Logistics And Reverse Supply Chain For Battery Collection

AUG 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Battery Collection Technology Background and Objectives

Battery collection technology has evolved significantly over the past two decades, driven by the exponential growth in battery usage across consumer electronics, electric vehicles, and energy storage systems. Initially, battery collection efforts were fragmented and primarily focused on lead-acid batteries from automotive applications. However, as lithium-ion batteries became ubiquitous in portable devices and later in electric vehicles, the need for sophisticated collection systems became apparent.

The evolution of battery collection technology has been characterized by three distinct phases. The first phase (2000-2010) involved basic collection points at retail locations and municipal waste facilities with minimal sorting capabilities. The second phase (2010-2020) saw the emergence of specialized reverse logistics networks with improved tracking and sorting technologies. The current phase (2020-present) features advanced automated collection systems with digital tracking, AI-powered sorting, and integration with circular economy principles.

The primary objective of modern battery collection technology is to establish efficient, cost-effective reverse supply chains that maximize the recovery rate of end-of-life batteries while ensuring environmental protection and resource conservation. This includes developing scalable collection infrastructure capable of handling the projected surge in battery waste, particularly from electric vehicles, which is expected to increase tenfold by 2030.

Technical objectives include improving collection efficiency through optimized logistics networks, enhancing battery identification and sorting technologies, and developing standardized protocols for safe handling and transportation of damaged or degraded batteries. Additionally, there is a growing focus on implementing track-and-trace systems to monitor batteries throughout their lifecycle, from manufacturing to recycling.

Economic objectives center on reducing collection costs, which currently represent 40-60% of the total recycling cost for batteries. This involves optimizing transportation routes, implementing decentralized collection points, and developing innovative business models that incentivize battery returns.

Environmental objectives aim to prevent improper disposal of batteries, which can lead to soil and water contamination from heavy metals and toxic electrolytes. Current collection rates vary significantly by region, with the EU achieving approximately 45% collection for portable batteries, while rates in developing economies often remain below 5%.

The technological trajectory points toward integrated digital platforms that connect consumers, collection points, logistics providers, and recyclers in real-time, creating more responsive and efficient reverse supply chains for the growing volume of end-of-life batteries.

The evolution of battery collection technology has been characterized by three distinct phases. The first phase (2000-2010) involved basic collection points at retail locations and municipal waste facilities with minimal sorting capabilities. The second phase (2010-2020) saw the emergence of specialized reverse logistics networks with improved tracking and sorting technologies. The current phase (2020-present) features advanced automated collection systems with digital tracking, AI-powered sorting, and integration with circular economy principles.

The primary objective of modern battery collection technology is to establish efficient, cost-effective reverse supply chains that maximize the recovery rate of end-of-life batteries while ensuring environmental protection and resource conservation. This includes developing scalable collection infrastructure capable of handling the projected surge in battery waste, particularly from electric vehicles, which is expected to increase tenfold by 2030.

Technical objectives include improving collection efficiency through optimized logistics networks, enhancing battery identification and sorting technologies, and developing standardized protocols for safe handling and transportation of damaged or degraded batteries. Additionally, there is a growing focus on implementing track-and-trace systems to monitor batteries throughout their lifecycle, from manufacturing to recycling.

Economic objectives center on reducing collection costs, which currently represent 40-60% of the total recycling cost for batteries. This involves optimizing transportation routes, implementing decentralized collection points, and developing innovative business models that incentivize battery returns.

Environmental objectives aim to prevent improper disposal of batteries, which can lead to soil and water contamination from heavy metals and toxic electrolytes. Current collection rates vary significantly by region, with the EU achieving approximately 45% collection for portable batteries, while rates in developing economies often remain below 5%.

The technological trajectory points toward integrated digital platforms that connect consumers, collection points, logistics providers, and recyclers in real-time, creating more responsive and efficient reverse supply chains for the growing volume of end-of-life batteries.

