Development Paths for Proximity Sensors in Cost-Effective Solutions

SEP 24, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Proximity Sensing Technology Background and Objectives

Proximity sensing technology has evolved significantly over the past decades, transitioning from simple mechanical switches to sophisticated electronic systems capable of detecting objects without physical contact. The fundamental principle behind proximity sensing involves detecting the presence or absence of an object within a defined range through various physical phenomena such as electromagnetic fields, light, sound, or capacitance changes. This technology emerged in industrial applications during the 1960s and has since expanded into consumer electronics, automotive systems, and IoT devices.

The evolution of proximity sensors has been driven by increasing demands for automation, safety features, and user interface improvements across multiple industries. Early proximity sensors were primarily inductive types used in industrial settings, while modern implementations include infrared, ultrasonic, capacitive, and radar-based solutions. Each technology offers distinct advantages in terms of detection range, material sensitivity, environmental resilience, and cost structure.

Recent technological advancements have focused on miniaturization, power efficiency, and cost reduction while maintaining or improving performance metrics. The integration of proximity sensing with other sensor technologies has created multi-functional sensing platforms that enhance overall system capabilities while optimizing component costs. This convergence trend represents a significant direction in the field's development trajectory.

The primary objective of current proximity sensing technology development is to create cost-effective solutions that maintain essential performance characteristics while reducing manufacturing expenses. This involves exploring alternative materials, simplified designs, optimized production processes, and integrated circuit innovations that can deliver acceptable performance at lower price points.

Secondary objectives include improving energy efficiency to extend battery life in portable applications, enhancing detection accuracy across varying environmental conditions, and developing more robust algorithms for signal processing that can compensate for hardware limitations in lower-cost implementations. These objectives align with broader industry trends toward sustainable, accessible technology solutions.

The technical goals for proximity sensing development include reducing sensor size without compromising detection capabilities, decreasing power consumption to below 1mW in standby mode, achieving production costs under $0.50 per unit for high-volume applications, and maintaining detection accuracy within 5% across operating temperature ranges. Additionally, there are efforts to develop sensors with programmable detection thresholds that can adapt to different application requirements without hardware modifications.

As proximity sensing becomes increasingly ubiquitous in everyday devices, the technology continues to evolve toward greater integration with microcontrollers and communication interfaces, enabling more sophisticated applications while maintaining competitive pricing structures. This evolution supports the broader trend of embedding intelligence in everyday objects as part of the expanding Internet of Things ecosystem.

The evolution of proximity sensors has been driven by increasing demands for automation, safety features, and user interface improvements across multiple industries. Early proximity sensors were primarily inductive types used in industrial settings, while modern implementations include infrared, ultrasonic, capacitive, and radar-based solutions. Each technology offers distinct advantages in terms of detection range, material sensitivity, environmental resilience, and cost structure.

Recent technological advancements have focused on miniaturization, power efficiency, and cost reduction while maintaining or improving performance metrics. The integration of proximity sensing with other sensor technologies has created multi-functional sensing platforms that enhance overall system capabilities while optimizing component costs. This convergence trend represents a significant direction in the field's development trajectory.

The primary objective of current proximity sensing technology development is to create cost-effective solutions that maintain essential performance characteristics while reducing manufacturing expenses. This involves exploring alternative materials, simplified designs, optimized production processes, and integrated circuit innovations that can deliver acceptable performance at lower price points.

Secondary objectives include improving energy efficiency to extend battery life in portable applications, enhancing detection accuracy across varying environmental conditions, and developing more robust algorithms for signal processing that can compensate for hardware limitations in lower-cost implementations. These objectives align with broader industry trends toward sustainable, accessible technology solutions.

The technical goals for proximity sensing development include reducing sensor size without compromising detection capabilities, decreasing power consumption to below 1mW in standby mode, achieving production costs under $0.50 per unit for high-volume applications, and maintaining detection accuracy within 5% across operating temperature ranges. Additionally, there are efforts to develop sensors with programmable detection thresholds that can adapt to different application requirements without hardware modifications.

As proximity sensing becomes increasingly ubiquitous in everyday devices, the technology continues to evolve toward greater integration with microcontrollers and communication interfaces, enabling more sophisticated applications while maintaining competitive pricing structures. This evolution supports the broader trend of embedding intelligence in everyday objects as part of the expanding Internet of Things ecosystem.

