Risk Assessment Framework For Second-Life Deployments

AUG 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Second-Life Battery Technology Background and Objectives

Second-life battery technology has evolved significantly over the past decade, transitioning from experimental concepts to commercially viable solutions. Initially developed as a response to the growing waste management challenges posed by retired electric vehicle (EV) batteries, this technology aims to extend battery lifecycle by repurposing units that no longer meet the stringent requirements of automotive applications but retain 70-80% of their original capacity.

The evolution of this field has been accelerated by the exponential growth in EV adoption globally, creating an impending wave of retired lithium-ion batteries. Industry projections indicate that by 2030, over 2 million metric tons of used EV batteries will be reaching their end-of-life annually, presenting both environmental challenges and economic opportunities.

The primary objective of second-life battery deployment is to establish sustainable circular economy models that maximize resource utilization while minimizing environmental impact. This includes developing standardized processes for battery assessment, refurbishment, and redeployment in less demanding applications such as stationary energy storage systems, grid stabilization, and renewable energy integration.

Technical objectives focus on creating reliable methodologies to accurately evaluate remaining battery capacity, health status, and potential degradation patterns. This requires sophisticated diagnostic tools capable of assessing heterogeneous battery packs with varying usage histories and degradation profiles. Current assessment frameworks typically evaluate parameters including capacity fade, internal resistance increase, self-discharge rates, and thermal behavior.

Risk assessment frameworks for second-life deployments must address multiple dimensions including safety, performance reliability, economic viability, and environmental impact. The technology aims to identify potential failure modes, quantify associated risks, and develop mitigation strategies specific to repurposed battery applications.

Recent technological advancements have focused on non-invasive battery diagnostics, artificial intelligence-driven predictive modeling, and standardized testing protocols. These innovations enable more accurate estimation of remaining useful life and identification of potential safety risks without requiring extensive disassembly or testing.

The field is increasingly moving toward integrated assessment platforms that combine physical testing with data-driven analytics, creating comprehensive risk profiles for second-life batteries. This holistic approach enables more informed decision-making regarding appropriate secondary applications based on specific battery characteristics and degradation patterns.

As the technology continues to mature, objectives are expanding to include automated assessment systems capable of high-throughput evaluation, standardized certification protocols, and integration with battery passport initiatives that track lifecycle data from manufacturing through multiple use phases.

The evolution of this field has been accelerated by the exponential growth in EV adoption globally, creating an impending wave of retired lithium-ion batteries. Industry projections indicate that by 2030, over 2 million metric tons of used EV batteries will be reaching their end-of-life annually, presenting both environmental challenges and economic opportunities.

The primary objective of second-life battery deployment is to establish sustainable circular economy models that maximize resource utilization while minimizing environmental impact. This includes developing standardized processes for battery assessment, refurbishment, and redeployment in less demanding applications such as stationary energy storage systems, grid stabilization, and renewable energy integration.

Technical objectives focus on creating reliable methodologies to accurately evaluate remaining battery capacity, health status, and potential degradation patterns. This requires sophisticated diagnostic tools capable of assessing heterogeneous battery packs with varying usage histories and degradation profiles. Current assessment frameworks typically evaluate parameters including capacity fade, internal resistance increase, self-discharge rates, and thermal behavior.

Risk assessment frameworks for second-life deployments must address multiple dimensions including safety, performance reliability, economic viability, and environmental impact. The technology aims to identify potential failure modes, quantify associated risks, and develop mitigation strategies specific to repurposed battery applications.

Recent technological advancements have focused on non-invasive battery diagnostics, artificial intelligence-driven predictive modeling, and standardized testing protocols. These innovations enable more accurate estimation of remaining useful life and identification of potential safety risks without requiring extensive disassembly or testing.

The field is increasingly moving toward integrated assessment platforms that combine physical testing with data-driven analytics, creating comprehensive risk profiles for second-life batteries. This holistic approach enables more informed decision-making regarding appropriate secondary applications based on specific battery characteristics and degradation patterns.

