Prussian White Versus Layered Oxide Cathodes For Cost And Durability

AUG 22, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Battery Cathode Technology Evolution and Objectives

Battery technology has evolved significantly over the past decades, with cathode materials playing a crucial role in determining battery performance, cost, and durability. The development of cathode materials has progressed through several generations, from simple lead-acid batteries to advanced lithium-ion chemistries. Early lithium-ion batteries utilized lithium cobalt oxide (LCO) cathodes, which offered high energy density but suffered from limited thermal stability and high costs due to cobalt content.

The evolution continued with the introduction of lithium manganese oxide (LMO), lithium iron phosphate (LFP), and various nickel-manganese-cobalt (NMC) formulations, each representing incremental improvements in specific performance aspects. Layered oxide cathodes, particularly NMC and NCA (nickel-cobalt-aluminum), have dominated the commercial market due to their high energy density, making them suitable for electric vehicles and portable electronics.

Concurrently, Prussian White materials, a class of coordination compounds with the general formula AxM[Fe(CN)6]y·□1-y·nH2O (where A represents alkali metals, M represents transition metals, and □ represents [Fe(CN)6] vacancies), have emerged as promising alternatives. These materials were initially explored for sodium-ion batteries but have gained attention for lithium-ion applications due to their potentially lower cost and improved sustainability profile.

The technical objectives in cathode development have consistently focused on five key parameters: energy density, power capability, cycle life, safety, and cost. Energy density determines the range of electric vehicles or runtime of portable devices, while power capability affects charging speed and high-current applications. Cycle life directly impacts the total cost of ownership and sustainability, while safety remains paramount for consumer acceptance and regulatory compliance.

Cost reduction has become increasingly important as battery applications scale up, particularly for electric vehicles and grid storage. This has driven research toward cathode materials with reduced dependence on critical raw materials like cobalt and nickel. Durability objectives have similarly evolved from basic cycle life requirements to more sophisticated metrics including calendar aging, performance under extreme temperatures, and resilience to fast charging.

The comparison between Prussian White and layered oxide cathodes represents a fundamental trade-off in current battery technology development. While layered oxides offer higher energy density, Prussian White materials potentially offer advantages in cost, resource availability, and certain durability aspects. This technological divergence reflects the broader industry trend toward application-specific optimization rather than a one-size-fits-all approach to battery chemistry.

The evolution continued with the introduction of lithium manganese oxide (LMO), lithium iron phosphate (LFP), and various nickel-manganese-cobalt (NMC) formulations, each representing incremental improvements in specific performance aspects. Layered oxide cathodes, particularly NMC and NCA (nickel-cobalt-aluminum), have dominated the commercial market due to their high energy density, making them suitable for electric vehicles and portable electronics.

Concurrently, Prussian White materials, a class of coordination compounds with the general formula AxM[Fe(CN)6]y·□1-y·nH2O (where A represents alkali metals, M represents transition metals, and □ represents [Fe(CN)6] vacancies), have emerged as promising alternatives. These materials were initially explored for sodium-ion batteries but have gained attention for lithium-ion applications due to their potentially lower cost and improved sustainability profile.

The technical objectives in cathode development have consistently focused on five key parameters: energy density, power capability, cycle life, safety, and cost. Energy density determines the range of electric vehicles or runtime of portable devices, while power capability affects charging speed and high-current applications. Cycle life directly impacts the total cost of ownership and sustainability, while safety remains paramount for consumer acceptance and regulatory compliance.

Cost reduction has become increasingly important as battery applications scale up, particularly for electric vehicles and grid storage. This has driven research toward cathode materials with reduced dependence on critical raw materials like cobalt and nickel. Durability objectives have similarly evolved from basic cycle life requirements to more sophisticated metrics including calendar aging, performance under extreme temperatures, and resilience to fast charging.

The comparison between Prussian White and layered oxide cathodes represents a fundamental trade-off in current battery technology development. While layered oxides offer higher energy density, Prussian White materials potentially offer advantages in cost, resource availability, and certain durability aspects. This technological divergence reflects the broader industry trend toward application-specific optimization rather than a one-size-fits-all approach to battery chemistry.

