Energy Balance And Net Energy Gains In BES Deployments

SEP 3, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

BES Energy Balance Background and Objectives

Battery Energy Storage (BES) systems have emerged as a critical component in the global transition towards sustainable energy infrastructure. The evolution of BES technology has been marked by significant advancements in energy density, cycle life, and cost reduction over the past decades. Initially developed for small-scale applications, BES systems have progressively scaled to utility-level deployments capable of providing grid stabilization, peak shaving, and renewable energy integration services.

The concept of energy balance in BES deployments refers to the comprehensive accounting of energy inputs versus outputs throughout the system's lifecycle. This encompasses energy consumed during raw material extraction, manufacturing processes, transportation, installation, operation, maintenance, and eventual decommissioning or recycling. Understanding this balance is fundamental to accurately assessing the true environmental and economic value of BES implementations.

Current technological trajectories indicate a continued improvement in energy efficiency ratios, with next-generation battery chemistries promising higher energy densities and lower production energy requirements. The industry is witnessing a shift from traditional lithium-ion technologies toward more sustainable alternatives such as solid-state batteries, flow batteries, and sodium-ion systems, each offering distinct advantages in specific deployment scenarios.

The primary objective of energy balance analysis in BES deployments is to establish quantifiable metrics for evaluating net energy gains across different battery technologies and application contexts. This involves developing standardized methodologies for calculating Energy Return on Investment (EROI) and Energy Payback Time (EPT) specific to energy storage systems, which have traditionally been more challenging to assess than generation technologies.

Another critical objective is to identify optimization opportunities throughout the BES lifecycle that can enhance overall energy efficiency. This includes improvements in manufacturing processes, system design for operational efficiency, integration strategies with renewable generation sources, and end-of-life management approaches that maximize material and energy recovery.

The research aims to establish clear correlations between system design parameters and energy balance outcomes, enabling more informed decision-making in BES deployment planning. By quantifying these relationships, stakeholders can better predict the long-term energy implications of different storage configurations and operational strategies.

Ultimately, this technical exploration seeks to provide a foundation for sustainable scaling of BES technologies by ensuring that their proliferation delivers genuine net energy benefits to society. As global energy systems continue their transformation toward higher renewable penetration, the energy efficiency of storage solutions becomes increasingly central to achieving meaningful carbon reduction and resource conservation goals.

The concept of energy balance in BES deployments refers to the comprehensive accounting of energy inputs versus outputs throughout the system's lifecycle. This encompasses energy consumed during raw material extraction, manufacturing processes, transportation, installation, operation, maintenance, and eventual decommissioning or recycling. Understanding this balance is fundamental to accurately assessing the true environmental and economic value of BES implementations.

Current technological trajectories indicate a continued improvement in energy efficiency ratios, with next-generation battery chemistries promising higher energy densities and lower production energy requirements. The industry is witnessing a shift from traditional lithium-ion technologies toward more sustainable alternatives such as solid-state batteries, flow batteries, and sodium-ion systems, each offering distinct advantages in specific deployment scenarios.

The primary objective of energy balance analysis in BES deployments is to establish quantifiable metrics for evaluating net energy gains across different battery technologies and application contexts. This involves developing standardized methodologies for calculating Energy Return on Investment (EROI) and Energy Payback Time (EPT) specific to energy storage systems, which have traditionally been more challenging to assess than generation technologies.

Another critical objective is to identify optimization opportunities throughout the BES lifecycle that can enhance overall energy efficiency. This includes improvements in manufacturing processes, system design for operational efficiency, integration strategies with renewable generation sources, and end-of-life management approaches that maximize material and energy recovery.

The research aims to establish clear correlations between system design parameters and energy balance outcomes, enabling more informed decision-making in BES deployment planning. By quantifying these relationships, stakeholders can better predict the long-term energy implications of different storage configurations and operational strategies.

