Alloying Strategies for Enhancing Sodium Metal Anode Performance

OCT 13, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Sodium Metal Anode Development Background and Objectives

Sodium-ion batteries (SIBs) have emerged as a promising alternative to lithium-ion batteries due to the abundance and low cost of sodium resources. The development of sodium metal anodes represents a critical frontier in advancing SIB technology, offering theoretical capacity of 1166 mAh/g and the lowest redox potential (-2.71 V vs. standard hydrogen electrode). This combination positions sodium metal as an ideal anode material for next-generation high-energy-density energy storage systems.

The historical trajectory of sodium metal anode research dates back to the 1970s, when initial investigations into alkali metal battery systems began. However, significant challenges, particularly the high reactivity of sodium with electrolytes and dendrite formation issues, hindered practical implementation. Research interest waned as lithium-ion technologies gained prominence in the 1990s and early 2000s.

A resurgence in sodium metal anode research occurred around 2012, driven by concerns about lithium resource limitations and cost escalation. This renewed focus has accelerated technological development, with particular emphasis on addressing the fundamental challenges of sodium metal anodes through innovative approaches, including alloying strategies.

The inherent properties of sodium metal present unique challenges compared to lithium. Sodium's lower melting point (97.7°C vs. 180.5°C for lithium), higher chemical reactivity, and larger ionic radius (1.02 Å vs. 0.76 Å for lithium) contribute to more severe dendrite formation and interfacial instability issues. These challenges have catalyzed exploration of alloying as a strategic approach to enhance sodium metal anode performance.

Alloying strategies aim to modify the physicochemical properties of sodium metal to mitigate its inherent limitations while preserving its high theoretical capacity. By forming alloys with selected elements, researchers seek to improve mechanical properties, reduce reactivity, and suppress dendrite formation, thereby enhancing cycling stability and safety.

The primary objectives of current sodium metal anode development through alloying include: achieving stable cycling performance with high Coulombic efficiency (>99.9%); minimizing volume expansion during sodium plating/stripping; developing dendrite-free sodium deposition morphologies; and creating stable solid-electrolyte interphases (SEI) that prevent continuous electrolyte decomposition.

Recent technological breakthroughs have demonstrated promising results with various alloying elements including tin, bismuth, indium, and antimony. These developments suggest that alloying strategies represent a viable pathway toward practical sodium metal batteries with enhanced safety and performance characteristics, potentially enabling commercial applications in grid-scale energy storage, electric vehicles, and portable electronics.

The historical trajectory of sodium metal anode research dates back to the 1970s, when initial investigations into alkali metal battery systems began. However, significant challenges, particularly the high reactivity of sodium with electrolytes and dendrite formation issues, hindered practical implementation. Research interest waned as lithium-ion technologies gained prominence in the 1990s and early 2000s.

A resurgence in sodium metal anode research occurred around 2012, driven by concerns about lithium resource limitations and cost escalation. This renewed focus has accelerated technological development, with particular emphasis on addressing the fundamental challenges of sodium metal anodes through innovative approaches, including alloying strategies.

The inherent properties of sodium metal present unique challenges compared to lithium. Sodium's lower melting point (97.7°C vs. 180.5°C for lithium), higher chemical reactivity, and larger ionic radius (1.02 Å vs. 0.76 Å for lithium) contribute to more severe dendrite formation and interfacial instability issues. These challenges have catalyzed exploration of alloying as a strategic approach to enhance sodium metal anode performance.

Alloying strategies aim to modify the physicochemical properties of sodium metal to mitigate its inherent limitations while preserving its high theoretical capacity. By forming alloys with selected elements, researchers seek to improve mechanical properties, reduce reactivity, and suppress dendrite formation, thereby enhancing cycling stability and safety.

The primary objectives of current sodium metal anode development through alloying include: achieving stable cycling performance with high Coulombic efficiency (>99.9%); minimizing volume expansion during sodium plating/stripping; developing dendrite-free sodium deposition morphologies; and creating stable solid-electrolyte interphases (SEI) that prevent continuous electrolyte decomposition.