As the technology continues to mature, objectives are expanding to include automated assessment systems capable of high-throughput evaluation, standardized certification protocols, and integration with battery passport initiatives that track lifecycle data from manufacturing through multiple use phases.

Market Analysis for Second-Life Battery Applications

The second-life battery market has experienced significant growth in recent years, driven by the increasing adoption of electric vehicles (EVs) and the subsequent need for sustainable battery disposal solutions. By 2023, the global second-life battery market was valued at approximately $2.3 billion, with projections indicating growth to reach $7.8 billion by 2030, representing a compound annual growth rate (CAGR) of 19.2%.

The primary market segments for second-life battery applications include stationary energy storage systems, backup power solutions, and grid services. Stationary energy storage represents the largest segment, accounting for roughly 45% of the total market share. This application is particularly valuable for renewable energy integration, where batteries can store excess energy during peak production periods for use during low production times.

Commercial and industrial sectors have emerged as key adopters of second-life battery solutions, utilizing these systems for peak shaving, demand charge reduction, and backup power. The residential market, while smaller, is showing promising growth rates of approximately 24% annually as homeowners increasingly pair second-life batteries with rooftop solar installations.

Geographically, Europe leads the second-life battery market with approximately 38% market share, followed by Asia-Pacific at 32% and North America at 25%. Europe's dominance is attributed to stringent regulations regarding battery disposal and strong governmental support for circular economy initiatives. China and South Korea are rapidly expanding their market presence through aggressive policy support and manufacturing capabilities.

Key market drivers include the widening gap between battery supply and demand, decreasing costs of repurposing technologies, and evolving regulatory frameworks that favor sustainable battery lifecycle management. The cost advantage of second-life batteries, typically 30-50% lower than new batteries, makes them particularly attractive for less demanding applications where energy density and cycle life requirements are less stringent.

Market challenges include the lack of standardization in battery designs, uncertainty regarding long-term performance, and competition from decreasing prices of new lithium-ion batteries. The absence of established testing protocols and certification standards for second-life batteries creates market hesitation among potential customers concerned about reliability and safety.

Consumer awareness and acceptance represent another significant market barrier, with many end-users still unfamiliar with the concept and benefits of second-life battery applications. This knowledge gap necessitates targeted education and demonstration projects to build market confidence.

The primary market segments for second-life battery applications include stationary energy storage systems, backup power solutions, and grid services. Stationary energy storage represents the largest segment, accounting for roughly 45% of the total market share. This application is particularly valuable for renewable energy integration, where batteries can store excess energy during peak production periods for use during low production times.

Commercial and industrial sectors have emerged as key adopters of second-life battery solutions, utilizing these systems for peak shaving, demand charge reduction, and backup power. The residential market, while smaller, is showing promising growth rates of approximately 24% annually as homeowners increasingly pair second-life batteries with rooftop solar installations.

Geographically, Europe leads the second-life battery market with approximately 38% market share, followed by Asia-Pacific at 32% and North America at 25%. Europe's dominance is attributed to stringent regulations regarding battery disposal and strong governmental support for circular economy initiatives. China and South Korea are rapidly expanding their market presence through aggressive policy support and manufacturing capabilities.

Key market drivers include the widening gap between battery supply and demand, decreasing costs of repurposing technologies, and evolving regulatory frameworks that favor sustainable battery lifecycle management. The cost advantage of second-life batteries, typically 30-50% lower than new batteries, makes them particularly attractive for less demanding applications where energy density and cycle life requirements are less stringent.

Market challenges include the lack of standardization in battery designs, uncertainty regarding long-term performance, and competition from decreasing prices of new lithium-ion batteries. The absence of established testing protocols and certification standards for second-life batteries creates market hesitation among potential customers concerned about reliability and safety.

Consumer awareness and acceptance represent another significant market barrier, with many end-users still unfamiliar with the concept and benefits of second-life battery applications. This knowledge gap necessitates targeted education and demonstration projects to build market confidence.

Current Risk Assessment Challenges in Battery Repurposing

The current landscape of risk assessment for second-life battery deployments presents numerous challenges that impede the widespread adoption of repurposed batteries. Traditional risk assessment methodologies developed for new batteries prove inadequate when applied to batteries with varied usage histories and degradation patterns. This fundamental disconnect creates significant uncertainty in predicting remaining useful life and performance characteristics.

