Comparative Study between Sodium Metal and Hard Carbon Anodes

OCT 13, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Sodium Battery Anode Technology Background and Objectives

Sodium-ion batteries (SIBs) have emerged as a promising alternative to lithium-ion batteries (LIBs) due to the abundance and low cost of sodium resources. The development of sodium battery technology can be traced back to the 1970s, when researchers began exploring sodium as an energy storage medium. However, interest waned as lithium-ion technology gained prominence. In recent years, concerns about lithium supply constraints and increasing demand for energy storage solutions have reignited interest in sodium-based energy storage systems.

The evolution of sodium battery technology has been marked by significant challenges, particularly in anode materials. Unlike lithium, sodium ions cannot effectively intercalate into graphite, which is the standard anode material for lithium-ion batteries. This fundamental limitation has driven extensive research into alternative anode materials, with sodium metal and hard carbon emerging as two primary contenders.

Sodium metal anodes offer theoretical capacity advantages (1166 mAh/g) but face serious challenges related to dendrite formation and reactivity. The historical trajectory of sodium metal anode research shows cyclical patterns of interest, with recent innovations in electrolyte formulations and protective interfaces showing promise for mitigating these issues.

Hard carbon anodes, developed in the 1990s and refined continuously since then, represent a more stable but lower capacity alternative. The technological evolution of hard carbon has focused on optimizing microstructure, porosity, and surface functionality to enhance sodium ion storage capabilities while maintaining structural stability during cycling.

The technical objectives in this field are multifaceted. Primary goals include developing anode materials that offer high capacity, excellent cycling stability, fast charging capabilities, and safety. For sodium metal anodes, the key objective is to suppress dendrite formation while maintaining the high theoretical capacity. For hard carbon anodes, objectives center on increasing capacity beyond current limits (typically 300-350 mAh/g) while improving first-cycle efficiency and rate capability.

Recent technological trends indicate growing interest in hybrid approaches that combine the advantages of both materials, such as sodium metal-carbon composites. Additionally, there is increasing focus on understanding the fundamental mechanisms of sodium storage in different carbon structures to guide rational material design.

The ultimate technical goal is to develop sodium battery anodes that can match or exceed the performance metrics of current lithium-ion technology while offering cost advantages and sustainability benefits. This requires addressing the inherent challenges of sodium's larger ionic radius and different chemical properties compared to lithium, while leveraging its greater natural abundance and accessibility.

The evolution of sodium battery technology has been marked by significant challenges, particularly in anode materials. Unlike lithium, sodium ions cannot effectively intercalate into graphite, which is the standard anode material for lithium-ion batteries. This fundamental limitation has driven extensive research into alternative anode materials, with sodium metal and hard carbon emerging as two primary contenders.

Sodium metal anodes offer theoretical capacity advantages (1166 mAh/g) but face serious challenges related to dendrite formation and reactivity. The historical trajectory of sodium metal anode research shows cyclical patterns of interest, with recent innovations in electrolyte formulations and protective interfaces showing promise for mitigating these issues.

Hard carbon anodes, developed in the 1990s and refined continuously since then, represent a more stable but lower capacity alternative. The technological evolution of hard carbon has focused on optimizing microstructure, porosity, and surface functionality to enhance sodium ion storage capabilities while maintaining structural stability during cycling.

The technical objectives in this field are multifaceted. Primary goals include developing anode materials that offer high capacity, excellent cycling stability, fast charging capabilities, and safety. For sodium metal anodes, the key objective is to suppress dendrite formation while maintaining the high theoretical capacity. For hard carbon anodes, objectives center on increasing capacity beyond current limits (typically 300-350 mAh/g) while improving first-cycle efficiency and rate capability.

Recent technological trends indicate growing interest in hybrid approaches that combine the advantages of both materials, such as sodium metal-carbon composites. Additionally, there is increasing focus on understanding the fundamental mechanisms of sodium storage in different carbon structures to guide rational material design.

The ultimate technical goal is to develop sodium battery anodes that can match or exceed the performance metrics of current lithium-ion technology while offering cost advantages and sustainability benefits. This requires addressing the inherent challenges of sodium's larger ionic radius and different chemical properties compared to lithium, while leveraging its greater natural abundance and accessibility.

Market Analysis for Sodium-ion Battery Applications

The sodium-ion battery market is experiencing significant growth as a promising alternative to lithium-ion batteries, driven by increasing concerns over lithium supply constraints and cost volatility. Current market projections indicate the sodium-ion battery market could reach $500 million by 2025, with a compound annual growth rate exceeding 25% through 2030, particularly as commercial-scale production ramps up.

The demand for sodium-ion batteries is primarily emerging in three key application segments. First, stationary energy storage systems represent the largest immediate opportunity, where cost advantages outweigh energy density limitations. Grid-scale storage projects in China and Europe have already begun incorporating sodium-ion technology, with several pilot installations demonstrating favorable performance metrics.

Second, the electric mobility sector—particularly e-bikes, low-speed electric vehicles, and commercial fleet applications—shows promising adoption potential where moderate energy density is acceptable. Companies like CATL and Faradion have announced partnerships with vehicle manufacturers to integrate sodium-ion batteries into specific mobility platforms by 2024.