Market Analysis for Battery Recycling Services

The global battery recycling market is experiencing significant growth, driven primarily by the rapid expansion of electric vehicle (EV) adoption and increasing environmental regulations. As of 2023, the market was valued at approximately $24.5 billion and is projected to reach $62.8 billion by 2030, representing a compound annual growth rate (CAGR) of 14.2%. This remarkable growth trajectory underscores the economic potential of battery recycling services in the coming decade.

Regional analysis reveals that Asia-Pacific currently dominates the market, accounting for over 45% of the global share, with China leading battery recycling activities due to its substantial EV manufacturing base. Europe follows closely, driven by stringent EU regulations on battery disposal and recycling, particularly the Battery Directive which mandates collection rates of at least 45% for used batteries. North America represents a rapidly growing market, especially with recent policy initiatives like the Inflation Reduction Act providing incentives for domestic battery recycling infrastructure.

Consumer electronics batteries currently constitute the largest segment of recycled batteries at 38%, followed by automotive batteries at 32%, and industrial batteries at 30%. However, the automotive segment is expected to overtake consumer electronics by 2025 due to the increasing number of EVs reaching end-of-life status. Lithium-ion batteries represent the fastest-growing recycling segment with a CAGR of 18.3%, reflecting their widespread use in modern applications.

The market structure is characterized by a mix of specialized recycling firms, battery manufacturers engaging in closed-loop systems, and waste management companies expanding into battery recycling. Major players include Umicore, Retriev Technologies, Li-Cycle, Redwood Materials, and GEM Co., with these top five companies controlling approximately 35% of the global market share.

Key market drivers include regulatory pressures, raw material security concerns, and economic incentives. The EU's proposed Battery Regulation aims to require 70% lithium recovery from batteries by 2030, while similar regulations are emerging globally. Additionally, volatility in critical battery material prices (lithium, cobalt, nickel) has increased interest in "urban mining" through recycling as a more stable supply source.

Consumer awareness and corporate sustainability commitments are also fueling market growth, with 67% of consumers in developed markets expressing willingness to pay premium prices for products with recycled battery materials. Major automotive and electronics manufacturers have announced targets to incorporate recycled materials into new batteries, creating stable demand for recycling services.

Regional analysis reveals that Asia-Pacific currently dominates the market, accounting for over 45% of the global share, with China leading battery recycling activities due to its substantial EV manufacturing base. Europe follows closely, driven by stringent EU regulations on battery disposal and recycling, particularly the Battery Directive which mandates collection rates of at least 45% for used batteries. North America represents a rapidly growing market, especially with recent policy initiatives like the Inflation Reduction Act providing incentives for domestic battery recycling infrastructure.

Consumer electronics batteries currently constitute the largest segment of recycled batteries at 38%, followed by automotive batteries at 32%, and industrial batteries at 30%. However, the automotive segment is expected to overtake consumer electronics by 2025 due to the increasing number of EVs reaching end-of-life status. Lithium-ion batteries represent the fastest-growing recycling segment with a CAGR of 18.3%, reflecting their widespread use in modern applications.

The market structure is characterized by a mix of specialized recycling firms, battery manufacturers engaging in closed-loop systems, and waste management companies expanding into battery recycling. Major players include Umicore, Retriev Technologies, Li-Cycle, Redwood Materials, and GEM Co., with these top five companies controlling approximately 35% of the global market share.

Key market drivers include regulatory pressures, raw material security concerns, and economic incentives. The EU's proposed Battery Regulation aims to require 70% lithium recovery from batteries by 2030, while similar regulations are emerging globally. Additionally, volatility in critical battery material prices (lithium, cobalt, nickel) has increased interest in "urban mining" through recycling as a more stable supply source.

Consumer awareness and corporate sustainability commitments are also fueling market growth, with 67% of consumers in developed markets expressing willingness to pay premium prices for products with recycled battery materials. Major automotive and electronics manufacturers have announced targets to incorporate recycled materials into new batteries, creating stable demand for recycling services.

Current Challenges in Battery Collection Systems

The battery collection landscape faces significant logistical challenges that impede efficient reverse supply chain operations. Current collection systems suffer from fragmentation and lack of standardization across regions and countries, creating inconsistent processes that complicate large-scale recovery efforts. This fragmentation results in varying collection rates, with some regions achieving less than 5% recovery while others reach over 50%, highlighting the disparity in effectiveness.

