Comparative CO2 Capture In Cement, Steel, And Petrochemical Industries

SEP 3, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

CO2 Capture Evolution and Objectives

Carbon dioxide capture technologies have evolved significantly over the past decades, driven by growing concerns about climate change and the need to reduce greenhouse gas emissions. The journey began in the 1970s with early experiments in CO2 separation for enhanced oil recovery, but gained momentum in the 1990s as climate science advanced. Initially, these technologies were primarily developed for the power generation sector, but attention has gradually shifted to hard-to-abate industrial sectors including cement, steel, and petrochemicals, which collectively account for approximately 20% of global CO2 emissions.

The cement industry, responsible for roughly 8% of global CO2 emissions, faces unique challenges as approximately 60% of its emissions come from the calcination process itself rather than from fuel combustion. Early capture efforts focused on post-combustion technologies, but recent developments have expanded to include oxyfuel combustion and direct separation methods specifically tailored to cement kilns.

In the steel industry, which contributes about 7% of global emissions, carbon capture evolution has followed a different trajectory. Initial approaches concentrated on blast furnace gas separation, but have since diversified to include innovative solutions for direct reduced iron processes and electric arc furnaces. The technological evolution in this sector has been closely tied to broader transitions in steelmaking methods.

The petrochemical industry presents yet another distinct profile, with CO2 capture technologies initially developed for natural gas processing and hydrogen production facilities where relatively pure CO2 streams were already being generated. The evolution here has been characterized by incremental efficiency improvements rather than radical technological shifts.

The primary objective of comparative CO2 capture across these industries is to identify cost-effective, energy-efficient solutions that can be deployed at industrial scale while accommodating the unique characteristics of each sector. Secondary objectives include minimizing the energy penalty associated with capture processes, reducing capital and operational costs, and ensuring compatibility with existing industrial infrastructure.

Looking forward, the technological goals include achieving capture costs below $50 per ton of CO2 by 2030 across all three industries, developing modular and retrofittable solutions that can be implemented without major process redesigns, and creating integrated systems that optimize energy use across industrial clusters. The ultimate aim is to enable these carbon-intensive industries to continue operating in a carbon-constrained world while progressing toward net-zero emissions by mid-century.

The cement industry, responsible for roughly 8% of global CO2 emissions, faces unique challenges as approximately 60% of its emissions come from the calcination process itself rather than from fuel combustion. Early capture efforts focused on post-combustion technologies, but recent developments have expanded to include oxyfuel combustion and direct separation methods specifically tailored to cement kilns.

In the steel industry, which contributes about 7% of global emissions, carbon capture evolution has followed a different trajectory. Initial approaches concentrated on blast furnace gas separation, but have since diversified to include innovative solutions for direct reduced iron processes and electric arc furnaces. The technological evolution in this sector has been closely tied to broader transitions in steelmaking methods.

The petrochemical industry presents yet another distinct profile, with CO2 capture technologies initially developed for natural gas processing and hydrogen production facilities where relatively pure CO2 streams were already being generated. The evolution here has been characterized by incremental efficiency improvements rather than radical technological shifts.

The primary objective of comparative CO2 capture across these industries is to identify cost-effective, energy-efficient solutions that can be deployed at industrial scale while accommodating the unique characteristics of each sector. Secondary objectives include minimizing the energy penalty associated with capture processes, reducing capital and operational costs, and ensuring compatibility with existing industrial infrastructure.

Looking forward, the technological goals include achieving capture costs below $50 per ton of CO2 by 2030 across all three industries, developing modular and retrofittable solutions that can be implemented without major process redesigns, and creating integrated systems that optimize energy use across industrial clusters. The ultimate aim is to enable these carbon-intensive industries to continue operating in a carbon-constrained world while progressing toward net-zero emissions by mid-century.

Market Drivers for Industrial Carbon Capture

The global drive towards decarbonization has significantly accelerated industrial carbon capture initiatives across cement, steel, and petrochemical sectors. Stringent regulatory frameworks, particularly the Paris Agreement's commitment to limit global warming to well below 2°C, have established clear carbon reduction targets that these carbon-intensive industries must meet. The European Union's Emissions Trading System (ETS) has created a functional carbon market where the price per ton of CO2 has risen substantially, reaching over €80 in 2022, making carbon capture economically viable for many industrial operations.