Third, consumer electronics with less stringent energy density requirements present a viable entry market. Applications such as power tools, emergency backup systems, and IoT devices could benefit from sodium-ion's enhanced safety profile and lower cost structure.

Regional market analysis reveals China leading sodium-ion battery development and commercialization, with over 40% of global patents in this field. The European market follows with substantial research investments and supportive regulatory frameworks promoting sustainable battery technologies. North America shows increasing interest, particularly in grid storage applications where cost-per-cycle metrics favor sodium-ion solutions.

Market penetration analysis indicates sodium-ion batteries are most competitive in price-sensitive segments where the total cost of ownership matters more than initial energy density. The cost advantage becomes particularly compelling in applications requiring frequent cycling and long calendar life, where sodium-ion technology demonstrates superior performance metrics compared to lithium-iron-phosphate batteries.

Customer adoption surveys reveal growing interest from utility companies and renewable energy developers seeking cost-effective storage solutions. However, concerns about technology maturity and performance consistency remain significant barriers to widespread adoption, necessitating more extensive field validation and performance data.

The competitive landscape is rapidly evolving with both established battery manufacturers and specialized startups entering the sodium-ion space. This market diversification is accelerating technology development while driving down production costs through increased competition and manufacturing scale.

The demand for sodium-ion batteries is primarily emerging in three key application segments. First, stationary energy storage systems represent the largest immediate opportunity, where cost advantages outweigh energy density limitations. Grid-scale storage projects in China and Europe have already begun incorporating sodium-ion technology, with several pilot installations demonstrating favorable performance metrics.

Second, the electric mobility sector—particularly e-bikes, low-speed electric vehicles, and commercial fleet applications—shows promising adoption potential where moderate energy density is acceptable. Companies like CATL and Faradion have announced partnerships with vehicle manufacturers to integrate sodium-ion batteries into specific mobility platforms by 2024.

Third, consumer electronics with less stringent energy density requirements present a viable entry market. Applications such as power tools, emergency backup systems, and IoT devices could benefit from sodium-ion's enhanced safety profile and lower cost structure.

Regional market analysis reveals China leading sodium-ion battery development and commercialization, with over 40% of global patents in this field. The European market follows with substantial research investments and supportive regulatory frameworks promoting sustainable battery technologies. North America shows increasing interest, particularly in grid storage applications where cost-per-cycle metrics favor sodium-ion solutions.

Market penetration analysis indicates sodium-ion batteries are most competitive in price-sensitive segments where the total cost of ownership matters more than initial energy density. The cost advantage becomes particularly compelling in applications requiring frequent cycling and long calendar life, where sodium-ion technology demonstrates superior performance metrics compared to lithium-iron-phosphate batteries.

Customer adoption surveys reveal growing interest from utility companies and renewable energy developers seeking cost-effective storage solutions. However, concerns about technology maturity and performance consistency remain significant barriers to widespread adoption, necessitating more extensive field validation and performance data.

The competitive landscape is rapidly evolving with both established battery manufacturers and specialized startups entering the sodium-ion space. This market diversification is accelerating technology development while driving down production costs through increased competition and manufacturing scale.

Current Challenges in Sodium Anode Development

Despite significant advancements in sodium-ion battery technology, the development of efficient sodium anodes continues to face substantial challenges. When comparing sodium metal and hard carbon anodes, several critical obstacles impede their widespread commercial adoption and optimal performance.

Sodium metal anodes suffer from severe reactivity issues with conventional electrolytes, leading to continuous SEI (Solid Electrolyte Interphase) formation and electrolyte depletion. This reactivity is significantly more pronounced than in lithium systems due to sodium's higher chemical activity and larger ionic radius (1.02Å vs. 0.76Å for lithium).

Dendrite formation represents another major challenge for sodium metal anodes. The uneven deposition of sodium during charging creates needle-like structures that can penetrate separators, causing short circuits and potential safety hazards. Research indicates that sodium's dendrite growth can be even more aggressive than lithium under certain conditions, with propagation rates up to 30% faster.

Volume expansion during cycling poses significant structural integrity problems. Sodium metal experiences approximately 330% volume change during plating/stripping cycles, creating mechanical stress that degrades electrode structure and accelerates capacity fading. This expansion exceeds that of lithium (approximately 300%), making mechanical stabilization more challenging.

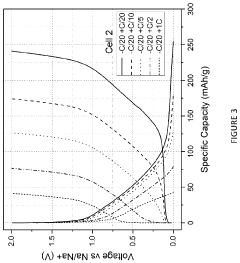

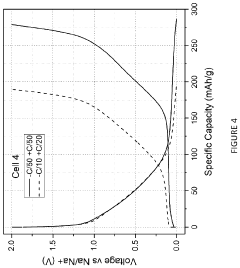

Hard carbon anodes, while more stable than sodium metal, face their own set of limitations. The sodium ion insertion/extraction mechanism in hard carbon involves both intercalation and adsorption processes, creating complex kinetics that limit rate capability. Current hard carbon anodes typically deliver specific capacities of 250-350 mAh/g, significantly lower than the theoretical capacity of sodium metal (1166 mAh/g).