Recent technological breakthroughs have demonstrated promising results with various alloying elements including tin, bismuth, indium, and antimony. These developments suggest that alloying strategies represent a viable pathway toward practical sodium metal batteries with enhanced safety and performance characteristics, potentially enabling commercial applications in grid-scale energy storage, electric vehicles, and portable electronics.

Market Analysis for Sodium-based Battery Technologies

The global market for sodium-based battery technologies has witnessed significant growth in recent years, driven by increasing demand for sustainable energy storage solutions. As of 2023, the sodium-ion battery market is valued at approximately $1.2 billion and is projected to grow at a CAGR of 18% through 2030, reaching an estimated market size of $4.5 billion.

The primary market drivers for sodium-based battery technologies include the rising costs and supply constraints of lithium, cobalt, and nickel used in conventional lithium-ion batteries. Sodium resources are abundant and widely distributed geographically, with estimated reserves over 23 billion tons globally, making them significantly more accessible than lithium resources.

Regionally, Asia-Pacific dominates the sodium battery market, accounting for nearly 65% of global production capacity. China leads manufacturing investments, with companies like CATL and BYD establishing dedicated sodium battery production lines. Europe follows with approximately 20% market share, driven by strong governmental support for sustainable energy technologies.

Market segmentation reveals diverse application potential. Grid-scale energy storage represents the largest segment at 45% of the market, where sodium batteries' lower cost outweighs their lower energy density compared to lithium alternatives. The electric vehicle segment, particularly for urban mobility and commercial vehicles, constitutes about 30% of the market, with the remaining 25% distributed across consumer electronics and specialized applications.

Alloying strategies for sodium metal anodes are attracting particular attention from investors, with venture capital funding in this specific technology reaching $380 million in 2023, a 40% increase from the previous year. The enhanced performance of alloyed sodium anodes directly addresses market demands for improved cycle life and safety in sodium-based energy storage systems.

Consumer demand patterns indicate growing acceptance of sodium-based technologies, particularly in price-sensitive markets and applications where energy density requirements are moderate. Survey data shows that 72% of grid storage operators consider sodium-based solutions for new installations, citing cost advantages of 30-40% over lithium alternatives.

Market barriers include technical challenges related to sodium's reactivity and dendrite formation, which alloying strategies aim to overcome. Additionally, the established infrastructure for lithium-ion production creates inertia against rapid adoption of sodium alternatives, despite their economic advantages.

The competitive landscape features both established battery manufacturers expanding into sodium technologies and specialized startups focused exclusively on sodium battery innovations. This dynamic ecosystem is driving rapid technological advancement, particularly in anode materials engineering where alloying approaches show promising commercial potential.

The primary market drivers for sodium-based battery technologies include the rising costs and supply constraints of lithium, cobalt, and nickel used in conventional lithium-ion batteries. Sodium resources are abundant and widely distributed geographically, with estimated reserves over 23 billion tons globally, making them significantly more accessible than lithium resources.

Regionally, Asia-Pacific dominates the sodium battery market, accounting for nearly 65% of global production capacity. China leads manufacturing investments, with companies like CATL and BYD establishing dedicated sodium battery production lines. Europe follows with approximately 20% market share, driven by strong governmental support for sustainable energy technologies.

Market segmentation reveals diverse application potential. Grid-scale energy storage represents the largest segment at 45% of the market, where sodium batteries' lower cost outweighs their lower energy density compared to lithium alternatives. The electric vehicle segment, particularly for urban mobility and commercial vehicles, constitutes about 30% of the market, with the remaining 25% distributed across consumer electronics and specialized applications.

Alloying strategies for sodium metal anodes are attracting particular attention from investors, with venture capital funding in this specific technology reaching $380 million in 2023, a 40% increase from the previous year. The enhanced performance of alloyed sodium anodes directly addresses market demands for improved cycle life and safety in sodium-based energy storage systems.

Consumer demand patterns indicate growing acceptance of sodium-based technologies, particularly in price-sensitive markets and applications where energy density requirements are moderate. Survey data shows that 72% of grid storage operators consider sodium-based solutions for new installations, citing cost advantages of 30-40% over lithium alternatives.

Market barriers include technical challenges related to sodium's reactivity and dendrite formation, which alloying strategies aim to overcome. Additionally, the established infrastructure for lithium-ion production creates inertia against rapid adoption of sodium alternatives, despite their economic advantages.

