Supply Chain Considerations For Commercial Quantum Dot Production

AUG 29, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Quantum Dot Technology Evolution and Objectives

Quantum dots (QDs) have evolved significantly since their initial discovery in the 1980s. Originally observed as a phenomenon in semiconductor nanocrystals, these nanoscale particles have transitioned from laboratory curiosities to commercially viable materials with diverse applications. The evolution began with fundamental research into quantum confinement effects, which demonstrated that particle size could directly influence electronic and optical properties. This breakthrough laid the foundation for controlled synthesis methods that emerged in the 1990s.

The technological trajectory accelerated in the early 2000s with the development of core-shell structures that enhanced quantum yield and stability. This advancement marked a critical transition from purely academic research to potential commercial applications. By the mid-2000s, solution-processable quantum dots emerged, enabling more cost-effective manufacturing techniques and expanding potential use cases beyond specialized laboratory environments.

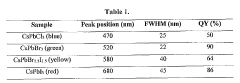

Recent years have witnessed remarkable progress in synthesis precision, with manufacturers now able to produce quantum dots with narrow size distributions and tailored surface chemistries. This precision has been crucial for commercial adoption in display technologies, where color purity and consistency are paramount. Concurrently, efforts to reduce or eliminate toxic heavy metals like cadmium have resulted in more environmentally friendly alternatives such as indium phosphide-based quantum dots.

The primary technological objectives in quantum dot production now center on scalability, consistency, and sustainability. Manufacturers aim to develop robust supply chains capable of delivering high-quality quantum dots at industrial scales while maintaining batch-to-batch consistency. This requires standardization of production processes and quality control metrics across the industry. Additionally, there is a strong focus on reducing environmental impact through greener synthesis methods and materials.

Cost reduction represents another critical objective, as current production methods often involve expensive precursors and energy-intensive processes. Research is actively pursuing more economical synthesis routes and precursor alternatives that maintain performance while reducing production expenses. Simultaneously, efforts are underway to improve quantum dot stability under various environmental conditions, addressing a key limitation for widespread commercial deployment.

Looking forward, the industry is targeting integration capabilities, developing quantum dots that can be seamlessly incorporated into existing manufacturing processes for displays, lighting, sensors, and biomedical applications. This integration focus is complemented by research into novel quantum dot architectures, such as perovskite quantum dots and quantum rods, which may offer enhanced performance characteristics for specific applications while potentially simplifying supply chain requirements.

The technological trajectory accelerated in the early 2000s with the development of core-shell structures that enhanced quantum yield and stability. This advancement marked a critical transition from purely academic research to potential commercial applications. By the mid-2000s, solution-processable quantum dots emerged, enabling more cost-effective manufacturing techniques and expanding potential use cases beyond specialized laboratory environments.

Recent years have witnessed remarkable progress in synthesis precision, with manufacturers now able to produce quantum dots with narrow size distributions and tailored surface chemistries. This precision has been crucial for commercial adoption in display technologies, where color purity and consistency are paramount. Concurrently, efforts to reduce or eliminate toxic heavy metals like cadmium have resulted in more environmentally friendly alternatives such as indium phosphide-based quantum dots.

The primary technological objectives in quantum dot production now center on scalability, consistency, and sustainability. Manufacturers aim to develop robust supply chains capable of delivering high-quality quantum dots at industrial scales while maintaining batch-to-batch consistency. This requires standardization of production processes and quality control metrics across the industry. Additionally, there is a strong focus on reducing environmental impact through greener synthesis methods and materials.

Cost reduction represents another critical objective, as current production methods often involve expensive precursors and energy-intensive processes. Research is actively pursuing more economical synthesis routes and precursor alternatives that maintain performance while reducing production expenses. Simultaneously, efforts are underway to improve quantum dot stability under various environmental conditions, addressing a key limitation for widespread commercial deployment.

