Comparative Study of Lithium and Sodium Metal Anode Behavior

OCT 13, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Li/Na Metal Anode Evolution & Research Objectives

The evolution of lithium and sodium metal anodes represents a critical trajectory in the development of high-energy-density battery technologies. Lithium metal anodes emerged in the 1970s with theoretical specific capacity of 3860 mAh/g and the lowest negative electrochemical potential (-3.04V vs. SHE), positioning them as ideal candidates for high-energy storage systems. However, persistent challenges including dendrite formation, infinite volume change, and unstable solid electrolyte interphase (SEI) formation have hindered their commercial viability for decades.

Sodium metal anodes have gained significant attention since the 2010s as potential alternatives to lithium, driven by sodium's greater natural abundance (2.3% of Earth's crust compared to lithium's 0.0065%) and lower cost. While sodium offers a theoretical capacity of 1166 mAh/g and electrochemical potential of -2.71V vs. SHE—less favorable than lithium—its economic advantages present compelling reasons for research investment.

The technical evolution of both anode materials has followed parallel paths, with research focusing on three primary challenges: dendrite suppression, interface stabilization, and volume expansion management. Early research (1980s-1990s) concentrated on electrolyte modifications, while the 2000s saw increased focus on protective coatings and artificial SEI formation. The 2010s marked significant advances in nanostructured host materials and 3D current collectors for both lithium and sodium systems.

Recent developments (2018-present) have demonstrated promising approaches including solid-state electrolytes, advanced host structures, and interface engineering techniques that show potential for overcoming historical limitations. Particularly noteworthy is the convergence of artificial intelligence and high-throughput experimentation in accelerating materials discovery for both anode systems.

The primary research objectives in this comparative study include: (1) systematically evaluating the fundamental electrochemical behaviors of lithium and sodium metal anodes under identical testing conditions; (2) identifying transferable technologies between lithium and sodium systems; (3) developing predictive models for dendrite formation mechanisms specific to each metal; (4) establishing standardized protocols for performance evaluation; and (5) creating a technology roadmap for commercial implementation pathways.

This research aims to bridge the gap between theoretical potential and practical application by addressing the critical challenges that have historically limited metal anode deployment. By conducting parallel investigations of lithium and sodium systems, we seek to accelerate development timelines through cross-system learning and establish clear metrics for technology readiness assessment in various application scenarios.

Sodium metal anodes have gained significant attention since the 2010s as potential alternatives to lithium, driven by sodium's greater natural abundance (2.3% of Earth's crust compared to lithium's 0.0065%) and lower cost. While sodium offers a theoretical capacity of 1166 mAh/g and electrochemical potential of -2.71V vs. SHE—less favorable than lithium—its economic advantages present compelling reasons for research investment.

The technical evolution of both anode materials has followed parallel paths, with research focusing on three primary challenges: dendrite suppression, interface stabilization, and volume expansion management. Early research (1980s-1990s) concentrated on electrolyte modifications, while the 2000s saw increased focus on protective coatings and artificial SEI formation. The 2010s marked significant advances in nanostructured host materials and 3D current collectors for both lithium and sodium systems.

Recent developments (2018-present) have demonstrated promising approaches including solid-state electrolytes, advanced host structures, and interface engineering techniques that show potential for overcoming historical limitations. Particularly noteworthy is the convergence of artificial intelligence and high-throughput experimentation in accelerating materials discovery for both anode systems.

The primary research objectives in this comparative study include: (1) systematically evaluating the fundamental electrochemical behaviors of lithium and sodium metal anodes under identical testing conditions; (2) identifying transferable technologies between lithium and sodium systems; (3) developing predictive models for dendrite formation mechanisms specific to each metal; (4) establishing standardized protocols for performance evaluation; and (5) creating a technology roadmap for commercial implementation pathways.

This research aims to bridge the gap between theoretical potential and practical application by addressing the critical challenges that have historically limited metal anode deployment. By conducting parallel investigations of lithium and sodium systems, we seek to accelerate development timelines through cross-system learning and establish clear metrics for technology readiness assessment in various application scenarios.