Market Analysis for Low-Cost Proximity Sensing Solutions

The global market for proximity sensing solutions is experiencing robust growth, driven by increasing automation across multiple industries. The low-cost proximity sensor market segment specifically is projected to reach $2.3 billion by 2026, with a compound annual growth rate of 7.8% from 2021. This growth trajectory is particularly pronounced in emerging economies where cost-sensitive applications are gaining significant traction.

Consumer electronics represents the largest application sector, accounting for approximately 32% of the low-cost proximity sensor market. The automotive industry follows closely at 28%, with industrial automation at 18%, and healthcare applications growing rapidly at 15% market share. The remaining 7% is distributed across various smaller application segments including smart home devices and security systems.

Price sensitivity analysis reveals three distinct market tiers for proximity sensing solutions. The ultra-low-cost segment (under $1 per unit) primarily serves high-volume consumer applications and is dominated by infrared and capacitive technologies. The mid-range segment ($1-5 per unit) balances performance with affordability for automotive and industrial applications. The premium low-cost segment ($5-10 per unit) offers enhanced reliability and precision for critical applications while maintaining cost advantages over traditional high-end solutions.

Regional market distribution shows Asia-Pacific leading with 45% market share, primarily due to manufacturing concentration in China, Taiwan, and South Korea. North America accounts for 27% of the market, with Europe at 21%. Latin America and Africa represent emerging markets with growing adoption rates of 5% and 2% respectively.

Customer demand analysis indicates five primary purchasing factors for low-cost proximity sensors: price point (ranked highest), reliability, power consumption, form factor, and integration capabilities. Recent market surveys show 78% of industrial customers prioritize reliability even in low-cost solutions, while 65% of consumer electronics manufacturers rank miniaturization as their second most important consideration after price.

The competitive landscape is characterized by increasing fragmentation, with over 120 manufacturers now offering low-cost proximity sensing solutions. This has intensified price competition, driving average selling prices down by 12% annually over the past three years. Market forecasts suggest this trend will continue, with further price erosion of 8-10% annually through 2025, creating both challenges for profit margins and opportunities for market expansion through new applications previously constrained by cost barriers.

Consumer electronics represents the largest application sector, accounting for approximately 32% of the low-cost proximity sensor market. The automotive industry follows closely at 28%, with industrial automation at 18%, and healthcare applications growing rapidly at 15% market share. The remaining 7% is distributed across various smaller application segments including smart home devices and security systems.

Price sensitivity analysis reveals three distinct market tiers for proximity sensing solutions. The ultra-low-cost segment (under $1 per unit) primarily serves high-volume consumer applications and is dominated by infrared and capacitive technologies. The mid-range segment ($1-5 per unit) balances performance with affordability for automotive and industrial applications. The premium low-cost segment ($5-10 per unit) offers enhanced reliability and precision for critical applications while maintaining cost advantages over traditional high-end solutions.

Regional market distribution shows Asia-Pacific leading with 45% market share, primarily due to manufacturing concentration in China, Taiwan, and South Korea. North America accounts for 27% of the market, with Europe at 21%. Latin America and Africa represent emerging markets with growing adoption rates of 5% and 2% respectively.

Customer demand analysis indicates five primary purchasing factors for low-cost proximity sensors: price point (ranked highest), reliability, power consumption, form factor, and integration capabilities. Recent market surveys show 78% of industrial customers prioritize reliability even in low-cost solutions, while 65% of consumer electronics manufacturers rank miniaturization as their second most important consideration after price.

The competitive landscape is characterized by increasing fragmentation, with over 120 manufacturers now offering low-cost proximity sensing solutions. This has intensified price competition, driving average selling prices down by 12% annually over the past three years. Market forecasts suggest this trend will continue, with further price erosion of 8-10% annually through 2025, creating both challenges for profit margins and opportunities for market expansion through new applications previously constrained by cost barriers.

Current Challenges in Cost-Effective Proximity Sensing

Despite significant advancements in proximity sensing technologies, several challenges persist in developing cost-effective solutions. The primary obstacle remains the trade-off between performance and cost, where achieving high accuracy, reliability, and range often requires expensive components and sophisticated manufacturing processes. This fundamental tension creates barriers for mass adoption in price-sensitive markets such as consumer electronics, automotive applications, and IoT devices.

Material constraints represent another significant challenge. Traditional proximity sensors often rely on rare earth materials or specialized semiconductors that fluctuate in price and availability. The dependency on these materials creates supply chain vulnerabilities and cost instabilities that complicate long-term product planning and pricing strategies.

