Market Entry Strategies For Novel Biomaterial Startups

SEP 2, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Biomaterial Innovation Landscape and Objectives

The biomaterials industry has undergone significant evolution over the past three decades, transitioning from simple replacement materials to sophisticated bioactive and biomimetic solutions. This progression reflects broader technological advances in materials science, biotechnology, and regenerative medicine. Current innovation trajectories point toward personalized biomaterials, smart responsive systems, and sustainable bio-based alternatives to synthetic polymers.

The global biomaterials market, valued at approximately $106.5 billion in 2022, is projected to reach $207 billion by 2030, growing at a CAGR of 14.5%. This growth is driven by increasing applications in tissue engineering, drug delivery systems, orthopedics, cardiovascular treatments, and wound healing technologies. Emerging economies, particularly in Asia-Pacific, represent rapidly expanding markets due to improving healthcare infrastructure and rising medical tourism.

Technical objectives in the biomaterials sector focus on addressing several persistent challenges. Biocompatibility remains paramount, with researchers seeking materials that integrate seamlessly with biological systems while minimizing immune responses. Mechanical property optimization continues to be critical, particularly for load-bearing applications where materials must simultaneously provide structural support and promote tissue regeneration.

Biodegradability with controlled degradation kinetics represents another key objective, allowing materials to support healing processes and then safely disappear once their function is complete. Antimicrobial properties are increasingly prioritized to combat healthcare-associated infections, with research focusing on intrinsically antimicrobial materials and controlled-release antimicrobial agents.

Manufacturing scalability presents significant challenges for novel biomaterials, as laboratory-scale production methods often prove difficult to translate to commercial volumes while maintaining consistent quality. Regulatory pathways for innovative biomaterials remain complex, with approval processes typically requiring extensive safety and efficacy data.

For startups entering this space, clear technical objectives should include developing proprietary biomaterial platforms with demonstrable advantages over existing solutions, establishing robust intellectual property positions, and generating compelling preclinical data packages. Strategic partnerships with established medical device manufacturers or pharmaceutical companies can accelerate commercialization pathways.

The convergence of biomaterials science with adjacent technologies—including 3D bioprinting, nanotechnology, and artificial intelligence—creates fertile ground for disruptive innovation. Successful market entry strategies will leverage these intersections to develop differentiated products addressing unmet clinical needs while navigating the complex regulatory landscape governing biomaterial commercialization.

The global biomaterials market, valued at approximately $106.5 billion in 2022, is projected to reach $207 billion by 2030, growing at a CAGR of 14.5%. This growth is driven by increasing applications in tissue engineering, drug delivery systems, orthopedics, cardiovascular treatments, and wound healing technologies. Emerging economies, particularly in Asia-Pacific, represent rapidly expanding markets due to improving healthcare infrastructure and rising medical tourism.

Technical objectives in the biomaterials sector focus on addressing several persistent challenges. Biocompatibility remains paramount, with researchers seeking materials that integrate seamlessly with biological systems while minimizing immune responses. Mechanical property optimization continues to be critical, particularly for load-bearing applications where materials must simultaneously provide structural support and promote tissue regeneration.

Biodegradability with controlled degradation kinetics represents another key objective, allowing materials to support healing processes and then safely disappear once their function is complete. Antimicrobial properties are increasingly prioritized to combat healthcare-associated infections, with research focusing on intrinsically antimicrobial materials and controlled-release antimicrobial agents.

Manufacturing scalability presents significant challenges for novel biomaterials, as laboratory-scale production methods often prove difficult to translate to commercial volumes while maintaining consistent quality. Regulatory pathways for innovative biomaterials remain complex, with approval processes typically requiring extensive safety and efficacy data.

For startups entering this space, clear technical objectives should include developing proprietary biomaterial platforms with demonstrable advantages over existing solutions, establishing robust intellectual property positions, and generating compelling preclinical data packages. Strategic partnerships with established medical device manufacturers or pharmaceutical companies can accelerate commercialization pathways.

The convergence of biomaterials science with adjacent technologies—including 3D bioprinting, nanotechnology, and artificial intelligence—creates fertile ground for disruptive innovation. Successful market entry strategies will leverage these intersections to develop differentiated products addressing unmet clinical needs while navigating the complex regulatory landscape governing biomaterial commercialization.

