Return On Investment Modeling For SLB Projects

AUG 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

SLB ROI Modeling Background and Objectives

Service Level Business (SLB) projects represent a strategic approach to IT service management that aligns technology investments with business outcomes. The concept of Return on Investment (ROI) modeling for SLB projects has evolved significantly over the past decade, transitioning from basic cost-benefit analyses to sophisticated models that capture both tangible and intangible value creation. This evolution reflects the increasing complexity of IT services and the growing recognition of their strategic importance to business operations.

The historical development of SLB ROI modeling can be traced through several distinct phases. Initially, organizations focused primarily on cost reduction metrics, viewing IT as a necessary expense rather than a value driver. As digital transformation accelerated across industries, the perspective shifted toward measuring productivity improvements and operational efficiencies. The most recent evolution incorporates customer experience metrics, innovation potential, and competitive advantage considerations into ROI calculations.

Current technological trends influencing SLB ROI modeling include cloud computing, which has transformed capital expenditures into operational expenses; artificial intelligence and automation, which create new value streams while disrupting traditional labor models; and data analytics capabilities that enable more precise measurement of service impacts. These trends necessitate more sophisticated modeling approaches that can account for dynamic service environments and evolving business requirements.

The primary objective of modern SLB ROI modeling is to create a comprehensive framework that accurately captures the full spectrum of value delivered by service-level investments. This includes quantifying direct financial returns such as cost savings and revenue generation, as well as indirect benefits like improved customer satisfaction, enhanced employee productivity, and increased organizational agility. Additionally, effective models must account for risk factors, time-value considerations, and the opportunity costs of alternative investments.

Another critical objective is to develop models that can adapt to different organizational contexts and service types. The ROI calculation for infrastructure services may differ substantially from that of customer-facing applications or data analytics platforms. Therefore, flexible modeling approaches that can be customized to specific business scenarios while maintaining methodological rigor are essential.

Looking forward, SLB ROI modeling aims to incorporate predictive analytics and scenario planning capabilities, enabling organizations to forecast the potential returns of service investments under various business conditions. This forward-looking approach supports more informed decision-making and strategic alignment between IT investments and long-term business objectives.

The historical development of SLB ROI modeling can be traced through several distinct phases. Initially, organizations focused primarily on cost reduction metrics, viewing IT as a necessary expense rather than a value driver. As digital transformation accelerated across industries, the perspective shifted toward measuring productivity improvements and operational efficiencies. The most recent evolution incorporates customer experience metrics, innovation potential, and competitive advantage considerations into ROI calculations.

Current technological trends influencing SLB ROI modeling include cloud computing, which has transformed capital expenditures into operational expenses; artificial intelligence and automation, which create new value streams while disrupting traditional labor models; and data analytics capabilities that enable more precise measurement of service impacts. These trends necessitate more sophisticated modeling approaches that can account for dynamic service environments and evolving business requirements.

The primary objective of modern SLB ROI modeling is to create a comprehensive framework that accurately captures the full spectrum of value delivered by service-level investments. This includes quantifying direct financial returns such as cost savings and revenue generation, as well as indirect benefits like improved customer satisfaction, enhanced employee productivity, and increased organizational agility. Additionally, effective models must account for risk factors, time-value considerations, and the opportunity costs of alternative investments.

Another critical objective is to develop models that can adapt to different organizational contexts and service types. The ROI calculation for infrastructure services may differ substantially from that of customer-facing applications or data analytics platforms. Therefore, flexible modeling approaches that can be customized to specific business scenarios while maintaining methodological rigor are essential.

Looking forward, SLB ROI modeling aims to incorporate predictive analytics and scenario planning capabilities, enabling organizations to forecast the potential returns of service investments under various business conditions. This forward-looking approach supports more informed decision-making and strategic alignment between IT investments and long-term business objectives.

Market Analysis for SLB Investment Opportunities

The Sale-Leaseback (SLB) investment market has experienced significant growth over the past decade, evolving from a niche financing strategy to a mainstream capital solution across multiple sectors. The global SLB transaction volume reached $98.5 billion in 2022, representing a 35% increase from 2020 levels despite economic uncertainties. This growth trajectory is expected to continue with a projected CAGR of 11.7% through 2028, driven by favorable market conditions and increasing corporate adoption.

The current market landscape for SLB investments spans diverse sectors with varying levels of maturity and opportunity. Commercial real estate remains the dominant segment, accounting for approximately 65% of all SLB transactions. Within this category, industrial properties have emerged as the most sought-after assets, delivering average cap rates between 5.5% and 7.2% depending on location and tenant quality. Retail properties follow with slightly higher cap rates ranging from 6.8% to 8.5%, reflecting higher perceived risk profiles.

Healthcare facilities represent a rapidly growing SLB segment, with transaction volumes increasing by 47% year-over-year in 2022. The defensive nature of healthcare assets, coupled with long-term triple-net lease structures, has attracted significant institutional capital seeking stable returns in volatile market conditions. Average cap rates in this sector typically range from 6.0% to 7.5%, with medical office buildings commanding premium valuations.

