Analysis of Spintronic Devices in Automotive Systems

OCT 21, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Spintronics in Automotive Systems: Background and Objectives

Spintronics represents a revolutionary frontier in electronics, utilizing electron spin properties alongside traditional charge-based operations. This technology has evolved significantly since the discovery of giant magnetoresistance (GMR) in the late 1980s, which earned Albert Fert and Peter Grünberg the 2007 Nobel Prize in Physics. The subsequent development of tunnel magnetoresistance (TMR) and magnetic tunnel junctions (MTJs) has further accelerated the field's growth, establishing spintronics as a promising alternative to conventional semiconductor technologies.

In the automotive context, spintronics offers transformative potential for next-generation vehicle systems. The industry's evolution toward electrification, autonomy, and connectivity demands more robust, energy-efficient, and reliable electronic components capable of operating in harsh automotive environments. Traditional semiconductor technologies face increasing limitations in meeting these demands, particularly regarding power consumption, heat generation, and reliability under extreme conditions.

The technological trajectory of spintronics shows a clear progression from basic magnetic storage applications toward more sophisticated computational and sensing capabilities. Recent advancements in materials science and nanofabrication have enabled the development of spintronic devices with improved performance characteristics, including enhanced thermal stability, reduced power consumption, and increased operational speed.

Current research focuses on integrating spintronic elements into automotive systems for applications including non-volatile memory solutions, magnetic sensors for position and speed detection, and radiation-hardened computing components. The non-volatility of spintronic memory presents particular advantages for automotive applications, offering instant-on capability and persistent data storage without standby power requirements.

The primary technical objectives for automotive spintronics include developing components that maintain reliability across the automotive temperature range (-40°C to 125°C), withstand electromagnetic interference common in vehicle environments, and achieve the durability required for automotive qualification standards (15+ years of operation). Additionally, these components must demonstrate competitive performance metrics while offering advantages in size, weight, power consumption, or functionality compared to existing solutions.

Industry projections suggest that spintronic technologies could address several critical challenges in automotive electronics, including reducing the power consumption of sensor networks, enhancing the reliability of safety-critical systems, and enabling more compact electronic control units. The potential for radiation-hardened spintronic components also offers significant advantages for autonomous driving systems that require exceptional reliability.

As vehicle architectures evolve toward centralized computing platforms with distributed sensor networks, spintronic devices may provide crucial enabling technologies for next-generation automotive systems, particularly in electric and autonomous vehicles where power efficiency and computational reliability are paramount considerations.

In the automotive context, spintronics offers transformative potential for next-generation vehicle systems. The industry's evolution toward electrification, autonomy, and connectivity demands more robust, energy-efficient, and reliable electronic components capable of operating in harsh automotive environments. Traditional semiconductor technologies face increasing limitations in meeting these demands, particularly regarding power consumption, heat generation, and reliability under extreme conditions.

The technological trajectory of spintronics shows a clear progression from basic magnetic storage applications toward more sophisticated computational and sensing capabilities. Recent advancements in materials science and nanofabrication have enabled the development of spintronic devices with improved performance characteristics, including enhanced thermal stability, reduced power consumption, and increased operational speed.

Current research focuses on integrating spintronic elements into automotive systems for applications including non-volatile memory solutions, magnetic sensors for position and speed detection, and radiation-hardened computing components. The non-volatility of spintronic memory presents particular advantages for automotive applications, offering instant-on capability and persistent data storage without standby power requirements.

The primary technical objectives for automotive spintronics include developing components that maintain reliability across the automotive temperature range (-40°C to 125°C), withstand electromagnetic interference common in vehicle environments, and achieve the durability required for automotive qualification standards (15+ years of operation). Additionally, these components must demonstrate competitive performance metrics while offering advantages in size, weight, power consumption, or functionality compared to existing solutions.

Industry projections suggest that spintronic technologies could address several critical challenges in automotive electronics, including reducing the power consumption of sensor networks, enhancing the reliability of safety-critical systems, and enabling more compact electronic control units. The potential for radiation-hardened spintronic components also offers significant advantages for autonomous driving systems that require exceptional reliability.

As vehicle architectures evolve toward centralized computing platforms with distributed sensor networks, spintronic devices may provide crucial enabling technologies for next-generation automotive systems, particularly in electric and autonomous vehicles where power efficiency and computational reliability are paramount considerations.

