Fuel Switching In Rotary Kilns: Gas, Oil, And Biomass Options Compared

AUG 22, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Rotary Kiln Fuel Evolution and Objectives

Rotary kilns have undergone significant fuel evolution since their inception in the late 19th century. Initially, coal was the predominant fuel source due to its widespread availability and high energy content. The early 20th century saw the first major transition as industrial operations began incorporating oil-fired systems during the 1920s and 1930s, offering improved combustion control and reduced labor requirements compared to coal-based operations.

The energy crises of the 1970s marked a pivotal moment in rotary kiln fuel evolution, prompting industries to seek alternatives to petroleum-based fuels. This period witnessed the accelerated development of natural gas firing systems, which offered cleaner combustion profiles and reduced emissions compared to coal and oil. The 1980s and 1990s brought increased environmental awareness and the implementation of stricter emissions regulations worldwide, further driving the shift toward cleaner fuel options.

Recent decades have seen a pronounced trend toward fuel flexibility in rotary kiln operations. Modern kilns are increasingly designed with multi-fuel capabilities, allowing operators to switch between gas, oil, coal, and various alternative fuels based on availability, cost, and environmental considerations. This adaptability has become a critical competitive advantage in industries facing volatile energy markets and stringent environmental regulations.

The emergence of biomass as a viable fuel option represents the latest significant evolution in rotary kiln technology. Beginning in the early 2000s, various biomass sources including wood waste, agricultural residues, and purpose-grown energy crops have been increasingly incorporated into kiln operations. This shift aligns with global sustainability initiatives and carbon reduction targets, offering potential pathways to reduced carbon footprints for traditionally energy-intensive processes.

The primary objectives driving current fuel switching initiatives in rotary kilns encompass several interconnected factors. Cost optimization remains paramount, with operators seeking to minimize fuel expenses while maintaining process stability and product quality. Environmental compliance has become equally critical, as industries work to meet increasingly stringent emissions standards for CO2, NOx, SOx, and particulate matter. Additionally, many organizations have established sustainability targets that necessitate reducing fossil fuel dependency and associated carbon emissions.

Looking forward, the industry aims to develop truly flexible rotary kiln systems capable of seamlessly transitioning between multiple fuel types without compromising operational efficiency or product quality. This includes overcoming technical challenges related to flame characteristics, heat transfer profiles, and combustion control when switching between disparate fuels such as natural gas, oil, and various biomass options.

The energy crises of the 1970s marked a pivotal moment in rotary kiln fuel evolution, prompting industries to seek alternatives to petroleum-based fuels. This period witnessed the accelerated development of natural gas firing systems, which offered cleaner combustion profiles and reduced emissions compared to coal and oil. The 1980s and 1990s brought increased environmental awareness and the implementation of stricter emissions regulations worldwide, further driving the shift toward cleaner fuel options.

Recent decades have seen a pronounced trend toward fuel flexibility in rotary kiln operations. Modern kilns are increasingly designed with multi-fuel capabilities, allowing operators to switch between gas, oil, coal, and various alternative fuels based on availability, cost, and environmental considerations. This adaptability has become a critical competitive advantage in industries facing volatile energy markets and stringent environmental regulations.

The emergence of biomass as a viable fuel option represents the latest significant evolution in rotary kiln technology. Beginning in the early 2000s, various biomass sources including wood waste, agricultural residues, and purpose-grown energy crops have been increasingly incorporated into kiln operations. This shift aligns with global sustainability initiatives and carbon reduction targets, offering potential pathways to reduced carbon footprints for traditionally energy-intensive processes.

The primary objectives driving current fuel switching initiatives in rotary kilns encompass several interconnected factors. Cost optimization remains paramount, with operators seeking to minimize fuel expenses while maintaining process stability and product quality. Environmental compliance has become equally critical, as industries work to meet increasingly stringent emissions standards for CO2, NOx, SOx, and particulate matter. Additionally, many organizations have established sustainability targets that necessitate reducing fossil fuel dependency and associated carbon emissions.

