Comparative System Designs For Retrofitting Membranes In Coal Plants

SEP 3, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Membrane Retrofitting Technology Background and Objectives

Membrane technology for carbon capture has evolved significantly over the past three decades, transitioning from laboratory experiments to commercial applications. Initially developed for gas separation in industrial processes, membrane technology has been adapted for post-combustion carbon capture in coal-fired power plants since the early 2000s. The evolution of materials science, particularly in polymer chemistry and nanotechnology, has enabled the development of more efficient and durable membrane materials capable of withstanding the harsh conditions present in coal plant flue gas streams.

The primary objective of membrane retrofitting technology in coal plants is to achieve cost-effective carbon dioxide separation from flue gas while minimizing energy penalties and operational disruptions. Current membrane technologies aim to capture at least 90% of CO2 emissions with a target cost of less than $40 per ton of CO2 captured, aligning with the U.S. Department of Energy's carbon capture goals. Additionally, these systems must be designed to operate continuously for extended periods, maintaining performance despite the presence of contaminants such as SOx, NOx, and particulate matter.

Recent technological advancements have focused on developing mixed-matrix membranes, facilitated transport membranes, and thermally rearranged polymers that offer improved selectivity and permeability. These innovations address the traditional trade-off between these two critical parameters, known as Robeson's upper bound. The integration of nanomaterials such as metal-organic frameworks (MOFs) and graphene oxide into polymer matrices has shown promising results in laboratory settings, with CO2/N2 selectivity exceeding 50 and CO2 permeability above 1000 Barrer.

The retrofitting approach presents unique engineering challenges compared to new construction, as systems must be designed to integrate with existing plant infrastructure, space constraints, and operational parameters. Successful implementation requires not only effective membrane materials but also innovative module designs and system configurations that can handle the large volumetric flow rates of flue gas while minimizing pressure drops and energy consumption.

Global research efforts are increasingly focused on developing membrane systems specifically designed for retrofitting applications, with significant investments from both public and private sectors. The European Union's Horizon Europe program, the U.S. Department of Energy's Carbon Capture Program, and China's 14th Five-Year Plan have all prioritized membrane technology development for existing coal plants, recognizing its potential for near-term decarbonization while renewable energy infrastructure continues to expand.

The technology trajectory suggests that membrane systems will play a crucial role in the transition period of the next 20-30 years, providing a bridge solution for reducing emissions from existing coal infrastructure until their eventual replacement with zero-carbon alternatives. This timeline aligns with most nations' net-zero carbon commitments, making membrane retrofitting a strategically important technology for meeting intermediate climate goals.

The primary objective of membrane retrofitting technology in coal plants is to achieve cost-effective carbon dioxide separation from flue gas while minimizing energy penalties and operational disruptions. Current membrane technologies aim to capture at least 90% of CO2 emissions with a target cost of less than $40 per ton of CO2 captured, aligning with the U.S. Department of Energy's carbon capture goals. Additionally, these systems must be designed to operate continuously for extended periods, maintaining performance despite the presence of contaminants such as SOx, NOx, and particulate matter.

Recent technological advancements have focused on developing mixed-matrix membranes, facilitated transport membranes, and thermally rearranged polymers that offer improved selectivity and permeability. These innovations address the traditional trade-off between these two critical parameters, known as Robeson's upper bound. The integration of nanomaterials such as metal-organic frameworks (MOFs) and graphene oxide into polymer matrices has shown promising results in laboratory settings, with CO2/N2 selectivity exceeding 50 and CO2 permeability above 1000 Barrer.

The retrofitting approach presents unique engineering challenges compared to new construction, as systems must be designed to integrate with existing plant infrastructure, space constraints, and operational parameters. Successful implementation requires not only effective membrane materials but also innovative module designs and system configurations that can handle the large volumetric flow rates of flue gas while minimizing pressure drops and energy consumption.

Global research efforts are increasingly focused on developing membrane systems specifically designed for retrofitting applications, with significant investments from both public and private sectors. The European Union's Horizon Europe program, the U.S. Department of Energy's Carbon Capture Program, and China's 14th Five-Year Plan have all prioritized membrane technology development for existing coal plants, recognizing its potential for near-term decarbonization while renewable energy infrastructure continues to expand.

The technology trajectory suggests that membrane systems will play a crucial role in the transition period of the next 20-30 years, providing a bridge solution for reducing emissions from existing coal infrastructure until their eventual replacement with zero-carbon alternatives. This timeline aligns with most nations' net-zero carbon commitments, making membrane retrofitting a strategically important technology for meeting intermediate climate goals.

