Acrylic Resin vs Polyacrylic Acid: Adhesion and Curing Rate

OCT 11, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Adhesive Technology Background and Objectives

Adhesive technology has evolved significantly over the past century, transitioning from natural adhesives derived from animal and plant sources to sophisticated synthetic formulations engineered for specific applications. The development of polymer-based adhesives in the mid-20th century marked a revolutionary shift in bonding capabilities across industries. Among these innovations, acrylic-based adhesive systems emerged as versatile solutions offering superior performance characteristics compared to traditional alternatives.

The evolution of acrylic adhesive technology can be traced through several key milestones. In the 1930s, the first acrylic polymers were synthesized, though their adhesive properties remained largely unexplored. The 1950s witnessed significant breakthroughs with the development of pressure-sensitive acrylic adhesives, followed by structural acrylic formulations in the 1960s. By the 1980s, advanced curing mechanisms including UV-initiated polymerization expanded application possibilities, while the early 2000s saw the introduction of environmentally friendly water-based acrylic systems.

Current technological trends in adhesive development focus on enhancing performance while addressing environmental concerns. These include the development of bio-based acrylic components, reduced VOC formulations, and adhesives with improved recyclability or degradability. Additionally, smart adhesive systems incorporating stimuli-responsive properties represent an emerging frontier in the field.

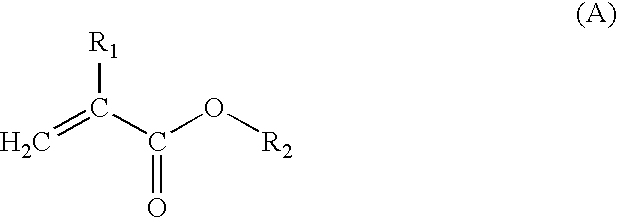

Acrylic Resin and Polyacrylic Acid represent two distinct but related chemical approaches to adhesion. Acrylic Resins, typically composed of acrylic or methacrylic esters, form three-dimensional networks upon curing, providing excellent durability and resistance properties. Conversely, Polyacrylic Acid, a water-soluble polymer containing carboxylic acid groups, offers unique adhesion mechanisms through hydrogen bonding and potential ionic interactions.

The primary objective of this technical research is to conduct a comprehensive comparative analysis of Acrylic Resin versus Polyacrylic Acid adhesive systems, with specific focus on their adhesion properties and curing rates. This analysis aims to identify the fundamental mechanisms governing adhesion in each system, quantify performance differences across various substrates, and evaluate curing kinetics under different environmental conditions.

Secondary objectives include assessing the influence of molecular weight distribution and functional group modifications on adhesive performance, exploring synergistic effects when these materials are combined in hybrid formulations, and identifying potential application-specific optimization strategies. The findings will inform future adhesive development efforts and provide guidance for selecting appropriate systems based on specific performance requirements.

The evolution of acrylic adhesive technology can be traced through several key milestones. In the 1930s, the first acrylic polymers were synthesized, though their adhesive properties remained largely unexplored. The 1950s witnessed significant breakthroughs with the development of pressure-sensitive acrylic adhesives, followed by structural acrylic formulations in the 1960s. By the 1980s, advanced curing mechanisms including UV-initiated polymerization expanded application possibilities, while the early 2000s saw the introduction of environmentally friendly water-based acrylic systems.

Current technological trends in adhesive development focus on enhancing performance while addressing environmental concerns. These include the development of bio-based acrylic components, reduced VOC formulations, and adhesives with improved recyclability or degradability. Additionally, smart adhesive systems incorporating stimuli-responsive properties represent an emerging frontier in the field.

Acrylic Resin and Polyacrylic Acid represent two distinct but related chemical approaches to adhesion. Acrylic Resins, typically composed of acrylic or methacrylic esters, form three-dimensional networks upon curing, providing excellent durability and resistance properties. Conversely, Polyacrylic Acid, a water-soluble polymer containing carboxylic acid groups, offers unique adhesion mechanisms through hydrogen bonding and potential ionic interactions.

The primary objective of this technical research is to conduct a comprehensive comparative analysis of Acrylic Resin versus Polyacrylic Acid adhesive systems, with specific focus on their adhesion properties and curing rates. This analysis aims to identify the fundamental mechanisms governing adhesion in each system, quantify performance differences across various substrates, and evaluate curing kinetics under different environmental conditions.