The competitive landscape features both established battery manufacturers expanding into sodium technologies and specialized startups focused exclusively on sodium battery innovations. This dynamic ecosystem is driving rapid technological advancement, particularly in anode materials engineering where alloying approaches show promising commercial potential.

Current Challenges in Sodium Metal Anode Technology

Despite the promising potential of sodium-ion batteries as a cost-effective alternative to lithium-ion batteries, sodium metal anodes face significant challenges that hinder their commercial viability. The primary obstacle is the high reactivity of sodium metal with conventional electrolytes, leading to continuous solid electrolyte interphase (SEI) formation and consumption of both sodium and electrolyte. This parasitic reaction not only reduces coulombic efficiency but also compromises long-term cycling stability.

Another critical challenge is the uncontrolled dendrite growth during sodium plating/stripping processes. Sodium dendrites can penetrate the separator, causing internal short circuits and serious safety hazards. The dendrite formation is exacerbated by the uneven distribution of current density across the electrode surface, creating localized hotspots for accelerated sodium deposition.

Volume expansion during cycling presents an additional hurdle. Sodium metal undergoes substantial volumetric changes (approximately 230% theoretical volume expansion) during plating and stripping, leading to mechanical stress that can fracture the SEI layer. This continuous breaking and reforming of the SEI consumes active sodium and electrolyte, further reducing battery performance and lifespan.

The poor wettability between sodium metal and conventional electrolytes represents another significant challenge. This poor interface contact leads to non-uniform current distribution and accelerates dendrite formation. Furthermore, the low melting point of sodium (97.8°C) compared to lithium (180.5°C) creates additional safety concerns, particularly in high-temperature applications.

The inherent softness of sodium metal (Mohr hardness of 0.5) compared to lithium (Mohr hardness of 0.6) makes it more susceptible to morphological changes during cycling. This mechanical instability contributes to the formation of "dead sodium" – electrically disconnected sodium particles that reduce the active material utilization and overall energy density of the battery.

Current electrolyte systems also struggle to form stable and flexible SEI layers on sodium metal surfaces. Unlike lithium batteries, where decades of research have optimized electrolyte formulations, sodium battery electrolytes are still in early development stages. The ideal SEI should be ionically conductive while electronically insulating, mechanically robust yet flexible enough to accommodate volume changes.

The challenges are further compounded by the limited understanding of sodium electrochemistry at the molecular level, particularly regarding the interfacial reactions between sodium metal and various electrolyte components. This knowledge gap hampers the rational design of advanced electrolytes and protective strategies specifically tailored for sodium metal anodes.

Another critical challenge is the uncontrolled dendrite growth during sodium plating/stripping processes. Sodium dendrites can penetrate the separator, causing internal short circuits and serious safety hazards. The dendrite formation is exacerbated by the uneven distribution of current density across the electrode surface, creating localized hotspots for accelerated sodium deposition.

Volume expansion during cycling presents an additional hurdle. Sodium metal undergoes substantial volumetric changes (approximately 230% theoretical volume expansion) during plating and stripping, leading to mechanical stress that can fracture the SEI layer. This continuous breaking and reforming of the SEI consumes active sodium and electrolyte, further reducing battery performance and lifespan.

The poor wettability between sodium metal and conventional electrolytes represents another significant challenge. This poor interface contact leads to non-uniform current distribution and accelerates dendrite formation. Furthermore, the low melting point of sodium (97.8°C) compared to lithium (180.5°C) creates additional safety concerns, particularly in high-temperature applications.

The inherent softness of sodium metal (Mohr hardness of 0.5) compared to lithium (Mohr hardness of 0.6) makes it more susceptible to morphological changes during cycling. This mechanical instability contributes to the formation of "dead sodium" – electrically disconnected sodium particles that reduce the active material utilization and overall energy density of the battery.

Current electrolyte systems also struggle to form stable and flexible SEI layers on sodium metal surfaces. Unlike lithium batteries, where decades of research have optimized electrolyte formulations, sodium battery electrolytes are still in early development stages. The ideal SEI should be ionically conductive while electronically insulating, mechanically robust yet flexible enough to accommodate volume changes.