Market Demand Analysis for Novel Biomaterials

The global biomaterials market is experiencing robust growth, projected to reach $296.5 billion by 2028, with a compound annual growth rate of 15.3% from 2021. This significant expansion is driven by several converging factors, including an aging global population, increasing prevalence of chronic diseases, and growing demand for advanced medical treatments. Novel biomaterials are particularly sought after in orthopedics, cardiovascular applications, wound healing, drug delivery systems, and tissue engineering.

Healthcare providers are increasingly demanding biomaterials with enhanced biocompatibility, reduced rejection rates, and improved integration with natural tissues. The shift toward personalized medicine has created substantial opportunities for customized biomaterial solutions that can be tailored to individual patient needs, representing a high-value market segment with premium pricing potential.

Regulatory changes worldwide are favoring innovative biomaterials that demonstrate superior safety profiles and clinical outcomes. Markets in North America and Europe currently dominate biomaterial consumption, but emerging economies in Asia-Pacific, particularly China and India, are showing the fastest growth rates due to improving healthcare infrastructure and increasing healthcare expenditure.

Consumer trends indicate growing preference for sustainable and eco-friendly biomaterials, creating new market niches for startups focusing on green technologies. The COVID-19 pandemic has accelerated demand for antimicrobial biomaterials and those that can be used in rapid diagnostic tools and vaccine delivery systems.

Investment patterns reveal strong venture capital interest in novel biomaterial startups, with funding rounds increasing by 27% in the past three years. Strategic partnerships between biomaterial startups and established medical device manufacturers have become a common market entry pathway, allowing for shared development costs and access to established distribution networks.

Market barriers include lengthy regulatory approval processes, high initial development costs, and entrenched competition from established players. However, specialized applications addressing unmet medical needs present significant opportunities for market penetration. Reimbursement landscapes are increasingly favorable for novel biomaterials that demonstrate cost-effectiveness and improved patient outcomes.

Customer adoption cycles typically involve extensive clinical validation, requiring startups to develop robust evidence generation strategies. Early adopters are often found in academic medical centers and specialized clinics before broader market acceptance occurs. Price sensitivity varies significantly by application, with critical care and life-saving applications commanding premium pricing compared to more routine uses.

Healthcare providers are increasingly demanding biomaterials with enhanced biocompatibility, reduced rejection rates, and improved integration with natural tissues. The shift toward personalized medicine has created substantial opportunities for customized biomaterial solutions that can be tailored to individual patient needs, representing a high-value market segment with premium pricing potential.

Regulatory changes worldwide are favoring innovative biomaterials that demonstrate superior safety profiles and clinical outcomes. Markets in North America and Europe currently dominate biomaterial consumption, but emerging economies in Asia-Pacific, particularly China and India, are showing the fastest growth rates due to improving healthcare infrastructure and increasing healthcare expenditure.

Consumer trends indicate growing preference for sustainable and eco-friendly biomaterials, creating new market niches for startups focusing on green technologies. The COVID-19 pandemic has accelerated demand for antimicrobial biomaterials and those that can be used in rapid diagnostic tools and vaccine delivery systems.

Investment patterns reveal strong venture capital interest in novel biomaterial startups, with funding rounds increasing by 27% in the past three years. Strategic partnerships between biomaterial startups and established medical device manufacturers have become a common market entry pathway, allowing for shared development costs and access to established distribution networks.

Market barriers include lengthy regulatory approval processes, high initial development costs, and entrenched competition from established players. However, specialized applications addressing unmet medical needs present significant opportunities for market penetration. Reimbursement landscapes are increasingly favorable for novel biomaterials that demonstrate cost-effectiveness and improved patient outcomes.

Customer adoption cycles typically involve extensive clinical validation, requiring startups to develop robust evidence generation strategies. Early adopters are often found in academic medical centers and specialized clinics before broader market acceptance occurs. Price sensitivity varies significantly by application, with critical care and life-saving applications commanding premium pricing compared to more routine uses.