Financial incentives have emerged as powerful market drivers, with governments worldwide implementing carbon taxes and cap-and-trade systems. The United States' 45Q tax credit now offers up to $85 per metric ton for CO2 permanently sequestered, while Canada's carbon pricing framework imposes costs starting at $65 per ton in 2023, scheduled to reach $170 by 2030. These mechanisms effectively transform carbon emissions from externalities into quantifiable financial liabilities on corporate balance sheets.

Consumer and investor pressures represent another significant market force. Major corporations face mounting demands for environmental responsibility, with 67% of consumers now considering carbon footprints when making purchasing decisions. The financial sector has similarly pivoted, with ESG-focused investments surpassing $35 trillion globally in 2022. This has compelled cement, steel, and petrochemical companies to adopt carbon capture technologies to maintain market access and investment appeal.

The emergence of carbon utilization markets has created additional economic incentives for captured carbon. The global market for CO2-derived products is projected to reach substantial value, with applications ranging from enhanced oil recovery to synthetic fuel production and building materials. This creates revenue streams that partially offset capture costs, improving the business case for implementation across industrial sectors.

Technology cost reductions have dramatically altered market dynamics for carbon capture. Second and third-generation capture technologies have demonstrated cost reductions of 30-40% compared to earlier systems, with energy penalties decreasing from 30% to below 10% in advanced systems. These improvements have expanded the range of industrial facilities where carbon capture can be economically deployed.

Supply chain considerations are increasingly driving carbon capture adoption as multinational corporations extend emissions reduction requirements to their suppliers. Steel and cement producers supplying construction materials for green building projects, and petrochemical companies providing raw materials for consumer goods manufacturers, face growing pressure to demonstrate verifiable carbon reduction strategies to maintain their position in evolving supply chains.

Financial incentives have emerged as powerful market drivers, with governments worldwide implementing carbon taxes and cap-and-trade systems. The United States' 45Q tax credit now offers up to $85 per metric ton for CO2 permanently sequestered, while Canada's carbon pricing framework imposes costs starting at $65 per ton in 2023, scheduled to reach $170 by 2030. These mechanisms effectively transform carbon emissions from externalities into quantifiable financial liabilities on corporate balance sheets.

Consumer and investor pressures represent another significant market force. Major corporations face mounting demands for environmental responsibility, with 67% of consumers now considering carbon footprints when making purchasing decisions. The financial sector has similarly pivoted, with ESG-focused investments surpassing $35 trillion globally in 2022. This has compelled cement, steel, and petrochemical companies to adopt carbon capture technologies to maintain market access and investment appeal.

The emergence of carbon utilization markets has created additional economic incentives for captured carbon. The global market for CO2-derived products is projected to reach substantial value, with applications ranging from enhanced oil recovery to synthetic fuel production and building materials. This creates revenue streams that partially offset capture costs, improving the business case for implementation across industrial sectors.

Technology cost reductions have dramatically altered market dynamics for carbon capture. Second and third-generation capture technologies have demonstrated cost reductions of 30-40% compared to earlier systems, with energy penalties decreasing from 30% to below 10% in advanced systems. These improvements have expanded the range of industrial facilities where carbon capture can be economically deployed.

Supply chain considerations are increasingly driving carbon capture adoption as multinational corporations extend emissions reduction requirements to their suppliers. Steel and cement producers supplying construction materials for green building projects, and petrochemical companies providing raw materials for consumer goods manufacturers, face growing pressure to demonstrate verifiable carbon reduction strategies to maintain their position in evolving supply chains.

Technical Barriers in Cross-Industry CO2 Capture

Carbon capture technologies face significant technical barriers across cement, steel, and petrochemical industries, though these challenges manifest differently in each sector due to varying process conditions and emission characteristics.

In the cement industry, the primary technical barrier stems from the dilute CO2 concentration in flue gases (approximately 14-33%), making capture less efficient and more energy-intensive compared to more concentrated sources. Additionally, cement kilns produce particulate matter and contaminants that can degrade capture solvents and foul equipment, requiring robust pre-treatment systems that add complexity and cost.

Steel production presents unique challenges, particularly in integrated steel mills where multiple emission points exist across the production chain. The blast furnace gases contain not only CO2 but also carbon monoxide, hydrogen, and nitrogen, creating a complex mixture that complicates selective CO2 capture. The high temperatures in steel production (exceeding 1600°C) also limit the types of capture technologies that can be deployed in proximity to emission sources.

