Comparative Cost-Analysis of Blade Battery and Solid-State Options

AUG 7, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Battery Tech Evolution

The evolution of battery technology has been a critical factor in the advancement of electric vehicles and renewable energy storage systems. This evolution can be traced through several key stages, each marked by significant improvements in energy density, safety, and cost-effectiveness.

In the early stages of electric vehicle development, lead-acid batteries were the primary energy storage solution. However, their low energy density and limited cycle life made them unsuitable for long-range electric vehicles. The introduction of nickel-metal hydride (NiMH) batteries in the late 1990s marked a significant improvement, offering higher energy density and better durability.

The lithium-ion battery revolution began in the early 2000s, with the technology quickly becoming the standard for electric vehicles and portable electronics. Lithium-ion batteries offered substantially higher energy density, longer cycle life, and faster charging capabilities compared to their predecessors. This breakthrough enabled the development of more practical and appealing electric vehicles.

As the demand for electric vehicles grew, manufacturers sought to improve battery performance further. This led to the development of various lithium-ion chemistries, including lithium iron phosphate (LFP), lithium nickel manganese cobalt oxide (NMC), and lithium nickel cobalt aluminum oxide (NCA). Each of these chemistries offered different trade-offs between energy density, power output, safety, and cost.

The blade battery, introduced by BYD in 2020, represents a significant evolution in LFP battery technology. This innovation addresses some of the key challenges faced by traditional lithium-ion batteries, particularly in terms of safety and energy density. The blade battery's unique design allows for better space utilization and improved thermal management, resulting in enhanced safety and performance.

Concurrently, solid-state battery technology has been advancing rapidly. Solid-state batteries promise even higher energy density, improved safety, and faster charging times compared to conventional lithium-ion batteries. However, they are still in the early stages of development and face challenges in terms of manufacturing scalability and cost.

The comparative cost analysis between blade batteries and solid-state options reflects the current state of these technologies. While blade batteries offer immediate benefits in terms of safety and energy density at a competitive cost, solid-state batteries hold the potential for even greater performance improvements but at a higher current cost due to their developmental stage.

As battery technology continues to evolve, we can expect further improvements in energy density, charging speed, and safety. The focus is likely to shift towards more sustainable and abundant materials, as well as enhanced recycling capabilities to address environmental concerns and resource scarcity.

In the early stages of electric vehicle development, lead-acid batteries were the primary energy storage solution. However, their low energy density and limited cycle life made them unsuitable for long-range electric vehicles. The introduction of nickel-metal hydride (NiMH) batteries in the late 1990s marked a significant improvement, offering higher energy density and better durability.

The lithium-ion battery revolution began in the early 2000s, with the technology quickly becoming the standard for electric vehicles and portable electronics. Lithium-ion batteries offered substantially higher energy density, longer cycle life, and faster charging capabilities compared to their predecessors. This breakthrough enabled the development of more practical and appealing electric vehicles.

As the demand for electric vehicles grew, manufacturers sought to improve battery performance further. This led to the development of various lithium-ion chemistries, including lithium iron phosphate (LFP), lithium nickel manganese cobalt oxide (NMC), and lithium nickel cobalt aluminum oxide (NCA). Each of these chemistries offered different trade-offs between energy density, power output, safety, and cost.

The blade battery, introduced by BYD in 2020, represents a significant evolution in LFP battery technology. This innovation addresses some of the key challenges faced by traditional lithium-ion batteries, particularly in terms of safety and energy density. The blade battery's unique design allows for better space utilization and improved thermal management, resulting in enhanced safety and performance.

Concurrently, solid-state battery technology has been advancing rapidly. Solid-state batteries promise even higher energy density, improved safety, and faster charging times compared to conventional lithium-ion batteries. However, they are still in the early stages of development and face challenges in terms of manufacturing scalability and cost.

The comparative cost analysis between blade batteries and solid-state options reflects the current state of these technologies. While blade batteries offer immediate benefits in terms of safety and energy density at a competitive cost, solid-state batteries hold the potential for even greater performance improvements but at a higher current cost due to their developmental stage.