Market Analysis for Li/Na Metal Battery Technologies

The global battery market is witnessing a significant shift towards advanced energy storage solutions, with lithium-ion batteries currently dominating the commercial landscape. However, sodium-metal batteries are emerging as a compelling alternative, particularly due to sodium's greater abundance and lower cost compared to lithium. The market for lithium metal batteries was valued at approximately $1.7 billion in 2022, with projections suggesting growth to $3.8 billion by 2030 at a CAGR of 10.2%. In contrast, the sodium-based battery market remains smaller but is experiencing accelerated growth rates of 15-18% annually, albeit from a lower base.

Consumer electronics currently represents the largest application segment for lithium metal batteries, accounting for roughly 35% of market share. Electric vehicles follow closely at 30%, with grid storage applications comprising about 20%. For sodium metal batteries, initial market penetration is occurring primarily in stationary storage applications where energy density constraints are less critical, capturing approximately 12% of new grid storage installations in developing markets.

Regional analysis reveals Asia-Pacific as the dominant manufacturing hub for both technologies, with China, Japan, and South Korea collectively controlling over 65% of lithium battery production capacity. European manufacturers are increasingly investing in sodium battery technology, with Germany and France leading research initiatives that have resulted in a 22% increase in sodium battery patents filed between 2020-2023.

Price sensitivity remains a critical market driver. Lithium carbonate prices have experienced significant volatility, reaching peaks of $80,000 per ton in 2022 before stabilizing around $35,000 in 2023. This volatility has accelerated interest in sodium technologies, where raw material costs are approximately 80-90% lower per kilowatt-hour of storage capacity.

Market adoption barriers differ significantly between the technologies. Lithium metal anodes face challenges related to dendrite formation and safety concerns, which have limited commercial deployment despite superior energy density. Sodium metal anodes encounter similar technical challenges but benefit from lower performance expectations in their target markets, allowing earlier commercialization in less demanding applications.

Industry forecasts suggest lithium metal batteries will maintain dominance in high-energy-density applications through 2030, while sodium metal batteries will likely capture 15-20% of the stationary storage market by 2028, particularly in regions with limited lithium supply chains or price sensitivity. This bifurcation represents a market opportunity exceeding $5 billion annually by 2030 for companies capable of addressing the specific technical challenges of each metal anode technology.

Consumer electronics currently represents the largest application segment for lithium metal batteries, accounting for roughly 35% of market share. Electric vehicles follow closely at 30%, with grid storage applications comprising about 20%. For sodium metal batteries, initial market penetration is occurring primarily in stationary storage applications where energy density constraints are less critical, capturing approximately 12% of new grid storage installations in developing markets.

Regional analysis reveals Asia-Pacific as the dominant manufacturing hub for both technologies, with China, Japan, and South Korea collectively controlling over 65% of lithium battery production capacity. European manufacturers are increasingly investing in sodium battery technology, with Germany and France leading research initiatives that have resulted in a 22% increase in sodium battery patents filed between 2020-2023.

Price sensitivity remains a critical market driver. Lithium carbonate prices have experienced significant volatility, reaching peaks of $80,000 per ton in 2022 before stabilizing around $35,000 in 2023. This volatility has accelerated interest in sodium technologies, where raw material costs are approximately 80-90% lower per kilowatt-hour of storage capacity.

Market adoption barriers differ significantly between the technologies. Lithium metal anodes face challenges related to dendrite formation and safety concerns, which have limited commercial deployment despite superior energy density. Sodium metal anodes encounter similar technical challenges but benefit from lower performance expectations in their target markets, allowing earlier commercialization in less demanding applications.

Industry forecasts suggest lithium metal batteries will maintain dominance in high-energy-density applications through 2030, while sodium metal batteries will likely capture 15-20% of the stationary storage market by 2028, particularly in regions with limited lithium supply chains or price sensitivity. This bifurcation represents a market opportunity exceeding $5 billion annually by 2030 for companies capable of addressing the specific technical challenges of each metal anode technology.

Current Challenges in Li/Na Metal Anode Development

Despite significant advancements in lithium-ion battery technology, both lithium and sodium metal anodes face persistent challenges that hinder their widespread commercial adoption. For lithium metal anodes, dendrite formation remains the most critical issue, where uneven metal deposition during charging creates needle-like structures that can penetrate the separator, causing short circuits and potential thermal runaway. This safety concern is particularly pronounced in fast-charging scenarios and after multiple cycles.

