Techno-Economic Comparison Of Aluminum-Ion And Sodium-Ion For Stationary Storage

AUG 22, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Battery Technology Background and Objectives

The evolution of energy storage technologies has been marked by continuous innovation aimed at addressing the growing demands for sustainable and efficient power solutions. Lithium-ion batteries have dominated the stationary storage market for decades due to their high energy density and efficiency. However, concerns regarding lithium's limited global reserves, geopolitical supply chain vulnerabilities, and rising costs have intensified the search for alternative battery technologies.

Aluminum-ion and sodium-ion batteries have emerged as promising candidates for stationary storage applications, offering potential advantages in terms of resource abundance, cost-effectiveness, and environmental sustainability. Aluminum is the third most abundant element in the Earth's crust, while sodium ranks as the sixth, making both significantly more available than lithium. This abundance translates to potentially lower material costs and reduced supply chain risks.

The technical evolution of these alternative battery technologies has accelerated notably in the past decade. Aluminum-ion batteries have progressed from theoretical concepts to functional prototypes, with breakthroughs in electrode materials and electrolyte formulations addressing previous challenges related to cycling stability and energy density. Similarly, sodium-ion technology has advanced considerably, with recent developments in cathode and anode materials enabling performance metrics increasingly comparable to commercial lithium-ion systems.

The primary objective of exploring these technologies for stationary storage applications is to develop cost-effective, long-duration energy storage solutions that can support grid stability, renewable energy integration, and peak demand management. Unlike mobile applications where weight and volume constraints are critical, stationary storage prioritizes cost per kilowatt-hour, cycle life, safety, and reliability—areas where aluminum-ion and sodium-ion technologies may offer competitive advantages.

Current research aims to overcome specific technical challenges, including improving energy density for aluminum-ion batteries and enhancing cycle life for sodium-ion systems. The development trajectory suggests potential commercialization pathways within the next 3-7 years, with initial applications likely in grid-scale storage and backup power systems where cost sensitivity outweighs energy density requirements.

The techno-economic comparison between these technologies must consider not only their technical specifications but also manufacturing scalability, integration requirements, and total cost of ownership across the full lifecycle. As renewable energy penetration increases globally, the demand for affordable stationary storage solutions becomes increasingly critical, positioning these alternative battery technologies as potentially transformative elements in the future energy landscape.

Aluminum-ion and sodium-ion batteries have emerged as promising candidates for stationary storage applications, offering potential advantages in terms of resource abundance, cost-effectiveness, and environmental sustainability. Aluminum is the third most abundant element in the Earth's crust, while sodium ranks as the sixth, making both significantly more available than lithium. This abundance translates to potentially lower material costs and reduced supply chain risks.

The technical evolution of these alternative battery technologies has accelerated notably in the past decade. Aluminum-ion batteries have progressed from theoretical concepts to functional prototypes, with breakthroughs in electrode materials and electrolyte formulations addressing previous challenges related to cycling stability and energy density. Similarly, sodium-ion technology has advanced considerably, with recent developments in cathode and anode materials enabling performance metrics increasingly comparable to commercial lithium-ion systems.

The primary objective of exploring these technologies for stationary storage applications is to develop cost-effective, long-duration energy storage solutions that can support grid stability, renewable energy integration, and peak demand management. Unlike mobile applications where weight and volume constraints are critical, stationary storage prioritizes cost per kilowatt-hour, cycle life, safety, and reliability—areas where aluminum-ion and sodium-ion technologies may offer competitive advantages.

Current research aims to overcome specific technical challenges, including improving energy density for aluminum-ion batteries and enhancing cycle life for sodium-ion systems. The development trajectory suggests potential commercialization pathways within the next 3-7 years, with initial applications likely in grid-scale storage and backup power systems where cost sensitivity outweighs energy density requirements.

The techno-economic comparison between these technologies must consider not only their technical specifications but also manufacturing scalability, integration requirements, and total cost of ownership across the full lifecycle. As renewable energy penetration increases globally, the demand for affordable stationary storage solutions becomes increasingly critical, positioning these alternative battery technologies as potentially transformative elements in the future energy landscape.

Market Analysis for Stationary Energy Storage

The global stationary energy storage market is experiencing unprecedented growth, driven by the increasing integration of renewable energy sources, grid modernization efforts, and the push for energy independence. As of 2023, the market valuation stands at approximately $27 billion, with projections indicating a compound annual growth rate of 20-25% through 2030, potentially reaching $100 billion by the end of the decade.

