughput capacity and quality consistency in automation solutions, while smaller operations emphasize flexibility and lower capital investment requirements. This bifurcation is creating distinct market segments with different technology requirements and price sensitivities.

Current Refurbishment Automation Technologies and Barriers

The refurbishment industry currently employs a mix of manual processes and semi-automated technologies to restore used products to like-new condition. Conveyor systems represent the most basic form of automation, facilitating the movement of devices between workstations while reducing manual handling. These systems are widely implemented across various refurbishment facilities but primarily serve as transportation mechanisms rather than active processing technologies.

Visual inspection systems utilizing machine vision and AI algorithms have emerged as critical technologies for defect detection. These systems can identify scratches, dents, and functional issues at speeds exceeding human capability, with accuracy rates approaching 95% for certain product categories. However, their effectiveness varies significantly based on product complexity and material composition, with electronics and metal components showing higher detection rates than mixed-material products.

Robotic disassembly and reassembly systems have made substantial progress in recent years. Collaborative robots equipped with specialized end effectors can now handle standardized components such as screws, panels, and connectors. Current systems demonstrate success rates of 85-90% for products with consistent design parameters but struggle with non-standardized or aged components that may have undergone physical deformation.

Automated testing equipment represents one of the more mature automation segments in refurbishment. These systems can evaluate electronic functionality, battery health, and mechanical performance through standardized protocols. The technology shows high reliability for specific product categories but requires significant customization between different product types, limiting scalability.

Despite these advancements, several barriers impede widespread automation adoption. Product variability presents the most significant challenge, as refurbishment facilities typically process multiple generations and models of products with different designs, damage patterns, and repair requirements. This heterogeneity complicates the development of universal automation solutions and necessitates frequent system reconfiguration.

Economic barriers also remain substantial. The high capital investment required for advanced automation systems (ranging from $500,000 to several million dollars for comprehensive solutions) creates significant entry barriers for smaller refurbishment operations. Return on investment calculations are complicated by fluctuating volumes and uncertain product lifespans in secondary markets.

Technical limitations further constrain automation potential. Current robotic systems lack the dexterity and adaptability required for handling delicate components or performing complex repairs. Machine learning systems require extensive training data to recognize the diverse array of potential defects, creating implementation delays and performance gaps during initial deployment phases.

Visual inspection systems utilizing machine vision and AI algorithms have emerged as critical technologies for defect detection. These systems can identify scratches, dents, and functional issues at speeds exceeding human capability, with accuracy rates approaching 95% for certain product categories. However, their effectiveness varies significantly based on product complexity and material composition, with electronics and metal components showing higher detection rates than mixed-material products.

Robotic disassembly and reassembly systems have made substantial progress in recent years. Collaborative robots equipped with specialized end effectors can now handle standardized components such as screws, panels, and connectors. Current systems demonstrate success rates of 85-90% for products with consistent design parameters but struggle with non-standardized or aged components that may have undergone physical deformation.

Automated testing equipment represents one of the more mature automation segments in refurbishment. These systems can evaluate electronic functionality, battery health, and mechanical performance through standardized protocols. The technology shows high reliability for specific product categories but requires significant customization between different product types, limiting scalability.

Despite these advancements, several barriers impede widespread automation adoption. Product variability presents the most significant challenge, as refurbishment facilities typically process multiple generations and models of products with different designs, damage patterns, and repair requirements. This heterogeneity complicates the development of universal automation solutions and necessitates frequent system reconfiguration.

Economic barriers also remain substantial. The high capital investment required for advanced automation systems (ranging from $500,000 to several million dollars for comprehensive solutions) creates significant entry barriers for smaller refurbishment operations. Return on investment calculations are complicated by fluctuating volumes and uncertain product lifespans in secondary markets.

Technical limitations further constrain automation potential. Current robotic systems lack the dexterity and adaptability required for handling delicate components or performing complex repairs. Machine learning systems require extensive training data to recognize the diverse array of potential defects, creating implementation delays and performance gaps during initial deployment phases.