Geographic distribution of SLB opportunities shows notable regional variations. North America continues to dominate with 58% of global transaction volume, followed by Europe (27%) and Asia-Pacific (12%). Emerging markets account for the remaining 3%, though this share is growing as regulatory frameworks evolve to accommodate SLB structures. Within the United States, secondary markets are experiencing accelerated growth as investors seek higher yields compared to gateway cities.

From an investor perspective, the SLB market features diverse participants with varying investment criteria and return expectations. REITs remain the largest buyer category, representing 42% of transaction volume, followed by private equity firms (28%), institutional investors (18%), and family offices (12%). Competition among these investor groups has intensified, compressing cap rates by an average of 75 basis points over the past three years across most property types.

The current economic environment presents both challenges and opportunities for SLB investments. Rising interest rates have moderated price appreciation but simultaneously created favorable conditions for sale-leaseback transactions as companies seek alternative capital sources amid tightening credit markets. This dynamic has expanded the potential deal pipeline, particularly among middle-market companies that previously relied heavily on traditional debt financing.

The current market landscape for SLB investments spans diverse sectors with varying levels of maturity and opportunity. Commercial real estate remains the dominant segment, accounting for approximately 65% of all SLB transactions. Within this category, industrial properties have emerged as the most sought-after assets, delivering average cap rates between 5.5% and 7.2% depending on location and tenant quality. Retail properties follow with slightly higher cap rates ranging from 6.8% to 8.5%, reflecting higher perceived risk profiles.

Healthcare facilities represent a rapidly growing SLB segment, with transaction volumes increasing by 47% year-over-year in 2022. The defensive nature of healthcare assets, coupled with long-term triple-net lease structures, has attracted significant institutional capital seeking stable returns in volatile market conditions. Average cap rates in this sector typically range from 6.0% to 7.5%, with medical office buildings commanding premium valuations.

Geographic distribution of SLB opportunities shows notable regional variations. North America continues to dominate with 58% of global transaction volume, followed by Europe (27%) and Asia-Pacific (12%). Emerging markets account for the remaining 3%, though this share is growing as regulatory frameworks evolve to accommodate SLB structures. Within the United States, secondary markets are experiencing accelerated growth as investors seek higher yields compared to gateway cities.

From an investor perspective, the SLB market features diverse participants with varying investment criteria and return expectations. REITs remain the largest buyer category, representing 42% of transaction volume, followed by private equity firms (28%), institutional investors (18%), and family offices (12%). Competition among these investor groups has intensified, compressing cap rates by an average of 75 basis points over the past three years across most property types.

The current economic environment presents both challenges and opportunities for SLB investments. Rising interest rates have moderated price appreciation but simultaneously created favorable conditions for sale-leaseback transactions as companies seek alternative capital sources amid tightening credit markets. This dynamic has expanded the potential deal pipeline, particularly among middle-market companies that previously relied heavily on traditional debt financing.

Current Challenges in SLB ROI Assessment

Despite significant advancements in Service Level Based (SLB) project management, the assessment of Return on Investment (ROI) for these initiatives continues to face substantial challenges. Traditional ROI models often fail to capture the unique characteristics of SLB projects, which typically involve complex service agreements with performance-based compensation structures rather than straightforward product deliveries.

One of the primary challenges is the difficulty in quantifying intangible benefits. While SLB projects frequently deliver significant improvements in operational efficiency, risk reduction, and enhanced decision-making capabilities, these benefits resist straightforward monetary valuation. Organizations struggle to translate improved service levels into financial metrics that can be incorporated into conventional ROI calculations.

The time-dependency of SLB benefits presents another significant obstacle. Unlike capital investments with predictable depreciation schedules, SLB projects often generate returns that fluctuate over time and may accelerate as operational maturity increases. Current assessment methodologies typically lack the sophistication to model these dynamic benefit patterns, leading to potential undervaluation of long-term advantages.

Risk assessment within SLB ROI models remains problematic. The performance-based nature of these agreements introduces unique risk profiles that are inadequately addressed by standard risk adjustment techniques. Organizations frequently either overlook critical risk factors or apply inappropriate risk premiums, resulting in distorted ROI projections that fail to reflect actual project economics.

Data availability and quality issues further complicate accurate ROI assessment. Many organizations lack robust baseline measurements prior to SLB implementation, making it difficult to quantify improvements attributable to the project. Additionally, the distributed nature of SLB benefits across multiple business functions often results in fragmented data collection, hampering comprehensive analysis.

Methodological inconsistencies across industries and organizations create additional challenges. The absence of standardized approaches to SLB ROI calculation makes benchmarking and comparative analysis difficult, limiting the ability of decision-makers to evaluate project performance against industry norms or historical precedents.

Finally, the evolving nature of service level agreements themselves introduces complexity into ROI modeling. As contracts incorporate increasingly sophisticated performance metrics and compensation structures, assessment methodologies struggle to keep pace. This gap between contractual complexity and evaluation capabilities frequently results in ROI models that fail to capture the full economic impact of SLB initiatives.