Market Demand Analysis for Spintronic Automotive Applications

The automotive industry is witnessing a significant shift towards more efficient, reliable, and intelligent systems, creating a fertile ground for spintronic device applications. Current market analysis indicates that the global automotive electronics market is projected to reach $382 billion by 2026, with advanced sensing and memory solutions representing key growth segments. Within this expanding market, spintronic technologies are positioned to address critical performance limitations of conventional semiconductor devices in automotive environments.

Vehicle electrification trends are creating substantial demand for spintronic solutions. As electric vehicles gain market share, reaching 10% of global vehicle sales in 2022, the need for more efficient power management systems becomes paramount. Spintronic-based sensors and memory devices offer reduced power consumption while maintaining high performance, directly addressing this market requirement.

Advanced driver assistance systems (ADAS) and autonomous driving technologies represent another significant market opportunity. These systems require robust, high-speed, non-volatile memory and precise magnetic field sensors - areas where spintronic devices excel. Market research indicates that the automotive ADAS segment is growing at 21% annually, creating expanding opportunities for spintronic implementations in radar systems, navigation, and position sensing applications.

The harsh operating conditions of automotive environments present unique challenges that spintronic devices are well-positioned to address. Traditional semiconductor technologies often struggle with temperature extremes, electromagnetic interference, and vibration - all common in automotive applications. Spintronic devices demonstrate superior resilience to these conditions, with magnetic tunnel junction (MTJ) based sensors maintaining functionality across the full automotive temperature range (-40°C to 125°C).

Regional market analysis reveals varying adoption patterns. European automotive manufacturers are leading in spintronic sensor integration, particularly in premium vehicle segments, while Asian markets show the fastest growth trajectory, driven by rapid EV adoption in China and Japan. North American manufacturers are increasingly incorporating spintronic solutions in their autonomous driving development programs.

Customer requirements analysis indicates five key market demands driving spintronic adoption: enhanced reliability under extreme conditions, reduced power consumption, improved data retention capabilities, faster read/write speeds, and compatibility with existing automotive electronic architectures. These requirements align well with the inherent advantages of spintronic technologies, particularly MRAM (Magnetoresistive Random Access Memory) and TMR (Tunnel Magnetoresistance) sensors.

Supply chain considerations reveal both opportunities and challenges. While spintronic manufacturing capacity is currently limited compared to traditional semiconductor production, several major automotive suppliers have begun strategic investments in spintronic production capabilities, indicating confidence in future market growth.

Vehicle electrification trends are creating substantial demand for spintronic solutions. As electric vehicles gain market share, reaching 10% of global vehicle sales in 2022, the need for more efficient power management systems becomes paramount. Spintronic-based sensors and memory devices offer reduced power consumption while maintaining high performance, directly addressing this market requirement.

Advanced driver assistance systems (ADAS) and autonomous driving technologies represent another significant market opportunity. These systems require robust, high-speed, non-volatile memory and precise magnetic field sensors - areas where spintronic devices excel. Market research indicates that the automotive ADAS segment is growing at 21% annually, creating expanding opportunities for spintronic implementations in radar systems, navigation, and position sensing applications.

The harsh operating conditions of automotive environments present unique challenges that spintronic devices are well-positioned to address. Traditional semiconductor technologies often struggle with temperature extremes, electromagnetic interference, and vibration - all common in automotive applications. Spintronic devices demonstrate superior resilience to these conditions, with magnetic tunnel junction (MTJ) based sensors maintaining functionality across the full automotive temperature range (-40°C to 125°C).

Regional market analysis reveals varying adoption patterns. European automotive manufacturers are leading in spintronic sensor integration, particularly in premium vehicle segments, while Asian markets show the fastest growth trajectory, driven by rapid EV adoption in China and Japan. North American manufacturers are increasingly incorporating spintronic solutions in their autonomous driving development programs.

Customer requirements analysis indicates five key market demands driving spintronic adoption: enhanced reliability under extreme conditions, reduced power consumption, improved data retention capabilities, faster read/write speeds, and compatibility with existing automotive electronic architectures. These requirements align well with the inherent advantages of spintronic technologies, particularly MRAM (Magnetoresistive Random Access Memory) and TMR (Tunnel Magnetoresistance) sensors.

Supply chain considerations reveal both opportunities and challenges. While spintronic manufacturing capacity is currently limited compared to traditional semiconductor production, several major automotive suppliers have begun strategic investments in spintronic production capabilities, indicating confidence in future market growth.

