BES For Onsite Energy Recovery In Food And Beverage Facilities

SEP 3, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

BES Technology Background and Objectives

Battery Energy Storage (BES) systems have emerged as a transformative technology in the energy landscape over the past two decades. Initially developed for small-scale applications, BES technology has evolved significantly to address larger industrial energy management challenges. The food and beverage industry, characterized by high energy consumption patterns and substantial waste heat generation, presents a unique opportunity for BES implementation in onsite energy recovery systems.

The evolution of BES technology has been marked by several key developments, including improvements in energy density, cycle life, safety features, and cost reduction. Early lithium-ion batteries used in consumer electronics have given way to more robust industrial-grade storage solutions capable of handling the demanding requirements of food and beverage manufacturing facilities. This progression has been accelerated by advancements in materials science, thermal management systems, and battery management software.

Current BES technologies applicable to food and beverage facilities include lithium-ion batteries, flow batteries, and emerging solid-state solutions. Each offers distinct advantages in terms of power capacity, discharge duration, and operational temperature ranges—critical factors when considering integration with existing food processing equipment that generates variable thermal loads.

The primary technical objective of BES implementation in food and beverage facilities is to capture, store, and repurpose energy that would otherwise be wasted during production processes. This includes recovering thermal energy from cooking, pasteurization, sterilization, and refrigeration systems, as well as managing electrical loads during peak demand periods to optimize energy costs and reduce grid dependency.

Secondary objectives include enhancing operational resilience through backup power capabilities, supporting the integration of onsite renewable energy generation, and enabling participation in demand response programs that can create additional revenue streams for facility operators. These objectives align with broader industry trends toward sustainability, carbon footprint reduction, and circular economy principles.

The technological trajectory for BES in food and beverage applications is moving toward more integrated systems that combine thermal and electrical storage capabilities. This holistic approach addresses the industry's unique energy profile, which features both high-temperature processes (baking, frying) and low-temperature requirements (freezing, chilling) often operating simultaneously within the same facility.

Future development goals include improving energy conversion efficiencies between thermal and electrical domains, extending system lifespans to match industrial equipment replacement cycles, and developing specialized BES configurations that can withstand the harsh cleaning regimes and food safety requirements inherent to food processing environments.

The evolution of BES technology has been marked by several key developments, including improvements in energy density, cycle life, safety features, and cost reduction. Early lithium-ion batteries used in consumer electronics have given way to more robust industrial-grade storage solutions capable of handling the demanding requirements of food and beverage manufacturing facilities. This progression has been accelerated by advancements in materials science, thermal management systems, and battery management software.

Current BES technologies applicable to food and beverage facilities include lithium-ion batteries, flow batteries, and emerging solid-state solutions. Each offers distinct advantages in terms of power capacity, discharge duration, and operational temperature ranges—critical factors when considering integration with existing food processing equipment that generates variable thermal loads.

The primary technical objective of BES implementation in food and beverage facilities is to capture, store, and repurpose energy that would otherwise be wasted during production processes. This includes recovering thermal energy from cooking, pasteurization, sterilization, and refrigeration systems, as well as managing electrical loads during peak demand periods to optimize energy costs and reduce grid dependency.

Secondary objectives include enhancing operational resilience through backup power capabilities, supporting the integration of onsite renewable energy generation, and enabling participation in demand response programs that can create additional revenue streams for facility operators. These objectives align with broader industry trends toward sustainability, carbon footprint reduction, and circular economy principles.

The technological trajectory for BES in food and beverage applications is moving toward more integrated systems that combine thermal and electrical storage capabilities. This holistic approach addresses the industry's unique energy profile, which features both high-temperature processes (baking, frying) and low-temperature requirements (freezing, chilling) often operating simultaneously within the same facility.

Future development goals include improving energy conversion efficiencies between thermal and electrical domains, extending system lifespans to match industrial equipment replacement cycles, and developing specialized BES configurations that can withstand the harsh cleaning regimes and food safety requirements inherent to food processing environments.

Market Demand Analysis for F&B Energy Recovery

The food and beverage (F&B) industry is experiencing significant pressure to reduce energy consumption and carbon emissions while maintaining operational efficiency. This has created a robust market demand for Battery Energy Storage (BES) systems specifically designed for onsite energy recovery applications. The global F&B sector currently consumes approximately 30% of the world's total industrial energy, making it one of the most energy-intensive manufacturing sectors.