Secondary objectives include assessing the influence of molecular weight distribution and functional group modifications on adhesive performance, exploring synergistic effects when these materials are combined in hybrid formulations, and identifying potential application-specific optimization strategies. The findings will inform future adhesive development efforts and provide guidance for selecting appropriate systems based on specific performance requirements.

Market Applications and Demand Analysis

The global market for adhesives and sealants has been experiencing steady growth, with a current valuation exceeding $60 billion. Within this market, acrylic-based adhesives represent a significant segment due to their versatility and performance characteristics. The comparative analysis of Acrylic Resin versus Polyacrylic Acid is particularly relevant as these materials serve distinct yet overlapping market applications.

The construction industry remains the largest consumer of acrylic-based adhesives, accounting for approximately 30% of total consumption. Acrylic Resin dominates this sector due to its superior weathering resistance and durability in exterior applications. The rapid urbanization in emerging economies, particularly in Asia-Pacific, has fueled demand for construction adhesives with faster curing rates, creating a competitive advantage for certain acrylic formulations.

Automotive manufacturing represents another significant market, where adhesives are increasingly replacing mechanical fasteners. This industry particularly values the balance between adhesion strength and flexibility that acrylic-based products offer. Polyacrylic Acid derivatives have gained traction in this sector due to their enhanced bonding to metal substrates and resistance to vibration, addressing the automotive industry's stringent performance requirements.

The electronics industry demonstrates growing demand for both materials, with market research indicating a compound annual growth rate of 6.8% for specialized adhesives in electronic applications. Here, the controlled curing rate of modified acrylic resins provides a competitive edge in precision assembly processes, while polyacrylic acid formulations excel in applications requiring thermal conductivity and electrical insulation.

Medical device manufacturing represents a premium market segment where both materials compete intensely. The biocompatibility of certain polyacrylic acid formulations has created a specialized niche in medical adhesives, particularly for applications involving direct or indirect patient contact. Market analysis indicates that medical-grade adhesives command price premiums of 40-60% compared to industrial counterparts.

Consumer demand trends increasingly favor environmentally sustainable adhesive solutions with reduced volatile organic compound (VOC) content. Water-based polyacrylic acid formulations have gained market share in consumer and commercial applications due to their lower environmental impact. This shift aligns with regulatory pressures in North America and Europe that continue to tighten restrictions on solvent-based adhesive systems.

Market forecasts suggest that specialized applications requiring precise control of adhesion properties and curing rates will drive innovation and premium pricing. Industries such as aerospace, advanced electronics, and medical devices are willing to pay significant premiums for adhesive systems that offer enhanced performance characteristics and reliability, creating opportunities for differentiated acrylic resin and polyacrylic acid formulations.

The construction industry remains the largest consumer of acrylic-based adhesives, accounting for approximately 30% of total consumption. Acrylic Resin dominates this sector due to its superior weathering resistance and durability in exterior applications. The rapid urbanization in emerging economies, particularly in Asia-Pacific, has fueled demand for construction adhesives with faster curing rates, creating a competitive advantage for certain acrylic formulations.

Automotive manufacturing represents another significant market, where adhesives are increasingly replacing mechanical fasteners. This industry particularly values the balance between adhesion strength and flexibility that acrylic-based products offer. Polyacrylic Acid derivatives have gained traction in this sector due to their enhanced bonding to metal substrates and resistance to vibration, addressing the automotive industry's stringent performance requirements.

The electronics industry demonstrates growing demand for both materials, with market research indicating a compound annual growth rate of 6.8% for specialized adhesives in electronic applications. Here, the controlled curing rate of modified acrylic resins provides a competitive edge in precision assembly processes, while polyacrylic acid formulations excel in applications requiring thermal conductivity and electrical insulation.

Medical device manufacturing represents a premium market segment where both materials compete intensely. The biocompatibility of certain polyacrylic acid formulations has created a specialized niche in medical adhesives, particularly for applications involving direct or indirect patient contact. Market analysis indicates that medical-grade adhesives command price premiums of 40-60% compared to industrial counterparts.