One of the primary challenges is the difficulty in quantifying intangible benefits. While SLB projects frequently deliver significant improvements in operational efficiency, risk reduction, and enhanced decision-making capabilities, these benefits resist straightforward monetary valuation. Organizations struggle to translate improved service levels into financial metrics that can be incorporated into conventional ROI calculations.

The time-dependency of SLB benefits presents another significant obstacle. Unlike capital investments with predictable depreciation schedules, SLB projects often generate returns that fluctuate over time and may accelerate as operational maturity increases. Current assessment methodologies typically lack the sophistication to model these dynamic benefit patterns, leading to potential undervaluation of long-term advantages.

Risk assessment within SLB ROI models remains problematic. The performance-based nature of these agreements introduces unique risk profiles that are inadequately addressed by standard risk adjustment techniques. Organizations frequently either overlook critical risk factors or apply inappropriate risk premiums, resulting in distorted ROI projections that fail to reflect actual project economics.

Data availability and quality issues further complicate accurate ROI assessment. Many organizations lack robust baseline measurements prior to SLB implementation, making it difficult to quantify improvements attributable to the project. Additionally, the distributed nature of SLB benefits across multiple business functions often results in fragmented data collection, hampering comprehensive analysis.

Methodological inconsistencies across industries and organizations create additional challenges. The absence of standardized approaches to SLB ROI calculation makes benchmarking and comparative analysis difficult, limiting the ability of decision-makers to evaluate project performance against industry norms or historical precedents.

Finally, the evolving nature of service level agreements themselves introduces complexity into ROI modeling. As contracts incorporate increasingly sophisticated performance metrics and compensation structures, assessment methodologies struggle to keep pace. This gap between contractual complexity and evaluation capabilities frequently results in ROI models that fail to capture the full economic impact of SLB initiatives.

Existing SLB ROI Calculation Methodologies

01 Financial ROI modeling methodologies

Various methodologies for modeling return on investment in financial contexts, including risk assessment frameworks, portfolio optimization techniques, and investment performance evaluation. These models help investors make informed decisions by analyzing historical data, market trends, and potential risks to predict future returns and optimize investment allocations across different asset classes.- Financial ROI modeling methodologies: Various methodologies for modeling return on investment in financial contexts, including systems for calculating expected returns, risk assessment, and portfolio optimization. These models incorporate historical data analysis, market trends, and predictive algorithms to forecast investment performance and help investors make informed decisions about asset allocation and investment timing.

- ROI analysis for business projects and initiatives: Systems and methods for evaluating the potential return on investment for business projects, marketing campaigns, and strategic initiatives. These approaches include frameworks for quantifying both tangible and intangible benefits, calculating payback periods, and comparing alternative investment options. The models help organizations prioritize resource allocation and make data-driven decisions about which projects to pursue.

- Technology investment ROI modeling: Specialized approaches for evaluating return on investment in technology implementations and digital transformation initiatives. These models account for factors such as implementation costs, maintenance expenses, productivity gains, and competitive advantages. The frameworks help organizations assess the financial impact of technology investments across different timeframes and business scenarios.

- Predictive analytics for investment returns: Advanced analytical techniques that leverage machine learning, artificial intelligence, and big data to predict investment returns with greater accuracy. These approaches incorporate multiple variables and complex market dynamics to generate sophisticated ROI forecasts. The models can adapt to changing conditions and provide dynamic investment recommendations based on real-time data analysis.

- Customer-centric ROI modeling: Methodologies focused on measuring the return on investment from customer acquisition, retention, and relationship management activities. These approaches calculate lifetime customer value, marketing efficiency, and the financial impact of customer experience improvements. The models help organizations optimize their customer-focused investments and quantify the business benefits of customer-centric strategies.

02 ROI analysis for business projects and initiatives

Systems and methods for evaluating the return on investment for business projects, marketing campaigns, and strategic initiatives. These approaches include frameworks for cost-benefit analysis, performance metrics tracking, and value assessment methodologies that help organizations prioritize investments based on expected returns and align resource allocation with business objectives.Expand Specific Solutions03 Technology investment ROI modeling

Specialized models for evaluating returns on technology investments, including IT infrastructure, software implementations, and digital transformation initiatives. These frameworks account for both tangible benefits like cost savings and revenue increases, as well as intangible benefits such as improved customer experience, operational efficiency, and competitive advantage.Expand Specific Solutions04 Predictive analytics for investment returns

Advanced analytical techniques that leverage machine learning, artificial intelligence, and statistical modeling to predict investment returns with greater accuracy. These approaches process large volumes of data to identify patterns, correlations, and trends that might impact investment performance, enabling more sophisticated risk-return optimization and scenario analysis.Expand Specific Solutions05 Customer-centric ROI measurement frameworks

Methodologies focused on measuring returns from investments in customer acquisition, retention, and relationship management. These frameworks track metrics like customer lifetime value, acquisition costs, churn rates, and engagement levels to determine the effectiveness of customer-focused investments and optimize marketing and sales strategies accordingly.Expand Specific Solutions