Market Analysis for Coal Plant Membrane Retrofitting Solutions

The global market for membrane retrofitting solutions in coal-fired power plants is experiencing significant growth, driven by increasingly stringent environmental regulations and the need for cost-effective emission control technologies. Current market valuations indicate that the membrane technology sector for coal plant applications reached approximately $3.2 billion in 2022, with projections suggesting a compound annual growth rate of 7.8% through 2030.

North America and Europe currently dominate the market share, accounting for over 60% of global installations, primarily due to their advanced regulatory frameworks and earlier adoption cycles. However, the Asia-Pacific region, particularly China and India, represents the fastest-growing market segment with annual growth rates exceeding 12%, reflecting their continued reliance on coal power generation while facing mounting pressure to reduce environmental impacts.

Market demand is primarily segmented into three categories: carbon capture membranes, which constitute about 45% of the market; flue gas desulfurization membranes at 30%; and nitrogen oxide reduction membranes at 25%. The carbon capture segment shows the strongest growth trajectory as global decarbonization efforts intensify.

Customer requirements are evolving toward solutions that offer lower energy penalties, reduced operational costs, and minimal downtime during installation. Survey data from plant operators indicates that retrofit solutions providing less than 15% energy penalty with payback periods under five years receive the highest consideration for implementation.

The competitive landscape features both established industrial gas separation companies expanding into the coal sector and specialized startups focusing exclusively on innovative membrane technologies for fossil fuel applications. Major industrial players like Air Liquide, Air Products, and Honeywell UOP have established significant market positions, while technology-focused companies such as Membrane Technology and Research (MTR) and SRI International are gaining traction with novel materials and designs.

Market barriers include high initial capital costs, technical uncertainties regarding long-term performance in harsh coal plant environments, and competition from alternative emission control technologies. However, the retrofit market benefits from substantial advantages over new-build alternatives, including significantly lower capital expenditure requirements and the ability to extend the operational lifespan of existing assets while meeting regulatory requirements.

Future market growth will likely be driven by advancements in membrane materials science, particularly the development of more temperature-resistant and fouling-resistant membranes that can maintain performance under the challenging conditions present in coal plant operations.

North America and Europe currently dominate the market share, accounting for over 60% of global installations, primarily due to their advanced regulatory frameworks and earlier adoption cycles. However, the Asia-Pacific region, particularly China and India, represents the fastest-growing market segment with annual growth rates exceeding 12%, reflecting their continued reliance on coal power generation while facing mounting pressure to reduce environmental impacts.

Market demand is primarily segmented into three categories: carbon capture membranes, which constitute about 45% of the market; flue gas desulfurization membranes at 30%; and nitrogen oxide reduction membranes at 25%. The carbon capture segment shows the strongest growth trajectory as global decarbonization efforts intensify.

Customer requirements are evolving toward solutions that offer lower energy penalties, reduced operational costs, and minimal downtime during installation. Survey data from plant operators indicates that retrofit solutions providing less than 15% energy penalty with payback periods under five years receive the highest consideration for implementation.

The competitive landscape features both established industrial gas separation companies expanding into the coal sector and specialized startups focusing exclusively on innovative membrane technologies for fossil fuel applications. Major industrial players like Air Liquide, Air Products, and Honeywell UOP have established significant market positions, while technology-focused companies such as Membrane Technology and Research (MTR) and SRI International are gaining traction with novel materials and designs.

Market barriers include high initial capital costs, technical uncertainties regarding long-term performance in harsh coal plant environments, and competition from alternative emission control technologies. However, the retrofit market benefits from substantial advantages over new-build alternatives, including significantly lower capital expenditure requirements and the ability to extend the operational lifespan of existing assets while meeting regulatory requirements.

Future market growth will likely be driven by advancements in membrane materials science, particularly the development of more temperature-resistant and fouling-resistant membranes that can maintain performance under the challenging conditions present in coal plant operations.

Current Membrane Technology Status and Implementation Challenges

Membrane technology for carbon capture in coal-fired power plants has advanced significantly in recent years, yet faces substantial implementation challenges. Current membrane systems primarily utilize polymeric, inorganic, or mixed matrix membranes, each with distinct performance characteristics. Polymeric membranes dominate commercial applications due to their cost-effectiveness and processability, with materials such as polyimides, polysulfones, and cellulose acetate showing promising CO2/N2 selectivity ratios between 20-50 under laboratory conditions.

Inorganic membranes, including zeolites, metal-organic frameworks (MOFs), and ceramic-based structures, demonstrate superior thermal and chemical stability compared to polymeric alternatives. These membranes can withstand the harsh conditions of flue gas environments, with some advanced zeolite membranes achieving CO2/N2 selectivity exceeding 100. However, their widespread implementation remains limited by high manufacturing costs and scalability challenges.