Market research indicates that energy costs typically represent 3-10% of total operating expenses for F&B facilities, with processes such as heating, cooling, refrigeration, and compressed air systems accounting for the majority of consumption. This economic burden has intensified interest in energy recovery solutions, with the market for industrial energy recovery systems projected to grow at a CAGR of 7.2% through 2028.

Regulatory pressures are further accelerating market demand. Many countries have implemented stringent energy efficiency standards and carbon reduction targets specifically for industrial facilities. The European Union's Green Deal aims for carbon neutrality by 2050, while similar initiatives in North America and Asia have established aggressive timelines for industrial decarbonization, creating compliance-driven demand for energy recovery technologies.

Consumer preferences are also shaping market dynamics. Studies show that 73% of global consumers are willing to pay premium prices for products from companies demonstrating environmental responsibility. Major F&B corporations including Nestlé, PepsiCo, and Anheuser-Busch have responded by setting ambitious sustainability targets, creating substantial internal demand for energy recovery solutions to meet these corporate commitments.

The specific market for BES in F&B facilities is particularly promising due to the industry's unique energy usage patterns. Production processes often create significant thermal energy that is traditionally wasted, while operations frequently experience peak demand charges due to high-power equipment cycling. BES systems can capture this otherwise wasted energy and redistribute it during peak demand periods, offering potential energy cost reductions of 15-25%.

Regional analysis reveals varying levels of market readiness. Europe leads adoption rates due to higher energy costs and stronger regulatory frameworks, while North America shows rapid growth driven by corporate sustainability initiatives. Emerging markets in Asia-Pacific demonstrate the highest potential growth rate as industrialization accelerates alongside increasing energy costs and environmental awareness.

Market segmentation indicates that medium to large-scale facilities (those consuming over 50,000 MWh annually) represent the most promising initial market, as they have both the energy recovery potential and capital resources to implement BES solutions. This segment alone represents a serviceable addressable market estimated at $4.7 billion globally.

Market research indicates that energy costs typically represent 3-10% of total operating expenses for F&B facilities, with processes such as heating, cooling, refrigeration, and compressed air systems accounting for the majority of consumption. This economic burden has intensified interest in energy recovery solutions, with the market for industrial energy recovery systems projected to grow at a CAGR of 7.2% through 2028.

Regulatory pressures are further accelerating market demand. Many countries have implemented stringent energy efficiency standards and carbon reduction targets specifically for industrial facilities. The European Union's Green Deal aims for carbon neutrality by 2050, while similar initiatives in North America and Asia have established aggressive timelines for industrial decarbonization, creating compliance-driven demand for energy recovery technologies.

Consumer preferences are also shaping market dynamics. Studies show that 73% of global consumers are willing to pay premium prices for products from companies demonstrating environmental responsibility. Major F&B corporations including Nestlé, PepsiCo, and Anheuser-Busch have responded by setting ambitious sustainability targets, creating substantial internal demand for energy recovery solutions to meet these corporate commitments.

The specific market for BES in F&B facilities is particularly promising due to the industry's unique energy usage patterns. Production processes often create significant thermal energy that is traditionally wasted, while operations frequently experience peak demand charges due to high-power equipment cycling. BES systems can capture this otherwise wasted energy and redistribute it during peak demand periods, offering potential energy cost reductions of 15-25%.

Regional analysis reveals varying levels of market readiness. Europe leads adoption rates due to higher energy costs and stronger regulatory frameworks, while North America shows rapid growth driven by corporate sustainability initiatives. Emerging markets in Asia-Pacific demonstrate the highest potential growth rate as industrialization accelerates alongside increasing energy costs and environmental awareness.

Market segmentation indicates that medium to large-scale facilities (those consuming over 50,000 MWh annually) represent the most promising initial market, as they have both the energy recovery potential and capital resources to implement BES solutions. This segment alone represents a serviceable addressable market estimated at $4.7 billion globally.

Current BES Implementation Challenges in F&B Sector

Despite the promising potential of Battery Energy Storage (BES) systems for onsite energy recovery in food and beverage (F&B) facilities, several significant implementation challenges persist. The integration of BES technologies faces substantial technical hurdles related to the unique operational characteristics of F&B production environments.

