Transparent Transistor Usage in Wireless Communication Devices

OCT 21, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Transparent Transistor Evolution and Objectives

Transparent transistors have evolved significantly since their inception in the early 2000s, transforming from laboratory curiosities to essential components in modern wireless communication devices. Initially developed using amorphous oxide semiconductors such as indium gallium zinc oxide (IGZO), these transistors offered unprecedented combinations of optical transparency and electrical performance. The evolution trajectory has been marked by continuous improvements in carrier mobility, stability, and manufacturing scalability, enabling their integration into increasingly sophisticated wireless communication systems.

The fundamental breakthrough came with the realization that certain metal oxides could function as semiconductors while maintaining high optical transparency in the visible spectrum. This dual functionality opened new design possibilities for wireless devices where traditional silicon-based transistors were limiting form factors and functionality. Early transparent transistors exhibited modest performance metrics, with carrier mobilities below 10 cm²/Vs and limited operational stability.

Significant technological advancements occurred around 2010-2015, when researchers achieved carrier mobilities exceeding 50 cm²/Vs while maintaining transparency above 80%. This performance threshold made transparent transistors viable for radio frequency (RF) applications in wireless communications. Concurrently, manufacturing techniques evolved from laboratory-scale processes to industrial methods compatible with large-area fabrication, including roll-to-roll processing and photolithographic patterning on flexible substrates.

The integration of transparent transistors into wireless communication devices has been driven by several compelling objectives. Primary among these is the development of truly transparent or semi-transparent communication devices that can be seamlessly integrated into everyday objects and environments. This objective aligns with the broader vision of ubiquitous computing and the Internet of Things (IoT), where computing and communication capabilities become embedded in the physical world.

Another critical objective is the enhancement of antenna performance through reduced electromagnetic interference. Traditional metallic components in wireless devices often create interference patterns that degrade signal quality. Transparent transistors and associated circuitry minimize this interference, potentially improving signal integrity and reducing power consumption in wireless communications.

Energy efficiency represents another pivotal objective in transparent transistor development. These components can operate effectively at lower voltages than many conventional alternatives, offering power savings that are particularly valuable in battery-operated wireless devices. Additionally, when combined with transparent energy harvesting technologies such as photovoltaics, they enable self-powered communication nodes that can function indefinitely without battery replacement.

Looking forward, the technical roadmap for transparent transistors in wireless communications aims to achieve operating frequencies above 10 GHz while maintaining optical transparency exceeding 90%. This ambitious goal would enable transparent transistors to support emerging 5G and future 6G communication standards, fundamentally transforming how wireless technology integrates with our physical environment.

The fundamental breakthrough came with the realization that certain metal oxides could function as semiconductors while maintaining high optical transparency in the visible spectrum. This dual functionality opened new design possibilities for wireless devices where traditional silicon-based transistors were limiting form factors and functionality. Early transparent transistors exhibited modest performance metrics, with carrier mobilities below 10 cm²/Vs and limited operational stability.

Significant technological advancements occurred around 2010-2015, when researchers achieved carrier mobilities exceeding 50 cm²/Vs while maintaining transparency above 80%. This performance threshold made transparent transistors viable for radio frequency (RF) applications in wireless communications. Concurrently, manufacturing techniques evolved from laboratory-scale processes to industrial methods compatible with large-area fabrication, including roll-to-roll processing and photolithographic patterning on flexible substrates.

The integration of transparent transistors into wireless communication devices has been driven by several compelling objectives. Primary among these is the development of truly transparent or semi-transparent communication devices that can be seamlessly integrated into everyday objects and environments. This objective aligns with the broader vision of ubiquitous computing and the Internet of Things (IoT), where computing and communication capabilities become embedded in the physical world.

Another critical objective is the enhancement of antenna performance through reduced electromagnetic interference. Traditional metallic components in wireless devices often create interference patterns that degrade signal quality. Transparent transistors and associated circuitry minimize this interference, potentially improving signal integrity and reducing power consumption in wireless communications.