Mixed matrix membranes (MMMs) represent the current technological frontier, combining polymeric matrices with inorganic fillers to leverage advantages of both materials. Recent developments in MMMs have achieved CO2 permeability of 1000-3000 Barrer with selectivity of 30-60, significantly outperforming conventional polymeric membranes.

Despite these advancements, several critical implementation challenges persist. Flue gas from coal plants contains particulates, SOx, NOx, and water vapor that can cause membrane fouling and degradation, reducing operational lifetimes to 2-3 years compared to the 5+ years required for economic viability. Current pretreatment systems add substantial capital costs, often increasing total system expenses by 15-25%.

The temperature differential between flue gas (typically 120-180°C) and optimal membrane operation (often below 100°C) necessitates cooling systems that reduce overall plant efficiency by 1-3 percentage points. Additionally, the low partial pressure of CO2 in flue gas (10-15%) limits driving force for separation, requiring either multiple membrane stages or vacuum systems that consume significant energy.

Scale-up challenges remain formidable, as most advanced membrane technologies have only been demonstrated at laboratory or small pilot scales (processing <1 ton CO2/day). Full-scale coal plants would require membrane areas of thousands to tens of thousands of square meters, presenting manufacturing and module design challenges that have not been fully resolved.

Economic barriers further complicate implementation, with current membrane retrofit systems estimated at $60-80 per tonne of CO2 captured, exceeding the commercially viable threshold of $30-40 per tonne. This gap must be addressed through technological improvements or policy incentives before widespread adoption becomes feasible.

Inorganic membranes, including zeolites, metal-organic frameworks (MOFs), and ceramic-based structures, demonstrate superior thermal and chemical stability compared to polymeric alternatives. These membranes can withstand the harsh conditions of flue gas environments, with some advanced zeolite membranes achieving CO2/N2 selectivity exceeding 100. However, their widespread implementation remains limited by high manufacturing costs and scalability challenges.

Mixed matrix membranes (MMMs) represent the current technological frontier, combining polymeric matrices with inorganic fillers to leverage advantages of both materials. Recent developments in MMMs have achieved CO2 permeability of 1000-3000 Barrer with selectivity of 30-60, significantly outperforming conventional polymeric membranes.

Despite these advancements, several critical implementation challenges persist. Flue gas from coal plants contains particulates, SOx, NOx, and water vapor that can cause membrane fouling and degradation, reducing operational lifetimes to 2-3 years compared to the 5+ years required for economic viability. Current pretreatment systems add substantial capital costs, often increasing total system expenses by 15-25%.

The temperature differential between flue gas (typically 120-180°C) and optimal membrane operation (often below 100°C) necessitates cooling systems that reduce overall plant efficiency by 1-3 percentage points. Additionally, the low partial pressure of CO2 in flue gas (10-15%) limits driving force for separation, requiring either multiple membrane stages or vacuum systems that consume significant energy.

Scale-up challenges remain formidable, as most advanced membrane technologies have only been demonstrated at laboratory or small pilot scales (processing <1 ton CO2/day). Full-scale coal plants would require membrane areas of thousands to tens of thousands of square meters, presenting manufacturing and module design challenges that have not been fully resolved.

Economic barriers further complicate implementation, with current membrane retrofit systems estimated at $60-80 per tonne of CO2 captured, exceeding the commercially viable threshold of $30-40 per tonne. This gap must be addressed through technological improvements or policy incentives before widespread adoption becomes feasible.

Comparative Analysis of Current Membrane Retrofitting Designs

01 Membrane retrofitting for building systems

Membrane retrofitting systems for buildings involve the installation of specialized membranes to improve energy efficiency, waterproofing, and structural integrity. These systems are designed to be applied to existing structures without requiring complete reconstruction. The design includes considerations for attachment methods, material compatibility with existing structures, and performance under various environmental conditions. These retrofitting solutions can significantly extend the lifespan of buildings while improving their performance characteristics.- Membrane retrofitting for building systems: Membrane retrofitting systems for buildings involve the installation of specialized membranes to improve energy efficiency, waterproofing, and structural integrity. These systems are designed to be applied to existing structures without requiring complete reconstruction. The design incorporates materials that can adapt to various building surfaces while providing enhanced insulation and protection against environmental factors. The retrofitting process typically includes assessment of the existing structure, selection of appropriate membrane materials, and implementation of installation techniques that minimize disruption to building occupants.

- Water filtration membrane retrofitting: Water filtration membrane retrofitting systems involve upgrading existing water treatment facilities with advanced membrane technologies. These systems are designed to enhance filtration efficiency, reduce operational costs, and improve water quality without complete system replacement. The design considerations include compatibility with existing infrastructure, flow rate optimization, and pressure management. Retrofitting approaches may incorporate modular components that allow for phased implementation and scalability based on treatment requirements.

