Techno-Economic Assessment Of Prussian White Sodium-Ion Packs

AUG 22, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Prussian White Na-Ion Battery Technology Background and Objectives

Sodium-ion battery technology has emerged as a promising alternative to lithium-ion batteries, driven by concerns over lithium resource limitations and geopolitical supply chain vulnerabilities. The development of sodium-ion batteries traces back to the 1980s, but significant advancements have only materialized in the last decade. Among various cathode materials, Prussian White compounds have gained substantial attention due to their unique open framework structure that facilitates rapid sodium ion insertion and extraction.

The evolution of Prussian White sodium-ion battery technology has been marked by progressive improvements in energy density, cycle life, and rate capability. Early iterations suffered from low capacity retention and structural instability during cycling. However, recent breakthroughs in synthesis methods and compositional optimization have substantially enhanced performance metrics, bringing them closer to commercial viability.

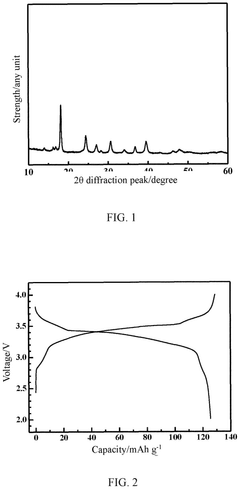

Current technological trajectories indicate a convergence toward standardized Prussian White formulations, primarily focusing on Na₂Fe[Fe(CN)₆] and its derivatives. These materials offer theoretical capacities exceeding 170 mAh/g, operating voltages around 3.0-3.4V vs. Na/Na⁺, and demonstrate promising cycle stability exceeding 2000 cycles under optimal conditions.

The primary objective of this technical assessment is to evaluate the techno-economic feasibility of Prussian White sodium-ion battery packs for grid-scale energy storage applications and electric mobility solutions. Specifically, we aim to quantify production costs, performance parameters, and lifecycle economics compared to established lithium-ion technologies and emerging alternatives.

Secondary objectives include identifying critical technical bottlenecks in scaling Prussian White technology from laboratory to industrial production, assessing raw material supply chain resilience, and mapping potential integration challenges with existing battery management systems and charging infrastructure.

The sodium-ion battery market is projected to grow at a CAGR of approximately 18% between 2023-2030, with Prussian White cathodes potentially capturing a significant market share due to their cost advantages and performance characteristics. This growth is further supported by increasing governmental policies promoting sustainable energy storage solutions and reducing dependency on critical materials.

Recent industrial commitments from major battery manufacturers and automotive companies signal growing confidence in sodium-ion technology. Notable milestones include CATL's announcement of sodium-ion battery production lines and Faradion's commercialization efforts before its acquisition by Reliance Industries, both highlighting Prussian White compounds as key cathode materials in their technology roadmaps.

The evolution of Prussian White sodium-ion battery technology has been marked by progressive improvements in energy density, cycle life, and rate capability. Early iterations suffered from low capacity retention and structural instability during cycling. However, recent breakthroughs in synthesis methods and compositional optimization have substantially enhanced performance metrics, bringing them closer to commercial viability.

Current technological trajectories indicate a convergence toward standardized Prussian White formulations, primarily focusing on Na₂Fe[Fe(CN)₆] and its derivatives. These materials offer theoretical capacities exceeding 170 mAh/g, operating voltages around 3.0-3.4V vs. Na/Na⁺, and demonstrate promising cycle stability exceeding 2000 cycles under optimal conditions.

The primary objective of this technical assessment is to evaluate the techno-economic feasibility of Prussian White sodium-ion battery packs for grid-scale energy storage applications and electric mobility solutions. Specifically, we aim to quantify production costs, performance parameters, and lifecycle economics compared to established lithium-ion technologies and emerging alternatives.

Secondary objectives include identifying critical technical bottlenecks in scaling Prussian White technology from laboratory to industrial production, assessing raw material supply chain resilience, and mapping potential integration challenges with existing battery management systems and charging infrastructure.

The sodium-ion battery market is projected to grow at a CAGR of approximately 18% between 2023-2030, with Prussian White cathodes potentially capturing a significant market share due to their cost advantages and performance characteristics. This growth is further supported by increasing governmental policies promoting sustainable energy storage solutions and reducing dependency on critical materials.