Infrastructure limitations present another major obstacle, as many regions lack adequate collection points and transportation networks specifically designed for battery waste. The geographical dispersion of used batteries among millions of consumers creates a "reverse logistics nightmare" where the cost of collection often exceeds the recoverable material value, particularly for smaller format batteries from consumer electronics.

Identification and sorting challenges further complicate the process, as batteries come in numerous chemistries, sizes, and states of degradation. Current automated sorting technologies struggle with mixed battery waste streams, often requiring manual intervention that increases processing costs and reduces economic viability. The absence of standardized labeling systems makes chemistry identification particularly problematic, leading to inefficient sorting and potential safety hazards.

Safety concerns represent a critical challenge throughout the collection process. Damaged lithium-ion batteries pose significant fire risks during transportation and storage, requiring specialized handling protocols that many existing logistics systems are ill-equipped to implement. Recent incidents of recycling facility fires attributed to improperly handled batteries have heightened regulatory scrutiny and increased operational costs.

Economic barriers further hinder progress, as the cost-benefit equation for battery collection remains unfavorable in many scenarios. Collection, transportation, and preliminary processing costs frequently exceed the value of recoverable materials, particularly when dealing with consumer electronics batteries with relatively small material content. This economic imbalance discourages private sector investment in collection infrastructure.

Regulatory inconsistencies across jurisdictions create additional complexity, with varying definitions of producer responsibility, collection targets, and handling requirements. These inconsistencies make it difficult for multinational companies to implement standardized collection strategies and often result in compliance-driven rather than efficiency-driven approaches to battery collection.

Consumer awareness and participation represent perhaps the most fundamental challenge, as many end-users remain unaware of proper battery disposal methods or lack convenient access to collection points. Studies indicate that convenience is the primary factor influencing consumer participation, yet many collection systems fail to integrate seamlessly into consumers' daily routines.

Infrastructure limitations present another major obstacle, as many regions lack adequate collection points and transportation networks specifically designed for battery waste. The geographical dispersion of used batteries among millions of consumers creates a "reverse logistics nightmare" where the cost of collection often exceeds the recoverable material value, particularly for smaller format batteries from consumer electronics.

Identification and sorting challenges further complicate the process, as batteries come in numerous chemistries, sizes, and states of degradation. Current automated sorting technologies struggle with mixed battery waste streams, often requiring manual intervention that increases processing costs and reduces economic viability. The absence of standardized labeling systems makes chemistry identification particularly problematic, leading to inefficient sorting and potential safety hazards.

Safety concerns represent a critical challenge throughout the collection process. Damaged lithium-ion batteries pose significant fire risks during transportation and storage, requiring specialized handling protocols that many existing logistics systems are ill-equipped to implement. Recent incidents of recycling facility fires attributed to improperly handled batteries have heightened regulatory scrutiny and increased operational costs.

Economic barriers further hinder progress, as the cost-benefit equation for battery collection remains unfavorable in many scenarios. Collection, transportation, and preliminary processing costs frequently exceed the value of recoverable materials, particularly when dealing with consumer electronics batteries with relatively small material content. This economic imbalance discourages private sector investment in collection infrastructure.

Regulatory inconsistencies across jurisdictions create additional complexity, with varying definitions of producer responsibility, collection targets, and handling requirements. These inconsistencies make it difficult for multinational companies to implement standardized collection strategies and often result in compliance-driven rather than efficiency-driven approaches to battery collection.

Consumer awareness and participation represent perhaps the most fundamental challenge, as many end-users remain unaware of proper battery disposal methods or lack convenient access to collection points. Studies indicate that convenience is the primary factor influencing consumer participation, yet many collection systems fail to integrate seamlessly into consumers' daily routines.