The challenges are further compounded by the limited understanding of sodium electrochemistry at the molecular level, particularly regarding the interfacial reactions between sodium metal and various electrolyte components. This knowledge gap hampers the rational design of advanced electrolytes and protective strategies specifically tailored for sodium metal anodes.

Current Alloying Approaches for Sodium Metal Anodes

01 Protective coatings for sodium metal anodes

Various protective coatings can be applied to sodium metal anodes to enhance their performance and stability. These coatings help prevent unwanted reactions between the sodium metal and electrolyte components, reducing dendrite formation and improving cycling efficiency. Materials used for these protective layers include polymers, inorganic compounds, and composite structures that allow sodium ion transport while blocking side reactions. These coatings significantly extend the lifespan of sodium metal anodes in battery applications.- Protective coatings for sodium metal anodes: Various protective coatings can be applied to sodium metal anodes to enhance their performance and stability. These coatings help prevent unwanted reactions between the sodium metal and electrolyte components, reducing dendrite formation and improving cycling efficiency. Materials used for these protective layers include polymers, inorganic compounds, and composite structures that allow sodium ion transport while protecting the metal surface from degradation.

- Electrolyte formulations for sodium metal batteries: Specialized electrolyte formulations play a crucial role in improving sodium metal anode performance. These formulations often include additives that form stable solid electrolyte interphase (SEI) layers on the sodium surface, fluorinated compounds that enhance stability, or ionic liquids that reduce reactivity. Properly designed electrolytes can significantly improve coulombic efficiency, reduce dendrite formation, and extend the cycle life of sodium metal anodes.

- Structured sodium anodes and interface engineering: Engineering the structure of sodium metal anodes and their interfaces can dramatically improve performance. This includes creating porous or 3D structured sodium anodes, using host materials to guide sodium deposition, and developing specialized interface layers. These approaches help distribute current density more evenly, accommodate volume changes during cycling, and prevent dendrite formation, resulting in enhanced cycling stability and improved energy density.

- Composite sodium anodes with supporting materials: Composite sodium anodes incorporate supporting materials such as carbon-based structures, metal frameworks, or ceramic components to enhance mechanical stability and electrochemical performance. These supporting materials provide pathways for sodium ion transport, help maintain structural integrity during cycling, and can serve as nucleation sites for uniform sodium deposition. The composite approach addresses key challenges of pure sodium metal anodes including volume expansion and dendrite formation.

- Advanced characterization and performance metrics for sodium anodes: Advanced characterization techniques and standardized performance metrics are essential for evaluating sodium metal anode performance. These include in-situ and operando methods to observe sodium deposition/stripping behavior, quantitative analysis of coulombic efficiency, dendrite formation studies, and long-term cycling protocols. Understanding the fundamental mechanisms of sodium anode degradation through these techniques enables the development of more effective strategies to improve performance and stability.

02 Electrolyte formulations for sodium metal batteries

Specialized electrolyte formulations play a crucial role in improving sodium metal anode performance. These formulations typically include carefully selected salts, solvents, and additives that form stable solid electrolyte interphase (SEI) layers on the sodium surface. Some electrolytes incorporate flame-retardant components for enhanced safety, while others focus on high ionic conductivity at room temperature. The right electrolyte composition can significantly reduce sodium dendrite formation, improve coulombic efficiency, and extend cycle life of sodium metal batteries.Expand Specific Solutions03 Sodium anode structural modifications

Structural modifications to sodium metal anodes can dramatically improve their electrochemical performance. These modifications include creating porous structures, 3D frameworks, and engineered interfaces that accommodate volume changes during cycling. Some approaches involve sodium metal composites with other materials to enhance mechanical stability. These structural designs help distribute current density more evenly across the anode surface, reducing dendrite formation and improving cycling stability. The modified structures also facilitate more efficient sodium ion transport at the electrode-electrolyte interface.Expand Specific Solutions04 Interface engineering for sodium anodes

Interface engineering focuses on optimizing the boundary between the sodium metal anode and the electrolyte. This approach involves creating artificial solid electrolyte interphase (SEI) layers with specific compositions and properties. These engineered interfaces can be formed through pre-treatment processes, in-situ reactions, or application of functional interlayers. Well-designed interfaces allow for uniform sodium ion flux while preventing dendrite penetration and side reactions. Interface engineering significantly improves the cycling stability and safety of sodium metal anodes in various battery configurations.Expand Specific Solutions05 Sodium anode current collector innovations