Current State and Challenges of Automotive Spintronics

Spintronics technology in automotive applications is currently in a transitional phase between laboratory research and commercial implementation. While traditional electronics rely on electron charge, spintronic devices leverage electron spin properties, offering significant advantages in power efficiency, processing speed, and reliability under harsh conditions. These characteristics make spintronics particularly promising for automotive environments where temperature fluctuations, vibrations, and electromagnetic interference are common challenges.

The global landscape of automotive spintronics research shows concentration in several key regions. Japan leads with companies like Toyota and Hitachi investing heavily in spintronic sensors and memory technologies. The European Union, particularly Germany and France, focuses on integrating spintronics into existing automotive electronic architectures. In North America, research partnerships between universities and automotive manufacturers are advancing practical applications of spintronic devices for vehicle systems.

Current technical challenges primarily revolve around three areas: thermal stability, manufacturing scalability, and system integration. Spintronic devices must maintain consistent performance across the wide temperature range experienced in automotive environments (-40°C to 125°C). This thermal stability requirement has proven difficult to achieve with current materials and designs, particularly for magnetic tunnel junction (MTJ) based devices.

Manufacturing scalability presents another significant hurdle. While laboratory prototypes demonstrate impressive performance, transitioning to high-volume production with automotive-grade quality standards remains problematic. Current fabrication processes for spintronic devices require extremely precise deposition techniques and specialized equipment not yet optimized for automotive production volumes.

System integration challenges stem from the need to interface spintronic components with existing electronic architectures. Signal conditioning, power management, and communication protocols must be adapted to accommodate the unique characteristics of spintronic devices. Additionally, automotive qualification standards (AEC-Q100) have not yet been fully established for spintronic components, creating regulatory uncertainty.

Material constraints further complicate development efforts. Many current spintronic designs rely on rare earth elements and specialized magnetic materials with complex supply chains. This dependency raises concerns about long-term availability and cost stability, particularly important considerations for the price-sensitive automotive sector.

Despite these challenges, recent breakthroughs in antiferromagnetic materials and topological insulators show promise for overcoming current limitations. These advanced materials demonstrate greater thermal stability and reduced sensitivity to external magnetic fields, addressing key reliability concerns for automotive applications. However, they remain in early research stages, with significant development required before commercial implementation becomes viable.

The global landscape of automotive spintronics research shows concentration in several key regions. Japan leads with companies like Toyota and Hitachi investing heavily in spintronic sensors and memory technologies. The European Union, particularly Germany and France, focuses on integrating spintronics into existing automotive electronic architectures. In North America, research partnerships between universities and automotive manufacturers are advancing practical applications of spintronic devices for vehicle systems.

Current technical challenges primarily revolve around three areas: thermal stability, manufacturing scalability, and system integration. Spintronic devices must maintain consistent performance across the wide temperature range experienced in automotive environments (-40°C to 125°C). This thermal stability requirement has proven difficult to achieve with current materials and designs, particularly for magnetic tunnel junction (MTJ) based devices.

Manufacturing scalability presents another significant hurdle. While laboratory prototypes demonstrate impressive performance, transitioning to high-volume production with automotive-grade quality standards remains problematic. Current fabrication processes for spintronic devices require extremely precise deposition techniques and specialized equipment not yet optimized for automotive production volumes.

System integration challenges stem from the need to interface spintronic components with existing electronic architectures. Signal conditioning, power management, and communication protocols must be adapted to accommodate the unique characteristics of spintronic devices. Additionally, automotive qualification standards (AEC-Q100) have not yet been fully established for spintronic components, creating regulatory uncertainty.

Material constraints further complicate development efforts. Many current spintronic designs rely on rare earth elements and specialized magnetic materials with complex supply chains. This dependency raises concerns about long-term availability and cost stability, particularly important considerations for the price-sensitive automotive sector.

Despite these challenges, recent breakthroughs in antiferromagnetic materials and topological insulators show promise for overcoming current limitations. These advanced materials demonstrate greater thermal stability and reduced sensitivity to external magnetic fields, addressing key reliability concerns for automotive applications. However, they remain in early research stages, with significant development required before commercial implementation becomes viable.