Looking forward, the industry is targeting integration capabilities, developing quantum dots that can be seamlessly incorporated into existing manufacturing processes for displays, lighting, sensors, and biomedical applications. This integration focus is complemented by research into novel quantum dot architectures, such as perovskite quantum dots and quantum rods, which may offer enhanced performance characteristics for specific applications while potentially simplifying supply chain requirements.

Market Analysis for Commercial Quantum Dot Applications

The quantum dot market has experienced significant growth in recent years, expanding from approximately $2.5 billion in 2020 to over $4.6 billion by 2022. Industry analysts project this market to reach $10.6 billion by 2028, representing a compound annual growth rate of 15.1%. This robust growth trajectory is primarily driven by increasing applications across multiple sectors including displays, lighting, healthcare, and photovoltaics.

Display technology currently dominates the commercial quantum dot market, accounting for roughly 65% of total market share. The superior color gamut and energy efficiency offered by quantum dot-enhanced displays have led to widespread adoption in premium televisions, monitors, and mobile devices. Major manufacturers including Samsung, LG, and TCL have integrated quantum dot technology into their flagship products, significantly expanding market penetration.

Healthcare applications represent the fastest-growing segment, with an estimated growth rate of 22.3% annually. Quantum dots' unique optical properties make them valuable for bioimaging, diagnostics, and targeted drug delivery systems. The COVID-19 pandemic accelerated research and development in this sector, as quantum dot-based diagnostic tools demonstrated potential for rapid, sensitive virus detection.

Regionally, Asia-Pacific leads the market with approximately 45% share, driven by the concentration of display manufacturing facilities in South Korea, Japan, China, and Taiwan. North America follows at 30%, with particularly strong growth in healthcare and security applications. Europe accounts for 20% of the market, with significant investments in quantum dot photovoltaic research.

Supply chain considerations directly impact market dynamics, with material availability and processing capabilities creating both constraints and opportunities. The limited supply of certain rare elements used in quantum dot production, particularly indium and cadmium, has prompted research into alternative compositions. Cadmium-free quantum dots have gained significant market traction, growing at 27% annually due to regulatory pressures, particularly in Europe under RoHS directives.

Manufacturing scalability remains a critical market factor. Current production methods face challenges in maintaining consistent quality at high volumes, creating a competitive advantage for companies with advanced manufacturing capabilities. This has led to market consolidation, with established players acquiring specialized quantum dot startups to secure proprietary production technologies.

Price sensitivity varies significantly by application sector. While display manufacturers demonstrate willingness to pay premium prices for high-performance quantum dots, emerging applications in consumer electronics and lighting require substantial cost reductions to achieve mass market adoption. Industry forecasts suggest production costs must decrease by 40-60% to unlock these high-volume market segments.

Display technology currently dominates the commercial quantum dot market, accounting for roughly 65% of total market share. The superior color gamut and energy efficiency offered by quantum dot-enhanced displays have led to widespread adoption in premium televisions, monitors, and mobile devices. Major manufacturers including Samsung, LG, and TCL have integrated quantum dot technology into their flagship products, significantly expanding market penetration.

Healthcare applications represent the fastest-growing segment, with an estimated growth rate of 22.3% annually. Quantum dots' unique optical properties make them valuable for bioimaging, diagnostics, and targeted drug delivery systems. The COVID-19 pandemic accelerated research and development in this sector, as quantum dot-based diagnostic tools demonstrated potential for rapid, sensitive virus detection.

Regionally, Asia-Pacific leads the market with approximately 45% share, driven by the concentration of display manufacturing facilities in South Korea, Japan, China, and Taiwan. North America follows at 30%, with particularly strong growth in healthcare and security applications. Europe accounts for 20% of the market, with significant investments in quantum dot photovoltaic research.

Supply chain considerations directly impact market dynamics, with material availability and processing capabilities creating both constraints and opportunities. The limited supply of certain rare elements used in quantum dot production, particularly indium and cadmium, has prompted research into alternative compositions. Cadmium-free quantum dots have gained significant market traction, growing at 27% annually due to regulatory pressures, particularly in Europe under RoHS directives.