- Industrial process membrane system upgrades: Industrial membrane retrofitting systems focus on enhancing manufacturing and processing operations through the integration of advanced membrane technologies into existing equipment. These systems are designed to improve separation processes, increase throughput, and reduce energy consumption. The design methodology includes analysis of current process parameters, identification of bottlenecks, and implementation of membrane solutions that can be integrated with minimal production disruption. Considerations include material compatibility, cleaning protocols, and monitoring systems to ensure optimal performance.

- Environmental protection membrane retrofits: Environmental protection membrane retrofitting systems are designed to upgrade existing facilities to meet stricter environmental regulations or improve ecological performance. These systems incorporate specialized membranes for emissions control, waste treatment, or containment of hazardous materials. The design approach focuses on sustainability, regulatory compliance, and long-term performance. Implementation strategies include phased installation, performance validation protocols, and integration with monitoring systems to ensure continuous environmental protection.

- Smart membrane system integration: Smart membrane retrofitting systems incorporate digital technologies, sensors, and automated controls to enhance the performance of membrane applications. These systems enable real-time monitoring, predictive maintenance, and adaptive operation of membrane installations. The design framework includes sensor placement, data analytics integration, and user interface development. Implementation considerations focus on compatibility with existing control systems, scalability for future expansions, and optimization algorithms that can adjust membrane operation based on changing conditions or requirements.

02 Water treatment membrane systems

Membrane retrofitting systems for water treatment facilities involve upgrading existing filtration infrastructure with advanced membrane technologies. These designs incorporate considerations for flow dynamics, pressure management, and fouling prevention. The system architecture typically includes pre-treatment components, membrane modules, and post-treatment processes. Retrofitting existing water treatment plants with membrane technology can significantly improve filtration efficiency, reduce operational costs, and enhance water quality without complete facility reconstruction.Expand Specific Solutions03 HVAC membrane integration systems

Retrofitting HVAC systems with membrane technology involves the integration of specialized membranes into existing heating, ventilation, and air conditioning infrastructure. These system designs focus on improving energy efficiency, air quality, and moisture control. The membrane components are engineered to enhance heat exchange, filter particulates, or control humidity levels. The retrofitting process requires careful consideration of airflow dynamics, pressure differentials, and integration with existing control systems to ensure optimal performance.Expand Specific Solutions04 Industrial process membrane retrofits

Membrane retrofitting systems for industrial processes involve upgrading existing manufacturing or processing equipment with advanced membrane technologies. These systems are designed to improve separation efficiency, product purity, or waste reduction. The retrofitting design must account for process conditions such as temperature, pressure, chemical compatibility, and flow rates. Implementation strategies typically include modular approaches that allow for phased installation to minimize production disruption while maximizing the benefits of membrane technology integration.Expand Specific Solutions05 Digital control systems for membrane retrofits

Digital control systems for membrane retrofitting involve the integration of sensors, monitoring equipment, and automated control mechanisms to optimize the performance of retrofitted membrane systems. These designs incorporate data collection, analysis algorithms, and feedback mechanisms to adjust operational parameters in real-time. The control architecture typically includes remote monitoring capabilities, predictive maintenance features, and performance optimization algorithms. These digital systems enhance the efficiency, reliability, and longevity of membrane retrofitting implementations across various applications.Expand Specific Solutions

Key Industry Players in Membrane Retrofitting Technologies

The membrane retrofitting market for coal plants is currently in a growth phase, driven by increasing environmental regulations and decarbonization initiatives. The market size is expanding as aging coal infrastructure requires modernization to meet emission standards. Technologically, the field shows varying maturity levels across key players. Xi'an Thermal Power Research Institute and Renaissance Energy Research Corp. lead in permselective film development, while Midrex Technologies and Modine Manufacturing offer advanced heat transfer solutions. State Grid Corp. of China and Guodian Longyuan are advancing implementation at scale. Academic institutions like Arizona State University and China Petroleum University Beijing are contributing fundamental research, creating a competitive landscape where industrial-academic partnerships are accelerating innovation in membrane technology adaptation for existing coal infrastructure.

Xi'an Thermal Power Research Institute Co., Ltd.

Technical Solution: Xi'an Thermal Power Research Institute has developed a comprehensive membrane retrofitting system specifically tailored for Chinese coal plants. Their technology employs composite membranes with a thin selective layer supported on porous substrates, optimized for the high particulate and sulfur content typical in Chinese coal plant emissions. The institute's design incorporates a novel pre-treatment system that extends membrane life by removing fine particulates and acid gas components before they reach the membrane surface. Their retrofit approach features a split-flow configuration where only a portion of the flue gas is processed through the membrane system, allowing for cost-effective partial carbon capture while minimizing energy penalties. The system includes heat integration elements that recover waste heat from various plant processes to provide the thermal energy required for membrane operation. Xi'an Thermal Power Research Institute has implemented this technology at several demonstration sites across China, showing consistent carbon capture rates of 70-80% with acceptable impacts on overall plant efficiency.