As battery technology continues to evolve, we can expect further improvements in energy density, charging speed, and safety. The focus is likely to shift towards more sustainable and abundant materials, as well as enhanced recycling capabilities to address environmental concerns and resource scarcity.

EV Market Demand Analysis

The electric vehicle (EV) market has experienced significant growth in recent years, driven by increasing environmental awareness, government incentives, and technological advancements. This surge in demand has created a robust market for EV batteries, with particular interest in blade batteries and solid-state options.

Global EV sales have been steadily rising, with major markets like China, Europe, and North America leading the charge. In 2022, global EV sales reached 10.5 million units, representing a 55% increase from the previous year. This growth trajectory is expected to continue, with projections suggesting that EVs could account for 30% of all vehicle sales by 2030.

The demand for high-performance, cost-effective batteries is a crucial factor in the EV market's expansion. Consumers are increasingly seeking vehicles with longer ranges, faster charging times, and improved safety features. This has led to a growing interest in advanced battery technologies such as blade batteries and solid-state options.

Blade batteries, introduced by BYD, have gained attention for their improved energy density and safety features. These batteries offer a higher volumetric efficiency compared to traditional lithium-ion batteries, allowing for increased range without compromising vehicle design. The market demand for blade batteries is expected to grow as more automakers recognize their potential benefits.

Solid-state batteries represent another promising technology that has captured significant market interest. These batteries offer potential advantages in terms of energy density, safety, and charging speed. While still in the early stages of commercialization, solid-state batteries are viewed as a potential game-changer in the EV industry, with several major automakers and battery manufacturers investing heavily in their development.

The market demand for both blade batteries and solid-state options is influenced by factors such as production costs, scalability, and performance characteristics. As these technologies continue to evolve, their relative cost-effectiveness will play a crucial role in determining market adoption rates.

Geographically, the demand for advanced battery technologies varies. In China, where BYD is based, blade batteries have seen rapid adoption. In contrast, solid-state battery development is more prominent in Japan, with companies like Toyota leading research efforts. The European and North American markets show interest in both technologies, with automakers exploring various options to meet stringent emissions regulations and consumer expectations.

In conclusion, the EV market demand analysis reveals a strong appetite for innovative battery technologies that can deliver improved performance, safety, and cost-effectiveness. Both blade batteries and solid-state options are positioned to play significant roles in shaping the future of the EV industry, with their success ultimately dependent on their ability to meet evolving market needs and overcome production challenges.

Global EV sales have been steadily rising, with major markets like China, Europe, and North America leading the charge. In 2022, global EV sales reached 10.5 million units, representing a 55% increase from the previous year. This growth trajectory is expected to continue, with projections suggesting that EVs could account for 30% of all vehicle sales by 2030.

The demand for high-performance, cost-effective batteries is a crucial factor in the EV market's expansion. Consumers are increasingly seeking vehicles with longer ranges, faster charging times, and improved safety features. This has led to a growing interest in advanced battery technologies such as blade batteries and solid-state options.

Blade batteries, introduced by BYD, have gained attention for their improved energy density and safety features. These batteries offer a higher volumetric efficiency compared to traditional lithium-ion batteries, allowing for increased range without compromising vehicle design. The market demand for blade batteries is expected to grow as more automakers recognize their potential benefits.

Solid-state batteries represent another promising technology that has captured significant market interest. These batteries offer potential advantages in terms of energy density, safety, and charging speed. While still in the early stages of commercialization, solid-state batteries are viewed as a potential game-changer in the EV industry, with several major automakers and battery manufacturers investing heavily in their development.

The market demand for both blade batteries and solid-state options is influenced by factors such as production costs, scalability, and performance characteristics. As these technologies continue to evolve, their relative cost-effectiveness will play a crucial role in determining market adoption rates.

Geographically, the demand for advanced battery technologies varies. In China, where BYD is based, blade batteries have seen rapid adoption. In contrast, solid-state battery development is more prominent in Japan, with companies like Toyota leading research efforts. The European and North American markets show interest in both technologies, with automakers exploring various options to meet stringent emissions regulations and consumer expectations.