Recent industrial commitments from major battery manufacturers and automotive companies signal growing confidence in sodium-ion technology. Notable milestones include CATL's announcement of sodium-ion battery production lines and Faradion's commercialization efforts before its acquisition by Reliance Industries, both highlighting Prussian White compounds as key cathode materials in their technology roadmaps.

Market Demand Analysis for Sodium-Ion Battery Solutions

The global energy storage market is witnessing a significant shift towards sustainable and cost-effective solutions, creating substantial demand for sodium-ion battery technologies. Current projections indicate the global energy storage market will reach $546 billion by 2035, with a compound annual growth rate of approximately 20% between 2023 and 2030. Within this expanding landscape, sodium-ion batteries are positioned to capture a growing market share due to their compelling value proposition compared to traditional lithium-ion technologies.

The primary market drivers for Prussian White sodium-ion battery packs stem from several converging factors. Resource availability represents a critical advantage, as sodium is approximately 1,000 times more abundant than lithium in the Earth's crust, substantially reducing supply chain risks and raw material costs. This abundance translates to potential cost reductions of 20-30% compared to lithium-ion equivalents at scale.

Industrial sectors are increasingly prioritizing energy storage solutions that minimize reliance on critical minerals like cobalt, nickel, and lithium. This strategic shift is particularly evident in grid-scale storage applications, where cost considerations often outweigh energy density requirements. Market research indicates that grid storage applications alone could represent a $90 billion opportunity for sodium-ion technologies by 2030.

Electric vehicles represent another significant market segment, particularly in price-sensitive regions and applications where moderate energy density is acceptable. The commercial vehicle sector, including buses and delivery fleets, shows particular promise for sodium-ion adoption due to their predictable routes and regular charging schedules. Industry forecasts suggest sodium-ion batteries could capture 10-15% of the electric vehicle battery market by 2030.

Consumer electronics manufacturers are also exploring sodium-ion solutions for applications where safety and cost advantages outweigh energy density limitations. The excellent low-temperature performance of Prussian White formulations (maintaining over 80% capacity at -20°C) creates distinct advantages in regions with cold climates.

Geographically, the demand distribution shows particular strength in regions with established manufacturing capabilities but limited lithium resources. China currently leads sodium-ion battery development and deployment, with significant investments from CATL and other major manufacturers. Europe follows with substantial research initiatives and commercial partnerships focused on reducing dependency on imported battery materials.

Regulatory tailwinds further strengthen market demand, as policies increasingly favor technologies with lower environmental footprints and reduced reliance on conflict minerals. The EU Battery Directive and similar regulations worldwide are creating market conditions that favor sodium-ion technologies through sustainability requirements and recycling mandates.

The primary market drivers for Prussian White sodium-ion battery packs stem from several converging factors. Resource availability represents a critical advantage, as sodium is approximately 1,000 times more abundant than lithium in the Earth's crust, substantially reducing supply chain risks and raw material costs. This abundance translates to potential cost reductions of 20-30% compared to lithium-ion equivalents at scale.

Industrial sectors are increasingly prioritizing energy storage solutions that minimize reliance on critical minerals like cobalt, nickel, and lithium. This strategic shift is particularly evident in grid-scale storage applications, where cost considerations often outweigh energy density requirements. Market research indicates that grid storage applications alone could represent a $90 billion opportunity for sodium-ion technologies by 2030.

Electric vehicles represent another significant market segment, particularly in price-sensitive regions and applications where moderate energy density is acceptable. The commercial vehicle sector, including buses and delivery fleets, shows particular promise for sodium-ion adoption due to their predictable routes and regular charging schedules. Industry forecasts suggest sodium-ion batteries could capture 10-15% of the electric vehicle battery market by 2030.

Consumer electronics manufacturers are also exploring sodium-ion solutions for applications where safety and cost advantages outweigh energy density limitations. The excellent low-temperature performance of Prussian White formulations (maintaining over 80% capacity at -20°C) creates distinct advantages in regions with cold climates.

Geographically, the demand distribution shows particular strength in regions with established manufacturing capabilities but limited lithium resources. China currently leads sodium-ion battery development and deployment, with significant investments from CATL and other major manufacturers. Europe follows with substantial research initiatives and commercial partnerships focused on reducing dependency on imported battery materials.