Lithium-ion batteries currently dominate this landscape, accounting for roughly 90% of new deployments. However, supply chain vulnerabilities, resource constraints, and cost considerations are creating significant opportunities for alternative technologies like aluminum-ion and sodium-ion batteries in stationary applications.

The utility-scale segment represents the largest market share at 65%, followed by commercial and industrial applications at 25%, and residential systems at 10%. Geographically, Asia-Pacific leads with 40% market share, followed by North America (30%), Europe (20%), and rest of world (10%). China, the United States, and Germany are the top three markets by installation volume.

Key market drivers include declining battery costs, which have decreased by approximately 85% over the past decade for lithium-ion technologies. Regulatory frameworks supporting renewable integration and grid resilience are also accelerating adoption, with over 30 countries implementing energy storage targets or incentives.

For emerging technologies like aluminum-ion and sodium-ion, the stationary storage market presents distinct advantages compared to the more demanding electric vehicle sector. Stationary applications typically prioritize cost-effectiveness, long cycle life, and safety over energy density constraints that limit EV applications.

Market segmentation analysis reveals that sodium-ion technologies are gaining particular traction in grid-scale applications requiring 4-8 hour duration storage, while aluminum-ion shows promise in applications requiring high power capabilities and rapid response times.

Customer requirements across segments consistently emphasize levelized cost of storage (LCOS), reliability, cycle life, and safety. Notably, the tolerance for lower energy density in stationary applications creates a significant market entry opportunity for both aluminum-ion and sodium-ion technologies, which typically offer 30-50% lower energy density than premium lithium-ion formulations but can potentially deliver superior economics and sustainability profiles.

Lithium-ion batteries currently dominate this landscape, accounting for roughly 90% of new deployments. However, supply chain vulnerabilities, resource constraints, and cost considerations are creating significant opportunities for alternative technologies like aluminum-ion and sodium-ion batteries in stationary applications.

The utility-scale segment represents the largest market share at 65%, followed by commercial and industrial applications at 25%, and residential systems at 10%. Geographically, Asia-Pacific leads with 40% market share, followed by North America (30%), Europe (20%), and rest of world (10%). China, the United States, and Germany are the top three markets by installation volume.

Key market drivers include declining battery costs, which have decreased by approximately 85% over the past decade for lithium-ion technologies. Regulatory frameworks supporting renewable integration and grid resilience are also accelerating adoption, with over 30 countries implementing energy storage targets or incentives.

For emerging technologies like aluminum-ion and sodium-ion, the stationary storage market presents distinct advantages compared to the more demanding electric vehicle sector. Stationary applications typically prioritize cost-effectiveness, long cycle life, and safety over energy density constraints that limit EV applications.

Market segmentation analysis reveals that sodium-ion technologies are gaining particular traction in grid-scale applications requiring 4-8 hour duration storage, while aluminum-ion shows promise in applications requiring high power capabilities and rapid response times.

Customer requirements across segments consistently emphasize levelized cost of storage (LCOS), reliability, cycle life, and safety. Notably, the tolerance for lower energy density in stationary applications creates a significant market entry opportunity for both aluminum-ion and sodium-ion technologies, which typically offer 30-50% lower energy density than premium lithium-ion formulations but can potentially deliver superior economics and sustainability profiles.

Technical Status and Challenges of Al-ion and Na-ion Batteries

The global energy storage landscape is witnessing significant transformations with aluminum-ion (AIB) and sodium-ion batteries (SIB) emerging as promising alternatives to lithium-ion technology for stationary storage applications. Currently, AIB technology remains predominantly in laboratory research phases, with limited commercial deployment. Key technical challenges include developing stable electrolytes that prevent aluminum dendrite formation and identifying cathode materials that can withstand the highly corrosive chloroaluminate electrolytes typically used in these systems.

AIBs demonstrate theoretical energy densities of 1060 Wh/kg and utilize the abundant aluminum resource (8.1% of Earth's crust), presenting significant cost advantages. However, their practical energy density remains limited to 40-70 Wh/kg due to challenges in electrode materials and electrolyte stability. The three-electron transfer mechanism of aluminum offers high theoretical capacity, but this advantage is often compromised by slow kinetics and structural degradation during cycling.