Market Analysis for Advanced Battery Cathode Materials

The global battery cathode materials market is experiencing significant growth, driven primarily by the expanding electric vehicle (EV) sector and increasing demand for energy storage solutions. Currently valued at approximately $27 billion, this market is projected to reach $58 billion by 2030, representing a compound annual growth rate of 8.9%. This growth trajectory is particularly relevant when comparing Prussian White and layered oxide cathode technologies, as both compete for market share in different application segments.

Layered oxide cathodes, particularly nickel-manganese-cobalt (NMC) and nickel-cobalt-aluminum (NCA) variants, currently dominate the premium EV battery market with approximately 70% market share. These materials are favored by automotive manufacturers seeking high energy density solutions, despite their higher costs and supply chain vulnerabilities related to cobalt and nickel sourcing.

Prussian White cathodes, while holding only about 5% of the current market, are gaining attention due to their cost advantages and superior durability characteristics. The average production cost of Prussian White cathodes is 30-40% lower than comparable layered oxide materials, primarily due to the absence of expensive elements like cobalt and reduced processing complexity. This cost differential is driving increased interest from manufacturers of grid storage systems and lower-cost electric vehicles.

Regional market dynamics show significant variations, with Asia-Pacific accounting for 65% of global cathode material production. China leads manufacturing capacity for both technologies, though recent policy shifts in North America and Europe aim to establish regional supply chains, potentially altering future market distribution patterns.

Consumer demand patterns indicate growing segmentation, with premium automotive applications continuing to favor layered oxides for their energy density advantages, while grid storage and commercial vehicle sectors increasingly adopt Prussian White solutions for their cost-efficiency and longer cycle life. Market research indicates that Prussian White cathodes typically demonstrate 20-30% longer operational lifespans in real-world applications compared to layered oxide alternatives.

The pricing trends further highlight market differentiation, with layered oxide cathode materials commanding $15-25 per kilogram, while Prussian White variants are available at $9-15 per kilogram. This price gap is expected to remain significant even as production scales increase for both technologies, maintaining Prussian White's position as the cost-effective alternative for durability-focused applications.

Market forecasts suggest that while layered oxides will maintain dominance in premium segments through 2025, Prussian White cathodes could capture up to 20% market share by 2030, particularly in stationary storage and commercial vehicle applications where cost and longevity outweigh energy density considerations.

Layered oxide cathodes, particularly nickel-manganese-cobalt (NMC) and nickel-cobalt-aluminum (NCA) variants, currently dominate the premium EV battery market with approximately 70% market share. These materials are favored by automotive manufacturers seeking high energy density solutions, despite their higher costs and supply chain vulnerabilities related to cobalt and nickel sourcing.

Prussian White cathodes, while holding only about 5% of the current market, are gaining attention due to their cost advantages and superior durability characteristics. The average production cost of Prussian White cathodes is 30-40% lower than comparable layered oxide materials, primarily due to the absence of expensive elements like cobalt and reduced processing complexity. This cost differential is driving increased interest from manufacturers of grid storage systems and lower-cost electric vehicles.

Regional market dynamics show significant variations, with Asia-Pacific accounting for 65% of global cathode material production. China leads manufacturing capacity for both technologies, though recent policy shifts in North America and Europe aim to establish regional supply chains, potentially altering future market distribution patterns.

Consumer demand patterns indicate growing segmentation, with premium automotive applications continuing to favor layered oxides for their energy density advantages, while grid storage and commercial vehicle sectors increasingly adopt Prussian White solutions for their cost-efficiency and longer cycle life. Market research indicates that Prussian White cathodes typically demonstrate 20-30% longer operational lifespans in real-world applications compared to layered oxide alternatives.

The pricing trends further highlight market differentiation, with layered oxide cathode materials commanding $15-25 per kilogram, while Prussian White variants are available at $9-15 per kilogram. This price gap is expected to remain significant even as production scales increase for both technologies, maintaining Prussian White's position as the cost-effective alternative for durability-focused applications.

Market forecasts suggest that while layered oxides will maintain dominance in premium segments through 2025, Prussian White cathodes could capture up to 20% market share by 2030, particularly in stationary storage and commercial vehicle applications where cost and longevity outweigh energy density considerations.

Current Challenges in Cathode Material Development

The development of cathode materials for lithium-ion batteries faces several significant challenges that impede the widespread adoption of advanced energy storage solutions. Layered oxide cathodes, predominantly represented by NMC (Nickel Manganese Cobalt) and NCA (Nickel Cobalt Aluminum) compositions, currently dominate the commercial market due to their high energy density. However, these materials suffer from structural instability during deep cycling, particularly at high voltages above 4.3V, leading to capacity fade and reduced battery lifespan.