The petrochemical industry faces barriers related to the diverse nature of its processes and emission sources. Refineries and chemical plants have multiple, distributed CO2 emission points with varying concentrations, pressures, and impurity profiles. This heterogeneity makes standardized capture solutions difficult to implement across facilities, often requiring customized approaches that increase capital expenditure.

Cross-cutting technical barriers include the substantial energy penalty associated with carbon capture, which typically consumes 15-30% of a plant's energy output. This parasitic load significantly impacts operational economics and can offset environmental benefits if the energy comes from fossil sources. Material limitations also present challenges, as current capture materials (solvents, sorbents, and membranes) suffer from degradation, capacity loss, and selectivity issues under industrial conditions.

Scale-up challenges persist across all three industries. Laboratory-proven technologies often encounter unforeseen issues when deployed at industrial scale, including heat and mass transfer limitations, material handling complications, and integration difficulties with existing infrastructure. The intermittent operation of some industrial processes further complicates capture system design, as these systems typically perform optimally under steady-state conditions.

Process integration represents another significant barrier, as retrofitting capture technologies into existing industrial facilities requires substantial modifications to plant layout, heat recovery systems, and utility networks. This integration complexity often results in higher costs and operational disruptions during implementation.

In the cement industry, the primary technical barrier stems from the dilute CO2 concentration in flue gases (approximately 14-33%), making capture less efficient and more energy-intensive compared to more concentrated sources. Additionally, cement kilns produce particulate matter and contaminants that can degrade capture solvents and foul equipment, requiring robust pre-treatment systems that add complexity and cost.

Steel production presents unique challenges, particularly in integrated steel mills where multiple emission points exist across the production chain. The blast furnace gases contain not only CO2 but also carbon monoxide, hydrogen, and nitrogen, creating a complex mixture that complicates selective CO2 capture. The high temperatures in steel production (exceeding 1600°C) also limit the types of capture technologies that can be deployed in proximity to emission sources.

The petrochemical industry faces barriers related to the diverse nature of its processes and emission sources. Refineries and chemical plants have multiple, distributed CO2 emission points with varying concentrations, pressures, and impurity profiles. This heterogeneity makes standardized capture solutions difficult to implement across facilities, often requiring customized approaches that increase capital expenditure.

Cross-cutting technical barriers include the substantial energy penalty associated with carbon capture, which typically consumes 15-30% of a plant's energy output. This parasitic load significantly impacts operational economics and can offset environmental benefits if the energy comes from fossil sources. Material limitations also present challenges, as current capture materials (solvents, sorbents, and membranes) suffer from degradation, capacity loss, and selectivity issues under industrial conditions.

Scale-up challenges persist across all three industries. Laboratory-proven technologies often encounter unforeseen issues when deployed at industrial scale, including heat and mass transfer limitations, material handling complications, and integration difficulties with existing infrastructure. The intermittent operation of some industrial processes further complicates capture system design, as these systems typically perform optimally under steady-state conditions.

Process integration represents another significant barrier, as retrofitting capture technologies into existing industrial facilities requires substantial modifications to plant layout, heat recovery systems, and utility networks. This integration complexity often results in higher costs and operational disruptions during implementation.

Current CO2 Capture Methodologies Across Industries

01 Amine-based CO2 capture technologies

Amine-based technologies are widely used for capturing CO2 from various gas streams. These systems typically involve the absorption of CO2 using amine solutions, followed by regeneration of the solvent through heating. The process allows for efficient separation of CO2 from flue gases and other industrial emissions. Advanced amine formulations have been developed to improve capture efficiency, reduce energy requirements, and minimize solvent degradation during the absorption-desorption cycle.- Chemical absorption methods for CO2 capture: Chemical absorption is a widely used method for capturing CO2 from various gas streams. This approach typically involves the use of liquid solvents such as amines that chemically react with CO2, allowing for its separation from other gases. The process generally consists of an absorption step where CO2 is captured by the solvent, followed by a regeneration step where the CO2 is released and the solvent is recycled. This method is particularly effective for post-combustion capture from power plants and industrial facilities.