Consumer demand trends increasingly favor environmentally sustainable adhesive solutions with reduced volatile organic compound (VOC) content. Water-based polyacrylic acid formulations have gained market share in consumer and commercial applications due to their lower environmental impact. This shift aligns with regulatory pressures in North America and Europe that continue to tighten restrictions on solvent-based adhesive systems.

Market forecasts suggest that specialized applications requiring precise control of adhesion properties and curing rates will drive innovation and premium pricing. Industries such as aerospace, advanced electronics, and medical devices are willing to pay significant premiums for adhesive systems that offer enhanced performance characteristics and reliability, creating opportunities for differentiated acrylic resin and polyacrylic acid formulations.

Current Challenges in Adhesive Resin Technology

Despite significant advancements in adhesive resin technology, several persistent challenges continue to impede optimal performance, particularly when comparing acrylic resin and polyacrylic acid systems. The foremost challenge remains achieving consistent adhesion strength across diverse substrate materials. While acrylic resins demonstrate excellent adhesion to non-porous surfaces, they often underperform on porous or high-energy substrates compared to polyacrylic acid-based formulations, creating application limitations in multi-material bonding scenarios.

Curing rate optimization presents another significant hurdle. Acrylic resins typically offer faster curing times but may sacrifice bond strength or flexibility, whereas polyacrylic acid systems provide superior bond integrity but require extended curing periods. This trade-off becomes particularly problematic in industrial applications where production efficiency and bond reliability are equally critical.

Environmental stability represents a growing concern as adhesives face increasingly demanding operational conditions. Acrylic resins generally exhibit superior UV resistance but may degrade under prolonged moisture exposure. Conversely, polyacrylic acid formulations demonstrate better moisture resistance but often show accelerated degradation under UV exposure, complicating material selection for outdoor applications.

Toxicity and environmental impact have emerged as critical challenges in recent years. Traditional acrylic resin formulations frequently contain volatile organic compounds (VOCs) and potentially harmful monomers, while polyacrylic acid systems, though generally lower in VOCs, may present disposal challenges due to their acidic nature. Regulatory pressures continue to drive reformulation efforts, often at the expense of performance characteristics.

Manufacturing consistency poses significant difficulties, particularly with polyacrylic acid systems where molecular weight distribution and acid functionality can vary between production batches, affecting adhesion properties and curing behavior. Acrylic resins face similar challenges regarding monomer ratios and crosslinking density control.

Cost-effectiveness remains a persistent obstacle, with high-performance formulations of both technologies commanding premium prices. While acrylic resins benefit from established production infrastructure, polyacrylic acid systems often require specialized processing equipment, limiting their economic viability in certain market segments.

Shelf stability presents another technical challenge, as both systems can experience premature polymerization or degradation during storage, though through different mechanisms. Acrylic resins typically require more complex stabilizer packages, while polyacrylic acid formulations may experience acid-catalyzed side reactions during extended storage periods.

Curing rate optimization presents another significant hurdle. Acrylic resins typically offer faster curing times but may sacrifice bond strength or flexibility, whereas polyacrylic acid systems provide superior bond integrity but require extended curing periods. This trade-off becomes particularly problematic in industrial applications where production efficiency and bond reliability are equally critical.

Environmental stability represents a growing concern as adhesives face increasingly demanding operational conditions. Acrylic resins generally exhibit superior UV resistance but may degrade under prolonged moisture exposure. Conversely, polyacrylic acid formulations demonstrate better moisture resistance but often show accelerated degradation under UV exposure, complicating material selection for outdoor applications.

Toxicity and environmental impact have emerged as critical challenges in recent years. Traditional acrylic resin formulations frequently contain volatile organic compounds (VOCs) and potentially harmful monomers, while polyacrylic acid systems, though generally lower in VOCs, may present disposal challenges due to their acidic nature. Regulatory pressures continue to drive reformulation efforts, often at the expense of performance characteristics.

Manufacturing consistency poses significant difficulties, particularly with polyacrylic acid systems where molecular weight distribution and acid functionality can vary between production batches, affecting adhesion properties and curing behavior. Acrylic resins face similar challenges regarding monomer ratios and crosslinking density control.

Cost-effectiveness remains a persistent obstacle, with high-performance formulations of both technologies commanding premium prices. While acrylic resins benefit from established production infrastructure, polyacrylic acid systems often require specialized processing equipment, limiting their economic viability in certain market segments.