Cost remains a critical barrier for layered oxide cathodes, primarily due to the reliance on cobalt, which faces supply chain vulnerabilities and ethical mining concerns. While the industry has been moving toward higher nickel content (NMC811) to reduce cobalt dependency, this shift introduces new stability challenges, including increased reactivity with electrolytes and thermal runaway risks.

Prussian White materials (AxM[Fe(CN)6]·yH2O, where A is an alkali metal and M is a transition metal) present an alternative approach with potentially lower material costs due to the absence of cobalt and nickel. However, they currently face challenges related to lower energy density compared to layered oxides, typically delivering 10-20% less specific capacity.

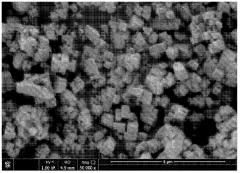

Water content management represents another significant challenge for Prussian White cathodes. The crystal structure contains coordinated and zeolitic water molecules that can affect ionic conductivity and structural stability. Controlling water content during synthesis and battery operation remains technically challenging but critical for performance optimization.

Manufacturing scalability differs significantly between these cathode types. Layered oxides benefit from established industrial production processes, while Prussian White materials require precise control of precipitation reactions to ensure structural uniformity and minimize defects. The presence of cyanide groups in Prussian White precursors also necessitates additional safety protocols during manufacturing.

Cycle life performance presents contrasting challenges: layered oxides suffer from transition metal dissolution and structural degradation during extended cycling, while Prussian White materials experience capacity fade primarily due to iron migration and phase transformations. Neither technology has fully resolved these durability limitations.

Electrolyte compatibility further complicates cathode development. Layered oxides typically require specialized electrolyte additives to form stable cathode-electrolyte interfaces, while Prussian White materials show different decomposition mechanisms that are not yet fully understood or mitigated in commercial cell designs.

Cost remains a critical barrier for layered oxide cathodes, primarily due to the reliance on cobalt, which faces supply chain vulnerabilities and ethical mining concerns. While the industry has been moving toward higher nickel content (NMC811) to reduce cobalt dependency, this shift introduces new stability challenges, including increased reactivity with electrolytes and thermal runaway risks.

Prussian White materials (AxM[Fe(CN)6]·yH2O, where A is an alkali metal and M is a transition metal) present an alternative approach with potentially lower material costs due to the absence of cobalt and nickel. However, they currently face challenges related to lower energy density compared to layered oxides, typically delivering 10-20% less specific capacity.

Water content management represents another significant challenge for Prussian White cathodes. The crystal structure contains coordinated and zeolitic water molecules that can affect ionic conductivity and structural stability. Controlling water content during synthesis and battery operation remains technically challenging but critical for performance optimization.

Manufacturing scalability differs significantly between these cathode types. Layered oxides benefit from established industrial production processes, while Prussian White materials require precise control of precipitation reactions to ensure structural uniformity and minimize defects. The presence of cyanide groups in Prussian White precursors also necessitates additional safety protocols during manufacturing.

Cycle life performance presents contrasting challenges: layered oxides suffer from transition metal dissolution and structural degradation during extended cycling, while Prussian White materials experience capacity fade primarily due to iron migration and phase transformations. Neither technology has fully resolved these durability limitations.

Electrolyte compatibility further complicates cathode development. Layered oxides typically require specialized electrolyte additives to form stable cathode-electrolyte interfaces, while Prussian White materials show different decomposition mechanisms that are not yet fully understood or mitigated in commercial cell designs.

Comparative Analysis of Prussian White and Layered Oxide Cathodes

01 Cost-effective Prussian White cathode materials

Prussian White materials offer a cost-effective alternative for cathodes in energy storage applications. These materials can be synthesized using inexpensive precursors and simple manufacturing processes, significantly reducing production costs compared to traditional cathode materials. The low-cost nature of Prussian White is attributed to the abundance of constituent elements and the straightforward synthesis methods that don't require high temperatures or specialized equipment.- Cost-effective synthesis methods for Prussian White cathodes: Various cost-effective synthesis methods have been developed for Prussian White cathodes to reduce manufacturing costs while maintaining performance. These methods include solution-based approaches, precipitation techniques, and low-temperature synthesis routes that minimize energy consumption. The simplified production processes help reduce the overall cost of battery production while ensuring the cathode materials maintain their electrochemical properties and stability during cycling.