The initial coulombic efficiency of hard carbon anodes remains problematic, typically ranging from 70-85%. This inefficiency stems from irreversible sodium consumption during initial SEI formation and trapping within the carbon structure, resulting in substantial capacity loss during the first cycle.

Moisture sensitivity presents challenges for both anode types but manifests differently. Sodium metal reacts violently with moisture, necessitating stringent handling protocols, while hard carbon's performance degrades significantly when exposed to humidity due to surface functional group interactions with water molecules.

Manufacturing scalability differs substantially between the two approaches. Hard carbon production faces challenges in achieving consistent microstructure and porosity across large-scale production, while sodium metal handling requires specialized equipment and environments to prevent oxidation and moisture contamination.

These challenges collectively represent significant barriers to the commercial viability of sodium-based battery systems, necessitating innovative solutions in materials science, electrode engineering, and manufacturing processes.

Sodium metal anodes suffer from severe reactivity issues with conventional electrolytes, leading to continuous SEI (Solid Electrolyte Interphase) formation and electrolyte depletion. This reactivity is significantly more pronounced than in lithium systems due to sodium's higher chemical activity and larger ionic radius (1.02Å vs. 0.76Å for lithium).

Dendrite formation represents another major challenge for sodium metal anodes. The uneven deposition of sodium during charging creates needle-like structures that can penetrate separators, causing short circuits and potential safety hazards. Research indicates that sodium's dendrite growth can be even more aggressive than lithium under certain conditions, with propagation rates up to 30% faster.

Volume expansion during cycling poses significant structural integrity problems. Sodium metal experiences approximately 330% volume change during plating/stripping cycles, creating mechanical stress that degrades electrode structure and accelerates capacity fading. This expansion exceeds that of lithium (approximately 300%), making mechanical stabilization more challenging.

Hard carbon anodes, while more stable than sodium metal, face their own set of limitations. The sodium ion insertion/extraction mechanism in hard carbon involves both intercalation and adsorption processes, creating complex kinetics that limit rate capability. Current hard carbon anodes typically deliver specific capacities of 250-350 mAh/g, significantly lower than the theoretical capacity of sodium metal (1166 mAh/g).

The initial coulombic efficiency of hard carbon anodes remains problematic, typically ranging from 70-85%. This inefficiency stems from irreversible sodium consumption during initial SEI formation and trapping within the carbon structure, resulting in substantial capacity loss during the first cycle.

Moisture sensitivity presents challenges for both anode types but manifests differently. Sodium metal reacts violently with moisture, necessitating stringent handling protocols, while hard carbon's performance degrades significantly when exposed to humidity due to surface functional group interactions with water molecules.

Manufacturing scalability differs substantially between the two approaches. Hard carbon production faces challenges in achieving consistent microstructure and porosity across large-scale production, while sodium metal handling requires specialized equipment and environments to prevent oxidation and moisture contamination.

These challenges collectively represent significant barriers to the commercial viability of sodium-based battery systems, necessitating innovative solutions in materials science, electrode engineering, and manufacturing processes.

Technical Comparison of Sodium Metal vs Hard Carbon Anodes

01 Hard carbon anode materials for sodium-ion batteries

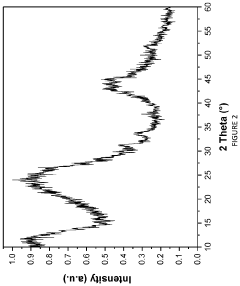

Hard carbon materials are widely used as anode materials in sodium-ion batteries due to their ability to intercalate sodium ions effectively. These materials have a disordered structure with micropores that can accommodate sodium ions, providing good capacity and cycling stability. The performance of hard carbon anodes can be optimized through various synthesis methods and precursor selection to achieve desired porosity and surface area.- Hard carbon anode materials for sodium-ion batteries: Hard carbon materials are widely used as anode materials in sodium-ion batteries due to their ability to effectively intercalate sodium ions. These materials typically have a disordered structure with micropores and defects that can accommodate sodium ions. The performance of hard carbon anodes can be enhanced through various synthesis methods, heat treatment processes, and precursor selection to optimize porosity, surface area, and sodium storage capacity.

- Composite anodes combining hard carbon with other materials: Composite anodes that combine hard carbon with other materials can improve the electrochemical performance of sodium-ion batteries. These composites often incorporate materials such as silicon, tin, phosphorus, or metal oxides to enhance capacity, cycling stability, and rate capability. The synergistic effects between hard carbon and these additional components can address the limitations of using hard carbon alone, such as low initial coulombic efficiency and capacity fading.

- Surface modification and coating of hard carbon anodes: Surface modification and coating techniques can significantly improve the performance of hard carbon anodes in sodium-ion batteries. These treatments can include carbon coating, nitrogen doping, oxygen functional group introduction, or metal oxide deposition. Such modifications help to enhance the electronic conductivity, reduce the solid electrolyte interphase formation, improve the wettability with electrolytes, and stabilize the structure during sodium insertion/extraction processes.

- Electrolyte formulations for sodium metal and hard carbon anodes: Specialized electrolyte formulations play a crucial role in the performance of sodium metal and hard carbon anodes. These formulations often include fluorinated solvents, additives, and sodium salts designed to form stable solid electrolyte interphases, prevent dendrite formation on sodium metal, and enhance ionic conductivity. The electrolyte composition significantly affects the cycling stability, coulombic efficiency, and rate capability of sodium-ion batteries with hard carbon anodes.