Ultimately, this technical exploration seeks to provide a foundation for sustainable scaling of BES technologies by ensuring that their proliferation delivers genuine net energy benefits to society. As global energy systems continue their transformation toward higher renewable penetration, the energy efficiency of storage solutions becomes increasingly central to achieving meaningful carbon reduction and resource conservation goals.

Market Analysis for Energy-Efficient BES Solutions

The global market for energy-efficient Battery Energy Storage (BES) solutions is experiencing unprecedented growth, driven by increasing energy costs, grid instability concerns, and the global push toward decarbonization. Current market valuations place the energy-efficient BES sector at approximately $8.5 billion as of 2023, with projections indicating a compound annual growth rate (CAGR) of 24.3% through 2030, potentially reaching $39.7 billion by the end of the decade.

Demand segmentation reveals distinct market drivers across regions. In North America and Europe, commercial and industrial applications dominate, with businesses seeking to reduce peak demand charges and enhance energy resilience. The Asia-Pacific region shows stronger growth in utility-scale applications, particularly in countries like China, Japan, and South Korea, where grid modernization initiatives are accelerating BES adoption.

Energy efficiency metrics have become critical differentiators in the BES marketplace. Systems demonstrating round-trip efficiency exceeding 85% command premium pricing, with customers increasingly willing to pay 15-20% more for solutions that deliver superior energy returns. This trend is particularly pronounced in markets with high electricity costs such as Germany, Japan, and California.

Regulatory landscapes are significantly influencing market dynamics. The Inflation Reduction Act in the United States has created substantial incentives for energy storage deployment, while the European Union's REPowerEU plan has established ambitious targets for energy storage capacity. These policy frameworks are expected to inject approximately $35 billion in direct and indirect subsidies into the BES ecosystem over the next five years.

Emerging customer requirements indicate a shift toward integrated energy management solutions rather than standalone storage products. End-users increasingly demand systems that optimize energy balance across multiple parameters including time-of-use arbitrage, demand charge management, and renewable integration. Solutions offering AI-driven predictive analytics for energy optimization are experiencing 32% faster market adoption compared to conventional systems.

The competitive landscape reveals consolidation among major players, with vertical integration becoming a dominant strategy. Traditional battery manufacturers are expanding into system integration and energy management software, while utilities and energy service providers are acquiring BES technology companies to enhance their service portfolios.

Market barriers persist, particularly around financing models and standardization. Despite declining battery costs (18% reduction year-over-year for lithium-ion technologies), total system costs remain prohibitive for many potential adopters. Innovative financing mechanisms, including energy-as-a-service models and performance contracting, are emerging to address these challenges and accelerate market penetration.

Demand segmentation reveals distinct market drivers across regions. In North America and Europe, commercial and industrial applications dominate, with businesses seeking to reduce peak demand charges and enhance energy resilience. The Asia-Pacific region shows stronger growth in utility-scale applications, particularly in countries like China, Japan, and South Korea, where grid modernization initiatives are accelerating BES adoption.

Energy efficiency metrics have become critical differentiators in the BES marketplace. Systems demonstrating round-trip efficiency exceeding 85% command premium pricing, with customers increasingly willing to pay 15-20% more for solutions that deliver superior energy returns. This trend is particularly pronounced in markets with high electricity costs such as Germany, Japan, and California.

Regulatory landscapes are significantly influencing market dynamics. The Inflation Reduction Act in the United States has created substantial incentives for energy storage deployment, while the European Union's REPowerEU plan has established ambitious targets for energy storage capacity. These policy frameworks are expected to inject approximately $35 billion in direct and indirect subsidies into the BES ecosystem over the next five years.

Emerging customer requirements indicate a shift toward integrated energy management solutions rather than standalone storage products. End-users increasingly demand systems that optimize energy balance across multiple parameters including time-of-use arbitrage, demand charge management, and renewable integration. Solutions offering AI-driven predictive analytics for energy optimization are experiencing 32% faster market adoption compared to conventional systems.