Energy efficiency represents another pivotal objective in transparent transistor development. These components can operate effectively at lower voltages than many conventional alternatives, offering power savings that are particularly valuable in battery-operated wireless devices. Additionally, when combined with transparent energy harvesting technologies such as photovoltaics, they enable self-powered communication nodes that can function indefinitely without battery replacement.

Looking forward, the technical roadmap for transparent transistors in wireless communications aims to achieve operating frequencies above 10 GHz while maintaining optical transparency exceeding 90%. This ambitious goal would enable transparent transistors to support emerging 5G and future 6G communication standards, fundamentally transforming how wireless technology integrates with our physical environment.

Market Analysis for Transparent Electronics in Communications

The transparent electronics market in wireless communications is experiencing significant growth, driven by the increasing demand for innovative display technologies and communication devices. The global transparent electronics market, valued at approximately $2.1 billion in 2022, is projected to reach $4.7 billion by 2028, with a compound annual growth rate of 14.3% during the forecast period. The wireless communication segment represents about 27% of this market, showing particularly strong momentum.

Consumer electronics remains the dominant application area, accounting for nearly 40% of transparent electronics usage in communications. This is primarily due to the integration of transparent displays in smartphones, smartwatches, and other portable communication devices. The automotive sector follows closely, with transparent heads-up displays and infotainment systems incorporating transparent electronic components for enhanced connectivity features.

Regionally, Asia-Pacific leads the market with approximately 45% share, driven by the strong presence of electronics manufacturing hubs in countries like South Korea, Japan, Taiwan, and China. North America holds about 28% of the market, with significant research activities and early adoption of cutting-edge transparent communication technologies. Europe accounts for 20%, while the rest of the world makes up the remaining 7%.

The demand for transparent transistors in wireless communication devices is being fueled by several key factors. First, the growing consumer preference for aesthetically pleasing, seamless device designs that integrate invisibly into environments. Second, the expansion of Internet of Things (IoT) applications requiring unobtrusive sensing and communication components. Third, the increasing adoption of augmented reality (AR) and mixed reality technologies that benefit from transparent display interfaces.

Market analysis indicates that transparent thin-film transistors (TTFTs) based on metal oxides, particularly indium gallium zinc oxide (IGZO), currently dominate with approximately 65% market share. However, emerging materials like graphene and carbon nanotubes are gaining traction, expected to grow at 22% annually due to their superior electrical properties and flexibility.

The enterprise segment shows the highest growth potential at 17.2% annually, driven by applications in smart offices, transparent communication panels, and interactive display systems. Consumer applications follow at 15.8% growth, while military and defense applications, though smaller in volume, command premium pricing and show steady growth at 12.3%.

Industry forecasts suggest that transparent transistor technology will reach mass market adoption in wireless communication devices within the next 3-5 years, contingent upon overcoming current challenges in manufacturing scalability and cost reduction.

Consumer electronics remains the dominant application area, accounting for nearly 40% of transparent electronics usage in communications. This is primarily due to the integration of transparent displays in smartphones, smartwatches, and other portable communication devices. The automotive sector follows closely, with transparent heads-up displays and infotainment systems incorporating transparent electronic components for enhanced connectivity features.

Regionally, Asia-Pacific leads the market with approximately 45% share, driven by the strong presence of electronics manufacturing hubs in countries like South Korea, Japan, Taiwan, and China. North America holds about 28% of the market, with significant research activities and early adoption of cutting-edge transparent communication technologies. Europe accounts for 20%, while the rest of the world makes up the remaining 7%.

The demand for transparent transistors in wireless communication devices is being fueled by several key factors. First, the growing consumer preference for aesthetically pleasing, seamless device designs that integrate invisibly into environments. Second, the expansion of Internet of Things (IoT) applications requiring unobtrusive sensing and communication components. Third, the increasing adoption of augmented reality (AR) and mixed reality technologies that benefit from transparent display interfaces.