Looking forward, the industry aims to develop truly flexible rotary kiln systems capable of seamlessly transitioning between multiple fuel types without compromising operational efficiency or product quality. This includes overcoming technical challenges related to flame characteristics, heat transfer profiles, and combustion control when switching between disparate fuels such as natural gas, oil, and various biomass options.

Market Demand Analysis for Alternative Kiln Fuels

The global market for alternative kiln fuels is experiencing significant growth driven by multiple factors including rising environmental regulations, volatile fossil fuel prices, and corporate sustainability commitments. The cement industry alone, which operates thousands of rotary kilns worldwide, consumes approximately 3-4% of global primary energy, creating substantial demand for alternative fuel solutions.

Recent market analysis indicates that the alternative fuels market for industrial kilns is growing at a compound annual growth rate of 7-8%, with particularly strong adoption in Europe and increasingly in Asia-Pacific regions. This growth is primarily attributed to the economic benefits of fuel switching, as traditional fuels like natural gas and oil remain subject to price volatility and geopolitical supply constraints.

The demand for biomass options has shown particularly strong momentum, with wood waste, agricultural residues, and purpose-grown energy crops gaining traction. Market research suggests that biomass currently represents approximately 15% of alternative fuels used in rotary kilns globally, with significant regional variations based on local biomass availability and supporting policy frameworks.

Industrial sectors beyond cement production are also driving demand, including lime production, iron ore processing, and various chemical manufacturing processes that utilize rotary kilns. These industries collectively represent a substantial addressable market for alternative fuel technologies and solutions.

Cost considerations remain paramount in market adoption decisions. While natural gas infrastructure requires significant capital investment, operational costs can be lower in regions with abundant supply. Oil-based systems offer flexibility but face increasing price pressures and environmental scrutiny. Biomass options typically involve higher handling and processing costs but benefit from lower fuel acquisition costs and potential carbon credits or incentives.

Market segmentation analysis reveals distinct preferences across different regions. European markets show stronger preference for biomass solutions due to stringent carbon regulations and well-established biomass supply chains. North American markets demonstrate balanced adoption across gas, oil, and biomass options, while emerging markets in Asia and Africa show growing interest in locally-sourced biomass alternatives to reduce dependence on imported fossil fuels.

Industry surveys indicate that approximately 65% of kiln operators consider fuel flexibility a critical factor in new equipment purchases or retrofits, highlighting the growing market demand for systems capable of accommodating multiple fuel types. This trend toward multi-fuel capability represents a significant market opportunity for technology providers and engineering firms specializing in kiln modifications and fuel handling systems.

Recent market analysis indicates that the alternative fuels market for industrial kilns is growing at a compound annual growth rate of 7-8%, with particularly strong adoption in Europe and increasingly in Asia-Pacific regions. This growth is primarily attributed to the economic benefits of fuel switching, as traditional fuels like natural gas and oil remain subject to price volatility and geopolitical supply constraints.

The demand for biomass options has shown particularly strong momentum, with wood waste, agricultural residues, and purpose-grown energy crops gaining traction. Market research suggests that biomass currently represents approximately 15% of alternative fuels used in rotary kilns globally, with significant regional variations based on local biomass availability and supporting policy frameworks.

Industrial sectors beyond cement production are also driving demand, including lime production, iron ore processing, and various chemical manufacturing processes that utilize rotary kilns. These industries collectively represent a substantial addressable market for alternative fuel technologies and solutions.

Cost considerations remain paramount in market adoption decisions. While natural gas infrastructure requires significant capital investment, operational costs can be lower in regions with abundant supply. Oil-based systems offer flexibility but face increasing price pressures and environmental scrutiny. Biomass options typically involve higher handling and processing costs but benefit from lower fuel acquisition costs and potential carbon credits or incentives.

