Acrylic Resin vs Urethane Acrylate: Surface Hardness Evaluation

OCT 11, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Resin Technology Background and Objectives

Resin technology has evolved significantly over the past several decades, transitioning from simple formulations to highly specialized compounds designed for specific applications. The development of synthetic resins began in the early 20th century, with significant advancements occurring post-World War II when industrial applications demanded materials with enhanced performance characteristics. Acrylic resins emerged in the 1930s, while urethane acrylates were developed later in the 1970s as hybrid systems combining properties of both urethanes and acrylates.

The evolution of these resin technologies has been driven by increasing demands for durability, chemical resistance, and superior mechanical properties across various industries including automotive, electronics, construction, and consumer goods. Surface hardness, in particular, has become a critical performance parameter as it directly impacts scratch resistance, wear characteristics, and overall product longevity.

Current market trends indicate a growing preference for high-performance coating materials that can deliver exceptional surface hardness while maintaining other desirable properties such as flexibility, adhesion, and environmental resistance. This has accelerated research into comparative performance analysis between traditional acrylic resins and newer urethane acrylate formulations.

The fundamental chemistry of these materials differs significantly. Acrylic resins are primarily based on acrylic and methacrylic monomers polymerized through free-radical mechanisms, resulting in linear polymer structures. Urethane acrylates, conversely, incorporate urethane linkages within an acrylic backbone, creating a more complex molecular architecture that influences mechanical properties, including surface hardness.

Recent technological advancements have focused on molecular design optimization, crosslinking density control, and nano-composite integration to enhance surface hardness without compromising other performance attributes. The incorporation of silica nanoparticles, for instance, has shown promising results in improving scratch resistance while maintaining transparency in both resin systems.

The primary objective of this technical research is to conduct a comprehensive evaluation of surface hardness characteristics between acrylic resins and urethane acrylates across various formulations and curing conditions. This assessment aims to establish quantitative performance benchmarks, identify key molecular and structural factors influencing hardness properties, and determine optimal formulation parameters for specific application requirements.

Additionally, this research seeks to develop predictive models correlating molecular structure with surface hardness, enabling more efficient formulation development and reducing empirical testing requirements. The findings will support strategic decision-making regarding material selection and formulation optimization for next-generation coating systems where surface durability is paramount.

The evolution of these resin technologies has been driven by increasing demands for durability, chemical resistance, and superior mechanical properties across various industries including automotive, electronics, construction, and consumer goods. Surface hardness, in particular, has become a critical performance parameter as it directly impacts scratch resistance, wear characteristics, and overall product longevity.

Current market trends indicate a growing preference for high-performance coating materials that can deliver exceptional surface hardness while maintaining other desirable properties such as flexibility, adhesion, and environmental resistance. This has accelerated research into comparative performance analysis between traditional acrylic resins and newer urethane acrylate formulations.

The fundamental chemistry of these materials differs significantly. Acrylic resins are primarily based on acrylic and methacrylic monomers polymerized through free-radical mechanisms, resulting in linear polymer structures. Urethane acrylates, conversely, incorporate urethane linkages within an acrylic backbone, creating a more complex molecular architecture that influences mechanical properties, including surface hardness.

Recent technological advancements have focused on molecular design optimization, crosslinking density control, and nano-composite integration to enhance surface hardness without compromising other performance attributes. The incorporation of silica nanoparticles, for instance, has shown promising results in improving scratch resistance while maintaining transparency in both resin systems.

The primary objective of this technical research is to conduct a comprehensive evaluation of surface hardness characteristics between acrylic resins and urethane acrylates across various formulations and curing conditions. This assessment aims to establish quantitative performance benchmarks, identify key molecular and structural factors influencing hardness properties, and determine optimal formulation parameters for specific application requirements.

Additionally, this research seeks to develop predictive models correlating molecular structure with surface hardness, enabling more efficient formulation development and reducing empirical testing requirements. The findings will support strategic decision-making regarding material selection and formulation optimization for next-generation coating systems where surface durability is paramount.