Manufacturing scalability remains a critical market factor. Current production methods face challenges in maintaining consistent quality at high volumes, creating a competitive advantage for companies with advanced manufacturing capabilities. This has led to market consolidation, with established players acquiring specialized quantum dot startups to secure proprietary production technologies.

Price sensitivity varies significantly by application sector. While display manufacturers demonstrate willingness to pay premium prices for high-performance quantum dots, emerging applications in consumer electronics and lighting require substantial cost reductions to achieve mass market adoption. Industry forecasts suggest production costs must decrease by 40-60% to unlock these high-volume market segments.

Global Quantum Dot Production Challenges

The commercialization of quantum dot technology faces significant global production challenges that impede widespread market adoption. Raw material sourcing represents a primary obstacle, as quantum dots require high-purity precursors including cadmium, selenium, indium, and zinc compounds. These materials often originate from geopolitically sensitive regions, creating supply vulnerabilities and price volatility. For instance, indium, essential for indium phosphide quantum dots, is predominantly mined in China, which controls approximately 60% of global production.

Manufacturing scalability presents another critical challenge. Current production methods such as colloidal synthesis achieve limited throughput, typically producing only grams to kilograms per batch. This contrasts sharply with industrial requirements for tons of material needed for mass-market applications like displays and lighting. The transition from laboratory to industrial scale production introduces quality control issues, including batch-to-batch consistency and defect rates that significantly impact device performance.

Environmental and regulatory compliance adds complexity to global production networks. Heavy metal content in cadmium-based quantum dots has triggered restrictive regulations in various jurisdictions, particularly the European Union's RoHS directive. Manufacturers must navigate a fragmented regulatory landscape, often requiring different formulations for different markets, which complicates production planning and inventory management.

Quality control during mass production represents a persistent technical hurdle. Quantum dot performance depends on precise size distribution, crystal structure, and surface chemistry. Maintaining these parameters at industrial scales requires sophisticated in-line monitoring systems and process controls that are still evolving. Even minor deviations can dramatically affect quantum yield, emission wavelength, and stability—critical parameters for commercial applications.

Supply chain resilience is further compromised by specialized equipment requirements. Quantum dot synthesis demands controlled atmosphere chambers, precise temperature regulation systems, and specialized purification equipment. These manufacturing assets are produced by a limited number of suppliers, creating potential bottlenecks during industry expansion phases.

Intellectual property fragmentation complicates global production strategies. The quantum dot landscape features overlapping patents controlled by universities, startups, and multinational corporations. Manufacturers must navigate this complex IP environment through licensing agreements or developing alternative technologies, adding cost and uncertainty to production planning.

These multifaceted challenges collectively contribute to higher production costs and slower market penetration than initially projected for quantum dot technologies, despite their promising performance characteristics in numerous applications.

Manufacturing scalability presents another critical challenge. Current production methods such as colloidal synthesis achieve limited throughput, typically producing only grams to kilograms per batch. This contrasts sharply with industrial requirements for tons of material needed for mass-market applications like displays and lighting. The transition from laboratory to industrial scale production introduces quality control issues, including batch-to-batch consistency and defect rates that significantly impact device performance.

Environmental and regulatory compliance adds complexity to global production networks. Heavy metal content in cadmium-based quantum dots has triggered restrictive regulations in various jurisdictions, particularly the European Union's RoHS directive. Manufacturers must navigate a fragmented regulatory landscape, often requiring different formulations for different markets, which complicates production planning and inventory management.

Quality control during mass production represents a persistent technical hurdle. Quantum dot performance depends on precise size distribution, crystal structure, and surface chemistry. Maintaining these parameters at industrial scales requires sophisticated in-line monitoring systems and process controls that are still evolving. Even minor deviations can dramatically affect quantum yield, emission wavelength, and stability—critical parameters for commercial applications.

Supply chain resilience is further compromised by specialized equipment requirements. Quantum dot synthesis demands controlled atmosphere chambers, precise temperature regulation systems, and specialized purification equipment. These manufacturing assets are produced by a limited number of suppliers, creating potential bottlenecks during industry expansion phases.