Temperature management represents a primary challenge, as many F&B facilities operate in environments with extreme temperature variations. Battery systems typically require stable thermal conditions to maintain optimal performance and longevity. The frequent temperature fluctuations in processing areas, refrigeration zones, and cooking sections create complex thermal management requirements that standard BES solutions are not designed to address.

Space constraints present another critical limitation. F&B production facilities are typically designed to maximize production efficiency, leaving minimal available space for large-scale energy storage installations. The footprint requirements of conventional BES systems often conflict with the spatial economics of existing facilities, particularly in urban or space-limited locations where many food processing operations are situated.

Regulatory compliance adds another layer of complexity. F&B facilities must adhere to strict food safety and hygiene regulations, which can restrict the placement and operation of battery systems. Concerns regarding potential contamination risks, fire safety, and chemical hazards associated with battery technologies necessitate additional safeguards and compliance measures that increase implementation costs and complexity.

The intermittent and highly variable load profiles characteristic of F&B operations present significant sizing and capacity planning challenges. Production processes often involve energy-intensive equipment operating in irregular cycles, creating demand patterns that are difficult to predict and optimize for energy recovery. This variability complicates the accurate sizing of BES systems and reduces their economic viability.

Integration with existing infrastructure poses substantial technical barriers. Many F&B facilities operate with legacy equipment and control systems that were not designed with energy storage capabilities in mind. The lack of standardized interfaces between production equipment, energy management systems, and BES technologies creates significant integration challenges and increases implementation costs.

Financial constraints further impede adoption, as F&B operations typically operate on thin margins with strict capital expenditure limitations. The high upfront costs of BES systems, combined with uncertain return on investment timelines in the context of fluctuating energy prices, create significant financial barriers to implementation, particularly for small and medium-sized enterprises that dominate certain segments of the F&B sector.

Temperature management represents a primary challenge, as many F&B facilities operate in environments with extreme temperature variations. Battery systems typically require stable thermal conditions to maintain optimal performance and longevity. The frequent temperature fluctuations in processing areas, refrigeration zones, and cooking sections create complex thermal management requirements that standard BES solutions are not designed to address.

Space constraints present another critical limitation. F&B production facilities are typically designed to maximize production efficiency, leaving minimal available space for large-scale energy storage installations. The footprint requirements of conventional BES systems often conflict with the spatial economics of existing facilities, particularly in urban or space-limited locations where many food processing operations are situated.

Regulatory compliance adds another layer of complexity. F&B facilities must adhere to strict food safety and hygiene regulations, which can restrict the placement and operation of battery systems. Concerns regarding potential contamination risks, fire safety, and chemical hazards associated with battery technologies necessitate additional safeguards and compliance measures that increase implementation costs and complexity.

The intermittent and highly variable load profiles characteristic of F&B operations present significant sizing and capacity planning challenges. Production processes often involve energy-intensive equipment operating in irregular cycles, creating demand patterns that are difficult to predict and optimize for energy recovery. This variability complicates the accurate sizing of BES systems and reduces their economic viability.

Integration with existing infrastructure poses substantial technical barriers. Many F&B facilities operate with legacy equipment and control systems that were not designed with energy storage capabilities in mind. The lack of standardized interfaces between production equipment, energy management systems, and BES technologies creates significant integration challenges and increases implementation costs.

Financial constraints further impede adoption, as F&B operations typically operate on thin margins with strict capital expenditure limitations. The high upfront costs of BES systems, combined with uncertain return on investment timelines in the context of fluctuating energy prices, create significant financial barriers to implementation, particularly for small and medium-sized enterprises that dominate certain segments of the F&B sector.

Current BES Integration Approaches for F&B Facilities

01 Battery energy recovery systems for electric vehicles

Battery energy storage systems in electric vehicles can recover energy through regenerative braking, converting kinetic energy back into electrical energy to recharge the battery. These systems improve overall energy efficiency by capturing energy that would otherwise be lost as heat during braking. Advanced BES systems can optimize energy recovery based on driving conditions, battery state of charge, and vehicle speed to maximize range and battery life.- Regenerative braking systems for energy recovery: Battery energy storage systems can be integrated with regenerative braking technology to recover kinetic energy during deceleration or braking processes. This recovered energy, which would otherwise be lost as heat, is converted to electrical energy and stored in batteries for later use. These systems are particularly valuable in electric vehicles and hybrid transportation systems, improving overall energy efficiency and extending driving range.