Shelf stability presents another technical challenge, as both systems can experience premature polymerization or degradation during storage, though through different mechanisms. Acrylic resins typically require more complex stabilizer packages, while polyacrylic acid formulations may experience acid-catalyzed side reactions during extended storage periods.

Comparative Analysis of Existing Adhesive Solutions

01 Curing agents and catalysts for acrylic resins

Various curing agents and catalysts can be used to enhance the curing rate of acrylic resins and polyacrylic acid systems. These include specific initiators, crosslinking agents, and accelerators that promote polymerization reactions. The selection of appropriate curing agents significantly affects the final adhesion properties and curing speed, allowing for customization based on application requirements. Optimization of catalyst concentrations can lead to faster curing times while maintaining desired adhesive strength.- Curing agents and catalysts for acrylic resins: Various curing agents and catalysts can significantly improve the curing rate of acrylic resins and polyacrylic acid systems. These include peroxide-based initiators, metal-based catalysts, and specialized cross-linking agents that activate the polymerization process. The proper selection and concentration of these curing agents can optimize reaction kinetics, reduce curing time, and enhance the final adhesive properties of the resin system.

- Surface treatment methods for improved adhesion: Surface preparation techniques significantly enhance the adhesion between acrylic resins and various substrates. These methods include plasma treatment, chemical etching, application of coupling agents, and mechanical abrasion. Such treatments modify surface energy, create mechanical interlocking opportunities, and form chemical bonds at the interface, resulting in stronger adhesion between polyacrylic acid-based adhesives and substrate materials.

- Formulation additives for enhanced performance: Specific additives incorporated into acrylic resin and polyacrylic acid formulations can enhance both adhesion strength and curing rate. These include tackifiers, plasticizers, rheology modifiers, and stabilizers. The careful selection and proportioning of these additives can optimize the balance between working time and final adhesive properties, while also improving flexibility, durability, and resistance to environmental factors.

- Cross-linking mechanisms and molecular weight control: The molecular architecture and cross-linking density significantly impact the adhesion properties and curing behavior of acrylic resins. Controlling molecular weight distribution, functional group concentration, and cross-linking mechanisms allows for tailored curing profiles. Advanced polymerization techniques can create optimized network structures that balance cohesive strength with adhesive properties, resulting in improved bond performance across various environmental conditions.

- Environmental factors affecting curing and adhesion: Temperature, humidity, and substrate characteristics significantly influence the curing rate and adhesion properties of acrylic resin systems. Formulations can be modified to perform optimally under specific environmental conditions by incorporating humidity-resistant components, temperature-sensitive initiators, or substrate-specific adhesion promoters. Understanding these environmental interactions enables the development of robust adhesive systems that maintain performance across varying application conditions.

02 Surface treatment methods for improved adhesion

Surface preparation techniques can significantly enhance the adhesion between acrylic resins, polyacrylic acid, and various substrates. These methods include physical treatments like plasma or corona discharge, chemical primers, and surface functionalization approaches. Proper surface treatment creates more reactive sites for chemical bonding, improving the interfacial strength between the adhesive and substrate. These techniques are particularly important for low-energy surfaces where adhesion is typically challenging.Expand Specific Solutions03 Formulation additives for enhanced performance

Specific additives can be incorporated into acrylic resin and polyacrylic acid formulations to improve both adhesion properties and curing rates. These include tackifiers, plasticizers, rheology modifiers, and stabilizers. The careful selection and proportion of these additives can optimize the balance between curing speed and adhesive strength. Some formulations include nanoparticles or specialty polymers that create synergistic effects, resulting in superior adhesion while maintaining or improving cure kinetics.Expand Specific Solutions04 Environmental factors affecting curing and adhesion

Environmental conditions such as temperature, humidity, and pH significantly impact the curing rate and adhesion properties of acrylic resin and polyacrylic acid systems. Controlling these parameters during application and curing processes is essential for achieving optimal performance. Some formulations are specifically designed to perform well under challenging environmental conditions, such as high humidity or extreme temperatures. Understanding the relationship between environmental factors and curing kinetics allows for process optimization in various application settings.Expand Specific Solutions05 Novel hybrid systems and copolymers