Current Battery Collection Methodologies

01 Battery collection systems and infrastructure

Various systems and infrastructure designs for efficient battery collection, including specialized containers, collection points, and automated sorting facilities. These systems are designed to facilitate the proper disposal and collection of used batteries from consumers and businesses, ensuring they enter the reverse supply chain for recycling or proper disposal. The infrastructure may include strategically placed collection bins, drop-off locations, and transportation networks.- Collection and recycling systems for batteries: Various systems and methods for collecting and recycling used batteries, including specialized containers, collection points, and automated sorting mechanisms. These systems facilitate the efficient gathering of spent batteries from consumers and businesses, ensuring proper handling and transportation to recycling facilities. The collection infrastructure may include retail drop-off locations, municipal collection centers, or direct pickup services.

- Reverse logistics management for battery supply chains: Comprehensive reverse logistics frameworks specifically designed for managing the return flow of batteries from end-users back to manufacturers or recycling facilities. These systems incorporate tracking technologies, transportation optimization, and inventory management to efficiently handle used batteries. The reverse logistics processes include collection planning, transportation routing, and coordination between various stakeholders in the battery lifecycle.

- Battery tracking and identification technologies: Technologies for tracking and identifying batteries throughout their lifecycle, including RFID tags, barcodes, and blockchain-based systems. These technologies enable efficient monitoring of battery movement through the supply chain, from manufacturing to disposal or recycling. Tracking systems help in managing battery inventory, ensuring compliance with regulations, and facilitating proper sorting during the recycling process.

- Automated battery sorting and processing systems: Automated systems for sorting and processing collected batteries based on chemistry, size, and condition. These systems employ various technologies including machine vision, robotic handling, and AI-based classification to efficiently separate different types of batteries for appropriate recycling pathways. Automated processing reduces human exposure to potentially hazardous materials and increases the efficiency of battery recycling operations.

- Sustainable business models for battery recycling: Innovative business models and economic frameworks that make battery collection and recycling financially viable and environmentally sustainable. These models include deposit-refund systems, producer responsibility programs, and service-based approaches where battery manufacturers retain ownership of their products throughout the lifecycle. Sustainable business models create incentives for consumers and businesses to participate in battery collection programs while ensuring the economic viability of recycling operations.

02 Reverse logistics management for battery recycling

Management systems and methods for handling the reverse flow of batteries from consumers back to manufacturers or recycling facilities. These systems include tracking mechanisms, logistics planning, and coordination between collection points, transportation providers, and processing facilities. The reverse logistics process involves the collection, sorting, transportation, and eventual recycling or disposal of used batteries in an environmentally responsible manner.Expand Specific Solutions03 Technology-enabled battery tracking and management

Digital solutions and technologies for tracking batteries throughout their lifecycle, including during the collection and reverse logistics phases. These technologies include RFID tags, blockchain systems, IoT sensors, and software platforms that enable real-time monitoring of battery locations, conditions, and movement through the supply chain. Such systems improve efficiency, compliance, and safety in battery collection and recycling operations.Expand Specific Solutions04 Sustainable battery recycling processes

Environmentally friendly methods and processes for recycling collected batteries, focusing on material recovery and waste reduction. These processes aim to extract valuable materials such as lithium, cobalt, and nickel from used batteries while minimizing environmental impact. The recycling processes are integrated with the reverse supply chain to ensure efficient processing of collected batteries and maximum resource recovery.Expand Specific Solutions05 Business models and incentive systems for battery collection

Economic frameworks and incentive programs designed to encourage battery return and participation in collection programs. These models include deposit-refund systems, reward programs, and business partnerships that create financial motivation for consumers and businesses to return used batteries. The incentive systems are crucial for increasing collection rates and ensuring a steady flow of used batteries into the reverse supply chain for recycling.Expand Specific Solutions

Key Players in Battery Reverse Logistics Industry

The battery collection logistics and reverse supply chain market is in a growth phase, characterized by increasing demand driven by environmental regulations and sustainability initiatives. The market size is expanding rapidly, with projections showing significant growth as electric vehicle adoption accelerates globally. Technologically, the field shows varying maturity levels across different segments. Leading players like CATL's subsidiary Guangdong Bangpu Recycling Technology have developed advanced automated processing techniques, while companies such as Toyota, Stellantis, and Mitsubishi Electric are integrating reverse logistics into their sustainability strategies. Academic institutions including Shanghai Polytechnic University and Wuhan University of Technology are contributing research to improve collection efficiency. The ecosystem is evolving with specialized players like GLC Recycle and CPS Technology Holdings developing niche expertise in battery collection infrastructure.