- Thermal energy recovery in battery systems: Heat generated during battery operation can be captured and repurposed through thermal energy recovery systems. These systems utilize heat exchangers and thermal management technologies to convert waste heat into usable energy or to maintain optimal battery operating temperatures. By recovering thermal energy, the overall efficiency of battery energy storage systems is improved, and battery lifespan can be extended through better temperature regulation.

- Grid-scale energy recovery and storage solutions: Large-scale battery energy storage systems enable energy recovery at the grid level, capturing excess energy during low demand periods and releasing it during peak demand. These systems incorporate advanced battery management technologies, power conversion systems, and control algorithms to optimize energy flow. Grid-scale solutions help balance supply and demand, integrate renewable energy sources, and provide grid stability services while reducing energy waste.

- Hybrid energy recovery systems combining batteries with other technologies: Hybrid energy recovery systems integrate battery storage with other energy recovery technologies such as supercapacitors, flywheels, or compressed air energy storage. These combined systems leverage the strengths of each technology to optimize energy recovery across different operational conditions. The hybrid approach allows for rapid energy capture during high-power events while maintaining long-term storage capacity, resulting in more efficient and versatile energy recovery solutions.

- Smart control systems for optimizing battery energy recovery: Advanced control algorithms and management systems are employed to maximize energy recovery in battery storage applications. These intelligent systems monitor operating conditions in real-time, predict energy demands, and dynamically adjust charging and discharging parameters. By implementing machine learning and predictive analytics, these control systems can significantly improve energy recovery efficiency, extend battery life, and reduce operational costs in various applications from residential to industrial settings.

02 Grid-scale BES energy recovery and management

Large-scale battery energy storage systems can recover and store excess energy from the grid during low-demand periods and discharge it during peak demand. These systems provide grid stability, frequency regulation, and load balancing capabilities. Advanced management systems optimize charging and discharging cycles to maximize energy recovery efficiency while minimizing battery degradation, extending the operational life of the storage system.Expand Specific Solutions03 Thermal management for BES energy recovery

Thermal management systems for battery energy storage improve energy recovery efficiency by maintaining optimal operating temperatures. These systems can recover waste heat generated during battery operation and either use it for heating purposes or convert it back into usable energy. Advanced cooling technologies prevent energy losses due to thermal runaway and ensure consistent performance across varying environmental conditions.Expand Specific Solutions04 Hybrid BES systems with renewable energy integration

Hybrid battery energy storage systems integrate with renewable energy sources like solar and wind to maximize energy recovery. These systems capture excess renewable energy that would otherwise be curtailed and store it for later use. Smart control algorithms optimize energy flow between renewable sources, storage systems, and loads to increase overall system efficiency and reliability while reducing dependence on conventional power sources.Expand Specific Solutions05 Second-life battery applications for energy recovery

Energy recovery systems utilizing second-life batteries repurpose used electric vehicle batteries for stationary storage applications. These systems extend the useful life of batteries that no longer meet the demanding requirements of vehicles but still retain significant capacity. Advanced battery management systems monitor individual cell performance to optimize energy recovery while ensuring safe operation, providing cost-effective energy storage solutions with reduced environmental impact.Expand Specific Solutions

Key Industry Players in Energy Recovery Solutions

The bioelectrochemical systems (BES) for onsite energy recovery in food and beverage facilities market is in its early growth stage, characterized by increasing adoption of sustainable energy solutions. The global market is estimated to reach $2-3 billion by 2030, driven by rising energy costs and environmental regulations. Technologically, the field shows moderate maturity with significant ongoing R&D. Leading players include established industrial giants like Hitachi, Siemens, and Schneider Electric who bring robust engineering capabilities, alongside specialized companies like Shanghai Linhai Ecological Technology and W&F Technologies focusing on niche applications. Academic institutions such as Tongji University, Harbin Institute of Technology, and University of California are advancing fundamental research, while energy companies like LG Energy Solution and SK E&S are developing commercial applications for industrial deployment.

LG Energy Solution Ltd.

Technical Solution: LG Energy Solution has developed specialized battery energy storage systems for food and beverage facilities that focus on capturing and reusing process energy. Their technology employs advanced lithium-ion battery configurations optimized for the rapid charge/discharge cycles typical in food processing energy recovery applications. LG's solution incorporates thermal management systems specifically designed to capture waste heat from refrigeration systems, cooking processes, and sterilization equipment. Their BES systems feature intelligent power management software that can predict energy demand patterns in food production environments and optimize recovery timing. The technology includes specialized inverters that can efficiently convert recovered energy for immediate use or storage. LG's systems are modular and scalable, allowing food processors to start with targeted recovery applications and expand as needed. Implementation data indicates their solutions typically achieve 10-20% energy cost reduction in beverage production facilities and 15-25% in food processing operations with high thermal loads.