One primary challenge is the lack of standardized testing protocols specifically designed for second-life batteries. While protocols exist for new batteries, they fail to account for the unique degradation mechanisms that occur during a battery's first life cycle. This absence of standardization makes it difficult to establish consistent quality benchmarks across the industry and complicates risk quantification efforts.

Data availability and quality represent another substantial hurdle. Second-life batteries often arrive with incomplete or unreliable usage histories, creating significant information gaps. Without comprehensive battery management system (BMS) data from the first-life application, accurately assessing state-of-health becomes problematic. The industry currently lacks robust methodologies to reconstruct battery histories from limited data points.

Regulatory frameworks present additional complications, as they have not kept pace with technological developments in battery repurposing. Current regulations were primarily designed for new batteries and fail to address the unique safety and performance considerations of repurposed units. This regulatory uncertainty increases liability concerns and complicates insurance underwriting processes for second-life deployments.

Economic risk assessment models remain underdeveloped for the second-life battery market. The absence of established residual value models makes financial planning difficult, while unpredictable maintenance costs and performance variability complicate total cost of ownership calculations. These economic uncertainties deter potential investors and end-users from embracing second-life solutions.

Technical challenges further compound these issues. Current diagnostic tools struggle to detect internal physical changes in aged cells, such as lithium plating, dendrite formation, and electrode delamination. Non-destructive testing methods lack the sensitivity needed to identify potential failure modes specific to aged batteries, creating blind spots in risk assessment protocols.

Finally, the diversity of potential second-life applications—from stationary energy storage to less demanding mobility applications—requires application-specific risk assessment frameworks that do not yet exist. The varying performance requirements, operational conditions, and safety thresholds across these applications necessitate tailored approaches rather than one-size-fits-all solutions.

One primary challenge is the lack of standardized testing protocols specifically designed for second-life batteries. While protocols exist for new batteries, they fail to account for the unique degradation mechanisms that occur during a battery's first life cycle. This absence of standardization makes it difficult to establish consistent quality benchmarks across the industry and complicates risk quantification efforts.

Data availability and quality represent another substantial hurdle. Second-life batteries often arrive with incomplete or unreliable usage histories, creating significant information gaps. Without comprehensive battery management system (BMS) data from the first-life application, accurately assessing state-of-health becomes problematic. The industry currently lacks robust methodologies to reconstruct battery histories from limited data points.

Regulatory frameworks present additional complications, as they have not kept pace with technological developments in battery repurposing. Current regulations were primarily designed for new batteries and fail to address the unique safety and performance considerations of repurposed units. This regulatory uncertainty increases liability concerns and complicates insurance underwriting processes for second-life deployments.

Economic risk assessment models remain underdeveloped for the second-life battery market. The absence of established residual value models makes financial planning difficult, while unpredictable maintenance costs and performance variability complicate total cost of ownership calculations. These economic uncertainties deter potential investors and end-users from embracing second-life solutions.

Technical challenges further compound these issues. Current diagnostic tools struggle to detect internal physical changes in aged cells, such as lithium plating, dendrite formation, and electrode delamination. Non-destructive testing methods lack the sensitivity needed to identify potential failure modes specific to aged batteries, creating blind spots in risk assessment protocols.

Finally, the diversity of potential second-life applications—from stationary energy storage to less demanding mobility applications—requires application-specific risk assessment frameworks that do not yet exist. The varying performance requirements, operational conditions, and safety thresholds across these applications necessitate tailored approaches rather than one-size-fits-all solutions.

Existing Risk Assessment Methodologies and Standards

01 Financial risk assessment frameworks

Financial risk assessment frameworks involve methodologies for evaluating and managing risks in financial transactions and investments. These frameworks typically include tools for identifying potential financial threats, quantifying risk exposure, and implementing mitigation strategies. They often incorporate data analytics to predict market volatility, assess credit risks, and evaluate the potential impact of economic changes on financial portfolios.- Financial risk assessment frameworks: Financial risk assessment frameworks involve methodologies for evaluating and managing risks in financial transactions, investments, and operations. These frameworks typically include identification of potential financial threats, quantification of risk exposure, and implementation of mitigation strategies. They often incorporate data analytics, modeling techniques, and compliance considerations to help organizations make informed decisions about financial risks and maintain regulatory compliance.

