Recycling And Reuse Pathways For Prussian White Cathode Materials

AUG 22, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Prussian White Cathode Recycling Background and Objectives

Prussian White cathode materials have emerged as a promising alternative to conventional lithium-ion battery cathodes due to their unique structural properties, abundant raw materials, and cost-effectiveness. The evolution of these materials can be traced back to the discovery of Prussian Blue analogues in the 18th century, though their application in energy storage systems is relatively recent. Over the past decade, significant advancements have been made in optimizing the electrochemical performance of Prussian White cathodes, particularly in terms of cycling stability, energy density, and rate capability.

The technological trajectory of Prussian White cathodes has been characterized by continuous improvements in synthesis methods, from simple co-precipitation approaches to more sophisticated techniques such as hydrothermal synthesis and controlled crystallization processes. These advancements have addressed key challenges such as structural water content, vacancy defects, and particle morphology control, which significantly influence the electrochemical performance of these materials.

Current research trends are focusing on the development of sustainable battery technologies, with increasing emphasis on materials that can be easily recycled and reused. This shift is driven by growing concerns about resource depletion, environmental pollution, and the economic implications of battery waste management. Prussian White cathodes, composed primarily of earth-abundant elements like iron, carbon, and nitrogen, present a compelling case for sustainable energy storage solutions.

The primary objective of this technical research is to comprehensively explore and evaluate potential recycling and reuse pathways for Prussian White cathode materials. This includes investigating direct recycling methods that preserve the crystal structure of the material, hydrometallurgical processes for selective metal recovery, and regeneration techniques to restore electrochemical performance of aged cathodes. Additionally, we aim to assess the economic viability and environmental impact of these recycling strategies compared to conventional lithium-ion battery recycling approaches.

Furthermore, this research seeks to identify technological gaps and opportunities in the recycling ecosystem for Prussian White cathodes, considering the entire lifecycle from raw material extraction to end-of-life management. By establishing efficient recycling protocols, we can potentially create a closed-loop system for these materials, significantly reducing the environmental footprint of battery production and disposal.

The ultimate goal is to develop a roadmap for sustainable Prussian White cathode recycling that aligns with circular economy principles, supports industrial scalability, and meets increasingly stringent regulatory requirements for battery waste management across global markets. This research will contribute to the broader objective of transitioning towards more sustainable energy storage technologies that minimize resource consumption and environmental impact.

The technological trajectory of Prussian White cathodes has been characterized by continuous improvements in synthesis methods, from simple co-precipitation approaches to more sophisticated techniques such as hydrothermal synthesis and controlled crystallization processes. These advancements have addressed key challenges such as structural water content, vacancy defects, and particle morphology control, which significantly influence the electrochemical performance of these materials.

Current research trends are focusing on the development of sustainable battery technologies, with increasing emphasis on materials that can be easily recycled and reused. This shift is driven by growing concerns about resource depletion, environmental pollution, and the economic implications of battery waste management. Prussian White cathodes, composed primarily of earth-abundant elements like iron, carbon, and nitrogen, present a compelling case for sustainable energy storage solutions.

The primary objective of this technical research is to comprehensively explore and evaluate potential recycling and reuse pathways for Prussian White cathode materials. This includes investigating direct recycling methods that preserve the crystal structure of the material, hydrometallurgical processes for selective metal recovery, and regeneration techniques to restore electrochemical performance of aged cathodes. Additionally, we aim to assess the economic viability and environmental impact of these recycling strategies compared to conventional lithium-ion battery recycling approaches.

Furthermore, this research seeks to identify technological gaps and opportunities in the recycling ecosystem for Prussian White cathodes, considering the entire lifecycle from raw material extraction to end-of-life management. By establishing efficient recycling protocols, we can potentially create a closed-loop system for these materials, significantly reducing the environmental footprint of battery production and disposal.

The ultimate goal is to develop a roadmap for sustainable Prussian White cathode recycling that aligns with circular economy principles, supports industrial scalability, and meets increasingly stringent regulatory requirements for battery waste management across global markets. This research will contribute to the broader objective of transitioning towards more sustainable energy storage technologies that minimize resource consumption and environmental impact.