Market segmentation analysis reveals distinct preferences across different regions. European markets show stronger preference for biomass solutions due to stringent carbon regulations and well-established biomass supply chains. North American markets demonstrate balanced adoption across gas, oil, and biomass options, while emerging markets in Asia and Africa show growing interest in locally-sourced biomass alternatives to reduce dependence on imported fossil fuels.

Industry surveys indicate that approximately 65% of kiln operators consider fuel flexibility a critical factor in new equipment purchases or retrofits, highlighting the growing market demand for systems capable of accommodating multiple fuel types. This trend toward multi-fuel capability represents a significant market opportunity for technology providers and engineering firms specializing in kiln modifications and fuel handling systems.

Current Status and Challenges in Rotary Kiln Fuel Technology

The global rotary kiln industry is currently experiencing significant transformation in fuel technology, driven by environmental regulations, economic considerations, and sustainability goals. Traditional fossil fuels like coal remain dominant in many regions, particularly in developing economies, accounting for approximately 60% of global kiln operations. Natural gas has gained substantial market share in North America and Europe, representing about 25% of fuel usage due to its lower carbon footprint and competitive pricing in these markets.

Oil-based fuels maintain relevance in regions with limited natural gas infrastructure, constituting roughly 10% of the global fuel mix. The remaining 5% is increasingly occupied by alternative fuels, particularly biomass and waste-derived fuels, with annual growth rates exceeding 15% in advanced markets like the European Union.

Despite this evolution, the industry faces several critical challenges in fuel technology implementation. Technical compatibility issues remain paramount, as many existing kilns were designed specifically for coal or other conventional fuels. Retrofitting these systems for alternative fuels often requires significant modifications to feeding systems, burner designs, and control mechanisms, with conversion costs potentially reaching $5-10 million per facility.

Combustion efficiency presents another major challenge, particularly with biomass fuels. The variable moisture content, inconsistent particle size, and lower calorific values of biomass compared to fossil fuels can reduce thermal efficiency by 10-30%, necessitating advanced pre-treatment processes and specialized combustion technologies to maintain production rates and product quality.

Emissions control represents a growing concern as regulatory frameworks become increasingly stringent. While natural gas offers cleaner combustion with lower particulate matter, switching to biomass can introduce challenges related to volatile organic compounds and variable ash content, requiring sophisticated filtration and monitoring systems.

Supply chain reliability constitutes a significant barrier, especially for biomass fuels. Unlike established fossil fuel networks, biomass supply chains often lack the necessary infrastructure for consistent quality, quantity, and delivery schedules. This creates operational uncertainties that many manufacturers are reluctant to accept without robust supply guarantees.

Economic viability remains perhaps the most significant challenge, with fuel switching decisions heavily influenced by regional price differentials, carbon taxation policies, and available subsidies for renewable alternatives. The payback period for fuel conversion projects typically ranges from 3-7 years, depending on local market conditions and regulatory incentives, creating hesitation among industry players facing uncertain policy landscapes.

Oil-based fuels maintain relevance in regions with limited natural gas infrastructure, constituting roughly 10% of the global fuel mix. The remaining 5% is increasingly occupied by alternative fuels, particularly biomass and waste-derived fuels, with annual growth rates exceeding 15% in advanced markets like the European Union.

Despite this evolution, the industry faces several critical challenges in fuel technology implementation. Technical compatibility issues remain paramount, as many existing kilns were designed specifically for coal or other conventional fuels. Retrofitting these systems for alternative fuels often requires significant modifications to feeding systems, burner designs, and control mechanisms, with conversion costs potentially reaching $5-10 million per facility.

Combustion efficiency presents another major challenge, particularly with biomass fuels. The variable moisture content, inconsistent particle size, and lower calorific values of biomass compared to fossil fuels can reduce thermal efficiency by 10-30%, necessitating advanced pre-treatment processes and specialized combustion technologies to maintain production rates and product quality.