Innovations in current collector design and materials have shown significant improvements in sodium metal anode performance. These include specially treated metal substrates, 3D structured current collectors, and composite current collectors with sodium-philic surfaces. Some designs incorporate materials that form beneficial alloys with sodium or provide nucleation sites for uniform sodium deposition. Advanced current collectors help distribute electrical current more evenly, reduce local hotspots, and provide mechanical support for the sodium metal. These innovations lead to more stable cycling performance and higher capacity retention in sodium metal batteries.Expand Specific Solutions

Leading Research Groups and Companies in Na-Metal Battery Field

The sodium metal anode technology market is currently in an early growth phase, characterized by intensive research and development efforts across academia and industry. The global market for sodium-based battery technologies is expanding rapidly, projected to reach significant scale as an alternative to lithium-ion batteries due to sodium's greater abundance and lower cost. Technologically, alloying strategies for sodium metal anodes remain at a moderate maturity level, with key players like Samsung Electronics, Albemarle Corp., and Farasis Energy leading commercial development efforts. Academic institutions including Guangdong University of Technology, Central South University, and IIT Delhi are advancing fundamental research, while specialized companies such as Guangdong Bangpu Recycling Technology and Xiamen Hithium New Energy are developing practical applications focusing on improving sodium anode stability, cyclability, and safety through innovative alloying approaches.

Samsung Electronics Co., Ltd.

Technical Solution: Samsung has developed a comprehensive sodium metal anode alloying strategy focusing on Na-Sn and Na-Sb alloy systems. Their approach involves pre-sodiation of tin and antimony to form Na-Sn and Na-Sb alloys that serve as protective layers on sodium metal anodes. The company employs a controlled deposition method where thin layers of tin or antimony are first deposited on current collectors, followed by sodiation to form stable alloy interfaces. This creates a buffer layer that accommodates volume changes during cycling while maintaining ionic conductivity. Samsung has also pioneered the use of liquid metal alloys (Na-K-Cs) that remain liquid at room temperature, providing self-healing properties and preventing dendrite formation through constant surface reorganization. Their research extends to composite alloy structures with gradient compositions to optimize both mechanical stability and electrochemical performance.

Strengths: Samsung's approach effectively mitigates dendrite formation while maintaining high ionic conductivity. Their liquid metal alloy technology offers unique self-healing properties. Weaknesses: The complex manufacturing process for gradient alloy structures may increase production costs, and some of their alloy systems show capacity degradation after extended cycling.

Xiamen University

Technical Solution: Xiamen University has developed a pioneering sodium metal anode technology based on Na-Ga-Sn alloy systems. Their approach utilizes a liquid-phase alloying method where gallium and tin are first melted together and then combined with sodium under controlled conditions, creating a semi-liquid alloy with unique properties. This semi-liquid state persists at room temperature, providing self-healing capabilities that effectively suppress dendrite formation. The research team has developed a nanostructured framework where the liquid alloy is confined within a carbon matrix, preventing leakage while maintaining the beneficial properties of the liquid phase. Their technology also incorporates a surface passivation technique where the alloy surface is treated with fluorinated compounds to form a stable and ion-conductive interface layer. Xiamen University has further enhanced this system by developing compatible electrolyte formulations containing ether-based solvents and sodium salt additives that work synergistically with the alloy structure to form stable solid electrolyte interphase layers, significantly improving cycling stability and rate capability.

Strengths: The semi-liquid alloy provides unique self-healing properties that effectively suppress dendrite formation. Their carbon-confined liquid alloy structure maintains high ionic conductivity while preventing leakage. Weaknesses: The use of gallium introduces significant cost considerations, and the liquid nature of the alloy may present challenges for certain battery configurations and orientations.