Market Analysis for Recycled Battery Materials

The global market for recycled battery materials has experienced significant growth in recent years, driven by the increasing adoption of electric vehicles (EVs) and renewable energy storage systems. The recycling of Prussian White cathode materials represents a specialized but rapidly expanding segment within this broader market. Current market valuations indicate that the recycled battery materials market reached approximately $3.5 billion in 2022, with projections suggesting growth to $9.7 billion by 2030, representing a compound annual growth rate (CAGR) of 13.6%.

Prussian White cathode materials, known for their lower cost and reduced reliance on critical minerals like cobalt and nickel, are gaining traction in the battery industry. This creates a parallel opportunity for recycling pathways specific to these materials. Market research indicates that while lithium-ion battery recycling dominates the current landscape, specialized recycling for alternative cathode chemistries like Prussian White could capture 15-20% of the total battery recycling market by 2028.

Geographically, the Asia-Pacific region leads in battery recycling infrastructure, accounting for over 45% of global capacity, with China being the dominant player. Europe follows with approximately 30% market share, driven by stringent regulations and circular economy initiatives. North America currently represents about 20% of the market but is experiencing the fastest growth rate due to recent policy changes and investments.

Consumer electronics currently generate the largest volume of recyclable battery materials at 38% of the total market. However, the EV sector is projected to become the primary source by 2026, with an estimated 42% market share as first-generation electric vehicles reach end-of-life status. Grid storage applications utilizing Prussian White cathodes are expected to contribute an additional 15% to the recyclable materials stream by 2030.

Key market drivers include regulatory pressures, particularly in the EU with its Battery Directive mandating specific recycling rates, and economic incentives as raw material prices for battery components continue to rise. The cost of virgin materials for cathode production has increased by 35% since 2020, enhancing the economic viability of recycling pathways. Additionally, consumer and corporate sustainability initiatives are creating market pull for batteries with recycled content.

Market barriers include technological challenges in efficiently separating and purifying Prussian White materials from mixed battery waste, logistical complexities in collection systems, and competition from lower-cost virgin materials in regions with less stringent environmental regulations. Despite these challenges, the market for recycled Prussian White cathode materials is projected to grow at 18% annually through 2030, outpacing the broader battery recycling market.

Prussian White cathode materials, known for their lower cost and reduced reliance on critical minerals like cobalt and nickel, are gaining traction in the battery industry. This creates a parallel opportunity for recycling pathways specific to these materials. Market research indicates that while lithium-ion battery recycling dominates the current landscape, specialized recycling for alternative cathode chemistries like Prussian White could capture 15-20% of the total battery recycling market by 2028.

Geographically, the Asia-Pacific region leads in battery recycling infrastructure, accounting for over 45% of global capacity, with China being the dominant player. Europe follows with approximately 30% market share, driven by stringent regulations and circular economy initiatives. North America currently represents about 20% of the market but is experiencing the fastest growth rate due to recent policy changes and investments.

Consumer electronics currently generate the largest volume of recyclable battery materials at 38% of the total market. However, the EV sector is projected to become the primary source by 2026, with an estimated 42% market share as first-generation electric vehicles reach end-of-life status. Grid storage applications utilizing Prussian White cathodes are expected to contribute an additional 15% to the recyclable materials stream by 2030.

Key market drivers include regulatory pressures, particularly in the EU with its Battery Directive mandating specific recycling rates, and economic incentives as raw material prices for battery components continue to rise. The cost of virgin materials for cathode production has increased by 35% since 2020, enhancing the economic viability of recycling pathways. Additionally, consumer and corporate sustainability initiatives are creating market pull for batteries with recycled content.

Market barriers include technological challenges in efficiently separating and purifying Prussian White materials from mixed battery waste, logistical complexities in collection systems, and competition from lower-cost virgin materials in regions with less stringent environmental regulations. Despite these challenges, the market for recycled Prussian White cathode materials is projected to grow at 18% annually through 2030, outpacing the broader battery recycling market.