Emissions control represents a growing concern as regulatory frameworks become increasingly stringent. While natural gas offers cleaner combustion with lower particulate matter, switching to biomass can introduce challenges related to volatile organic compounds and variable ash content, requiring sophisticated filtration and monitoring systems.

Supply chain reliability constitutes a significant barrier, especially for biomass fuels. Unlike established fossil fuel networks, biomass supply chains often lack the necessary infrastructure for consistent quality, quantity, and delivery schedules. This creates operational uncertainties that many manufacturers are reluctant to accept without robust supply guarantees.

Economic viability remains perhaps the most significant challenge, with fuel switching decisions heavily influenced by regional price differentials, carbon taxation policies, and available subsidies for renewable alternatives. The payback period for fuel conversion projects typically ranges from 3-7 years, depending on local market conditions and regulatory incentives, creating hesitation among industry players facing uncertain policy landscapes.

Comparative Analysis of Gas, Oil, and Biomass Fuel Systems

01 Alternative fuel systems for rotary kilns

Rotary kilns can be designed with systems that allow switching between different fuel types to optimize efficiency and reduce emissions. These systems may include specialized burners, fuel injection mechanisms, and control systems that can accommodate various fuels such as natural gas, coal, biomass, or waste-derived fuels. The ability to switch fuels provides operational flexibility and can lead to significant cost savings and environmental benefits depending on fuel availability and pricing.- Alternative fuel systems for rotary kilns: Rotary kilns can be designed with systems that allow switching between different fuel types to improve efficiency and reduce emissions. These systems include multi-fuel burners, fuel injection mechanisms, and control systems that can seamlessly transition between fuels such as natural gas, coal, biomass, or waste-derived fuels. The ability to switch fuels provides operational flexibility and can optimize energy consumption based on fuel availability and cost.

- Biomass and waste-derived fuel utilization: Incorporating biomass and waste-derived fuels in rotary kiln operations can significantly improve fuel efficiency and reduce environmental impact. These alternative fuels can be processed and introduced into the kiln through specialized feeding systems. The use of these renewable or waste materials as supplementary fuels reduces dependency on fossil fuels while maintaining thermal performance. Technologies have been developed to ensure consistent combustion properties despite the variable nature of these alternative fuels.

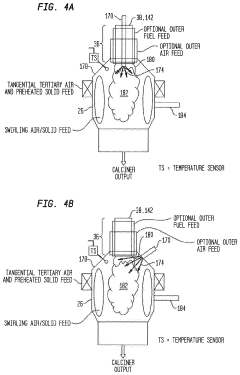

- Advanced burner technologies for improved combustion: Advanced burner designs enhance fuel efficiency in rotary kilns through improved combustion control and heat distribution. These technologies include low-NOx burners, multi-channel burners, and burners with adjustable flame characteristics. By optimizing the combustion process, these burners ensure more complete fuel utilization, reduce heat losses, and allow for precise temperature control throughout the kiln. The improved combustion efficiency directly translates to reduced fuel consumption and lower operating costs.

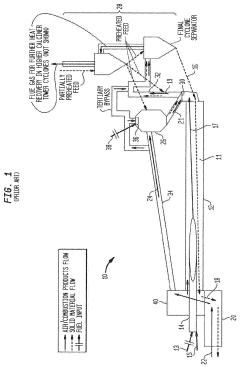

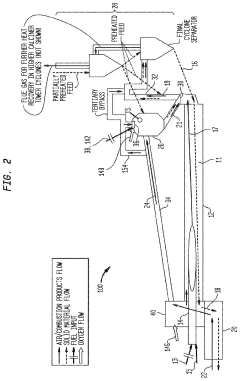

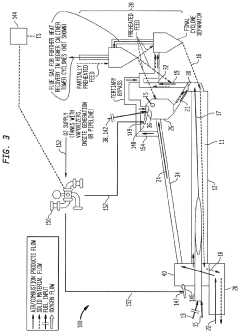

- Heat recovery and energy optimization systems: Heat recovery systems capture and reuse thermal energy that would otherwise be lost in rotary kiln operations. These systems include preheaters, heat exchangers, and waste heat recovery boilers that can significantly improve overall energy efficiency. By recirculating hot gases, preheating incoming materials, or generating electricity from waste heat, these technologies reduce the primary fuel requirements of the kiln. Integrated energy management systems further optimize fuel usage by monitoring and adjusting operational parameters in real-time.