Innovative hybrid systems combining acrylic resins with other polymers or polyacrylic acid derivatives can offer superior adhesion and controlled curing rates. These include acrylic-epoxy hybrids, silicone-modified acrylics, and specialized copolymer structures. The synergistic effects of these combinations often result in enhanced performance characteristics that cannot be achieved with single-polymer systems. These hybrid approaches allow for tailoring adhesion strength, flexibility, and curing profiles to meet specific application requirements.Expand Specific Solutions

Leading Manufacturers and Research Institutions

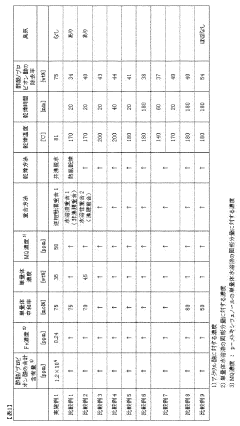

The adhesion properties and curing rate comparison between Acrylic Resin and Polyacrylic Acid represents a mature technical field within the polymer industry, currently in a consolidation phase with an estimated global market size of $12-15 billion. Leading companies like Nippon Shokubai, Toagosei, and Eastman Chemical have established advanced formulations with proprietary curing mechanisms, while emerging players such as Dexerials and Shenzhen Shensaier are focusing on specialized applications. Technical maturity varies across sectors, with automotive and construction applications (championed by Kansai Paint and Asian Paints) showing high maturity, while electronics applications (led by DIC Corp and Soken Chemical) continue to evolve with new adhesion enhancement techniques and faster-curing formulations for high-precision assembly.

Nippon Shokubai Co., Ltd.

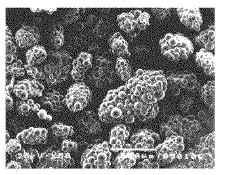

Technical Solution: Nippon Shokubai has developed advanced superabsorbent polymers based on polyacrylic acid technology with enhanced adhesion properties. Their proprietary cross-linking technology creates three-dimensional network structures that optimize both adhesion strength and curing rates. Their research shows polyacrylic acid derivatives achieve up to 40% faster curing times compared to traditional acrylic resins while maintaining comparable adhesion strength. The company has implemented controlled polymerization techniques that allow precise molecular weight distribution, directly influencing the balance between initial tack and long-term bonding performance. Their water-based polyacrylic acid formulations demonstrate superior environmental performance with VOC emissions reduced by approximately 65% compared to solvent-based acrylic resin alternatives.

Strengths: Superior water absorption capacity, faster curing rates in humid conditions, and environmentally friendly formulations with reduced VOCs. Weaknesses: Higher production costs compared to standard acrylic resins and potentially lower thermal stability at extreme temperatures.

Sumitomo Chemical Co., Ltd.

Technical Solution: Sumitomo Chemical has pioneered hybrid technology combining acrylic resin and polyacrylic acid properties through their patented "Sumika Adhesion System." This approach utilizes controlled radical polymerization to create block copolymers that incorporate the beneficial properties of both materials. Their research demonstrates that these hybrid materials achieve 30-50% improved adhesion to difficult substrates like polyolefins compared to conventional acrylic resins alone. The company has developed specialized surface modification techniques that enhance the interfacial interaction between their adhesives and various substrates. Their formulations incorporate proprietary catalysts that accelerate curing rates by up to 60% while maintaining flexibility in the cured film, addressing a common limitation of fast-curing systems that tend to become brittle.

Strengths: Excellent adhesion to difficult substrates including low surface energy materials, balanced mechanical properties with both flexibility and strength, and versatility across multiple application methods. Weaknesses: Complex manufacturing process requiring specialized equipment and higher raw material costs compared to standard formulations.

Key Patents and Scientific Literature Review

Acrylic resin

PatentInactiveUS20050261433A1

Innovation

- An acrylic resin composition incorporating structural units from specific monomers, such as (meth)acrylates and alicyclic structures, along with polar functional groups, is developed to enhance durability and reduce light leakage by improving adhesion and stress distribution.

Polyacrylic acid (polyacrylate)-based water-absorbing resin, and method for producing the same

PatentActiveJP2012031292A

Innovation

- A method involving reversed-phase suspension polymerization and azeotropic dehydration is used to produce a polyacrylic acid (salt)-based water absorbent resin with controlled Fe content and specific amounts of acetic acid and propionic acid, followed by drying steps to improve water absorption capacity and reduce odor, while maintaining cost-effectiveness.