The competitive landscape reveals consolidation among major players, with vertical integration becoming a dominant strategy. Traditional battery manufacturers are expanding into system integration and energy management software, while utilities and energy service providers are acquiring BES technology companies to enhance their service portfolios.

Market barriers persist, particularly around financing models and standardization. Despite declining battery costs (18% reduction year-over-year for lithium-ion technologies), total system costs remain prohibitive for many potential adopters. Innovative financing mechanisms, including energy-as-a-service models and performance contracting, are emerging to address these challenges and accelerate market penetration.

Current Challenges in BES Energy Balance Technologies

Despite significant advancements in Battery Energy Storage (BES) technologies, achieving optimal energy balance remains a formidable challenge. Current BES systems struggle with energy efficiency limitations, with round-trip efficiency typically ranging between 70-85% depending on battery chemistry and system design. This efficiency gap represents substantial energy losses that undermine the economic viability and environmental benefits of large-scale deployments.

Thermal management presents a persistent challenge, as batteries generate heat during both charging and discharging cycles. Inadequate thermal regulation not only reduces operational efficiency but accelerates degradation processes. Advanced cooling systems add complexity and parasitic energy consumption, creating a negative feedback loop that further diminishes net energy gains.

Auxiliary power requirements constitute another significant drain on system efficiency. BES installations require continuous power for battery management systems (BMS), environmental controls, safety systems, and monitoring equipment. These parasitic loads can consume 2-5% of stored energy in large-scale deployments, substantially reducing net energy available for grid services or end-user applications.

Energy density limitations continue to constrain deployment scenarios. Current lithium-ion technologies offer practical energy densities of 150-250 Wh/kg, which necessitates substantial physical footprints for utility-scale installations. This spatial requirement translates to increased infrastructure costs and embodied energy in system components, further complicating energy balance calculations.

Degradation mechanisms represent perhaps the most complex challenge to energy balance optimization. Calendar aging and cycling-induced capacity fade progressively reduce the energy storage capability while maintaining similar auxiliary power requirements. This declining efficiency curve means that lifetime energy balance calculations must account for performance degradation trajectories, which vary significantly based on operating conditions and use patterns.

Integration inefficiencies at the system level further compound these challenges. Power conversion systems (PCS) introduce additional losses during AC-DC and DC-AC conversions, typically ranging from 2-4% in each direction. These conversion losses accumulate in applications requiring frequent energy exchanges with the grid or connected systems.

Seasonal and environmental factors introduce variability that complicates energy balance optimization. Ambient temperature fluctuations can cause efficiency variations of 10-15% between optimal and suboptimal operating conditions. This environmental sensitivity necessitates adaptive management strategies that themselves consume additional computational and operational energy.

Measurement and verification challenges make it difficult to accurately quantify real-world energy balance. The complex interplay between various loss mechanisms creates uncertainty in performance metrics, complicating investment decisions and system optimization efforts.

Thermal management presents a persistent challenge, as batteries generate heat during both charging and discharging cycles. Inadequate thermal regulation not only reduces operational efficiency but accelerates degradation processes. Advanced cooling systems add complexity and parasitic energy consumption, creating a negative feedback loop that further diminishes net energy gains.

Auxiliary power requirements constitute another significant drain on system efficiency. BES installations require continuous power for battery management systems (BMS), environmental controls, safety systems, and monitoring equipment. These parasitic loads can consume 2-5% of stored energy in large-scale deployments, substantially reducing net energy available for grid services or end-user applications.

Energy density limitations continue to constrain deployment scenarios. Current lithium-ion technologies offer practical energy densities of 150-250 Wh/kg, which necessitates substantial physical footprints for utility-scale installations. This spatial requirement translates to increased infrastructure costs and embodied energy in system components, further complicating energy balance calculations.