Guangdong Bangpu Recycling Technology Co., Ltd.

Technical Solution: Guangdong Bangpu has pioneered a comprehensive battery collection and recycling ecosystem called "Green Loop" that focuses on maximizing collection efficiency through multi-channel approaches. Their system integrates online and offline collection networks, including partnerships with electronics retailers, automotive service centers, and municipal waste facilities. Bangpu's logistics solution features specialized collection vehicles equipped with compartmentalized storage for different battery types and conditions, along with real-time monitoring systems that track temperature and potential hazards during transportation. The company has developed a proprietary sorting technology that uses AI-powered visual recognition to quickly identify and categorize collected batteries by chemistry, size, and condition at collection points, streamlining the reverse logistics process. Their system includes a consumer-facing mobile application that allows individuals to schedule battery pickups and receive incentives for returning end-of-life batteries, significantly increasing collection rates in urban areas.

Strengths: Extensive collection network across multiple channels increases capture rate; advanced sorting technology reduces handling costs and improves processing efficiency. Weaknesses: Regional focus primarily in China limits global scalability; heavy reliance on consumer participation requires ongoing education and incentive programs.

Contemporary Amperex Technology Co., Ltd.

Technical Solution: Contemporary Amperex Technology Co., Ltd. (CATL) has developed an integrated battery recycling system called "Battery Lifecycle Management" that encompasses collection, transportation, dismantling, and material recovery. Their approach includes smart battery management systems that track battery health and predict end-of-life, facilitating timely collection. CATL has established a network of collection points at their service centers and partner locations across major markets, utilizing QR code tracking systems for real-time monitoring of battery movement through the reverse supply chain. Their logistics solution incorporates specialized transportation containers with fire suppression systems and impact protection designed specifically for damaged or end-of-life batteries. CATL has also implemented a centralized digital platform that connects all stakeholders in the reverse supply chain, enabling efficient coordination between collection points, transportation providers, and recycling facilities.

Strengths: Vertical integration as both a battery manufacturer and recycler provides complete lifecycle control; advanced battery management systems enable predictive collection planning. Weaknesses: Heavy dependence on their own battery products limits third-party battery collection capabilities; system requires significant infrastructure investment across multiple regions.

Technical Innovations in Battery Sorting and Processing

Closed-loop lead acid battery recycling process and product

PatentWO2022056303A1

Innovation

- A closed-loop system for recycling lead acid batteries that collects, processes, and reuses components such as lead, polymer, and acid, achieving 90% or more recycling by weight, with a circular process that includes tracking and managing the recycling and manufacturing of lead acid batteries, enabling the creation of new batteries from recycled materials.

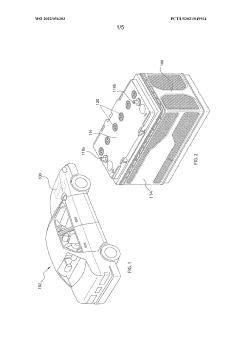

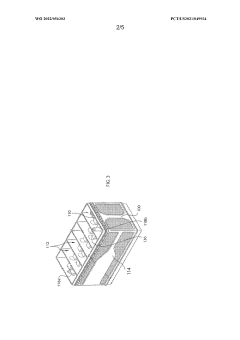

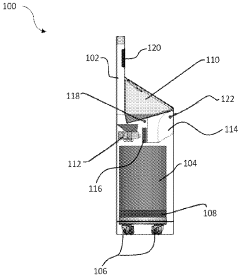

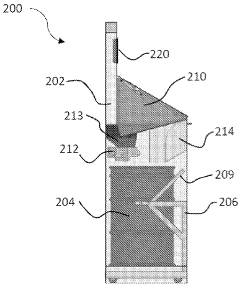

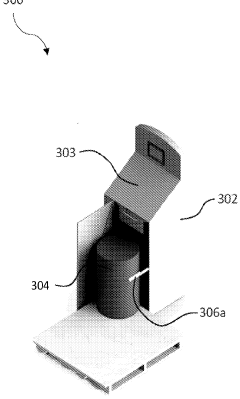

Battery collection systems and methods of using the same

PatentWO2024147832A1

Innovation

- A battery collection system with an automated chute and fire suppressant dispensing mechanism that allows consumers to safely deposit batteries without assistance, using sensors to detect fill levels and thermal events, and intelligently dispense fire suppressant to prevent thermal incidents.