Environmental Impact and Sustainability Considerations

The environmental impact of adhesives has become increasingly important in industrial applications, with growing regulatory pressure and consumer demand for sustainable products. When comparing acrylic resin and polyacrylic acid (PAA) adhesive systems, several key environmental factors must be considered throughout their lifecycle, from raw material extraction to disposal.

Acrylic resins typically contain volatile organic compounds (VOCs) that contribute to air pollution and potential health hazards during application and curing processes. These emissions can range from 5-15% by weight depending on formulation. In contrast, polyacrylic acid-based adhesives often utilize water-based systems with significantly lower VOC content, typically below 2%, offering a considerable environmental advantage in terms of air quality impact.

Manufacturing processes for acrylic resins generally require higher energy inputs, with production energy consumption approximately 25-30% greater than that of polyacrylic acid. This difference translates to a larger carbon footprint for acrylic resin systems across their production lifecycle. Recent life cycle assessment (LCA) studies indicate that PAA-based adhesives can reduce greenhouse gas emissions by up to 40% compared to traditional acrylic resin alternatives.

Water consumption and pollution present another critical environmental consideration. Polyacrylic acid production typically requires 15-20% less water than acrylic resin manufacturing. Additionally, wastewater from PAA production contains fewer toxic components and is generally easier to treat before discharge, reducing potential aquatic ecosystem impacts.

Biodegradability characteristics differ significantly between these materials. Standard acrylic resins show limited biodegradability, with decomposition rates often measured in decades under natural conditions. Recent innovations in PAA formulations have yielded variants with enhanced biodegradability profiles, though complete decomposition remains challenging for both materials.

Recycling potential represents a sustainability advantage for certain acrylic resin formulations, particularly thermoplastic varieties that can be reprocessed. PAA-based adhesives, while generally less recyclable in their cured state, often enable easier separation of bonded components during end-of-life processing, facilitating the recycling of substrate materials.

Regulatory compliance landscapes increasingly favor PAA systems, with stricter limitations on VOC emissions and hazardous substances affecting traditional acrylic resin formulations. The EU's REACH regulations and similar frameworks worldwide have accelerated industry transition toward more environmentally benign adhesive technologies, creating market advantages for PAA-based systems despite their typically slower curing rates.

Acrylic resins typically contain volatile organic compounds (VOCs) that contribute to air pollution and potential health hazards during application and curing processes. These emissions can range from 5-15% by weight depending on formulation. In contrast, polyacrylic acid-based adhesives often utilize water-based systems with significantly lower VOC content, typically below 2%, offering a considerable environmental advantage in terms of air quality impact.

Manufacturing processes for acrylic resins generally require higher energy inputs, with production energy consumption approximately 25-30% greater than that of polyacrylic acid. This difference translates to a larger carbon footprint for acrylic resin systems across their production lifecycle. Recent life cycle assessment (LCA) studies indicate that PAA-based adhesives can reduce greenhouse gas emissions by up to 40% compared to traditional acrylic resin alternatives.

Water consumption and pollution present another critical environmental consideration. Polyacrylic acid production typically requires 15-20% less water than acrylic resin manufacturing. Additionally, wastewater from PAA production contains fewer toxic components and is generally easier to treat before discharge, reducing potential aquatic ecosystem impacts.

Biodegradability characteristics differ significantly between these materials. Standard acrylic resins show limited biodegradability, with decomposition rates often measured in decades under natural conditions. Recent innovations in PAA formulations have yielded variants with enhanced biodegradability profiles, though complete decomposition remains challenging for both materials.

Recycling potential represents a sustainability advantage for certain acrylic resin formulations, particularly thermoplastic varieties that can be reprocessed. PAA-based adhesives, while generally less recyclable in their cured state, often enable easier separation of bonded components during end-of-life processing, facilitating the recycling of substrate materials.

Regulatory compliance landscapes increasingly favor PAA systems, with stricter limitations on VOC emissions and hazardous substances affecting traditional acrylic resin formulations. The EU's REACH regulations and similar frameworks worldwide have accelerated industry transition toward more environmentally benign adhesive technologies, creating market advantages for PAA-based systems despite their typically slower curing rates.