Strengths: Specifically designed for high-sulfur coal common in Chinese power plants; lower implementation costs through partial capture approach; extensive experience with Chinese power plant configurations enabling smoother retrofits. Weaknesses: Lower overall carbon capture rates compared to full-scale systems; requires significant plant real estate for installation; membrane performance degrades more rapidly under certain coal quality variations.

Renaissance Energy Research Corp.

Technical Solution: Renaissance Energy Research Corporation has developed a revolutionary facilitated transport membrane system specifically designed for retrofitting existing coal plants. Their proprietary membrane technology incorporates mobile carriers within the membrane structure that selectively bind with CO2 molecules, dramatically increasing separation efficiency compared to conventional solution-diffusion membranes. The system features a unique multi-layer membrane architecture with gradient functionality that optimizes both flux and selectivity. Renaissance's retrofit design includes a modular skid-mounted configuration that minimizes installation complexity and can be implemented during standard maintenance outages. Their approach incorporates an innovative flue gas conditioning system that removes membrane-fouling contaminants while recovering valuable heat energy. The membrane modules employ a novel self-tensioning mechanism that maintains optimal membrane performance despite thermal cycling and aging. Renaissance has demonstrated their technology at pilot scale on multiple coal plant types, achieving consistent CO2 capture rates above 90% with energy penalties approximately 30% lower than conventional amine scrubbing systems.

Strengths: Superior CO2/N2 selectivity compared to conventional membranes; modular design enables phased implementation to match budget constraints; lower regeneration energy requirements than competing technologies. Weaknesses: Membrane carriers require periodic replenishment increasing operational complexity; performance more sensitive to flue gas composition variations; technology has less commercial operating history than some alternatives.