Current Biomaterial Technology Challenges

The biomaterials industry faces several significant technological challenges that impact novel startups attempting to enter this competitive market. Scale-up manufacturing remains one of the most formidable barriers, as laboratory-scale production methods often fail to translate efficiently to commercial volumes. This disconnect creates substantial cost inefficiencies and quality control issues that particularly affect startups with limited capital resources.

Regulatory compliance presents another major hurdle, with biomaterials facing stringent approval processes from agencies like the FDA and EMA. These processes typically require extensive clinical trials and safety documentation that can extend development timelines by 3-7 years and consume significant financial resources, creating a challenging environment for cash-constrained startups.

Biocompatibility and immunogenicity concerns continue to plague biomaterial development. Despite advances in material science, ensuring long-term compatibility with human tissues while preventing adverse immune responses remains technically challenging. Recent studies indicate that approximately 15-20% of promising biomaterials fail during advanced testing phases due to unforeseen immunological complications.

Consistency in material properties represents another critical challenge. Biomaterials often exhibit batch-to-batch variations that can significantly impact performance and safety profiles. This variability is particularly problematic for medical applications where precise material specifications are essential for regulatory approval and clinical efficacy.

The integration of biomaterials with existing medical technologies and manufacturing processes presents additional technical difficulties. Many novel biomaterials require specialized handling, processing, or sterilization methods that may be incompatible with standard medical device manufacturing protocols, creating barriers to adoption and commercialization.

Shelf-life and stability limitations affect many innovative biomaterials, particularly those derived from natural sources or incorporating biological components. These materials may degrade under standard storage conditions, requiring specialized preservation techniques that add complexity and cost to the supply chain.

Cost-effectiveness remains a persistent challenge, with many advanced biomaterials requiring expensive precursors, complex synthesis processes, or specialized equipment. These factors drive up production costs, making it difficult for startups to achieve competitive pricing while maintaining sustainable margins, especially when competing against established synthetic alternatives.

Environmental sustainability concerns are increasingly important, with growing regulatory and market pressure to develop biomaterials with reduced environmental footprints. Startups must balance performance requirements with sustainability considerations, often requiring innovative approaches to material sourcing, processing, and end-of-life management.

Regulatory compliance presents another major hurdle, with biomaterials facing stringent approval processes from agencies like the FDA and EMA. These processes typically require extensive clinical trials and safety documentation that can extend development timelines by 3-7 years and consume significant financial resources, creating a challenging environment for cash-constrained startups.

Biocompatibility and immunogenicity concerns continue to plague biomaterial development. Despite advances in material science, ensuring long-term compatibility with human tissues while preventing adverse immune responses remains technically challenging. Recent studies indicate that approximately 15-20% of promising biomaterials fail during advanced testing phases due to unforeseen immunological complications.

Consistency in material properties represents another critical challenge. Biomaterials often exhibit batch-to-batch variations that can significantly impact performance and safety profiles. This variability is particularly problematic for medical applications where precise material specifications are essential for regulatory approval and clinical efficacy.

The integration of biomaterials with existing medical technologies and manufacturing processes presents additional technical difficulties. Many novel biomaterials require specialized handling, processing, or sterilization methods that may be incompatible with standard medical device manufacturing protocols, creating barriers to adoption and commercialization.

Shelf-life and stability limitations affect many innovative biomaterials, particularly those derived from natural sources or incorporating biological components. These materials may degrade under standard storage conditions, requiring specialized preservation techniques that add complexity and cost to the supply chain.

Cost-effectiveness remains a persistent challenge, with many advanced biomaterials requiring expensive precursors, complex synthesis processes, or specialized equipment. These factors drive up production costs, making it difficult for startups to achieve competitive pricing while maintaining sustainable margins, especially when competing against established synthetic alternatives.

Environmental sustainability concerns are increasingly important, with growing regulatory and market pressure to develop biomaterials with reduced environmental footprints. Startups must balance performance requirements with sustainability considerations, often requiring innovative approaches to material sourcing, processing, and end-of-life management.