Sodium-ion battery technology has progressed further toward commercialization, with several companies including CATL and Faradion demonstrating pilot production. SIBs benefit from sodium's abundance (2.6% of Earth's crust), making them potentially 30-40% less expensive than lithium-ion counterparts. Current SIB systems achieve energy densities of 90-150 Wh/kg, with cycle life approaching 2000-3000 cycles under optimal conditions.

Technical challenges for SIBs include the larger ionic radius of Na+ (1.02Å) compared to Li+ (0.76Å), resulting in slower diffusion kinetics and greater volume changes during cycling. This necessitates specialized electrode materials that can accommodate these larger ions while maintaining structural integrity. Hard carbon remains the predominant anode material, though its capacity (300 mAh/g) falls short of graphite anodes used in lithium-ion systems (372 mAh/g).

Geographically, AIB research is concentrated in North America and Europe, with notable advancements from research groups at Cornell University, ETH Zurich, and Clemson University. SIB development shows broader distribution, with significant progress in China, Japan, Europe, and Australia. China currently leads in patents and commercial development for sodium-ion technology.

Both technologies face critical materials challenges in electrolyte formulation. AIBs typically employ ionic liquid electrolytes that are expensive and environmentally problematic, while SIBs require electrolyte additives to form stable solid-electrolyte interphases. Additionally, both technologies must overcome power density limitations to compete effectively in grid-scale applications where rapid response capabilities are increasingly valued.

The technical readiness level (TRL) currently stands at 3-4 for aluminum-ion and 6-7 for sodium-ion technologies, indicating the substantial development gap between these emerging storage solutions. This differential in maturity significantly impacts their near-term economic viability for stationary storage applications.

AIBs demonstrate theoretical energy densities of 1060 Wh/kg and utilize the abundant aluminum resource (8.1% of Earth's crust), presenting significant cost advantages. However, their practical energy density remains limited to 40-70 Wh/kg due to challenges in electrode materials and electrolyte stability. The three-electron transfer mechanism of aluminum offers high theoretical capacity, but this advantage is often compromised by slow kinetics and structural degradation during cycling.

Sodium-ion battery technology has progressed further toward commercialization, with several companies including CATL and Faradion demonstrating pilot production. SIBs benefit from sodium's abundance (2.6% of Earth's crust), making them potentially 30-40% less expensive than lithium-ion counterparts. Current SIB systems achieve energy densities of 90-150 Wh/kg, with cycle life approaching 2000-3000 cycles under optimal conditions.

Technical challenges for SIBs include the larger ionic radius of Na+ (1.02Å) compared to Li+ (0.76Å), resulting in slower diffusion kinetics and greater volume changes during cycling. This necessitates specialized electrode materials that can accommodate these larger ions while maintaining structural integrity. Hard carbon remains the predominant anode material, though its capacity (300 mAh/g) falls short of graphite anodes used in lithium-ion systems (372 mAh/g).

Geographically, AIB research is concentrated in North America and Europe, with notable advancements from research groups at Cornell University, ETH Zurich, and Clemson University. SIB development shows broader distribution, with significant progress in China, Japan, Europe, and Australia. China currently leads in patents and commercial development for sodium-ion technology.

Both technologies face critical materials challenges in electrolyte formulation. AIBs typically employ ionic liquid electrolytes that are expensive and environmentally problematic, while SIBs require electrolyte additives to form stable solid-electrolyte interphases. Additionally, both technologies must overcome power density limitations to compete effectively in grid-scale applications where rapid response capabilities are increasingly valued.

The technical readiness level (TRL) currently stands at 3-4 for aluminum-ion and 6-7 for sodium-ion technologies, indicating the substantial development gap between these emerging storage solutions. This differential in maturity significantly impacts their near-term economic viability for stationary storage applications.

Current Technical Solutions for Stationary Storage

01 Cost-effective electrode materials for sodium-ion batteries

Sodium-ion batteries utilize abundant and low-cost electrode materials as alternatives to lithium-ion batteries. These materials include sodium-based compounds, carbon-based anodes, and transition metal oxides that offer good electrochemical performance at reduced costs. The development of these materials focuses on improving energy density while maintaining economic advantages, making sodium-ion batteries particularly attractive for large-scale energy storage applications where cost is a primary concern.- Cost-effective electrode materials for sodium-ion batteries: Sodium-ion batteries offer a cost-effective alternative to lithium-ion batteries due to the abundance and low cost of sodium resources. Various electrode materials have been developed to enhance the techno-economic performance of sodium-ion batteries, including carbon-based anodes, transition metal oxides, and phosphates. These materials provide good electrochemical performance while maintaining low production costs, making sodium-ion batteries economically viable for large-scale energy storage applications.