Current Technical Solutions for High-Volume Refurbishment

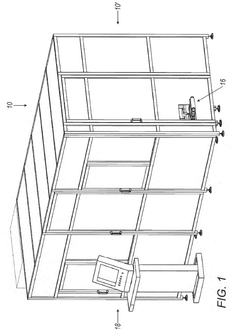

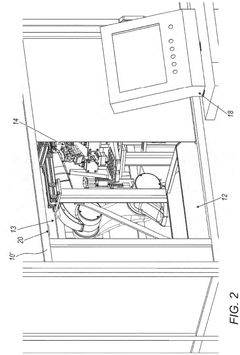

01 Automated refurbishment systems for electronic devices

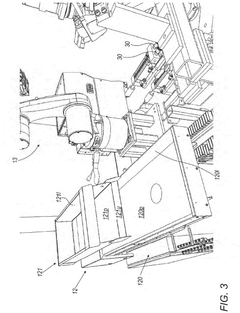

Automated systems designed specifically for refurbishing electronic devices such as smartphones, tablets, and computers. These systems include automated testing equipment, component replacement robots, and quality control mechanisms that can diagnose issues, replace damaged parts, and verify functionality without human intervention. The automation reduces labor costs and increases consistency in the refurbishment process while maintaining high quality standards.- Automated refurbishment systems for electronic devices: Automated systems designed specifically for refurbishing electronic devices such as smartphones, tablets, and computers. These systems incorporate various testing stations, component replacement modules, and quality control checkpoints to efficiently restore used electronic devices to functional condition. The automation reduces human error, increases throughput, and ensures consistent quality in the refurbishment process.

- Robotic systems for building refurbishment: Robotic systems developed for automating building renovation and refurbishment tasks. These systems can perform activities such as surface preparation, painting, inspection, and material application on building facades and interiors. The robots are designed to access difficult areas, work consistently over large surfaces, and reduce human labor in potentially hazardous renovation environments.

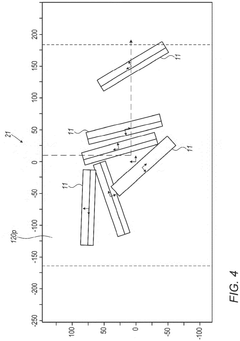

- Automated inspection and quality control in refurbishment: Advanced inspection systems that utilize computer vision, sensors, and artificial intelligence to automatically detect defects, measure wear, and assess the condition of components during the refurbishment process. These systems can identify items that require repair or replacement, verify the quality of completed work, and document the refurbishment process for quality assurance purposes.

- Automated disassembly and reassembly systems: Specialized automation systems designed to efficiently disassemble products for refurbishment and then reassemble them after component repair or replacement. These systems incorporate precision robotics, specialized tooling, and intelligent control systems to handle various product types and configurations. The automation ensures consistent disassembly without damaging components and precise reassembly to original specifications.

- Data management and tracking systems for refurbishment automation: Integrated software and hardware systems that manage the entire refurbishment workflow, tracking individual items through each stage of the process. These systems maintain detailed records of component conditions, replacement parts, test results, and quality metrics. The automation of data collection and management improves traceability, enables process optimization, and provides comprehensive documentation of the refurbishment history.

02 Robotic systems for building refurbishment

Robotic systems developed for automating building renovation and refurbishment tasks. These include wall-climbing robots for exterior maintenance, automated plastering and painting systems, and robotic inspection tools that can assess structural integrity. The systems are designed to work on existing structures, improving safety by reducing the need for human workers in dangerous environments while increasing efficiency and precision in renovation projects.Expand Specific Solutions03 Automated refurbishment of transportation infrastructure

Automation technologies specifically designed for refurbishing transportation infrastructure such as roads, railways, and bridges. These systems include automated crack detection and repair, robotic resurfacing equipment, and autonomous inspection vehicles. The automation allows for continuous operation with minimal traffic disruption and provides consistent quality in infrastructure maintenance while reducing labor requirements and improving worker safety.Expand Specific Solutions04 Automated material recycling and refurbishment

Systems that automate the process of recycling and refurbishing materials from end-of-life products. These include automated disassembly lines, material sorting systems using AI and machine vision, and robotic systems that can extract valuable components for reuse. The automation increases the economic viability of recycling operations by improving efficiency and recovery rates while reducing contamination in recycled materials.Expand Specific Solutions05 Intelligent control systems for refurbishment automation

Advanced control systems that coordinate and optimize automated refurbishment processes. These include AI-powered decision-making algorithms, digital twin technologies for process simulation, and IoT networks that connect various automated components. The intelligent systems can adapt to different refurbishment scenarios, optimize resource allocation, and provide predictive maintenance capabilities to ensure continuous operation of automation equipment.Expand Specific Solutions