Sodium metal anodes exhibit similar dendrite formation problems but with distinct characteristics due to sodium's different electrochemical properties. The larger ionic radius of sodium (1.02Å compared to lithium's 0.76Å) results in slower diffusion kinetics and more pronounced volume expansion during cycling, exacerbating mechanical stability issues.

Both metal anodes suffer from significant volume changes during cycling—approximately 80% for lithium and even greater for sodium due to its larger atomic volume. These dimensional fluctuations create mechanical stress that degrades electrode integrity and accelerates capacity fade. The continuous breaking and reforming of the solid electrolyte interphase (SEI) layer during these volume changes consumes active material and electrolyte, further diminishing cycle life.

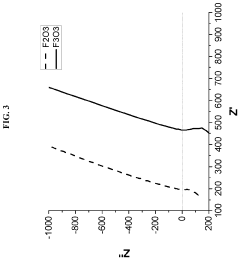

Interfacial instability presents another major challenge. The highly reactive nature of both metals leads to continuous parasitic reactions with conventional electrolytes, forming unstable SEI layers. For lithium, this typically results in mossy or dead lithium formation, while sodium's more reactive nature often produces thicker, more resistive interfaces that impede ion transport.

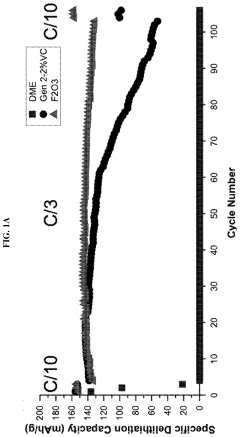

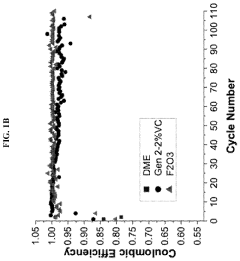

Low Coulombic efficiency plagues both systems, with first-cycle efficiencies often below 90% and declining further with cycling. This inefficiency stems from irreversible capacity loss due to SEI formation and trapped inactive metal. Sodium systems generally demonstrate even lower initial efficiencies than their lithium counterparts.

Manufacturing challenges also impede commercialization. Both metals are highly reactive with moisture and oxygen, necessitating stringent handling protocols and dry-room processing. Sodium's lower melting point (97.8°C versus lithium's 180.5°C) creates additional processing complications, as it becomes more difficult to maintain dimensional stability during manufacturing and operation at elevated temperatures.

Environmental sensitivity represents another significant barrier, as both metals react violently with water. While sodium's greater abundance offers sustainability advantages over lithium, its higher reactivity with atmospheric components presents more severe safety and handling challenges during production, assembly, and recycling processes.

Sodium metal anodes exhibit similar dendrite formation problems but with distinct characteristics due to sodium's different electrochemical properties. The larger ionic radius of sodium (1.02Å compared to lithium's 0.76Å) results in slower diffusion kinetics and more pronounced volume expansion during cycling, exacerbating mechanical stability issues.

Both metal anodes suffer from significant volume changes during cycling—approximately 80% for lithium and even greater for sodium due to its larger atomic volume. These dimensional fluctuations create mechanical stress that degrades electrode integrity and accelerates capacity fade. The continuous breaking and reforming of the solid electrolyte interphase (SEI) layer during these volume changes consumes active material and electrolyte, further diminishing cycle life.

Interfacial instability presents another major challenge. The highly reactive nature of both metals leads to continuous parasitic reactions with conventional electrolytes, forming unstable SEI layers. For lithium, this typically results in mossy or dead lithium formation, while sodium's more reactive nature often produces thicker, more resistive interfaces that impede ion transport.

Low Coulombic efficiency plagues both systems, with first-cycle efficiencies often below 90% and declining further with cycling. This inefficiency stems from irreversible capacity loss due to SEI formation and trapped inactive metal. Sodium systems generally demonstrate even lower initial efficiencies than their lithium counterparts.

Manufacturing challenges also impede commercialization. Both metals are highly reactive with moisture and oxygen, necessitating stringent handling protocols and dry-room processing. Sodium's lower melting point (97.8°C versus lithium's 180.5°C) creates additional processing complications, as it becomes more difficult to maintain dimensional stability during manufacturing and operation at elevated temperatures.

