Vacuum Condensing Of Hydrocarbons: Venting, Degassing And Drainage Layout

SEP 12, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Hydrocarbon Vacuum Condensing Technology Background and Objectives

Hydrocarbon vacuum condensing technology has evolved significantly over the past several decades, transforming from rudimentary systems to sophisticated processes that maximize efficiency and minimize environmental impact. The technology originated in the early 20th century petroleum industry, where basic vacuum distillation techniques were employed to separate hydrocarbon fractions. By the 1950s, enhanced condensing systems emerged with improved heat exchange capabilities and more efficient vacuum generation methods.

The evolution accelerated in the 1970s and 1980s with the introduction of computer-controlled systems and advanced materials that could withstand extreme operating conditions. This period marked a significant shift from purely mechanical designs to integrated systems incorporating electronic monitoring and control mechanisms. The 1990s saw further refinements with the development of specialized condensing surfaces and optimized flow dynamics to enhance heat transfer efficiency.

Recent technological advancements have focused on energy efficiency, environmental compliance, and operational safety. Modern vacuum condensing systems incorporate sophisticated venting arrangements, precise degassing mechanisms, and optimized drainage layouts that significantly reduce hydrocarbon losses while ensuring stable operation. The integration of real-time monitoring systems has enabled predictive maintenance approaches, substantially reducing downtime and operational risks.

The primary objective of current hydrocarbon vacuum condensing technology is to achieve maximum recovery of valuable hydrocarbon components while minimizing energy consumption and environmental footprint. This involves optimizing the condensation process through precise temperature and pressure control, efficient heat exchange, and effective separation of non-condensable gases from the hydrocarbon vapor stream.

Additional objectives include enhancing operational flexibility to accommodate varying feedstock compositions and process conditions, improving system reliability through redundant safety features and robust design, and reducing maintenance requirements through innovative materials and component designs. The technology also aims to address increasingly stringent environmental regulations by minimizing fugitive emissions and improving overall process efficiency.

Looking forward, the technology trajectory points toward more compact designs with higher throughput capabilities, advanced materials that extend equipment lifespan, and intelligent control systems that can autonomously optimize operating parameters based on real-time process data. Integration with renewable energy sources and heat recovery systems represents another frontier in the evolution of hydrocarbon vacuum condensing technology, aligning with global sustainability initiatives and carbon reduction targets.

The evolution accelerated in the 1970s and 1980s with the introduction of computer-controlled systems and advanced materials that could withstand extreme operating conditions. This period marked a significant shift from purely mechanical designs to integrated systems incorporating electronic monitoring and control mechanisms. The 1990s saw further refinements with the development of specialized condensing surfaces and optimized flow dynamics to enhance heat transfer efficiency.

Recent technological advancements have focused on energy efficiency, environmental compliance, and operational safety. Modern vacuum condensing systems incorporate sophisticated venting arrangements, precise degassing mechanisms, and optimized drainage layouts that significantly reduce hydrocarbon losses while ensuring stable operation. The integration of real-time monitoring systems has enabled predictive maintenance approaches, substantially reducing downtime and operational risks.

The primary objective of current hydrocarbon vacuum condensing technology is to achieve maximum recovery of valuable hydrocarbon components while minimizing energy consumption and environmental footprint. This involves optimizing the condensation process through precise temperature and pressure control, efficient heat exchange, and effective separation of non-condensable gases from the hydrocarbon vapor stream.

Additional objectives include enhancing operational flexibility to accommodate varying feedstock compositions and process conditions, improving system reliability through redundant safety features and robust design, and reducing maintenance requirements through innovative materials and component designs. The technology also aims to address increasingly stringent environmental regulations by minimizing fugitive emissions and improving overall process efficiency.

Looking forward, the technology trajectory points toward more compact designs with higher throughput capabilities, advanced materials that extend equipment lifespan, and intelligent control systems that can autonomously optimize operating parameters based on real-time process data. Integration with renewable energy sources and heat recovery systems represents another frontier in the evolution of hydrocarbon vacuum condensing technology, aligning with global sustainability initiatives and carbon reduction targets.

Market Analysis of Vacuum Condensing Systems for Hydrocarbons

The global market for vacuum condensing systems in hydrocarbon processing has experienced significant growth over the past decade, driven primarily by increasing demand for efficient processing methods in petroleum refining, petrochemical production, and natural gas processing. The market size was valued at approximately $3.2 billion in 2022 and is projected to reach $4.7 billion by 2028, representing a compound annual growth rate of 6.5%.

