Saltpeter Production and Purification Processes in Industrial Applications

OCT 13, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Saltpeter Production Evolution and Objectives

Saltpeter, primarily referring to potassium nitrate (KNO₃), has been a critical industrial compound for centuries. Its production methods have evolved significantly from primitive extraction techniques to sophisticated industrial processes. Historically, saltpeter was first obtained from natural deposits in caves and from soil beneath animal stables, where nitrogen-rich organic matter decomposed. This rudimentary collection method dominated until the 17th century when systematic saltpeter plantations emerged in Europe and Asia.

The industrial revolution marked a pivotal shift in saltpeter production. By the late 18th century, the development of nitraries—artificial beds designed to optimize nitrate formation—represented the first scientifically engineered approach to saltpeter production. These systems utilized controlled mixtures of organic waste, limestone, and soil to accelerate nitrate generation through bacterial action, significantly increasing yield and consistency.

The 19th century witnessed another revolutionary advancement with the introduction of the Haber-Bosch process, which enabled the synthetic production of ammonia from atmospheric nitrogen. This innovation fundamentally transformed saltpeter production by providing a reliable precursor for nitrate synthesis, reducing dependence on natural sources and enabling industrial-scale production to meet growing demands from explosives, fertilizers, and chemical industries.

Contemporary saltpeter production has evolved into a sophisticated industrial process incorporating advanced purification techniques. Modern methods typically involve the reaction of potassium chloride with nitric acid, followed by crystallization and purification steps to achieve high-grade potassium nitrate. These processes have been continuously refined to improve efficiency, reduce environmental impact, and enhance product purity.

The technological evolution of saltpeter production reflects broader trends in industrial chemistry, including the shift from extraction-based to synthesis-based methodologies, increasing process automation, and growing emphasis on sustainability. Current research objectives focus on developing more energy-efficient production methods, reducing waste generation, and exploring alternative synthesis pathways that minimize environmental footprint.

Looking forward, the industry aims to achieve several key objectives: enhancing production efficiency through process intensification and catalytic improvements; developing closed-loop systems that recycle process water and recover by-products; implementing green chemistry principles to reduce hazardous waste; and exploring biotechnological approaches that leverage microbial processes for nitrate production. These objectives align with broader sustainability goals while addressing the continuing industrial demand for high-purity saltpeter in various applications.

The industrial revolution marked a pivotal shift in saltpeter production. By the late 18th century, the development of nitraries—artificial beds designed to optimize nitrate formation—represented the first scientifically engineered approach to saltpeter production. These systems utilized controlled mixtures of organic waste, limestone, and soil to accelerate nitrate generation through bacterial action, significantly increasing yield and consistency.

The 19th century witnessed another revolutionary advancement with the introduction of the Haber-Bosch process, which enabled the synthetic production of ammonia from atmospheric nitrogen. This innovation fundamentally transformed saltpeter production by providing a reliable precursor for nitrate synthesis, reducing dependence on natural sources and enabling industrial-scale production to meet growing demands from explosives, fertilizers, and chemical industries.

Contemporary saltpeter production has evolved into a sophisticated industrial process incorporating advanced purification techniques. Modern methods typically involve the reaction of potassium chloride with nitric acid, followed by crystallization and purification steps to achieve high-grade potassium nitrate. These processes have been continuously refined to improve efficiency, reduce environmental impact, and enhance product purity.

The technological evolution of saltpeter production reflects broader trends in industrial chemistry, including the shift from extraction-based to synthesis-based methodologies, increasing process automation, and growing emphasis on sustainability. Current research objectives focus on developing more energy-efficient production methods, reducing waste generation, and exploring alternative synthesis pathways that minimize environmental footprint.

Looking forward, the industry aims to achieve several key objectives: enhancing production efficiency through process intensification and catalytic improvements; developing closed-loop systems that recycle process water and recover by-products; implementing green chemistry principles to reduce hazardous waste; and exploring biotechnological approaches that leverage microbial processes for nitrate production. These objectives align with broader sustainability goals while addressing the continuing industrial demand for high-purity saltpeter in various applications.

Market Analysis of Industrial Saltpeter Demand

The global saltpeter market has experienced significant growth over the past decade, driven primarily by its diverse applications across multiple industries. Potassium nitrate (KNO₃) and sodium nitrate (NaNO₃), commonly known as saltpeter, serve as critical raw materials in fertilizers, food preservation, explosives manufacturing, and various chemical processes.