Intellectual property fragmentation complicates global production strategies. The quantum dot landscape features overlapping patents controlled by universities, startups, and multinational corporations. Manufacturers must navigate this complex IP environment through licensing agreements or developing alternative technologies, adding cost and uncertainty to production planning.

These multifaceted challenges collectively contribute to higher production costs and slower market penetration than initially projected for quantum dot technologies, despite their promising performance characteristics in numerous applications.

Current Supply Chain Models for Quantum Dot Production

01 Quantum dot synthesis and composition

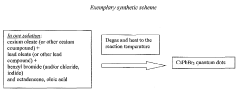

Various methods and compositions for synthesizing quantum dots with specific properties. These include techniques for creating quantum dots with controlled size, shape, and composition to achieve desired optical and electronic characteristics. The synthesis processes often involve chemical reactions under controlled conditions to produce semiconductor nanocrystals with quantum confinement effects.- Quantum dot synthesis and fabrication methods: Various methods for synthesizing and fabricating quantum dots with controlled properties. These techniques include chemical synthesis routes, physical deposition methods, and specialized processes to create quantum dots with specific sizes, shapes, and compositions. The fabrication methods aim to achieve precise control over quantum dot characteristics to optimize their optical, electronic, and quantum properties for various applications.

- Quantum dot applications in optoelectronic devices: Implementation of quantum dots in various optoelectronic devices such as light-emitting diodes (LEDs), photodetectors, solar cells, and display technologies. Quantum dots offer advantages including tunable emission wavelengths, high quantum efficiency, and enhanced color purity. These properties make them valuable for next-generation display technologies, lighting solutions, and photovoltaic applications.

- Quantum dot integration in semiconductor technologies: Methods for integrating quantum dots into semiconductor devices and circuits. This includes techniques for embedding quantum dots in traditional semiconductor materials, creating hybrid quantum-classical systems, and developing quantum dot-based transistors and memory elements. The integration approaches aim to leverage quantum effects while maintaining compatibility with existing semiconductor manufacturing processes.

- Quantum dot materials and compositions: Development of various quantum dot materials and compositions with enhanced properties. This includes core-shell structures, alloyed quantum dots, perovskite quantum dots, and quantum dots with specialized surface modifications. The materials research focuses on improving stability, quantum yield, reducing toxicity, and tailoring electronic properties for specific applications.

- Quantum dot applications in quantum computing and information: Utilization of quantum dots for quantum computing, quantum information processing, and quantum communication systems. This includes quantum dot-based qubits, quantum gates, quantum memory elements, and quantum cryptography implementations. The research focuses on leveraging the quantum mechanical properties of quantum dots to perform quantum computations and secure information transfer.

02 Quantum dots in display technologies

Applications of quantum dots in display technologies, including LED, OLED, and LCD displays. Quantum dots enhance color gamut, brightness, and energy efficiency in displays through their unique light-emitting properties. These nanocrystals can be incorporated into display components to produce more vibrant colors and improved visual performance compared to conventional display technologies.Expand Specific Solutions03 Quantum dots for energy applications

Implementation of quantum dots in energy harvesting and conversion systems, particularly in solar cells and photovoltaic devices. Quantum dots can absorb light across a broad spectrum and efficiently convert it to electrical energy. Their tunable bandgap allows for optimization of energy harvesting efficiency and the development of next-generation renewable energy technologies.Expand Specific Solutions04 Quantum dot functionalization and surface modification

Methods for functionalizing and modifying the surface of quantum dots to enhance their stability, solubility, and compatibility with various applications. Surface modifications can include coating with organic ligands, polymers, or inorganic shells to prevent aggregation, improve quantum yield, and enable integration into different material systems or biological environments.Expand Specific Solutions05 Quantum dots in sensing and biomedical applications

Utilization of quantum dots as fluorescent probes for sensing, imaging, and biomedical applications. Their unique optical properties, including high brightness, photostability, and size-dependent emission wavelengths, make them valuable tools for biological detection, medical diagnostics, and therapeutic applications. Quantum dots can be conjugated with biomolecules for targeted sensing and imaging in complex biological systems.Expand Specific Solutions