Regionally, Asia-Pacific dominates the market share, accounting for nearly 40% of global demand, with China and India being the primary growth engines due to rapid industrialization and expansion of refining capacities. North America follows with 25% market share, where the focus has shifted toward upgrading existing facilities with more efficient vacuum condensing technologies to meet stricter environmental regulations.

The demand drivers for vacuum condensing systems are multifaceted. Environmental regulations have become increasingly stringent worldwide, particularly regarding VOC emissions and waste management in hydrocarbon processing. This regulatory pressure has compelled companies to invest in advanced vacuum condensing systems that offer superior venting, degassing, and drainage capabilities.

Energy efficiency considerations represent another significant market driver. Modern vacuum condensing systems can reduce energy consumption by 15-20% compared to conventional systems, offering substantial operational cost savings over equipment lifetimes. This efficiency factor has become particularly important as energy prices fluctuate and companies seek to reduce their carbon footprint.

Market segmentation reveals distinct customer preferences based on application requirements. The petroleum refining segment currently holds the largest market share at 45%, followed by petrochemical production at 30% and natural gas processing at 20%. The remaining 5% encompasses specialty applications such as biofuel production and chemical recycling processes.

Customer demand patterns indicate a growing preference for integrated systems that combine vacuum condensing with advanced monitoring and control capabilities. End-users increasingly seek solutions that offer real-time performance data, predictive maintenance features, and compatibility with existing digital infrastructure. This trend toward "smart" vacuum condensing systems is expected to accelerate, with the market for digitally-enhanced systems growing at nearly twice the rate of conventional systems.

Price sensitivity varies significantly by region and application. While initial capital expenditure remains a key consideration, total cost of ownership calculations increasingly favor more advanced systems that offer superior efficiency and reduced maintenance requirements. The average return on investment period for premium vacuum condensing systems has decreased from 4-5 years to 2-3 years, further driving market adoption.

Regionally, Asia-Pacific dominates the market share, accounting for nearly 40% of global demand, with China and India being the primary growth engines due to rapid industrialization and expansion of refining capacities. North America follows with 25% market share, where the focus has shifted toward upgrading existing facilities with more efficient vacuum condensing technologies to meet stricter environmental regulations.

The demand drivers for vacuum condensing systems are multifaceted. Environmental regulations have become increasingly stringent worldwide, particularly regarding VOC emissions and waste management in hydrocarbon processing. This regulatory pressure has compelled companies to invest in advanced vacuum condensing systems that offer superior venting, degassing, and drainage capabilities.

Energy efficiency considerations represent another significant market driver. Modern vacuum condensing systems can reduce energy consumption by 15-20% compared to conventional systems, offering substantial operational cost savings over equipment lifetimes. This efficiency factor has become particularly important as energy prices fluctuate and companies seek to reduce their carbon footprint.

Market segmentation reveals distinct customer preferences based on application requirements. The petroleum refining segment currently holds the largest market share at 45%, followed by petrochemical production at 30% and natural gas processing at 20%. The remaining 5% encompasses specialty applications such as biofuel production and chemical recycling processes.

Customer demand patterns indicate a growing preference for integrated systems that combine vacuum condensing with advanced monitoring and control capabilities. End-users increasingly seek solutions that offer real-time performance data, predictive maintenance features, and compatibility with existing digital infrastructure. This trend toward "smart" vacuum condensing systems is expected to accelerate, with the market for digitally-enhanced systems growing at nearly twice the rate of conventional systems.

Price sensitivity varies significantly by region and application. While initial capital expenditure remains a key consideration, total cost of ownership calculations increasingly favor more advanced systems that offer superior efficiency and reduced maintenance requirements. The average return on investment period for premium vacuum condensing systems has decreased from 4-5 years to 2-3 years, further driving market adoption.

Current Challenges in Hydrocarbon Venting and Degassing Technologies

The hydrocarbon industry faces significant challenges in vacuum condensing systems, particularly in venting, degassing, and drainage operations. One of the primary obstacles is the management of non-condensable gases (NCGs) which can severely impact system efficiency. These gases create vapor blankets that reduce heat transfer rates in condensers, leading to decreased operational performance and increased energy consumption. Current venting technologies struggle to effectively remove these gases without also losing valuable hydrocarbon vapors.