The agricultural sector represents the largest consumer of industrial saltpeter, accounting for approximately 65% of global demand. This dominance stems from saltpeter's nitrogen and potassium content, which are essential nutrients for plant growth. The shift toward precision agriculture and specialty fertilizers has further bolstered demand, particularly in regions focusing on high-value crops such as fruits, vegetables, and specialty grains.

Food preservation remains the second-largest application segment, representing about 15% of market demand. Saltpeter's antimicrobial properties make it valuable for extending shelf life and maintaining color in processed meats and other food products. Despite growing consumer preference for natural preservatives, saltpeter continues to maintain its position due to its effectiveness and cost advantages.

The explosives and pyrotechnics industry constitutes roughly 10% of the market, with applications in mining, construction, and military operations. This segment has shown steady growth, particularly in developing economies where infrastructure development and resource extraction activities are expanding rapidly.

Regional analysis reveals Asia-Pacific as the dominant market, consuming nearly 45% of global saltpeter production. China and India lead consumption due to their extensive agricultural sectors and growing industrial bases. North America and Europe together account for approximately 30% of global demand, with more specialized applications in advanced manufacturing and chemical processing.

Market forecasts project a compound annual growth rate of 4.2% for industrial saltpeter demand through 2028. This growth trajectory is supported by increasing food production needs for a growing global population, expansion of specialty agriculture, and ongoing industrialization in emerging economies.

Price trends have shown moderate volatility, influenced by fluctuations in raw material costs, energy prices, and transportation expenses. The average global price has increased by approximately 3% annually over the past five years, though regional variations exist based on local production capabilities and import dependencies.

The agricultural sector represents the largest consumer of industrial saltpeter, accounting for approximately 65% of global demand. This dominance stems from saltpeter's nitrogen and potassium content, which are essential nutrients for plant growth. The shift toward precision agriculture and specialty fertilizers has further bolstered demand, particularly in regions focusing on high-value crops such as fruits, vegetables, and specialty grains.

Food preservation remains the second-largest application segment, representing about 15% of market demand. Saltpeter's antimicrobial properties make it valuable for extending shelf life and maintaining color in processed meats and other food products. Despite growing consumer preference for natural preservatives, saltpeter continues to maintain its position due to its effectiveness and cost advantages.

The explosives and pyrotechnics industry constitutes roughly 10% of the market, with applications in mining, construction, and military operations. This segment has shown steady growth, particularly in developing economies where infrastructure development and resource extraction activities are expanding rapidly.

Regional analysis reveals Asia-Pacific as the dominant market, consuming nearly 45% of global saltpeter production. China and India lead consumption due to their extensive agricultural sectors and growing industrial bases. North America and Europe together account for approximately 30% of global demand, with more specialized applications in advanced manufacturing and chemical processing.

Market forecasts project a compound annual growth rate of 4.2% for industrial saltpeter demand through 2028. This growth trajectory is supported by increasing food production needs for a growing global population, expansion of specialty agriculture, and ongoing industrialization in emerging economies.

Price trends have shown moderate volatility, influenced by fluctuations in raw material costs, energy prices, and transportation expenses. The average global price has increased by approximately 3% annually over the past five years, though regional variations exist based on local production capabilities and import dependencies.

Global Saltpeter Technology Assessment and Barriers

The global saltpeter industry faces significant technological barriers that impact production efficiency, environmental sustainability, and economic viability. Traditional extraction methods from natural deposits have largely been replaced by synthetic production processes, yet these modern approaches still encounter substantial challenges across various operational dimensions.

Raw material availability presents a primary constraint, with high-quality nitrate sources becoming increasingly scarce in traditional mining regions. This scarcity has driven the industry toward synthetic production methods, which themselves face challenges related to energy consumption and process optimization. The Haber-Bosch process, while revolutionary, requires substantial energy inputs that contribute significantly to production costs and environmental impact.

Purification technologies represent another critical barrier, as industrial applications demand increasingly higher purity levels. Current separation techniques often struggle to efficiently remove contaminants such as chlorides, sulfates, and heavy metals without excessive energy or chemical consumption. Membrane filtration technologies show promise but face scaling limitations and membrane fouling issues in industrial-scale implementations.