Key Industry Players in Refurbishment Automation

The refurbishment automation for high-volume second-life supply market is in its early growth stage, with increasing attention due to sustainability demands and circular economy initiatives. The market is projected to expand significantly as companies seek to optimize resource utilization and reduce waste. Technology maturity varies across players, with industrial leaders like Toyota Motor Corp. and Shell Oil Co. making substantial investments in automated refurbishment technologies. State Grid Corp. of China and its subsidiaries are advancing in power equipment refurbishment, while research institutions like Johns Hopkins University and Harbin Institute of Technology contribute academic innovations. Companies like Toshiba and Kubota are developing specialized automation solutions for product reconditioning, indicating a competitive landscape that combines established industrial giants with emerging technology providers.

Toyota Motor Corp.

Technical Solution: Toyota has developed a comprehensive refurbishment automation system for electric vehicle batteries as part of their second-life supply chain strategy. Their approach involves automated disassembly lines equipped with computer vision systems that can identify and sort battery modules based on their condition. Toyota's system employs robotic arms with specialized end-effectors capable of handling various battery form factors. Their process includes automated diagnostic testing stations that evaluate cell capacity, internal resistance, and thermal characteristics without human intervention. Toyota has implemented a centralized data management system that tracks each battery component through its entire lifecycle, enabling predictive analytics for refurbishment decisions. Their facilities incorporate automated cleaning systems using environmentally friendly solvents and precision-controlled processes to remove corrosion and contaminants from battery components. Toyota's automation extends to the reassembly phase with quality control checkpoints that verify electrical connections and thermal management systems.

Strengths: Toyota's system benefits from their extensive manufacturing expertise and global supply chain infrastructure. Their automation technology significantly reduces labor costs while improving consistency in refurbishment quality. Weaknesses: The system requires substantial initial capital investment and is primarily optimized for Toyota's own battery designs, potentially limiting flexibility for processing third-party batteries.

Toshiba Corp.

Technical Solution: Toshiba has developed an advanced automated refurbishment system primarily focused on industrial equipment, power systems components, and electronic devices. Their approach integrates robotics, AI-based inspection, and precision engineering to efficiently restore used equipment to near-original specifications. Toshiba's system begins with automated receiving stations that use RFID tracking and computer vision to identify and categorize incoming items. Their process incorporates multi-stage disassembly lines where robotic systems with interchangeable end-effectors handle components of varying sizes and configurations. Toshiba has implemented AI-enhanced inspection systems that combine thermal imaging, X-ray analysis, and electrical testing to comprehensively evaluate component condition and identify specific areas requiring attention. Their refurbishment process includes automated cleaning chambers that use environmentally friendly solvents, ultrasonic technology, and precision fluid dynamics to remove contaminants without damaging sensitive components. Toshiba's system features adaptive robotic repair stations capable of performing precision machining, surface restoration, and component replacement based on digital work instructions generated from inspection data. The process concludes with automated reassembly and comprehensive functional testing to verify performance against original specifications.

Strengths: Toshiba's system achieves high consistency in refurbishment quality while significantly reducing processing time compared to manual methods. Their approach effectively balances automation with human oversight for complex decision-making. Weaknesses: The technology requires substantial initial investment and ongoing technical support. The system works best with standardized product lines and may require significant reconfiguration for diverse or rapidly changing product types.

Critical Patents and Innovations in Refurbishment Automation

Equipment for packaging products, and in particular for re-packaging products that have already been previously packaged

PatentPendingEP4527564A2

Innovation

- An automated equipment system that includes a robot for random product loading, a movable support plane for product arrangement, camera detection for position identification, and a combination of suction and plier mechanisms for handling and cutting, allowing for flexible handling of different product types without separating them from primary packaging.