Degassing operations present another set of technical difficulties. Conventional degassing methods often fail to achieve complete removal of dissolved gases from hydrocarbon liquids, resulting in downstream processing complications and product quality issues. The balance between thorough degassing and minimizing product loss remains a persistent challenge, with existing technologies frequently requiring excessive energy inputs or producing suboptimal results.

Drainage layout design faces complexity due to the diverse physical properties of different hydrocarbon streams. Engineers must account for varying viscosities, densities, and flow behaviors when designing drainage systems. Current drainage configurations frequently encounter issues with liquid holdup, uneven distribution, and insufficient removal rates, particularly in large-scale industrial applications.

Material limitations constitute another significant hurdle. Components in vacuum condensing systems must withstand corrosive environments, high temperature differentials, and mechanical stress. Existing materials often demonstrate accelerated degradation under these conditions, necessitating frequent maintenance and replacement, which increases operational costs and downtime.

Energy efficiency remains a critical concern across the industry. Traditional vacuum systems require substantial power for operation, with vacuum pumps and associated equipment consuming significant energy resources. The industry continues to search for more efficient technologies that can maintain required vacuum levels while reducing overall energy footprint.

Control system integration presents ongoing challenges, particularly in achieving precise pressure control in multi-component hydrocarbon systems. Current instrumentation sometimes lacks the sensitivity or response time needed for optimal vacuum management, resulting in process instabilities and reduced separation efficiency.

Environmental and safety considerations add another layer of complexity. Regulations increasingly restrict emissions from venting operations, while safety standards demand robust systems to prevent hazardous conditions. Current technologies sometimes struggle to meet these dual requirements without compromising operational performance.

Scale-up issues persist when transitioning from pilot to industrial scale. Designs that function effectively in laboratory or small-scale applications often encounter unforeseen complications when implemented at production scale, particularly regarding flow distribution, thermal management, and mechanical stability.

Degassing operations present another set of technical difficulties. Conventional degassing methods often fail to achieve complete removal of dissolved gases from hydrocarbon liquids, resulting in downstream processing complications and product quality issues. The balance between thorough degassing and minimizing product loss remains a persistent challenge, with existing technologies frequently requiring excessive energy inputs or producing suboptimal results.

Drainage layout design faces complexity due to the diverse physical properties of different hydrocarbon streams. Engineers must account for varying viscosities, densities, and flow behaviors when designing drainage systems. Current drainage configurations frequently encounter issues with liquid holdup, uneven distribution, and insufficient removal rates, particularly in large-scale industrial applications.

Material limitations constitute another significant hurdle. Components in vacuum condensing systems must withstand corrosive environments, high temperature differentials, and mechanical stress. Existing materials often demonstrate accelerated degradation under these conditions, necessitating frequent maintenance and replacement, which increases operational costs and downtime.

Energy efficiency remains a critical concern across the industry. Traditional vacuum systems require substantial power for operation, with vacuum pumps and associated equipment consuming significant energy resources. The industry continues to search for more efficient technologies that can maintain required vacuum levels while reducing overall energy footprint.

Control system integration presents ongoing challenges, particularly in achieving precise pressure control in multi-component hydrocarbon systems. Current instrumentation sometimes lacks the sensitivity or response time needed for optimal vacuum management, resulting in process instabilities and reduced separation efficiency.

Environmental and safety considerations add another layer of complexity. Regulations increasingly restrict emissions from venting operations, while safety standards demand robust systems to prevent hazardous conditions. Current technologies sometimes struggle to meet these dual requirements without compromising operational performance.

Scale-up issues persist when transitioning from pilot to industrial scale. Designs that function effectively in laboratory or small-scale applications often encounter unforeseen complications when implemented at production scale, particularly regarding flow distribution, thermal management, and mechanical stability.

Current Venting, Degassing and Drainage Layout Solutions

01 Vacuum condensing systems for hydrocarbon recovery

Vacuum condensing systems are used to recover hydrocarbons from various sources by creating negative pressure that facilitates the extraction and condensation of hydrocarbon vapors. These systems typically include vacuum pumps, condensers, and collection vessels that work together to efficiently capture volatile hydrocarbons that would otherwise be vented to the atmosphere. The recovered hydrocarbons can then be reused or properly disposed of, reducing environmental impact and improving resource efficiency.- Vacuum condensing systems for hydrocarbon recovery: Vacuum condensing systems are used to recover hydrocarbons from various sources by creating negative pressure that facilitates the extraction and condensation of hydrocarbon vapors. These systems typically include vacuum pumps, condensers, and collection vessels that work together to efficiently capture volatile hydrocarbons that would otherwise be vented to the atmosphere. The vacuum environment lowers the boiling point of hydrocarbons, enabling more effective separation and recovery at lower temperatures.