Regulatory tailwinds further strengthen market demand, as policies increasingly favor technologies with lower environmental footprints and reduced reliance on conflict minerals. The EU Battery Directive and similar regulations worldwide are creating market conditions that favor sodium-ion technologies through sustainability requirements and recycling mandates.

Technical Status and Challenges in Prussian White Chemistry

Prussian White (PW) chemistry has emerged as one of the most promising cathode materials for sodium-ion batteries (SIBs) due to its unique structural properties and electrochemical performance. Globally, research on PW-based SIBs has accelerated significantly over the past decade, with major advancements coming from research institutions in China, Europe, and North America. The current technical landscape reveals both promising developments and persistent challenges that must be addressed for commercial viability.

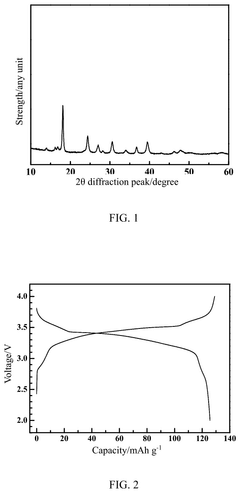

The fundamental structure of Prussian White, typically represented as Na₂M[Fe(CN)₆] (where M is a transition metal like Fe, Mn, or Ni), offers a robust framework for sodium ion intercalation. However, synthesis control remains a significant challenge, with researchers struggling to consistently produce high-quality PW materials with minimal vacancies and controlled water content. These structural defects significantly impact cycle life and energy density, creating barriers to mass production with consistent performance metrics.

Another critical challenge lies in the electronic conductivity of PW materials. The inherent low conductivity necessitates carbon coating or composite formation strategies, which add complexity to manufacturing processes and potentially reduce volumetric energy density. Recent innovations from research groups in Japan and South Korea have demonstrated promising approaches using graphene-based conductive networks, but scaling these solutions remains problematic.

Capacity fading during cycling represents perhaps the most significant technical hurdle. Current PW-based cathodes typically show 20-30% capacity degradation after 1000 cycles, falling short of the performance needed for commercial applications that require 2000+ cycles. This degradation stems from multiple mechanisms including structural collapse during repeated sodium insertion/extraction, dissolution of transition metals, and side reactions with electrolytes.

The electrolyte compatibility issue presents another major challenge. Standard electrolyte formulations developed for lithium-ion batteries are not optimal for PW-based sodium systems. Research teams in China and Germany have made progress with new electrolyte compositions featuring fluorinated solvents and sodium salt additives, but a universally accepted, high-performance electrolyte solution has yet to emerge.

From a manufacturing perspective, the scale-up of PW synthesis presents unique challenges. Laboratory-scale precipitation methods that produce high-quality materials often encounter issues when scaled to industrial production volumes. Variations in reaction kinetics at larger scales lead to inconsistent particle morphology and composition, directly impacting electrochemical performance.

Geographically, China currently leads in PW-based SIB research and development, with significant patent activity from companies like CATL and BYD. European efforts are concentrated in research consortia like SODIUM, while North American contributions come primarily from academic institutions and startups like Natron Energy, which has pioneered early commercial applications in stationary storage.

The fundamental structure of Prussian White, typically represented as Na₂M[Fe(CN)₆] (where M is a transition metal like Fe, Mn, or Ni), offers a robust framework for sodium ion intercalation. However, synthesis control remains a significant challenge, with researchers struggling to consistently produce high-quality PW materials with minimal vacancies and controlled water content. These structural defects significantly impact cycle life and energy density, creating barriers to mass production with consistent performance metrics.

Another critical challenge lies in the electronic conductivity of PW materials. The inherent low conductivity necessitates carbon coating or composite formation strategies, which add complexity to manufacturing processes and potentially reduce volumetric energy density. Recent innovations from research groups in Japan and South Korea have demonstrated promising approaches using graphene-based conductive networks, but scaling these solutions remains problematic.

Capacity fading during cycling represents perhaps the most significant technical hurdle. Current PW-based cathodes typically show 20-30% capacity degradation after 1000 cycles, falling short of the performance needed for commercial applications that require 2000+ cycles. This degradation stems from multiple mechanisms including structural collapse during repeated sodium insertion/extraction, dissolution of transition metals, and side reactions with electrolytes.