Environmental sensitivity represents another significant barrier, as both metals react violently with water. While sodium's greater abundance offers sustainability advantages over lithium, its higher reactivity with atmospheric components presents more severe safety and handling challenges during production, assembly, and recycling processes.

Comparative Analysis of Li/Na Metal Anode Solutions

01 Dendrite formation and suppression in lithium and sodium metal anodes

Lithium and sodium metal anodes tend to form dendrites during cycling, which can lead to safety issues and reduced battery performance. Various approaches have been developed to suppress dendrite formation, including the use of protective layers, electrolyte additives, and structured current collectors. These methods help to achieve more uniform metal deposition and prevent the growth of needle-like structures that can penetrate separators and cause short circuits.- Dendrite formation and suppression in lithium and sodium metal anodes: Lithium and sodium metal anodes tend to form dendrites during cycling, which can lead to short circuits and safety hazards. Various approaches have been developed to suppress dendrite formation, including the use of protective layers, electrolyte additives, and structured current collectors. These methods help to achieve more uniform metal deposition and improve the cycling stability of the anodes.

- Solid electrolyte interfaces (SEI) for metal anodes: The formation and stability of the solid electrolyte interface (SEI) layer is crucial for the performance of lithium and sodium metal anodes. Engineered SEI layers can prevent continuous electrolyte decomposition, reduce irreversible capacity loss, and enhance cycling efficiency. Various approaches to SEI engineering include electrolyte formulation, artificial SEI construction, and in-situ SEI modification techniques.

- Composite and structured metal anodes: Composite and structured metal anodes incorporate lithium or sodium with other materials to improve performance characteristics. These designs may include metal-carbon composites, metal alloys, or 3D structured frameworks that accommodate volume changes during cycling. Such structures can provide better mechanical stability, enhanced ionic conductivity, and reduced local current density, leading to improved cycling performance and safety.

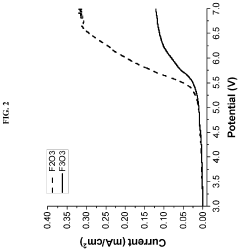

- Electrolyte systems for lithium and sodium metal anodes: Specialized electrolyte systems play a critical role in the behavior of lithium and sodium metal anodes. These include liquid electrolytes with specific additives, solid-state electrolytes, and hybrid electrolyte systems. The electrolyte composition significantly affects the interfacial stability, ion transport kinetics, and overall electrochemical performance of metal anodes, with tailored formulations helping to mitigate common failure modes.

- Comparative behavior of lithium versus sodium metal anodes: Lithium and sodium metal anodes exhibit different electrochemical behaviors due to their inherent chemical and physical properties. Sodium has lower energy density but may offer cost advantages over lithium. The larger ionic radius of sodium affects its diffusion kinetics and plating/stripping behavior. Understanding these differences is crucial for designing appropriate electrode structures, electrolytes, and battery systems for each metal anode type.

02 Solid electrolyte interfaces for metal anodes

The formation and stability of solid electrolyte interfaces (SEI) on lithium and sodium metal anodes significantly impact their cycling performance. Engineered SEI layers can protect the reactive metal surfaces from continuous reactions with the electrolyte, reduce impedance, and enable more stable cycling. Various approaches to SEI engineering include electrolyte formulation, artificial SEI construction, and in-situ SEI modification techniques that enhance the mechanical and chemical stability of the interface.Expand Specific Solutions03 Composite and alloying strategies for metal anodes

Composite and alloying approaches are employed to improve the stability and performance of lithium and sodium metal anodes. These strategies involve combining the active metal with other materials such as carbon, polymers, or other metals to create composite structures that can better accommodate volume changes during cycling and provide enhanced mechanical stability. Alloying with elements like silicon, tin, or aluminum can also modify the electrochemical properties and improve cycling efficiency.Expand Specific Solutions04 Electrolyte design for lithium and sodium metal anodes

Electrolyte composition plays a crucial role in the behavior of lithium and sodium metal anodes. Specialized electrolytes containing additives, high salt concentrations, or novel solvent systems can significantly improve metal deposition morphology and cycling stability. Advanced electrolyte designs focus on creating stable interfaces, reducing side reactions, and enabling high coulombic efficiency during repeated plating and stripping cycles of the metal anodes.Expand Specific Solutions05 Three-dimensional structured metal anodes