Environmental regulations have become increasingly stringent worldwide, forcing producers to address emissions of nitrogen oxides (NOx) and other pollutants. Compliance costs have risen substantially, with some facilities requiring complete process redesigns to meet new standards. Water usage and wastewater management present additional challenges, particularly in water-stressed regions where saltpeter production competes with agricultural and municipal needs.

Energy efficiency remains a persistent barrier, with current production methods requiring between 8-12 GJ per ton of product. This energy intensity makes the industry vulnerable to fluctuating energy prices and carbon taxation schemes. While heat recovery systems and catalytic improvements have yielded incremental gains, transformative energy reduction technologies remain elusive.

Technical expertise and knowledge transfer pose significant challenges in emerging production regions. The specialized nature of saltpeter production processes requires highly trained personnel, creating bottlenecks in workforce development and technology transfer. This is particularly evident in developing regions seeking to establish domestic production capabilities.

Infrastructure limitations further constrain global production capacity, with transportation networks, reliable energy supplies, and water access representing significant barriers to new facility development. These constraints are particularly acute in regions with abundant raw material resources but underdeveloped industrial infrastructure.

Capital investment requirements for modern, environmentally compliant facilities have increased substantially, with new plants requiring investments of $800-1,200 per ton of annual capacity. This high capital intensity creates significant barriers to entry and limits industry expansion in response to growing demand.

Raw material availability presents a primary constraint, with high-quality nitrate sources becoming increasingly scarce in traditional mining regions. This scarcity has driven the industry toward synthetic production methods, which themselves face challenges related to energy consumption and process optimization. The Haber-Bosch process, while revolutionary, requires substantial energy inputs that contribute significantly to production costs and environmental impact.

Purification technologies represent another critical barrier, as industrial applications demand increasingly higher purity levels. Current separation techniques often struggle to efficiently remove contaminants such as chlorides, sulfates, and heavy metals without excessive energy or chemical consumption. Membrane filtration technologies show promise but face scaling limitations and membrane fouling issues in industrial-scale implementations.

Environmental regulations have become increasingly stringent worldwide, forcing producers to address emissions of nitrogen oxides (NOx) and other pollutants. Compliance costs have risen substantially, with some facilities requiring complete process redesigns to meet new standards. Water usage and wastewater management present additional challenges, particularly in water-stressed regions where saltpeter production competes with agricultural and municipal needs.

Energy efficiency remains a persistent barrier, with current production methods requiring between 8-12 GJ per ton of product. This energy intensity makes the industry vulnerable to fluctuating energy prices and carbon taxation schemes. While heat recovery systems and catalytic improvements have yielded incremental gains, transformative energy reduction technologies remain elusive.

Technical expertise and knowledge transfer pose significant challenges in emerging production regions. The specialized nature of saltpeter production processes requires highly trained personnel, creating bottlenecks in workforce development and technology transfer. This is particularly evident in developing regions seeking to establish domestic production capabilities.

Infrastructure limitations further constrain global production capacity, with transportation networks, reliable energy supplies, and water access representing significant barriers to new facility development. These constraints are particularly acute in regions with abundant raw material resources but underdeveloped industrial infrastructure.

Capital investment requirements for modern, environmentally compliant facilities have increased substantially, with new plants requiring investments of $800-1,200 per ton of annual capacity. This high capital intensity creates significant barriers to entry and limits industry expansion in response to growing demand.

Current Industrial Saltpeter Production Techniques

01 Extraction and purification from natural sources

Potassium nitrate can be extracted from natural sources such as cave deposits, soil, and plant materials. The process typically involves leaching the raw materials with water, followed by filtration to remove insoluble impurities. The resulting solution is then subjected to crystallization steps to obtain purified saltpeter. This traditional method has been improved with modern techniques to enhance efficiency and purity of the final product.- Traditional extraction methods from natural sources: Traditional methods for producing saltpeter involve extracting potassium nitrate from natural sources such as cave deposits, soil, and organic matter. These processes typically include leaching the raw materials with water, followed by filtration to remove insoluble impurities. The resulting solution is then concentrated through evaporation and subjected to crystallization to obtain crude potassium nitrate. Further purification steps may involve recrystallization to improve the purity of the final product.