Environmental Impact Assessment of Battery Collection Methods

The environmental impact of battery collection methods is a critical consideration in the development of sustainable reverse logistics systems. Current collection methods vary significantly in their ecological footprint, with traditional manual collection often resulting in higher carbon emissions due to inefficient transportation routes and multiple pickup points. Studies indicate that centralized collection points reduce overall vehicle miles traveled by up to 40% compared to door-to-door collection services, substantially decreasing associated greenhouse gas emissions.

Material recovery efficiency also differs markedly between collection methods. Advanced automated sorting facilities achieve recovery rates of 95-98% for valuable materials like lithium, cobalt, and nickel, while manual sorting typically achieves only 60-75% recovery. This difference translates directly to reduced mining pressure and lower environmental degradation in resource-extraction regions.

Energy consumption across the collection chain presents another significant environmental factor. Mobile collection units, despite their convenience, consume 2.3 times more energy per ton of batteries collected than fixed collection infrastructure. However, this calculation changes in rural areas where population density is low, making mobile solutions potentially more environmentally sound in specific geographical contexts.

Contamination risks pose serious environmental threats when improper collection methods are employed. Batteries disposed of in general waste streams can leach toxic chemicals into soil and groundwater. Research demonstrates that specialized battery collection systems reduce hazardous material leakage by approximately 87% compared to general waste disposal methods, protecting local ecosystems and water resources.

The packaging materials used in collection systems also contribute to the overall environmental impact. Single-use plastic containers commonly employed in many collection schemes generate substantial waste, whereas reusable collection containers reduce packaging waste by up to 90% over their lifecycle. Some innovative collection systems have implemented biodegradable collection bags, reducing environmental persistence of collection materials.

Carbon footprint analysis of various collection methods reveals that optimized multi-modal collection systems—combining fixed collection points with scheduled regional transportation—can reduce overall carbon emissions by 35-50% compared to ad-hoc collection approaches. These systems strategically balance accessibility with transportation efficiency to minimize environmental impact while maintaining high collection rates.

Long-term environmental modeling suggests that investment in environmentally optimized collection infrastructure could prevent the release of approximately 2.3 million tons of CO2 equivalent annually in developed economies, representing a significant opportunity for environmental impact reduction in the battery reverse supply chain.

Material recovery efficiency also differs markedly between collection methods. Advanced automated sorting facilities achieve recovery rates of 95-98% for valuable materials like lithium, cobalt, and nickel, while manual sorting typically achieves only 60-75% recovery. This difference translates directly to reduced mining pressure and lower environmental degradation in resource-extraction regions.

Energy consumption across the collection chain presents another significant environmental factor. Mobile collection units, despite their convenience, consume 2.3 times more energy per ton of batteries collected than fixed collection infrastructure. However, this calculation changes in rural areas where population density is low, making mobile solutions potentially more environmentally sound in specific geographical contexts.

Contamination risks pose serious environmental threats when improper collection methods are employed. Batteries disposed of in general waste streams can leach toxic chemicals into soil and groundwater. Research demonstrates that specialized battery collection systems reduce hazardous material leakage by approximately 87% compared to general waste disposal methods, protecting local ecosystems and water resources.

The packaging materials used in collection systems also contribute to the overall environmental impact. Single-use plastic containers commonly employed in many collection schemes generate substantial waste, whereas reusable collection containers reduce packaging waste by up to 90% over their lifecycle. Some innovative collection systems have implemented biodegradable collection bags, reducing environmental persistence of collection materials.