- Process control and monitoring for fuel efficiency: Advanced process control and monitoring systems optimize fuel efficiency in rotary kilns through real-time data analysis and automated adjustments. These systems use sensors, thermal imaging, and predictive algorithms to maintain optimal combustion conditions and material processing parameters. By continuously monitoring key variables such as temperature profiles, oxygen levels, and material flow, these control systems can make precise adjustments to fuel input, air flow, and kiln rotation speed. This results in consistent product quality while minimizing fuel consumption and reducing thermal inefficiencies.

02 Biomass and waste-derived fuel utilization

Incorporating biomass and waste-derived fuels in rotary kiln operations can significantly improve fuel efficiency and reduce environmental impact. These alternative fuels can be processed and fed into rotary kilns either as a complete replacement for fossil fuels or as part of a co-firing strategy. Special preparation techniques and feeding systems are required to ensure consistent combustion properties and to maintain production quality while reducing carbon emissions and operational costs.Expand Specific Solutions03 Advanced burner technology for fuel efficiency

Advanced burner designs specifically engineered for rotary kilns can significantly improve fuel efficiency through better combustion control and heat distribution. These technologies include multi-channel burners, low-NOx burners, and burners with adjustable flame characteristics. By optimizing the combustion process, these advanced burners ensure more complete fuel utilization, reduced heat loss, and improved thermal efficiency throughout the kiln system.Expand Specific Solutions04 Process control and monitoring systems

Sophisticated control and monitoring systems can optimize fuel efficiency in rotary kilns by precisely regulating fuel-to-air ratios, temperature profiles, and material flow. These systems employ sensors, predictive models, and automated controls to maintain optimal operating conditions regardless of fuel type or quality variations. Real-time adjustments based on continuous monitoring help minimize energy consumption while maintaining product quality and production rates, resulting in significant fuel savings.Expand Specific Solutions05 Heat recovery and thermal efficiency improvements

Implementing heat recovery systems and thermal efficiency improvements in rotary kiln operations can substantially reduce fuel consumption. These technologies include preheaters, heat exchangers, insulation improvements, and waste heat recovery systems that capture and reuse thermal energy that would otherwise be lost. By maximizing the utilization of generated heat and minimizing thermal losses, these systems can significantly reduce the overall fuel requirements while maintaining or improving production capacity.Expand Specific Solutions

Major Industry Players in Rotary Kiln Fuel Solutions

The fuel switching landscape in rotary kilns is evolving rapidly as industries transition toward cleaner energy options. Currently, the market is in a growth phase with increasing demand for sustainable alternatives, driven by stringent emissions regulations. Companies like FLSmidth, Air Liquide, and thyssenkrupp are leading technological innovations in this space, while Guangzhou Devotion Thermal and Coolbrook are advancing biomass and alternative fuel technologies. The cement industry, represented by players such as Taiheiyo Cement and KHD Humboldt Wedag, is particularly active in fuel switching initiatives. The technology maturity varies significantly: gas solutions are well-established, oil options are mature but declining due to environmental concerns, while biomass technologies are gaining momentum but still require optimization for widespread industrial adoption.

