Policy Incentives And Business Models To Commercialize BES Solutions

SEP 3, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

BES Solutions Background and Commercialization Goals

Battery Energy Storage (BES) solutions have emerged as a critical component in the global transition towards sustainable energy systems. The evolution of BES technology has progressed significantly over the past decades, from basic lead-acid batteries to advanced lithium-ion, flow batteries, and emerging solid-state technologies. This technological progression has been driven by increasing demands for grid stability, renewable energy integration, and the electrification of transportation sectors worldwide.

The current trajectory of BES development is characterized by rapid improvements in energy density, cycle life, safety features, and cost reduction. Historical data indicates that battery costs have declined by approximately 85% over the past decade, with projections suggesting continued cost reductions of 6-8% annually through 2030. This cost trajectory is crucial for widespread commercialization and adoption across various market segments.

Commercialization goals for BES solutions encompass multiple dimensions that extend beyond pure technological advancement. Primary objectives include achieving cost parity with conventional energy solutions, enhancing grid resilience and reliability, enabling higher penetration of renewable energy sources, and creating sustainable business models that generate value for stakeholders throughout the energy ecosystem.

Key performance targets for commercial viability include reducing levelized cost of storage (LCOS) below $100/MWh, extending operational lifetimes beyond 15 years, improving round-trip efficiency to over 90%, and developing flexible deployment capabilities that can serve multiple grid functions simultaneously. These targets represent the threshold requirements for BES solutions to compete effectively against incumbent technologies.

The policy landscape surrounding BES commercialization varies significantly across regions but generally includes a combination of direct incentives (tax credits, grants, subsidies), market-based mechanisms (capacity markets, ancillary service markets), and regulatory frameworks (storage mandates, renewable portfolio standards). The interplay between these policy instruments creates the economic foundation upon which viable business models can be constructed.

Successful commercialization of BES solutions ultimately depends on aligning technological capabilities with market needs while navigating complex regulatory environments. The industry is currently transitioning from demonstration projects and niche applications toward mainstream deployment, with annual global installations projected to exceed 30 GWh by 2025. This growth trajectory presents significant opportunities for innovation in both technology development and business model design.

The current trajectory of BES development is characterized by rapid improvements in energy density, cycle life, safety features, and cost reduction. Historical data indicates that battery costs have declined by approximately 85% over the past decade, with projections suggesting continued cost reductions of 6-8% annually through 2030. This cost trajectory is crucial for widespread commercialization and adoption across various market segments.

Commercialization goals for BES solutions encompass multiple dimensions that extend beyond pure technological advancement. Primary objectives include achieving cost parity with conventional energy solutions, enhancing grid resilience and reliability, enabling higher penetration of renewable energy sources, and creating sustainable business models that generate value for stakeholders throughout the energy ecosystem.

Key performance targets for commercial viability include reducing levelized cost of storage (LCOS) below $100/MWh, extending operational lifetimes beyond 15 years, improving round-trip efficiency to over 90%, and developing flexible deployment capabilities that can serve multiple grid functions simultaneously. These targets represent the threshold requirements for BES solutions to compete effectively against incumbent technologies.

The policy landscape surrounding BES commercialization varies significantly across regions but generally includes a combination of direct incentives (tax credits, grants, subsidies), market-based mechanisms (capacity markets, ancillary service markets), and regulatory frameworks (storage mandates, renewable portfolio standards). The interplay between these policy instruments creates the economic foundation upon which viable business models can be constructed.

Successful commercialization of BES solutions ultimately depends on aligning technological capabilities with market needs while navigating complex regulatory environments. The industry is currently transitioning from demonstration projects and niche applications toward mainstream deployment, with annual global installations projected to exceed 30 GWh by 2025. This growth trajectory presents significant opportunities for innovation in both technology development and business model design.

Market Analysis for BES Solutions

The Battery Energy Storage (BES) solutions market is experiencing unprecedented growth globally, driven by the increasing integration of renewable energy sources and the need for grid stability. Current market valuations place the global BES market at approximately $8.5 billion as of 2023, with projections indicating a compound annual growth rate (CAGR) of 26% through 2030, potentially reaching $45 billion by the end of the decade.