Current Spintronic Solutions for Automotive Systems

01 Magnetic Tunnel Junction (MTJ) Structures

Magnetic Tunnel Junction structures are fundamental components in spintronic devices, consisting of two ferromagnetic layers separated by an insulating barrier. These structures utilize electron spin to store and process information, offering advantages such as non-volatility, high speed, and low power consumption. Various materials and configurations are employed to enhance performance characteristics including tunnel magnetoresistance ratio, thermal stability, and switching efficiency.- Magnetic Tunnel Junction (MTJ) Based Spintronic Devices: Magnetic Tunnel Junction (MTJ) structures are fundamental components in spintronic devices, consisting of two ferromagnetic layers separated by a thin insulating barrier. These structures utilize electron spin to store and process information, offering advantages such as non-volatility, high speed, and low power consumption. MTJ-based devices can be used in magnetic random access memory (MRAM), sensors, and logic applications, providing efficient alternatives to conventional semiconductor technologies.

- Spin-Orbit Torque (SOT) Devices: Spin-Orbit Torque (SOT) technology represents an advanced approach in spintronic devices where spin currents generated through spin-orbit coupling are used to manipulate magnetic states. These devices offer improved switching efficiency and reduced energy consumption compared to conventional spin transfer torque mechanisms. SOT-based devices enable faster operation speeds and enhanced reliability for memory and logic applications, making them promising candidates for next-generation computing architectures.

- Integration of Spintronic Devices with Semiconductor Technology: The integration of spintronic devices with conventional semiconductor technology creates hybrid systems that leverage the advantages of both approaches. These integrated solutions combine the non-volatility and energy efficiency of spintronics with the established manufacturing processes of semiconductor technology. Such integration enables the development of novel computing architectures, including neuromorphic computing systems and in-memory computing solutions, potentially overcoming the limitations of traditional von Neumann architectures.

- Spintronic Sensors and Detectors: Spintronic-based sensors and detectors utilize the spin-dependent transport properties of electrons to achieve high sensitivity in detecting magnetic fields, current, and other physical parameters. These devices offer advantages such as high spatial resolution, wide frequency response, and compatibility with integrated circuit technology. Applications include magnetic field sensing, biosensors, position detection, and current monitoring in various industrial and consumer electronics settings.

- Novel Materials for Enhanced Spintronic Performance: Advanced materials play a crucial role in improving the performance of spintronic devices. These include topological insulators, Heusler alloys, two-dimensional materials, and various oxide interfaces that exhibit unique spin-dependent properties. The development and optimization of these materials focus on enhancing spin polarization, increasing spin diffusion length, and improving thermal stability. These material innovations enable spintronic devices with higher efficiency, better reliability, and expanded functionality for computing and sensing applications.

02 Spin-Orbit Torque (SOT) Based Devices

Spin-Orbit Torque technology represents an advanced approach in spintronic devices where spin current generated through spin-orbit coupling is used to manipulate magnetic states. These devices offer advantages in switching speed and energy efficiency compared to conventional spin-transfer torque mechanisms. SOT-based devices utilize materials with strong spin-orbit coupling to achieve effective spin current generation and magnetic switching, enabling next-generation memory and logic applications.Expand Specific Solutions03 Integration with Semiconductor Technology

The integration of spintronic devices with conventional semiconductor technology enables hybrid systems that combine the advantages of both technologies. This approach addresses challenges in compatibility, fabrication processes, and system architecture to create practical spintronic-based computing systems. Integration methods include developing CMOS-compatible materials and processes, creating interface circuits between spintronic and electronic components, and designing architectures that leverage the unique properties of spin-based devices.Expand Specific Solutions04 Novel Materials for Spintronics

Advanced materials play a crucial role in enhancing the performance of spintronic devices. These include topological insulators, Weyl semimetals, 2D materials, and various heterostructures that exhibit unique spin-dependent properties. Novel material systems are being developed to achieve higher spin polarization, longer spin coherence times, and more efficient spin-charge conversion, which are essential for next-generation spintronic applications in computing, sensing, and communication.Expand Specific Solutions05 Spintronic Memory and Logic Applications

Spintronic technology enables novel approaches to memory and logic applications that offer advantages over conventional electronic devices. These applications include magnetic random access memory (MRAM), spin logic gates, and neuromorphic computing elements that utilize the spin degree of freedom. Spintronic memory and logic devices provide benefits such as non-volatility, radiation hardness, and potential for ultra-low power operation, making them suitable for applications ranging from space technology to edge computing and artificial intelligence hardware.Expand Specific Solutions