Market Demand Analysis for Hard-Surface Coatings

The global market for hard-surface coatings has experienced significant growth in recent years, driven by increasing demand across multiple industries including automotive, electronics, furniture, and construction. The market value for high-performance coatings reached approximately $24.5 billion in 2022, with projections indicating a compound annual growth rate of 5.7% through 2028.

Consumer preferences have shifted notably toward more durable and scratch-resistant surfaces, particularly in high-touch applications such as electronic devices, automotive interiors, and household furniture. This trend has accelerated the development of advanced coating technologies that can deliver superior surface hardness while maintaining other desirable properties such as clarity, flexibility, and chemical resistance.

The comparison between acrylic resin and urethane acrylate coatings represents a critical decision point for manufacturers seeking optimal surface hardness solutions. Market research indicates that sectors requiring exceptional abrasion resistance, such as flooring and industrial equipment, have shown 15% higher adoption rates for urethane acrylate formulations over traditional acrylic resins in the past three years.

Environmental regulations have become a significant market driver, with VOC (Volatile Organic Compound) restrictions tightening globally. This regulatory landscape has pushed coating manufacturers toward water-based and UV-curable formulations, where both acrylic resins and urethane acrylates play important roles. The market for environmentally compliant hard coatings grew by 8.3% in 2022, outpacing the overall coatings market.

Regional analysis reveals varying demand patterns, with North America and Europe prioritizing environmental compliance alongside performance, while Asia-Pacific markets often emphasize cost-effectiveness and production efficiency. The fastest growth is observed in emerging economies where rapid industrialization and increasing consumer purchasing power drive demand for premium surface finishes.

End-user feedback indicates a willingness to pay premium prices for coatings that demonstrably extend product lifespans through enhanced scratch and wear resistance. Consumer electronics manufacturers report that devices with superior hardness coatings command price premiums of 7-12% and experience 23% fewer returns due to cosmetic damage.

The automotive industry represents another significant market segment, with interior and exterior applications requiring different performance profiles. The trend toward shared mobility services has intensified the need for highly durable interior surfaces that can withstand frequent use, creating new opportunities for advanced coating solutions with exceptional hardness characteristics.

Consumer preferences have shifted notably toward more durable and scratch-resistant surfaces, particularly in high-touch applications such as electronic devices, automotive interiors, and household furniture. This trend has accelerated the development of advanced coating technologies that can deliver superior surface hardness while maintaining other desirable properties such as clarity, flexibility, and chemical resistance.

The comparison between acrylic resin and urethane acrylate coatings represents a critical decision point for manufacturers seeking optimal surface hardness solutions. Market research indicates that sectors requiring exceptional abrasion resistance, such as flooring and industrial equipment, have shown 15% higher adoption rates for urethane acrylate formulations over traditional acrylic resins in the past three years.

Environmental regulations have become a significant market driver, with VOC (Volatile Organic Compound) restrictions tightening globally. This regulatory landscape has pushed coating manufacturers toward water-based and UV-curable formulations, where both acrylic resins and urethane acrylates play important roles. The market for environmentally compliant hard coatings grew by 8.3% in 2022, outpacing the overall coatings market.

Regional analysis reveals varying demand patterns, with North America and Europe prioritizing environmental compliance alongside performance, while Asia-Pacific markets often emphasize cost-effectiveness and production efficiency. The fastest growth is observed in emerging economies where rapid industrialization and increasing consumer purchasing power drive demand for premium surface finishes.

End-user feedback indicates a willingness to pay premium prices for coatings that demonstrably extend product lifespans through enhanced scratch and wear resistance. Consumer electronics manufacturers report that devices with superior hardness coatings command price premiums of 7-12% and experience 23% fewer returns due to cosmetic damage.

The automotive industry represents another significant market segment, with interior and exterior applications requiring different performance profiles. The trend toward shared mobility services has intensified the need for highly durable interior surfaces that can withstand frequent use, creating new opportunities for advanced coating solutions with exceptional hardness characteristics.

Current State and Challenges in Resin Hardness Technology

The global resin hardness technology landscape presents a complex picture with significant regional variations. In North America and Europe, advanced research into polymer chemistry has yielded substantial improvements in surface hardness properties of both acrylic resins and urethane acrylates. Asian markets, particularly Japan and South Korea, have demonstrated remarkable innovation in hybrid formulations that combine the benefits of both resin types. China has emerged as a manufacturing powerhouse, though often focusing on cost-effective production rather than cutting-edge innovation.