Strengths: Industry-leading battery technology with high cycle life suitable for industrial applications; compact system footprint compared to competitors; strong safety record important for food facility implementation. Weaknesses: Less experience with food-specific process integration compared to industrial automation companies; higher battery replacement costs over system lifetime; more limited thermal energy storage capabilities.

Caterpillar, Inc.

Technical Solution: Caterpillar has developed specialized BES solutions for food and beverage facilities through their Cat® Microgrid technology. Their approach focuses on integrating energy recovery systems with onsite power generation capabilities. The technology captures waste heat from production processes and converts it to electricity through Organic Rankine Cycle (ORC) generators specifically sized for food industry applications. Their system includes thermal storage components that can store recovered heat energy for later use during peak demand periods. Cat's solution incorporates advanced control systems that optimize the balance between recovered energy, grid power, and supplemental generation. Their technology is particularly effective in facilities with high-temperature processes like baking, frying, and drying operations, where waste heat recovery potential is greatest. Caterpillar's systems typically achieve 20-30% reduction in facility energy costs with payback periods of 3-5 years for most food processing applications.

Strengths: Robust industrial-grade hardware designed for demanding environments; strong integration with existing power generation systems; extensive dealer network for implementation and service. Weaknesses: Less specialized in food-specific processes compared to competitors; higher maintenance requirements; solutions better suited for larger facilities than small/medium operations.

Core BES Patents and Technical Innovations

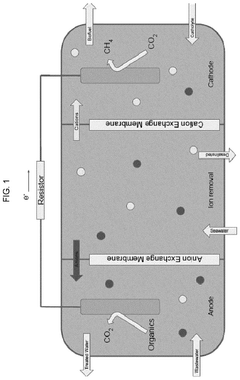

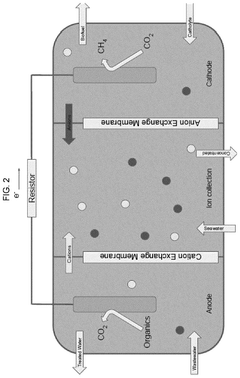

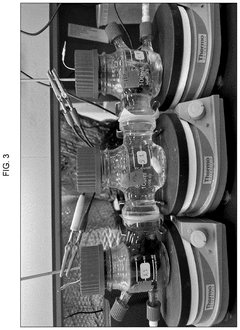

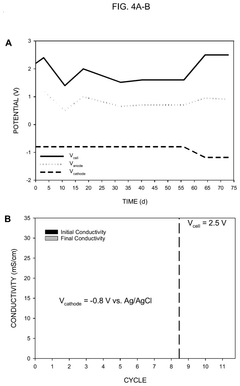

Bioelectrochemical system for water deionization and desalination, wastewater treatment and energy recovery

PatentActiveUS12384705B2

Innovation

- The development of anoxic and anaerobic BESs with engineered microbial communities at the bioanode and methanogenic communities at the biocathode, utilizing anion and cation exchange membranes to separate and concentrate ions, and applying a controlled voltage for enhanced desalination and wastewater treatment, with optional abiotic cathodes for simplicity.

Bioelectrochemical system for treatment of organic liquid wastes

PatentInactiveUS20220399560A1

Innovation

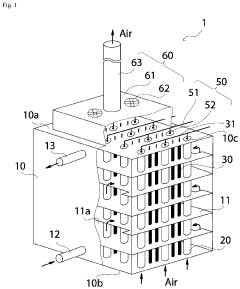

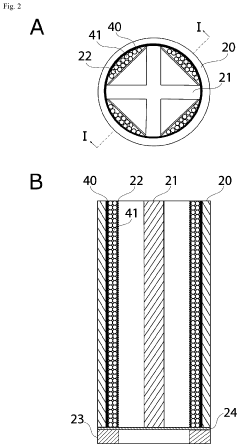

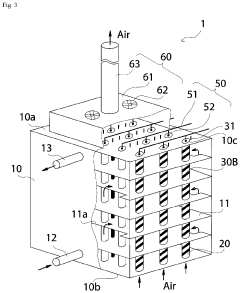

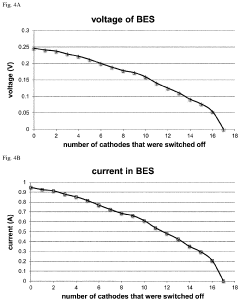

- A scalable bioelectrochemical system design featuring a container with vertically disposed tube-shaped separators, multistage horizontal flow channels, and strategically positioned anodes and cathodes, including an air cathode with a porous electrically conductive support material and a cation exchange polymer separator, enhances power generation and mass transport properties.