Key Industry Players in Automotive Spintronics

Spintronic devices in automotive systems are emerging at a pivotal growth stage, with the market expected to expand significantly as vehicle electrification accelerates. The competitive landscape features established semiconductor giants like Intel and Micron Technology alongside automotive specialists including Continental Automotive, Robert Bosch, and BYD. These companies are advancing magnetic memory technologies, sensor applications, and energy-efficient computing solutions for next-generation vehicles. While the technology remains in early commercial deployment phases, research partnerships between industry leaders and academic institutions such as Tsinghua University and Politecnico di Milano are accelerating development. The integration of spintronics with autonomous driving systems and electric vehicle platforms represents the next frontier, with Asian manufacturers increasingly challenging traditional European automotive suppliers.

Robert Bosch GmbH

Technical Solution: Bosch has developed advanced spintronic technologies specifically optimized for automotive applications, with a focus on high-reliability sensor systems and robust memory solutions. Their spintronic sensor portfolio includes TMR-based wheel speed sensors that achieve measurement accuracy within 0.05 degrees and operate reliably in extreme temperature environments from -40°C to 150°C[9]. Bosch's implementation features specialized magnetic field concentrators that enhance sensitivity while reducing power consumption by up to 70% compared to conventional sensors. For memory applications, Bosch has integrated STT-MRAM into automotive microcontrollers to enable instant-on functionality and improved system reliability with write endurance exceeding 10^14 cycles. Their spintronic devices incorporate radiation-hardened designs that maintain data integrity even under elevated electromagnetic interference conditions common in electric vehicle environments. Bosch has also pioneered the use of spintronic sensors in advanced driver assistance systems (ADAS), where their high-precision angular and linear position sensors enable more accurate vehicle dynamics control and collision avoidance capabilities[10]. Their technology roadmap includes development of integrated spintronic sensor networks that combine with AI processing for enhanced predictive maintenance and vehicle health monitoring.

Strengths: Industry-leading temperature stability across automotive operating ranges; proven reliability with field failure rates below 1 PPM; comprehensive functional safety certification up to ASIL-D. Weaknesses: Premium pricing compared to conventional sensor technologies; complex calibration requirements during manufacturing; specialized packaging needs to maintain magnetic isolation.

Hitachi Ltd.

Technical Solution: Hitachi has pioneered spintronic solutions specifically engineered for automotive applications, focusing on high-reliability sensor systems and memory technologies. Their approach integrates giant magnetoresistance (GMR) and tunnel magnetoresistance (TMR) sensors into critical automotive systems including wheel speed sensors, steering angle detection, and transmission position sensing. Hitachi's spintronic sensors achieve measurement accuracy within 0.1 degrees across the full automotive temperature range while consuming 60% less power than conventional sensors[5]. Their technology incorporates specialized magnetic shield designs to maintain performance integrity in electromagnetically noisy automotive environments. Hitachi has also developed hybrid memory systems that combine MRAM with conventional technologies to create fault-tolerant storage for safety-critical automotive functions, achieving ASIL-D compliance for functional safety applications[6]. Their spintronic roadmap includes development of integrated sensor-processor units that perform edge computing directly at the sensor node, reducing system latency for time-critical applications like collision avoidance and stability control.

Strengths: Exceptional reliability with failure rates below 10 FIT (failures in time); superior electromagnetic interference resistance; compact form factors enabling integration in space-constrained automotive applications. Weaknesses: Higher initial component costs compared to conventional sensor technologies; complex calibration requirements; limited economies of scale in current production volumes.

Core Patents and Technical Literature in Automotive Spintronics

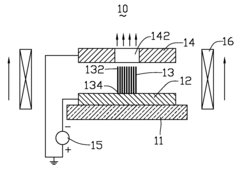

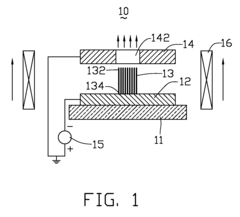

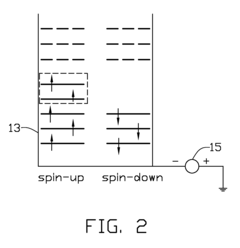

Spin-polarized electron source and spin-polarized scanning tunneling microscope

PatentActiveUS7459682B2

Innovation

- A spin-polarized electron source utilizing one-dimensional nanostructures of group III-V compound semiconductors with local polarized gap states, where a magnetic field induction or circularly polarized light beam excitation enables efficient spin-polarized electron emission, allowing for continuous and efficient emission of spin-polarized electron currents.