- Durability enhancement of layered oxide cathodes: Improving the durability of layered oxide cathodes involves structural stabilization techniques and surface modifications. These enhancements include doping with various elements, coating with protective layers, and gradient composition designs that minimize structural degradation during cycling. Such modifications effectively reduce capacity fading, prevent transition metal dissolution, and enhance the overall cycle life of batteries using layered oxide cathodes.

- Composite cathodes combining Prussian White and layered oxides: Hybrid cathode systems that combine Prussian White structures with layered oxide materials offer synergistic benefits in terms of both cost and durability. These composite cathodes leverage the high stability of Prussian White compounds and the high energy density of layered oxides. The resulting materials demonstrate improved cycling performance, better rate capability, and enhanced thermal stability compared to single-component cathodes, while potentially reducing overall material costs.

- Electrolyte optimization for extended cathode lifespan: Specialized electrolyte formulations can significantly improve the durability of both Prussian White and layered oxide cathodes. These formulations include additives that form stable cathode-electrolyte interfaces, prevent unwanted side reactions, and mitigate structural degradation during cycling. Advanced electrolyte systems also help reduce cost by extending battery lifespan and reducing the frequency of replacements, while maintaining compatibility with both cathode chemistries.

- Manufacturing scale-up and industrial production techniques: Industrial-scale production methods for Prussian White and layered oxide cathodes focus on maintaining quality while reducing costs. These techniques include continuous flow processes, automated production lines, and quality control systems that ensure consistent performance. Innovations in manufacturing equipment and process optimization help reduce energy consumption, minimize waste, and increase production yield, thereby lowering the overall cost of cathode materials while maintaining their durability specifications.

02 Durability enhancement of Layered Oxide Cathodes

Various methods have been developed to enhance the durability of layered oxide cathodes, including surface coating, doping with stabilizing elements, and structural modifications. These approaches help mitigate issues such as capacity fading, structural degradation during cycling, and unwanted side reactions with the electrolyte. Improved durability leads to longer battery life and better performance retention under various operating conditions.Expand Specific Solutions03 Composite cathodes combining Prussian White and Layered Oxides

Hybrid cathode materials that combine Prussian White structures with layered oxide components can leverage the advantages of both material types. These composite cathodes often demonstrate improved electrochemical performance, enhanced cycling stability, and better rate capability compared to single-component cathodes. The synergistic effects between the two materials can also lead to cost reductions while maintaining or improving durability metrics.Expand Specific Solutions04 Manufacturing processes affecting cost and durability

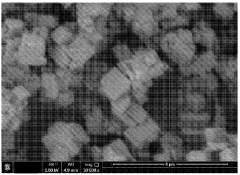

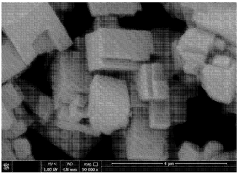

The manufacturing processes for both Prussian White and layered oxide cathodes significantly impact their cost and durability characteristics. Advanced synthesis methods, including controlled precipitation, hydrothermal techniques, and sol-gel processes, can optimize particle morphology and crystal structure. These optimizations lead to improved electrochemical performance and longer cycle life while potentially reducing production costs through more efficient material utilization and energy consumption.Expand Specific Solutions05 Electrolyte compatibility for extended cathode lifespan

The compatibility between electrolytes and cathode materials plays a crucial role in determining the overall durability of both Prussian White and layered oxide cathodes. Specialized electrolyte formulations can minimize parasitic reactions at the cathode surface, reduce transition metal dissolution, and prevent structural degradation during cycling. These tailored electrolytes can significantly extend cathode lifespan without substantially increasing costs, offering an economical approach to improving battery durability.Expand Specific Solutions

Leading Companies in Battery Cathode Research

The battery technology landscape for Prussian White versus Layered Oxide Cathodes is evolving rapidly, with the market currently in a growth phase as manufacturers seek cost-effective and durable alternatives for energy storage applications. While layered oxide cathodes dominate the commercial market with established players like LG Chem and POSCO Holdings leading production, Prussian White technology is emerging as a promising alternative due to its superior durability and cost advantages. Companies like Altris AB have made significant progress in scaling Prussian White production from laboratory to industrial scale, while research institutions such as Wuhan University of Technology and Korea Electronics Technology Institute are advancing the fundamental science. The competitive landscape is characterized by established battery manufacturers exploring both technologies, with increasing focus on sustainability and resource efficiency driving innovation.