Degradation mechanisms represent perhaps the most complex challenge to energy balance optimization. Calendar aging and cycling-induced capacity fade progressively reduce the energy storage capability while maintaining similar auxiliary power requirements. This declining efficiency curve means that lifetime energy balance calculations must account for performance degradation trajectories, which vary significantly based on operating conditions and use patterns.

Integration inefficiencies at the system level further compound these challenges. Power conversion systems (PCS) introduce additional losses during AC-DC and DC-AC conversions, typically ranging from 2-4% in each direction. These conversion losses accumulate in applications requiring frequent energy exchanges with the grid or connected systems.

Seasonal and environmental factors introduce variability that complicates energy balance optimization. Ambient temperature fluctuations can cause efficiency variations of 10-15% between optimal and suboptimal operating conditions. This environmental sensitivity necessitates adaptive management strategies that themselves consume additional computational and operational energy.

Measurement and verification challenges make it difficult to accurately quantify real-world energy balance. The complex interplay between various loss mechanisms creates uncertainty in performance metrics, complicating investment decisions and system optimization efforts.

Current Energy Balance Optimization Approaches

01 Energy efficiency optimization in BES

Bioelectrochemical systems can be optimized for energy efficiency through various approaches including electrode design, operational parameters adjustment, and system configuration. These optimizations aim to maximize the energy output while minimizing input requirements. Techniques include improving electron transfer rates, reducing internal resistance, and enhancing substrate utilization efficiency to achieve positive net energy gains.- Microbial Fuel Cell Efficiency and Energy Recovery: Bioelectrochemical systems like microbial fuel cells (MFCs) can convert chemical energy from organic waste into electrical energy through microbial metabolism. These systems achieve energy recovery by utilizing bacteria that oxidize organic matter and transfer electrons to electrodes. The efficiency of these systems depends on factors such as electrode materials, microbial communities, and operational parameters. Optimizing these factors can lead to higher net energy gains and improved overall system performance.

- Integration of BES with Wastewater Treatment: Bioelectrochemical systems can be integrated with wastewater treatment processes to simultaneously treat wastewater and generate energy. This dual-purpose application improves the energy balance by offsetting the energy requirements of conventional wastewater treatment. The organic matter in wastewater serves as fuel for electricity generation, while contaminants are removed through microbial metabolism. This integration represents a sustainable approach to wastewater management with positive net energy gains.

- Advanced Electrode Materials for Enhanced BES Performance: The development of advanced electrode materials significantly impacts the energy balance in bioelectrochemical systems. Materials with high conductivity, large surface area, and biocompatibility can enhance electron transfer rates and microbial attachment, leading to improved power output. Modifications such as surface treatments, nanostructuring, and incorporation of catalysts can further optimize electrode performance, resulting in greater net energy gains from these systems.

- System Design and Configuration Optimization: The design and configuration of bioelectrochemical systems play crucial roles in determining their energy balance. Factors such as reactor architecture, membrane selection, electrode spacing, and flow patterns affect system efficiency. Innovative designs that minimize internal resistance, optimize ion exchange, and enhance mass transfer can significantly improve power output. Modular and scalable configurations allow for flexible deployment and better adaptation to varying input conditions, maximizing net energy production.

- Energy Management and Control Systems for BES: Advanced energy management and control systems are essential for optimizing the energy balance in bioelectrochemical systems. Real-time monitoring of operational parameters, automated control of feeding rates, and dynamic adjustment of external resistance can maximize power output while minimizing energy inputs. Intelligent systems that incorporate machine learning algorithms can predict performance fluctuations and adapt operational strategies accordingly. These control mechanisms ensure consistent performance and improved net energy gains over the system's lifetime.