FLSmidth A/S

Technical Solution: FLSmidth has developed advanced multi-fuel firing systems for rotary kilns that enable seamless switching between gas, oil, and various biomass fuels. Their technology incorporates specialized burner designs with adjustable flame characteristics to accommodate different fuel properties. The company's MissionZero program specifically targets fuel flexibility in cement production, with their JETFLEX burner allowing producers to use up to 100% alternative fuels. Their system includes sophisticated fuel preparation equipment that can process various biomass materials to achieve consistent particle size and moisture content, ensuring stable combustion. FLSmidth's control systems provide real-time monitoring and automatic adjustment of air-to-fuel ratios during fuel transitions, minimizing production disruptions and maintaining product quality. Recent implementations have demonstrated CO2 emission reductions of up to 40% when switching from fossil fuels to biomass alternatives.

Strengths: Highly adaptable burner technology that maintains clinker quality during fuel transitions; comprehensive fuel preparation systems for various biomass types; advanced control systems for optimizing combustion parameters. Weaknesses: Higher initial capital investment compared to single-fuel systems; requires more complex maintenance procedures; biomass fuel preparation adds operational complexity.

Coolbrook Oy

Technical Solution: Coolbrook has pioneered the Roto Dynamic Heater (RDH) technology, a revolutionary approach to heating in rotary kilns that can replace conventional combustion processes entirely. Rather than focusing on fuel switching, their technology transforms the fundamental heating mechanism by using electric-powered rotor systems to generate heat through friction and compression. This enables complete elimination of direct fossil fuel combustion in high-temperature industrial processes. The RDH technology can achieve temperatures exceeding 1700°C, sufficient for cement and chemical processing applications. Their system integrates with renewable electricity sources, creating a pathway to fully decarbonize rotary kiln operations without the combustion-related challenges of traditional fuel switching. Coolbrook's pilot installations have demonstrated energy efficiency improvements of 30-40% compared to conventional fossil fuel firing systems, with the potential to eliminate up to 2.4 billion tons of CO2 emissions annually if deployed across all suitable industrial applications.

Strengths: Complete elimination of direct combustion emissions; significantly higher energy efficiency than combustion-based systems; eliminates challenges of handling multiple fuel types. Weaknesses: Requires substantial modification to existing kiln infrastructure; dependent on access to abundant renewable electricity; higher upfront capital costs than conventional fuel switching solutions.

Key Technical Innovations in Multi-Fuel Kiln Operations

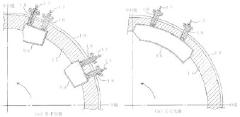

Oxygen injection for alternative fuels used in cement production

PatentPendingUS20230175781A1

Innovation

- The introduction of a system that includes a precalciner oxygen injector and an ancillary oxygen injector to enhance combustion by delivering targeted oxygen streams to the biomass fuel and heated air, ensuring improved ignition and burn-out of biomass fuels, while maintaining process temperature and production continuity.

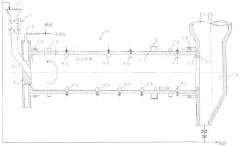

Rotary kiln type gasification furnace

PatentActiveJP2018135451A

Innovation

- The implementation of pipe lifters and reverse feed chutes within the rotary kiln, designed to enhance solid-gas reaction efficiency by preheating, thermal decomposition, and water-gas reactions, with components made of heat-resistant materials to withstand high temperatures and minimize refractory wear, and the use of partial combustion heat as a heat source.

Environmental Impact Assessment of Different Fuel Options

The environmental impact of fuel choices in rotary kilns represents a critical consideration for industries seeking to balance operational efficiency with sustainability goals. Natural gas, traditionally favored for its relatively clean combustion profile, produces significantly lower particulate matter and sulfur dioxide emissions compared to heavy fuel oil. When properly combusted, natural gas generates approximately 40-50% less carbon dioxide per unit of energy than coal and 25-30% less than oil, making it the cleanest fossil fuel option available for kiln operations.