Market analysis indicates that transparent thin-film transistors (TTFTs) based on metal oxides, particularly indium gallium zinc oxide (IGZO), currently dominate with approximately 65% market share. However, emerging materials like graphene and carbon nanotubes are gaining traction, expected to grow at 22% annually due to their superior electrical properties and flexibility.

The enterprise segment shows the highest growth potential at 17.2% annually, driven by applications in smart offices, transparent communication panels, and interactive display systems. Consumer applications follow at 15.8% growth, while military and defense applications, though smaller in volume, command premium pricing and show steady growth at 12.3%.

Industry forecasts suggest that transparent transistor technology will reach mass market adoption in wireless communication devices within the next 3-5 years, contingent upon overcoming current challenges in manufacturing scalability and cost reduction.

Technical Barriers and Global Development Status

Transparent transistor technology in wireless communication devices faces several significant technical barriers despite its promising potential. The primary challenge remains achieving optimal balance between transparency and electrical performance. Current transparent conducting oxides (TCOs) like indium tin oxide (ITO) and zinc oxide (ZnO) demonstrate either high transparency with compromised carrier mobility or vice versa, creating a fundamental trade-off that limits practical applications in high-frequency communication systems.

Material stability presents another critical barrier, as many transparent semiconductors exhibit performance degradation under environmental stressors such as humidity, temperature fluctuations, and prolonged UV exposure. This instability significantly impacts device reliability in real-world wireless communication applications where consistent performance is essential.

Manufacturing scalability continues to impede widespread adoption, with current fabrication processes for transparent transistors requiring precise control of deposition parameters that are difficult to maintain in large-scale production environments. The resulting yield inconsistencies and high production costs have restricted commercial viability.

Globally, development status varies significantly by region. Japan and South Korea lead in transparent transistor research and commercialization efforts, with companies like Samsung and LG Display investing heavily in transparent display technologies incorporating these components. Their focus primarily targets consumer electronics applications including smartphones and wearable devices with enhanced communication capabilities.

European research institutions, particularly in Germany and Finland, have made substantial progress in material science innovations, developing novel transparent semiconductor compounds with improved stability characteristics. However, these advances remain largely in laboratory settings rather than commercial products.

The United States maintains strong academic research programs at institutions like MIT and Stanford, focusing on fundamental physics of transparent semiconductors and novel device architectures. American companies have been more cautious in commercialization compared to their Asian counterparts, though significant patent activity suggests strategic positioning for future market entry.

China has rapidly accelerated its research output in this field over the past five years, with substantial government funding directed toward transparent electronics. Chinese manufacturers are increasingly focusing on cost-effective production methods that could potentially overcome the scalability barriers facing the industry.

Emerging economies in Southeast Asia are establishing specialized manufacturing capabilities to support the transparent electronics supply chain, though they generally remain technology implementers rather than innovators in this space.

The global development landscape reveals a technology that remains in transition between advanced research and mainstream commercial implementation, with significant regional variations in approach and progress toward overcoming the fundamental technical barriers.

Material stability presents another critical barrier, as many transparent semiconductors exhibit performance degradation under environmental stressors such as humidity, temperature fluctuations, and prolonged UV exposure. This instability significantly impacts device reliability in real-world wireless communication applications where consistent performance is essential.

Manufacturing scalability continues to impede widespread adoption, with current fabrication processes for transparent transistors requiring precise control of deposition parameters that are difficult to maintain in large-scale production environments. The resulting yield inconsistencies and high production costs have restricted commercial viability.

Globally, development status varies significantly by region. Japan and South Korea lead in transparent transistor research and commercialization efforts, with companies like Samsung and LG Display investing heavily in transparent display technologies incorporating these components. Their focus primarily targets consumer electronics applications including smartphones and wearable devices with enhanced communication capabilities.