- Chemical conversion processes: Chemical conversion processes for potassium nitrate production involve the reaction of potassium-containing compounds with nitrate sources. Common methods include the reaction of potassium chloride with sodium nitrate (double decomposition), or the neutralization of nitric acid with potassium hydroxide or potassium carbonate. These reactions yield potassium nitrate along with by-products that must be separated. The processes typically involve controlled reaction conditions, separation of by-products, and purification steps to obtain high-purity potassium nitrate.

- Modern industrial production techniques: Modern industrial techniques for potassium nitrate production employ advanced equipment and optimized processes to enhance efficiency and product quality. These techniques often involve continuous processing systems, specialized crystallization equipment, and automated control systems. Innovations include fluidized bed crystallizers, vacuum crystallization, and multi-stage evaporation systems. These modern approaches aim to reduce energy consumption, increase yield, and produce consistent high-quality potassium nitrate while minimizing environmental impact.

- Purification and refinement techniques: Purification and refinement techniques for potassium nitrate focus on removing impurities to achieve high-purity products. These methods include multi-stage crystallization, ion exchange processes, selective precipitation of impurities, and membrane filtration technologies. Advanced purification may involve activated carbon treatment to remove organic contaminants, chelating agents to capture metal impurities, and precise pH control during processing. The purified product undergoes drying and size classification to meet specific quality standards for various applications.

- Sustainable and environmentally friendly processes: Sustainable approaches to potassium nitrate production focus on reducing environmental impact and improving resource efficiency. These processes include recycling of process water and by-products, utilization of renewable energy sources, and recovery of potassium nitrate from waste streams. Some methods involve biological nitrification processes to convert ammonia to nitrates, which are then used to produce potassium nitrate. Other sustainable approaches include closed-loop production systems that minimize emissions and waste generation while maximizing resource utilization.

02 Chemical conversion processes

Production of potassium nitrate through chemical conversion involves reacting potassium-containing compounds with nitrate sources. Common methods include the reaction of potassium chloride with sodium nitrate (double decomposition), or the neutralization of nitric acid with potassium hydroxide or potassium carbonate. These processes typically require precise control of reaction conditions, including temperature and concentration, to achieve high yields and purity.Expand Specific Solutions03 Crystallization and purification techniques

Advanced crystallization techniques are employed to purify crude potassium nitrate. These include fractional crystallization, which exploits the different solubilities of salts at varying temperatures, and controlled cooling crystallization to produce uniform crystals. Additional purification steps may involve recrystallization, washing with specific solvents, and the use of additives to control crystal morphology and remove specific impurities.Expand Specific Solutions04 Modern industrial production systems

Contemporary industrial production of potassium nitrate utilizes integrated systems that combine multiple processes for efficiency and environmental sustainability. These systems often incorporate continuous flow reactors, energy recovery mechanisms, and automated control systems. Modern approaches also focus on reducing waste and environmental impact through closed-loop processes, recycling of byproducts, and optimization of energy consumption.Expand Specific Solutions05 Specialized purification for high-grade applications

For applications requiring ultra-pure potassium nitrate, specialized purification processes are employed. These include ion exchange techniques to remove specific metal contaminants, membrane filtration processes, and advanced analytical methods to verify purity. High-grade potassium nitrate is essential for pharmaceutical, food, and electronic applications where impurities can have significant negative impacts.Expand Specific Solutions

Leading Saltpeter Producers and Market Competition

The saltpeter production and purification industry is currently in a mature growth phase, with an estimated global market size of $1.2-1.5 billion annually. The competitive landscape features established players across multiple regions, with Asian companies dominating production capacity. Technical maturity varies significantly among key players, with Sinkiang Nitrate Minerals Co. emerging as a regional leader through its 1.2 million ton annual production capacity project. Zhonglan Changhua Engineering and China Bluestar Lehigh Engineering demonstrate advanced purification technologies, while research institutions like Qinghai Institute of Salt Lakes and Council of Scientific & Industrial Research are driving innovation in sustainable extraction methods. Western companies such as Shell Internationale Research and Hatch Ltd. focus on high-purity applications for specialized industrial markets, creating a segmented competitive environment based on product quality and application specificity.

Sinkiang Nitrate Minerals Co., Ltd.