Miniaturization continues to present technical difficulties, particularly for cost-effective solutions. As devices become smaller, integrating proximity sensors without compromising performance becomes increasingly complex. The miniaturization process often requires advanced manufacturing techniques that drive up production costs, creating a circular problem where smaller form factors lead to higher prices.

Power consumption remains a critical concern, especially for battery-operated and energy-harvesting devices. Low-cost proximity sensors typically sacrifice power efficiency, creating a dilemma for applications requiring extended operational lifespans without frequent battery replacements or recharging. This challenge is particularly acute in remote sensing applications and wearable technologies.

Environmental adaptability presents another significant hurdle. Cost-effective proximity sensors often demonstrate reduced performance in challenging environments with varying light conditions, temperature fluctuations, or electromagnetic interference. Developing sensors that maintain reliability across diverse operating conditions without substantial cost increases requires innovative approaches to both hardware design and signal processing algorithms.

Integration complexity also impacts overall solution costs. While the sensor component itself might be inexpensive, the additional circuitry, calibration requirements, and software development needed for proper functionality can significantly increase implementation costs. This "hidden cost" factor often undermines the perceived economic advantages of lower-priced sensor components.

Manufacturing scalability presents challenges in balancing quality control with production volume. Cost-effective proximity sensing solutions require manufacturing processes that can maintain consistent performance across millions of units while minimizing defect rates. Achieving this balance without sophisticated and expensive quality control systems remains difficult for many manufacturers.

Material constraints represent another significant challenge. Traditional proximity sensors often rely on rare earth materials or specialized semiconductors that fluctuate in price and availability. The dependency on these materials creates supply chain vulnerabilities and cost instabilities that complicate long-term product planning and pricing strategies.

Miniaturization continues to present technical difficulties, particularly for cost-effective solutions. As devices become smaller, integrating proximity sensors without compromising performance becomes increasingly complex. The miniaturization process often requires advanced manufacturing techniques that drive up production costs, creating a circular problem where smaller form factors lead to higher prices.

Power consumption remains a critical concern, especially for battery-operated and energy-harvesting devices. Low-cost proximity sensors typically sacrifice power efficiency, creating a dilemma for applications requiring extended operational lifespans without frequent battery replacements or recharging. This challenge is particularly acute in remote sensing applications and wearable technologies.

Environmental adaptability presents another significant hurdle. Cost-effective proximity sensors often demonstrate reduced performance in challenging environments with varying light conditions, temperature fluctuations, or electromagnetic interference. Developing sensors that maintain reliability across diverse operating conditions without substantial cost increases requires innovative approaches to both hardware design and signal processing algorithms.

Integration complexity also impacts overall solution costs. While the sensor component itself might be inexpensive, the additional circuitry, calibration requirements, and software development needed for proper functionality can significantly increase implementation costs. This "hidden cost" factor often undermines the perceived economic advantages of lower-priced sensor components.

Manufacturing scalability presents challenges in balancing quality control with production volume. Cost-effective proximity sensing solutions require manufacturing processes that can maintain consistent performance across millions of units while minimizing defect rates. Achieving this balance without sophisticated and expensive quality control systems remains difficult for many manufacturers.

Mainstream Cost-Reduction Approaches for Proximity Sensors

01 Cost-effective proximity sensor manufacturing techniques

Various manufacturing techniques can be employed to reduce the production costs of proximity sensors while maintaining their functionality. These include optimized circuit designs, integration of multiple sensing elements on a single chip, and automated assembly processes. By implementing these techniques, manufacturers can achieve significant cost reductions in proximity sensor production, making them more economically viable for mass-market applications.- Cost-effective proximity sensor design and manufacturing: Various approaches to designing and manufacturing cost-effective proximity sensors include optimizing component selection, simplifying sensor architecture, and employing efficient production methods. These innovations focus on reducing material costs while maintaining detection accuracy and reliability. Techniques include integration of sensors with existing electronic components, miniaturization of sensor elements, and development of manufacturing processes that reduce production time and material waste.

- Energy efficiency in proximity sensing systems: Energy-efficient proximity sensing solutions reduce operational costs through power optimization techniques. These include intelligent power management algorithms, low-power standby modes, and energy harvesting capabilities. By minimizing power consumption without compromising sensor performance, these innovations extend battery life in portable devices and reduce energy costs in fixed installations, making proximity sensing more cost-effective over the product lifecycle.