Current Market Entry Strategies

01 Biocompatible materials for medical implants

Novel biomaterials designed specifically for medical implants with enhanced biocompatibility properties. These materials are engineered to integrate with biological tissues while minimizing rejection or adverse immune responses. They often incorporate surface modifications or specialized coatings that promote cell adhesion and tissue integration. These biomaterials can be used in various applications including orthopedic implants, dental materials, and cardiovascular devices.- Biocompatible materials for medical implants and devices: Novel biomaterials designed specifically for medical implants and devices with enhanced biocompatibility properties. These materials are engineered to integrate with biological tissues, reduce rejection risks, and provide structural support. They include advanced polymers, composites, and surface-modified materials that can be used in various applications such as orthopedic implants, cardiovascular devices, and tissue engineering scaffolds.

- Biodegradable and bioresorbable materials: Development of biomaterials that can safely degrade or be resorbed by the body over time, eliminating the need for removal surgeries. These materials are designed with controlled degradation rates to match tissue healing processes and include modified natural polymers, synthetic polyesters, and bioactive ceramics. Applications include temporary implants, drug delivery systems, and tissue engineering scaffolds that provide initial support before gradually transferring load to regenerating tissues.

- Biomaterials for tissue engineering and regenerative medicine: Advanced biomaterials specifically designed to support cell growth, differentiation, and tissue formation. These materials serve as scaffolds that mimic the extracellular matrix and provide structural support while promoting tissue regeneration. They incorporate bioactive components that can stimulate specific cellular responses and may be combined with growth factors or stem cells to enhance tissue repair and regeneration in various applications including wound healing, organ replacement, and treatment of degenerative diseases.

- Smart and responsive biomaterials: Innovative biomaterials that can respond to specific biological stimuli or environmental changes such as pH, temperature, or mechanical stress. These materials can change their properties, structure, or function in response to these stimuli, enabling applications such as controlled drug release, self-healing implants, and adaptive tissue scaffolds. They incorporate advanced polymer systems, nanocomposites, and biomimetic designs that can interact dynamically with biological environments.

- Characterization and testing methods for novel biomaterials: Advanced techniques and methodologies for evaluating the properties, performance, and safety of novel biomaterials. These include specialized analytical instruments, imaging technologies, and testing protocols to assess mechanical properties, biocompatibility, degradation behavior, and biological interactions. The methods help in quality control, regulatory compliance, and optimization of biomaterial design for specific applications, ensuring their efficacy and safety before clinical use.

02 Biodegradable and bioresorbable polymers

Advanced biodegradable polymers that can be metabolized and eliminated by the body after serving their purpose. These materials are designed with controlled degradation rates to match tissue healing or drug delivery requirements. The polymers can be natural or synthetic and are often used in tissue engineering scaffolds, drug delivery systems, and temporary implants. Their degradation products are non-toxic and can be easily processed by the body's natural metabolic pathways.Expand Specific Solutions03 Biomaterials for tissue engineering and regeneration

Specialized biomaterials designed to support tissue growth and regeneration. These materials serve as scaffolds that mimic the extracellular matrix, providing structural support while promoting cell attachment, proliferation, and differentiation. They often incorporate growth factors or other bioactive molecules to enhance tissue formation. Applications include skin substitutes, bone regeneration matrices, and engineered tissues for organ replacement.Expand Specific Solutions04 Smart responsive biomaterials

Innovative biomaterials that can respond to specific biological or environmental stimuli such as temperature, pH, light, or biochemical signals. These materials can change their properties, structure, or function in response to these stimuli, enabling applications such as controlled drug release, self-healing materials, or shape-memory implants. The responsive nature allows for dynamic interaction with biological systems and targeted therapeutic effects.Expand Specific Solutions05 Nanostructured biomaterials and composites

Advanced biomaterials with nanoscale features or components that enhance their performance and functionality. These materials often combine organic and inorganic components to create composites with superior mechanical, biological, or antimicrobial properties. Nanostructuring can improve surface interactions with cells, enhance drug loading capacity, or provide unique mechanical properties. Applications include antimicrobial surfaces, high-strength implants, and advanced drug delivery systems.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The biomaterials market is currently in a growth phase, characterized by increasing innovation and commercialization opportunities for novel startups. The global biomaterials market is projected to reach significant scale, driven by applications in medical devices, tissue engineering, and regenerative medicine. From a technological maturity perspective, the landscape shows varied development stages across different biomaterial applications. Academic institutions like University of Zurich, ETH Zurich, and EPFL are driving fundamental research, while companies such as Seed Health, FibroGen, and Medtronic are advancing commercial applications. Technology transfer organizations like Yissum Research Development are bridging the research-commercialization gap. Pharmaceutical giants including Novartis and Boston Scientific provide potential partnership and acquisition pathways for startups, creating a dynamic ecosystem where novel biomaterial innovations can find multiple market entry points through strategic collaborations.