Current surface hardness evaluation methodologies show considerable limitations when comparing acrylic resins with urethane acrylates. Standard testing protocols such as pencil hardness tests (ASTM D3363), Knoop and Vickers microhardness measurements, and Persoz pendulum hardness tests often yield inconsistent results when applied across different resin systems. This inconsistency stems from the fundamental structural differences between these materials, creating significant challenges for direct comparative analysis.

A primary technical challenge involves the inherent trade-off between hardness and flexibility. Acrylic resins typically offer superior initial hardness but may become brittle over time, while urethane acrylates provide better impact resistance but often with reduced scratch resistance. This dichotomy has proven difficult to resolve despite extensive research efforts. Furthermore, environmental factors significantly impact hardness performance, with temperature fluctuations and UV exposure affecting each resin type differently.

Crosslinking density optimization represents another major technical hurdle. While higher crosslinking generally improves hardness, it can negatively impact other desirable properties. Researchers have struggled to develop formulations that maintain an optimal balance across the full spectrum of performance requirements. The molecular weight distribution of polymer chains also significantly influences hardness characteristics but remains difficult to control precisely during manufacturing.

Additive compatibility presents additional complications. Silica nanoparticles, aluminum oxide, and other hardness-enhancing additives interact differently with acrylic resins versus urethane acrylates. These interactions are not fully understood at the molecular level, limiting formulators' ability to predict performance outcomes accurately. Recent research has focused on developing universal additives that function effectively across different resin systems, but progress has been incremental.

Curing technology limitations further constrain advancement in this field. UV-curing systems, thermal curing, and dual-cure approaches each present unique challenges when optimizing for surface hardness. The energy requirements, cure depth limitations, and oxygen inhibition effects vary significantly between acrylic resins and urethane acrylates, necessitating different processing approaches that complicate manufacturing standardization.

Current surface hardness evaluation methodologies show considerable limitations when comparing acrylic resins with urethane acrylates. Standard testing protocols such as pencil hardness tests (ASTM D3363), Knoop and Vickers microhardness measurements, and Persoz pendulum hardness tests often yield inconsistent results when applied across different resin systems. This inconsistency stems from the fundamental structural differences between these materials, creating significant challenges for direct comparative analysis.

A primary technical challenge involves the inherent trade-off between hardness and flexibility. Acrylic resins typically offer superior initial hardness but may become brittle over time, while urethane acrylates provide better impact resistance but often with reduced scratch resistance. This dichotomy has proven difficult to resolve despite extensive research efforts. Furthermore, environmental factors significantly impact hardness performance, with temperature fluctuations and UV exposure affecting each resin type differently.

Crosslinking density optimization represents another major technical hurdle. While higher crosslinking generally improves hardness, it can negatively impact other desirable properties. Researchers have struggled to develop formulations that maintain an optimal balance across the full spectrum of performance requirements. The molecular weight distribution of polymer chains also significantly influences hardness characteristics but remains difficult to control precisely during manufacturing.

Additive compatibility presents additional complications. Silica nanoparticles, aluminum oxide, and other hardness-enhancing additives interact differently with acrylic resins versus urethane acrylates. These interactions are not fully understood at the molecular level, limiting formulators' ability to predict performance outcomes accurately. Recent research has focused on developing universal additives that function effectively across different resin systems, but progress has been incremental.

Curing technology limitations further constrain advancement in this field. UV-curing systems, thermal curing, and dual-cure approaches each present unique challenges when optimizing for surface hardness. The energy requirements, cure depth limitations, and oxygen inhibition effects vary significantly between acrylic resins and urethane acrylates, necessitating different processing approaches that complicate manufacturing standardization.