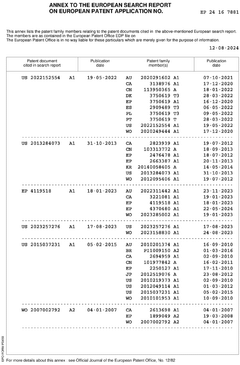

- Solid sorbent technologies for CO2 capture: Solid sorbent technologies utilize porous materials that can selectively adsorb CO2 from gas mixtures. These materials include metal-organic frameworks (MOFs), zeolites, activated carbons, and amine-functionalized solids. The CO2 capture process typically involves pressure or temperature swing adsorption cycles, where CO2 is first adsorbed onto the solid material and then released through changes in pressure or temperature. Solid sorbents offer advantages such as lower energy requirements for regeneration and reduced corrosion issues compared to liquid solvents.

- Membrane-based systems for CO2 separation: Membrane technology utilizes selective barriers that allow CO2 to permeate while blocking other gases. These membranes can be made from polymers, ceramics, or composite materials with specific CO2 affinity. The driving force for separation is typically a pressure or concentration gradient across the membrane. Membrane systems are valued for their compact design, continuous operation capability, and scalability. Recent advances focus on improving membrane selectivity, permeability, and stability under various operating conditions to enhance CO2 capture efficiency.

- Cryogenic CO2 capture processes: Cryogenic CO2 capture involves cooling gas streams to very low temperatures where CO2 condenses or solidifies, allowing for its separation from other gases. This method can produce high-purity CO2 suitable for various applications including enhanced oil recovery and food processing. The process typically requires significant cooling energy but can be economically viable when integrated with liquefied natural gas (LNG) facilities or other processes that already involve cryogenic operations. Recent innovations focus on reducing the energy requirements through heat integration and process optimization.

- Control systems and process integration for CO2 capture: Advanced control systems and process integration strategies are essential for optimizing CO2 capture operations. These systems incorporate sensors, monitoring equipment, and automated controls to maintain optimal operating conditions while responding to fluctuations in feed gas composition or flow rate. Process integration approaches focus on heat recovery, energy efficiency, and minimizing parasitic loads on host facilities. Smart control algorithms can predict and adjust for changing conditions, while integration with renewable energy sources can reduce the carbon footprint of the capture process itself.

02 Solid sorbent materials for CO2 capture

Solid sorbent materials offer an alternative approach to liquid-based CO2 capture systems. These materials include metal-organic frameworks (MOFs), zeolites, activated carbons, and functionalized porous materials that can selectively adsorb CO2 from gas mixtures. The solid sorbents can be regenerated through temperature or pressure swing processes. Research in this area focuses on developing materials with high CO2 selectivity, capacity, and stability over multiple adsorption-desorption cycles.Expand Specific Solutions03 Membrane-based CO2 separation systems

Membrane technology utilizes selective barriers that allow CO2 to permeate while blocking other gases. These systems offer advantages such as continuous operation, compact design, and potentially lower energy requirements compared to traditional absorption processes. Advanced membrane materials include polymeric membranes, mixed matrix membranes, and facilitated transport membranes. Research focuses on improving membrane permeability, selectivity, and durability under industrial operating conditions.Expand Specific Solutions04 Direct air capture (DAC) technologies

Direct air capture technologies are designed to extract CO2 directly from ambient air, addressing distributed CO2 emissions that cannot be captured at source. These systems typically use specialized sorbents or solutions that can capture CO2 at very low concentrations. The captured CO2 can then be concentrated, purified, and either utilized or sequestered. DAC technologies face unique challenges due to the low concentration of CO2 in ambient air, requiring innovative designs to minimize energy consumption and operational costs.Expand Specific Solutions05 Control systems and process optimization for CO2 capture

Advanced control systems and process optimization techniques are essential for efficient operation of CO2 capture facilities. These include automated monitoring systems, predictive models, and intelligent control algorithms that can adjust operating parameters in real-time to maximize capture efficiency while minimizing energy consumption. Integration of capture systems with industrial processes and power generation facilities requires sophisticated control strategies to handle variations in flue gas composition and flow rates while maintaining optimal performance.Expand Specific Solutions

Leading Companies in Industrial CO2 Capture Solutions

The CO2 capture market in cement, steel, and petrochemical industries is in a growth phase, with increasing market size driven by global decarbonization efforts. The technology landscape shows varying maturity levels across sectors, with cement industry applications leading through innovations from China National Building Material Group and Tianjin Cement Industry Design & Research Institute. Academic-industrial partnerships are accelerating development, as seen in collaborations between Air Liquide and research institutions like CSIC and CNRS. CarbonCure Technologies represents commercial maturity in cement applications, while steel and petrochemical sectors show promising but less mature capture technologies, with companies like Schlumberger and Industrial Technology Research Institute advancing cross-sector solutions through integrated approaches.