Critical Patents and Innovations in Coal Plant Membrane Systems

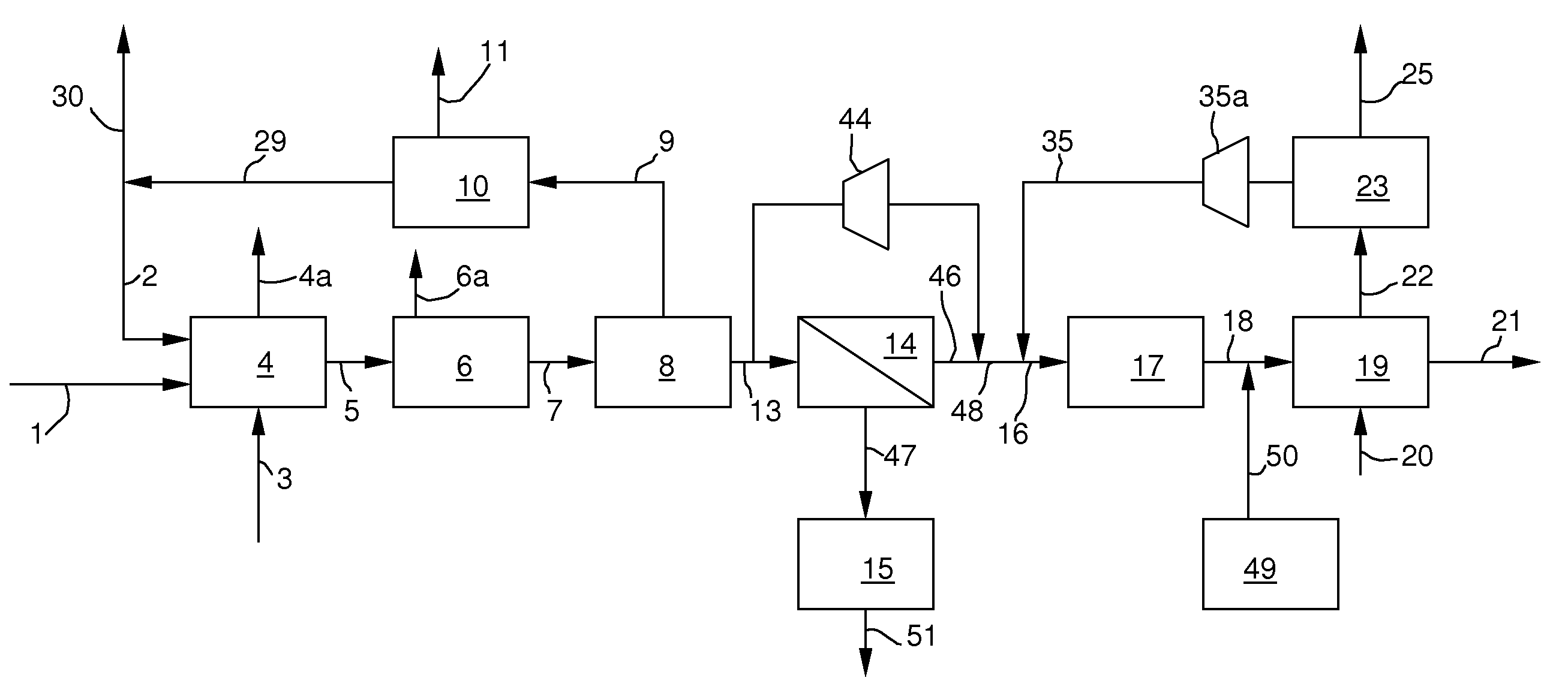

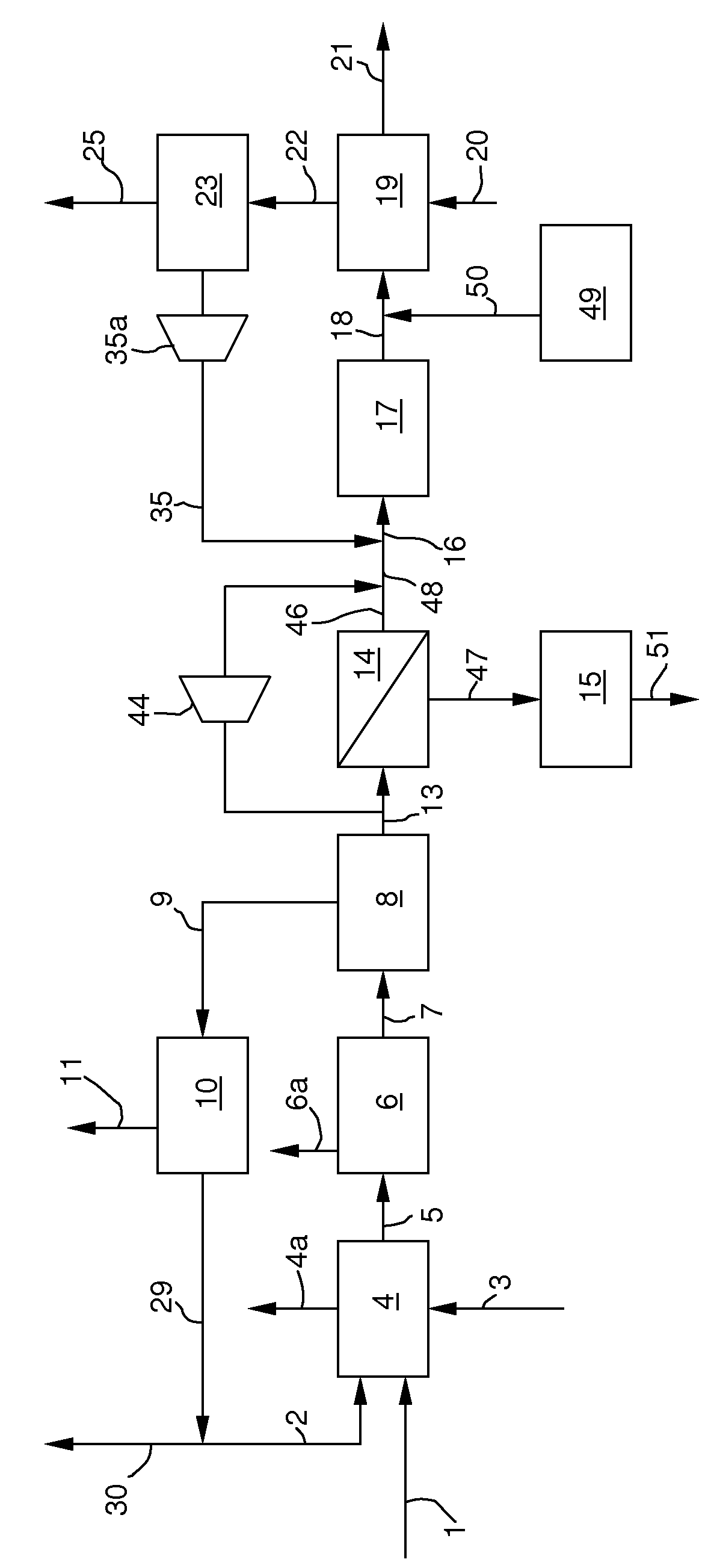

Process for production of elemental iron

PatentInactiveUS7931731B2

Innovation

- A process that adapts DRI by partially oxidizing a carbonaceous fuel with oxygen to produce a reducing gas rich in H2 and CO, then purifies it using a H2-selective membrane to generate a H2-rich permeate, which is heated to create a reducing gas, while also reusing the SMR reactor and utilizing the CO-rich retentate for power generation.