Key Industry Players in Quantum Dot Supply Chain

The quantum dot production supply chain is currently in a transitional phase, moving from early commercialization to broader market adoption. The global market is experiencing robust growth, projected to reach $10.6 billion by 2025 with a CAGR of 30.4%. Technologically, established display manufacturers like Samsung Display, BOE Technology, and Sharp have achieved significant maturity in commercial applications, while semiconductor leaders such as TSMC are integrating quantum dots into advanced manufacturing processes. Research institutions including KAIST, Zhejiang University, and Emory University are driving fundamental innovations, while specialized producers like Nanoco Technologies and Najing Technology are scaling production capabilities. The ecosystem shows a clear division between large-scale manufacturers with vertical integration capabilities and specialized material developers focusing on next-generation formulations.

Samsung Display Co., Ltd.

Technical Solution: Samsung Display has developed a comprehensive supply chain strategy for commercial quantum dot production, focusing on vertical integration to control key components. Their approach includes in-house synthesis of cadmium-free quantum dots (QDs) for their QLED displays, utilizing a hot-injection colloidal synthesis method that enables precise control over particle size distribution and quantum yield. Samsung has established dedicated QD production facilities with automated manufacturing lines capable of producing over 1 ton of quantum dots annually. Their supply chain incorporates rigorous quality control protocols with in-line optical characterization to ensure consistent QD performance across batches. Samsung has also developed proprietary encapsulation technologies to enhance QD stability and longevity in display applications, while implementing closed-loop recycling systems to recover and reuse solvents and precursors, reducing waste by approximately 30%.

Strengths: Vertical integration provides greater control over quality and supply security; large-scale production capabilities enable economies of scale; proprietary encapsulation technology enhances product performance. Weaknesses: Higher capital investment requirements compared to outsourced production; potential vulnerability to raw material supply disruptions for specific precursors.

AG Materials, Inc.

Technical Solution: AG Materials has developed a specialized supply chain for quantum dot production focused on high-purity materials and precision manufacturing. Their approach centers on a proprietary hot-injection synthesis method that achieves quantum yields consistently above 85% while maintaining narrow size distributions (standard deviation <5%). AG Materials has established strategic partnerships with specialty chemical suppliers to secure reliable access to high-purity precursors, implementing rigorous quality control protocols that include ICP-MS analysis to detect contaminants at parts-per-billion levels. Their production facilities utilize automated reactor systems with real-time monitoring of reaction parameters, enabling precise control over nucleation and growth phases. AG Materials has developed specialized purification techniques that remove unreacted precursors and byproducts without damaging the quantum dot surface, resulting in enhanced stability and performance. Their supply chain incorporates just-in-time inventory management for sensitive materials with limited shelf life, reducing waste and ensuring freshness of critical components. AG Materials also offers custom quantum dot formulations optimized for specific applications, with dedicated production lines for different product categories to prevent cross-contamination.

Strengths: Focus on high-purity materials enables premium product quality; specialized purification techniques enhance product performance; custom formulation capabilities address specific application requirements. Weaknesses: Higher production costs limit competitiveness in price-sensitive markets; specialized focus may limit economies of scale; potential vulnerability to disruptions in specialty chemical supply.

Critical Patents and Technical Literature in QD Manufacturing

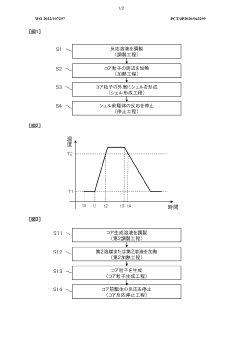

Method for synthesizing quantum dots and compositions and uses thereof

PatentWO2017100950A1

Innovation

- A novel method using low-cost precursor materials and mild reaction conditions, specifically a one-pot heat-up synthesis approach with cesium and lead precursors in an organic solvent, under inert atmosphere, to produce quantum dots with superior optical properties and reduced lead precursor usage, enabling scalable and environmentally friendly production.