Key Industry Players in SLB Project Financing

The Return on Investment (ROI) modeling for SLB projects is currently in an emerging growth phase, with increasing market adoption across the power sector. The global market size is expanding rapidly, driven by the need for more efficient investment decision-making in smart grid initiatives. Technologically, the field shows varying maturity levels among key players. Academic institutions like Tsinghua University and North China Electric Power University are advancing theoretical frameworks, while State Grid subsidiaries in Jilin, Hubei, and Fujian are implementing practical applications. Companies like Ericsson and Lam Research bring cross-industry expertise to enhance modeling sophistication. The integration of big data analytics and AI by firms such as Shenzhen Yuntu Zhilian is pushing the technology toward greater predictive accuracy, though standardized methodologies remain under development.

North China Electric Power University

Technical Solution: North China Electric Power University has developed a comprehensive ROI modeling framework for Smart Load Balancing projects that integrates technical, economic, and environmental dimensions. Their approach employs a multi-criteria decision analysis (MCDA) methodology that allows utilities to balance competing objectives when evaluating SLB investments. The model incorporates detailed power flow analysis to quantify technical benefits such as loss reduction, voltage profile improvement, and equipment loading optimization. On the economic side, the framework utilizes real options theory to value the flexibility inherent in modular SLB deployments, allowing for more accurate valuation of staged implementation strategies. The university's research team has developed specialized algorithms that can simulate the impact of various load balancing technologies under different grid topologies and load profiles, enabling customized ROI assessments for specific utility contexts. Their model also features a unique "benefit distribution analysis" component that helps utilities understand how investment returns are allocated among different stakeholders, including the utility itself, customers, and society at large. This approach has been implemented in several provincial grid companies in China, demonstrating its ability to identify high-value SLB investment opportunities that might be overlooked by conventional financial analysis.

Strengths: The multi-criteria approach allows for balanced consideration of financial returns alongside technical and environmental benefits. The real options valuation methodology captures the strategic value of implementation flexibility that traditional NPV calculations miss. Weaknesses: The model requires extensive data inputs from multiple domains, which may be challenging to collect and integrate in some utility environments. The stakeholder benefit distribution analysis adds complexity that may not be necessary for all decision contexts.

Tsinghua University

Technical Solution: Tsinghua University has developed a sophisticated ROI modeling framework for Smart Load Balancing projects that combines economic theory with power systems engineering principles. Their approach utilizes a hierarchical modeling structure that evaluates investments at multiple levels: device-level, subsystem-level, and grid-level returns. The model incorporates both deterministic and stochastic elements to account for uncertainties in electricity markets, policy environments, and technological performance. Tsinghua's framework features a unique "policy sensitivity module" that allows users to simulate how changes in regulatory environments might affect investment returns over time. Their approach also integrates life-cycle assessment methodologies to capture the full spectrum of costs and benefits throughout the project lifespan. The university's research team has developed specialized algorithms that can optimize investment timing and sequencing to maximize ROI while maintaining system reliability constraints. This model has been validated through several case studies in collaboration with major Chinese utilities, demonstrating its ability to identify optimal investment strategies that balance short-term returns with long-term grid modernization objectives.

Strengths: The hierarchical modeling approach allows for detailed analysis at multiple system levels, providing insights that single-layer models cannot capture. The policy sensitivity module offers valuable strategic planning capabilities in evolving regulatory environments. Weaknesses: The model's academic origins may limit its immediate practical application without significant customization, and its computational complexity may present challenges for routine use in operational planning contexts.