02 Integration of BES with renewable energy sources

Combining bioelectrochemical systems with other renewable energy technologies creates synergistic effects that improve overall energy balance. These integrated systems can utilize solar, wind, or biomass energy to power BES operations, reducing external energy inputs and increasing net energy production. Such hybrid approaches enhance sustainability and economic viability of bioelectrochemical processes.Expand Specific Solutions03 Waste-to-energy conversion in BES

Bioelectrochemical systems can effectively convert various waste streams into usable energy, improving the overall energy balance. By utilizing wastewater, agricultural residues, or industrial effluents as substrates, these systems simultaneously achieve waste treatment and energy recovery. This dual-purpose functionality enhances the net energy gain by offsetting treatment costs while generating valuable energy outputs.Expand Specific Solutions04 Advanced materials for improved BES performance

Novel electrode materials and catalysts significantly enhance the energy efficiency of bioelectrochemical systems. These advanced materials improve electron transfer, reduce activation energy requirements, and increase reaction rates. Innovations include nanostructured electrodes, biocompatible conductive polymers, and low-cost catalysts that collectively contribute to higher power densities and improved net energy gains.Expand Specific Solutions05 Monitoring and control systems for BES optimization

Real-time monitoring and intelligent control systems enable dynamic optimization of bioelectrochemical processes to maximize energy efficiency. These systems adjust operational parameters based on changing conditions, maintain optimal microbial activity, and prevent performance degradation. Advanced sensors, data analytics, and automation technologies help achieve consistent energy production while minimizing energy inputs, resulting in improved net energy balance.Expand Specific Solutions

Leading Companies in BES Energy Management

The Battery Energy Storage (BES) market is currently in a growth phase, characterized by increasing adoption across utility, commercial, and residential sectors. The global BES market is projected to reach approximately $20-25 billion by 2025, with a CAGR of 30-35%. Technologically, the field shows varying maturity levels, with established players like Hitachi, ABB Group, and Siemens Energy offering comprehensive grid-scale solutions, while newer entrants like Fluence Energy and LG Energy Solution focus on innovative storage technologies. Chinese entities including State Grid Corporation and China Three Gorges are rapidly scaling deployment capabilities, while research institutions like Tsinghua University and The Regents of the University of California are advancing next-generation energy balance methodologies. The competitive landscape reflects a mix of traditional energy conglomerates, specialized BES providers, and emerging technology firms working to optimize energy balance and maximize net energy gains.

Hitachi Ltd.

Technical Solution: Hitachi has pioneered an integrated Battery Energy Storage System (BESS) solution that focuses on maximizing net energy gains through their advanced Energy Management System (EMS). Their approach combines high-efficiency power conversion systems (achieving up to 98% efficiency) with sophisticated battery management technology that minimizes parasitic losses during standby operations. Hitachi's BESS deployments feature dynamic energy balancing capabilities that continuously optimize between charging, discharging, and idle states based on grid conditions and energy price signals. Their systems incorporate thermal management solutions that reduce cooling energy requirements by up to 30% compared to conventional designs, significantly improving overall energy balance. Hitachi's technology also includes predictive analytics that forecast optimal charging/discharging cycles to maximize revenue while minimizing battery degradation, resulting in documented improvements of 12-18% in net energy returns across multiple utility-scale deployments in Asia and Europe.

Strengths: Exceptional power conversion efficiency; sophisticated thermal management system that reduces auxiliary power consumption; comprehensive system integration with existing grid infrastructure. Weaknesses: Higher upfront costs compared to simpler solutions; complex implementation requiring specialized engineering expertise; system optimization heavily dependent on quality of input data and forecasting.

ABB Group

Technical Solution: ABB Group has developed a comprehensive Battery Energy Storage System (BESS) solution that addresses energy balance challenges through their proprietary PowerStore and Ability e-mesh platforms. Their approach focuses on maximizing net energy gains through high-efficiency power electronics (>97% conversion efficiency) and advanced control algorithms that minimize standby losses. ABB's technology incorporates real-time monitoring of all energy flows within the system, including auxiliary power consumption for cooling, control systems, and safety equipment. Their deployments feature sophisticated thermal management systems that adapt cooling requirements based on ambient conditions and operational status, reducing parasitic loads by up to 25%. ABB's energy management system optimizes charging and discharging cycles based on multiple variables including electricity prices, renewable generation forecasts, and battery state of health, resulting in documented improvements in net energy returns of 10-15% compared to basic BESS implementations. The system also incorporates predictive maintenance capabilities that identify potential efficiency losses before they significantly impact performance.