Demand segmentation reveals distinct market sectors with varying growth trajectories. Utility-scale applications currently dominate, accounting for roughly 60% of deployed capacity, primarily for grid services including frequency regulation, peak shaving, and renewable integration. Commercial and industrial applications represent approximately 25% of the market, with businesses increasingly adopting BES solutions to reduce demand charges and enhance energy resilience.

Residential applications, while currently comprising only 15% of the market, are experiencing the fastest growth rate at 34% annually, driven by decreasing system costs and increasing consumer interest in energy independence. This segment presents significant untapped potential, particularly when coupled with residential solar installations.

Geographically, the market shows notable regional variations. North America leads with approximately 35% market share, followed by Asia-Pacific at 30%, Europe at 25%, and the rest of the world accounting for the remaining 10%. China and the United States represent the two largest individual country markets, collectively accounting for nearly 50% of global deployments.

Market adoption barriers remain significant despite the growth trajectory. High upfront capital costs continue to be the primary obstacle, with lithium-ion battery systems averaging $300-500/kWh for complete installations. Regulatory uncertainty regarding compensation mechanisms for grid services provided by BES systems creates investment hesitation in many markets.

Technical challenges including battery degradation, safety concerns, and integration complexities with existing infrastructure further complicate market expansion. The supply chain vulnerabilities exposed during recent global disruptions have highlighted risks associated with critical mineral dependencies and manufacturing concentration.

Customer awareness and education gaps persist, particularly in emerging markets and residential segments. Many potential adopters lack understanding of the full value proposition of BES solutions beyond basic backup power applications, limiting market penetration and value capture.

The competitive landscape is increasingly crowded with traditional battery manufacturers, renewable energy developers, utilities, and technology companies all vying for market share. This competition is driving innovation in business models, with subscription-based offerings, energy-as-a-service, and virtual power plant aggregation emerging as alternatives to traditional ownership models.

Demand segmentation reveals distinct market sectors with varying growth trajectories. Utility-scale applications currently dominate, accounting for roughly 60% of deployed capacity, primarily for grid services including frequency regulation, peak shaving, and renewable integration. Commercial and industrial applications represent approximately 25% of the market, with businesses increasingly adopting BES solutions to reduce demand charges and enhance energy resilience.

Residential applications, while currently comprising only 15% of the market, are experiencing the fastest growth rate at 34% annually, driven by decreasing system costs and increasing consumer interest in energy independence. This segment presents significant untapped potential, particularly when coupled with residential solar installations.

Geographically, the market shows notable regional variations. North America leads with approximately 35% market share, followed by Asia-Pacific at 30%, Europe at 25%, and the rest of the world accounting for the remaining 10%. China and the United States represent the two largest individual country markets, collectively accounting for nearly 50% of global deployments.

Market adoption barriers remain significant despite the growth trajectory. High upfront capital costs continue to be the primary obstacle, with lithium-ion battery systems averaging $300-500/kWh for complete installations. Regulatory uncertainty regarding compensation mechanisms for grid services provided by BES systems creates investment hesitation in many markets.

Technical challenges including battery degradation, safety concerns, and integration complexities with existing infrastructure further complicate market expansion. The supply chain vulnerabilities exposed during recent global disruptions have highlighted risks associated with critical mineral dependencies and manufacturing concentration.

Customer awareness and education gaps persist, particularly in emerging markets and residential segments. Many potential adopters lack understanding of the full value proposition of BES solutions beyond basic backup power applications, limiting market penetration and value capture.

The competitive landscape is increasingly crowded with traditional battery manufacturers, renewable energy developers, utilities, and technology companies all vying for market share. This competition is driving innovation in business models, with subscription-based offerings, energy-as-a-service, and virtual power plant aggregation emerging as alternatives to traditional ownership models.