Current Hardness Evaluation Methodologies and Standards

01 Formulation of acrylic resin and urethane acrylate for enhanced surface hardness

Specific formulations combining acrylic resin and urethane acrylate can significantly improve surface hardness properties. The ratio of these components, along with the molecular weight and structure of the polymers, plays a crucial role in determining the final hardness characteristics. These formulations typically involve optimizing crosslinking density and polymer chain flexibility to achieve desired hardness while maintaining other physical properties.- Composition of acrylic resin and urethane acrylate for improved surface hardness: Formulations combining acrylic resin and urethane acrylate can significantly enhance surface hardness properties. These compositions typically include specific ratios of acrylic resin to urethane acrylate, along with crosslinking agents that promote network formation. The resulting materials exhibit superior scratch resistance and durability while maintaining flexibility. These formulations are particularly useful in coatings where both hardness and impact resistance are required.

- Curing methods to optimize surface hardness: Various curing methods can be employed to optimize the surface hardness of acrylic resin and urethane acrylate compositions. UV curing, thermal curing, and dual-cure systems significantly influence the final hardness properties. The curing parameters, including intensity, duration, and temperature profiles, can be adjusted to achieve desired hardness levels. Proper curing ensures complete polymerization and crosslinking, resulting in maximum surface hardness while minimizing shrinkage and internal stress.

- Additives and modifiers for enhanced hardness: Specific additives and modifiers can be incorporated into acrylic resin and urethane acrylate systems to enhance surface hardness. These include silica nanoparticles, aluminum oxide, and specialized hardening agents that improve scratch resistance and durability. Reactive diluents can be added to control viscosity while contributing to the crosslink density. Certain additives also provide synergistic effects, improving both hardness and other properties such as chemical resistance and weatherability.

- Molecular structure design for optimized hardness: The molecular structure of acrylic resins and urethane acrylates significantly impacts surface hardness. Controlling molecular weight, functionality, and crosslink density allows for tailored hardness properties. Higher functionality monomers and oligomers typically yield harder surfaces due to increased crosslinking. The backbone structure of urethane acrylates can be modified with rigid segments to enhance hardness while maintaining other desirable properties such as adhesion and flexibility.

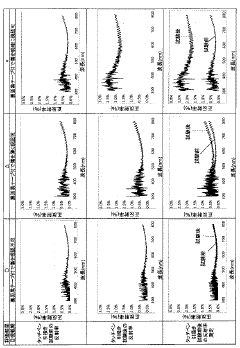

- Testing and measurement methods for surface hardness: Various testing and measurement methods are employed to evaluate the surface hardness of acrylic resin and urethane acrylate materials. These include pencil hardness tests, nanoindentation, Konig pendulum hardness, and Persoz hardness measurements. Standardized testing protocols ensure consistent evaluation of hardness properties across different formulations. Advanced characterization techniques can correlate molecular structure and crosslink density with measured hardness values, enabling more precise formulation development.

02 Additives and modifiers to improve hardness in acrylic-urethane systems

Various additives can be incorporated into acrylic resin and urethane acrylate formulations to enhance surface hardness. These include silica nanoparticles, metal oxide fillers, crosslinking agents, and specialized hardening catalysts. The addition of these components can significantly improve scratch resistance, abrasion resistance, and overall surface durability while maintaining other desirable coating properties such as flexibility and adhesion.Expand Specific Solutions03 Curing methods for optimizing surface hardness

Different curing methods significantly impact the surface hardness of acrylic resin and urethane acrylate systems. UV curing, thermal curing, and dual-cure systems each provide distinct advantages for hardness development. The curing parameters, including temperature, time, and radiation intensity, can be optimized to achieve maximum crosslinking density and consequently improved surface hardness while minimizing shrinkage and internal stress.Expand Specific Solutions04 Hybrid acrylic-urethane systems for balanced hardness and flexibility

Hybrid systems combining different types of acrylic resins and urethane acrylates can achieve an optimal balance between surface hardness and flexibility. These formulations often incorporate specialized monomers, oligomers with varying functionality, and carefully selected polymer backbones. The synergistic effect of these components results in coatings with excellent surface hardness while maintaining impact resistance and preventing brittleness or cracking under stress.Expand Specific Solutions05 Testing and measurement methods for surface hardness

Various testing methodologies are employed to evaluate the surface hardness of acrylic resin and urethane acrylate coatings. These include pencil hardness tests, pendulum hardness tests, nanoindentation, and scratch resistance measurements. Standardized testing protocols ensure consistent evaluation of hardness properties across different formulations, enabling systematic optimization of coating compositions for specific hardness requirements in various applications.Expand Specific Solutions