Altris AB

Technical Solution: Altris AB has developed an innovative sodium-ion battery technology utilizing Prussian White cathodes (specifically Sodium Iron Hexacyanoferrate) as a sustainable alternative to conventional lithium-ion batteries. Their proprietary "Fennac®" cathode material employs a solvent-free manufacturing process that significantly reduces environmental impact while maintaining high performance characteristics. The technology delivers energy densities of approximately 160 Wh/kg at the cell level, with cycling stability exceeding 2000 cycles at 80% capacity retention. Altris' approach addresses critical raw material concerns by eliminating cobalt, nickel, and lithium dependencies, instead utilizing abundant elements like sodium, iron, carbon, and nitrogen. Their manufacturing process operates at lower temperatures (around 300-400°C) compared to conventional layered oxide cathode production (800-900°C), resulting in approximately 30% lower CO2 emissions during production.

Strengths: Uses abundant, low-cost materials (Na, Fe) avoiding critical raw materials like cobalt and lithium; environmentally friendly production process with lower carbon footprint; excellent thermal stability and safety profile with no thermal runaway issues. Weaknesses: Lower energy density compared to advanced layered oxide cathodes; technology still scaling to mass production; performance at extreme temperatures may require further optimization.

Ningbo Ronbay New Energy Technology Co., Ltd.

Technical Solution: Ningbo Ronbay has developed a comprehensive portfolio of layered oxide cathode materials, with particular focus on high-nickel NCM formulations for automotive applications. Their technology includes both conventional polycrystalline and advanced single-crystal NCM cathodes with nickel content ranging from 60% to over 90%. Ronbay's manufacturing process employs proprietary co-precipitation techniques with precise control of reaction parameters to achieve uniform particle morphology and consistent elemental distribution. Their high-nickel cathodes deliver specific capacities exceeding 200 mAh/g while maintaining 80% capacity retention after 1000 cycles. Ronbay has also developed innovative doping strategies incorporating aluminum, zirconium, and magnesium to stabilize the crystal structure during deep charge-discharge cycles. Their cathode materials feature engineered porosity and particle size distribution optimized for both energy density and power performance, with recent advancements focusing on reducing cobalt content while maintaining structural stability.

Strengths: High energy density suitable for long-range electric vehicles; established production capacity with economies of scale; compatible with existing lithium-ion battery manufacturing infrastructure; strong performance at moderate temperatures. Weaknesses: Reliance on constrained supply chains for nickel and cobalt; higher raw material costs compared to Prussian White alternatives; potential thermal runaway risks requiring sophisticated safety systems; performance degradation at elevated temperatures.

Key Patents and Innovations in Cathode Materials

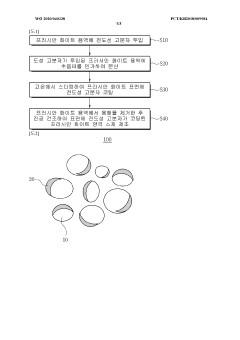

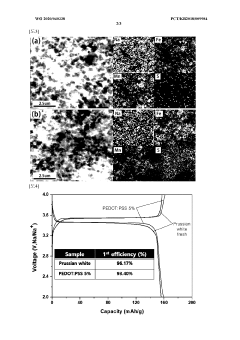

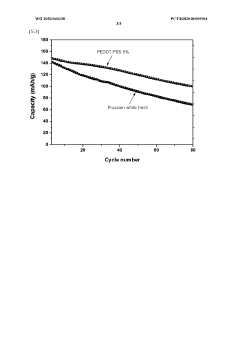

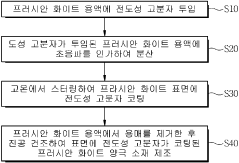

Positive electrode material, positive electrode and sodium-ion battery comprising same, and preparation method therefor

PatentWO2020040338A1

Innovation

- A conductive polymer is coated onto the surface of Prussian white (Na_xMnFe(CN)_6) to enhance the charge and discharge reaction characteristics of the sodium ion battery, specifically using PEDOT:PSS, PEDOS, PANI, or PProDOT polymers, dispersed via ultrasonic waves and high-temperature stirring, followed by solvent removal and vacuum drying to produce an improved anode material.