In conclusion, the EV market demand analysis reveals a strong appetite for innovative battery technologies that can deliver improved performance, safety, and cost-effectiveness. Both blade batteries and solid-state options are positioned to play significant roles in shaping the future of the EV industry, with their success ultimately dependent on their ability to meet evolving market needs and overcome production challenges.

Current Battery Challenges

The current landscape of battery technology is marked by several significant challenges that impede the widespread adoption of electric vehicles (EVs) and large-scale energy storage systems. One of the primary concerns is the energy density of existing battery technologies. While lithium-ion batteries have seen substantial improvements over the years, they are approaching their theoretical limits in terms of energy storage capacity. This limitation directly impacts the range of EVs and the efficiency of grid-scale storage solutions.

Cost remains a critical factor in battery development and implementation. Despite significant reductions in battery costs over the past decade, further decreases are necessary to achieve price parity with conventional internal combustion engine vehicles and make large-scale energy storage economically viable. The high costs associated with raw materials, particularly for cathode components like cobalt and nickel, continue to be a major hurdle.

Safety concerns persist in the battery industry, with thermal runaway and fire risks being paramount. These issues are particularly pertinent for high-energy-density batteries, which store large amounts of energy in compact spaces. Addressing these safety challenges without compromising performance is a delicate balancing act that researchers and manufacturers must navigate.

The environmental impact of battery production and disposal presents another significant challenge. The mining of raw materials for batteries often involves substantial environmental degradation and social issues. Additionally, the lack of efficient, large-scale recycling processes for end-of-life batteries poses a growing environmental concern as the number of EVs and energy storage systems increases.

Longevity and degradation of batteries over time continue to be areas of focus. The gradual loss of capacity and performance in batteries affects both consumer satisfaction in EVs and the long-term viability of grid storage solutions. Improving cycle life and reducing capacity fade are crucial for enhancing the overall value proposition of battery-powered systems.

Manufacturing scalability presents another hurdle, particularly for emerging technologies like solid-state batteries. While these new battery types show promise in laboratory settings, translating these innovations into mass production while maintaining quality and performance is a significant challenge. The industry must overcome issues related to material stability, interface engineering, and manufacturing processes to bring these advanced batteries to market at scale.

Cost remains a critical factor in battery development and implementation. Despite significant reductions in battery costs over the past decade, further decreases are necessary to achieve price parity with conventional internal combustion engine vehicles and make large-scale energy storage economically viable. The high costs associated with raw materials, particularly for cathode components like cobalt and nickel, continue to be a major hurdle.

Safety concerns persist in the battery industry, with thermal runaway and fire risks being paramount. These issues are particularly pertinent for high-energy-density batteries, which store large amounts of energy in compact spaces. Addressing these safety challenges without compromising performance is a delicate balancing act that researchers and manufacturers must navigate.

The environmental impact of battery production and disposal presents another significant challenge. The mining of raw materials for batteries often involves substantial environmental degradation and social issues. Additionally, the lack of efficient, large-scale recycling processes for end-of-life batteries poses a growing environmental concern as the number of EVs and energy storage systems increases.

Longevity and degradation of batteries over time continue to be areas of focus. The gradual loss of capacity and performance in batteries affects both consumer satisfaction in EVs and the long-term viability of grid storage solutions. Improving cycle life and reducing capacity fade are crucial for enhancing the overall value proposition of battery-powered systems.

Manufacturing scalability presents another hurdle, particularly for emerging technologies like solid-state batteries. While these new battery types show promise in laboratory settings, translating these innovations into mass production while maintaining quality and performance is a significant challenge. The industry must overcome issues related to material stability, interface engineering, and manufacturing processes to bring these advanced batteries to market at scale.

Blade vs Solid-State Costs

01 Cost reduction in blade battery manufacturing

Blade batteries utilize innovative manufacturing techniques and materials to reduce production costs. These include optimized cell design, improved electrode coating processes, and efficient assembly methods. The streamlined production process and reduced material waste contribute to lower overall costs compared to traditional battery designs.- Cost reduction in blade battery manufacturing: Blade batteries utilize a unique design that improves space utilization and reduces production costs. The manufacturing process involves innovative techniques for cell stacking and packaging, resulting in higher energy density and lower overall costs compared to traditional lithium-ion batteries.