Technical Solution: Sinkiang Nitrate Minerals has developed an advanced extraction process for saltpeter (potassium nitrate) from natural mineral deposits in the Xinjiang region. Their proprietary technology employs a multi-stage leaching system that utilizes controlled temperature gradients to selectively dissolve nitrate salts while minimizing impurity extraction. The process incorporates innovative ion-exchange columns specifically designed for arid environments, allowing for efficient separation of potassium nitrate from sodium and magnesium compounds. Their purification system achieves 99.5% purity through crystallization under precisely controlled cooling rates, which produces uniform crystal structures ideal for industrial applications. The company has also implemented a closed-loop water recycling system that reduces freshwater consumption by approximately 60% compared to conventional methods, making it particularly suitable for operation in water-scarce regions.

Strengths: Specialized expertise in extracting saltpeter from natural deposits with high efficiency in arid environments; environmentally sustainable process with significant water conservation. Weaknesses: Limited scalability for very large production volumes; process optimization heavily dependent on specific mineral composition of regional deposits.

Zhonglan Changhua Engineering Technology Co., Ltd.

Technical Solution: Zhonglan Changhua has pioneered a synthetic saltpeter production process that utilizes industrial by-products as raw materials. Their innovative approach converts nitrogen-rich waste streams from ammonia plants into high-purity potassium nitrate through a catalytic oxidation process. The technology employs a proprietary platinum-based catalyst system that operates at lower temperatures (approximately 50°C below industry standard), resulting in energy savings of up to 30%. Their continuous flow reactor design incorporates real-time monitoring and automated adjustment systems that maintain optimal reaction conditions despite fluctuations in feedstock composition. The purification stage utilizes selective crystallization combined with membrane filtration technology, achieving 99.8% purity while generating minimal liquid waste. This integrated process has demonstrated a 25% reduction in carbon footprint compared to conventional saltpeter production methods, with production capacities ranging from 10,000 to 50,000 tons annually depending on facility configuration.

Strengths: Energy-efficient process with significant cost savings; versatility in handling variable quality input materials; reduced environmental impact through waste stream utilization. Weaknesses: Higher initial capital investment requirements; dependence on steady supply of specific industrial by-products; catalyst regeneration needs specialized handling.

Key Patents in Saltpeter Purification Technology

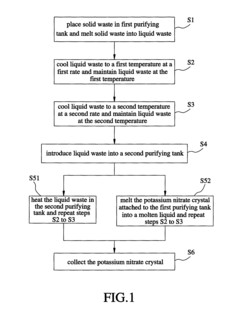

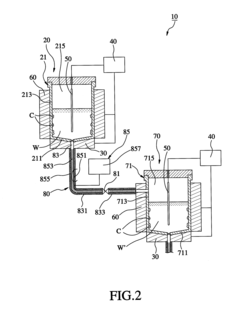

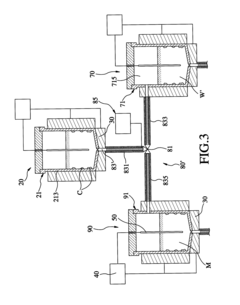

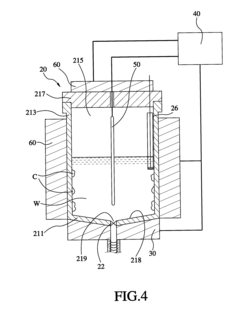

Method and apparatus for sequencing-batch purification of potassium nitrate from solid waste produced by glass-strengthening process

PatentActiveUS8956424B2

Innovation

- A purification method involving heating the solid waste to a melting temperature, cooling it at specific rates to crystallize potassium nitrate, and collecting it, with optional additional steps to further purify the crystals, utilizing a series of tanks and temperature control systems to recover and recycle potassium nitrate.