Critical Financial Metrics for SLB Projects

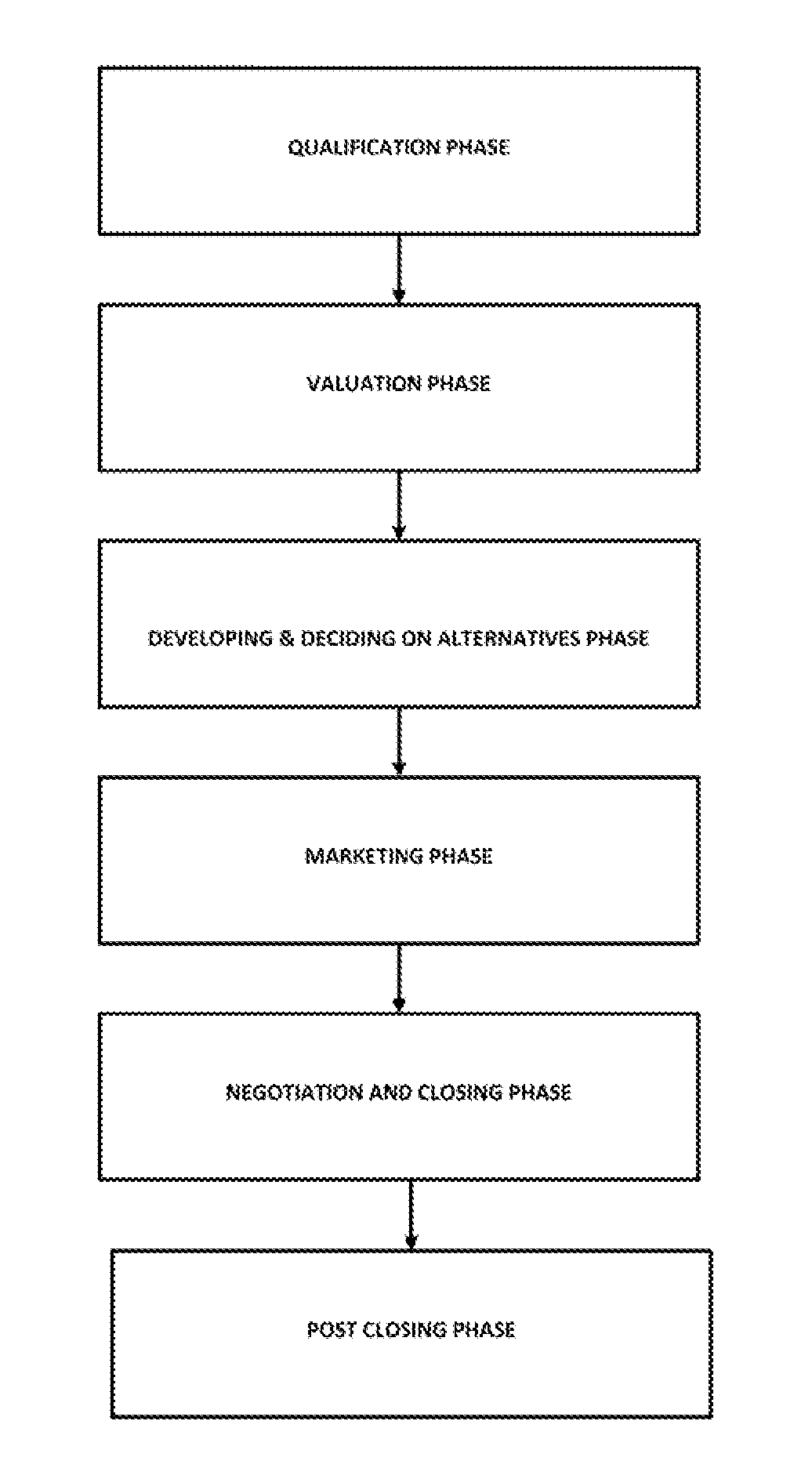

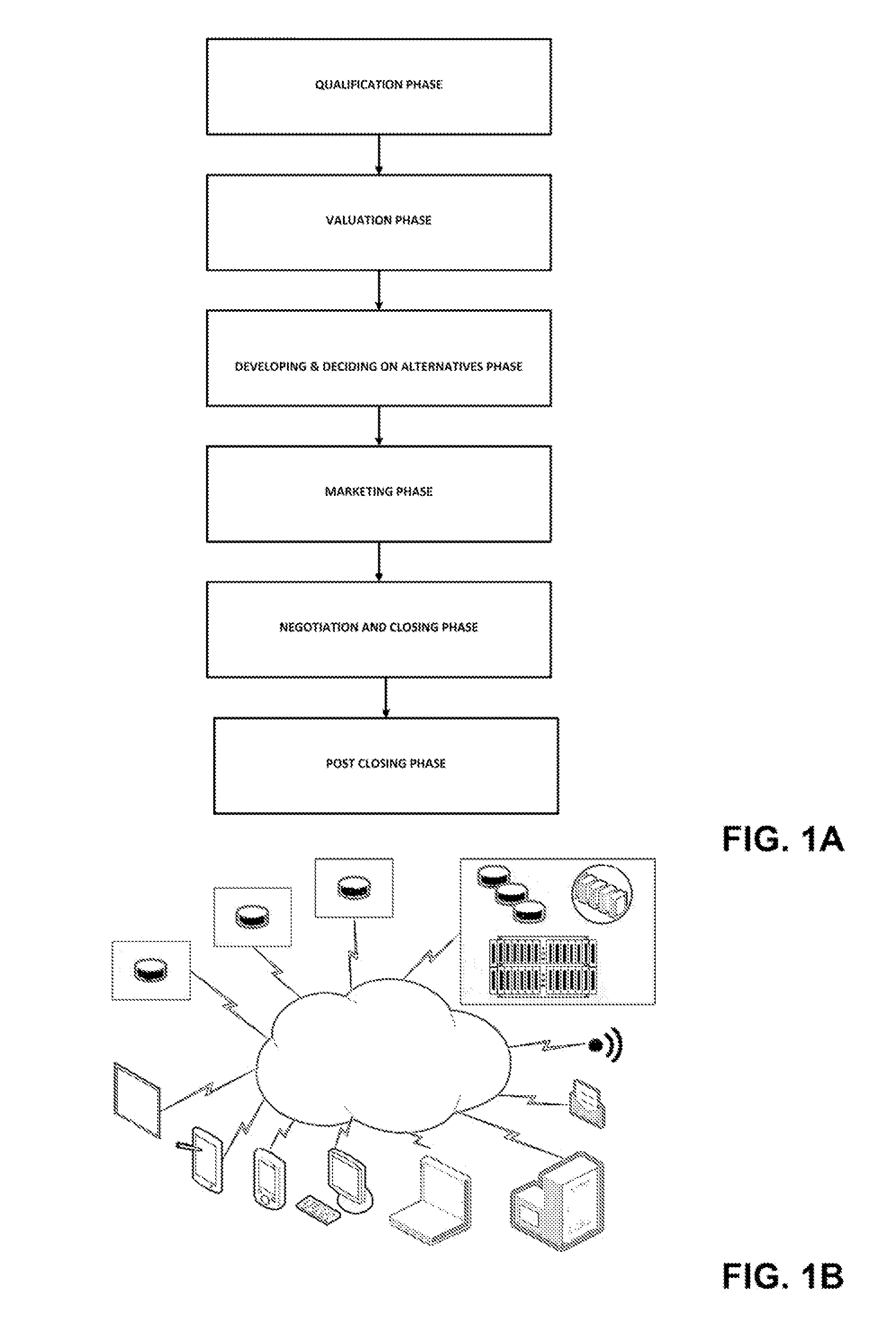

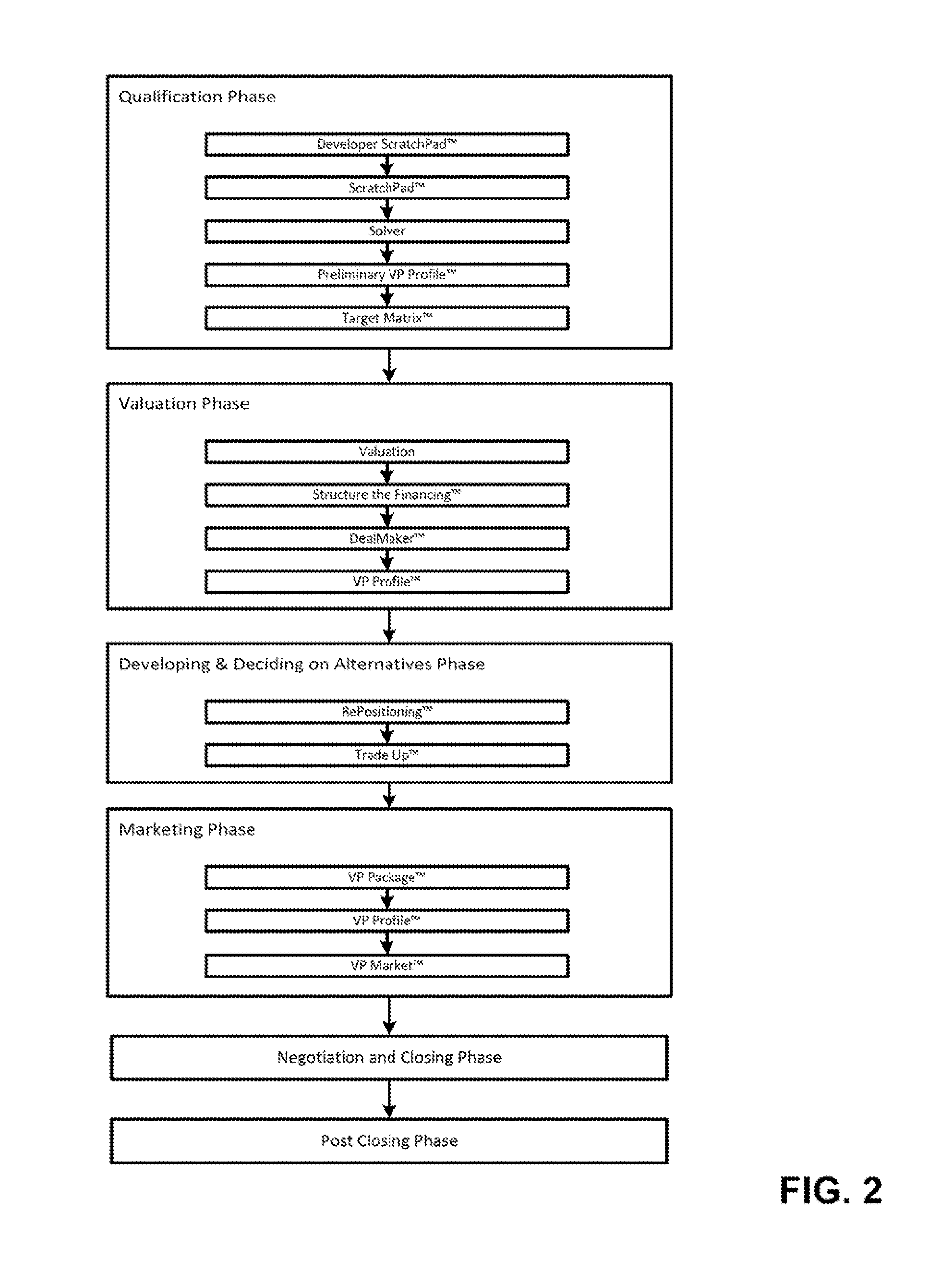

Optimizing return on investment in real property

PatentInactiveUS20140279692A1

Innovation

- A computer-implemented web-based system that serves as an expert decision support system, guiding users through a logical step-by-step process to optimize real property investments or loans by qualifying transactions, valuing properties, structuring financing, and evaluating alternatives, while providing tools for lease negotiations and property trading, using features like Anticipatory Help, VP Solver, and DealMaker.