Three-dimensional structured designs for lithium and sodium metal anodes offer advantages over traditional planar electrodes. These structures, which include porous frameworks, nanostructured hosts, and 3D current collectors, can reduce local current density, provide space for volume expansion, and guide uniform metal deposition. By controlling the deposition process through structural engineering, these designs mitigate dendrite formation and improve the cycling stability and rate capability of metal anodes.Expand Specific Solutions

Key Industry Players in Metal Anode Research

The lithium and sodium metal anode market is currently in a transitional phase, with lithium technology dominating commercial applications while sodium-based solutions emerge as promising alternatives. The global market for these technologies is projected to grow significantly, driven by increasing demand for high-energy-density batteries in electric vehicles and energy storage systems. Technologically, lithium metal anodes are more mature, with companies like Samsung SDI, Toyota, and CATL (Ningde Amperex) leading commercial deployment. However, sodium-based alternatives are gaining momentum due to cost advantages and resource abundance, with Faradion, Factorial, and Johnson Matthey making significant research advances. Academic institutions including Northwestern University, Xiamen University, and KAIST are accelerating innovation through fundamental research, particularly in addressing dendrite formation and interface stability challenges common to both chemistries.

Toyota Motor Corp.

Technical Solution: Toyota has developed a multi-faceted approach to both lithium and sodium metal anode technologies through their advanced battery research division. For lithium metal anodes, Toyota has pioneered solid-state electrolyte systems using sulfide-based materials that enable stable lithium metal cycling. Their proprietary technology includes a gradient interface between the lithium metal and solid electrolyte that minimizes interfacial resistance while preventing dendrite penetration. This approach has demonstrated over 1000 cycles with minimal capacity degradation in laboratory settings. For sodium metal anodes, Toyota has focused on developing specialized carbon-based host structures that accommodate sodium's larger ionic radius and different plating/stripping behaviors compared to lithium. Their research includes novel electrolyte formulations with sodium-specific additives that form stable SEI layers, addressing the higher reactivity of sodium metal with conventional electrolyte components.

Strengths: Toyota's extensive experience in vehicle electrification provides practical insights into real-world battery requirements; their solid-state battery research for lithium metal is among the most advanced in the automotive sector. Weaknesses: Their sodium metal anode technology remains at a lower technology readiness level compared to their lithium metal systems, with challenges in achieving comparable energy density and cycle life to lithium-based alternatives.

Faradion Ltd.

Technical Solution: Faradion has established itself as a global leader in sodium-ion battery technology with significant comparative research between lithium and sodium metal anodes. Their proprietary technology focuses on hard carbon anode materials specifically engineered for sodium-ion intercalation, which they've optimized through precise control of porosity and surface functionality. While not directly using sodium metal anodes in their commercial products due to safety concerns, their research extensively compares sodium metal half-cells with their practical sodium-ion systems to benchmark performance. Faradion has developed specialized electrolyte formulations that address the unique challenges of sodium's higher reactivity compared to lithium, incorporating fluorinated solvents and novel salt combinations that form more stable solid-electrolyte interphases on both sodium and carbon surfaces. Their comparative studies have demonstrated that properly engineered sodium-ion systems can achieve energy densities approaching 160 Wh/kg at the cell level, with significantly lower raw material costs than lithium-based alternatives.

Strengths: Unparalleled expertise in sodium-based battery chemistry; commercial-ready technology with established manufacturing processes; significantly lower cost profile compared to lithium technologies. Weaknesses: Lower energy density compared to lithium metal systems; less mature supply chain for sodium-specific battery materials; still working to improve low-temperature performance relative to lithium counterparts.

Critical Patents in Metal Anode Interface Engineering

Lithium metal anode comprising protective layer

PatentPendingUS20250210636A1

Innovation

- A lithium metal anode with a protective layer comprising lithium iodide (LiI) and lithium fluoride (LiF) is developed, where LiI is dispersed in a porous LiF matrix, enhancing lithium ion conductivity and allowing for homogeneous lithium stripping and plating, and LiI leaching replenishes lithium in the cathode.