Strengths: Highly efficient power conversion technology; sophisticated energy management system with predictive capabilities; extensive integration experience with various grid infrastructures and renewable energy sources. Weaknesses: Complex system architecture requiring specialized configuration; higher initial investment compared to simpler solutions; performance optimization dependent on quality of grid data inputs.

Key Innovations in Net Energy Gain Technologies

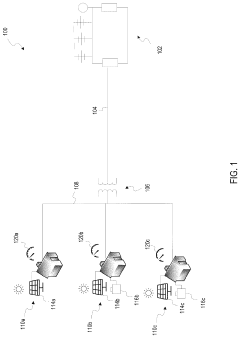

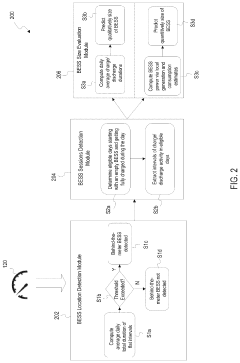

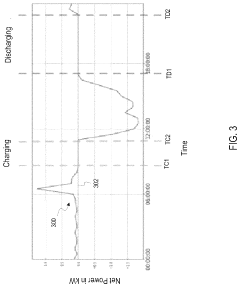

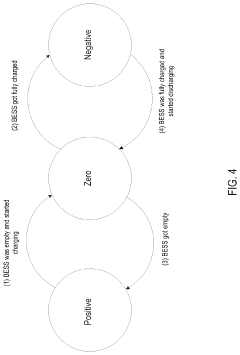

Method and system for unsupervised identification of behind-the-meter battery energy storage systems

PatentPendingUS20240258796A1

Innovation

- An unsupervised method that processes time series data from smart meters to identify flat intervals indicative of BESS charge/discharge activity, determining states of net power consumption, generation, and BESS activity, and evaluates BESS size by analyzing eligible days with state changes and charge/discharge intervals.

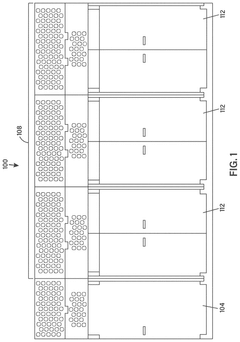

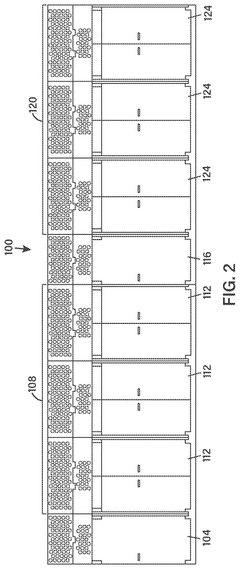

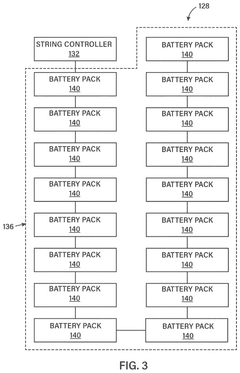

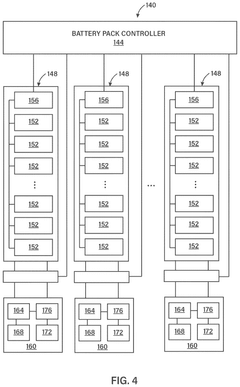

Energy storage systems and associated methods

PatentPendingUS20250183464A1

Innovation

- The implementation of an energy storage system with a ventilation system that includes an enclosure with a vent and a vent covering that can be electronically controlled to open or close, allowing for active or passive ventilation modes to manage gas concentrations and prevent explosions.