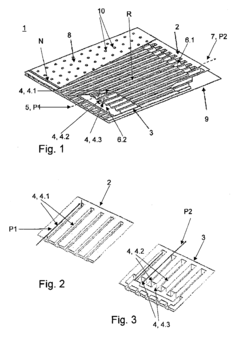

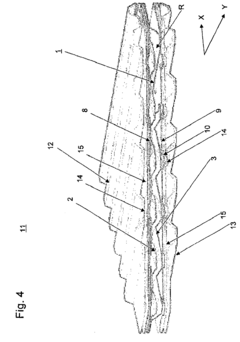

Device for performing a chemical reaction

PatentInactiveEP1887646A1

Innovation

- A device comprising two molded parts forming a reaction flow field with a catalyst-coated flow channel on both sides, allowing for a larger catalytic surface area with minimal construction volume, and featuring regenerative gas preheating to enhance reforming efficiency, along with support elements to minimize heat loss and maintain high temperatures.

Environmental Impact Assessment of Membrane Retrofitting Solutions

The environmental implications of retrofitting membrane technologies in coal-fired power plants are substantial and multifaceted. These impacts must be thoroughly assessed to ensure that the implementation of membrane systems delivers net environmental benefits while minimizing potential negative consequences.

Membrane retrofitting solutions in coal plants primarily target emissions reduction, particularly for carbon dioxide capture. When properly implemented, these systems can achieve CO2 capture rates of 85-95%, significantly reducing greenhouse gas emissions from coal combustion processes. This represents a substantial contribution to climate change mitigation efforts, especially considering that coal plants remain major carbon emitters globally.

Water usage impacts vary significantly between different membrane technologies. Polymeric membranes typically require less cooling water compared to conventional amine-based carbon capture systems, potentially reducing water withdrawal by 30-40%. However, certain membrane systems, particularly those requiring substantial pre-treatment of flue gas, may increase overall water consumption. This trade-off must be carefully evaluated in water-stressed regions where coal plants operate.

The land footprint of membrane retrofitting solutions is generally smaller than alternative carbon capture technologies. Membrane systems can be integrated into existing plant infrastructure with space requirements approximately 25-35% less than equivalent amine scrubbing systems. This reduced spatial demand minimizes habitat disruption and land use changes associated with plant modifications.

Waste generation profiles shift significantly with membrane implementation. While traditional coal plants produce substantial solid waste in the form of ash and scrubber sludge, membrane systems generate different waste streams, primarily spent membrane modules requiring disposal approximately every 3-5 years. These materials may contain contaminants that necessitate specialized disposal protocols, though the overall waste volume is typically reduced.

Air quality improvements extend beyond CO2 reduction. Many membrane systems simultaneously capture other pollutants such as SOx and NOx, potentially reducing these emissions by 40-60% depending on the specific membrane technology employed. This co-benefit significantly improves local air quality in communities surrounding coal facilities.

Energy penalties associated with membrane operation must be factored into the environmental assessment. Current membrane technologies impose efficiency penalties of 15-25% on plant operations, requiring additional fuel consumption to maintain power output. This parasitic energy demand partially offsets the environmental benefits of emissions reduction and must be included in comprehensive life cycle assessments of these technologies.

Membrane retrofitting solutions in coal plants primarily target emissions reduction, particularly for carbon dioxide capture. When properly implemented, these systems can achieve CO2 capture rates of 85-95%, significantly reducing greenhouse gas emissions from coal combustion processes. This represents a substantial contribution to climate change mitigation efforts, especially considering that coal plants remain major carbon emitters globally.

Water usage impacts vary significantly between different membrane technologies. Polymeric membranes typically require less cooling water compared to conventional amine-based carbon capture systems, potentially reducing water withdrawal by 30-40%. However, certain membrane systems, particularly those requiring substantial pre-treatment of flue gas, may increase overall water consumption. This trade-off must be carefully evaluated in water-stressed regions where coal plants operate.

The land footprint of membrane retrofitting solutions is generally smaller than alternative carbon capture technologies. Membrane systems can be integrated into existing plant infrastructure with space requirements approximately 25-35% less than equivalent amine scrubbing systems. This reduced spatial demand minimizes habitat disruption and land use changes associated with plant modifications.

Waste generation profiles shift significantly with membrane implementation. While traditional coal plants produce substantial solid waste in the form of ash and scrubber sludge, membrane systems generate different waste streams, primarily spent membrane modules requiring disposal approximately every 3-5 years. These materials may contain contaminants that necessitate specialized disposal protocols, though the overall waste volume is typically reduced.