Yissum Research Development Co. Ltd.

Technical Solution: Yissum, the technology transfer company of the Hebrew University of Jerusalem, has developed a comprehensive market entry strategy for biomaterial startups focusing on licensing and partnership models. Their approach involves creating a pipeline of university-developed biomaterials with proven efficacy and then strategically licensing these technologies to established industry players. Yissum employs a staged commercialization process that begins with rigorous scientific validation, followed by intellectual property protection, and culminating in strategic partnerships with industry leaders. Their technology transfer model emphasizes early-stage risk mitigation through preliminary market validation and regulatory pathway planning. Yissum has successfully commercialized several novel biomaterials, including regenerative scaffolds and drug delivery systems, by leveraging their extensive network of industry connections and providing startups with access to specialized facilities and expertise.

Strengths: Strong academic-industry bridge with established networks for technology transfer; comprehensive IP protection strategies; access to world-class research facilities. Weaknesses: Potential for lengthy commercialization timelines due to academic origins; may face challenges with scaling manufacturing processes beyond laboratory settings.

Medtronic, Inc.

Technical Solution: Medtronic has pioneered an acquisition-based market entry strategy for novel biomaterials, focusing on identifying and integrating promising startups into their established commercial infrastructure. Their approach involves a systematic scouting process to identify biomaterial innovations that complement their existing product lines, particularly in cardiovascular, orthopedic, and neurological applications. Medtronic's strategy includes providing startups with access to their regulatory expertise, manufacturing capabilities, and global distribution networks, significantly accelerating time-to-market. They implement a phased integration model that preserves the innovative culture of acquired startups while providing the resources needed for commercial scale-up. Medtronic has established dedicated innovation centers that serve as incubators for biomaterial technologies, offering startups access to clinical testing resources and market intelligence. Their approach emphasizes regulatory compliance from early development stages, with dedicated teams to navigate the complex approval processes for novel biomaterials across different global markets.

Strengths: Extensive global distribution network; robust regulatory expertise; significant financial resources for scaling operations; established relationships with healthcare providers. Weaknesses: Potential for bureaucratic processes that may slow innovation; risk of smaller technologies being deprioritized within the larger corporate portfolio.

Critical Patents and Research Breakthroughs

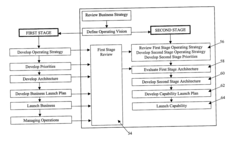

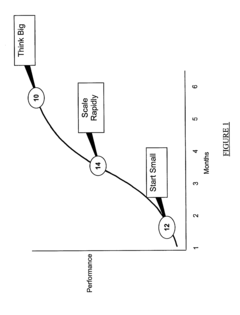

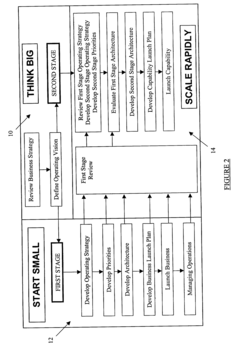

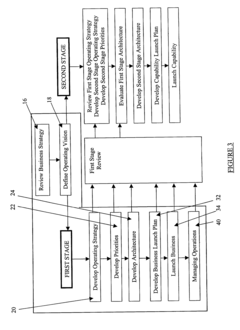

Method for guiding a business after an initial funding state to an initial public offering readiness state

PatentInactiveUS20030216926A1

Innovation

- A method comprising a two-stage approach to guide businesses from an initial funding state to IPO readiness, focusing on 'Think Big', 'Start Small', and 'Scale Rapidly' by compressing the timeframe for launching and maturing the business, with the first stage emphasizing quick market entry and brand building, and the second stage focusing on market capture, customer retention, and infrastructure development.

Regulatory Framework for Biomaterial Commercialization

The regulatory landscape for biomaterial commercialization represents one of the most critical factors determining market entry success for novel biomaterial startups. Navigating this complex framework requires thorough understanding of multiple regulatory bodies and their specific requirements across different jurisdictions.