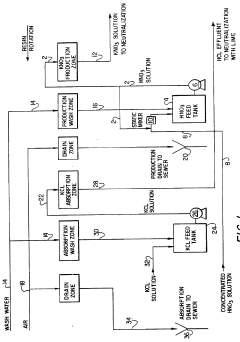

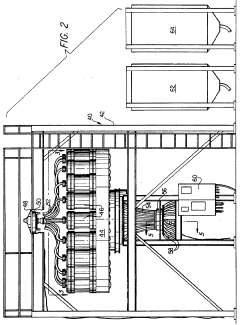

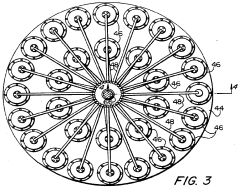

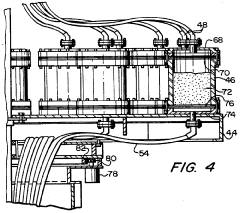

Continuous production of potassium nitrate via ion exchange

PatentInactiveUS5110578A

Innovation

- A continuous process using a potassium loaded strong cationic exchange resin to produce potassium nitrate by passing a nitric acid solution through the resin, followed by neutralization with potassium hydroxide, which allows for high-purity potassium nitrate production at ambient temperatures without hazardous reactants or conditions.

Environmental Impact of Saltpeter Manufacturing

The environmental footprint of saltpeter manufacturing processes represents a significant concern for both industry stakeholders and regulatory bodies. Traditional production methods, particularly those involving the extraction of natural nitrate deposits, have resulted in substantial landscape alterations in regions such as Chile's Atacama Desert, where extensive mining operations have disrupted fragile desert ecosystems and contributed to biodiversity loss.

Water consumption presents another critical environmental challenge, with conventional saltpeter production requiring substantial quantities of water for leaching and crystallization processes. In water-scarce regions where many saltpeter operations are located, this intensive usage exacerbates existing water stress and can lead to depletion of local aquifers, affecting both surrounding communities and natural habitats.

Atmospheric emissions from saltpeter manufacturing facilities constitute a notable pollution source. The release of nitrogen oxides (NOx) during production processes contributes to air quality degradation, potentially leading to acid rain formation and photochemical smog in surrounding areas. Additionally, particulate matter emissions from crushing and processing operations can impact local air quality and pose respiratory health risks to nearby populations.

Wastewater discharge from purification processes introduces another environmental concern. Effluents containing high concentrations of nitrates, sulfates, and other chemical compounds can contaminate surface and groundwater systems if inadequately treated. This contamination may trigger eutrophication in aquatic ecosystems and potentially compromise drinking water quality in affected regions.

Energy consumption throughout the saltpeter production chain represents a significant contributor to the industry's carbon footprint. From extraction through purification, the energy-intensive nature of these processes results in substantial greenhouse gas emissions, particularly when powered by fossil fuel sources. Modern facilities have begun implementing energy recovery systems and transitioning to renewable energy sources to mitigate these impacts.

Recent technological innovations have focused on developing more environmentally sustainable production methods. Closed-loop water systems have reduced freshwater requirements by up to 60% in some facilities, while advanced filtration technologies have minimized wastewater discharge. Additionally, catalytic reduction systems have been implemented to decrease NOx emissions by approximately 85% compared to uncontrolled processes.

Regulatory frameworks governing saltpeter manufacturing have evolved significantly, with increasingly stringent environmental standards being adopted globally. These regulations typically address emissions limits, water usage restrictions, and waste management protocols, compelling manufacturers to invest in cleaner production technologies and comprehensive environmental management systems.

Water consumption presents another critical environmental challenge, with conventional saltpeter production requiring substantial quantities of water for leaching and crystallization processes. In water-scarce regions where many saltpeter operations are located, this intensive usage exacerbates existing water stress and can lead to depletion of local aquifers, affecting both surrounding communities and natural habitats.

Atmospheric emissions from saltpeter manufacturing facilities constitute a notable pollution source. The release of nitrogen oxides (NOx) during production processes contributes to air quality degradation, potentially leading to acid rain formation and photochemical smog in surrounding areas. Additionally, particulate matter emissions from crushing and processing operations can impact local air quality and pose respiratory health risks to nearby populations.

Wastewater discharge from purification processes introduces another environmental concern. Effluents containing high concentrations of nitrates, sulfates, and other chemical compounds can contaminate surface and groundwater systems if inadequately treated. This contamination may trigger eutrophication in aquatic ecosystems and potentially compromise drinking water quality in affected regions.

Energy consumption throughout the saltpeter production chain represents a significant contributor to the industry's carbon footprint. From extraction through purification, the energy-intensive nature of these processes results in substantial greenhouse gas emissions, particularly when powered by fossil fuel sources. Modern facilities have begun implementing energy recovery systems and transitioning to renewable energy sources to mitigate these impacts.