- Solid-state battery material advancements: Recent developments in solid-state electrolyte materials have led to improved ionic conductivity and stability. These advancements contribute to enhanced battery performance and potentially lower production costs by reducing the need for expensive components and simplifying the manufacturing process.

- Scalability and mass production of solid-state batteries: Efforts to scale up solid-state battery production focus on developing cost-effective manufacturing techniques. This includes innovations in electrode fabrication, electrolyte deposition, and cell assembly processes, aimed at reducing production costs and making solid-state batteries more commercially viable.

- Integration of blade batteries in electric vehicles: Blade batteries are being increasingly adopted in electric vehicles due to their compact design and cost-effectiveness. The integration process involves optimizing battery pack configurations and thermal management systems to maximize energy density and reduce overall vehicle costs.

- Comparative cost analysis of blade and solid-state batteries: Studies comparing the production costs of blade batteries and solid-state batteries highlight the current advantages and challenges of each technology. While blade batteries offer immediate cost benefits, solid-state batteries show promise for long-term cost reduction as manufacturing processes improve and economies of scale are achieved.

02 Solid-state battery material advancements

Advancements in solid-state electrolyte materials and manufacturing processes are driving down the cost of solid-state batteries. New compositions and synthesis methods for solid electrolytes are improving ionic conductivity and stability while reducing production expenses. These developments are making solid-state batteries more economically viable for large-scale applications.Expand Specific Solutions03 Scalability and mass production of blade batteries

Blade batteries are designed for easy scalability and mass production, which helps reduce costs. The simplified structure and standardized manufacturing processes allow for efficient production line setup and automation. This scalability enables economies of scale, further driving down the cost per unit as production volumes increase.Expand Specific Solutions04 Integration of solid-state technology in electric vehicles

The integration of solid-state batteries in electric vehicles is progressing, with a focus on cost-effective solutions. Researchers are developing methods to adapt solid-state technology to existing vehicle architectures, minimizing the need for extensive redesigns. This approach aims to reduce implementation costs and accelerate the adoption of solid-state batteries in the automotive industry.Expand Specific Solutions05 Recycling and sustainability impact on battery costs

Both blade batteries and solid-state batteries are being designed with recycling and sustainability in mind, which can impact long-term costs. Improved recyclability of battery materials and the development of closed-loop recycling processes are expected to reduce raw material costs and environmental impact. This focus on sustainability contributes to the overall cost-effectiveness of these battery technologies.Expand Specific Solutions

Key Battery Manufacturers

The comparative cost analysis of blade battery and solid-state options is currently in a dynamic phase, with the market showing significant growth potential. The industry is transitioning from traditional lithium-ion batteries to more advanced technologies, driven by the demand for improved energy density, safety, and cost-effectiveness in electric vehicles. Key players like QuantumScape, Samsung SDI, and LG Energy Solution are investing heavily in solid-state battery development, while companies such as BYD are advancing blade battery technology. The market size is expanding rapidly, with projections indicating substantial growth in the coming years. However, the technology is still in various stages of maturity, with solid-state batteries generally considered less mature than blade batteries, requiring further development for mass production and commercialization.

Svolt Energy Technology Co., Ltd.

Technical Solution: Svolt Energy Technology has made significant strides in both blade battery and solid-state battery technologies. Their blade battery design, marketed as the "Dragon Armor Battery," utilizes LFP chemistry in a novel cell structure that improves energy density and thermal management. Svolt claims their blade batteries can achieve up to 30% higher energy density compared to traditional LFP cells, while also enhancing safety through improved heat dissipation [10]. In the solid-state battery domain, Svolt is developing sulfide-based all-solid-state batteries (ASSBs) with the goal of commercialization by 2025. Their solid-state technology aims to achieve energy densities of over 350 Wh/kg and 1000 Wh/L, potentially doubling the range of electric vehicles compared to current lithium-ion batteries [11]. Svolt's approach focuses on addressing key challenges in solid-state battery production, including interface stability and scalable manufacturing processes.