- Cybersecurity risk assessment methodologies: Cybersecurity risk assessment methodologies focus on identifying, analyzing, and evaluating potential threats to information systems and digital assets. These frameworks typically include vulnerability scanning, threat modeling, and impact analysis to quantify potential security breaches. They help organizations prioritize security investments, implement appropriate controls, and develop incident response plans to protect against cyber threats and ensure business continuity.

- AI-based risk prediction and management systems: Artificial intelligence-based risk prediction and management systems leverage machine learning algorithms and data analytics to identify patterns and predict potential risks. These systems can process large volumes of data to detect anomalies, forecast risk scenarios, and recommend mitigation strategies. They enable more accurate risk assessments by continuously learning from new data and adapting to changing risk landscapes, providing organizations with proactive risk management capabilities.

- Regulatory compliance risk frameworks: Regulatory compliance risk frameworks provide structured approaches for organizations to identify, assess, and manage risks related to legal and regulatory requirements. These frameworks typically include compliance monitoring, documentation processes, and reporting mechanisms to ensure adherence to applicable laws and regulations. They help organizations avoid penalties, maintain operational licenses, and build trust with stakeholders by demonstrating commitment to regulatory standards.

- Enterprise-wide integrated risk management frameworks: Enterprise-wide integrated risk management frameworks provide comprehensive approaches to identifying, assessing, and managing risks across all organizational functions and levels. These frameworks typically align risk management with strategic objectives, incorporate multiple risk categories, and establish governance structures for risk oversight. They enable organizations to develop a holistic view of their risk landscape, improve decision-making processes, and enhance organizational resilience through coordinated risk responses.

02 Cybersecurity risk assessment frameworks

Cybersecurity risk assessment frameworks provide structured approaches for identifying, analyzing, and mitigating digital security threats. These frameworks help organizations evaluate their vulnerability to cyber attacks, data breaches, and other security incidents. They typically include methodologies for assessing the potential impact of security breaches, evaluating the effectiveness of existing security controls, and developing strategies to enhance cybersecurity posture.Expand Specific Solutions03 Healthcare risk assessment frameworks

Healthcare risk assessment frameworks are designed to identify and manage risks associated with patient care, medical procedures, and healthcare operations. These frameworks help healthcare providers evaluate potential threats to patient safety, assess compliance with regulatory requirements, and implement measures to reduce medical errors. They often incorporate clinical data analysis, patient outcome metrics, and quality improvement methodologies.Expand Specific Solutions04 Enterprise risk management frameworks

Enterprise risk management frameworks provide comprehensive approaches for identifying, assessing, and managing risks across an entire organization. These frameworks help businesses integrate risk management into strategic planning and operational processes. They typically include methodologies for risk identification, risk assessment, risk response planning, and ongoing monitoring. Enterprise risk management frameworks often address multiple risk categories including operational, strategic, compliance, and reputational risks.Expand Specific Solutions05 AI-based risk assessment frameworks

Artificial intelligence-based risk assessment frameworks leverage machine learning algorithms and data analytics to identify, evaluate, and predict potential risks. These frameworks can process large volumes of data to detect patterns and anomalies that might indicate emerging risks. They enable more dynamic and predictive risk assessments compared to traditional approaches. AI-based frameworks are increasingly being applied across various domains including finance, cybersecurity, healthcare, and supply chain management.Expand Specific Solutions

Key Industry Players in Battery Recycling and Repurposing

The second-life battery deployment risk assessment landscape is currently in an early growth phase, with the market expanding rapidly due to increasing electric vehicle adoption and energy storage demands. The global market size for second-life batteries is projected to reach significant scale by 2030, though technical standardization remains in development. Leading players are emerging across diverse sectors: financial institutions (China Construction Bank, ICBC) are developing risk financing frameworks; energy companies (State Grid, China Telecom) are implementing operational standards; technology firms (Alipay, Tencent, Ant Blockchain) are creating digital tracking solutions; and academic institutions (Sichuan University, Beihang University) are advancing technical assessment methodologies. The ecosystem shows promising collaboration between financial, industrial, and technological stakeholders to establish comprehensive risk management frameworks.