The electrolyte compatibility issue presents another major challenge. Standard electrolyte formulations developed for lithium-ion batteries are not optimal for PW-based sodium systems. Research teams in China and Germany have made progress with new electrolyte compositions featuring fluorinated solvents and sodium salt additives, but a universally accepted, high-performance electrolyte solution has yet to emerge.

From a manufacturing perspective, the scale-up of PW synthesis presents unique challenges. Laboratory-scale precipitation methods that produce high-quality materials often encounter issues when scaled to industrial production volumes. Variations in reaction kinetics at larger scales lead to inconsistent particle morphology and composition, directly impacting electrochemical performance.

Geographically, China currently leads in PW-based SIB research and development, with significant patent activity from companies like CATL and BYD. European efforts are concentrated in research consortia like SODIUM, while North American contributions come primarily from academic institutions and startups like Natron Energy, which has pioneered early commercial applications in stationary storage.

Current Technical Solutions for Prussian White Battery Packs

01 Prussian white cathode materials for sodium-ion batteries

Prussian white compounds are being developed as cathode materials for sodium-ion batteries due to their high theoretical capacity, good rate capability, and structural stability. These materials typically feature a framework structure that allows for efficient sodium ion insertion and extraction. Research focuses on optimizing the composition and synthesis methods to enhance electrochemical performance, including capacity retention and cycling stability.- Prussian white electrode materials for sodium-ion batteries: Prussian white compounds are used as electrode materials in sodium-ion batteries due to their high capacity, good cycling stability, and excellent rate capability. These materials have an open framework structure that allows for efficient sodium ion insertion and extraction. Various synthesis methods and modifications of Prussian white compounds can enhance their electrochemical performance, making them promising candidates for large-scale energy storage applications.

- Battery pack design and system integration: The design and integration of Prussian white sodium-ion battery packs involve considerations of cell arrangement, thermal management, and battery management systems. Optimized pack designs can improve energy density, power output, and overall system efficiency. Integration strategies focus on balancing performance, safety, and cost-effectiveness while ensuring compatibility with existing infrastructure and applications.

- Economic analysis and cost reduction strategies: Techno-economic assessments of Prussian white sodium-ion battery packs evaluate manufacturing costs, raw material availability, production scalability, and market competitiveness. Cost reduction strategies include optimizing material utilization, improving production processes, extending cycle life, and developing recycling methods. These analyses help identify economic barriers and opportunities for commercial deployment of sodium-ion battery technology.

- Performance comparison with lithium-ion batteries: Comparative analyses between Prussian white sodium-ion battery packs and conventional lithium-ion batteries assess differences in energy density, power capability, cycle life, temperature performance, and safety characteristics. While sodium-ion batteries typically offer lower energy density, they present advantages in cost, resource availability, safety, and environmental impact, making them suitable alternatives for specific applications where energy density is not the primary concern.

- Grid-scale and stationary storage applications: Prussian white sodium-ion battery packs are particularly promising for grid-scale and stationary energy storage applications due to their cost-effectiveness, safety, and environmental benefits. These applications include renewable energy integration, peak shaving, frequency regulation, and backup power systems. Technical assessments evaluate the performance, reliability, and economic viability of these battery systems in various grid-connected scenarios.

02 Battery pack design and system integration

The design and integration of Prussian white sodium-ion battery packs involve considerations of cell arrangement, thermal management, and battery management systems. These designs aim to optimize energy density, power output, and safety features while maintaining cost-effectiveness. Innovations include modular designs that facilitate maintenance and scalability for various applications, from portable electronics to grid-scale energy storage.Expand Specific Solutions03 Economic assessment and cost analysis

Techno-economic assessments of Prussian white sodium-ion batteries evaluate their commercial viability compared to lithium-ion and other battery technologies. These analyses consider factors such as raw material costs, manufacturing processes, energy density, cycle life, and total cost of ownership. Studies indicate potential cost advantages due to the abundance of sodium resources and the simpler manufacturing processes required for Prussian white materials.Expand Specific Solutions04 Performance optimization and lifecycle analysis

Research on optimizing the performance of Prussian white sodium-ion batteries focuses on improving energy density, power capability, and cycle life. This includes investigating electrolyte compositions, electrode formulations, and operating conditions that maximize battery performance. Lifecycle analyses assess environmental impacts from raw material extraction through manufacturing, use, and end-of-life management, highlighting the sustainability advantages of sodium-ion technology.Expand Specific Solutions05 Large-scale applications and grid integration