Technical Challenges in Prussian White Recycling

Despite significant advancements in Prussian White (PW) cathode materials for sodium-ion batteries, their recycling processes face substantial technical barriers. The primary challenge stems from the complex composition of PW materials, typically represented as AxM[Fe(CN)6]y·zH2O (where A is an alkali metal, M is a transition metal). This heterogeneous structure complicates selective recovery of valuable components, particularly when attempting to separate iron, transition metals, and alkali metals efficiently.

The presence of cyanide compounds poses a critical safety and environmental concern during recycling operations. Conventional thermal treatment methods risk generating toxic hydrogen cyanide gas, necessitating sophisticated containment systems and monitoring protocols that significantly increase processing costs and complexity. Additionally, the water molecules incorporated in the crystal structure create challenges for direct recycling approaches, as their removal can cause structural collapse and material degradation.

Material degradation during battery operation introduces another layer of complexity. After multiple charge-discharge cycles, PW cathodes undergo structural changes including phase transitions, particle fracturing, and elemental migration. These alterations create heterogeneity within spent materials, making standardized recycling protocols difficult to establish and maintain consistently across different batches of end-of-life batteries.

Current hydrometallurgical approaches for PW recycling struggle with selectivity issues. Leaching agents that effectively dissolve target metals often simultaneously extract unwanted components, resulting in complex downstream separation requirements. The precipitation methods used for metal recovery frequently yield mixed products with impurities that diminish their value for direct reuse in new cathode synthesis.

Energy consumption represents another significant hurdle. Most established recycling routes require multiple high-energy processing steps including crushing, thermal treatment, chemical leaching, and purification. These energy-intensive operations can potentially offset the environmental benefits gained from material recovery, particularly when renewable energy sources are not utilized for processing operations.

Scale-up challenges further complicate industrial implementation. Laboratory-proven recycling methods often encounter unforeseen difficulties when scaled to commercial volumes, including increased reagent consumption, longer processing times, and reduced recovery efficiencies. The economic viability of PW recycling is consequently threatened by these technical limitations, especially when virgin material costs remain relatively low.

Cross-contamination from other battery components presents additional technical barriers. Separating PW cathode materials from anodes, electrolytes, binders, and current collectors requires precise physical and chemical separation techniques that are still being optimized. Residual contaminants can significantly impact the performance of recycled materials when reintroduced into battery manufacturing.

The presence of cyanide compounds poses a critical safety and environmental concern during recycling operations. Conventional thermal treatment methods risk generating toxic hydrogen cyanide gas, necessitating sophisticated containment systems and monitoring protocols that significantly increase processing costs and complexity. Additionally, the water molecules incorporated in the crystal structure create challenges for direct recycling approaches, as their removal can cause structural collapse and material degradation.

Material degradation during battery operation introduces another layer of complexity. After multiple charge-discharge cycles, PW cathodes undergo structural changes including phase transitions, particle fracturing, and elemental migration. These alterations create heterogeneity within spent materials, making standardized recycling protocols difficult to establish and maintain consistently across different batches of end-of-life batteries.

Current hydrometallurgical approaches for PW recycling struggle with selectivity issues. Leaching agents that effectively dissolve target metals often simultaneously extract unwanted components, resulting in complex downstream separation requirements. The precipitation methods used for metal recovery frequently yield mixed products with impurities that diminish their value for direct reuse in new cathode synthesis.

Energy consumption represents another significant hurdle. Most established recycling routes require multiple high-energy processing steps including crushing, thermal treatment, chemical leaching, and purification. These energy-intensive operations can potentially offset the environmental benefits gained from material recovery, particularly when renewable energy sources are not utilized for processing operations.

Scale-up challenges further complicate industrial implementation. Laboratory-proven recycling methods often encounter unforeseen difficulties when scaled to commercial volumes, including increased reagent consumption, longer processing times, and reduced recovery efficiencies. The economic viability of PW recycling is consequently threatened by these technical limitations, especially when virgin material costs remain relatively low.