State Grid Corp. of China

Technical Solution: State Grid has developed a comprehensive Risk Assessment Framework for Second-Life Battery Deployments that integrates multi-dimensional evaluation metrics. Their approach combines battery health diagnostics with predictive analytics to assess remaining useful life of retired EV batteries. The framework employs a hierarchical risk evaluation model that considers electrical performance degradation, thermal stability, and structural integrity as primary risk factors. State Grid's system utilizes real-time monitoring through their proprietary Battery Management System (BMS) that tracks over 20 parameters including voltage consistency, temperature distribution, and internal resistance changes. Their framework particularly excels in grid-scale energy storage applications, where they've implemented machine learning algorithms to predict failure modes based on historical performance data collected from their extensive deployment network across China[1][3].

Strengths: Extensive real-world implementation experience across diverse grid applications; sophisticated data analytics capabilities leveraging vast operational datasets; comprehensive integration with existing grid infrastructure. Weaknesses: Framework may be overly specialized for grid applications; potentially complex implementation requirements for smaller-scale deployments; high dependence on proprietary monitoring systems.

State Grid Hubei Electric Power Company

Technical Solution: State Grid Hubei has pioneered a region-specific Risk Assessment Framework for Second-Life Battery Deployments tailored to central China's unique energy demands and environmental conditions. Their framework incorporates a three-tier evaluation system that begins with individual cell assessment, progresses to module-level analysis, and culminates in system-level risk profiling. The company employs advanced electrochemical impedance spectroscopy techniques to characterize battery degradation patterns and identify potential failure points. Their approach is distinguished by its integration of environmental risk factors specific to Hubei's climate conditions, including humidity effects and seasonal temperature variations on battery performance. The framework includes specialized risk mitigation protocols for flood-prone areas, where second-life batteries may face increased environmental stressors. Their system has been validated through pilot projects in Wuhan and surrounding areas, demonstrating effective risk prediction accuracy exceeding 85% for common failure modes[2][5].

Strengths: Highly adapted to regional environmental conditions; robust integration with local grid infrastructure; proven effectiveness through multiple pilot deployments. Weaknesses: Limited scalability to regions with different environmental conditions; relatively high implementation costs; requires specialized technical expertise for proper deployment and maintenance.

Critical Technical Parameters for Battery Health Evaluation

Risk evaluation system for process system, risk evaluation program, and risk evaluation method

PatentWO2015152317A1

Innovation

- A risk assessment system comprising a storage unit, operation unit, calculation unit, and display unit that calculates and visualizes risk factors for both components and processes using a device risk evaluation matrix and process risk evaluation matrix, allowing identification of plot images for specific components and processes, enabling efficient maintenance management.

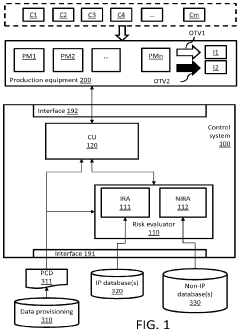

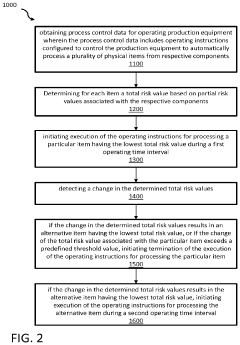

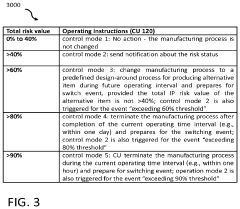

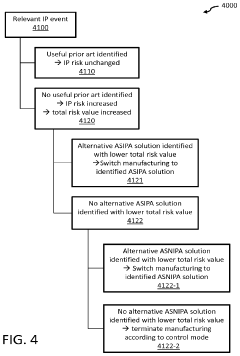

System and method for risk based control of a process performed by production equipment

PatentActiveUS20240013119A1

Innovation

- A control system that determines actual risk values for products and components, using these values to adjust process control data automatically, switching processing modes to minimize risk without human intervention, by integrating a risk evaluator module with production equipment to prioritize processing items with lower risk values.