Regulatory Framework and Compliance Requirements

The regulatory landscape for Battery Energy Storage (BES) systems in food and beverage facilities is complex and multifaceted, requiring careful navigation to ensure compliance while maximizing energy recovery benefits. At the federal level, the Federal Energy Regulatory Commission (FERC) Order 841 has been instrumental in removing barriers to BES participation in wholesale electricity markets, creating opportunities for food and beverage facilities to monetize their energy storage capabilities.

The National Fire Protection Association (NFPA) standards, particularly NFPA 855, establish specific requirements for the installation of energy storage systems, addressing critical safety concerns in food processing environments where flammable materials may be present. These standards mandate specific fire detection systems, suppression mechanisms, and thermal runaway prevention measures that must be integrated into BES implementations.

Environmental regulations also significantly impact BES deployments in food and beverage facilities. The Environmental Protection Agency (EPA) guidelines under the Clean Air Act and Resource Conservation and Recovery Act (RCRA) govern aspects of battery disposal and potential emissions, particularly relevant when considering end-of-life management for energy storage systems.

Local building codes and permitting requirements vary substantially across jurisdictions, creating a patchwork of compliance challenges for multi-location food and beverage operations. Many municipalities have updated their codes to specifically address energy storage systems, requiring specialized permits and inspections that can extend project timelines and increase implementation costs.

Grid interconnection standards present another regulatory hurdle, with utilities imposing technical requirements for connecting BES systems to the broader electrical grid. IEEE 1547 standards provide the technical framework for these connections, but individual utility requirements may impose additional constraints specific to local grid conditions and stability concerns.

Incentive program compliance adds another layer of complexity, as many government and utility programs offering financial support for BES implementations come with specific technical and operational requirements. The Investment Tax Credit (ITC) for energy storage, for instance, requires systems to meet certain efficiency and operational parameters to qualify for the full tax benefit.

Food safety regulations intersect with energy systems in critical ways, with the Food Safety Modernization Act (FSMA) requiring uninterrupted power for critical processing and refrigeration systems. BES implementations must demonstrate compliance with these requirements, ensuring that energy recovery operations never compromise food safety protocols or create risks of contamination.

Occupational Safety and Health Administration (OSHA) standards further govern workplace safety aspects of BES installations, mandating specific training, signage, and operational procedures for staff working in proximity to energy storage systems. These requirements must be integrated into broader facility safety programs to ensure comprehensive compliance.

The National Fire Protection Association (NFPA) standards, particularly NFPA 855, establish specific requirements for the installation of energy storage systems, addressing critical safety concerns in food processing environments where flammable materials may be present. These standards mandate specific fire detection systems, suppression mechanisms, and thermal runaway prevention measures that must be integrated into BES implementations.

Environmental regulations also significantly impact BES deployments in food and beverage facilities. The Environmental Protection Agency (EPA) guidelines under the Clean Air Act and Resource Conservation and Recovery Act (RCRA) govern aspects of battery disposal and potential emissions, particularly relevant when considering end-of-life management for energy storage systems.

Local building codes and permitting requirements vary substantially across jurisdictions, creating a patchwork of compliance challenges for multi-location food and beverage operations. Many municipalities have updated their codes to specifically address energy storage systems, requiring specialized permits and inspections that can extend project timelines and increase implementation costs.

Grid interconnection standards present another regulatory hurdle, with utilities imposing technical requirements for connecting BES systems to the broader electrical grid. IEEE 1547 standards provide the technical framework for these connections, but individual utility requirements may impose additional constraints specific to local grid conditions and stability concerns.

Incentive program compliance adds another layer of complexity, as many government and utility programs offering financial support for BES implementations come with specific technical and operational requirements. The Investment Tax Credit (ITC) for energy storage, for instance, requires systems to meet certain efficiency and operational parameters to qualify for the full tax benefit.