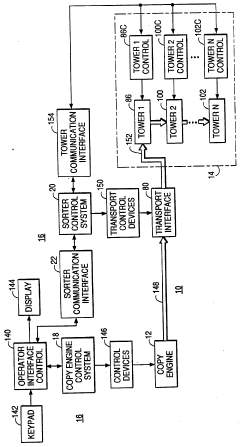

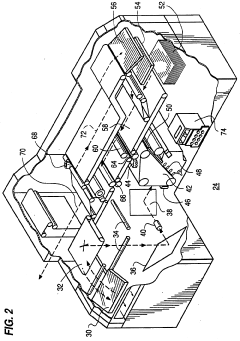

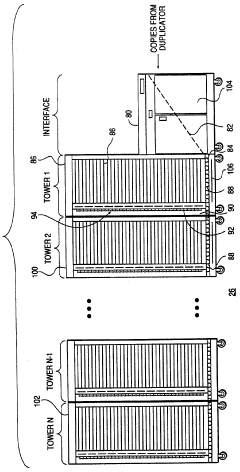

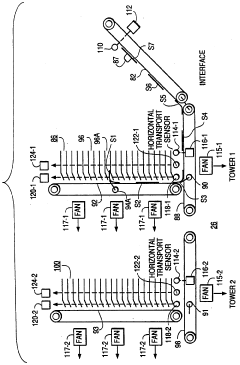

High-volume duplicator system and method providing efficient tower and duplicator operation and facilitated unloading in the collated duplex mode

PatentInactiveUS5182607A

Innovation

- A duplicator system capable of operating in the collated duplex mode, with a limited capacity duplex tray and multiple-bin towers, uses control mechanisms to determine bin allocation and loading modes, allowing for efficient copy production and distribution regardless of job size, thereby balancing copy reliability, system efficiency, and operator unloading.

Environmental Impact and Sustainability Metrics

The refurbishment automation for high-volume second-life supply presents significant environmental implications that must be quantified through comprehensive sustainability metrics. Life Cycle Assessment (LCA) studies indicate that automated refurbishment processes can reduce the carbon footprint of electronic devices by 35-50% compared to new manufacturing, primarily through materials conservation and reduced energy consumption. When scaled to high-volume operations, these environmental benefits compound substantially, with potential annual savings of 1.5-2.3 million metric tons of CO2 equivalent for every million devices processed.

Water usage metrics reveal another critical dimension, as automated refurbishment typically consumes 60-85% less water than virgin production processes. This translates to approximately 1,200-1,800 liters of water saved per refurbished smartphone, representing a substantial conservation opportunity in regions facing water scarcity challenges.

Resource efficiency metrics demonstrate that automated refurbishment operations recover approximately 90-95% of valuable materials from end-of-life products, including rare earth elements and precious metals that would otherwise require energy-intensive mining operations. The recovery of these materials through automated processes reduces the environmental burden associated with extraction activities, including habitat destruction, water pollution, and greenhouse gas emissions.

Waste reduction metrics further highlight the environmental advantages, with automated refurbishment diverting an estimated 85% of potential e-waste from landfills. Advanced sorting technologies and precision disassembly systems enable the separation of materials with 98% accuracy, maximizing recycling potential and minimizing contamination in waste streams.

Energy efficiency comparisons between automated refurbishment facilities and traditional manufacturing reveal a 40-60% reduction in energy consumption per unit processed. This efficiency gain stems from streamlined processes, optimized equipment utilization, and the elimination of energy-intensive steps required in primary production.

Circular economy indicators provide a holistic view of sustainability performance, measuring factors such as product lifespan extension (typically 2-4 additional years per refurbished device), material circularity index (averaging 0.75-0.85 for automated systems versus 0.15-0.25 for linear production models), and value retention (preserving 60-75% of embedded economic and resource value). These metrics demonstrate the substantial environmental benefits of transitioning from linear to circular business models through automated refurbishment technologies.

Water usage metrics reveal another critical dimension, as automated refurbishment typically consumes 60-85% less water than virgin production processes. This translates to approximately 1,200-1,800 liters of water saved per refurbished smartphone, representing a substantial conservation opportunity in regions facing water scarcity challenges.

Resource efficiency metrics demonstrate that automated refurbishment operations recover approximately 90-95% of valuable materials from end-of-life products, including rare earth elements and precious metals that would otherwise require energy-intensive mining operations. The recovery of these materials through automated processes reduces the environmental burden associated with extraction activities, including habitat destruction, water pollution, and greenhouse gas emissions.

Waste reduction metrics further highlight the environmental advantages, with automated refurbishment diverting an estimated 85% of potential e-waste from landfills. Advanced sorting technologies and precision disassembly systems enable the separation of materials with 98% accuracy, maximizing recycling potential and minimizing contamination in waste streams.