Strengths: Innovative blade battery design with high energy density; Significant progress in solid-state battery development. Weaknesses: Relatively new player in the global market, which may affect adoption rates; Potential challenges in scaling up production to meet growing demand.

Ford Global Technologies LLC

Technical Solution: Ford, through its Global Technologies division, is actively researching and developing both blade battery and solid-state battery technologies. For blade batteries, Ford is exploring LFP chemistry in a flat cell design, aiming to improve energy density and reduce costs for their electric vehicle lineup. Their approach focuses on optimizing the cell-to-pack ratio, potentially increasing overall battery capacity by up to 15% compared to traditional battery pack designs [8]. In the solid-state battery arena, Ford has partnered with Solid Power, investing in the company to accelerate the development of solid-state technology. This collaboration aims to produce solid-state batteries with silicon-rich anodes and sulfide-based electrolytes, promising higher energy density, improved safety, and potentially lower costs compared to conventional lithium-ion batteries [9].

Strengths: Strong partnerships for solid-state battery development; Integrated approach to battery technology and vehicle design. Weaknesses: Reliance on external partners for core battery technology development; Potential challenges in integrating new battery technologies into existing vehicle platforms.

Battery Innovation Patents

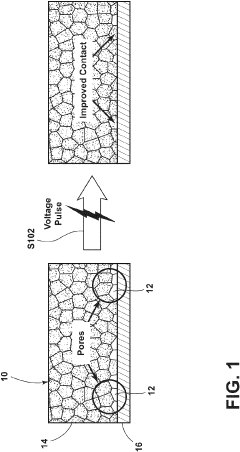

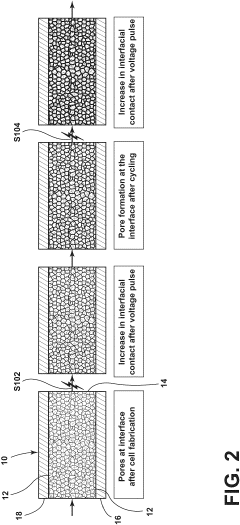

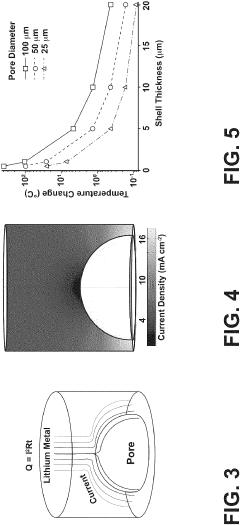

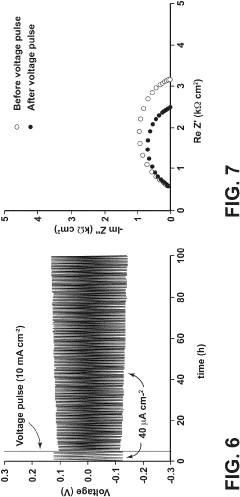

Method of improving electrode-to-solid-electrolyte interface contact in solid-state batteries

PatentPendingUS20230361266A1

Innovation

- Applying a voltage pulse at high current density for a short duration to electrochemically improve interfacial contact by causing electrode material to diffuse into pores in the solid electrolyte, thereby healing the interface and eliminating space charge effects, which can be repeated in-operando to maintain contact and prevent failure.

Methods and apparatus to facilitate alkali metal transport during battery cycling, and batteries incorporating same

PatentWO2020061565A1

Innovation

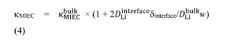

- A mixed ionic-electronic conductor (MIEC) with an open pore structure is used as the anode, allowing for the transport of alkali metals and relieving mechanical stresses through open spaces, maintaining contact with the solid electrolyte and preventing SEI formation, while being electrochemically stable and mechanically compliant.

Battery Supply Chain

The battery supply chain plays a crucial role in the comparative cost analysis of Blade Battery and solid-state options. This complex network encompasses raw material sourcing, component manufacturing, cell production, and final assembly, each contributing significantly to the overall cost structure of these advanced battery technologies.