Key Alloying Mechanisms and Performance Enhancement Principles

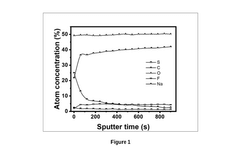

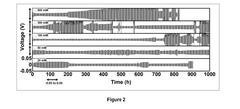

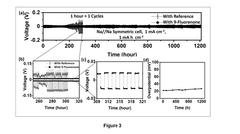

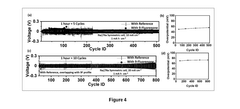

An electrolyte composition for a highly stable and reversible sodium-metal anode for high-energy rechargeable batteries

PatentPendingIN202211027550A

Innovation

- An electrolyte composition comprising an organic aromatic additive, 9-Fluorenone, which solubilizes in ether-based electrolytes and electrochemically decomposes to form a protective layer, stabilizing the sodium-metal anode and reducing sodium deposition overpotential, enabling dendrite-free and uniform sodium deposition.

Sustainability and Resource Considerations for Na-based Batteries

The sustainability advantages of sodium-based batteries represent a significant driver for their development and implementation. Unlike lithium, sodium is abundantly available in the Earth's crust (approximately 2.8% compared to lithium's 0.006%) and oceans, making it substantially more accessible and geographically distributed. This widespread availability reduces geopolitical supply risks and potential resource monopolies that currently affect lithium supply chains.

From an environmental perspective, sodium extraction processes generally have a lower ecological footprint compared to lithium mining operations. Traditional lithium extraction, particularly from brine pools, consumes vast quantities of water in water-stressed regions and can lead to soil contamination and ecosystem disruption. Sodium, conversely, can be obtained through more environmentally benign processes such as seawater extraction or as byproducts from chlor-alkali processes.

Economic considerations further strengthen the case for sodium-based battery technologies. The raw material cost for sodium is approximately 30-40% lower than lithium, providing a significant cost advantage at scale. This economic benefit becomes particularly relevant when considering alloying strategies for sodium metal anodes, as the base material cost remains competitive even when incorporating performance-enhancing elements.

The carbon footprint analysis of full lifecycle assessments reveals that Na-based batteries with alloyed anodes can achieve up to 20-25% reduction in greenhouse gas emissions compared to conventional lithium-ion technologies. This reduction stems from both the lower energy requirements for sodium processing and the potential for using more sustainable alloying elements compared to those required for lithium-based systems.

Recycling infrastructure represents another critical sustainability dimension. The development of sodium battery recycling processes is still in its infancy but shows promising characteristics. The lower reactivity of sodium compounds compared to lithium facilitates safer recycling operations. Additionally, many alloying elements used in sodium anodes (such as tin, antimony, and phosphorus) have established recycling streams in other industries, potentially allowing for integration with existing infrastructure.

Resource circularity strategies for sodium battery systems are increasingly focusing on "design for recycling" approaches, where alloying elements are selected not only for their electrochemical performance but also for their recoverability and reusability. This holistic approach to material selection represents a significant advancement toward truly sustainable energy storage systems that align with circular economy principles.

From an environmental perspective, sodium extraction processes generally have a lower ecological footprint compared to lithium mining operations. Traditional lithium extraction, particularly from brine pools, consumes vast quantities of water in water-stressed regions and can lead to soil contamination and ecosystem disruption. Sodium, conversely, can be obtained through more environmentally benign processes such as seawater extraction or as byproducts from chlor-alkali processes.

Economic considerations further strengthen the case for sodium-based battery technologies. The raw material cost for sodium is approximately 30-40% lower than lithium, providing a significant cost advantage at scale. This economic benefit becomes particularly relevant when considering alloying strategies for sodium metal anodes, as the base material cost remains competitive even when incorporating performance-enhancing elements.

The carbon footprint analysis of full lifecycle assessments reveals that Na-based batteries with alloyed anodes can achieve up to 20-25% reduction in greenhouse gas emissions compared to conventional lithium-ion technologies. This reduction stems from both the lower energy requirements for sodium processing and the potential for using more sustainable alloying elements compared to those required for lithium-based systems.

Recycling infrastructure represents another critical sustainability dimension. The development of sodium battery recycling processes is still in its infancy but shows promising characteristics. The lower reactivity of sodium compounds compared to lithium facilitates safer recycling operations. Additionally, many alloying elements used in sodium anodes (such as tin, antimony, and phosphorus) have established recycling streams in other industries, potentially allowing for integration with existing infrastructure.