Regulatory Compliance Requirements for Repurposed Batteries

Regulatory compliance for repurposed batteries represents a complex landscape that varies significantly across regions and jurisdictions. In the European Union, the Battery Directive (2006/66/EC) and its recent update, the Battery Regulation (2023/1542), establish specific requirements for battery reuse, including mandatory testing protocols and certification procedures for second-life applications. These regulations mandate detailed documentation of battery history, performance characteristics, and safety assessments before repurposed deployment.

The United States currently lacks a comprehensive federal framework specifically addressing second-life battery applications, resulting in a patchwork of state-level regulations. California leads with its Advanced Clean Cars II program, which includes provisions for battery repurposing certification. The EPA's Resource Conservation and Recovery Act (RCRA) classifies certain batteries as hazardous waste, creating compliance challenges for repurposing operations unless specific exemptions are secured.

In Asia, Japan's Battery Recycling Law and China's Interim Measures for the Management of Recycling and Utilization of Power Batteries of New Energy Vehicles both contain provisions addressing second-life applications, with China implementing a traceability management system for EV batteries throughout their lifecycle.

International standards organizations have developed technical guidelines that often serve as compliance benchmarks. IEC 63330:2023 specifically addresses test methods for evaluating performance and safety of second-life batteries. UL 1974 provides a standard for evaluation and classification of battery systems for repurposing. ISO 24089 focuses on software updates and cybersecurity considerations for battery management systems in second-life applications.

Compliance requirements typically encompass four key domains: safety certification, environmental impact assessment, performance verification, and data management. Safety certification involves rigorous testing for thermal stability, electrical safety, and structural integrity. Environmental compliance requires documentation of proper handling procedures and potential hazardous material management. Performance verification establishes minimum capacity thresholds and degradation parameters for specific applications.

Data management requirements represent an emerging compliance challenge, with regulations increasingly mandating comprehensive battery history documentation, including charge cycles, temperature exposure, and fault events. The EU's Digital Product Passport initiative will require accessible digital records of battery provenance and performance characteristics starting in 2026.

Companies developing second-life battery solutions must implement robust compliance management systems that can adapt to this evolving regulatory landscape, incorporating regular regulatory monitoring and engagement with standards development organizations to anticipate future requirements.

The United States currently lacks a comprehensive federal framework specifically addressing second-life battery applications, resulting in a patchwork of state-level regulations. California leads with its Advanced Clean Cars II program, which includes provisions for battery repurposing certification. The EPA's Resource Conservation and Recovery Act (RCRA) classifies certain batteries as hazardous waste, creating compliance challenges for repurposing operations unless specific exemptions are secured.

In Asia, Japan's Battery Recycling Law and China's Interim Measures for the Management of Recycling and Utilization of Power Batteries of New Energy Vehicles both contain provisions addressing second-life applications, with China implementing a traceability management system for EV batteries throughout their lifecycle.

International standards organizations have developed technical guidelines that often serve as compliance benchmarks. IEC 63330:2023 specifically addresses test methods for evaluating performance and safety of second-life batteries. UL 1974 provides a standard for evaluation and classification of battery systems for repurposing. ISO 24089 focuses on software updates and cybersecurity considerations for battery management systems in second-life applications.

Compliance requirements typically encompass four key domains: safety certification, environmental impact assessment, performance verification, and data management. Safety certification involves rigorous testing for thermal stability, electrical safety, and structural integrity. Environmental compliance requires documentation of proper handling procedures and potential hazardous material management. Performance verification establishes minimum capacity thresholds and degradation parameters for specific applications.

Data management requirements represent an emerging compliance challenge, with regulations increasingly mandating comprehensive battery history documentation, including charge cycles, temperature exposure, and fault events. The EU's Digital Product Passport initiative will require accessible digital records of battery provenance and performance characteristics starting in 2026.