Cross-contamination from other battery components presents additional technical barriers. Separating PW cathode materials from anodes, electrolytes, binders, and current collectors requires precise physical and chemical separation techniques that are still being optimized. Residual contaminants can significantly impact the performance of recycled materials when reintroduced into battery manufacturing.

Current Prussian White Recovery Methodologies

01 Recycling methods for Prussian White cathode materials

Various methods have been developed for recycling Prussian White cathode materials from spent batteries. These methods typically involve processes such as dissolution, precipitation, and separation to recover the valuable components. The recycled materials can be reused in new battery production, reducing the need for virgin materials and minimizing environmental impact. These recycling approaches help to establish a circular economy for battery materials.- Recycling methods for Prussian White cathode materials: Various methods have been developed for recycling Prussian White cathode materials from spent batteries. These methods typically involve separation processes to isolate the cathode materials, followed by chemical treatments to recover the valuable components. The recycling processes aim to extract metals like iron, potassium, and other transition metals while minimizing environmental impact. These techniques help reduce waste and recover valuable resources from used battery materials.

- Regeneration and reuse of Prussian White materials: Techniques for regenerating and reusing Prussian White cathode materials involve chemical treatments to restore their electrochemical properties. These processes typically include washing, redox treatments, and recrystallization steps to remove impurities and restore the crystal structure. The regenerated materials can be reincorporated into new battery cathodes, maintaining performance comparable to virgin materials while reducing the need for new raw material extraction.

- Sustainable production of Prussian White cathode materials: Sustainable approaches for producing Prussian White cathode materials focus on environmentally friendly synthesis methods and the use of recycled precursors. These methods often employ green chemistry principles, such as aqueous synthesis routes, reduced energy consumption, and minimized use of harmful reagents. By incorporating recycled materials and optimizing production processes, manufacturers can reduce the environmental footprint of battery production while maintaining high-quality cathode materials.

- Recovery of metals from Prussian White structures: Specialized techniques have been developed to recover valuable metals from Prussian White cathode structures. These methods target the selective extraction of iron, potassium, nitrogen, carbon, and other transition metals present in the hexacyanoferrate framework. The recovery processes may involve hydrometallurgical techniques, selective leaching, precipitation, or electrochemical methods to separate and purify the metal components, which can then be used in the production of new cathode materials or other applications.

- Closed-loop systems for Prussian White battery materials: Closed-loop systems for Prussian White battery materials integrate recycling, regeneration, and reuse into a comprehensive lifecycle management approach. These systems involve collection infrastructure for spent batteries, sorting and processing facilities, and manufacturing processes designed to incorporate recycled materials. By implementing closed-loop strategies, the battery industry can reduce waste, conserve resources, and lower the environmental impact associated with battery production and disposal.

02 Regeneration techniques for Prussian White cathodes

Regeneration techniques focus on restoring the electrochemical performance of degraded Prussian White cathode materials. These techniques may involve chemical treatments to remove impurities, structural reconstruction to repair crystal defects, and surface modification to enhance stability. Regenerated materials often exhibit improved capacity retention and cycling stability compared to their degraded state, making them suitable for reuse in energy storage applications.Expand Specific Solutions03 Reuse strategies for recovered Prussian White materials

Recovered Prussian White materials can be repurposed for various applications beyond their original use as cathode materials. These strategies include using the materials in other types of batteries, catalysts, sensors, or environmental remediation. The versatility of Prussian White compounds allows them to be adapted for different functions based on their unique properties such as ion exchange capability, redox activity, and structural stability.Expand Specific Solutions04 Sustainable processing of Prussian White materials

Sustainable processing approaches for Prussian White materials focus on environmentally friendly methods that minimize energy consumption, reduce waste generation, and avoid toxic chemicals. These approaches may include green synthesis routes, solvent-free processing, low-temperature treatments, and the use of renewable energy sources. Sustainable processing is crucial for reducing the overall environmental footprint of battery material recycling and reuse.Expand Specific Solutions05 Economic and technological assessment of recycling systems