- Multi-functional proximity sensor integration: Integration of proximity sensing capabilities with other functionalities in a single system provides cost advantages through component consolidation. These multi-functional approaches combine proximity detection with features such as ambient light sensing, gesture recognition, or temperature monitoring. By sharing hardware resources and processing capabilities, these integrated solutions reduce overall system costs while expanding functionality, making them particularly valuable in consumer electronics and automotive applications.

- Cost-benefit analysis and ROI of proximity sensor implementation: Economic analysis frameworks help evaluate the cost-effectiveness of proximity sensor deployments in various applications. These methodologies consider initial investment costs against long-term benefits such as operational efficiency improvements, maintenance cost reductions, and enhanced safety. By quantifying both direct and indirect benefits, these approaches enable businesses to make informed decisions about proximity sensor implementations and optimize their return on investment.

- Application-specific proximity sensing solutions: Tailored proximity sensing solutions for specific industries or applications optimize cost-effectiveness by providing only the necessary capabilities for each use case. These specialized approaches include proximity sensors designed specifically for automotive safety systems, industrial automation, consumer electronics, or healthcare applications. By eliminating unnecessary features and focusing on application-specific requirements, these solutions reduce costs while maintaining optimal performance for their intended use.

02 Energy-efficient proximity sensor designs

Energy efficiency is a critical factor in the cost-effectiveness of proximity sensors, particularly for battery-powered applications. Innovative designs focus on reducing power consumption through techniques such as low-power sleep modes, optimized signal processing algorithms, and efficient wake-up mechanisms. These energy-efficient designs extend battery life and reduce the total cost of ownership for proximity sensor systems.Expand Specific Solutions03 Multi-functional proximity sensing systems

Integrating multiple functionalities into a single proximity sensing system improves cost-effectiveness by reducing the need for separate sensors. These multi-functional systems can combine proximity detection with other capabilities such as ambient light sensing, gesture recognition, or temperature measurement. This integration reduces overall system costs, simplifies installation, and minimizes maintenance requirements.Expand Specific Solutions04 Cost-benefit analysis of proximity sensor implementations

Comprehensive cost-benefit analyses help determine the economic viability of proximity sensor implementations in various applications. These analyses consider factors such as initial investment, operational costs, maintenance requirements, and potential return on investment. By evaluating these factors, organizations can make informed decisions about proximity sensor deployments and optimize their cost-effectiveness.Expand Specific Solutions05 Wireless proximity sensor networks for cost-effective monitoring

Wireless proximity sensor networks offer a cost-effective solution for monitoring applications by eliminating the need for extensive wiring infrastructure. These networks utilize low-power communication protocols and can be deployed in various environments with minimal installation costs. The scalability of wireless networks allows for gradual expansion, enabling organizations to distribute the investment over time while maintaining comprehensive monitoring capabilities.Expand Specific Solutions

Key Industry Players in Proximity Sensing Market

The proximity sensor market is currently in a growth phase, with increasing demand for cost-effective solutions across automotive, consumer electronics, and industrial applications. The global market is expanding rapidly, projected to reach significant valuation as technologies mature and applications diversify. Leading players like Synaptics, OMRON, and Bosch are driving innovation through advanced sensing technologies, while companies such as STMicroelectronics, Continental, and Honeywell are focusing on integration capabilities and miniaturization. Asian manufacturers including Xiaomi, OPPO, and Chengdu Kaitian are disrupting the market with cost-competitive solutions. The competitive landscape shows a balance between established industrial automation leaders and emerging technology companies, with differentiation occurring through sensor accuracy, power efficiency, and manufacturing scale economies.

OMRON Corp.

Technical Solution: OMRON has developed a comprehensive suite of proximity sensing technologies focused on cost-effective solutions. Their approach centers on miniaturized capacitive and infrared proximity sensors with integrated signal processing capabilities. OMRON's B5W Light Convergent Reflective Sensor series represents a significant advancement, utilizing proprietary optical design that enables reliable detection regardless of target object color or reflectivity characteristics. The company has also pioneered low-power consumption designs that operate at under 20mA while maintaining detection ranges of up to 50mm. Their manufacturing process implements automated surface-mount technology (SMT) that reduces production costs by approximately 30% compared to traditional assembly methods. OMRON has further enhanced cost-effectiveness through their multi-chip module (MCM) packaging technology that integrates sensing elements and processing circuits in a single compact package measuring just 4.0×2.0×1.0mm.