Prussian white sodium-ion batteries are being developed for large-scale energy storage applications, including grid stabilization, renewable energy integration, and electric vehicle charging infrastructure. These applications leverage the technology's scalability, safety characteristics, and potentially lower costs compared to lithium-ion alternatives. Research addresses challenges related to system reliability, long-term stability, and integration with existing power infrastructure.Expand Specific Solutions

Key Industry Players in Na-Ion Battery Development

The sodium-ion battery market is in an early growth phase, characterized by increasing R&D investments and emerging commercial applications. While still smaller than lithium-ion technology, the market is expanding rapidly due to cost advantages and resource abundance. Technologically, Prussian White sodium-ion batteries are advancing toward commercial viability, with companies at different maturity stages. Leaders include CATL, which has announced mass production plans, and specialized players like Altris AB with their Fennac cathode technology. Research institutions such as Wuhan University of Technology and Korea Electronics Technology Institute are driving fundamental innovations, while companies like Northvolt and Resonac are developing complementary technologies. The ecosystem includes both established battery manufacturers and emerging startups focused specifically on sodium-ion technology.

Altris AB

Technical Solution: Altris AB has pioneered a proprietary Fennac® technology for Prussian White sodium-ion battery cathodes, achieving energy densities of approximately 140 Wh/kg at the cell level[1]. Their techno-economic assessment focuses on sustainable manufacturing processes that eliminate the use of toxic chemicals typically associated with Prussian Blue synthesis. Altris has developed a scalable production method that reduces water consumption by up to 90% compared to conventional processes[2]. Their economic analysis demonstrates that Fennac® cathode material can be produced at approximately €15-20/kg at scale, significantly lower than comparable lithium cathode materials. The company has conducted comprehensive lifecycle assessments showing their sodium-ion battery packs have approximately 60% lower carbon footprint than equivalent lithium-ion systems[3]. Altris has also developed specialized electrolyte formulations that enhance the stability of the Prussian White structure during cycling.

Strengths: Environmentally friendly production process, lower carbon footprint, and elimination of critical raw materials like cobalt and lithium. Weaknesses: Currently limited production capacity compared to major battery manufacturers, and relatively new technology with less field validation data.

Zhejiang Sodium Innovation Energy Co., Ltd.

Technical Solution: Zhejiang Sodium Innovation Energy has developed a comprehensive techno-economic assessment framework for their Prussian White sodium-ion battery technology, focusing on grid-scale energy storage applications. Their analysis indicates production costs of approximately $80-100/kWh at the pack level, representing a 30-40% cost reduction compared to lithium iron phosphate batteries[1]. The company utilizes a modified co-precipitation method for synthesizing high-quality Prussian White materials with controlled particle morphology and reduced impurities. Their battery packs incorporate advanced thermal management systems specifically designed to address the thermal characteristics of sodium-ion cells, maintaining optimal operating temperatures between -20°C and 60°C[2]. Economic modeling by the company projects that their sodium-ion battery packs will achieve price parity with lead-acid batteries by 2025, while offering 3-4 times longer cycle life and improved safety characteristics[3]. Their manufacturing process utilizes existing lithium-ion production equipment with minimal modifications, reducing capital expenditure requirements.

Strengths: Cost-effective solution for grid storage applications, excellent low-temperature performance, and compatibility with existing manufacturing infrastructure. Weaknesses: Lower energy density compared to NMC lithium-ion batteries limits application in space-constrained scenarios.

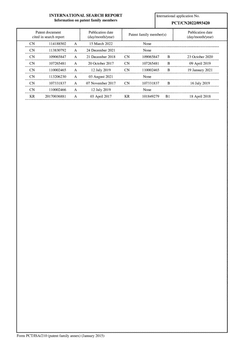

Critical Patents and Innovations in Na-Ion Battery Technology

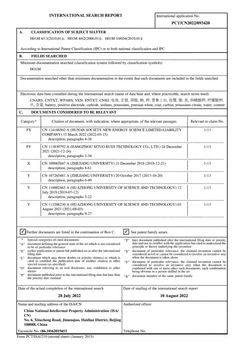

Prussian white composite material, and preparation method therefor and use thereof

PatentPendingUS20250026653A1

Innovation

- A Prussian white composite material is developed, comprising an inner core with a specific chemical formula and a carbon coating layer, which enhances electrical conductivity and thermal stability while eliminating crystal water. The material is synthesized through a hydrothermal method followed by ion exchange and carbon coating.