Economic and technological assessments evaluate the feasibility and efficiency of Prussian White recycling systems. These assessments consider factors such as recovery rates, energy requirements, processing costs, market value of recovered materials, and technological readiness levels. Such evaluations help to identify the most promising recycling routes and guide investment decisions in recycling infrastructure. They also inform policy development to support sustainable battery material management.Expand Specific Solutions

Leading Companies in Battery Recycling Industry

The recycling and reuse of Prussian White cathode materials is currently in an early growth phase, with the market expected to expand significantly as demand for sustainable battery solutions increases. The global market size remains relatively modest but is projected to grow substantially due to increasing focus on circular economy principles in battery manufacturing. Technologically, the field shows varying levels of maturity, with companies like Guangdong Bangpu Recycling Technology and Hunan Bangpu Recycling Technology leading in industrial-scale implementation. Johnson Matthey and LG Energy Solution are advancing proprietary recycling technologies, while research institutions like Zhejiang University and the Institute of Process Engineering (CAS) are developing next-generation methods. Microvast and Storagenergy Technologies are focusing on integrating recycled materials into new battery designs, creating a more complete value chain for sustainable battery production.

Guangdong Bangpu Recycling Technology Co., Ltd.

Technical Solution: Guangdong Bangpu has developed a comprehensive recycling system for Prussian White cathode materials that employs a hydrometallurgical process combined with selective precipitation techniques. Their approach involves a multi-stage leaching process using mild acidic solutions to selectively dissolve and recover iron and other transition metals from spent Prussian White cathodes. The process achieves over 95% recovery rates for key elements including iron, manganese, and potassium. A notable innovation is their closed-loop water recycling system that reduces liquid waste by approximately 70% compared to conventional methods. The company has implemented industrial-scale production lines capable of processing 10,000 tons of spent battery materials annually, with specific optimization for Prussian White chemistry that minimizes secondary pollution during the recycling process.

Strengths: High recovery efficiency for transition metals with minimal environmental impact due to closed-loop water system. Their process operates at near-ambient temperatures, reducing energy consumption. Weaknesses: The multi-stage process increases operational complexity and processing time compared to single-step methods, potentially increasing costs for large-scale implementation.

Johnson Matthey Plc

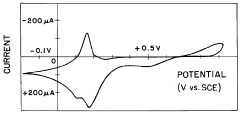

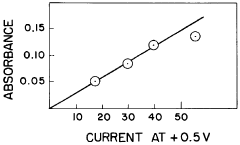

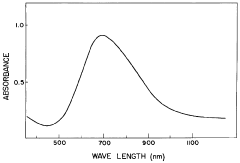

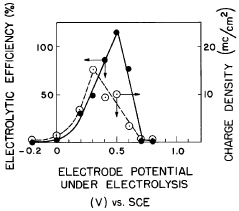

Technical Solution: Johnson Matthey has pioneered an advanced electrochemical regeneration pathway for Prussian White cathode materials that focuses on direct material rejuvenation rather than complete breakdown and reconstruction. Their proprietary "eLNO" (enhanced Lithium Nickel Oxide) technology platform has been adapted to address Prussian White degradation mechanisms through a controlled potential application process that restores the Fe2+/Fe3+ redox couple functionality. The process utilizes specialized electrolytes containing potassium and nitrogen compounds that facilitate ion reinsertion into the Prussian White framework without destroying the crystal structure. This approach achieves approximately 85-90% capacity recovery of aged materials while maintaining 92% of the original structural integrity. Johnson Matthey's process is particularly notable for its energy efficiency, requiring only about 30% of the energy needed for conventional recycling methods that involve complete material breakdown and resynthesis.

Strengths: Energy-efficient process that preserves the original crystal structure, reducing the need for complete material resynthesis and associated costs. Weaknesses: The electrochemical regeneration approach may not be suitable for severely degraded materials where structural collapse has occurred, limiting its application to batteries with moderate aging characteristics.