- Pre-sodiation techniques for hard carbon anodes: Pre-sodiation techniques are employed to improve the initial coulombic efficiency and overall performance of hard carbon anodes in sodium-ion batteries. These methods involve introducing sodium into the hard carbon structure before battery assembly, which compensates for the irreversible capacity loss during the first cycle. Pre-sodiation can be achieved through chemical, electrochemical, or physical methods, and helps to enhance the energy density and cycle life of sodium-ion batteries.

02 Sodium metal anode protection strategies

Sodium metal anodes face challenges such as dendrite formation and unstable solid electrolyte interphase (SEI). Various protection strategies have been developed, including artificial SEI layers, electrolyte additives, and physical barriers to prevent dendrite growth. These approaches aim to improve the cycling stability and safety of sodium metal anodes while maintaining their high theoretical capacity.Expand Specific Solutions03 Composite anodes combining sodium and hard carbon

Composite anode materials that combine sodium metal with hard carbon offer improved performance by leveraging the high capacity of sodium metal and the structural stability of hard carbon. These composites can be prepared through various methods such as melt infiltration, electrochemical deposition, or mechanical mixing. The hard carbon component helps to regulate sodium deposition and prevent dendrite formation.Expand Specific Solutions04 Electrolyte formulations for sodium-based anodes

Specialized electrolyte formulations play a crucial role in the performance of sodium metal and hard carbon anodes. These formulations often include fluorinated solvents, ether-based electrolytes, or ionic liquids that form stable interfaces with the anode materials. Additives such as fluoroethylene carbonate (FEC) can significantly improve the cycling stability by forming protective films on the anode surface.Expand Specific Solutions05 Surface modification of hard carbon for enhanced sodium storage

Surface modification techniques can significantly enhance the performance of hard carbon anodes in sodium-ion batteries. These modifications include nitrogen doping, heteroatom incorporation, and surface functionalization with oxygen-containing groups. Such treatments can increase the number of active sites for sodium storage, improve the electronic conductivity, and enhance the wettability of the electrode with the electrolyte.Expand Specific Solutions

Leading Companies and Research Institutions in Na-ion Battery Field

The sodium-ion battery market is in an early growth phase, characterized by increasing R&D investments but limited commercial deployment compared to lithium-ion technologies. While the global market size remains relatively small (under $500 million), it's projected to grow significantly due to sodium's abundance and cost advantages over lithium. Technologically, sodium metal anodes offer higher energy density but face stability challenges, while hard carbon anodes demonstrate better cycling performance and safety. Companies like Faradion and CATL's subsidiaries lead in sodium-ion commercialization, with research institutions including Xiamen University and Shanghai Jiao Tong University advancing fundamental science. Toyota, Sharp, and emerging players like Svolt and HiNa Battery are developing complementary technologies to address the stability-performance trade-off between these anode materials.

Faradion Ltd.

Technical Solution: Faradion has pioneered proprietary sodium-ion technology that represents a significant advancement in the comparative study between sodium metal and hard carbon anodes. Their technology utilizes optimized hard carbon anodes with tailored porosity and surface functionality that enables superior sodium-ion intercalation. The company has developed a layered oxide cathode paired with their engineered hard carbon anode to create sodium-ion cells that achieve energy densities of approximately 140-150 Wh/kg, which is competitive with certain lithium-ion chemistries. Faradion's approach specifically addresses the dendrite formation issues common with sodium metal anodes by focusing on hard carbon materials that offer more stable cycling performance. Their patented electrolyte formulations are specifically designed to form optimal solid-electrolyte interphase (SEI) layers on hard carbon surfaces, significantly improving the first cycle efficiency which is typically a challenge for hard carbon anodes.

Strengths: Faradion's hard carbon technology offers superior safety compared to sodium metal anodes by eliminating dendrite formation risks. Their solution is also cost-effective as it uses abundant materials and standard manufacturing equipment. Weaknesses: Their hard carbon anodes still face challenges with first-cycle irreversible capacity loss and lower energy density compared to theoretical sodium metal performance.

Jiangsu Zenergy Battery Technologies Group Co., Ltd.

Technical Solution: Zenergy Battery Technologies has developed advanced sodium-ion battery systems through extensive comparative studies between sodium metal and hard carbon anodes. Their proprietary hard carbon synthesis process utilizes a controlled pyrolysis of organic precursors followed by phosphorus doping to create an optimized structure with expanded d-spacing between graphene layers, facilitating improved sodium-ion intercalation. Their hard carbon anodes achieve specific capacities of approximately 330 mAh/g with first-cycle coulombic efficiencies reaching 83%. Zenergy's comparative testing has demonstrated that while sodium metal anodes offer higher theoretical capacity (1166 mAh/g), their practical implementation is limited by severe dendrite formation and poor cycling stability. The company has developed a novel electrolyte system specifically formulated for hard carbon anodes, containing ether-based solvents and sodium salt additives that form stable SEI layers, significantly improving cycling performance. Their sodium-ion cells using hard carbon anodes have demonstrated energy densities of 160 Wh/kg at the cell level, with cycle life exceeding 3000 cycles at 80% capacity retention, positioning their technology as a commercially viable alternative to lithium-ion batteries for certain applications.