- Aluminum-ion battery electrode compositions and manufacturing: Aluminum-ion batteries present promising techno-economic advantages due to the abundance, low cost, and high theoretical capacity of aluminum. Research focuses on developing efficient cathode materials such as graphite, vanadium oxide, and conductive polymers that can withstand the complex chemistry of aluminum-ion systems. Manufacturing processes have been optimized to reduce production costs while maintaining performance, addressing challenges related to electrolyte stability and electrode degradation during cycling.

- Electrolyte innovations for improved performance and cost reduction: Advanced electrolyte formulations play a crucial role in enhancing the techno-economic performance of both aluminum-ion and sodium-ion batteries. Novel electrolytes with improved ionic conductivity, wider electrochemical stability windows, and better compatibility with electrode materials have been developed. These innovations help extend battery cycle life, improve energy density, and reduce overall system costs, making these alternative battery technologies more competitive with conventional lithium-ion batteries.

- System integration and techno-economic analysis methodologies: Comprehensive techno-economic analysis frameworks have been developed to evaluate the performance and economic viability of aluminum-ion and sodium-ion battery technologies. These methodologies consider factors such as material costs, manufacturing processes, energy density, cycle life, and system integration requirements. Life cycle assessment approaches help identify cost drivers and optimization opportunities throughout the battery value chain, enabling more accurate comparisons with established battery technologies.

- Large-scale production and commercial applications: Scaling up production of aluminum-ion and sodium-ion batteries presents both challenges and opportunities for improving techno-economic performance. Innovations in manufacturing processes, equipment design, and quality control systems have been developed to enable cost-effective mass production. Various commercial applications have been identified where these battery technologies offer competitive advantages, including grid-scale energy storage, electric vehicles with less stringent weight requirements, and backup power systems where cost is prioritized over energy density.

02 Aluminum-ion battery electrolyte innovations

Advanced electrolyte formulations for aluminum-ion batteries enhance ionic conductivity and electrochemical stability. These innovations include novel ionic liquids, non-aqueous electrolytes, and additives that improve the aluminum ion transport mechanism. The electrolyte developments address challenges such as electrode corrosion and dendrite formation, leading to improved cycling performance and battery lifespan while maintaining the inherent cost advantages of aluminum as an electrode material.Expand Specific Solutions03 Manufacturing scalability and production economics

Manufacturing processes for aluminum-ion and sodium-ion batteries are being optimized for industrial scalability and cost reduction. These advancements include simplified cell assembly techniques, reduced processing temperatures, and automation of production lines. The economic advantages stem from compatibility with existing lithium-ion battery manufacturing infrastructure, allowing for lower capital investment when transitioning to these alternative battery technologies. This manufacturing scalability is crucial for achieving competitive production costs.Expand Specific Solutions04 Comparative lifecycle and environmental performance

Techno-economic analyses of aluminum-ion and sodium-ion batteries reveal favorable environmental profiles compared to conventional lithium-ion technologies. These batteries utilize more abundant raw materials with lower extraction impacts and reduced supply chain risks. Life cycle assessments demonstrate reduced carbon footprints and energy requirements during manufacturing, while end-of-life considerations show improved recyclability potential. These environmental advantages contribute significantly to the overall economic value proposition of these alternative battery technologies.Expand Specific Solutions05 Grid-scale energy storage applications and economic viability

Aluminum-ion and sodium-ion batteries show particular promise for stationary energy storage applications where cost per kilowatt-hour is prioritized over energy density. Economic modeling demonstrates competitive levelized cost of storage for grid applications, frequency regulation, and renewable energy integration. The long cycle life, safety characteristics, and thermal stability of these battery technologies provide additional economic benefits through reduced maintenance and safety management costs, making them increasingly viable alternatives to lithium-ion batteries for large-scale deployment.Expand Specific Solutions

Key Industry Players in Alternative Battery Development

The stationary energy storage market is witnessing a transition from traditional lithium-ion to alternative technologies, with aluminum-ion and sodium-ion batteries emerging as promising contenders. Currently in the early growth phase, this sector is projected to expand significantly as renewable energy integration accelerates. Companies like Faradion Ltd. are pioneering sodium-ion technology, while research institutions including KAIST, University of California, and Chinese Academy of Sciences are advancing aluminum-ion solutions. Phillips 66 and Sumitomo Chemical contribute materials expertise, while recycling specialists such as GEM Co. and Guangdong Bangpu address sustainability concerns. The technology maturity varies, with sodium-ion closer to commercialization through companies like Faradion and Chaowei Power, while aluminum-ion remains predominantly in research phase with fewer commercial players.