European research institutions, particularly in Germany and Finland, have made substantial progress in material science innovations, developing novel transparent semiconductor compounds with improved stability characteristics. However, these advances remain largely in laboratory settings rather than commercial products.

The United States maintains strong academic research programs at institutions like MIT and Stanford, focusing on fundamental physics of transparent semiconductors and novel device architectures. American companies have been more cautious in commercialization compared to their Asian counterparts, though significant patent activity suggests strategic positioning for future market entry.

China has rapidly accelerated its research output in this field over the past five years, with substantial government funding directed toward transparent electronics. Chinese manufacturers are increasingly focusing on cost-effective production methods that could potentially overcome the scalability barriers facing the industry.

Emerging economies in Southeast Asia are establishing specialized manufacturing capabilities to support the transparent electronics supply chain, though they generally remain technology implementers rather than innovators in this space.

The global development landscape reveals a technology that remains in transition between advanced research and mainstream commercial implementation, with significant regional variations in approach and progress toward overcoming the fundamental technical barriers.

Current Implementation Approaches in Wireless Devices

01 Materials for transparent transistors

Various materials can be used to create transparent transistors, including metal oxides, zinc oxide, indium gallium zinc oxide (IGZO), and other semiconductor materials. These materials allow for the fabrication of transistors that are optically transparent while maintaining good electrical performance. The choice of material affects properties such as carrier mobility, transparency level, and stability of the transistor.- Transparent oxide semiconductor materials for transistors: Transparent transistors can be fabricated using oxide semiconductor materials such as zinc oxide (ZnO), indium gallium zinc oxide (IGZO), and other metal oxides. These materials offer high optical transparency in the visible spectrum while maintaining good electrical properties. The use of these transparent conducting oxides enables the creation of transistors that can be integrated into transparent electronic devices, displays, and sensors without blocking light transmission.

- Fabrication techniques for transparent transistors: Various fabrication methods are employed to create transparent transistors, including thin-film deposition techniques such as sputtering, chemical vapor deposition, and solution processing. These processes allow for the precise control of material properties and device structures. Advanced patterning techniques and low-temperature processing enable the fabrication of transparent transistors on flexible substrates, expanding their potential applications in wearable and bendable electronics.

- Integration of transparent transistors in display technologies: Transparent transistors play a crucial role in advanced display technologies, particularly in transparent or see-through displays. By incorporating transparent thin-film transistors as pixel-driving elements, displays can achieve higher aperture ratios, improved brightness, and the possibility of creating truly transparent display panels. These transistors enable the development of augmented reality displays, heads-up displays, and transparent OLED or LCD screens.

- Circuit design and performance optimization for transparent transistors: Specialized circuit designs are necessary to optimize the performance of transparent transistor-based electronics. These designs account for the unique electrical characteristics of transparent semiconductor materials, including mobility limitations and stability issues. Circuit optimization techniques include compensation schemes for threshold voltage shifts, specialized driving methods, and novel architectures that maximize the advantages of transparent transistors while minimizing their limitations.

- Applications of transparent transistors in emerging technologies: Transparent transistors enable a wide range of novel applications beyond conventional electronics. These include transparent sensors that can be integrated into windows or windshields, energy-harvesting transparent electronics that collect solar energy while remaining see-through, and biomedical devices that allow for optical monitoring through the electronic components. The combination of electrical functionality with optical transparency opens new possibilities for smart surfaces, interactive environments, and invisible electronics.