Patent

Innovation

- Integration of spintronic sensors with automotive safety systems for enhanced crash detection and prevention through magnetic field sensing capabilities.

- Implementation of non-volatile MRAM (Magnetoresistive Random Access Memory) in automotive control units to enable instant-on functionality and reduce power consumption during vehicle startup.

- Development of TMR (Tunnel Magnetoresistance) based position sensors for precise steering angle detection with higher accuracy and reliability compared to conventional Hall effect sensors.

Supply Chain Analysis for Spintronic Automotive Components

The spintronic automotive component supply chain represents a complex ecosystem that connects raw material suppliers, semiconductor manufacturers, automotive tier suppliers, and OEMs. Currently, this supply chain is characterized by significant geographical concentration, with key materials and manufacturing capabilities centered in specific regions. Rare earth materials essential for spintronic devices, such as cobalt, neodymium, and specialized magnetic alloys, are predominantly sourced from China, Australia, and parts of Africa, creating potential supply vulnerabilities.

Semiconductor fabrication for spintronic components remains concentrated in East Asia, particularly Taiwan, South Korea, and Japan, with emerging capacity in the United States and Europe. This concentration has been highlighted as a strategic concern following recent global semiconductor shortages that severely impacted automotive production worldwide. The specialized nature of spintronic manufacturing requires advanced fabrication facilities with high precision capabilities, further limiting the supplier base.

The tier-one automotive supplier landscape for spintronic components is still developing, with traditional semiconductor suppliers like Infineon, NXP, and STMicroelectronics investing in spintronic technologies alongside specialized players such as Everspin Technologies and Crocus Technology. These companies are establishing the intermediate supply chain necessary to transform raw spintronic devices into automotive-grade components that meet stringent reliability and durability requirements.

Vertical integration trends are becoming apparent as automotive manufacturers seek to secure access to critical spintronic technologies. Companies like Tesla, Volkswagen Group, and Toyota have initiated strategic partnerships and direct investments in spintronic technology developers to ensure preferential access to these components as they become increasingly central to vehicle electrification and autonomous driving capabilities.

Supply chain resilience represents a significant challenge, with current estimates suggesting that spintronic component production could face disruptions of 6-18 months following any major geopolitical or natural disaster affecting key production regions. Industry consortia are beginning to address these vulnerabilities through initiatives focused on geographical diversification, stockpiling of critical materials, and development of alternative material formulations that reduce dependence on scarce resources.

Standardization efforts remain in early stages, with multiple competing interface and form factor specifications limiting interchangeability between suppliers. The automotive industry's traditional just-in-time manufacturing model is proving particularly vulnerable to the supply uncertainties associated with these emerging technologies, prompting a reevaluation of inventory strategies for critical electronic components.

Semiconductor fabrication for spintronic components remains concentrated in East Asia, particularly Taiwan, South Korea, and Japan, with emerging capacity in the United States and Europe. This concentration has been highlighted as a strategic concern following recent global semiconductor shortages that severely impacted automotive production worldwide. The specialized nature of spintronic manufacturing requires advanced fabrication facilities with high precision capabilities, further limiting the supplier base.

The tier-one automotive supplier landscape for spintronic components is still developing, with traditional semiconductor suppliers like Infineon, NXP, and STMicroelectronics investing in spintronic technologies alongside specialized players such as Everspin Technologies and Crocus Technology. These companies are establishing the intermediate supply chain necessary to transform raw spintronic devices into automotive-grade components that meet stringent reliability and durability requirements.

Vertical integration trends are becoming apparent as automotive manufacturers seek to secure access to critical spintronic technologies. Companies like Tesla, Volkswagen Group, and Toyota have initiated strategic partnerships and direct investments in spintronic technology developers to ensure preferential access to these components as they become increasingly central to vehicle electrification and autonomous driving capabilities.

Supply chain resilience represents a significant challenge, with current estimates suggesting that spintronic component production could face disruptions of 6-18 months following any major geopolitical or natural disaster affecting key production regions. Industry consortia are beginning to address these vulnerabilities through initiatives focused on geographical diversification, stockpiling of critical materials, and development of alternative material formulations that reduce dependence on scarce resources.