Faradion Ltd.

Technical Solution: Faradion has pioneered sodium-ion battery technology specifically designed for stationary energy storage applications. Their proprietary technology utilizes sodium-ion chemistry with layered oxide cathodes and hard carbon anodes, achieving energy densities of 140-160 Wh/kg. Faradion's approach eliminates the need for copper and cobalt, reducing material costs by approximately 30% compared to lithium-ion alternatives. Their batteries demonstrate excellent cycle life (>2000 cycles at 80% depth of discharge) and operate effectively across a wide temperature range (-20°C to +60°C). For stationary storage applications, Faradion has developed modular systems that can scale from 10kWh to multi-MWh installations, with a focus on grid stabilization and renewable energy integration.

Strengths: Lower raw material costs (sodium is approximately 1000 times more abundant than lithium); safer operation with reduced fire risk; compatible with existing manufacturing infrastructure. Weaknesses: Lower energy density compared to some lithium-ion chemistries; technology still scaling to achieve manufacturing economies of scale; market perception challenges as a newer technology.

National Technology & Engineering Solutions of Sandia LLC

Technical Solution: Sandia National Laboratories has conducted extensive techno-economic analysis comparing aluminum-ion and sodium-ion technologies for grid-scale energy storage. Their research includes comprehensive cost modeling that accounts for capital expenditure, operational expenses, and lifecycle performance metrics. Sandia's analysis indicates that sodium-ion systems could achieve levelized cost of storage (LCOS) of $0.20-0.25/kWh for 4-hour duration systems at scale, while their aluminum-ion assessments suggest potential for even lower costs ($0.15-0.20/kWh) but with greater technological uncertainty. Their modeling incorporates detailed supply chain analysis, manufacturing scale-up scenarios, and grid integration requirements. Sandia has developed specialized testing protocols to evaluate the performance of both technologies under conditions that simulate real-world grid applications, including frequency regulation, peak shaving, and renewable energy time-shifting.

Strengths: Comprehensive modeling approach that integrates technical performance with economic factors; access to extensive grid operation data; ability to conduct accelerated testing to predict long-term performance. Weaknesses: As a research organization rather than a commercial entity, faces challenges in technology commercialization; modeling assumptions may not fully capture market dynamics and manufacturing realities.

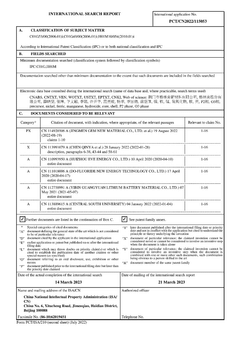

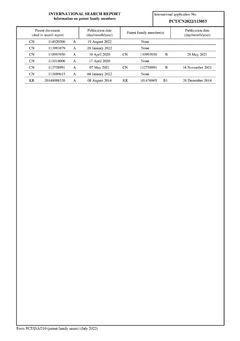

Critical Patents and Research in Al-ion and Na-ion Technologies

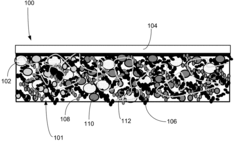

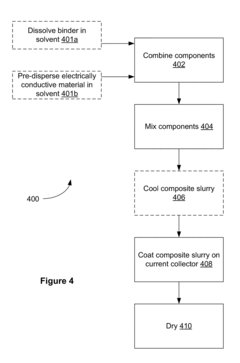

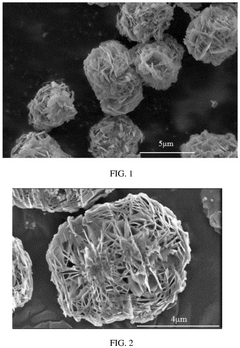

Composite electrode including microporous ionically conducting material, composite slurry, and methods of manufacturing same

PatentInactiveUS20180287134A1

Innovation

- A composite electrode comprising an active electrode material, an electrically conductive matrix, and a microporous ionically conducting material, such as zeolite or porous nano silica, is developed, which improves electrochemical properties, buffers volume expansion, and stabilizes the slurry viscosity, enhancing the stability and performance of sodium-ion batteries.