Heavy fuel oil, while offering high energy density and established infrastructure advantages, presents substantial environmental challenges. Its combustion typically results in elevated levels of sulfur oxides (SOx), nitrogen oxides (NOx), and particulate matter. Modern emission control technologies such as flue gas desulfurization and selective catalytic reduction can mitigate these impacts, though implementation costs remain significant for many operators.

Biomass fuels represent an increasingly viable alternative with distinct environmental advantages. When sourced sustainably, biomass can approach carbon neutrality in its lifecycle assessment, as the carbon released during combustion was previously sequestered during plant growth. Studies indicate that substituting even 20-30% of conventional fuels with biomass can reduce net greenhouse gas emissions by 15-25% in rotary kiln operations. However, biomass utilization introduces concerns regarding land use change, biodiversity impacts, and competition with food production when not properly managed.

Water consumption patterns vary significantly across fuel options. Oil-based systems typically require substantial water for cooling and emission control processes, while natural gas systems generally demonstrate lower water intensity. Biomass preparation and handling may introduce additional water requirements, though these vary considerably based on feedstock type and preprocessing methods.

Lifecycle assessment (LCA) methodologies reveal that fuel switching decisions must consider upstream and downstream environmental impacts beyond direct combustion effects. Natural gas extraction involves methane leakage concerns, oil production carries risks of spills and habitat disruption, while biomass cultivation impacts depend heavily on land management practices and transportation distances.

Regulatory frameworks increasingly influence fuel selection decisions, with carbon pricing mechanisms, emission trading schemes, and renewable portfolio standards creating economic incentives that can fundamentally alter the comparative advantage of different fuel options. The European Union Emissions Trading System, for instance, has accelerated the transition away from carbon-intensive fuels in cement and lime production sectors that utilize rotary kilns.

Local environmental considerations, including air quality management zones, water scarcity conditions, and community health impacts, further complicate the environmental assessment of fuel switching initiatives, necessitating site-specific analysis rather than generalized conclusions about optimal fuel pathways.

Heavy fuel oil, while offering high energy density and established infrastructure advantages, presents substantial environmental challenges. Its combustion typically results in elevated levels of sulfur oxides (SOx), nitrogen oxides (NOx), and particulate matter. Modern emission control technologies such as flue gas desulfurization and selective catalytic reduction can mitigate these impacts, though implementation costs remain significant for many operators.

Biomass fuels represent an increasingly viable alternative with distinct environmental advantages. When sourced sustainably, biomass can approach carbon neutrality in its lifecycle assessment, as the carbon released during combustion was previously sequestered during plant growth. Studies indicate that substituting even 20-30% of conventional fuels with biomass can reduce net greenhouse gas emissions by 15-25% in rotary kiln operations. However, biomass utilization introduces concerns regarding land use change, biodiversity impacts, and competition with food production when not properly managed.

Water consumption patterns vary significantly across fuel options. Oil-based systems typically require substantial water for cooling and emission control processes, while natural gas systems generally demonstrate lower water intensity. Biomass preparation and handling may introduce additional water requirements, though these vary considerably based on feedstock type and preprocessing methods.

Lifecycle assessment (LCA) methodologies reveal that fuel switching decisions must consider upstream and downstream environmental impacts beyond direct combustion effects. Natural gas extraction involves methane leakage concerns, oil production carries risks of spills and habitat disruption, while biomass cultivation impacts depend heavily on land management practices and transportation distances.

Regulatory frameworks increasingly influence fuel selection decisions, with carbon pricing mechanisms, emission trading schemes, and renewable portfolio standards creating economic incentives that can fundamentally alter the comparative advantage of different fuel options. The European Union Emissions Trading System, for instance, has accelerated the transition away from carbon-intensive fuels in cement and lime production sectors that utilize rotary kilns.

Local environmental considerations, including air quality management zones, water scarcity conditions, and community health impacts, further complicate the environmental assessment of fuel switching initiatives, necessitating site-specific analysis rather than generalized conclusions about optimal fuel pathways.