Novel fluorinated ethers as electrolyte solvents for lithium metal, sodium metal, magnesium metal or sulfur batteries

PatentInactiveUS20230246237A1

Innovation

- Incorporating a perfluorinated alkyl segment and an ether segment into highly fluorinated materials to create asymmetric fluorinated glycol ethers, which exhibit high oxidation potential and good solubility of lithium salts, forming a promising electrolyte solvent for lithium metal batteries with improved capacity retention and Coulombic efficiency.

Safety Considerations for Metal Anode Batteries

Safety considerations for metal anode batteries represent a critical aspect in the comparative analysis of lithium and sodium metal anodes. The inherent reactivity of alkali metals with atmospheric components poses significant challenges. Lithium metal anodes demonstrate extreme sensitivity to moisture and oxygen, potentially leading to violent reactions including fire and explosion when exposed to air or water. Sodium metal exhibits similar reactivity patterns, though with some distinct characteristics that affect safety profiles.

Dendrite formation constitutes a major safety concern in both lithium and sodium metal batteries. These needle-like structures can grow during charging cycles, potentially penetrating the separator and causing internal short circuits. Research indicates that lithium dendrites typically grow more aggressively than sodium dendrites under similar conditions, attributable to differences in surface energy and ion transport mechanisms.

Thermal runaway risk varies between these metal anode systems. Lithium metal anodes generally store higher energy density, which correlates with more severe thermal events when failure occurs. Sodium systems typically demonstrate lower energy density, potentially resulting in less catastrophic failure modes, though still requiring robust safety measures.

Electrolyte compatibility significantly impacts safety profiles. Conventional carbonate-based electrolytes form unstable interfaces with both metals, though recent advances in electrolyte engineering have shown promising improvements. Sodium systems often demonstrate greater compatibility with alternative electrolytes, including those based on glyme structures, potentially offering safety advantages in specific applications.

The solid electrolyte interphase (SEI) formation dynamics differ substantially between lithium and sodium anodes, affecting long-term stability and safety. Lithium typically forms more compact and stable SEI layers under optimal conditions, while sodium SEI layers tend to be more brittle and mechanically unstable, potentially leading to different failure mechanisms during extended cycling.

Transportation and storage regulations reflect these safety concerns, with both metals classified as dangerous goods requiring specialized handling protocols. Lithium metal faces stricter transportation restrictions due to its established history of safety incidents, while sodium metal regulations continue to evolve as the technology advances toward commercialization.

Advanced safety engineering approaches include physical protection mechanisms such as pressure-relief designs, thermal fuses, and battery management systems calibrated to the specific characteristics of each metal anode system. Recent innovations in separator technology and cell architecture demonstrate promising pathways to mitigate the inherent risks associated with both lithium and sodium metal anodes.

Dendrite formation constitutes a major safety concern in both lithium and sodium metal batteries. These needle-like structures can grow during charging cycles, potentially penetrating the separator and causing internal short circuits. Research indicates that lithium dendrites typically grow more aggressively than sodium dendrites under similar conditions, attributable to differences in surface energy and ion transport mechanisms.

Thermal runaway risk varies between these metal anode systems. Lithium metal anodes generally store higher energy density, which correlates with more severe thermal events when failure occurs. Sodium systems typically demonstrate lower energy density, potentially resulting in less catastrophic failure modes, though still requiring robust safety measures.

Electrolyte compatibility significantly impacts safety profiles. Conventional carbonate-based electrolytes form unstable interfaces with both metals, though recent advances in electrolyte engineering have shown promising improvements. Sodium systems often demonstrate greater compatibility with alternative electrolytes, including those based on glyme structures, potentially offering safety advantages in specific applications.

The solid electrolyte interphase (SEI) formation dynamics differ substantially between lithium and sodium anodes, affecting long-term stability and safety. Lithium typically forms more compact and stable SEI layers under optimal conditions, while sodium SEI layers tend to be more brittle and mechanically unstable, potentially leading to different failure mechanisms during extended cycling.

Transportation and storage regulations reflect these safety concerns, with both metals classified as dangerous goods requiring specialized handling protocols. Lithium metal faces stricter transportation restrictions due to its established history of safety incidents, while sodium metal regulations continue to evolve as the technology advances toward commercialization.

Advanced safety engineering approaches include physical protection mechanisms such as pressure-relief designs, thermal fuses, and battery management systems calibrated to the specific characteristics of each metal anode system. Recent innovations in separator technology and cell architecture demonstrate promising pathways to mitigate the inherent risks associated with both lithium and sodium metal anodes.