Strengths: Zenergy's hard carbon technology offers excellent cycling stability and rate capability, making it suitable for grid storage applications. Their manufacturing process is compatible with existing battery production infrastructure, enabling rapid scaling. Weaknesses: Despite optimizations, their hard carbon anodes still exhibit higher voltage hysteresis than ideal, resulting in some energy efficiency losses during cycling, and face challenges with low-temperature performance.

Critical Patents and Research Breakthroughs in Sodium Anodes

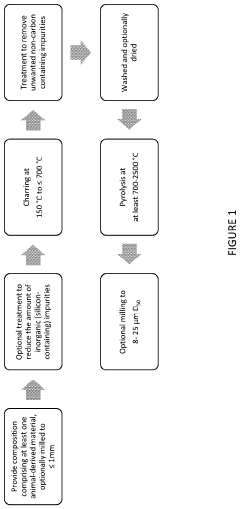

Process for preparing and use of hard-carbon containing materials

PatentInactiveUS20220190338A1

Innovation

- A novel process utilizing animal-derived carbon-containing materials, such as animal faeces, to produce hard carbon materials with a non-graphitisable structure, which are then purified and combined with other elements to enhance electrochemical performance, resulting in high first discharge specific capacity and coulombic efficiency for use in sodium-ion batteries.