Resource circularity strategies for sodium battery systems are increasingly focusing on "design for recycling" approaches, where alloying elements are selected not only for their electrochemical performance but also for their recoverability and reusability. This holistic approach to material selection represents a significant advancement toward truly sustainable energy storage systems that align with circular economy principles.

Scalability and Manufacturing Challenges for Alloyed Na Anodes

The transition from laboratory-scale research to industrial production of alloyed sodium metal anodes presents significant manufacturing challenges that must be addressed for commercial viability. Current production methods for sodium alloy anodes typically involve complex processes such as melt-casting, mechanical alloying, or electrochemical deposition, each with inherent scalability limitations. The reactive nature of sodium metal compounds these difficulties, requiring stringent environmental controls during manufacturing to prevent oxidation and moisture contamination.

Material consistency represents a critical challenge in large-scale production. Achieving uniform distribution of alloying elements throughout the sodium matrix becomes increasingly difficult as production volumes increase. This heterogeneity can lead to inconsistent electrochemical performance across batches, compromising the reliability of the final energy storage devices. Additionally, the precise control of microstructure and phase composition, which is relatively manageable in laboratory settings, becomes exponentially more complex in industrial-scale operations.

Cost considerations further complicate the manufacturing landscape. While sodium itself is abundant and inexpensive compared to lithium, many potential alloying elements (such as tin, antimony, or indium) carry significant cost implications at scale. The additional processing steps required for alloying also contribute to higher production expenses, potentially offsetting the inherent cost advantages of sodium-based systems over lithium-ion technologies.

Equipment compatibility presents another barrier to commercialization. Existing battery manufacturing infrastructure, largely optimized for lithium-ion technology, requires substantial modification to accommodate the unique handling requirements of sodium alloy anodes. The development of specialized equipment and processes represents a significant capital investment for manufacturers considering adoption of this technology.

Safety protocols for large-scale handling of reactive sodium alloys necessitate robust engineering controls and specialized training. The risk of thermal events during manufacturing is heightened compared to conventional electrode materials, requiring advanced fire suppression systems and emergency response capabilities. These safety requirements add another layer of complexity and cost to manufacturing operations.

Addressing these challenges requires collaborative efforts between materials scientists, chemical engineers, and manufacturing specialists. Potential solutions include the development of continuous processing techniques to improve consistency, exploration of more abundant and cost-effective alloying elements, and design of dedicated manufacturing equipment specifically optimized for sodium alloy anodes. Progress in these areas will be essential for bridging the gap between promising laboratory results and commercially viable products.

Material consistency represents a critical challenge in large-scale production. Achieving uniform distribution of alloying elements throughout the sodium matrix becomes increasingly difficult as production volumes increase. This heterogeneity can lead to inconsistent electrochemical performance across batches, compromising the reliability of the final energy storage devices. Additionally, the precise control of microstructure and phase composition, which is relatively manageable in laboratory settings, becomes exponentially more complex in industrial-scale operations.

Cost considerations further complicate the manufacturing landscape. While sodium itself is abundant and inexpensive compared to lithium, many potential alloying elements (such as tin, antimony, or indium) carry significant cost implications at scale. The additional processing steps required for alloying also contribute to higher production expenses, potentially offsetting the inherent cost advantages of sodium-based systems over lithium-ion technologies.

Equipment compatibility presents another barrier to commercialization. Existing battery manufacturing infrastructure, largely optimized for lithium-ion technology, requires substantial modification to accommodate the unique handling requirements of sodium alloy anodes. The development of specialized equipment and processes represents a significant capital investment for manufacturers considering adoption of this technology.

Safety protocols for large-scale handling of reactive sodium alloys necessitate robust engineering controls and specialized training. The risk of thermal events during manufacturing is heightened compared to conventional electrode materials, requiring advanced fire suppression systems and emergency response capabilities. These safety requirements add another layer of complexity and cost to manufacturing operations.

Addressing these challenges requires collaborative efforts between materials scientists, chemical engineers, and manufacturing specialists. Potential solutions include the development of continuous processing techniques to improve consistency, exploration of more abundant and cost-effective alloying elements, and design of dedicated manufacturing equipment specifically optimized for sodium alloy anodes. Progress in these areas will be essential for bridging the gap between promising laboratory results and commercially viable products.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!