Food safety regulations intersect with energy systems in critical ways, with the Food Safety Modernization Act (FSMA) requiring uninterrupted power for critical processing and refrigeration systems. BES implementations must demonstrate compliance with these requirements, ensuring that energy recovery operations never compromise food safety protocols or create risks of contamination.

Occupational Safety and Health Administration (OSHA) standards further govern workplace safety aspects of BES installations, mandating specific training, signage, and operational procedures for staff working in proximity to energy storage systems. These requirements must be integrated into broader facility safety programs to ensure comprehensive compliance.

ROI Analysis and Implementation Cost Structures

The implementation of Battery Energy Storage (BES) systems for onsite energy recovery in food and beverage facilities requires substantial initial investment, yet offers compelling returns over time. Initial capital expenditures typically range from $500-$1,500 per kWh of storage capacity, with total system costs for industrial-scale installations ranging from $1-5 million depending on capacity requirements and integration complexity.

Installation costs comprise approximately 60% of total expenditure, while ongoing maintenance represents 2-5% of the initial investment annually. The cost structure varies significantly based on facility size, energy consumption patterns, and existing infrastructure compatibility. Facilities with high thermal energy demands often see more favorable economics due to the potential for heat recovery applications.

Return on Investment (ROI) calculations for BES systems in food and beverage facilities demonstrate payback periods typically ranging from 3-7 years. Key financial benefits include peak demand charge reduction (20-40% savings potential), time-of-use arbitrage (10-15% energy cost reduction), and enhanced renewable energy utilization (increasing self-consumption by up to 60%). Additionally, participation in grid services and demand response programs can generate revenue streams of $50-200/kW-year.

The ROI analysis must account for both direct and indirect benefits. Direct benefits include quantifiable energy cost savings and potential revenue from grid services. Indirect benefits encompass improved production reliability, reduced downtime costs, and enhanced sustainability metrics that may translate to premium pricing opportunities or regulatory compliance advantages.

Sensitivity analysis reveals that ROI is most heavily influenced by utility rate structures, peak demand charges, and facility operational patterns. Facilities with pronounced peak-to-average demand ratios typically achieve faster payback periods. The financial case strengthens in regions with high electricity costs, significant time-of-use differentials, or generous incentive programs for energy storage deployment.

Financing options significantly impact ROI calculations. Beyond traditional capital expenditure models, third-party ownership arrangements, energy-as-a-service contracts, and performance-based models can reduce initial investment requirements while still delivering substantial operational savings. Government incentives, including investment tax credits, accelerated depreciation, and utility rebates can improve ROI metrics by 15-30% in eligible markets.

Installation costs comprise approximately 60% of total expenditure, while ongoing maintenance represents 2-5% of the initial investment annually. The cost structure varies significantly based on facility size, energy consumption patterns, and existing infrastructure compatibility. Facilities with high thermal energy demands often see more favorable economics due to the potential for heat recovery applications.

Return on Investment (ROI) calculations for BES systems in food and beverage facilities demonstrate payback periods typically ranging from 3-7 years. Key financial benefits include peak demand charge reduction (20-40% savings potential), time-of-use arbitrage (10-15% energy cost reduction), and enhanced renewable energy utilization (increasing self-consumption by up to 60%). Additionally, participation in grid services and demand response programs can generate revenue streams of $50-200/kW-year.

The ROI analysis must account for both direct and indirect benefits. Direct benefits include quantifiable energy cost savings and potential revenue from grid services. Indirect benefits encompass improved production reliability, reduced downtime costs, and enhanced sustainability metrics that may translate to premium pricing opportunities or regulatory compliance advantages.

Sensitivity analysis reveals that ROI is most heavily influenced by utility rate structures, peak demand charges, and facility operational patterns. Facilities with pronounced peak-to-average demand ratios typically achieve faster payback periods. The financial case strengthens in regions with high electricity costs, significant time-of-use differentials, or generous incentive programs for energy storage deployment.

Financing options significantly impact ROI calculations. Beyond traditional capital expenditure models, third-party ownership arrangements, energy-as-a-service contracts, and performance-based models can reduce initial investment requirements while still delivering substantial operational savings. Government incentives, including investment tax credits, accelerated depreciation, and utility rebates can improve ROI metrics by 15-30% in eligible markets.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!