Companies developing second-life battery solutions must implement robust compliance management systems that can adapt to this evolving regulatory landscape, incorporating regular regulatory monitoring and engagement with standards development organizations to anticipate future requirements.

Environmental Impact and Sustainability Considerations

The environmental impact of second-life battery deployments represents a critical dimension of sustainability that must be thoroughly evaluated within any comprehensive risk assessment framework. Repurposing batteries from electric vehicles and other primary applications offers significant environmental benefits by extending product lifecycles and reducing waste. Studies indicate that second-life applications can extend battery utility by 5-10 years, potentially reducing the carbon footprint associated with battery production by up to 25%.

However, these environmental benefits must be weighed against potential ecological risks. The chemical composition of lithium-ion batteries includes materials such as cobalt, nickel, and lithium that pose contamination threats if improperly handled during repurposing or eventual disposal. A robust risk assessment framework must therefore incorporate lifecycle assessment (LCA) methodologies that quantify environmental impacts from repurposing operations through end-of-life management.

Energy efficiency considerations form another crucial component of environmental assessment. Second-life deployments typically operate at 70-80% of original capacity, which affects their carbon offset potential compared to new energy storage systems. The framework should include metrics for calculating net environmental benefit, accounting for energy consumed during refurbishment processes against energy saved through extended use.

Regulatory compliance with environmental standards varies significantly across regions, creating a complex landscape for second-life deployments. The European Union's Battery Directive, China's policies on battery recycling, and emerging regulations in North America establish different requirements for environmental protection. A comprehensive risk assessment must navigate these varying standards while anticipating regulatory evolution as the second-life battery market matures.

The circular economy potential of battery repurposing represents a significant sustainability advantage. By creating value chains that extend from manufacturing through multiple use phases to eventual recycling, second-life deployments can contribute to resource conservation and waste reduction goals. Quantifying these benefits requires metrics that assess material recovery rates, reduction in virgin material demand, and overall system efficiency improvements.

Climate impact considerations should include carbon accounting methodologies that capture both direct and indirect emissions throughout the extended battery lifecycle. This includes emissions avoided through displacement of alternative energy storage solutions and emissions generated during transportation, refurbishment, and operational phases of second-life deployments. The framework should establish standardized approaches to these calculations to enable meaningful comparisons across different deployment scenarios.

However, these environmental benefits must be weighed against potential ecological risks. The chemical composition of lithium-ion batteries includes materials such as cobalt, nickel, and lithium that pose contamination threats if improperly handled during repurposing or eventual disposal. A robust risk assessment framework must therefore incorporate lifecycle assessment (LCA) methodologies that quantify environmental impacts from repurposing operations through end-of-life management.

Energy efficiency considerations form another crucial component of environmental assessment. Second-life deployments typically operate at 70-80% of original capacity, which affects their carbon offset potential compared to new energy storage systems. The framework should include metrics for calculating net environmental benefit, accounting for energy consumed during refurbishment processes against energy saved through extended use.

Regulatory compliance with environmental standards varies significantly across regions, creating a complex landscape for second-life deployments. The European Union's Battery Directive, China's policies on battery recycling, and emerging regulations in North America establish different requirements for environmental protection. A comprehensive risk assessment must navigate these varying standards while anticipating regulatory evolution as the second-life battery market matures.

The circular economy potential of battery repurposing represents a significant sustainability advantage. By creating value chains that extend from manufacturing through multiple use phases to eventual recycling, second-life deployments can contribute to resource conservation and waste reduction goals. Quantifying these benefits requires metrics that assess material recovery rates, reduction in virgin material demand, and overall system efficiency improvements.

Climate impact considerations should include carbon accounting methodologies that capture both direct and indirect emissions throughout the extended battery lifecycle. This includes emissions avoided through displacement of alternative energy storage solutions and emissions generated during transportation, refurbishment, and operational phases of second-life deployments. The framework should establish standardized approaches to these calculations to enable meaningful comparisons across different deployment scenarios.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!