Air Liquide SA

Technical Solution: Air Liquide has pioneered a comprehensive cryogenic carbon capture (CCC) technology applicable across cement, steel, and petrochemical industries. Their system employs a proprietary multi-stage cooling process that freezes CO2 directly from flue gases at temperatures around -140°C, achieving separation efficiencies of over 95%. For steel manufacturing specifically, Air Liquide has developed the "Cryocap Steel" solution that captures CO2 from blast furnace gases while simultaneously recovering valuable components like carbon monoxide for reuse in the steelmaking process. In petrochemical applications, their technology integrates with hydrogen production units, capturing CO2 during the steam methane reforming process. Air Liquide's systems incorporate advanced heat exchangers that recover up to 90% of the cooling energy, significantly reducing the energy penalty typically associated with carbon capture. The company has successfully deployed commercial-scale installations that demonstrate capture costs between €40-60 per ton of CO2, with their latest generation technology targeting further 20% cost reductions through improved process integration and equipment optimization.

Strengths: Cross-industry applicability provides versatile implementation options; high capture efficiency (>95%); energy recovery systems significantly reduce operational costs; valuable by-product recovery creates additional revenue streams. Weaknesses: High initial capital expenditure; requires significant cooling infrastructure; energy-intensive process despite heat recovery systems; requires careful integration with existing industrial processes.

China National Building Material Group Co., Ltd.

Technical Solution: China National Building Material Group (CNBM) has developed an integrated carbon capture system specifically for cement production that combines oxy-fuel combustion technology with calcium looping. Their approach involves modifying the cement kiln to operate with oxygen-enriched air, which produces a more concentrated CO2 stream (up to 90% concentration) that's easier to capture. The system integrates with their existing cement production facilities, allowing for retrofitting rather than complete plant redesign. CNBM's technology captures approximately 85-95% of CO2 emissions from cement production while utilizing the heat generated during the calcium looping process to improve overall energy efficiency. Their pilot projects have demonstrated capture costs of approximately $40-50 per ton of CO2, significantly lower than first-generation capture technologies. The company has also developed specialized sorbents that maintain reactivity over multiple carbonation-calcination cycles, extending operational life and reducing material replacement costs.

Strengths: Integration with existing cement production infrastructure reduces implementation costs; heat recovery systems improve energy efficiency; specialized sorbents with extended lifecycle reduce operational costs. Weaknesses: Initial capital investment remains high; technology still requires significant energy input; performance at full industrial scale needs further validation.

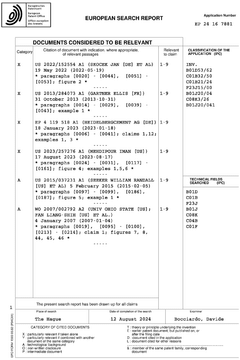

Key Patents and Breakthroughs in Carbon Capture

Method of capturing carbon dioxide

PatentPendingEP4556102A1

Innovation

- A method involving particles containing magnesium oxide, calcium oxide, or a combination thereof, which are contacted with a mixture gas containing water vapor, carbon dioxide, and nitrogen oxide, to capture carbon dioxide and form carbonated particles, optimizing conditions such as relative humidity, nitrogen oxide concentration, and temperature.