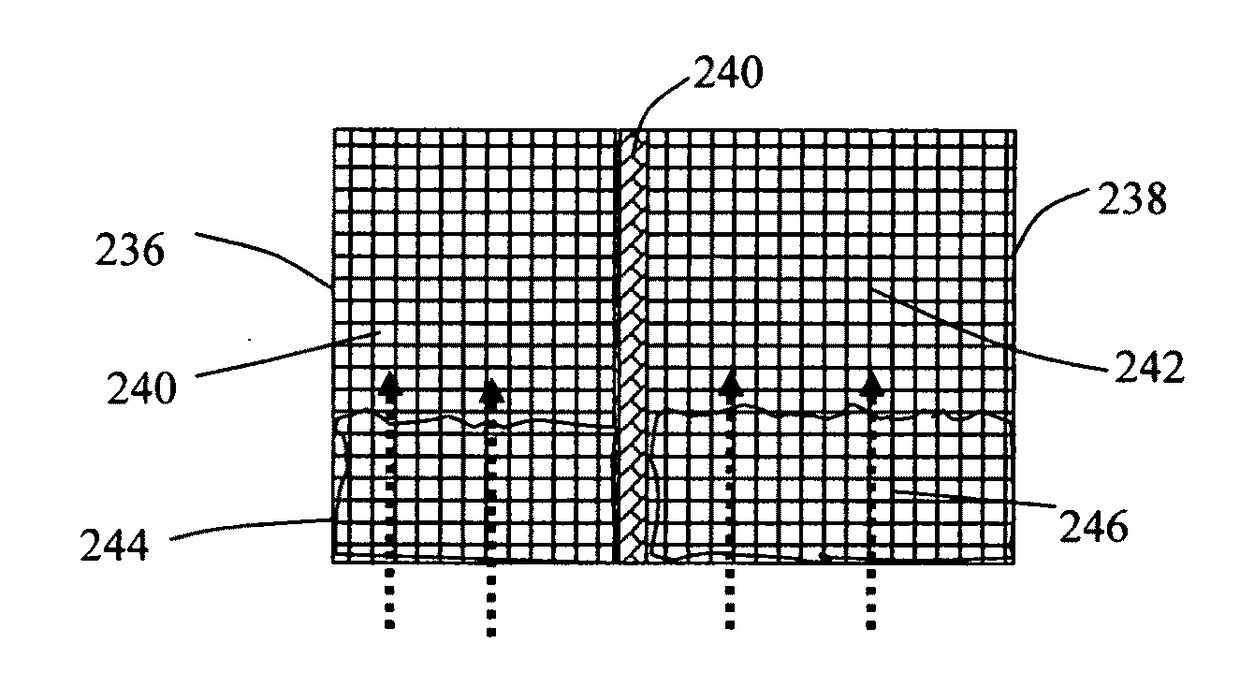

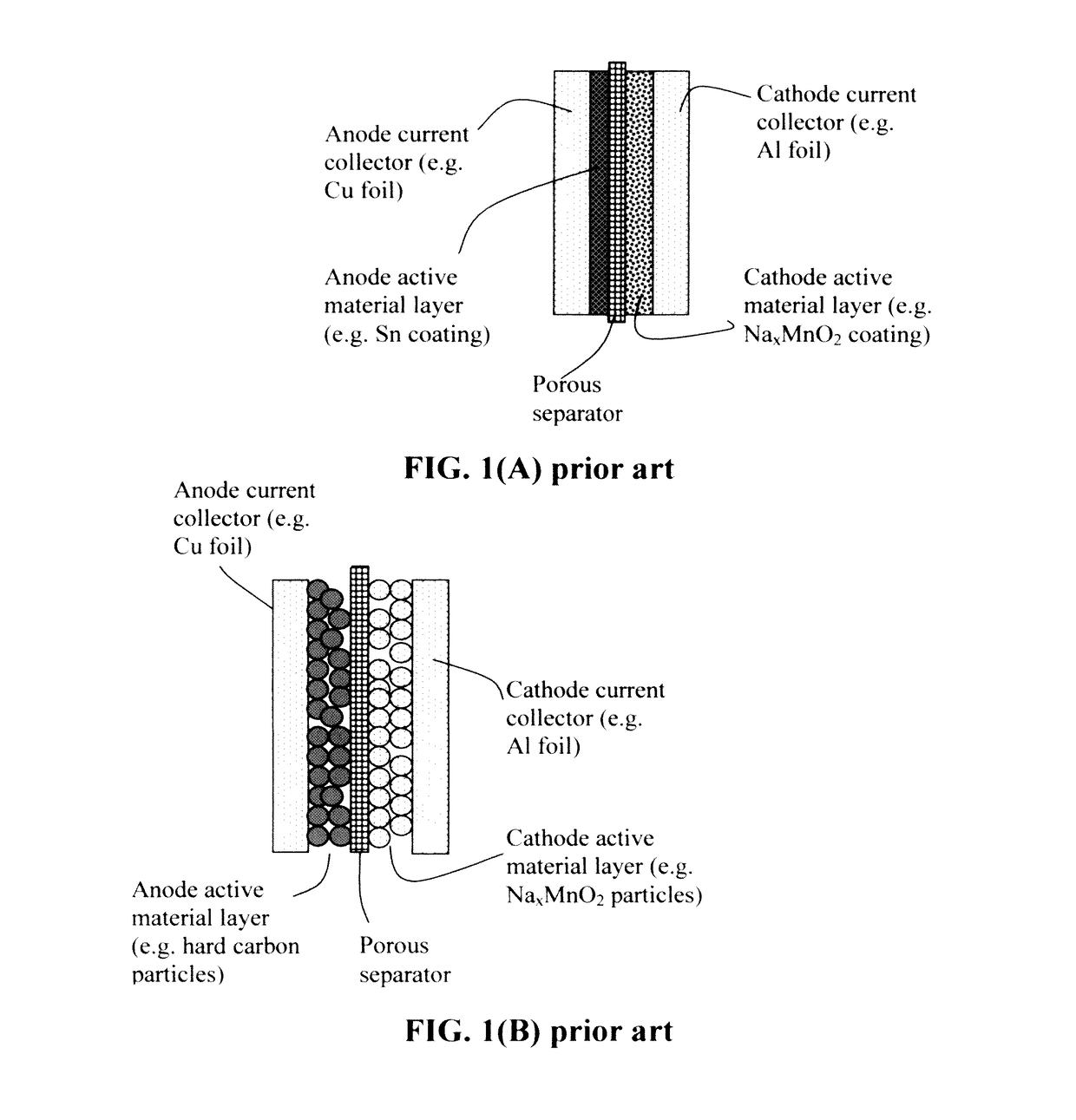

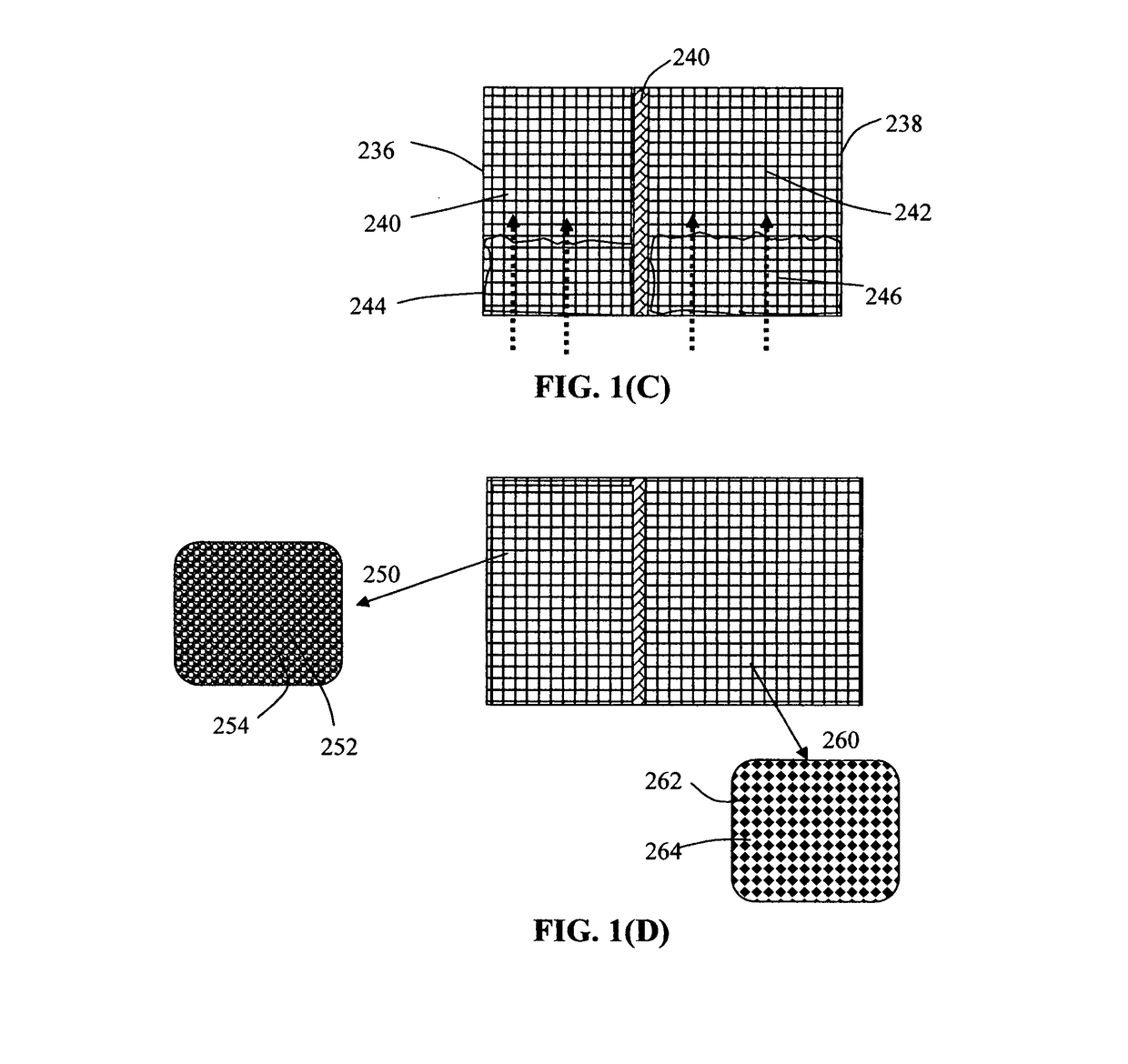

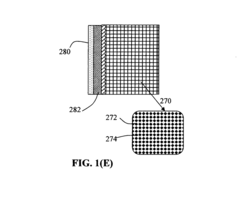

Alkali metal or Alkali-Ion batteries having high volumetric and gravimetric energy densities

PatentInactiveUS20170077546A1

Innovation

- The development of a battery design featuring a 3D porous current collector with high porosity, allowing for increased active material loading and improved electrode thickness, which enhances both gravimetric and volumetric energy densities, and incorporates a novel electrolyte injection process to ensure uniform deposition of alkali metal ions, preventing dendrite formation.

Sustainability and Resource Considerations for Na-ion Technology

The sustainability profile of sodium-ion battery technology represents a significant advantage over lithium-ion systems, particularly when comparing sodium metal and hard carbon anodes. Sodium resources are approximately 1000 times more abundant than lithium in the Earth's crust, with widespread global distribution that reduces geopolitical supply risks. This abundance translates directly to lower raw material costs, with sodium carbonate trading at approximately one-tenth the price of lithium carbonate.

From an environmental perspective, sodium extraction processes generally require less water consumption and generate fewer harmful byproducts compared to lithium extraction, especially when considering the water-intensive brine evaporation methods used in lithium production. The carbon footprint of sodium processing is also typically lower, contributing to reduced greenhouse gas emissions across the battery lifecycle.

Hard carbon anodes, derived from renewable biomass sources such as agricultural waste, present additional sustainability benefits. These materials enable carbon-negative production pathways when proper carbon accounting is applied. The synthesis of hard carbon anodes can utilize pyrolysis processes that require less energy and fewer harsh chemicals than the production of graphite anodes commonly used in lithium-ion batteries.