Carbon footprint analysis of various collection methods reveals that optimized multi-modal collection systems—combining fixed collection points with scheduled regional transportation—can reduce overall carbon emissions by 35-50% compared to ad-hoc collection approaches. These systems strategically balance accessibility with transportation efficiency to minimize environmental impact while maintaining high collection rates.

Long-term environmental modeling suggests that investment in environmentally optimized collection infrastructure could prevent the release of approximately 2.3 million tons of CO2 equivalent annually in developed economies, representing a significant opportunity for environmental impact reduction in the battery reverse supply chain.

Regulatory Framework for Battery Waste Management

The regulatory landscape for battery waste management has evolved significantly over the past decade, reflecting growing environmental concerns and the increasing volume of battery waste globally. The European Union's Battery Directive (2006/66/EC) established one of the first comprehensive frameworks, mandating collection rates and recycling efficiencies for different battery types. This directive was recently updated with the new Battery Regulation in 2023, which introduces more stringent requirements for collection rates (up to 70% by 2030) and establishes a battery passport system for enhanced traceability.

In the United States, regulations vary by state, with California's Battery Recycling Act and New York's Rechargeable Battery Recycling Act representing some of the more progressive approaches. These frameworks typically establish Extended Producer Responsibility (EPR) systems, placing the financial and operational burden of collection and recycling on manufacturers.

Asian markets present a diverse regulatory picture. China's "New Energy Vehicle Industry Development Plan" includes specific provisions for battery recycling, while Japan's Law for the Promotion of Effective Utilization of Resources mandates collection and recycling of specified battery types. South Korea has implemented a deposit-refund system to incentivize battery returns.

Compliance mechanisms typically include registration requirements, reporting obligations, collection targets, and financial guarantees. Penalties for non-compliance range from financial sanctions to market access restrictions, with enforcement varying significantly across jurisdictions.

Recent regulatory trends include the integration of circular economy principles, with emphasis on design for recyclability and second-life applications. The concept of "battery passports" is gaining traction, providing digital records of a battery's composition, performance, and lifecycle history to facilitate proper end-of-life management.

Regulatory gaps remain significant challenges, particularly regarding the classification of batteries (especially lithium-ion) as hazardous waste and the transboundary movement of used batteries. The Basel Convention governs international shipments of hazardous waste, but interpretation and enforcement vary considerably.

For logistics providers and reverse supply chain operators, these regulations create both challenges and opportunities. Compliance requires sophisticated tracking systems, specialized handling procedures, and extensive documentation. However, well-designed regulatory frameworks can also create stable markets for collection services and recycled materials, providing long-term business certainty.

In the United States, regulations vary by state, with California's Battery Recycling Act and New York's Rechargeable Battery Recycling Act representing some of the more progressive approaches. These frameworks typically establish Extended Producer Responsibility (EPR) systems, placing the financial and operational burden of collection and recycling on manufacturers.

Asian markets present a diverse regulatory picture. China's "New Energy Vehicle Industry Development Plan" includes specific provisions for battery recycling, while Japan's Law for the Promotion of Effective Utilization of Resources mandates collection and recycling of specified battery types. South Korea has implemented a deposit-refund system to incentivize battery returns.

Compliance mechanisms typically include registration requirements, reporting obligations, collection targets, and financial guarantees. Penalties for non-compliance range from financial sanctions to market access restrictions, with enforcement varying significantly across jurisdictions.

Recent regulatory trends include the integration of circular economy principles, with emphasis on design for recyclability and second-life applications. The concept of "battery passports" is gaining traction, providing digital records of a battery's composition, performance, and lifecycle history to facilitate proper end-of-life management.

Regulatory gaps remain significant challenges, particularly regarding the classification of batteries (especially lithium-ion) as hazardous waste and the transboundary movement of used batteries. The Basel Convention governs international shipments of hazardous waste, but interpretation and enforcement vary considerably.

For logistics providers and reverse supply chain operators, these regulations create both challenges and opportunities. Compliance requires sophisticated tracking systems, specialized handling procedures, and extensive documentation. However, well-designed regulatory frameworks can also create stable markets for collection services and recycled materials, providing long-term business certainty.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!