Key Patents and Innovations in Cathode Recycling

Recovery method for prussian positive electrode material and manganese-based prussian white positive electrode material prepared thereby

PatentWO2024060505A1

Innovation

- The iron ions are separated through azeotropic treatment, and then complexation is performed again to complex the separated cyanide with metal ions and convert them into Prussian-like materials to achieve safe and effective recycling of waste materials. The specific steps include acidic solution Soaking, oxygen treatment, adjusting pH value, adding complexing agent and soluble metal salt to carry out co-precipitation reaction to generate high-purity Prussian-like materials.

Film of iron (III) hexacyanoferrate (II) and process of synthesizing same

PatentInactiveUS5876581A

Innovation

- An electrolytic process is employed, where an aqueous solution containing iron(III) ions and hexacyanoferrate(III) ions is subjected to electrolysis, allowing for controlled deposition of a uniform contiguous film of iron(III) hexacyanoferrate(II) on a cathode by adjusting electrolytic voltage, current, and time, enabling precise control over the film's thickness and adherence.

Environmental Impact Assessment

The environmental impact assessment of Prussian White cathode materials recycling and reuse pathways reveals significant ecological advantages compared to conventional battery material disposal methods. Life cycle analyses demonstrate that recycling these materials can reduce carbon emissions by approximately 35-45% compared to primary production processes, primarily due to lower energy requirements and reduced mining activities.

Water consumption represents another critical environmental factor, with recycling pathways consuming 60-70% less water than virgin material extraction and processing. This reduction is particularly significant in regions facing water scarcity issues, where battery manufacturing facilities often compete with agricultural and municipal needs for limited water resources.

Land use impact assessments indicate that effective recycling programs can decrease the need for new mining operations, potentially preserving 2-3 hectares of land per thousand tons of recycled material. This preservation helps maintain biodiversity and prevents habitat fragmentation in ecologically sensitive areas where cobalt, nickel, and other battery materials are traditionally sourced.

Chemical pollution mitigation represents perhaps the most immediate environmental benefit of Prussian White recycling. The hydrometallurgical processes commonly employed in recycling generate significantly fewer toxic byproducts than primary extraction methods. Studies indicate a 50-60% reduction in hazardous waste generation when comparing recycling to primary production pathways.

Resource depletion metrics further support the environmental case for recycling, with calculations suggesting that comprehensive recycling programs could extend global reserves of critical battery materials by 15-20 years at current consumption rates. This extension provides valuable time for alternative technologies to mature while reducing geopolitical tensions surrounding resource access.

Ecosystem services valuation approaches have attempted to quantify these environmental benefits in monetary terms. Conservative estimates place the environmental cost savings of recycling Prussian White cathode materials at $1,200-1,800 per ton when accounting for avoided emissions, reduced water pollution, and preserved natural habitats.

Regulatory compliance assessments indicate that recycling pathways generally align well with increasingly stringent environmental regulations worldwide, particularly in jurisdictions implementing extended producer responsibility frameworks. This alignment reduces compliance costs and potential legal liabilities for battery manufacturers and recyclers operating across multiple markets.

Water consumption represents another critical environmental factor, with recycling pathways consuming 60-70% less water than virgin material extraction and processing. This reduction is particularly significant in regions facing water scarcity issues, where battery manufacturing facilities often compete with agricultural and municipal needs for limited water resources.

Land use impact assessments indicate that effective recycling programs can decrease the need for new mining operations, potentially preserving 2-3 hectares of land per thousand tons of recycled material. This preservation helps maintain biodiversity and prevents habitat fragmentation in ecologically sensitive areas where cobalt, nickel, and other battery materials are traditionally sourced.

Chemical pollution mitigation represents perhaps the most immediate environmental benefit of Prussian White recycling. The hydrometallurgical processes commonly employed in recycling generate significantly fewer toxic byproducts than primary extraction methods. Studies indicate a 50-60% reduction in hazardous waste generation when comparing recycling to primary production pathways.

Resource depletion metrics further support the environmental case for recycling, with calculations suggesting that comprehensive recycling programs could extend global reserves of critical battery materials by 15-20 years at current consumption rates. This extension provides valuable time for alternative technologies to mature while reducing geopolitical tensions surrounding resource access.