- Degassing techniques for hydrocarbon processing: Degassing techniques are employed in hydrocarbon processing to remove dissolved gases and volatile components from liquid hydrocarbons. These methods often utilize vacuum conditions to extract unwanted gases, improving product quality and safety. The degassing process may involve multiple stages with controlled temperature and pressure conditions to optimize the removal of specific gases. Advanced degassing systems may incorporate specialized membranes or catalysts to enhance separation efficiency while minimizing energy consumption.

- Drainage systems for hydrocarbon containment: Specialized drainage systems are designed for hydrocarbon containment areas to safely collect and process leaked or spilled hydrocarbons. These systems typically include sloped surfaces, collection sumps, and separation chambers that prevent environmental contamination. The drainage infrastructure often incorporates oil-water separators and monitoring equipment to ensure proper handling of collected hydrocarbons. Advanced drainage systems may feature automated controls that detect hydrocarbon presence and activate appropriate containment or treatment protocols.

- Integrated venting systems for hydrocarbon storage: Integrated venting systems for hydrocarbon storage facilities provide controlled release of pressure while minimizing emissions. These systems typically include pressure relief valves, flame arrestors, and vapor recovery connections that work together to maintain safe operating conditions. Modern venting systems often incorporate sensors and automated controls to optimize performance based on temperature, pressure, and vapor composition. Some designs feature condensation capabilities that capture valuable hydrocarbons during venting operations, reducing both environmental impact and product loss.

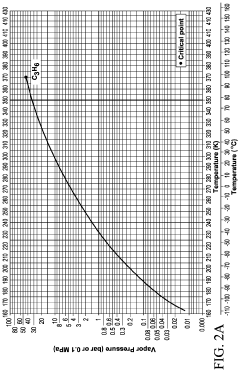

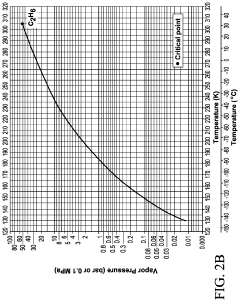

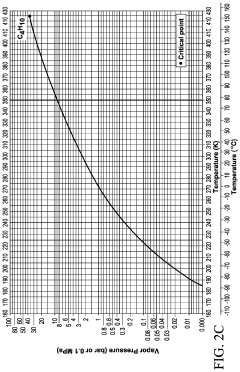

- Thermal management in hydrocarbon condensing processes: Thermal management plays a critical role in hydrocarbon condensing processes, where temperature control directly impacts recovery efficiency and product quality. Advanced heat exchange systems, including multi-stage cooling and heat recovery mechanisms, optimize energy usage while maximizing hydrocarbon capture. Thermal management strategies may involve precise temperature gradients to selectively condense different hydrocarbon fractions based on their boiling points. Some systems utilize cryogenic cooling for enhanced recovery of lighter hydrocarbons that are difficult to condense at ambient temperatures.

02 Degassing techniques for hydrocarbon-containing fluids

Degassing techniques are employed to remove dissolved gases from hydrocarbon-containing fluids. These methods often utilize vacuum conditions to lower the partial pressure of gases in the fluid, causing them to separate from the liquid phase. The process may involve specialized equipment such as degassing chambers, membrane separators, or vacuum towers that provide sufficient residence time and surface area for effective gas-liquid separation. Proper degassing improves product quality, prevents equipment damage, and enhances safety by reducing the risk of unexpected gas releases.Expand Specific Solutions03 Drainage systems for hydrocarbon processing facilities

Specialized drainage systems are designed for hydrocarbon processing facilities to safely collect, contain, and treat hydrocarbon-contaminated liquids. These systems typically include sloped collection areas, oil-water separators, containment sumps, and monitoring equipment to prevent environmental contamination. Vacuum-assisted drainage may be employed to enhance liquid removal from equipment or containment areas, particularly in situations where gravity flow is insufficient or where rapid drainage is required for safety reasons.Expand Specific Solutions04 Integrated venting and vapor recovery solutions