Air quality improvements extend beyond CO2 reduction. Many membrane systems simultaneously capture other pollutants such as SOx and NOx, potentially reducing these emissions by 40-60% depending on the specific membrane technology employed. This co-benefit significantly improves local air quality in communities surrounding coal facilities.

Energy penalties associated with membrane operation must be factored into the environmental assessment. Current membrane technologies impose efficiency penalties of 15-25% on plant operations, requiring additional fuel consumption to maintain power output. This parasitic energy demand partially offsets the environmental benefits of emissions reduction and must be included in comprehensive life cycle assessments of these technologies.

Economic Feasibility and ROI Analysis for Coal Plant Retrofits

The economic feasibility of retrofitting membrane systems in coal plants represents a critical decision point for utility operators facing increasingly stringent environmental regulations. Initial capital expenditure for membrane retrofits typically ranges from $100-300 per kW of capacity, varying significantly based on plant size, age, and existing pollution control infrastructure. For a standard 500MW coal plant, this translates to investment requirements of $50-150 million, necessitating careful financial planning and potentially phased implementation.

Return on investment calculations reveal promising economics under certain conditions. Plants operating in regions with carbon pricing mechanisms or emissions trading schemes can achieve ROI periods of 5-7 years, compared to 8-12 years in unregulated markets. The financial model improves substantially when accounting for avoided compliance costs related to conventional pollution control systems, which can reduce payback periods by 20-30%.

Operational cost impacts present a mixed picture. While membrane systems increase parasitic energy consumption by 1-3% of gross generation, they simultaneously reduce conventional reagent costs (limestone, ammonia) by up to 60%. Maintenance expenses typically add $0.002-0.004 per kWh to operational costs, though these figures continue to improve as the technology matures and economies of scale develop in the membrane manufacturing sector.

Financing mechanisms significantly influence feasibility assessments. Green bonds, sustainability-linked loans, and various government incentive programs can reduce effective capital costs by 15-25%. Several case studies demonstrate successful implementation of innovative financing structures, including public-private partnerships that distribute risk across multiple stakeholders while accelerating deployment timelines.

Long-term economic modeling indicates that membrane retrofits become increasingly attractive as carbon constraints tighten. Sensitivity analysis shows that plants with remaining operational lifespans of 15+ years achieve the most favorable economics, while those with shorter horizons may require accelerated depreciation schedules or regulatory assurances to justify investments. The analysis also reveals that membrane retrofits typically offer 30-40% lower lifetime costs compared to complete plant replacements with alternative generation technologies.

Market valuation impacts extend beyond direct operational considerations. Coal plants with advanced membrane systems have demonstrated 15-25% higher asset valuations in recent transactions, reflecting the market's recognition of future-proofed infrastructure. This premium valuation creates additional incentive for forward-looking operators to pursue retrofit strategies rather than decommissioning aging facilities.

Return on investment calculations reveal promising economics under certain conditions. Plants operating in regions with carbon pricing mechanisms or emissions trading schemes can achieve ROI periods of 5-7 years, compared to 8-12 years in unregulated markets. The financial model improves substantially when accounting for avoided compliance costs related to conventional pollution control systems, which can reduce payback periods by 20-30%.

Operational cost impacts present a mixed picture. While membrane systems increase parasitic energy consumption by 1-3% of gross generation, they simultaneously reduce conventional reagent costs (limestone, ammonia) by up to 60%. Maintenance expenses typically add $0.002-0.004 per kWh to operational costs, though these figures continue to improve as the technology matures and economies of scale develop in the membrane manufacturing sector.

Financing mechanisms significantly influence feasibility assessments. Green bonds, sustainability-linked loans, and various government incentive programs can reduce effective capital costs by 15-25%. Several case studies demonstrate successful implementation of innovative financing structures, including public-private partnerships that distribute risk across multiple stakeholders while accelerating deployment timelines.

Long-term economic modeling indicates that membrane retrofits become increasingly attractive as carbon constraints tighten. Sensitivity analysis shows that plants with remaining operational lifespans of 15+ years achieve the most favorable economics, while those with shorter horizons may require accelerated depreciation schedules or regulatory assurances to justify investments. The analysis also reveals that membrane retrofits typically offer 30-40% lower lifetime costs compared to complete plant replacements with alternative generation technologies.

Market valuation impacts extend beyond direct operational considerations. Coal plants with advanced membrane systems have demonstrated 15-25% higher asset valuations in recent transactions, reflecting the market's recognition of future-proofed infrastructure. This premium valuation creates additional incentive for forward-looking operators to pursue retrofit strategies rather than decommissioning aging facilities.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!