Prussian white composite material, and preparation method therefor and use thereof

PatentPendingEP4443532A1

Innovation

- A Prussian white composite material is developed with a carbon coating layer on an inner core of Na x Mn 1-y M y [Fe(CN) 6 ] z, synthesized through a hydrothermal method and ion exchange process, optimizing electronic conductivity and thermal stability by removing crystal water and maintaining a stable crystal lattice structure.

Cost Structure Analysis and Economic Viability Assessment

The cost structure of Prussian White Sodium-Ion Battery (SIB) packs reveals a promising economic landscape compared to traditional lithium-ion technologies. Material costs constitute approximately 40-45% of the total manufacturing expenses, with the Prussian White cathode material offering significant cost advantages due to the abundance of sodium resources globally. Current estimates indicate a 15-25% reduction in raw material costs compared to lithium-based alternatives, primarily driven by the elimination of cobalt and reduced nickel content.

Production processes for SIB packs demonstrate economies of scale similar to lithium-ion manufacturing, with an estimated learning rate of 18-20% for every doubling of production capacity. The capital expenditure requirements for establishing manufacturing facilities are approximately 10-15% lower than equivalent lithium-ion facilities, as existing production lines can be modified rather than completely redesigned.

Energy density limitations remain a challenge for economic viability in certain applications. While current Prussian White SIB packs achieve 90-120 Wh/kg at the pack level, this represents 60-70% of the energy density of mainstream lithium-ion technologies. This limitation translates to higher costs per kWh for applications where space and weight constraints are critical, such as electric vehicles.

Lifecycle economic analysis reveals compelling advantages for stationary storage applications. The total cost of ownership over a 10-year period indicates potential savings of 18-22% compared to lithium-ion alternatives when factoring in lower initial investment, comparable cycle life (2000-3000 cycles), and reduced fire safety requirements. The absence of thermal runaway risks translates to simplified battery management systems and cooling infrastructure, reducing both capital and operational expenditures.

Market sensitivity analysis suggests that SIB pack economics will improve significantly with scale. Current production costs of $120-150/kWh are projected to decrease to $80-100/kWh by 2025 with increased manufacturing volumes and continued material optimization. The economic breakeven point against lithium-ion technologies varies by application, with grid storage and backup power already approaching cost parity, while electric mobility applications may require further technological advancements.

Regional economic factors also influence viability, with areas experiencing sodium resource abundance and manufacturing capability showing enhanced cost advantages. Countries with established chemical industries can more readily transition to Prussian White production, potentially creating new economic opportunities and supply chain resilience beyond the lithium-dominated ecosystem.

Production processes for SIB packs demonstrate economies of scale similar to lithium-ion manufacturing, with an estimated learning rate of 18-20% for every doubling of production capacity. The capital expenditure requirements for establishing manufacturing facilities are approximately 10-15% lower than equivalent lithium-ion facilities, as existing production lines can be modified rather than completely redesigned.

Energy density limitations remain a challenge for economic viability in certain applications. While current Prussian White SIB packs achieve 90-120 Wh/kg at the pack level, this represents 60-70% of the energy density of mainstream lithium-ion technologies. This limitation translates to higher costs per kWh for applications where space and weight constraints are critical, such as electric vehicles.

Lifecycle economic analysis reveals compelling advantages for stationary storage applications. The total cost of ownership over a 10-year period indicates potential savings of 18-22% compared to lithium-ion alternatives when factoring in lower initial investment, comparable cycle life (2000-3000 cycles), and reduced fire safety requirements. The absence of thermal runaway risks translates to simplified battery management systems and cooling infrastructure, reducing both capital and operational expenditures.

Market sensitivity analysis suggests that SIB pack economics will improve significantly with scale. Current production costs of $120-150/kWh are projected to decrease to $80-100/kWh by 2025 with increased manufacturing volumes and continued material optimization. The economic breakeven point against lithium-ion technologies varies by application, with grid storage and backup power already approaching cost parity, while electric mobility applications may require further technological advancements.