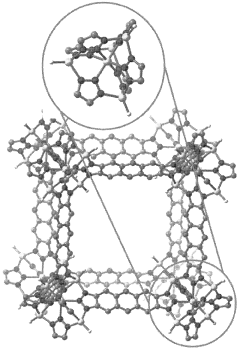

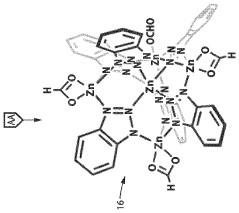

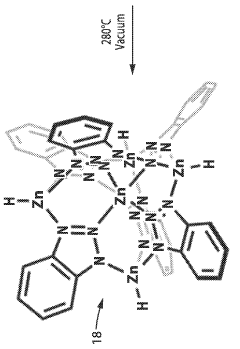

Acid gas capture through metal-ligand insertion in porous materials at elevated temperatures

PatentWO2024145655A2

Innovation

- Development of metal-ligand insertion mechanisms within metal-organic frameworks (MOFs) like ZnH-MFU-4l and ZnH-CFA-1, which demonstrate high affinity for CO2 and other acid gases at temperatures up to 500°C, enabling efficient and reversible capture without the need for cooling, using a synthesis method that optimizes active binding sites and stability.

Economic Feasibility and Cost Analysis

The economic feasibility of CO2 capture technologies varies significantly across cement, steel, and petrochemical industries, with capital expenditure (CAPEX) and operational expenditure (OPEX) being the primary cost drivers. In the cement industry, post-combustion capture technologies currently represent costs of approximately $40-80 per ton of CO2 captured, with total implementation costs ranging from $50-100 million for a typical cement plant. These costs are particularly challenging for an industry with thin profit margins, often representing 50-120% of the cement production cost itself.

Steel industry carbon capture presents a different economic profile, with costs ranging from $60-100 per ton of CO2 captured. The higher concentration of CO2 in blast furnace gases (20-25%) compared to cement kiln exhaust (14-33%) provides some efficiency advantages. However, the capital investment required for steel plants is substantially higher, typically $100-300 million per facility, due to larger emission volumes and more complex integration requirements.

The petrochemical industry demonstrates the most favorable economics for carbon capture, with costs ranging from $25-60 per ton of CO2 captured. This advantage stems from higher process efficiencies and the existence of concentrated CO2 streams in certain processes like hydrogen production via steam methane reforming, where CO2 concentrations can reach 30-99%.

Across all three industries, energy requirements represent 40-60% of operational costs for carbon capture, with the cement industry facing the highest relative burden due to its already energy-intensive processes. Government incentives significantly impact economic feasibility, with carbon pricing mechanisms, tax credits (such as the 45Q tax credit in the US offering $50-85 per ton), and subsidies playing crucial roles in investment decisions.

Scale effects are particularly important for economic viability. Larger facilities in all three sectors demonstrate improved economics through better integration opportunities and lower per-unit costs. Analysis indicates that facilities capturing at least 500,000 tons of CO2 annually achieve 15-30% lower costs per ton compared to smaller operations.

Future cost trajectories show promising trends, with projected reductions of 25-40% by 2030 through technological improvements, particularly in sorbent efficiency and energy integration. The learning rate for carbon capture technologies across these industries is estimated at 10-15% cost reduction for each doubling of installed capacity, suggesting accelerating economic feasibility as deployment expands.

Steel industry carbon capture presents a different economic profile, with costs ranging from $60-100 per ton of CO2 captured. The higher concentration of CO2 in blast furnace gases (20-25%) compared to cement kiln exhaust (14-33%) provides some efficiency advantages. However, the capital investment required for steel plants is substantially higher, typically $100-300 million per facility, due to larger emission volumes and more complex integration requirements.

The petrochemical industry demonstrates the most favorable economics for carbon capture, with costs ranging from $25-60 per ton of CO2 captured. This advantage stems from higher process efficiencies and the existence of concentrated CO2 streams in certain processes like hydrogen production via steam methane reforming, where CO2 concentrations can reach 30-99%.

Across all three industries, energy requirements represent 40-60% of operational costs for carbon capture, with the cement industry facing the highest relative burden due to its already energy-intensive processes. Government incentives significantly impact economic feasibility, with carbon pricing mechanisms, tax credits (such as the 45Q tax credit in the US offering $50-85 per ton), and subsidies playing crucial roles in investment decisions.

Scale effects are particularly important for economic viability. Larger facilities in all three sectors demonstrate improved economics through better integration opportunities and lower per-unit costs. Analysis indicates that facilities capturing at least 500,000 tons of CO2 annually achieve 15-30% lower costs per ton compared to smaller operations.

Future cost trajectories show promising trends, with projected reductions of 25-40% by 2030 through technological improvements, particularly in sorbent efficiency and energy integration. The learning rate for carbon capture technologies across these industries is estimated at 10-15% cost reduction for each doubling of installed capacity, suggesting accelerating economic feasibility as deployment expands.