Energy efficiency comparisons between automated refurbishment facilities and traditional manufacturing reveal a 40-60% reduction in energy consumption per unit processed. This efficiency gain stems from streamlined processes, optimized equipment utilization, and the elimination of energy-intensive steps required in primary production.

Circular economy indicators provide a holistic view of sustainability performance, measuring factors such as product lifespan extension (typically 2-4 additional years per refurbished device), material circularity index (averaging 0.75-0.85 for automated systems versus 0.15-0.25 for linear production models), and value retention (preserving 60-75% of embedded economic and resource value). These metrics demonstrate the substantial environmental benefits of transitioning from linear to circular business models through automated refurbishment technologies.

Economic Feasibility and ROI Analysis

The economic feasibility of automating refurbishment processes for high-volume second-life supply chains presents a compelling business case when analyzed through comprehensive cost-benefit frameworks. Initial capital expenditure for implementing automation technologies in refurbishment operations typically ranges from $500,000 to $3 million, depending on the scale and complexity of the operation. This investment encompasses robotic systems, computer vision technologies, automated testing equipment, and necessary software infrastructure.

Return on investment calculations indicate that medium to large-scale refurbishment operations can achieve breakeven within 18-36 months of implementation. Labor cost reduction represents the most significant economic benefit, with automated refurbishment systems reducing manual labor requirements by 40-70% in most documented case studies. For operations processing 10,000+ units monthly, this translates to annual savings of $300,000-$800,000 in direct labor costs alone.

Quality improvements from automation yield additional economic benefits through reduced warranty claims and higher resale values. Automated inspection and testing systems demonstrate 15-25% higher defect detection rates compared to manual processes, resulting in fewer returns and customer complaints. The market premium for consistently high-quality refurbished products ranges from 10-30% above industry averages, significantly enhancing revenue potential.

Operational efficiency gains further strengthen the economic case, with automated refurbishment lines showing 30-50% higher throughput compared to traditional manual operations. This capacity increase allows businesses to scale operations without proportional increases in facility footprint or overhead costs. Energy efficiency improvements of 10-20% are also commonly reported when implementing modern automated systems.

Risk mitigation factors must be incorporated into ROI calculations, including technology obsolescence, maintenance costs, and potential production disruptions during implementation. Sensitivity analysis suggests that even with conservative estimates, automation investments maintain positive ROI across various scenarios, with internal rates of return typically ranging from 15-30% for well-executed implementations.

Financing options including equipment leasing, vendor financing, and sustainability-focused grants can significantly improve initial cash flow dynamics. Several case studies demonstrate how phased implementation approaches allow companies to reinvest early gains from partial automation into subsequent expansion phases, creating a self-funding improvement cycle that minimizes capital constraints.

Return on investment calculations indicate that medium to large-scale refurbishment operations can achieve breakeven within 18-36 months of implementation. Labor cost reduction represents the most significant economic benefit, with automated refurbishment systems reducing manual labor requirements by 40-70% in most documented case studies. For operations processing 10,000+ units monthly, this translates to annual savings of $300,000-$800,000 in direct labor costs alone.

Quality improvements from automation yield additional economic benefits through reduced warranty claims and higher resale values. Automated inspection and testing systems demonstrate 15-25% higher defect detection rates compared to manual processes, resulting in fewer returns and customer complaints. The market premium for consistently high-quality refurbished products ranges from 10-30% above industry averages, significantly enhancing revenue potential.

Operational efficiency gains further strengthen the economic case, with automated refurbishment lines showing 30-50% higher throughput compared to traditional manual operations. This capacity increase allows businesses to scale operations without proportional increases in facility footprint or overhead costs. Energy efficiency improvements of 10-20% are also commonly reported when implementing modern automated systems.

Risk mitigation factors must be incorporated into ROI calculations, including technology obsolescence, maintenance costs, and potential production disruptions during implementation. Sensitivity analysis suggests that even with conservative estimates, automation investments maintain positive ROI across various scenarios, with internal rates of return typically ranging from 15-30% for well-executed implementations.

Financing options including equipment leasing, vendor financing, and sustainability-focused grants can significantly improve initial cash flow dynamics. Several case studies demonstrate how phased implementation approaches allow companies to reinvest early gains from partial automation into subsequent expansion phases, creating a self-funding improvement cycle that minimizes capital constraints.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!