For Blade Battery technology, the supply chain benefits from leveraging existing lithium-ion battery infrastructure. Key raw materials include lithium, iron, and phosphate, which are relatively abundant and geographically diverse. The manufacturing process for Blade Batteries requires specialized equipment for cell stacking and packaging, but many components can be sourced from established suppliers in the lithium-ion ecosystem.

Solid-state batteries, on the other hand, present unique supply chain challenges. The production of solid electrolytes, a critical component, requires new manufacturing processes and specialized materials. Sourcing these materials, such as ceramic compounds or sulfide-based electrolytes, may involve developing new supplier relationships and potentially facing limited availability or higher costs due to nascent production scales.

The cathode and anode materials for solid-state batteries may differ from traditional lithium-ion cells, potentially requiring adjustments in the supply chain. Some solid-state designs aim to use lithium metal anodes, which could introduce new sourcing and handling considerations due to the reactive nature of lithium metal.

Manufacturing processes for solid-state batteries are still evolving, with various approaches being explored by different companies. This diversity in production methods may lead to fragmented supply chains initially, potentially increasing costs until standardization and economies of scale are achieved.

Both technologies face challenges in scaling up production to meet growing demand. Blade Batteries benefit from similarities to existing lithium-ion manufacturing, potentially allowing for faster scaling and lower capital expenditure. Solid-state battery production scaling may require more significant investments in new manufacturing facilities and equipment.

The geographical distribution of the supply chain also impacts costs. Blade Batteries can leverage existing global battery manufacturing hubs, while solid-state battery production may initially be concentrated in regions with advanced research and development capabilities, potentially leading to higher logistics costs.

As these technologies mature, the evolution of their respective supply chains will significantly influence their cost competitiveness. Factors such as raw material availability, production efficiency improvements, and the development of specialized manufacturing equipment will play crucial roles in determining the long-term cost trajectories of Blade Battery and solid-state options.

For Blade Battery technology, the supply chain benefits from leveraging existing lithium-ion battery infrastructure. Key raw materials include lithium, iron, and phosphate, which are relatively abundant and geographically diverse. The manufacturing process for Blade Batteries requires specialized equipment for cell stacking and packaging, but many components can be sourced from established suppliers in the lithium-ion ecosystem.

Solid-state batteries, on the other hand, present unique supply chain challenges. The production of solid electrolytes, a critical component, requires new manufacturing processes and specialized materials. Sourcing these materials, such as ceramic compounds or sulfide-based electrolytes, may involve developing new supplier relationships and potentially facing limited availability or higher costs due to nascent production scales.

The cathode and anode materials for solid-state batteries may differ from traditional lithium-ion cells, potentially requiring adjustments in the supply chain. Some solid-state designs aim to use lithium metal anodes, which could introduce new sourcing and handling considerations due to the reactive nature of lithium metal.

Manufacturing processes for solid-state batteries are still evolving, with various approaches being explored by different companies. This diversity in production methods may lead to fragmented supply chains initially, potentially increasing costs until standardization and economies of scale are achieved.

Both technologies face challenges in scaling up production to meet growing demand. Blade Batteries benefit from similarities to existing lithium-ion manufacturing, potentially allowing for faster scaling and lower capital expenditure. Solid-state battery production scaling may require more significant investments in new manufacturing facilities and equipment.

The geographical distribution of the supply chain also impacts costs. Blade Batteries can leverage existing global battery manufacturing hubs, while solid-state battery production may initially be concentrated in regions with advanced research and development capabilities, potentially leading to higher logistics costs.

As these technologies mature, the evolution of their respective supply chains will significantly influence their cost competitiveness. Factors such as raw material availability, production efficiency improvements, and the development of specialized manufacturing equipment will play crucial roles in determining the long-term cost trajectories of Blade Battery and solid-state options.

Environmental Impact

The environmental impact of battery technologies is a critical consideration in the comparative analysis of Blade Battery and solid-state options. Both technologies aim to improve upon traditional lithium-ion batteries, but their environmental footprints differ significantly.

Blade Batteries, developed by BYD, utilize lithium iron phosphate (LFP) chemistry. This composition offers several environmental advantages. LFP batteries are cobalt-free, reducing the reliance on this controversial mineral often associated with unethical mining practices and environmental degradation. The production process for Blade Batteries also consumes less energy compared to conventional lithium-ion batteries, resulting in lower carbon emissions during manufacturing.