Key Industry Players in High-Performance Resin Development

The acrylic resin versus urethane acrylate surface hardness evaluation market is currently in a growth phase, with increasing demand for high-performance coating solutions across automotive, electronics, and industrial applications. The global market size for these specialty resins is estimated at $15-20 billion, expanding at 5-7% CAGR. Technical maturity varies between formulations, with major players driving innovation through differentiated approaches. Companies like BASF SE, LG Chem, and Sumitomo Chemical lead with broad portfolios, while specialized manufacturers such as Allnex, JSR Corp, and DIC Corp focus on high-performance formulations. Japanese firms including Kansai Paint, Nippon Kayaku, and FUJIFILM Business Innovation are advancing technical capabilities in scratch-resistant coatings, while research institutions like Fudan University contribute to fundamental understanding of surface hardness mechanisms.

Kansai Paint Co., Ltd.

Technical Solution: Kansai Paint has developed a proprietary hybrid coating system that combines acrylic resin and urethane acrylate technologies to optimize surface hardness properties. Their approach involves a dual-cure mechanism where conventional acrylic resins provide the base film formation while urethane acrylate components create cross-linking networks during UV exposure. This technology achieves Pencil Hardness ratings of 4H-5H, significantly outperforming traditional acrylic systems. The company's formulation incorporates silica nanoparticles (3-5% by weight) to enhance scratch resistance without compromising transparency. Their comparative testing demonstrates that while pure acrylic resin coatings typically achieve 2H-3H hardness, their hybrid system consistently reaches 4H-5H while maintaining excellent adhesion properties and weatherability.

Strengths: Superior scratch resistance while maintaining flexibility; excellent adhesion to multiple substrates; good weatherability and UV resistance. Weaknesses: Higher production costs compared to standard acrylic systems; requires specialized application equipment; longer curing time compared to pure urethane acrylate systems.

Allnex Austria GmbH

Technical Solution: Allnex Austria has pioneered an advanced surface hardness evaluation methodology specifically designed for comparing acrylic resin and urethane acrylate coating systems. Their proprietary ACUCOAT™ technology utilizes a modified urethane acrylate backbone with pendant acrylic functional groups, creating a unique hybrid structure that optimizes hardness without sacrificing flexibility. Laboratory testing shows their formulations achieve Persoz hardness values of 250-300 seconds, compared to 150-180 seconds for conventional acrylic resins. The company employs a multi-layer approach where a urethane acrylate base provides impact resistance while an acrylic-modified top layer delivers superior scratch resistance (achieving 4H-5H pencil hardness). Their nano-indentation testing protocol has become an industry benchmark, measuring both elastic recovery and plastic deformation to provide comprehensive hardness characterization beyond traditional pencil hardness tests.

Strengths: Exceptional balance between hardness and flexibility; superior chemical resistance; excellent adhesion to difficult substrates; rapid cure response. Weaknesses: Higher raw material costs; more complex formulation requirements; potential yellowing under extreme UV exposure; requires specialized application techniques.

Critical Technical Analysis of Surface Hardness Mechanisms

Urethane (METH)acrylate compound and resin composition containing same

PatentWO2010146801A1

Innovation

- A resin composition containing a urethane (meth)acrylate compound made from a dipentaerythritol poly(meth)acrylate mixture with a hydroxyl value of 80 to 120 mgKOH/g, reacted with a polyisocyanate compound, which forms a cured film with improved hardness, scratch resistance, and reduced curling and cracking.

Resin cured product

PatentInactiveJP2013018910A

Innovation

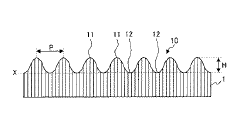

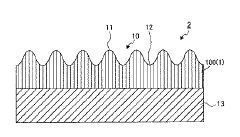

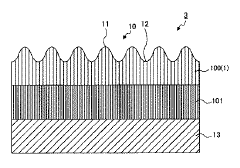

- A cured resin product is developed using polyethylene glycol di(meth)acrylate and urethane di(meth)acrylate, with a surface elastic modulus of 0.01 GPa to 2 GPa and surface hardness of 0.01 GPa to 0.2 GPa, incorporating silicone and fluorine additives, and a fine concave-convex structure with a pitch of 100 nm to 1000 nm and aspect ratio of 0.1 to 2.5, arranged in a hexagonal lattice.