Method for regulating size of prussian white

PatentPendingGB2625849A

Innovation

- A method involving a precipitation reaction using a food-grade manganese sulfate solution and sodium ferrocyanide, followed by the addition of an industrial-grade manganese sulfate solution, controls the particle size of Prussian white by adjusting the adding time of the solutions, resulting in a product with improved rate capability and compaction density.

Supply Chain Considerations for Cathode Materials

The cathode material supply chain represents a critical factor in determining the overall cost, sustainability, and scalability of battery technologies. For Prussian White (PW) cathodes, the supply chain offers distinct advantages compared to layered oxide alternatives. PW cathodes primarily utilize abundant elements such as iron, nitrogen, and carbon, significantly reducing dependency on critical materials like cobalt and nickel that dominate layered oxide supply chains.

Raw material sourcing for PW cathodes benefits from geographically diverse supply networks, with iron being the 4th most abundant element in Earth's crust and available across multiple continents. This contrasts sharply with layered oxide cathodes, which rely heavily on cobalt and nickel resources concentrated in politically sensitive regions such as the Democratic Republic of Congo and Indonesia, creating potential supply vulnerabilities and price volatility.

Manufacturing processes for PW cathodes typically require lower energy inputs and fewer specialized precursors compared to layered oxide alternatives. The synthesis of PW materials can occur at room temperature or with minimal heating requirements, whereas layered oxide production demands energy-intensive high-temperature calcination processes exceeding 800°C. This translates to reduced carbon footprint and lower production costs throughout the manufacturing pipeline.

Recycling considerations also favor PW cathodes, as their simpler chemical composition facilitates more straightforward end-of-life recovery processes. The absence of cobalt and reduced nickel content eliminates the economic drivers that currently make layered oxide recycling financially viable, potentially necessitating new recycling incentive structures for PW materials.

Supply chain resilience analysis indicates that PW cathode production faces fewer bottlenecks and geopolitical risks. The 2021-2022 nickel price volatility demonstrated the vulnerability of layered oxide supply chains to market disruptions, while PW materials remained relatively stable due to their reliance on more commonly traded commodities.

Scaling considerations reveal that PW cathode production can potentially ramp up more rapidly than layered oxide alternatives due to fewer material constraints. However, the industry must develop specialized manufacturing infrastructure optimized for PW production to fully realize these advantages, as current manufacturing facilities are predominantly configured for layered oxide production.

Future supply chain development for both cathode types will likely be influenced by evolving environmental regulations, particularly regarding water usage and waste management in production processes. PW cathodes currently demonstrate advantages in these areas, potentially positioning them favorably as regulatory frameworks become more stringent.

Raw material sourcing for PW cathodes benefits from geographically diverse supply networks, with iron being the 4th most abundant element in Earth's crust and available across multiple continents. This contrasts sharply with layered oxide cathodes, which rely heavily on cobalt and nickel resources concentrated in politically sensitive regions such as the Democratic Republic of Congo and Indonesia, creating potential supply vulnerabilities and price volatility.

Manufacturing processes for PW cathodes typically require lower energy inputs and fewer specialized precursors compared to layered oxide alternatives. The synthesis of PW materials can occur at room temperature or with minimal heating requirements, whereas layered oxide production demands energy-intensive high-temperature calcination processes exceeding 800°C. This translates to reduced carbon footprint and lower production costs throughout the manufacturing pipeline.

Recycling considerations also favor PW cathodes, as their simpler chemical composition facilitates more straightforward end-of-life recovery processes. The absence of cobalt and reduced nickel content eliminates the economic drivers that currently make layered oxide recycling financially viable, potentially necessitating new recycling incentive structures for PW materials.

Supply chain resilience analysis indicates that PW cathode production faces fewer bottlenecks and geopolitical risks. The 2021-2022 nickel price volatility demonstrated the vulnerability of layered oxide supply chains to market disruptions, while PW materials remained relatively stable due to their reliance on more commonly traded commodities.

Scaling considerations reveal that PW cathode production can potentially ramp up more rapidly than layered oxide alternatives due to fewer material constraints. However, the industry must develop specialized manufacturing infrastructure optimized for PW production to fully realize these advantages, as current manufacturing facilities are predominantly configured for layered oxide production.