Current Policy Landscape and Implementation Challenges

The global policy landscape for Battery Energy Storage (BES) solutions exhibits significant regional variations, with developed economies generally leading in comprehensive policy frameworks. The United States has implemented investment tax credits (ITC) for energy storage systems, while the European Union's Green Deal provides substantial funding for clean energy technologies including BES. China's 14th Five-Year Plan explicitly targets energy storage development with specific capacity goals and financial incentives. However, emerging economies often lack dedicated policies for BES commercialization, typically embedding limited storage provisions within broader renewable energy frameworks.

Regulatory frameworks present a complex challenge for BES deployment. Many jurisdictions operate with outdated electricity market regulations that fail to recognize the unique characteristics of storage technologies. These regulations often classify storage ambiguously—sometimes as generation, sometimes as transmission assets—creating compliance uncertainties and market participation barriers. Additionally, the absence of standardized interconnection procedures specifically designed for storage systems creates technical hurdles and delays project implementation.

Market design issues further complicate BES commercialization. Current electricity markets frequently undervalue the multiple services BES can provide, including frequency regulation, peak shaving, and grid stability. The lack of appropriate price signals and compensation mechanisms for these services undermines the economic viability of BES projects. Moreover, many markets lack transparent valuation methodologies for storage-specific attributes like rapid response capabilities and operational flexibility.

Implementation challenges extend to permitting and siting processes, which remain cumbersome and inconsistent across jurisdictions. Local authorities often lack technical expertise to evaluate BES projects, resulting in extended approval timelines and increased development costs. Safety regulations and building codes have not kept pace with BES technology evolution, creating additional compliance uncertainties.

Financial barriers persist despite improving technology economics. Many financial institutions still consider BES investments high-risk due to limited operational track records and uncertain revenue streams. This risk perception translates into higher capital costs and stricter financing terms. Furthermore, existing subsidies and incentives often favor traditional energy technologies, creating an uneven playing field for BES solutions.

Knowledge gaps among policymakers, regulators, and utilities represent another significant challenge. Limited understanding of BES capabilities and value propositions leads to suboptimal policy design and implementation. This knowledge deficit extends to technical standards and grid integration protocols, which remain underdeveloped in many regions, hampering interoperability and system optimization.

Regulatory frameworks present a complex challenge for BES deployment. Many jurisdictions operate with outdated electricity market regulations that fail to recognize the unique characteristics of storage technologies. These regulations often classify storage ambiguously—sometimes as generation, sometimes as transmission assets—creating compliance uncertainties and market participation barriers. Additionally, the absence of standardized interconnection procedures specifically designed for storage systems creates technical hurdles and delays project implementation.

Market design issues further complicate BES commercialization. Current electricity markets frequently undervalue the multiple services BES can provide, including frequency regulation, peak shaving, and grid stability. The lack of appropriate price signals and compensation mechanisms for these services undermines the economic viability of BES projects. Moreover, many markets lack transparent valuation methodologies for storage-specific attributes like rapid response capabilities and operational flexibility.

Implementation challenges extend to permitting and siting processes, which remain cumbersome and inconsistent across jurisdictions. Local authorities often lack technical expertise to evaluate BES projects, resulting in extended approval timelines and increased development costs. Safety regulations and building codes have not kept pace with BES technology evolution, creating additional compliance uncertainties.

Financial barriers persist despite improving technology economics. Many financial institutions still consider BES investments high-risk due to limited operational track records and uncertain revenue streams. This risk perception translates into higher capital costs and stricter financing terms. Furthermore, existing subsidies and incentives often favor traditional energy technologies, creating an uneven playing field for BES solutions.

Knowledge gaps among policymakers, regulators, and utilities represent another significant challenge. Limited understanding of BES capabilities and value propositions leads to suboptimal policy design and implementation. This knowledge deficit extends to technical standards and grid integration protocols, which remain underdeveloped in many regions, hampering interoperability and system optimization.