Regulatory Framework and Emission Standards

The regulatory landscape for CO2 emissions has evolved significantly across global industrial sectors, with cement, steel, and petrochemical industries facing increasingly stringent standards. The Paris Agreement established the foundation for national commitments to reduce greenhouse gas emissions, with many countries subsequently developing industry-specific regulations targeting these carbon-intensive sectors.

In the European Union, the Emissions Trading System (ETS) represents the most comprehensive regulatory framework, imposing a cap-and-trade mechanism that directly impacts cement, steel, and petrochemical operations. The EU's Carbon Border Adjustment Mechanism (CBAM) further extends these requirements to imported goods, creating a level playing field while preventing carbon leakage. The European Green Deal has established ambitious targets of 55% emissions reduction by 2030 and carbon neutrality by 2050.

The United States has implemented a more fragmented approach, with regulations varying by state. The Clean Air Act provides federal authority for emissions regulation, while California's Cap-and-Trade Program serves as a model for market-based mechanisms. Recent federal initiatives, including the Inflation Reduction Act, have introduced significant incentives for carbon capture technologies across these industrial sectors.

China, as the world's largest emitter, has launched its national ETS focusing initially on power generation with plans to expand to cement and steel sectors. The country's 14th Five-Year Plan includes specific carbon intensity reduction targets for these industries, signaling a shift toward more stringent regulation despite allowing continued industrial growth.

Industry-specific standards have emerged globally, with the cement sector facing requirements under initiatives like the Cement Sustainability Initiative. The steel industry operates under frameworks such as ResponsibleSteel, while petrochemical operations must comply with regulations like the EU's Industrial Emissions Directive and various national hydrocarbon laws.

Compliance mechanisms vary significantly, with some jurisdictions favoring direct regulation through emissions limits, while others implement market-based approaches including carbon pricing, taxes, or tradable permit systems. The regulatory trend clearly indicates progressive tightening of standards, with increasing focus on measurement, reporting, and verification protocols to ensure accountability.

The comparative analysis of these frameworks reveals that while cement and steel industries often face similar regulatory approaches due to their process emissions profiles, petrochemical regulations frequently address a broader range of pollutants beyond CO2. This regulatory complexity creates both challenges and opportunities for implementing carbon capture technologies across these three vital industrial sectors.

In the European Union, the Emissions Trading System (ETS) represents the most comprehensive regulatory framework, imposing a cap-and-trade mechanism that directly impacts cement, steel, and petrochemical operations. The EU's Carbon Border Adjustment Mechanism (CBAM) further extends these requirements to imported goods, creating a level playing field while preventing carbon leakage. The European Green Deal has established ambitious targets of 55% emissions reduction by 2030 and carbon neutrality by 2050.

The United States has implemented a more fragmented approach, with regulations varying by state. The Clean Air Act provides federal authority for emissions regulation, while California's Cap-and-Trade Program serves as a model for market-based mechanisms. Recent federal initiatives, including the Inflation Reduction Act, have introduced significant incentives for carbon capture technologies across these industrial sectors.

China, as the world's largest emitter, has launched its national ETS focusing initially on power generation with plans to expand to cement and steel sectors. The country's 14th Five-Year Plan includes specific carbon intensity reduction targets for these industries, signaling a shift toward more stringent regulation despite allowing continued industrial growth.

Industry-specific standards have emerged globally, with the cement sector facing requirements under initiatives like the Cement Sustainability Initiative. The steel industry operates under frameworks such as ResponsibleSteel, while petrochemical operations must comply with regulations like the EU's Industrial Emissions Directive and various national hydrocarbon laws.

Compliance mechanisms vary significantly, with some jurisdictions favoring direct regulation through emissions limits, while others implement market-based approaches including carbon pricing, taxes, or tradable permit systems. The regulatory trend clearly indicates progressive tightening of standards, with increasing focus on measurement, reporting, and verification protocols to ensure accountability.

The comparative analysis of these frameworks reveals that while cement and steel industries often face similar regulatory approaches due to their process emissions profiles, petrochemical regulations frequently address a broader range of pollutants beyond CO2. This regulatory complexity creates both challenges and opportunities for implementing carbon capture technologies across these three vital industrial sectors.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!