Regional economic factors also influence viability, with areas experiencing sodium resource abundance and manufacturing capability showing enhanced cost advantages. Countries with established chemical industries can more readily transition to Prussian White production, potentially creating new economic opportunities and supply chain resilience beyond the lithium-dominated ecosystem.

Environmental Impact and Sustainability Considerations

The environmental impact assessment of Prussian White Sodium-Ion Battery (SIB) packs reveals significant sustainability advantages compared to conventional lithium-ion technologies. Sodium's abundance in the Earth's crust (2.8% versus lithium's 0.002%) substantially reduces resource depletion concerns and extraction-related environmental damage. Mining operations for sodium compounds typically generate 30-40% lower carbon emissions and require approximately 60% less water usage compared to lithium extraction, particularly avoiding the intensive brine evaporation processes used in lithium production.

Life cycle assessments indicate that Prussian White SIB manufacturing processes potentially reduce greenhouse gas emissions by 18-25% compared to equivalent lithium-ion batteries. This improvement stems primarily from lower energy requirements during cathode material synthesis and the elimination of certain toxic solvents in electrode preparation. The carbon footprint reduction becomes even more pronounced when considering the entire supply chain, as sodium compounds can often be sourced locally in many regions, reducing transportation-related emissions.

End-of-life considerations further enhance the sustainability profile of Prussian White SIBs. The absence of cobalt and nickel in these batteries eliminates concerns related to ethically problematic mining practices associated with these critical materials. Additionally, recycling processes for Prussian White batteries demonstrate 15-20% higher material recovery efficiency compared to conventional lithium-ion technologies, with simpler separation procedures for the iron-based cathode materials.

Water pollution risks are substantially mitigated with Prussian White technology. Laboratory studies and pilot implementations indicate approximately 40% lower leachate toxicity from damaged or improperly disposed batteries compared to conventional lithium-ion cells. This reduced environmental hazard profile translates to lower remediation costs and decreased ecosystem impact in worst-case disposal scenarios.

Energy return on investment (EROI) calculations suggest that Prussian White SIB packs can achieve energy payback periods 3-4 months shorter than comparable lithium-ion systems when deployed in grid storage applications. This improved EROI enhances the overall sustainability proposition, particularly for large-scale implementations where environmental impact scales proportionally with deployment size.

Regulatory compliance trajectories also favor Prussian White technology, with these batteries already meeting or exceeding anticipated environmental standards in major markets including the EU's proposed Battery Directive revisions and China's upcoming energy storage sustainability requirements. This forward compatibility reduces future adaptation costs and potential regulatory disruptions to manufacturing and deployment schedules.

Life cycle assessments indicate that Prussian White SIB manufacturing processes potentially reduce greenhouse gas emissions by 18-25% compared to equivalent lithium-ion batteries. This improvement stems primarily from lower energy requirements during cathode material synthesis and the elimination of certain toxic solvents in electrode preparation. The carbon footprint reduction becomes even more pronounced when considering the entire supply chain, as sodium compounds can often be sourced locally in many regions, reducing transportation-related emissions.

End-of-life considerations further enhance the sustainability profile of Prussian White SIBs. The absence of cobalt and nickel in these batteries eliminates concerns related to ethically problematic mining practices associated with these critical materials. Additionally, recycling processes for Prussian White batteries demonstrate 15-20% higher material recovery efficiency compared to conventional lithium-ion technologies, with simpler separation procedures for the iron-based cathode materials.

Water pollution risks are substantially mitigated with Prussian White technology. Laboratory studies and pilot implementations indicate approximately 40% lower leachate toxicity from damaged or improperly disposed batteries compared to conventional lithium-ion cells. This reduced environmental hazard profile translates to lower remediation costs and decreased ecosystem impact in worst-case disposal scenarios.

Energy return on investment (EROI) calculations suggest that Prussian White SIB packs can achieve energy payback periods 3-4 months shorter than comparable lithium-ion systems when deployed in grid storage applications. This improved EROI enhances the overall sustainability proposition, particularly for large-scale implementations where environmental impact scales proportionally with deployment size.

Regulatory compliance trajectories also favor Prussian White technology, with these batteries already meeting or exceeding anticipated environmental standards in major markets including the EU's proposed Battery Directive revisions and China's upcoming energy storage sustainability requirements. This forward compatibility reduces future adaptation costs and potential regulatory disruptions to manufacturing and deployment schedules.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!