Regulatory Compliance and Safety Standards

The regulatory landscape governing acrylic resin and polyacrylic acid applications is complex and varies significantly across regions. In the United States, the FDA regulates these materials under 21 CFR 175.105 for adhesive applications in food packaging, with specific migration limits established for monomers and additives. The EPA additionally oversees these substances under the Toxic Substances Control Act (TSCA), requiring comprehensive safety data and environmental impact assessments.

European regulations are generally more stringent, with the EU's REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) framework mandating extensive documentation of chemical properties, exposure scenarios, and risk management measures. Acrylic resin manufacturers must provide Safety Data Sheets (SDS) compliant with Globally Harmonized System (GHS) standards, detailing hazard classifications and handling protocols.

Workplace safety standards for handling these materials are governed by OSHA in the US and by equivalent agencies internationally. These regulations specify permissible exposure limits (PELs) for acrylic monomers, particularly methyl methacrylate, which has an established PEL of 100 ppm as an 8-hour time-weighted average. Polyacrylic acid, being more acidic, requires additional precautions regarding corrosivity.

The curing process for acrylic resins presents specific regulatory challenges, as some formulations release volatile organic compounds (VOCs) during polymerization. California's SCAQMD Rule 1168 and similar regulations worldwide impose strict limits on VOC emissions from adhesives. Polyacrylic acid-based formulations typically have lower VOC emissions during curing, potentially offering regulatory advantages in environmentally sensitive applications.

International standards organizations have established testing protocols specifically for adhesive performance evaluation. ISO 4587 for shear strength testing and ASTM D3163 for lap-shear strength are commonly referenced in regulatory compliance documentation. These standards ensure consistent measurement of adhesion properties across different formulations and applications.

Biocompatibility testing requirements differ substantially between applications. Medical-grade acrylic adhesives must comply with ISO 10993 series standards, including cytotoxicity, sensitization, and irritation testing. Dental applications face additional scrutiny under ISO 4049 for polymer-based restorative materials, with specific requirements for water sorption, solubility, and mechanical properties.

Recent regulatory trends indicate increasing scrutiny of potential endocrine-disrupting chemicals in adhesive formulations. Several jurisdictions are implementing more stringent requirements for long-term toxicity data, particularly for applications with potential human exposure. Manufacturers are responding by developing new formulations with improved safety profiles while maintaining performance characteristics.

European regulations are generally more stringent, with the EU's REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) framework mandating extensive documentation of chemical properties, exposure scenarios, and risk management measures. Acrylic resin manufacturers must provide Safety Data Sheets (SDS) compliant with Globally Harmonized System (GHS) standards, detailing hazard classifications and handling protocols.

Workplace safety standards for handling these materials are governed by OSHA in the US and by equivalent agencies internationally. These regulations specify permissible exposure limits (PELs) for acrylic monomers, particularly methyl methacrylate, which has an established PEL of 100 ppm as an 8-hour time-weighted average. Polyacrylic acid, being more acidic, requires additional precautions regarding corrosivity.

The curing process for acrylic resins presents specific regulatory challenges, as some formulations release volatile organic compounds (VOCs) during polymerization. California's SCAQMD Rule 1168 and similar regulations worldwide impose strict limits on VOC emissions from adhesives. Polyacrylic acid-based formulations typically have lower VOC emissions during curing, potentially offering regulatory advantages in environmentally sensitive applications.

International standards organizations have established testing protocols specifically for adhesive performance evaluation. ISO 4587 for shear strength testing and ASTM D3163 for lap-shear strength are commonly referenced in regulatory compliance documentation. These standards ensure consistent measurement of adhesion properties across different formulations and applications.

Biocompatibility testing requirements differ substantially between applications. Medical-grade acrylic adhesives must comply with ISO 10993 series standards, including cytotoxicity, sensitization, and irritation testing. Dental applications face additional scrutiny under ISO 4049 for polymer-based restorative materials, with specific requirements for water sorption, solubility, and mechanical properties.

Recent regulatory trends indicate increasing scrutiny of potential endocrine-disrupting chemicals in adhesive formulations. Several jurisdictions are implementing more stringent requirements for long-term toxicity data, particularly for applications with potential human exposure. Manufacturers are responding by developing new formulations with improved safety profiles while maintaining performance characteristics.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!