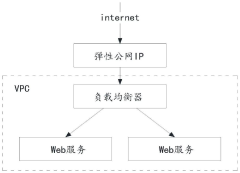

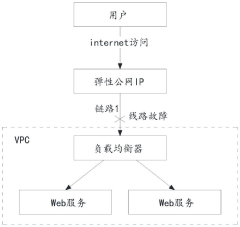

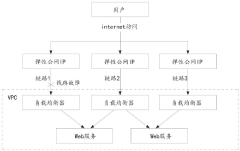

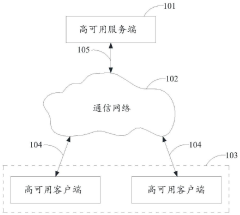

Method and system for realizing cross-operator link high availability through same load balancer

PatentPendingCN117938761A

Innovation

- By creating a public network address pool on the same load balancer, binding multiple operators' public network IPs, and using the DNS server to dynamically update the public network address pool, the load balancer can be flexibly bound and resolved with multiple operator links. tied to ensure high availability.

Risk Management Strategies for SLB Investments

Effective risk management is crucial for Sale-Leaseback (SLB) investments to ensure optimal returns while minimizing potential losses. Organizations engaging in SLB transactions must implement comprehensive risk assessment frameworks that identify, quantify, and mitigate various risk factors throughout the investment lifecycle.

Market volatility represents a significant risk factor in SLB investments, necessitating robust hedging strategies. These may include diversification across property types and geographic locations, as well as the use of financial instruments such as interest rate swaps or caps to protect against adverse market movements. Regular market analysis and scenario planning enable investors to anticipate potential downturns and adjust their portfolios accordingly.

Counterparty risk assessment should be a fundamental component of SLB risk management. This involves thorough due diligence on the lessee's financial stability, business model viability, and credit history. Establishing stringent tenant selection criteria and implementing regular financial monitoring protocols can significantly reduce default risk. Additionally, structuring lease agreements with appropriate security deposits and guarantees provides an additional layer of protection.

Regulatory and compliance risks must be systematically addressed through dedicated legal oversight. SLB transactions often involve complex tax implications and accounting treatments that vary across jurisdictions. Maintaining relationships with specialized legal and tax advisors ensures compliance with evolving regulations and helps optimize the transaction structure to mitigate potential regulatory risks.

Operational risk management for SLB investments should focus on property condition, maintenance responsibilities, and potential environmental liabilities. Comprehensive property inspections, environmental assessments, and clear delineation of maintenance obligations in lease agreements can prevent unexpected costs. Establishing contingency reserves for property-related emergencies further strengthens the risk management framework.

Liquidity risk represents another critical consideration, particularly for institutional investors who may need to exit investments prematurely. Developing exit strategies at the investment initiation stage, maintaining relationships with potential buyers, and structuring lease terms to enhance marketability can help mitigate liquidity constraints. Some investors also incorporate liquidity premiums into their return calculations to account for this risk factor.

Technology-enabled risk monitoring systems have emerged as valuable tools for ongoing risk management. These platforms can track key performance indicators, flag early warning signs of tenant distress, monitor compliance with lease covenants, and provide real-time portfolio risk analytics. Implementing such systems enables proactive risk management rather than reactive crisis response.

Market volatility represents a significant risk factor in SLB investments, necessitating robust hedging strategies. These may include diversification across property types and geographic locations, as well as the use of financial instruments such as interest rate swaps or caps to protect against adverse market movements. Regular market analysis and scenario planning enable investors to anticipate potential downturns and adjust their portfolios accordingly.

Counterparty risk assessment should be a fundamental component of SLB risk management. This involves thorough due diligence on the lessee's financial stability, business model viability, and credit history. Establishing stringent tenant selection criteria and implementing regular financial monitoring protocols can significantly reduce default risk. Additionally, structuring lease agreements with appropriate security deposits and guarantees provides an additional layer of protection.

Regulatory and compliance risks must be systematically addressed through dedicated legal oversight. SLB transactions often involve complex tax implications and accounting treatments that vary across jurisdictions. Maintaining relationships with specialized legal and tax advisors ensures compliance with evolving regulations and helps optimize the transaction structure to mitigate potential regulatory risks.