Integrated systems combine venting, vapor recovery, and condensing functions to manage hydrocarbon emissions effectively. These solutions typically incorporate pressure relief mechanisms, vapor collection headers, condensing equipment, and control systems that work together to prevent dangerous pressure build-up while capturing valuable hydrocarbon vapors. The integrated approach improves operational safety, reduces emissions, and enhances resource recovery by treating vented gases as a recoverable resource rather than waste.Expand Specific Solutions05 Thermal management in hydrocarbon condensing processes

Effective thermal management is critical in hydrocarbon condensing processes to optimize efficiency and prevent operational issues. This includes careful control of cooling media temperature, flow rates, and heat exchange surface areas to achieve desired condensation while avoiding problems like freezing, hydrate formation, or incomplete condensation. Advanced heat exchanger designs, multi-stage cooling arrangements, and temperature monitoring systems are employed to maintain optimal thermal conditions throughout the condensing process, particularly when dealing with mixed hydrocarbon streams with varying condensation points.Expand Specific Solutions

Leading Manufacturers and Service Providers in Vacuum Technology

The vacuum condensing of hydrocarbons market is currently in a growth phase, driven by increasing demand for efficient hydrocarbon processing systems across petrochemical and refining industries. The global market size is estimated to exceed $5 billion, with projected annual growth of 4-6% through 2028. Technologically, the field is moderately mature but continues to evolve with innovations in venting, degassing, and drainage layout designs. Key players demonstrate varying levels of technical sophistication: Baker Hughes, Phillips 66, and Ecopetrol lead with advanced vacuum condensing technologies, while companies like Edwards Ltd. and Nikkiso offer specialized vacuum equipment solutions. Westinghouse Electric and Siemens VAI Metals Technologies provide integrated systems with proprietary condensing technologies, creating a competitive landscape where specialized expertise and system integration capabilities determine market positioning.

Baker Hughes Co.

Technical Solution: Baker Hughes has developed advanced vacuum condensing systems for hydrocarbon processing that incorporate multi-stage vacuum pumps with specialized liquid ring technology. Their solution features integrated venting systems that efficiently remove non-condensable gases while maintaining optimal vacuum levels. The company's degassing technology employs proprietary mechanical agitation methods combined with controlled pressure reduction to maximize hydrocarbon recovery. Their drainage layout incorporates strategically positioned collection points with automated level controls and heat-traced piping to prevent solidification of high-melting-point hydrocarbons. Baker Hughes' systems also feature intelligent monitoring capabilities that continuously analyze process conditions and adjust operational parameters to maintain efficiency across varying feed compositions and flow rates.

Strengths: Extensive oil and gas industry experience provides deep understanding of hydrocarbon behavior under vacuum conditions; integrated systems approach ensures compatibility between components. Weaknesses: Higher initial capital investment compared to simpler systems; requires specialized maintenance expertise.

Univation Technologies LLC

Technical Solution: Univation Technologies has pioneered vacuum condensing systems specifically designed for polyolefin production processes. Their technology employs a cascaded condensing approach with multiple temperature zones to fractionate different hydrocarbon components efficiently. The venting system incorporates proprietary cyclonic separators that remove entrained liquid droplets from vapor streams before they enter vacuum equipment, significantly reducing fouling issues. For degassing, Univation utilizes a combination of residence time optimization and mechanical agitation in specially designed vessels that maximize surface area exposure. Their drainage layout features a "smart slope" design with self-cleaning capabilities to prevent polymer buildup in critical areas. The system includes specialized heat management to maintain hydrocarbons above their solidification points while preventing thermal degradation.

Strengths: Highly specialized for polyolefin production environments; excellent fouling resistance in systems handling sticky polymeric materials. Weaknesses: Less versatile for applications outside polyolefin production; higher complexity requires more sophisticated control systems.

Key Patents and Innovations in Hydrocarbon Vacuum Systems

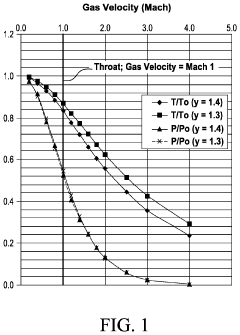

Supersonic treatment of vapor streams for separation and drying of hydrocarbon gases

PatentWO2017112419A1

Innovation

- The use of a de Laval nozzle to accelerate gas mixtures to supersonic speeds, inducing condensation of hydrocarbons by reducing temperature and pressure, followed by a vortex chamber to separate condensed droplets from the gas stream using centrifugal forces.