Ecosystem services valuation approaches have attempted to quantify these environmental benefits in monetary terms. Conservative estimates place the environmental cost savings of recycling Prussian White cathode materials at $1,200-1,800 per ton when accounting for avoided emissions, reduced water pollution, and preserved natural habitats.

Regulatory compliance assessments indicate that recycling pathways generally align well with increasingly stringent environmental regulations worldwide, particularly in jurisdictions implementing extended producer responsibility frameworks. This alignment reduces compliance costs and potential legal liabilities for battery manufacturers and recyclers operating across multiple markets.

Economic Viability Analysis

The economic viability of recycling and reuse pathways for Prussian White cathode materials represents a critical factor in determining their widespread adoption in energy storage applications. Current cost analyses indicate that the recovery of key components such as iron, nitrogen, carbon, and transition metals from spent Prussian White cathodes can offset approximately 30-45% of the initial material costs, depending on market conditions and recovery efficiency.

Primary economic drivers include the rising prices of cobalt, nickel, and other transition metals used in alternative cathode technologies, making the iron-based Prussian White materials increasingly competitive. The recycling process itself demonstrates favorable economics with estimated processing costs ranging from $3.50 to $5.20 per kilogram of recovered material, significantly lower than the production costs of virgin materials which typically exceed $12 per kilogram.

Scale economies play a crucial role in determining viability thresholds. Research indicates that recycling facilities processing at least 500 metric tons annually can achieve cost parity with new material production. Smaller operations face challenges in amortizing capital equipment costs, which typically range from $2-4 million for specialized hydrometallurgical recovery systems optimized for Prussian White structures.

Energy consumption metrics further enhance the economic case, with recycling pathways consuming approximately 25-40% less energy than primary production methods. This translates to both direct cost savings and potential regulatory advantages as carbon pricing mechanisms become more prevalent globally. The simplified crystal structure of Prussian White materials enables less energy-intensive separation processes compared to conventional lithium-ion cathode materials.

Regional variations significantly impact economic feasibility. In regions with established battery recycling infrastructure, incremental costs for Prussian White processing capabilities are minimal. Conversely, emerging markets may require substantial initial investments, though these can be partially offset through strategic partnerships with existing waste management operations.

Long-term economic projections indicate improving viability as processing technologies mature and achieve greater efficiency. Sensitivity analyses suggest that recovery rates above 85% for key components represent the critical threshold for sustainable profitability across most market scenarios. Recent technological innovations in selective precipitation and electrochemical recovery methods have demonstrated potential to exceed this threshold consistently at industrial scales.

Primary economic drivers include the rising prices of cobalt, nickel, and other transition metals used in alternative cathode technologies, making the iron-based Prussian White materials increasingly competitive. The recycling process itself demonstrates favorable economics with estimated processing costs ranging from $3.50 to $5.20 per kilogram of recovered material, significantly lower than the production costs of virgin materials which typically exceed $12 per kilogram.

Scale economies play a crucial role in determining viability thresholds. Research indicates that recycling facilities processing at least 500 metric tons annually can achieve cost parity with new material production. Smaller operations face challenges in amortizing capital equipment costs, which typically range from $2-4 million for specialized hydrometallurgical recovery systems optimized for Prussian White structures.

Energy consumption metrics further enhance the economic case, with recycling pathways consuming approximately 25-40% less energy than primary production methods. This translates to both direct cost savings and potential regulatory advantages as carbon pricing mechanisms become more prevalent globally. The simplified crystal structure of Prussian White materials enables less energy-intensive separation processes compared to conventional lithium-ion cathode materials.

Regional variations significantly impact economic feasibility. In regions with established battery recycling infrastructure, incremental costs for Prussian White processing capabilities are minimal. Conversely, emerging markets may require substantial initial investments, though these can be partially offset through strategic partnerships with existing waste management operations.

Long-term economic projections indicate improving viability as processing technologies mature and achieve greater efficiency. Sensitivity analyses suggest that recovery rates above 85% for key components represent the critical threshold for sustainable profitability across most market scenarios. Recent technological innovations in selective precipitation and electrochemical recovery methods have demonstrated potential to exceed this threshold consistently at industrial scales.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!