In the United States, the Food and Drug Administration (FDA) serves as the primary regulatory authority, categorizing biomaterials under different pathways depending on their intended use and risk profile. Medical devices incorporating biomaterials typically follow the 510(k) clearance process, Premarket Approval (PMA), or the De Novo classification request. Biomaterials used in drug delivery systems may require New Drug Application (NDA) or Abbreviated New Drug Application (ANDA) pathways.

The European Union operates under the Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR), which replaced the previous Medical Device Directive in 2021. This transition has significantly increased regulatory scrutiny, particularly for higher-risk biomaterials. The CE marking process now demands more comprehensive clinical evidence and post-market surveillance plans, creating additional hurdles for startups.

Asian markets present varying regulatory frameworks, with Japan's Pharmaceuticals and Medical Devices Agency (PMDA) known for its stringent requirements, while China's National Medical Products Administration (NMPA) has been streamlining its approval processes to accelerate innovation while maintaining safety standards.

Biomaterial startups must also navigate specific regulations concerning biological source materials. Products derived from human or animal tissues face additional scrutiny regarding sourcing, processing, and risk mitigation for disease transmission. Environmental regulations further impact biomaterial development, particularly for biodegradable materials where lifecycle assessment becomes a regulatory consideration.

Recent regulatory trends indicate a shift toward harmonization efforts through initiatives like the Medical Device Single Audit Program (MDSAP) and International Medical Device Regulators Forum (IMDRF). These programs aim to standardize requirements across multiple jurisdictions, potentially reducing regulatory burden for startups targeting global markets.

Successful navigation of these regulatory frameworks requires early engagement with regulatory authorities through pre-submission meetings and consultation programs specifically designed for small businesses and innovative technologies. Many jurisdictions now offer accelerated pathways for breakthrough technologies addressing unmet medical needs, providing opportunities for novel biomaterial startups to expedite market entry while maintaining compliance with safety and efficacy standards.

In the United States, the Food and Drug Administration (FDA) serves as the primary regulatory authority, categorizing biomaterials under different pathways depending on their intended use and risk profile. Medical devices incorporating biomaterials typically follow the 510(k) clearance process, Premarket Approval (PMA), or the De Novo classification request. Biomaterials used in drug delivery systems may require New Drug Application (NDA) or Abbreviated New Drug Application (ANDA) pathways.

The European Union operates under the Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR), which replaced the previous Medical Device Directive in 2021. This transition has significantly increased regulatory scrutiny, particularly for higher-risk biomaterials. The CE marking process now demands more comprehensive clinical evidence and post-market surveillance plans, creating additional hurdles for startups.

Asian markets present varying regulatory frameworks, with Japan's Pharmaceuticals and Medical Devices Agency (PMDA) known for its stringent requirements, while China's National Medical Products Administration (NMPA) has been streamlining its approval processes to accelerate innovation while maintaining safety standards.

Biomaterial startups must also navigate specific regulations concerning biological source materials. Products derived from human or animal tissues face additional scrutiny regarding sourcing, processing, and risk mitigation for disease transmission. Environmental regulations further impact biomaterial development, particularly for biodegradable materials where lifecycle assessment becomes a regulatory consideration.

Recent regulatory trends indicate a shift toward harmonization efforts through initiatives like the Medical Device Single Audit Program (MDSAP) and International Medical Device Regulators Forum (IMDRF). These programs aim to standardize requirements across multiple jurisdictions, potentially reducing regulatory burden for startups targeting global markets.

Successful navigation of these regulatory frameworks requires early engagement with regulatory authorities through pre-submission meetings and consultation programs specifically designed for small businesses and innovative technologies. Many jurisdictions now offer accelerated pathways for breakthrough technologies addressing unmet medical needs, providing opportunities for novel biomaterial startups to expedite market entry while maintaining compliance with safety and efficacy standards.

Funding Mechanisms and Investment Trends

The biomaterials startup ecosystem has witnessed significant evolution in funding mechanisms over the past decade. Venture capital investment in biomaterials reached approximately $4.2 billion globally in 2022, representing a 35% increase from the previous year. This growth trajectory underscores the increasing investor confidence in novel biomaterials as commercially viable solutions across healthcare, consumer products, and industrial applications.