Supersonic treatment of vapor streams for separation and drying of hydrocarbon gases

PatentActiveUS20220323880A1

Innovation

- The use of a de Laval nozzle to accelerate gas mixtures to supersonic speeds, inducing condensation of hydrocarbons by reducing temperature and pressure, and employing swirl chambers to separate condensed droplets from the gas stream through centrifugal forces, allowing for efficient recovery and recycling of hydrocarbons.

Safety Standards and Compliance Requirements

Vacuum condensing operations for hydrocarbons must adhere to stringent safety standards and compliance requirements to mitigate risks associated with flammable materials, pressure systems, and potential environmental impacts. The primary regulatory frameworks governing these operations include OSHA Process Safety Management (PSM) standards, EPA Risk Management Plan (RMP) requirements, and industry-specific codes such as API 520/521 for pressure-relieving systems.

Equipment used in vacuum condensing systems must comply with ASME Boiler and Pressure Vessel Code Section VIII, which establishes design, fabrication, and inspection requirements for pressure vessels. For electrical components in hazardous areas, compliance with NFPA 70 (National Electrical Code) and specifically Article 500 for classified locations is mandatory to prevent ignition sources.

Venting systems must be designed according to API 2000 standards for venting atmospheric and low-pressure storage tanks, ensuring proper sizing and configuration to prevent over-pressurization. The degassing operations must follow EPA's Maximum Achievable Control Technology (MACT) standards, which specify emission limits and control requirements for hydrocarbon processing facilities.

Drainage layouts require compliance with NFPA 30 (Flammable and Combustible Liquids Code) for proper containment and disposal of hydrocarbon liquids. Additionally, facilities must implement secondary containment systems that meet EPA's Spill Prevention, Control, and Countermeasure (SPCC) regulations to prevent environmental contamination.

Personnel safety considerations are governed by OSHA 1910.146 for confined space entry procedures, which are critical during maintenance of condensers and associated equipment. Respiratory protection standards (OSHA 1910.134) apply when workers may be exposed to hydrocarbon vapors during venting or degassing operations.

International standards such as IEC 60079 for explosive atmospheres and ISO 13702 for control and mitigation of fires and explosions provide additional guidance for global operations. European facilities must also comply with ATEX directives 2014/34/EU and 1999/92/EC for equipment and worker protection in potentially explosive atmospheres.

Documentation and training requirements include maintaining Process Safety Information (PSI), conducting Process Hazard Analyses (PHAs), and implementing Management of Change (MOC) procedures as specified in OSHA's PSM standard. Regular compliance audits and inspections must be conducted to verify adherence to these standards and identify potential safety gaps.

Emerging regulations increasingly focus on fugitive emissions monitoring and reduction, with EPA's Leak Detection and Repair (LDAR) programs becoming more stringent for hydrocarbon processing facilities. Companies must stay current with evolving regulatory requirements and industry best practices to ensure continued compliance and operational safety.

Equipment used in vacuum condensing systems must comply with ASME Boiler and Pressure Vessel Code Section VIII, which establishes design, fabrication, and inspection requirements for pressure vessels. For electrical components in hazardous areas, compliance with NFPA 70 (National Electrical Code) and specifically Article 500 for classified locations is mandatory to prevent ignition sources.

Venting systems must be designed according to API 2000 standards for venting atmospheric and low-pressure storage tanks, ensuring proper sizing and configuration to prevent over-pressurization. The degassing operations must follow EPA's Maximum Achievable Control Technology (MACT) standards, which specify emission limits and control requirements for hydrocarbon processing facilities.

Drainage layouts require compliance with NFPA 30 (Flammable and Combustible Liquids Code) for proper containment and disposal of hydrocarbon liquids. Additionally, facilities must implement secondary containment systems that meet EPA's Spill Prevention, Control, and Countermeasure (SPCC) regulations to prevent environmental contamination.

Personnel safety considerations are governed by OSHA 1910.146 for confined space entry procedures, which are critical during maintenance of condensers and associated equipment. Respiratory protection standards (OSHA 1910.134) apply when workers may be exposed to hydrocarbon vapors during venting or degassing operations.

International standards such as IEC 60079 for explosive atmospheres and ISO 13702 for control and mitigation of fires and explosions provide additional guidance for global operations. European facilities must also comply with ATEX directives 2014/34/EU and 1999/92/EC for equipment and worker protection in potentially explosive atmospheres.