Sustainability Impact of BES Energy Balance Solutions

The sustainability impact of Battery Energy Storage (BES) energy balance solutions extends far beyond simple energy efficiency metrics. When properly implemented, these solutions contribute significantly to reducing greenhouse gas emissions by enabling greater integration of renewable energy sources into the grid. By storing excess renewable energy during peak production periods and releasing it during high demand, BES systems help mitigate the intermittency challenges associated with solar and wind power generation.

From a lifecycle perspective, the environmental footprint of BES deployments must be carefully assessed. While operational energy balance may show positive net gains, manufacturing processes for battery components often involve energy-intensive extraction of raw materials like lithium, cobalt, and nickel. Advanced energy balance solutions are increasingly focusing on reducing this embedded carbon cost through improved manufacturing techniques and material recycling programs.

Water conservation represents another critical sustainability dimension. Traditional power generation consumes substantial water resources for cooling, whereas BES systems paired with renewables significantly reduce water usage. Energy balance solutions that optimize BES deployment can help quantify and maximize these water conservation benefits, particularly in water-stressed regions where this represents a crucial sustainability advantage.

Land use efficiency also improves with optimized BES energy balance solutions. By enabling greater energy density storage and more effective utilization of existing infrastructure, these systems reduce the need for extensive new power generation facilities. This aspect is particularly valuable in densely populated areas where land availability is limited and environmental preservation is prioritized.

The circular economy potential of BES deployments is enhanced through sophisticated energy balance solutions that account for end-of-life considerations. Advanced systems now incorporate second-life applications for batteries that can no longer meet primary storage requirements but retain sufficient capacity for less demanding applications. This extends the useful life of these resources and improves the overall sustainability profile of the technology.

Social sustainability benefits emerge as energy balance solutions enable more reliable and accessible energy in remote or underserved communities. By optimizing BES deployments for maximum efficiency and longevity, these technologies can provide stable power to areas previously dependent on diesel generators or inconsistent grid connections, improving quality of life while reducing environmental impact.

From a lifecycle perspective, the environmental footprint of BES deployments must be carefully assessed. While operational energy balance may show positive net gains, manufacturing processes for battery components often involve energy-intensive extraction of raw materials like lithium, cobalt, and nickel. Advanced energy balance solutions are increasingly focusing on reducing this embedded carbon cost through improved manufacturing techniques and material recycling programs.

Water conservation represents another critical sustainability dimension. Traditional power generation consumes substantial water resources for cooling, whereas BES systems paired with renewables significantly reduce water usage. Energy balance solutions that optimize BES deployment can help quantify and maximize these water conservation benefits, particularly in water-stressed regions where this represents a crucial sustainability advantage.

Land use efficiency also improves with optimized BES energy balance solutions. By enabling greater energy density storage and more effective utilization of existing infrastructure, these systems reduce the need for extensive new power generation facilities. This aspect is particularly valuable in densely populated areas where land availability is limited and environmental preservation is prioritized.

The circular economy potential of BES deployments is enhanced through sophisticated energy balance solutions that account for end-of-life considerations. Advanced systems now incorporate second-life applications for batteries that can no longer meet primary storage requirements but retain sufficient capacity for less demanding applications. This extends the useful life of these resources and improves the overall sustainability profile of the technology.

Social sustainability benefits emerge as energy balance solutions enable more reliable and accessible energy in remote or underserved communities. By optimizing BES deployments for maximum efficiency and longevity, these technologies can provide stable power to areas previously dependent on diesel generators or inconsistent grid connections, improving quality of life while reducing environmental impact.

ROI Analysis Framework for BES Energy Deployments

The ROI Analysis Framework for BES (Building Energy Storage) Energy Deployments provides a structured methodology for evaluating the financial viability of energy storage investments. This framework integrates both quantitative metrics and qualitative factors to deliver comprehensive investment insights for stakeholders.