Current Business Models for BES Commercialization

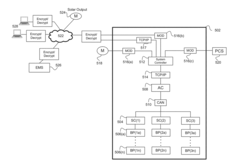

01 Grid Integration and Energy Management Systems

Battery energy storage solutions are being commercialized with advanced grid integration capabilities and energy management systems. These systems enable efficient coordination between energy storage units and the power grid, allowing for optimal energy dispatch, demand response, and grid stabilization. The technologies include smart controllers, predictive algorithms, and communication protocols that enhance the commercial viability of BES by providing grid services such as frequency regulation, peak shaving, and load balancing.- Grid Integration and Energy Management Systems: Battery energy storage solutions are being commercialized with advanced grid integration capabilities and energy management systems. These systems enable efficient power distribution, grid stabilization, and demand response management. The technologies include smart controllers that optimize battery charging/discharging cycles based on grid conditions, energy demand forecasting algorithms, and seamless integration with existing power infrastructure to enhance grid reliability and resilience.

- Battery Technology Innovations for Commercial Applications: Commercialization efforts focus on developing advanced battery technologies with improved energy density, cycle life, and safety features. These innovations include new electrode materials, electrolyte formulations, and battery management systems that extend operational lifespan while reducing costs. Commercial solutions incorporate thermal management systems and safety mechanisms to address concerns in large-scale deployments, making battery storage more viable for various market applications.

- Business Models and Financial Structures for BES Deployment: Novel business models are emerging to accelerate the commercialization of battery energy storage systems. These include energy-as-a-service offerings, power purchase agreements specifically for storage, and shared ownership structures that distribute costs and benefits among multiple stakeholders. Financial innovations such as specialized leasing arrangements, performance guarantees, and aggregated fleet management approaches are helping overcome initial capital cost barriers and creating sustainable revenue streams.

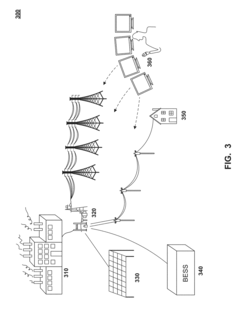

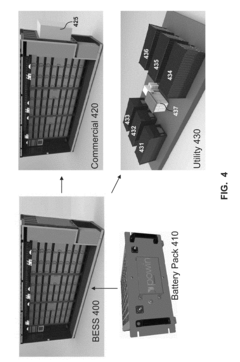

- Mobile and Modular BES Solutions: The commercialization landscape includes mobile and modular battery energy storage solutions that offer flexibility and scalability. These systems are designed for rapid deployment in various settings, from temporary power needs to permanent installations that can be expanded incrementally. Containerized solutions with plug-and-play capabilities allow for strategic placement near load centers or renewable generation sites, reducing transmission losses and providing localized grid support services.

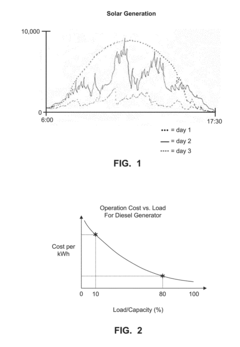

- Integration with Renewable Energy Sources: Commercial battery energy storage solutions are increasingly designed to work in tandem with renewable energy sources like solar and wind. These integrated systems address intermittency issues by storing excess energy during peak production periods and discharging when renewable generation is low. Advanced control algorithms optimize the interaction between storage and generation assets, maximizing renewable energy utilization and providing consistent power output to meet commercial and industrial requirements.

02 Scalable and Modular BES Architectures

Commercialization of battery energy storage solutions is advancing through scalable and modular architectures that allow for flexible deployment across various applications. These designs enable customization based on capacity requirements, space constraints, and budget considerations. Modular approaches facilitate easier installation, maintenance, and future expansion of storage capacity, making BES solutions more commercially attractive for diverse markets from residential to utility-scale applications.Expand Specific Solutions03 Battery Management and Optimization Technologies

Commercial BES solutions incorporate sophisticated battery management systems that optimize performance, extend battery life, and enhance safety. These technologies monitor cell conditions, balance charging and discharging processes, and implement thermal management strategies. Advanced algorithms predict battery degradation patterns and adjust operational parameters accordingly, maximizing return on investment and improving the economic feasibility of energy storage deployments in commercial settings.Expand Specific Solutions04 Business Models and Market Integration