Future supply chain development for both cathode types will likely be influenced by evolving environmental regulations, particularly regarding water usage and waste management in production processes. PW cathodes currently demonstrate advantages in these areas, potentially positioning them favorably as regulatory frameworks become more stringent.

Environmental Impact Assessment of Cathode Technologies

The environmental impact of battery cathode technologies represents a critical dimension in evaluating their overall sustainability and long-term viability. When comparing Prussian White and layered oxide cathodes, several environmental factors require thorough examination across their complete life cycles.

Prussian White cathodes demonstrate notable environmental advantages through their composition of abundant, low-toxicity materials including iron, carbon, and nitrogen. The synthesis process for these cathodes typically requires lower temperatures (around 80-150°C) compared to the energy-intensive calcination processes (700-900°C) needed for layered oxide cathodes. This temperature differential translates to approximately 40-60% reduction in energy consumption during manufacturing, with corresponding decreases in greenhouse gas emissions.

Water consumption patterns also differ significantly between these technologies. Layered oxide cathode production typically requires 15-20 liters of water per kilogram of material, primarily for washing and purification steps. In contrast, Prussian White synthesis generally consumes 30-50% less water, though exact figures vary based on specific manufacturing protocols and recycling systems implemented.

Mining impacts constitute another critical environmental consideration. Layered oxide cathodes rely heavily on nickel, cobalt, and manganese, whose extraction often involves significant habitat disruption, water pollution, and energy-intensive processing. Studies indicate that cobalt mining in particular generates approximately 30 kg of CO2 equivalent per kilogram extracted, alongside concerns regarding toxic waste management. Prussian White cathodes substantially reduce dependence on these problematic materials, potentially decreasing mining-related environmental degradation by 40-70% compared to conventional cathodes.

End-of-life considerations reveal further distinctions. Recycling processes for layered oxide cathodes have reached commercial scale but remain energy-intensive and complex due to the variety of metals involved. Prussian White cathodes, with their simpler composition, potentially offer more straightforward recycling pathways, though these technologies remain less developed at industrial scale. Current research suggests recovery rates of 85-95% for iron from Prussian White structures under optimized conditions.

Lifecycle assessment studies indicate that Prussian White cathodes may reduce overall environmental impact by 30-45% across categories including global warming potential, acidification, and resource depletion. However, these advantages must be balanced against current performance limitations, as environmental benefits could be partially offset if battery replacement occurs more frequently due to durability concerns.

Prussian White cathodes demonstrate notable environmental advantages through their composition of abundant, low-toxicity materials including iron, carbon, and nitrogen. The synthesis process for these cathodes typically requires lower temperatures (around 80-150°C) compared to the energy-intensive calcination processes (700-900°C) needed for layered oxide cathodes. This temperature differential translates to approximately 40-60% reduction in energy consumption during manufacturing, with corresponding decreases in greenhouse gas emissions.

Water consumption patterns also differ significantly between these technologies. Layered oxide cathode production typically requires 15-20 liters of water per kilogram of material, primarily for washing and purification steps. In contrast, Prussian White synthesis generally consumes 30-50% less water, though exact figures vary based on specific manufacturing protocols and recycling systems implemented.

Mining impacts constitute another critical environmental consideration. Layered oxide cathodes rely heavily on nickel, cobalt, and manganese, whose extraction often involves significant habitat disruption, water pollution, and energy-intensive processing. Studies indicate that cobalt mining in particular generates approximately 30 kg of CO2 equivalent per kilogram extracted, alongside concerns regarding toxic waste management. Prussian White cathodes substantially reduce dependence on these problematic materials, potentially decreasing mining-related environmental degradation by 40-70% compared to conventional cathodes.

End-of-life considerations reveal further distinctions. Recycling processes for layered oxide cathodes have reached commercial scale but remain energy-intensive and complex due to the variety of metals involved. Prussian White cathodes, with their simpler composition, potentially offer more straightforward recycling pathways, though these technologies remain less developed at industrial scale. Current research suggests recovery rates of 85-95% for iron from Prussian White structures under optimized conditions.

Lifecycle assessment studies indicate that Prussian White cathodes may reduce overall environmental impact by 30-45% across categories including global warming potential, acidification, and resource depletion. However, these advantages must be balanced against current performance limitations, as environmental benefits could be partially offset if battery replacement occurs more frequently due to durability concerns.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!