Sustainability Impact of Li vs Na Battery Technologies

The environmental impact of battery technologies has become increasingly critical as the world transitions to renewable energy systems. When comparing lithium and sodium-based battery technologies, several sustainability factors emerge as significant differentiators that could shape future energy storage landscapes.

Lithium extraction processes, particularly from brine operations in South America's "Lithium Triangle," consume vast quantities of water—approximately 500,000 gallons per ton of lithium. This intensive water usage threatens local ecosystems and agricultural communities in already water-stressed regions. Additionally, hard-rock lithium mining generates substantial carbon emissions and creates significant land disturbance through open-pit operations.

In contrast, sodium resources demonstrate superior sustainability characteristics. Sodium is approximately 1,000 times more abundant in the Earth's crust than lithium, with vast reserves available from seawater and common salt deposits. This abundance translates to reduced extraction pressures on any single geographic region and potentially lower environmental impact per unit of battery production.

The carbon footprint analysis reveals notable differences between these technologies. Life cycle assessments indicate that sodium-ion batteries could reduce production-phase carbon emissions by 18-30% compared to lithium-ion alternatives. This advantage stems primarily from less energy-intensive mining and refining processes for sodium materials, alongside reduced requirements for high-purity processing environments.

Resource circularity presents another critical sustainability dimension. Current lithium battery recycling rates remain suboptimal at approximately 5% globally, with complex separation processes required for material recovery. Emerging sodium battery designs show promise for simplified recycling pathways due to less complex material compositions and reduced dependency on critical minerals like cobalt and nickel.

Supply chain resilience further differentiates these technologies. Lithium supply chains face geopolitical vulnerabilities with production concentrated in Australia, Chile, and China. Sodium's widespread availability could enable more distributed manufacturing networks, potentially reducing transportation emissions and supporting regional energy independence.

Water impact metrics particularly favor sodium technologies. While lithium extraction can consume 2,000 liters of water per kilogram of battery-grade material in arid regions, sodium extraction methods typically require 65-80% less water, offering significant advantages in water-stressed environments where energy storage deployment is often critical.

As battery deployment scales to terawatt-hour levels required for global energy transition, these sustainability differentials between lithium and sodium technologies will likely become increasingly consequential for environmental outcomes and resource security.

Lithium extraction processes, particularly from brine operations in South America's "Lithium Triangle," consume vast quantities of water—approximately 500,000 gallons per ton of lithium. This intensive water usage threatens local ecosystems and agricultural communities in already water-stressed regions. Additionally, hard-rock lithium mining generates substantial carbon emissions and creates significant land disturbance through open-pit operations.

In contrast, sodium resources demonstrate superior sustainability characteristics. Sodium is approximately 1,000 times more abundant in the Earth's crust than lithium, with vast reserves available from seawater and common salt deposits. This abundance translates to reduced extraction pressures on any single geographic region and potentially lower environmental impact per unit of battery production.

The carbon footprint analysis reveals notable differences between these technologies. Life cycle assessments indicate that sodium-ion batteries could reduce production-phase carbon emissions by 18-30% compared to lithium-ion alternatives. This advantage stems primarily from less energy-intensive mining and refining processes for sodium materials, alongside reduced requirements for high-purity processing environments.

Resource circularity presents another critical sustainability dimension. Current lithium battery recycling rates remain suboptimal at approximately 5% globally, with complex separation processes required for material recovery. Emerging sodium battery designs show promise for simplified recycling pathways due to less complex material compositions and reduced dependency on critical minerals like cobalt and nickel.

Supply chain resilience further differentiates these technologies. Lithium supply chains face geopolitical vulnerabilities with production concentrated in Australia, Chile, and China. Sodium's widespread availability could enable more distributed manufacturing networks, potentially reducing transportation emissions and supporting regional energy independence.

Water impact metrics particularly favor sodium technologies. While lithium extraction can consume 2,000 liters of water per kilogram of battery-grade material in arid regions, sodium extraction methods typically require 65-80% less water, offering significant advantages in water-stressed environments where energy storage deployment is often critical.

As battery deployment scales to terawatt-hour levels required for global energy transition, these sustainability differentials between lithium and sodium technologies will likely become increasingly consequential for environmental outcomes and resource security.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!