Traditional venture capital remains the predominant funding source, with specialized life science VCs like OrbiMed, ARCH Venture Partners, and Flagship Pioneering leading significant early-stage investments. These firms typically seek biomaterial startups with clear intellectual property positions and defined commercial applications, particularly those addressing unmet medical needs or sustainability challenges.

Government grants constitute another critical funding channel, with programs like the NIH SBIR/STTR in the US, Horizon Europe in the EU, and various national innovation funds providing non-dilutive capital for early-stage research and development. These grants often bridge the "valley of death" between academic research and commercial viability, enabling crucial proof-of-concept work and initial regulatory studies.

Corporate strategic investment has emerged as an increasingly important funding mechanism, with major pharmaceutical, medical device, and consumer product companies establishing dedicated corporate venture arms focused on biomaterials innovation. These investments frequently include strategic partnerships that provide startups with access to manufacturing expertise, regulatory guidance, and established distribution channels alongside capital.

Recent investment trends reveal growing interest in biomaterials with multifunctional properties, particularly those addressing sustainability challenges. Investments in biodegradable polymers, plant-based alternatives to petroleum-derived materials, and regenerative biomaterials have seen compound annual growth rates exceeding 40% since 2019. Additionally, biomaterials enabling advanced drug delivery systems and tissue engineering applications continue attracting premium valuations.

The funding landscape also shows increasing geographic diversification, with significant growth in Asian investment, particularly from China, Singapore, and Japan. These regions are establishing specialized biomaterial innovation hubs with integrated funding mechanisms combining government support, academic partnerships, and private capital. This trend creates new opportunities for cross-border collaborations and market access strategies for Western biomaterial startups.

Successful biomaterial startups typically pursue staged funding strategies aligned with technical milestones and regulatory pathways. Early-stage funding focuses on proof-of-concept and initial safety data, while Series A and B rounds typically support clinical trials, regulatory submissions, and manufacturing scale-up. This milestone-based approach helps manage investor expectations while navigating the lengthy development timelines characteristic of biomaterial innovations.

Traditional venture capital remains the predominant funding source, with specialized life science VCs like OrbiMed, ARCH Venture Partners, and Flagship Pioneering leading significant early-stage investments. These firms typically seek biomaterial startups with clear intellectual property positions and defined commercial applications, particularly those addressing unmet medical needs or sustainability challenges.

Government grants constitute another critical funding channel, with programs like the NIH SBIR/STTR in the US, Horizon Europe in the EU, and various national innovation funds providing non-dilutive capital for early-stage research and development. These grants often bridge the "valley of death" between academic research and commercial viability, enabling crucial proof-of-concept work and initial regulatory studies.

Corporate strategic investment has emerged as an increasingly important funding mechanism, with major pharmaceutical, medical device, and consumer product companies establishing dedicated corporate venture arms focused on biomaterials innovation. These investments frequently include strategic partnerships that provide startups with access to manufacturing expertise, regulatory guidance, and established distribution channels alongside capital.

Recent investment trends reveal growing interest in biomaterials with multifunctional properties, particularly those addressing sustainability challenges. Investments in biodegradable polymers, plant-based alternatives to petroleum-derived materials, and regenerative biomaterials have seen compound annual growth rates exceeding 40% since 2019. Additionally, biomaterials enabling advanced drug delivery systems and tissue engineering applications continue attracting premium valuations.

The funding landscape also shows increasing geographic diversification, with significant growth in Asian investment, particularly from China, Singapore, and Japan. These regions are establishing specialized biomaterial innovation hubs with integrated funding mechanisms combining government support, academic partnerships, and private capital. This trend creates new opportunities for cross-border collaborations and market access strategies for Western biomaterial startups.

Successful biomaterial startups typically pursue staged funding strategies aligned with technical milestones and regulatory pathways. Early-stage funding focuses on proof-of-concept and initial safety data, while Series A and B rounds typically support clinical trials, regulatory submissions, and manufacturing scale-up. This milestone-based approach helps manage investor expectations while navigating the lengthy development timelines characteristic of biomaterial innovations.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!