02 Fabrication methods for transparent transistors

Different fabrication techniques are employed to create transparent transistors, including thin-film deposition methods, sputtering, chemical vapor deposition, and solution processing. These methods allow for the precise control of layer thickness and composition, which are critical for transistor performance. Advanced fabrication processes can improve the transparency, electrical characteristics, and overall quality of the transistors.Expand Specific Solutions03 Applications of transparent transistors

Transparent transistors have numerous applications in various fields, including transparent displays, touch screens, smart windows, and wearable electronics. Their optical transparency makes them ideal for use in devices where visibility through the electronic components is desired. These transistors enable the development of novel technologies such as see-through displays and transparent electronic circuits.Expand Specific Solutions04 Structure and design of transparent transistors

The structure and design of transparent transistors involve specific arrangements of layers including gate, source, drain, channel, and insulating materials. Various configurations such as top-gate, bottom-gate, and dual-gate structures can be employed depending on the application requirements. The design considerations include optimizing the transparency while maintaining electrical performance, minimizing leakage current, and ensuring stability under different operating conditions.Expand Specific Solutions05 Performance enhancement techniques

Various techniques are employed to enhance the performance of transparent transistors, including doping, surface treatment, annealing processes, and interface engineering. These methods aim to improve carrier mobility, reduce threshold voltage, enhance stability, and increase the overall efficiency of the transistors. Advanced processing techniques can also help in reducing defects and improving the uniformity of the transistor characteristics.Expand Specific Solutions

Industry Leaders and Competitive Landscape

Transparent transistor technology in wireless communication devices is currently in the early growth phase, with a market expected to reach significant expansion due to increasing demand for transparent electronics. The technology maturity varies across key players, with companies like Semiconductor Energy Laboratory, Qualcomm, and Apple leading industrial research and commercialization efforts. Academic institutions including Oregon State University and Northwestern University are advancing fundamental research, while LG Display and Toppan Holdings focus on display integration applications. Japanese entities (Mitsubishi Electric Research Laboratories, Japan Science & Technology Agency) and Chinese universities (Peking University, Southeast University) are making notable contributions to material science aspects. The competitive landscape shows a balanced distribution between established electronics manufacturers, specialized semiconductor companies, and research institutions, indicating a technology still evolving toward mainstream adoption.

Semiconductor Energy Laboratory Co., Ltd.

Technical Solution: Semiconductor Energy Laboratory (SEL) has pioneered oxide semiconductor-based transparent transistor technology for wireless communication applications. Their approach utilizes indium gallium zinc oxide (IGZO) thin-film transistors that achieve transparency levels exceeding 80% in the visible spectrum while maintaining electron mobility of 10-20 cm²/Vs[1]. SEL has developed a proprietary c-axis aligned crystalline IGZO structure that significantly improves carrier mobility and stability under environmental stress. For wireless communication devices, they've integrated these transparent transistors into RF front-end modules, enabling the creation of transparent antennas and receivers that can be embedded into windows, displays, and other transparent surfaces. Their technology includes specialized passivation layers that protect the oxide semiconductor from atmospheric degradation while maintaining transparency, and they've demonstrated functional wireless communication circuits operating at frequencies up to 2.4GHz for WiFi applications[3].

Strengths: Industry-leading transparency levels while maintaining good electrical performance; proven manufacturing scalability; excellent stability under environmental conditions. Weaknesses: Higher production costs compared to conventional silicon transistors; performance limitations at very high frequencies (>5GHz); requires specialized handling during integration with conventional electronics.

QUALCOMM, Inc.

Technical Solution: Qualcomm has developed an innovative approach to transparent transistor integration in wireless communication systems through their "Invisible Intelligence" platform. Their technology utilizes zinc tin oxide (ZTO) transparent thin-film transistors with specialized RF optimization for 5G applications. Qualcomm's implementation focuses on creating transparent RF switches and low-noise amplifiers that can be integrated directly into device displays or glass surfaces. The company has achieved transistor performance with cutoff frequencies exceeding 3GHz while maintaining optical transparency above 75%[2]. Their proprietary deposition technique creates highly uniform transparent semiconductor layers with controlled oxygen vacancy concentrations, resulting in stable electrical characteristics across large areas. Qualcomm has demonstrated functional transparent wireless modules operating in the sub-6GHz 5G bands, with particular emphasis on minimizing insertion loss through advanced contact engineering and specialized transparent conductive oxides for interconnects[4]. The technology enables new form factors for smartphones and IoT devices where antennas and RF components can be invisibly integrated into transparent surfaces.