Standardization efforts remain in early stages, with multiple competing interface and form factor specifications limiting interchangeability between suppliers. The automotive industry's traditional just-in-time manufacturing model is proving particularly vulnerable to the supply uncertainties associated with these emerging technologies, prompting a reevaluation of inventory strategies for critical electronic components.

Environmental Impact and Sustainability of Spintronic Vehicle Technologies

The integration of spintronic devices in automotive systems presents significant environmental advantages compared to conventional semiconductor technologies. Spintronic components operate with substantially lower power consumption, potentially reducing vehicle energy requirements by 15-20% when implemented across critical control systems. This efficiency translates directly to decreased carbon emissions, particularly relevant for electric and hybrid vehicles where power management remains crucial for extending range and reducing environmental impact.

Material sustainability represents another key environmental benefit of spintronic automotive applications. Unlike traditional semiconductor manufacturing, which relies heavily on rare earth elements and toxic compounds, spintronic devices can be fabricated using more abundant materials such as iron, cobalt, and nickel. Recent advancements in manufacturing techniques have reduced the dependence on critical materials like ruthenium and platinum by approximately 40%, significantly decreasing the ecological footprint of production processes.

The extended operational lifespan of spintronic components further enhances their sustainability profile. Laboratory testing indicates that magnetic tunnel junction (MTJ) based automotive sensors maintain performance parameters for up to 15 years under simulated harsh conditions, compared to 7-10 years for conventional semiconductor alternatives. This longevity reduces electronic waste generation and minimizes the environmental impact associated with component replacement and vehicle maintenance.

Heat generation represents a significant environmental concern in automotive electronics. Spintronic devices operate with minimal thermal output, reducing cooling requirements and associated energy consumption. Thermal analysis of spintronic-based control units shows temperature increases of only 5-8°C during peak operation, compared to 15-25°C for traditional semiconductor systems, resulting in reduced thermal management needs and improved overall system efficiency.

End-of-life considerations also favor spintronic automotive technologies. The materials used in spintronic devices show higher recoverability rates during recycling processes, with approximately 75% of key metals being recoverable using current technologies. This circular economy advantage reduces the environmental burden associated with automotive electronic waste, which currently accounts for approximately 4% of total vehicle disposal impact.

Manufacturing processes for spintronic automotive components are evolving toward greater sustainability. Recent innovations in deposition techniques have reduced process energy requirements by approximately 30% compared to conventional semiconductor fabrication. Water usage in production has similarly decreased by 25%, addressing critical resource conservation concerns in electronics manufacturing.

Material sustainability represents another key environmental benefit of spintronic automotive applications. Unlike traditional semiconductor manufacturing, which relies heavily on rare earth elements and toxic compounds, spintronic devices can be fabricated using more abundant materials such as iron, cobalt, and nickel. Recent advancements in manufacturing techniques have reduced the dependence on critical materials like ruthenium and platinum by approximately 40%, significantly decreasing the ecological footprint of production processes.

The extended operational lifespan of spintronic components further enhances their sustainability profile. Laboratory testing indicates that magnetic tunnel junction (MTJ) based automotive sensors maintain performance parameters for up to 15 years under simulated harsh conditions, compared to 7-10 years for conventional semiconductor alternatives. This longevity reduces electronic waste generation and minimizes the environmental impact associated with component replacement and vehicle maintenance.

Heat generation represents a significant environmental concern in automotive electronics. Spintronic devices operate with minimal thermal output, reducing cooling requirements and associated energy consumption. Thermal analysis of spintronic-based control units shows temperature increases of only 5-8°C during peak operation, compared to 15-25°C for traditional semiconductor systems, resulting in reduced thermal management needs and improved overall system efficiency.

End-of-life considerations also favor spintronic automotive technologies. The materials used in spintronic devices show higher recoverability rates during recycling processes, with approximately 75% of key metals being recoverable using current technologies. This circular economy advantage reduces the environmental burden associated with automotive electronic waste, which currently accounts for approximately 4% of total vehicle disposal impact.

Manufacturing processes for spintronic automotive components are evolving toward greater sustainability. Recent innovations in deposition techniques have reduced process energy requirements by approximately 30% compared to conventional semiconductor fabrication. Water usage in production has similarly decreased by 25%, addressing critical resource conservation concerns in electronics manufacturing.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!