Positive electrode material precursor and positive electrode material and preparation methods therefor, and sodium-ion battery

PatentPendingEP4455092A1

Innovation

- A positive electrode material precursor with a heterogeneous structure of an O3-phase core and a P2-phase shell is developed, where the core and shell are composed of flaky primary particles, allowing for improved sodium ion diffusion and stability, achieved through a controlled co-precipitation process and calcination method suitable for large-scale production.

Cost Structure Analysis and Economic Viability

The cost structure of aluminum-ion and sodium-ion batteries for stationary storage applications reveals significant differences that impact their economic viability. Capital expenditure (CAPEX) for aluminum-ion technology currently exceeds that of sodium-ion batteries by approximately 15-20%, primarily due to the specialized manufacturing processes required for aluminum-ion cells and the higher cost of aluminum-based electrode materials. However, this gap is expected to narrow as manufacturing scales up and production processes are optimized.

Operational expenditure (OPEX) analysis shows potential advantages for aluminum-ion technology in the long term. While sodium-ion batteries demonstrate lower initial maintenance costs, aluminum-ion systems potentially offer extended cycle life—reaching up to 10,000 cycles in laboratory conditions compared to sodium-ion's typical 2,000-4,000 cycles. This longevity could translate to lower lifetime costs despite higher upfront investment.

Raw material economics strongly favor both technologies over traditional lithium-ion batteries. Sodium resources are abundant and widely distributed geographically, with extraction costs approximately 60-70% lower than lithium. Aluminum, while more energy-intensive to refine, benefits from established global supply chains and recycling infrastructure, with nearly 75% of all aluminum ever produced still in circulation.

Levelized cost of storage (LCOS) calculations indicate that sodium-ion technology currently holds a 10-15% advantage over aluminum-ion for short-duration storage applications (2-4 hours). However, for long-duration storage (8+ hours), aluminum-ion's superior energy density and cycle life narrow this gap significantly, with projections suggesting cost parity by 2026-2027.

Market entry barriers differ substantially between technologies. Sodium-ion benefits from manufacturing processes similar to lithium-ion, allowing for retrofitting of existing production lines at approximately 30-40% of the cost of new facilities. Aluminum-ion faces higher initial commercialization hurdles but may achieve better economies of scale in the long term due to the abundance and lower cost volatility of raw materials.

Sensitivity analysis reveals that aluminum-ion economics are particularly dependent on advances in electrolyte formulation and manufacturing scale, with potential cost reductions of up to 35% achievable through these improvements. Sodium-ion costs are more sensitive to cathode material innovations and energy density improvements, which could drive down costs by 20-30% over the next five years.

Operational expenditure (OPEX) analysis shows potential advantages for aluminum-ion technology in the long term. While sodium-ion batteries demonstrate lower initial maintenance costs, aluminum-ion systems potentially offer extended cycle life—reaching up to 10,000 cycles in laboratory conditions compared to sodium-ion's typical 2,000-4,000 cycles. This longevity could translate to lower lifetime costs despite higher upfront investment.

Raw material economics strongly favor both technologies over traditional lithium-ion batteries. Sodium resources are abundant and widely distributed geographically, with extraction costs approximately 60-70% lower than lithium. Aluminum, while more energy-intensive to refine, benefits from established global supply chains and recycling infrastructure, with nearly 75% of all aluminum ever produced still in circulation.

Levelized cost of storage (LCOS) calculations indicate that sodium-ion technology currently holds a 10-15% advantage over aluminum-ion for short-duration storage applications (2-4 hours). However, for long-duration storage (8+ hours), aluminum-ion's superior energy density and cycle life narrow this gap significantly, with projections suggesting cost parity by 2026-2027.

Market entry barriers differ substantially between technologies. Sodium-ion benefits from manufacturing processes similar to lithium-ion, allowing for retrofitting of existing production lines at approximately 30-40% of the cost of new facilities. Aluminum-ion faces higher initial commercialization hurdles but may achieve better economies of scale in the long term due to the abundance and lower cost volatility of raw materials.

Sensitivity analysis reveals that aluminum-ion economics are particularly dependent on advances in electrolyte formulation and manufacturing scale, with potential cost reductions of up to 35% achievable through these improvements. Sodium-ion costs are more sensitive to cathode material innovations and energy density improvements, which could drive down costs by 20-30% over the next five years.