Quantum dot production method and quantum dots

PatentWO2022107297A1

Innovation

- A method involving the preparation of a solution with a solvent and core particles, followed by heating the core particles with light to generate heat and react a shell precursor, forming a shell epitaxially on the core particle's periphery, while controlling temperature and light intensity to ensure uniformity.

Raw Material Sourcing and Sustainability Considerations

The sustainable sourcing of raw materials represents a critical challenge in scaling quantum dot (QD) production from laboratory to commercial levels. Primary materials for QD synthesis include semiconductor precursors such as cadmium, lead, indium, zinc, and selenium compounds, which are often characterized by limited global supply and geopolitical supply chain vulnerabilities. Particularly concerning is the concentration of rare earth elements in specific geographical regions, with China controlling approximately 85% of the global rare earth processing capacity as of 2023, creating potential bottlenecks in the QD manufacturing ecosystem.

Environmental considerations further complicate the raw material landscape, as traditional QD synthesis often involves toxic heavy metals like cadmium and lead. This has prompted regulatory scrutiny worldwide, with the European Union's Restriction of Hazardous Substances (RoHS) directive limiting cadmium content to 100 ppm in electronic devices. Forward-thinking manufacturers are increasingly exploring alternative compositions, including indium phosphide and copper indium sulfide quantum dots, which demonstrate reduced environmental toxicity while maintaining acceptable optical performance.

Recycling and circular economy principles are emerging as essential strategies for sustainable QD production. Current recovery rates for critical materials used in quantum dots remain below 1% globally, representing both an environmental challenge and a significant economic opportunity. Advanced hydrometallurgical and bioleaching techniques are showing promise for recovering semiconductor materials from end-of-life QD-containing products, potentially reducing primary resource dependency by 30-40% over the next decade.

Supply chain resilience strategies being implemented by leading manufacturers include diversification of supplier networks, development of material stockpiles, and investment in alternative material research. Companies like Nanosys and Samsung have established redundant supply chains across multiple continents, while research institutions are developing synthesis methods that reduce precursor quantities needed by up to 60% through improved reaction efficiency.

Certification and traceability systems are increasingly important for ensuring ethical sourcing practices. The Responsible Minerals Initiative (RMI) has begun expanding its frameworks beyond traditional conflict minerals to include materials used in advanced electronics manufacturing, including quantum dot components. Implementation of blockchain-based traceability systems by companies like UbiQD demonstrates the industry's movement toward greater supply chain transparency, allowing verification of material origins and processing conditions throughout the production lifecycle.

Environmental considerations further complicate the raw material landscape, as traditional QD synthesis often involves toxic heavy metals like cadmium and lead. This has prompted regulatory scrutiny worldwide, with the European Union's Restriction of Hazardous Substances (RoHS) directive limiting cadmium content to 100 ppm in electronic devices. Forward-thinking manufacturers are increasingly exploring alternative compositions, including indium phosphide and copper indium sulfide quantum dots, which demonstrate reduced environmental toxicity while maintaining acceptable optical performance.

Recycling and circular economy principles are emerging as essential strategies for sustainable QD production. Current recovery rates for critical materials used in quantum dots remain below 1% globally, representing both an environmental challenge and a significant economic opportunity. Advanced hydrometallurgical and bioleaching techniques are showing promise for recovering semiconductor materials from end-of-life QD-containing products, potentially reducing primary resource dependency by 30-40% over the next decade.

Supply chain resilience strategies being implemented by leading manufacturers include diversification of supplier networks, development of material stockpiles, and investment in alternative material research. Companies like Nanosys and Samsung have established redundant supply chains across multiple continents, while research institutions are developing synthesis methods that reduce precursor quantities needed by up to 60% through improved reaction efficiency.