At its core, the framework employs a multi-tiered approach to ROI calculation, beginning with direct financial returns. This includes capital expenditure analysis covering initial equipment costs, installation expenses, and system integration requirements. Operational expenditure tracking encompasses maintenance costs, replacement schedules, and system degradation factors that affect long-term performance.

Energy arbitrage opportunities represent a significant value stream, allowing organizations to purchase and store energy during low-cost periods and utilize or sell it during peak pricing hours. The framework quantifies these potential savings through historical price differential analysis and future market trend projections, accounting for seasonal variations and regulatory changes that might impact pricing structures.

Demand charge reduction constitutes another critical component, particularly for commercial and industrial facilities facing substantial peak demand penalties. The analysis methodology incorporates facility load profiles, peak demand patterns, and utility rate structures to calculate potential savings from strategic discharge during anticipated peak periods.

Beyond direct financial metrics, the framework evaluates grid service revenues, including frequency regulation, capacity markets, and demand response program participation. These revenue streams are weighted according to market availability, contract terms, and historical performance data from similar deployments.

The framework also incorporates risk assessment tools that account for market volatility, regulatory uncertainty, and technology obsolescence. Sensitivity analysis examines how variations in key parameters—such as battery degradation rates, electricity price fluctuations, and policy changes—might affect projected returns, providing decision-makers with confidence intervals for expected outcomes.

Implementation timelines are factored into the ROI calculations through discounted cash flow analysis, recognizing that benefits realized in later years carry less value than immediate returns. This approach allows for fair comparison between technologies with different lifecycle characteristics and implementation schedules.

Finally, the framework includes non-monetary benefits valuation, such as enhanced energy resilience, carbon emission reductions, and corporate sustainability goal advancement. While challenging to quantify precisely, these factors are assigned value ranges based on organizational priorities and industry benchmarks, ensuring a holistic view of the investment's total return potential.

At its core, the framework employs a multi-tiered approach to ROI calculation, beginning with direct financial returns. This includes capital expenditure analysis covering initial equipment costs, installation expenses, and system integration requirements. Operational expenditure tracking encompasses maintenance costs, replacement schedules, and system degradation factors that affect long-term performance.

Energy arbitrage opportunities represent a significant value stream, allowing organizations to purchase and store energy during low-cost periods and utilize or sell it during peak pricing hours. The framework quantifies these potential savings through historical price differential analysis and future market trend projections, accounting for seasonal variations and regulatory changes that might impact pricing structures.

Demand charge reduction constitutes another critical component, particularly for commercial and industrial facilities facing substantial peak demand penalties. The analysis methodology incorporates facility load profiles, peak demand patterns, and utility rate structures to calculate potential savings from strategic discharge during anticipated peak periods.

Beyond direct financial metrics, the framework evaluates grid service revenues, including frequency regulation, capacity markets, and demand response program participation. These revenue streams are weighted according to market availability, contract terms, and historical performance data from similar deployments.

The framework also incorporates risk assessment tools that account for market volatility, regulatory uncertainty, and technology obsolescence. Sensitivity analysis examines how variations in key parameters—such as battery degradation rates, electricity price fluctuations, and policy changes—might affect projected returns, providing decision-makers with confidence intervals for expected outcomes.

Implementation timelines are factored into the ROI calculations through discounted cash flow analysis, recognizing that benefits realized in later years carry less value than immediate returns. This approach allows for fair comparison between technologies with different lifecycle characteristics and implementation schedules.

Finally, the framework includes non-monetary benefits valuation, such as enhanced energy resilience, carbon emission reductions, and corporate sustainability goal advancement. While challenging to quantify precisely, these factors are assigned value ranges based on organizational priorities and industry benchmarks, ensuring a holistic view of the investment's total return potential.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!