Environmental Impact and Sustainability Assessment

The environmental footprint of battery technologies represents a critical dimension in evaluating their suitability for stationary storage applications. When comparing aluminum-ion and sodium-ion batteries, several environmental factors merit consideration across their entire lifecycle.

Aluminum-ion batteries demonstrate promising environmental advantages due to the abundance of aluminum in the Earth's crust (approximately 8%), making it the third most abundant element. This abundance translates to reduced mining impacts compared to lithium extraction, which often involves water-intensive brine operations or environmentally disruptive hard-rock mining. Additionally, aluminum has a well-established global recycling infrastructure with recovery rates exceeding 90% in many developed economies, significantly reducing the need for primary resource extraction.

Sodium-ion batteries similarly benefit from resource abundance, as sodium constitutes approximately 2.6% of the Earth's crust and is readily available from seawater. This eliminates concerns about resource scarcity and geopolitical supply constraints that plague lithium-based technologies. The extraction processes for sodium compounds generally require less energy and water than lithium extraction, resulting in lower greenhouse gas emissions during the raw material acquisition phase.

Manufacturing processes for both technologies currently show varying degrees of environmental impact. Aluminum-ion battery production typically involves energy-intensive aluminum processing, though innovations in electrode design are progressively reducing these requirements. Sodium-ion manufacturing generally exhibits lower energy demands and employs less toxic materials than lithium-ion counterparts, avoiding cobalt and nickel that present significant environmental and ethical concerns.

End-of-life management represents another crucial sustainability dimension. Both technologies offer advantages over conventional lithium-ion batteries regarding recyclability. Aluminum-ion batteries contain valuable aluminum that incentivizes recycling, while sodium-ion batteries generally incorporate less toxic materials, facilitating safer disposal or recycling processes. However, dedicated recycling infrastructure for these emerging technologies remains underdeveloped compared to established battery systems.

Life cycle assessment (LCA) studies indicate that both technologies could potentially reduce carbon footprints by 30-45% compared to lithium-ion alternatives when considering full cradle-to-grave impacts. This advantage stems primarily from abundant raw materials, potentially simplified manufacturing processes, and improved recyclability. However, these environmental benefits remain contingent on the development of optimized production methods and establishment of effective recycling systems as these technologies mature and scale.

Aluminum-ion batteries demonstrate promising environmental advantages due to the abundance of aluminum in the Earth's crust (approximately 8%), making it the third most abundant element. This abundance translates to reduced mining impacts compared to lithium extraction, which often involves water-intensive brine operations or environmentally disruptive hard-rock mining. Additionally, aluminum has a well-established global recycling infrastructure with recovery rates exceeding 90% in many developed economies, significantly reducing the need for primary resource extraction.

Sodium-ion batteries similarly benefit from resource abundance, as sodium constitutes approximately 2.6% of the Earth's crust and is readily available from seawater. This eliminates concerns about resource scarcity and geopolitical supply constraints that plague lithium-based technologies. The extraction processes for sodium compounds generally require less energy and water than lithium extraction, resulting in lower greenhouse gas emissions during the raw material acquisition phase.

Manufacturing processes for both technologies currently show varying degrees of environmental impact. Aluminum-ion battery production typically involves energy-intensive aluminum processing, though innovations in electrode design are progressively reducing these requirements. Sodium-ion manufacturing generally exhibits lower energy demands and employs less toxic materials than lithium-ion counterparts, avoiding cobalt and nickel that present significant environmental and ethical concerns.

End-of-life management represents another crucial sustainability dimension. Both technologies offer advantages over conventional lithium-ion batteries regarding recyclability. Aluminum-ion batteries contain valuable aluminum that incentivizes recycling, while sodium-ion batteries generally incorporate less toxic materials, facilitating safer disposal or recycling processes. However, dedicated recycling infrastructure for these emerging technologies remains underdeveloped compared to established battery systems.

Life cycle assessment (LCA) studies indicate that both technologies could potentially reduce carbon footprints by 30-45% compared to lithium-ion alternatives when considering full cradle-to-grave impacts. This advantage stems primarily from abundant raw materials, potentially simplified manufacturing processes, and improved recyclability. However, these environmental benefits remain contingent on the development of optimized production methods and establishment of effective recycling systems as these technologies mature and scale.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!