Innovative business models are emerging to accelerate the commercialization of battery energy storage solutions. These include energy-as-a-service offerings, revenue stacking approaches that capitalize on multiple value streams, and shared ownership structures. Market integration strategies enable BES operators to participate in energy markets, capacity markets, and ancillary services markets simultaneously, improving the economic proposition of storage investments and driving wider commercial adoption.Expand Specific Solutions05 Integration with Renewable Energy Systems

Battery energy storage solutions are being commercialized in conjunction with renewable energy systems to address intermittency challenges and enhance the value proposition of clean energy. These integrated systems combine solar, wind, or other renewable sources with storage capabilities to provide reliable power supply, enable time-shifting of energy production, and maximize self-consumption. The commercial applications include microgrids, hybrid power plants, and behind-the-meter installations that optimize renewable energy utilization and provide resilience benefits.Expand Specific Solutions

Key Stakeholders in BES Industry

The Battery Energy Storage (BES) solutions market is currently in a growth phase, characterized by increasing policy incentives and evolving business models driving commercialization. The market size is expanding rapidly, with projections indicating substantial growth as grid modernization efforts accelerate globally. Technologically, BES solutions are advancing from early commercial deployment toward maturity, with key players demonstrating varying levels of expertise. State Grid Corporation of China and its subsidiaries are leading implementation in Asia, while Siemens and GE Grid Solutions represent established industrial players with comprehensive offerings. Academic institutions like MIT, North China Electric Power University, and Stevens Institute of Technology are contributing significant research advancements. The ecosystem also includes specialized entities like Midcontinent Independent System Operator focusing on grid integration, indicating a diverse competitive landscape with both established utilities and emerging technology providers.

State Grid Corp. of China

Technical Solution: State Grid has developed a comprehensive BES commercialization framework that integrates policy incentives with innovative business models. Their approach includes a tiered pricing mechanism for grid-connected battery storage systems, offering higher compensation rates during peak demand periods to incentivize deployment. The company has implemented a "storage as a service" business model where they own and operate large-scale battery systems while providing grid services to various stakeholders. State Grid has also pioneered a hybrid ownership structure where costs and benefits are shared between grid operators, renewable generators, and industrial consumers. Their policy advocacy has resulted in favorable regulatory frameworks including capacity payments for storage assets and streamlined interconnection processes. Additionally, they've developed a digital platform that enables real-time trading of storage services across their network, creating new revenue streams for BES operators.

Strengths: Extensive grid infrastructure ownership provides unique positioning to integrate BES solutions at scale; strong government relationships enable policy influence. Weaknesses: Heavy reliance on government subsidies creates vulnerability to policy changes; business models may not be easily transferable to more market-driven economies.

Hitachi Ltd.

Technical Solution: Hitachi has developed an advanced BES commercialization strategy centered around their "Social Innovation Business" framework. Their approach combines hardware manufacturing with digital service offerings to create comprehensive energy solutions. Hitachi's business model incorporates a "Storage-as-a-Service" (STaaS) offering where customers pay for outcomes rather than equipment, reducing upfront capital requirements. They've pioneered a value-stacking approach that enables BES systems to simultaneously provide multiple services including frequency regulation, peak shaving, and renewable integration. Hitachi has worked extensively with regulators in Japan and internationally to develop favorable policy frameworks, including capacity market mechanisms that properly value storage contributions. Their digital platforms enable real-time optimization of storage assets across multiple value streams, maximizing return on investment. Hitachi has also developed innovative financing mechanisms including shared savings models and performance guarantees to overcome initial cost barriers.

Strengths: Strong integration capabilities across hardware, software, and services enable comprehensive solutions; global presence provides diverse market insights and policy expertise. Weaknesses: Premium pricing strategy may limit adoption in cost-sensitive markets; complex solutions require significant customer education and longer sales cycles.

Critical Policy Frameworks Supporting BES Adoption

Battery energy storage system

PatentActiveUS20180233931A1

Innovation

- A battery energy storage system (BESS) that can be charged by both conventional and renewable sources, providing on-demand energy and stabilizing the grid frequency, acting as a 'spinning reserve' to supplement renewable energy sources during peak demand or low production periods.