Operational risk management for SLB investments should focus on property condition, maintenance responsibilities, and potential environmental liabilities. Comprehensive property inspections, environmental assessments, and clear delineation of maintenance obligations in lease agreements can prevent unexpected costs. Establishing contingency reserves for property-related emergencies further strengthens the risk management framework.

Liquidity risk represents another critical consideration, particularly for institutional investors who may need to exit investments prematurely. Developing exit strategies at the investment initiation stage, maintaining relationships with potential buyers, and structuring lease terms to enhance marketability can help mitigate liquidity constraints. Some investors also incorporate liquidity premiums into their return calculations to account for this risk factor.

Technology-enabled risk monitoring systems have emerged as valuable tools for ongoing risk management. These platforms can track key performance indicators, flag early warning signs of tenant distress, monitor compliance with lease covenants, and provide real-time portfolio risk analytics. Implementing such systems enables proactive risk management rather than reactive crisis response.

ESG Impact Assessment in SLB ROI Models

Environmental, Social, and Governance (ESG) considerations have become increasingly central to Sustainability-Linked Bond (SLB) projects, necessitating their integration into Return on Investment (ROI) models. Traditional financial metrics alone no longer suffice for comprehensive project evaluation, as investors and stakeholders demand quantifiable ESG impact assessments alongside financial returns.

The incorporation of ESG metrics into SLB ROI models requires a multi-dimensional approach. Environmental factors typically include carbon footprint reduction, renewable energy adoption rates, and resource efficiency improvements. These metrics can be monetized through carbon pricing mechanisms, avoided costs from regulatory compliance, and potential premium pricing for environmentally responsible products.

Social impact assessment within ROI models encompasses community engagement outcomes, labor practice improvements, and diversity initiatives. While traditionally challenging to quantify, advanced methodologies now enable the financial valuation of social impacts through metrics such as reduced turnover costs, enhanced productivity from improved working conditions, and brand value appreciation from positive community relations.

Governance improvements contribute to ROI through reduced compliance risks, lower insurance premiums, and enhanced operational efficiency. Transparent reporting frameworks and robust governance structures demonstrably reduce the cost of capital for SLB projects, creating a direct financial benefit that can be incorporated into ROI calculations.

Recent innovations in ESG impact assessment include the development of standardized metrics aligned with frameworks such as the Sustainability Accounting Standards Board (SASB) and Task Force on Climate-related Financial Disclosures (TCFD). These frameworks enable more consistent comparison across projects and reduce the reporting burden on organizations implementing SLBs.

Dynamic modeling approaches now allow for the incorporation of time-variant ESG impacts, recognizing that environmental and social benefits often accrue over different timeframes than financial returns. Sensitivity analysis incorporating various ESG scenarios has become standard practice in sophisticated SLB ROI models, allowing investors to understand the resilience of returns under different regulatory and market conditions.

The monetization of ESG impacts remains challenging but essential for comprehensive ROI modeling. Emerging methodologies include the application of shadow pricing for environmental externalities, contingent valuation for social impacts, and regression analysis to correlate governance improvements with financial performance metrics. These approaches enable the translation of qualitative ESG benefits into quantitative financial terms compatible with traditional ROI frameworks.

The incorporation of ESG metrics into SLB ROI models requires a multi-dimensional approach. Environmental factors typically include carbon footprint reduction, renewable energy adoption rates, and resource efficiency improvements. These metrics can be monetized through carbon pricing mechanisms, avoided costs from regulatory compliance, and potential premium pricing for environmentally responsible products.

Social impact assessment within ROI models encompasses community engagement outcomes, labor practice improvements, and diversity initiatives. While traditionally challenging to quantify, advanced methodologies now enable the financial valuation of social impacts through metrics such as reduced turnover costs, enhanced productivity from improved working conditions, and brand value appreciation from positive community relations.

Governance improvements contribute to ROI through reduced compliance risks, lower insurance premiums, and enhanced operational efficiency. Transparent reporting frameworks and robust governance structures demonstrably reduce the cost of capital for SLB projects, creating a direct financial benefit that can be incorporated into ROI calculations.

Recent innovations in ESG impact assessment include the development of standardized metrics aligned with frameworks such as the Sustainability Accounting Standards Board (SASB) and Task Force on Climate-related Financial Disclosures (TCFD). These frameworks enable more consistent comparison across projects and reduce the reporting burden on organizations implementing SLBs.

Dynamic modeling approaches now allow for the incorporation of time-variant ESG impacts, recognizing that environmental and social benefits often accrue over different timeframes than financial returns. Sensitivity analysis incorporating various ESG scenarios has become standard practice in sophisticated SLB ROI models, allowing investors to understand the resilience of returns under different regulatory and market conditions.

The monetization of ESG impacts remains challenging but essential for comprehensive ROI modeling. Emerging methodologies include the application of shadow pricing for environmental externalities, contingent valuation for social impacts, and regression analysis to correlate governance improvements with financial performance metrics. These approaches enable the translation of qualitative ESG benefits into quantitative financial terms compatible with traditional ROI frameworks.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!