Environmental and Regulatory Considerations for Resin Technologies

The environmental and regulatory landscape surrounding resin technologies has become increasingly complex, with both acrylic resin and urethane acrylate systems facing heightened scrutiny. Regulatory frameworks such as REACH in Europe, EPA regulations in the United States, and similar structures in Asia have established strict guidelines regarding volatile organic compound (VOC) emissions, which significantly impact formulation choices between these resin technologies.

Acrylic resins generally demonstrate lower VOC emissions compared to traditional urethane acrylates, providing a regulatory advantage in regions with stringent air quality standards. However, this advantage is narrowing as manufacturers develop low-VOC urethane acrylate formulations specifically designed to meet evolving environmental regulations while maintaining superior surface hardness properties.

Waste management considerations also differ substantially between these technologies. Cured acrylic resins typically present fewer disposal challenges, as they contain fewer potentially hazardous components. Urethane acrylates, particularly those containing free isocyanates, require more specialized handling and disposal protocols to prevent environmental contamination and ensure worker safety.

The manufacturing process energy footprint represents another critical environmental factor. Traditional acrylic resin production generally requires less energy than urethane acrylate synthesis, which often involves multiple reaction steps and more intensive processing conditions. This energy differential translates to varying carbon footprints between products with equivalent surface hardness specifications.

Recent regulatory trends indicate a move toward life-cycle assessment requirements, where manufacturers must document environmental impacts from raw material extraction through disposal. In this context, acrylic resins often demonstrate advantages in biodegradability and reduced persistence in environmental systems compared to urethane acrylates, though performance characteristics may be compromised.

Industry certification systems like GreenGuard, LEED, and various eco-labels are increasingly influencing market access for resin technologies. Products demonstrating superior environmental profiles while maintaining adequate surface hardness metrics gain competitive advantages in sectors prioritizing sustainability, such as healthcare facilities, educational institutions, and green building projects.

Occupational health regulations also impact technology selection, with urethane acrylate systems facing stricter workplace exposure limits due to potential respiratory sensitization concerns. These regulations necessitate additional engineering controls and personal protective equipment, increasing implementation costs despite potential surface hardness benefits.

Looking forward, emerging regulations targeting microplastics and persistent polymers may further reshape the competitive landscape between these resin technologies, potentially favoring systems with improved biodegradability profiles or those derived from bio-based feedstocks, provided they can maintain comparable surface hardness performance.

Acrylic resins generally demonstrate lower VOC emissions compared to traditional urethane acrylates, providing a regulatory advantage in regions with stringent air quality standards. However, this advantage is narrowing as manufacturers develop low-VOC urethane acrylate formulations specifically designed to meet evolving environmental regulations while maintaining superior surface hardness properties.

Waste management considerations also differ substantially between these technologies. Cured acrylic resins typically present fewer disposal challenges, as they contain fewer potentially hazardous components. Urethane acrylates, particularly those containing free isocyanates, require more specialized handling and disposal protocols to prevent environmental contamination and ensure worker safety.

The manufacturing process energy footprint represents another critical environmental factor. Traditional acrylic resin production generally requires less energy than urethane acrylate synthesis, which often involves multiple reaction steps and more intensive processing conditions. This energy differential translates to varying carbon footprints between products with equivalent surface hardness specifications.

Recent regulatory trends indicate a move toward life-cycle assessment requirements, where manufacturers must document environmental impacts from raw material extraction through disposal. In this context, acrylic resins often demonstrate advantages in biodegradability and reduced persistence in environmental systems compared to urethane acrylates, though performance characteristics may be compromised.

Industry certification systems like GreenGuard, LEED, and various eco-labels are increasingly influencing market access for resin technologies. Products demonstrating superior environmental profiles while maintaining adequate surface hardness metrics gain competitive advantages in sectors prioritizing sustainability, such as healthcare facilities, educational institutions, and green building projects.