Recycling considerations also favor sodium-ion technology. The absence of costly metals like cobalt and nickel in many Na-ion formulations simplifies end-of-life processing. Current recycling infrastructure, however, remains primarily optimized for lithium-ion batteries, indicating a need for dedicated sodium-ion recycling pathways as the technology scales.

When comparing sodium metal anodes to hard carbon alternatives, the sustainability equation becomes more complex. Sodium metal production requires energy-intensive electrolysis processes similar to those used for lithium metal. However, the lower melting point of sodium (97.8°C vs. 180.5°C for lithium) potentially reduces energy requirements during processing.

Resource security represents another critical dimension. The geographically concentrated nature of lithium reserves (primarily in Australia, Chile, and China) contrasts sharply with sodium's widespread availability, reducing supply chain vulnerabilities for sodium-based technologies. This distribution pattern supports more localized production capabilities and potentially shorter supply chains.

Looking forward, the scaling of sodium-ion technology faces fewer resource constraints than lithium-ion systems. While performance metrics currently favor lithium-ion batteries in certain applications, the sustainability advantages of sodium-based systems may drive adoption in stationary storage and other applications where energy density requirements are less stringent.

From an environmental perspective, sodium extraction processes generally require less water consumption and generate fewer harmful byproducts compared to lithium extraction, especially when considering the water-intensive brine evaporation methods used in lithium production. The carbon footprint of sodium processing is also typically lower, contributing to reduced greenhouse gas emissions across the battery lifecycle.

Hard carbon anodes, derived from renewable biomass sources such as agricultural waste, present additional sustainability benefits. These materials enable carbon-negative production pathways when proper carbon accounting is applied. The synthesis of hard carbon anodes can utilize pyrolysis processes that require less energy and fewer harsh chemicals than the production of graphite anodes commonly used in lithium-ion batteries.