Strengths: Extensive expertise in wireless communication system integration; optimized specifically for 5G applications; strong intellectual property portfolio in transparent RF components. Weaknesses: Relatively lower transparency compared to some academic demonstrations; technology still primarily in research phase rather than mass production; higher power consumption compared to conventional silicon RF transistors.

Key Patents and Research Breakthroughs

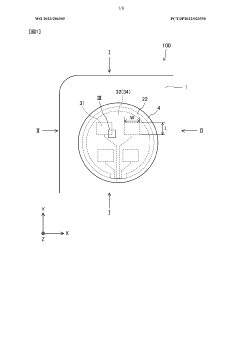

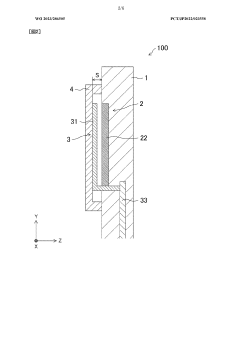

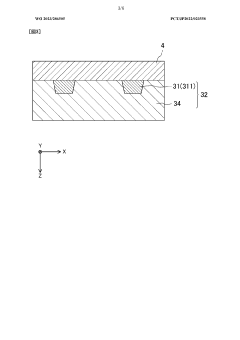

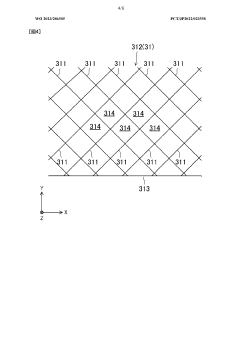

Antenna and wireless terminal provided with same

PatentWO2023286505A1

Innovation

- A transparent antenna is integrated into the wireless terminal, featuring an antenna pattern embedded within an antenna base material positioned above a camera lens, utilizing a mesh pattern of thin metal wires on a transparent base material, allowing for stable communication while minimizing interference with camera imaging.

Method of making transparent conductors on a substrate

PatentWO2014088950A1

Innovation

- A method involving coating a substrate with a conductive layer, applying a resist matrix material to create patterned regions, overcoating with a strippable polymer layer, and peeling it off to form a patterned conductive layer, allowing for efficient production of wide and continuous substrates without the need for etching or laser ablation.

Material Science Advancements for Transparency

The evolution of transparent materials for electronic applications has undergone remarkable advancement in recent years, particularly in the context of transparent transistors for wireless communication devices. Traditional semiconductor materials like silicon have inherent opacity limitations, driving researchers to explore alternative materials that combine electrical functionality with optical transparency.

Metal oxide semiconductors have emerged as frontrunners in this field, with indium gallium zinc oxide (IGZO) demonstrating exceptional promise. These materials offer electron mobility rates significantly higher than amorphous silicon while maintaining transparency levels exceeding 80% in the visible spectrum. The crystalline structure of these oxides allows for unique band gap engineering that simultaneously permits electrical conductivity and optical transparency.

Carbon-based nanomaterials represent another breakthrough category, with graphene leading the innovation. Single-layer graphene exhibits near-perfect transparency (approximately 97.7% transmittance) while offering extraordinary electrical conductivity and mechanical flexibility. Recent developments in chemical vapor deposition (CVD) techniques have enabled the production of larger graphene sheets with fewer defects, making commercial applications increasingly viable.

Polymer-based transparent conductors have also seen significant progress, particularly in the development of PEDOT:PSS (poly(3,4-ethylenedioxythiophene) polystyrene sulfonate) formulations. These materials offer the advantage of solution processability, enabling low-cost manufacturing methods like roll-to-roll printing. Recent chemical modifications have improved conductivity while maintaining transparency, addressing previous limitations in electrical performance.