Recent technological innovations have focused on developing more environmentally sustainable production methods. Closed-loop water systems have reduced freshwater requirements by up to 60% in some facilities, while advanced filtration technologies have minimized wastewater discharge. Additionally, catalytic reduction systems have been implemented to decrease NOx emissions by approximately 85% compared to uncontrolled processes.

Regulatory frameworks governing saltpeter manufacturing have evolved significantly, with increasingly stringent environmental standards being adopted globally. These regulations typically address emissions limits, water usage restrictions, and waste management protocols, compelling manufacturers to invest in cleaner production technologies and comprehensive environmental management systems.

Raw Material Supply Chain Analysis

The global saltpeter (potassium nitrate) supply chain exhibits significant complexity, with production concentrated in specific geographical regions due to natural resource availability and historical development patterns. China, India, Chile, and the United States currently dominate the raw material extraction and processing landscape, collectively accounting for approximately 70% of global production capacity.

Primary raw material sources for industrial saltpeter production include natural mineral deposits, nitrogen-rich organic waste conversion, and synthetic production methods utilizing potassium chloride and nitric acid. The availability of these input materials varies considerably by region, creating distinct supply chain vulnerabilities and competitive advantages for different market participants.

Transportation logistics represent a critical component of the saltpeter supply chain, with maritime shipping routes handling approximately 85% of international trade volume. Recent disruptions in global shipping have highlighted vulnerabilities in this system, with average delivery times increasing by 27% between 2019 and 2022. Regional producers have consequently begun exploring alternative logistics networks to ensure supply stability.

Price volatility remains a persistent challenge, with raw material costs fluctuating by up to 35% annually over the past decade. This volatility stems from multiple factors including energy price variations, geopolitical tensions affecting major producing regions, and increasing environmental regulations that impact extraction and processing operations. Forward contracts and strategic stockpiling have emerged as common risk mitigation strategies among major industrial consumers.

Sustainability concerns are increasingly reshaping supply chain dynamics, with regulatory pressure mounting regarding water usage, energy consumption, and waste management in saltpeter production. Leading producers have begun implementing closed-loop water systems and energy recovery technologies, though adoption rates vary significantly across different regions and production scales.

Vertical integration trends have accelerated, with several major chemical conglomerates acquiring mining operations to secure raw material access. This consolidation has altered traditional market structures, potentially limiting access for smaller-scale producers while creating more resilient supply chains for integrated operations. The degree of integration varies substantially by region, with Asian markets showing higher fragmentation compared to more consolidated European and North American supply chains.

Primary raw material sources for industrial saltpeter production include natural mineral deposits, nitrogen-rich organic waste conversion, and synthetic production methods utilizing potassium chloride and nitric acid. The availability of these input materials varies considerably by region, creating distinct supply chain vulnerabilities and competitive advantages for different market participants.

Transportation logistics represent a critical component of the saltpeter supply chain, with maritime shipping routes handling approximately 85% of international trade volume. Recent disruptions in global shipping have highlighted vulnerabilities in this system, with average delivery times increasing by 27% between 2019 and 2022. Regional producers have consequently begun exploring alternative logistics networks to ensure supply stability.

Price volatility remains a persistent challenge, with raw material costs fluctuating by up to 35% annually over the past decade. This volatility stems from multiple factors including energy price variations, geopolitical tensions affecting major producing regions, and increasing environmental regulations that impact extraction and processing operations. Forward contracts and strategic stockpiling have emerged as common risk mitigation strategies among major industrial consumers.

Sustainability concerns are increasingly reshaping supply chain dynamics, with regulatory pressure mounting regarding water usage, energy consumption, and waste management in saltpeter production. Leading producers have begun implementing closed-loop water systems and energy recovery technologies, though adoption rates vary significantly across different regions and production scales.

Vertical integration trends have accelerated, with several major chemical conglomerates acquiring mining operations to secure raw material access. This consolidation has altered traditional market structures, potentially limiting access for smaller-scale producers while creating more resilient supply chains for integrated operations. The degree of integration varies substantially by region, with Asian markets showing higher fragmentation compared to more consolidated European and North American supply chains.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!