Certification and traceability systems are increasingly important for ensuring ethical sourcing practices. The Responsible Minerals Initiative (RMI) has begun expanding its frameworks beyond traditional conflict minerals to include materials used in advanced electronics manufacturing, including quantum dot components. Implementation of blockchain-based traceability systems by companies like UbiQD demonstrates the industry's movement toward greater supply chain transparency, allowing verification of material origins and processing conditions throughout the production lifecycle.

Regulatory Framework for Quantum Dot Manufacturing

The regulatory landscape for quantum dot manufacturing presents a complex framework that manufacturers must navigate to ensure compliance across global markets. At the international level, organizations such as the International Organization for Standardization (ISO) have developed specific standards for nanomaterials, including quantum dots, which address characterization, toxicity assessment, and handling protocols. These standards provide a foundation for consistent quality control and safety measures across borders.

In the United States, quantum dot production falls under the purview of multiple regulatory bodies. The Environmental Protection Agency (EPA) regulates quantum dots under the Toxic Substances Control Act (TSCA), requiring manufacturers to submit premanufacturing notices for new chemical substances. The Food and Drug Administration (FDA) oversees quantum dots used in medical applications, imposing rigorous safety and efficacy requirements before market approval.

European regulations present additional complexities through the Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) framework, which requires manufacturers to register quantum dot materials and provide comprehensive safety data. The European Union has also implemented specific nanomaterial regulations that impact quantum dot production, including mandatory reporting of nanomaterial content in consumer products.

Asian markets, particularly China, Japan, and South Korea, have established their own regulatory frameworks for nanomaterials, creating a patchwork of compliance requirements for global manufacturers. These varying standards necessitate tailored production approaches for different target markets, increasing supply chain complexity.

Waste management regulations present another critical consideration, as quantum dot production may generate hazardous byproducts containing heavy metals like cadmium or lead. Manufacturers must implement proper disposal protocols compliant with local hazardous waste regulations, which vary significantly by jurisdiction.

Occupational safety regulations also impact production facilities, with agencies like the Occupational Safety and Health Administration (OSHA) in the US establishing exposure limits and safety protocols for workers handling nanomaterials. These requirements influence facility design, equipment selection, and operational procedures throughout the supply chain.

The evolving nature of quantum dot regulation creates additional challenges, as frameworks continue to develop in response to emerging research on environmental and health impacts. Forward-thinking manufacturers are adopting proactive compliance strategies, implementing robust tracking systems to monitor regulatory changes across markets and engaging with regulatory bodies during policy development phases.

In the United States, quantum dot production falls under the purview of multiple regulatory bodies. The Environmental Protection Agency (EPA) regulates quantum dots under the Toxic Substances Control Act (TSCA), requiring manufacturers to submit premanufacturing notices for new chemical substances. The Food and Drug Administration (FDA) oversees quantum dots used in medical applications, imposing rigorous safety and efficacy requirements before market approval.

European regulations present additional complexities through the Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) framework, which requires manufacturers to register quantum dot materials and provide comprehensive safety data. The European Union has also implemented specific nanomaterial regulations that impact quantum dot production, including mandatory reporting of nanomaterial content in consumer products.

Asian markets, particularly China, Japan, and South Korea, have established their own regulatory frameworks for nanomaterials, creating a patchwork of compliance requirements for global manufacturers. These varying standards necessitate tailored production approaches for different target markets, increasing supply chain complexity.

Waste management regulations present another critical consideration, as quantum dot production may generate hazardous byproducts containing heavy metals like cadmium or lead. Manufacturers must implement proper disposal protocols compliant with local hazardous waste regulations, which vary significantly by jurisdiction.

Occupational safety regulations also impact production facilities, with agencies like the Occupational Safety and Health Administration (OSHA) in the US establishing exposure limits and safety protocols for workers handling nanomaterials. These requirements influence facility design, equipment selection, and operational procedures throughout the supply chain.

The evolving nature of quantum dot regulation creates additional challenges, as frameworks continue to develop in response to emerging research on environmental and health impacts. Forward-thinking manufacturers are adopting proactive compliance strategies, implementing robust tracking systems to monitor regulatory changes across markets and engaging with regulatory bodies during policy development phases.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!