Hybrid composite materials combining inorganic transparent conductors with organic polymers represent the cutting edge of material science in this domain. These composites leverage the complementary properties of their constituents, with recent research demonstrating transparency exceeding 90% while achieving sheet resistances below 50 ohms per square – performance metrics approaching those of industry-standard indium tin oxide (ITO).

Manufacturing processes have evolved in parallel with material innovations. Atomic layer deposition (ALD) techniques now enable precise control over film thickness at the atomic scale, critical for optimizing the transparency-conductivity trade-off. Advanced sputtering methods with improved target materials have reduced defect densities, while solution-based deposition approaches have opened pathways to lower-cost production of transparent electronic components.

The environmental stability of transparent materials has also improved substantially, with new encapsulation technologies protecting sensitive materials from oxygen and moisture degradation. This advancement is particularly crucial for wireless communication applications where device longevity under variable environmental conditions is essential.

Metal oxide semiconductors have emerged as frontrunners in this field, with indium gallium zinc oxide (IGZO) demonstrating exceptional promise. These materials offer electron mobility rates significantly higher than amorphous silicon while maintaining transparency levels exceeding 80% in the visible spectrum. The crystalline structure of these oxides allows for unique band gap engineering that simultaneously permits electrical conductivity and optical transparency.

Carbon-based nanomaterials represent another breakthrough category, with graphene leading the innovation. Single-layer graphene exhibits near-perfect transparency (approximately 97.7% transmittance) while offering extraordinary electrical conductivity and mechanical flexibility. Recent developments in chemical vapor deposition (CVD) techniques have enabled the production of larger graphene sheets with fewer defects, making commercial applications increasingly viable.

Polymer-based transparent conductors have also seen significant progress, particularly in the development of PEDOT:PSS (poly(3,4-ethylenedioxythiophene) polystyrene sulfonate) formulations. These materials offer the advantage of solution processability, enabling low-cost manufacturing methods like roll-to-roll printing. Recent chemical modifications have improved conductivity while maintaining transparency, addressing previous limitations in electrical performance.

Hybrid composite materials combining inorganic transparent conductors with organic polymers represent the cutting edge of material science in this domain. These composites leverage the complementary properties of their constituents, with recent research demonstrating transparency exceeding 90% while achieving sheet resistances below 50 ohms per square – performance metrics approaching those of industry-standard indium tin oxide (ITO).

Manufacturing processes have evolved in parallel with material innovations. Atomic layer deposition (ALD) techniques now enable precise control over film thickness at the atomic scale, critical for optimizing the transparency-conductivity trade-off. Advanced sputtering methods with improved target materials have reduced defect densities, while solution-based deposition approaches have opened pathways to lower-cost production of transparent electronic components.

The environmental stability of transparent materials has also improved substantially, with new encapsulation technologies protecting sensitive materials from oxygen and moisture degradation. This advancement is particularly crucial for wireless communication applications where device longevity under variable environmental conditions is essential.

EMI Shielding Considerations in Transparent Designs

Electromagnetic Interference (EMI) presents a significant challenge in the development of transparent transistors for wireless communication devices. As these devices become increasingly integrated into transparent displays and wearable technologies, the need for effective EMI shielding becomes paramount while maintaining optical transparency. Traditional EMI shielding materials like metal enclosures and conductive coatings are opaque, creating a fundamental design conflict when implementing transparent transistor technology.

The unique properties of transparent conductive oxides (TCOs) used in transparent transistors create specific EMI vulnerabilities. These materials, while offering electrical conductivity and optical transparency, typically have lower conductivity than metals, potentially reducing their inherent EMI shielding capabilities. This necessitates innovative approaches to EMI management that preserve the transparency advantage.