Electric power storage system, energy storage management system

PatentWO2017002591A1

Innovation

- An energy storage management system that integrates a thermal energy storage system thermally coupled with the air conditioning system, allowing for controlled temperature management and cold energy storage, which is managed by an energy management device to optimize battery operation and reduce cooling system costs.

Regulatory Framework and Compliance Requirements

The regulatory landscape for Battery Energy Storage (BES) solutions varies significantly across regions, creating a complex environment for commercialization efforts. In the United States, the Federal Energy Regulatory Commission (FERC) has established Order 841, which requires grid operators to develop participation models allowing energy storage resources to provide all capacity, energy, and ancillary services they are technically capable of providing. This landmark regulation has opened markets previously inaccessible to BES providers, though implementation remains inconsistent across regional transmission organizations.

The European Union has developed the Clean Energy Package, which explicitly recognizes energy storage as a distinct asset class in the electricity value chain. This regulatory clarity has removed previous barriers where storage was ambiguously classified as both generation and consumption, subjecting operators to double taxation and network charges. Member states are now required to adapt national frameworks to accommodate storage technologies, though progress varies considerably between countries.

In Asia-Pacific regions, regulatory approaches differ substantially. China's energy storage policy is integrated within its broader renewable energy strategy, with specific provincial-level incentives for BES deployment. Japan has implemented a certification system for storage systems that meet specific safety and performance standards, providing market certainty for manufacturers and consumers alike.

Safety regulations represent a critical compliance area for BES commercialization. Standards such as UL 9540 for energy storage systems and IEC 62619 for safety requirements of lithium-ion batteries in industrial applications establish minimum safety thresholds. Fire codes have been updated in many jurisdictions to address the unique challenges posed by lithium-ion battery installations, particularly following high-profile thermal runaway incidents.

Grid interconnection requirements present another significant regulatory hurdle. These technical standards ensure that BES systems can safely and reliably connect to the existing electricity infrastructure. IEEE 1547 in the United States and similar standards internationally govern interconnection parameters, though requirements can vary dramatically between utilities and regions, creating compliance challenges for manufacturers seeking scale.

Environmental regulations also impact BES deployment, with particular focus on end-of-life management. The EU's Battery Directive establishes extended producer responsibility for battery recycling, while similar frameworks are emerging globally. These regulations increasingly incorporate lifecycle carbon footprint considerations, potentially favoring certain battery chemistries and manufacturing processes over others.

Navigating this complex regulatory landscape requires significant expertise and resources, creating barriers to entry for smaller players. However, regulatory harmonization efforts are underway in several regions, potentially simplifying compliance requirements and accelerating BES commercialization in the coming years.

The European Union has developed the Clean Energy Package, which explicitly recognizes energy storage as a distinct asset class in the electricity value chain. This regulatory clarity has removed previous barriers where storage was ambiguously classified as both generation and consumption, subjecting operators to double taxation and network charges. Member states are now required to adapt national frameworks to accommodate storage technologies, though progress varies considerably between countries.

In Asia-Pacific regions, regulatory approaches differ substantially. China's energy storage policy is integrated within its broader renewable energy strategy, with specific provincial-level incentives for BES deployment. Japan has implemented a certification system for storage systems that meet specific safety and performance standards, providing market certainty for manufacturers and consumers alike.

Safety regulations represent a critical compliance area for BES commercialization. Standards such as UL 9540 for energy storage systems and IEC 62619 for safety requirements of lithium-ion batteries in industrial applications establish minimum safety thresholds. Fire codes have been updated in many jurisdictions to address the unique challenges posed by lithium-ion battery installations, particularly following high-profile thermal runaway incidents.

Grid interconnection requirements present another significant regulatory hurdle. These technical standards ensure that BES systems can safely and reliably connect to the existing electricity infrastructure. IEEE 1547 in the United States and similar standards internationally govern interconnection parameters, though requirements can vary dramatically between utilities and regions, creating compliance challenges for manufacturers seeking scale.

Environmental regulations also impact BES deployment, with particular focus on end-of-life management. The EU's Battery Directive establishes extended producer responsibility for battery recycling, while similar frameworks are emerging globally. These regulations increasingly incorporate lifecycle carbon footprint considerations, potentially favoring certain battery chemistries and manufacturing processes over others.