Documentation and training requirements include maintaining Process Safety Information (PSI), conducting Process Hazard Analyses (PHAs), and implementing Management of Change (MOC) procedures as specified in OSHA's PSM standard. Regular compliance audits and inspections must be conducted to verify adherence to these standards and identify potential safety gaps.

Emerging regulations increasingly focus on fugitive emissions monitoring and reduction, with EPA's Leak Detection and Repair (LDAR) programs becoming more stringent for hydrocarbon processing facilities. Companies must stay current with evolving regulatory requirements and industry best practices to ensure continued compliance and operational safety.

Energy Efficiency Optimization in Vacuum Condensing Systems

Energy efficiency optimization in vacuum condensing systems for hydrocarbon processing represents a critical area for operational cost reduction and environmental impact minimization. Current vacuum condensing technologies typically operate at 40-60% efficiency, with significant energy losses occurring through heat transfer inefficiencies, non-condensable gas handling, and suboptimal pressure control.

The implementation of advanced heat exchanger designs has demonstrated potential energy savings of 15-25% compared to conventional systems. Shell-and-tube condensers with enhanced tube geometries show particularly promising results in hydrocarbon applications, offering improved heat transfer coefficients while minimizing fouling tendencies that commonly plague these systems.

Pressure optimization strategies play a fundamental role in energy conservation. Research indicates that maintaining optimal vacuum levels specific to the hydrocarbon mixture being processed can reduce energy consumption by 8-12%. This requires sophisticated pressure control systems capable of dynamic adjustment based on feed composition and desired product specifications.

Non-condensable gas management represents another significant opportunity for efficiency improvement. Efficient venting and degassing systems that minimize hydrocarbon losses while effectively removing non-condensables can improve overall system efficiency by 5-10%. Multi-stage ejector systems with intercondensers have proven particularly effective for this purpose.

Heat integration across the broader process represents perhaps the most substantial opportunity for energy conservation. Waste heat recovery from condensate streams can provide valuable thermal energy for upstream processes, potentially reducing overall plant energy requirements by 10-20%. This approach requires careful analysis of the entire process heat cascade to identify optimal integration points.

Advanced control systems utilizing model predictive control algorithms have demonstrated the ability to maintain optimal operating conditions despite variations in feed composition and ambient conditions. These systems can deliver an additional 3-7% efficiency improvement through real-time optimization of key operating parameters.

The economic analysis of energy efficiency improvements in vacuum condensing systems typically shows payback periods of 1-3 years for most optimization projects, with ROI exceeding 30% in many cases. This favorable economic profile, combined with increasingly stringent environmental regulations regarding emissions and energy consumption, makes efficiency optimization a strategic priority for hydrocarbon processing facilities.

The implementation of advanced heat exchanger designs has demonstrated potential energy savings of 15-25% compared to conventional systems. Shell-and-tube condensers with enhanced tube geometries show particularly promising results in hydrocarbon applications, offering improved heat transfer coefficients while minimizing fouling tendencies that commonly plague these systems.

Pressure optimization strategies play a fundamental role in energy conservation. Research indicates that maintaining optimal vacuum levels specific to the hydrocarbon mixture being processed can reduce energy consumption by 8-12%. This requires sophisticated pressure control systems capable of dynamic adjustment based on feed composition and desired product specifications.

Non-condensable gas management represents another significant opportunity for efficiency improvement. Efficient venting and degassing systems that minimize hydrocarbon losses while effectively removing non-condensables can improve overall system efficiency by 5-10%. Multi-stage ejector systems with intercondensers have proven particularly effective for this purpose.

Heat integration across the broader process represents perhaps the most substantial opportunity for energy conservation. Waste heat recovery from condensate streams can provide valuable thermal energy for upstream processes, potentially reducing overall plant energy requirements by 10-20%. This approach requires careful analysis of the entire process heat cascade to identify optimal integration points.

Advanced control systems utilizing model predictive control algorithms have demonstrated the ability to maintain optimal operating conditions despite variations in feed composition and ambient conditions. These systems can deliver an additional 3-7% efficiency improvement through real-time optimization of key operating parameters.

The economic analysis of energy efficiency improvements in vacuum condensing systems typically shows payback periods of 1-3 years for most optimization projects, with ROI exceeding 30% in many cases. This favorable economic profile, combined with increasingly stringent environmental regulations regarding emissions and energy consumption, makes efficiency optimization a strategic priority for hydrocarbon processing facilities.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!