Occupational health regulations also impact technology selection, with urethane acrylate systems facing stricter workplace exposure limits due to potential respiratory sensitization concerns. These regulations necessitate additional engineering controls and personal protective equipment, increasing implementation costs despite potential surface hardness benefits.

Looking forward, emerging regulations targeting microplastics and persistent polymers may further reshape the competitive landscape between these resin technologies, potentially favoring systems with improved biodegradability profiles or those derived from bio-based feedstocks, provided they can maintain comparable surface hardness performance.

Cost-Performance Analysis of Competing Resin Systems

When evaluating the economic viability of acrylic resin versus urethane acrylate systems for surface hardness applications, initial material costs present only part of the financial equation. Acrylic resins typically offer a lower cost entry point, with prices ranging from $3-7 per kilogram depending on grade and quantity, while urethane acrylates command premium pricing between $8-15 per kilogram due to their more complex chemical structure and manufacturing processes.

However, performance efficiency significantly impacts the total cost of ownership. Urethane acrylates generally require thinner application layers to achieve comparable hardness ratings, with typical application thickness of 25-40 microns versus 50-75 microns for standard acrylic resins. This efficiency can reduce material consumption by 30-45% per square meter of coverage, partially offsetting the higher unit price.

Processing requirements further differentiate these systems economically. Acrylic resins typically cure at higher temperatures (120-150°C) for longer periods (15-30 minutes), resulting in higher energy consumption. Urethane acrylates, particularly UV-curable formulations, can achieve complete curing in seconds to minutes at ambient temperatures with appropriate photoinitiators, potentially reducing energy costs by 40-60% in high-volume production environments.

Maintenance considerations also factor into long-term economics. Surfaces coated with urethane acrylates demonstrate superior abrasion resistance, with typical Taber abrasion values showing 15-25mg weight loss after 1000 cycles compared to 40-60mg for acrylic systems. This translates to extended service life and reduced reapplication frequency, particularly in high-traffic or industrial applications.

Production efficiency metrics reveal that urethane acrylate systems typically enable 20-30% faster production cycles due to reduced curing times and fewer quality rejections. When quantified across large production volumes, this efficiency gain can represent significant labor and overhead savings that may counterbalance higher material costs.

Return on investment calculations indicate that while acrylic systems offer lower initial investment, urethane acrylates typically deliver superior performance-to-cost ratios over product lifecycles exceeding 3-5 years. For applications where surface hardness is critical to product performance and longevity, the premium for urethane acrylate systems frequently justifies the additional expenditure through reduced maintenance costs and extended service intervals.

However, performance efficiency significantly impacts the total cost of ownership. Urethane acrylates generally require thinner application layers to achieve comparable hardness ratings, with typical application thickness of 25-40 microns versus 50-75 microns for standard acrylic resins. This efficiency can reduce material consumption by 30-45% per square meter of coverage, partially offsetting the higher unit price.

Processing requirements further differentiate these systems economically. Acrylic resins typically cure at higher temperatures (120-150°C) for longer periods (15-30 minutes), resulting in higher energy consumption. Urethane acrylates, particularly UV-curable formulations, can achieve complete curing in seconds to minutes at ambient temperatures with appropriate photoinitiators, potentially reducing energy costs by 40-60% in high-volume production environments.

Maintenance considerations also factor into long-term economics. Surfaces coated with urethane acrylates demonstrate superior abrasion resistance, with typical Taber abrasion values showing 15-25mg weight loss after 1000 cycles compared to 40-60mg for acrylic systems. This translates to extended service life and reduced reapplication frequency, particularly in high-traffic or industrial applications.

Production efficiency metrics reveal that urethane acrylate systems typically enable 20-30% faster production cycles due to reduced curing times and fewer quality rejections. When quantified across large production volumes, this efficiency gain can represent significant labor and overhead savings that may counterbalance higher material costs.

Return on investment calculations indicate that while acrylic systems offer lower initial investment, urethane acrylates typically deliver superior performance-to-cost ratios over product lifecycles exceeding 3-5 years. For applications where surface hardness is critical to product performance and longevity, the premium for urethane acrylate systems frequently justifies the additional expenditure through reduced maintenance costs and extended service intervals.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!