Furthermore, Blade Batteries demonstrate excellent thermal stability, reducing the risk of thermal runaway and fire hazards. This enhanced safety profile not only protects users but also minimizes the potential for environmental contamination in case of accidents. The long cycle life of Blade Batteries contributes to sustainability by reducing the frequency of battery replacements and associated waste.

Solid-state batteries, on the other hand, present a different set of environmental considerations. These batteries use solid electrolytes instead of liquid ones, potentially eliminating the need for certain hazardous materials found in conventional lithium-ion batteries. This change could reduce the risk of electrolyte leakage and subsequent environmental contamination.

The production of solid-state batteries may require less energy than traditional lithium-ion batteries, potentially lowering the carbon footprint of manufacturing. However, the environmental impact of large-scale production remains uncertain as the technology is still in development and not yet widely commercialized.

Both Blade Batteries and solid-state options offer improved energy density compared to traditional lithium-ion batteries. This advancement allows for longer driving ranges in electric vehicles, potentially reducing the overall environmental impact of transportation by promoting the adoption of electric mobility.

End-of-life considerations are crucial for both technologies. Blade Batteries, being based on LFP chemistry, are generally easier to recycle than conventional lithium-ion batteries. The absence of cobalt simplifies the recycling process and reduces the environmental burden associated with battery disposal. Solid-state batteries may offer similar recycling advantages, but their recyclability is still being researched as the technology evolves.

In conclusion, both Blade Batteries and solid-state options present potential environmental benefits over traditional lithium-ion batteries. Blade Batteries offer immediate advantages in terms of cobalt-free composition and proven recyclability, while solid-state batteries hold promise for future environmental improvements as the technology matures. The ultimate environmental impact will depend on factors such as production scale, adoption rates, and the development of efficient recycling processes for each technology.

Blade Batteries, developed by BYD, utilize lithium iron phosphate (LFP) chemistry. This composition offers several environmental advantages. LFP batteries are cobalt-free, reducing the reliance on this controversial mineral often associated with unethical mining practices and environmental degradation. The production process for Blade Batteries also consumes less energy compared to conventional lithium-ion batteries, resulting in lower carbon emissions during manufacturing.

Furthermore, Blade Batteries demonstrate excellent thermal stability, reducing the risk of thermal runaway and fire hazards. This enhanced safety profile not only protects users but also minimizes the potential for environmental contamination in case of accidents. The long cycle life of Blade Batteries contributes to sustainability by reducing the frequency of battery replacements and associated waste.

Solid-state batteries, on the other hand, present a different set of environmental considerations. These batteries use solid electrolytes instead of liquid ones, potentially eliminating the need for certain hazardous materials found in conventional lithium-ion batteries. This change could reduce the risk of electrolyte leakage and subsequent environmental contamination.

The production of solid-state batteries may require less energy than traditional lithium-ion batteries, potentially lowering the carbon footprint of manufacturing. However, the environmental impact of large-scale production remains uncertain as the technology is still in development and not yet widely commercialized.

Both Blade Batteries and solid-state options offer improved energy density compared to traditional lithium-ion batteries. This advancement allows for longer driving ranges in electric vehicles, potentially reducing the overall environmental impact of transportation by promoting the adoption of electric mobility.

End-of-life considerations are crucial for both technologies. Blade Batteries, being based on LFP chemistry, are generally easier to recycle than conventional lithium-ion batteries. The absence of cobalt simplifies the recycling process and reduces the environmental burden associated with battery disposal. Solid-state batteries may offer similar recycling advantages, but their recyclability is still being researched as the technology evolves.

In conclusion, both Blade Batteries and solid-state options present potential environmental benefits over traditional lithium-ion batteries. Blade Batteries offer immediate advantages in terms of cobalt-free composition and proven recyclability, while solid-state batteries hold promise for future environmental improvements as the technology matures. The ultimate environmental impact will depend on factors such as production scale, adoption rates, and the development of efficient recycling processes for each technology.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!