Recycling considerations also favor sodium-ion technology. The absence of costly metals like cobalt and nickel in many Na-ion formulations simplifies end-of-life processing. Current recycling infrastructure, however, remains primarily optimized for lithium-ion batteries, indicating a need for dedicated sodium-ion recycling pathways as the technology scales.

When comparing sodium metal anodes to hard carbon alternatives, the sustainability equation becomes more complex. Sodium metal production requires energy-intensive electrolysis processes similar to those used for lithium metal. However, the lower melting point of sodium (97.8°C vs. 180.5°C for lithium) potentially reduces energy requirements during processing.

Resource security represents another critical dimension. The geographically concentrated nature of lithium reserves (primarily in Australia, Chile, and China) contrasts sharply with sodium's widespread availability, reducing supply chain vulnerabilities for sodium-based technologies. This distribution pattern supports more localized production capabilities and potentially shorter supply chains.

Looking forward, the scaling of sodium-ion technology faces fewer resource constraints than lithium-ion systems. While performance metrics currently favor lithium-ion batteries in certain applications, the sustainability advantages of sodium-based systems may drive adoption in stationary storage and other applications where energy density requirements are less stringent.

Manufacturing Scalability and Cost Analysis

The manufacturing scalability of sodium-ion battery technologies presents distinct challenges and opportunities when comparing sodium metal and hard carbon anodes. Hard carbon anodes demonstrate significant advantages in terms of manufacturing scalability due to their compatibility with existing lithium-ion battery production infrastructure. This compatibility allows manufacturers to repurpose production lines with minimal modifications, substantially reducing capital expenditure requirements for transitioning to sodium-ion technology.

From a cost perspective, hard carbon anodes offer compelling economic benefits. The raw materials for hard carbon production are abundant and inexpensive, often derived from sustainable sources such as biomass waste. Current market analysis indicates that hard carbon material costs range from $5-15 per kilogram, with projections suggesting further price reductions as production scales. The manufacturing process for hard carbon anodes closely resembles that of graphite anodes in lithium-ion batteries, enabling operational efficiencies and cost savings through established production techniques.

In contrast, sodium metal anodes face considerable manufacturing challenges that impact their scalability. The highly reactive nature of sodium metal necessitates specialized handling equipment and stringent environmental controls, significantly increasing production complexity and cost. Current sodium metal production methods require energy-intensive processes, with estimated manufacturing costs between $15-25 per kilogram, substantially higher than hard carbon alternatives.

Safety considerations further complicate the manufacturing scalability of sodium metal anodes. The pyrophoric nature of sodium metal demands advanced safety protocols and specialized facilities, adding substantial overhead to production costs. These requirements create significant barriers to entry for manufacturers and limit the potential for rapid production scaling.

Supply chain analysis reveals additional advantages for hard carbon anodes. The precursor materials for hard carbon production are widely available globally, reducing geopolitical supply risks. Conversely, while sodium is abundant, the specialized processing required for battery-grade sodium metal creates potential supply bottlenecks that could impact large-scale manufacturing capabilities.

Economic modeling of production scenarios indicates that hard carbon anodes could achieve cost parity with graphite anodes at production volumes of approximately 5-10 GWh annually, while sodium metal anodes would require significantly higher volumes to achieve similar cost efficiencies. This economic differential becomes particularly pronounced when considering the total cost of ownership, including safety systems, specialized equipment maintenance, and operational complexities associated with sodium metal handling.

From a cost perspective, hard carbon anodes offer compelling economic benefits. The raw materials for hard carbon production are abundant and inexpensive, often derived from sustainable sources such as biomass waste. Current market analysis indicates that hard carbon material costs range from $5-15 per kilogram, with projections suggesting further price reductions as production scales. The manufacturing process for hard carbon anodes closely resembles that of graphite anodes in lithium-ion batteries, enabling operational efficiencies and cost savings through established production techniques.

In contrast, sodium metal anodes face considerable manufacturing challenges that impact their scalability. The highly reactive nature of sodium metal necessitates specialized handling equipment and stringent environmental controls, significantly increasing production complexity and cost. Current sodium metal production methods require energy-intensive processes, with estimated manufacturing costs between $15-25 per kilogram, substantially higher than hard carbon alternatives.

Safety considerations further complicate the manufacturing scalability of sodium metal anodes. The pyrophoric nature of sodium metal demands advanced safety protocols and specialized facilities, adding substantial overhead to production costs. These requirements create significant barriers to entry for manufacturers and limit the potential for rapid production scaling.

Supply chain analysis reveals additional advantages for hard carbon anodes. The precursor materials for hard carbon production are widely available globally, reducing geopolitical supply risks. Conversely, while sodium is abundant, the specialized processing required for battery-grade sodium metal creates potential supply bottlenecks that could impact large-scale manufacturing capabilities.

Economic modeling of production scenarios indicates that hard carbon anodes could achieve cost parity with graphite anodes at production volumes of approximately 5-10 GWh annually, while sodium metal anodes would require significantly higher volumes to achieve similar cost efficiencies. This economic differential becomes particularly pronounced when considering the total cost of ownership, including safety systems, specialized equipment maintenance, and operational complexities associated with sodium metal handling.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!