Economic Feasibility and ROI Analysis of Fuel Switching

The economic feasibility of fuel switching in rotary kilns represents a critical decision point for manufacturers seeking to optimize operational costs while addressing environmental concerns. Initial capital expenditure varies significantly across fuel options, with natural gas systems typically requiring investments of $1.5-3 million for conversion, oil-based systems averaging $1-2 million, and biomass installations demanding $3-5 million due to additional handling and processing equipment requirements.

Operational cost differentials create compelling long-term economic cases for specific fuel transitions. Natural gas offers 15-25% lower operational costs compared to oil, primarily due to stable pricing trends and reduced maintenance requirements. Biomass presents variable economics depending on feedstock availability, with potential operational savings of 20-40% when locally sourced waste materials are utilized, though these savings diminish considerably when transportation distances exceed 100 kilometers.

Return on investment timelines demonstrate significant variation across industries and fuel types. Gas conversion projects typically achieve payback periods of 2-4 years in high-energy consumption applications such as cement production. Oil-to-biomass transitions show longer payback periods of 4-7 years but offer greater long-term cost stability. The ROI calculations must incorporate carbon pricing mechanisms, which increasingly favor biomass solutions despite higher initial investments.

Sensitivity analysis reveals that fuel price volatility represents the most significant risk factor in economic projections. Natural gas conversion projects remain economically viable even with 30% price increases, while oil-based systems become financially challenging with just 15% price escalation. Biomass systems demonstrate the greatest resilience to market fluctuations but remain vulnerable to feedstock availability constraints.

Regional economic incentives substantially alter the financial calculus of fuel switching initiatives. European manufacturers benefit from carbon credit systems that can accelerate ROI timelines by 15-30% for biomass conversions. North American operations often leverage tax incentives reducing initial capital requirements by 10-20%, while developing markets frequently offer subsidized financing for cleaner fuel technologies.

The total cost of ownership analysis demonstrates that while natural gas presents the lowest immediate conversion costs, biomass systems typically deliver superior lifetime economic performance when operational spans exceed 15 years. This advantage stems from insulation against fossil fuel price volatility and increasing carbon taxation regimes, providing a hedge against future regulatory changes.

Operational cost differentials create compelling long-term economic cases for specific fuel transitions. Natural gas offers 15-25% lower operational costs compared to oil, primarily due to stable pricing trends and reduced maintenance requirements. Biomass presents variable economics depending on feedstock availability, with potential operational savings of 20-40% when locally sourced waste materials are utilized, though these savings diminish considerably when transportation distances exceed 100 kilometers.

Return on investment timelines demonstrate significant variation across industries and fuel types. Gas conversion projects typically achieve payback periods of 2-4 years in high-energy consumption applications such as cement production. Oil-to-biomass transitions show longer payback periods of 4-7 years but offer greater long-term cost stability. The ROI calculations must incorporate carbon pricing mechanisms, which increasingly favor biomass solutions despite higher initial investments.

Sensitivity analysis reveals that fuel price volatility represents the most significant risk factor in economic projections. Natural gas conversion projects remain economically viable even with 30% price increases, while oil-based systems become financially challenging with just 15% price escalation. Biomass systems demonstrate the greatest resilience to market fluctuations but remain vulnerable to feedstock availability constraints.

Regional economic incentives substantially alter the financial calculus of fuel switching initiatives. European manufacturers benefit from carbon credit systems that can accelerate ROI timelines by 15-30% for biomass conversions. North American operations often leverage tax incentives reducing initial capital requirements by 10-20%, while developing markets frequently offer subsidized financing for cleaner fuel technologies.

The total cost of ownership analysis demonstrates that while natural gas presents the lowest immediate conversion costs, biomass systems typically deliver superior lifetime economic performance when operational spans exceed 15 years. This advantage stems from insulation against fossil fuel price volatility and increasing carbon taxation regimes, providing a hedge against future regulatory changes.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!