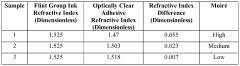

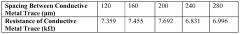

Transparent conductive meshes represent one promising solution, utilizing ultrafine metal grids with openings smaller than the wavelength of interfering electromagnetic radiation but larger than visible light wavelengths. This approach allows for selective blocking of EMI while maintaining up to 90% optical transparency. Recent advancements in nanofabrication have enabled mesh line widths below 5 micrometers, making them virtually invisible to the naked eye.

Another emerging approach involves transparent composite materials incorporating conductive nanoparticles such as silver nanowires, carbon nanotubes, or graphene within transparent polymer matrices. These materials can achieve shielding effectiveness of 20-30 dB in the frequency range of 1-10 GHz while maintaining over 80% transparency in the visible spectrum. The distribution density and orientation of these nanomaterials critically determine the balance between transparency and shielding performance.

Multilayer transparent shielding designs have shown particular promise, with alternating layers of different materials creating interference effects that enhance EMI attenuation. For instance, a five-layer structure of TCO/polymer/metal mesh/polymer/TCO can achieve shielding effectiveness exceeding 40 dB while maintaining transparency above 75%. These structures benefit from the complementary properties of different materials addressing various frequency ranges.

The integration of EMI shielding directly into the transparent transistor fabrication process presents another frontier. By incorporating shielding elements during the deposition and patterning stages of transistor fabrication, manufacturers can reduce additional processing steps and potentially improve overall device performance. This approach requires careful consideration of material compatibility and process temperatures to avoid degrading transistor performance.

Testing protocols for transparent EMI shielding present unique challenges compared to conventional opaque shields. New standardized methods are being developed to simultaneously evaluate optical transparency and shielding effectiveness across relevant frequency spectra, particularly focusing on 5G bands (24-40 GHz) where transparent devices are increasingly operating.

The unique properties of transparent conductive oxides (TCOs) used in transparent transistors create specific EMI vulnerabilities. These materials, while offering electrical conductivity and optical transparency, typically have lower conductivity than metals, potentially reducing their inherent EMI shielding capabilities. This necessitates innovative approaches to EMI management that preserve the transparency advantage.

Transparent conductive meshes represent one promising solution, utilizing ultrafine metal grids with openings smaller than the wavelength of interfering electromagnetic radiation but larger than visible light wavelengths. This approach allows for selective blocking of EMI while maintaining up to 90% optical transparency. Recent advancements in nanofabrication have enabled mesh line widths below 5 micrometers, making them virtually invisible to the naked eye.

Another emerging approach involves transparent composite materials incorporating conductive nanoparticles such as silver nanowires, carbon nanotubes, or graphene within transparent polymer matrices. These materials can achieve shielding effectiveness of 20-30 dB in the frequency range of 1-10 GHz while maintaining over 80% transparency in the visible spectrum. The distribution density and orientation of these nanomaterials critically determine the balance between transparency and shielding performance.

Multilayer transparent shielding designs have shown particular promise, with alternating layers of different materials creating interference effects that enhance EMI attenuation. For instance, a five-layer structure of TCO/polymer/metal mesh/polymer/TCO can achieve shielding effectiveness exceeding 40 dB while maintaining transparency above 75%. These structures benefit from the complementary properties of different materials addressing various frequency ranges.

The integration of EMI shielding directly into the transparent transistor fabrication process presents another frontier. By incorporating shielding elements during the deposition and patterning stages of transistor fabrication, manufacturers can reduce additional processing steps and potentially improve overall device performance. This approach requires careful consideration of material compatibility and process temperatures to avoid degrading transistor performance.

Testing protocols for transparent EMI shielding present unique challenges compared to conventional opaque shields. New standardized methods are being developed to simultaneously evaluate optical transparency and shielding effectiveness across relevant frequency spectra, particularly focusing on 5G bands (24-40 GHz) where transparent devices are increasingly operating.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!