Navigating this complex regulatory landscape requires significant expertise and resources, creating barriers to entry for smaller players. However, regulatory harmonization efforts are underway in several regions, potentially simplifying compliance requirements and accelerating BES commercialization in the coming years.

Public-Private Partnership Opportunities

Public-Private Partnership (PPP) models represent a crucial framework for accelerating the commercialization of Battery Energy Storage (BES) solutions. These partnerships strategically combine government resources and policy support with private sector innovation and capital, creating synergistic relationships that address market barriers more effectively than either sector could independently.

Government entities can contribute land access, regulatory streamlining, and financial incentives while private companies bring technical expertise, operational efficiency, and investment capital. This complementary relationship has proven particularly valuable in large-scale infrastructure projects where high initial costs and extended payback periods might otherwise deter private investment.

Several successful PPP models have emerged specifically for BES deployment. The Design-Build-Finance-Operate-Maintain (DBFOM) structure allows private entities to handle the entire project lifecycle while public entities provide enabling conditions and performance-based payments. Joint ventures between utilities and technology providers have also demonstrated effectiveness, particularly in grid-scale applications where regulatory complexity requires multi-stakeholder coordination.

Risk-sharing mechanisms represent another critical dimension of successful BES partnerships. Government loan guarantees, minimum revenue guarantees, and tax incentives can significantly reduce private sector exposure while maintaining appropriate incentives for performance. These mechanisms have proven particularly important during early market development phases when technology and market risks remain elevated.

Internationally, countries like South Korea, Australia, and the United Kingdom have pioneered innovative PPP structures for energy storage. The UK's Capacity Market mechanism, for instance, provides revenue certainty for storage assets while serving critical grid functions. South Korea's regulatory framework enables private developers to participate in multiple value streams, enhancing project economics while delivering public benefits.

For emerging markets, development finance institutions (DFIs) often play a catalytic role in BES partnerships. Organizations like the World Bank and Asian Development Bank provide concessional financing, technical assistance, and risk mitigation instruments that enable projects in regions where commercial financing alone would be insufficient.

The most promising future direction for BES partnerships involves community-inclusive models that distribute benefits beyond traditional stakeholders. These approaches incorporate local ownership structures, workforce development programs, and environmental justice considerations, ensuring broader societal value while maintaining commercial viability.

Government entities can contribute land access, regulatory streamlining, and financial incentives while private companies bring technical expertise, operational efficiency, and investment capital. This complementary relationship has proven particularly valuable in large-scale infrastructure projects where high initial costs and extended payback periods might otherwise deter private investment.

Several successful PPP models have emerged specifically for BES deployment. The Design-Build-Finance-Operate-Maintain (DBFOM) structure allows private entities to handle the entire project lifecycle while public entities provide enabling conditions and performance-based payments. Joint ventures between utilities and technology providers have also demonstrated effectiveness, particularly in grid-scale applications where regulatory complexity requires multi-stakeholder coordination.

Risk-sharing mechanisms represent another critical dimension of successful BES partnerships. Government loan guarantees, minimum revenue guarantees, and tax incentives can significantly reduce private sector exposure while maintaining appropriate incentives for performance. These mechanisms have proven particularly important during early market development phases when technology and market risks remain elevated.

Internationally, countries like South Korea, Australia, and the United Kingdom have pioneered innovative PPP structures for energy storage. The UK's Capacity Market mechanism, for instance, provides revenue certainty for storage assets while serving critical grid functions. South Korea's regulatory framework enables private developers to participate in multiple value streams, enhancing project economics while delivering public benefits.

For emerging markets, development finance institutions (DFIs) often play a catalytic role in BES partnerships. Organizations like the World Bank and Asian Development Bank provide concessional financing, technical assistance, and risk mitigation instruments that enable projects in regions where commercial financing alone would be insufficient.

The most promising future direction for BES partnerships involves community-inclusive models that distribute benefits beyond traditional stakeholders. These approaches incorporate local ownership structures, workforce development programs, and environmental justice considerations, ensuring broader societal value while maintaining commercial viability.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!