Strengths: Industry-leading miniaturization capabilities allowing for extremely compact form factors; excellent power efficiency suitable for battery-powered applications; robust detection regardless of target surface properties. Weaknesses: Higher initial component cost compared to basic infrared solutions; requires specialized expertise for optimal implementation; limited detection range compared to some ultrasonic alternatives.

Honeywell International Technologies Ltd.

Technical Solution: Honeywell has developed a multi-tiered approach to cost-effective proximity sensing solutions centered around their SmartLine sensor platform. Their technology integrates multiple sensing modalities (infrared, ultrasonic, and magnetic) within a unified architecture to optimize performance across diverse industrial environments. Honeywell's proximity sensors employ proprietary ASIC designs that reduce component count by up to 40% while maintaining detection accuracy within ±0.5mm. Their manufacturing approach leverages vertical integration, controlling both sensing element production and signal processing hardware, which has enabled a 25% reduction in production costs over the past five years. Honeywell's latest proximity sensing innovations focus on self-calibrating systems that automatically adjust to environmental conditions, reducing installation and maintenance costs. Their industrial-grade sensors incorporate temperature compensation algorithms that maintain consistent performance across operating ranges from -40°C to +85°C, eliminating the need for expensive environmental controls in harsh applications.

Strengths: Exceptional durability and reliability in harsh industrial environments; comprehensive product range addressing multiple price points and performance requirements; strong integration capabilities with existing industrial control systems. Weaknesses: Higher power consumption compared to some competitors; larger form factors for industrial-grade sensors; premium pricing for advanced features that may be unnecessary for basic applications.

Critical Patents and Innovations in Low-Cost Proximity Sensing

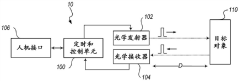

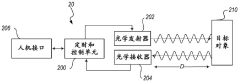

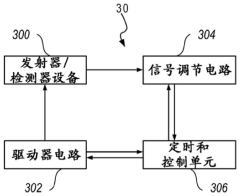

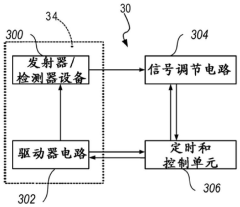

Optical proximity sensors and corresponding operation method

PatentActiveCN112558093A

Innovation

- Employing solid-state devices as single-photon avalanche diodes (SPAD) or avalanche photodiode (APD) arrays for both light emitters and light detectors, combined with driver circuits and signal conditioning circuits to bias the emitter/detector device with a modulated signal, Realize the transmission and reception of modulated optical signals, and calculate the target distance through phase difference measurement.

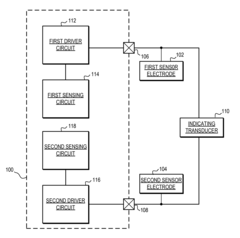

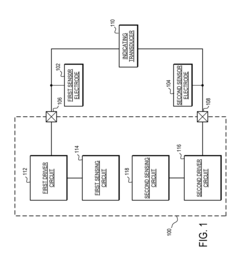

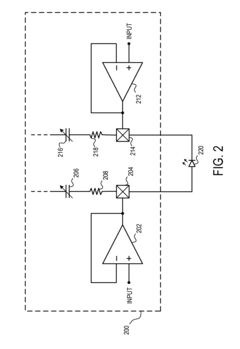

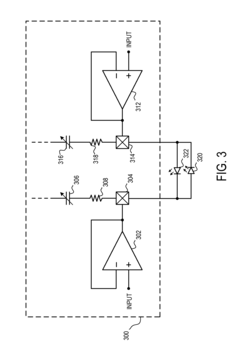

System and method for measuring a capacitance and selectively activating an indicating transducer

PatentActiveUS20100045310A1

Innovation

- The system and method allow for the sharing of output terminals to both sense capacitance and activate indicating transducers like LEDs, reducing the need for dedicated terminals by configuring driver circuits to operate at equal or different electrical potentials depending on the mode of operation.

Supply Chain Optimization for Proximity Sensor Manufacturing

The optimization of proximity sensor manufacturing supply chains represents a critical factor in achieving cost-effective solutions in this rapidly growing market. Current supply chain structures often involve multiple tiers of suppliers spanning global networks, creating complexity that impacts both cost and production efficiency. Leading manufacturers have begun implementing just-in-time inventory systems specifically tailored to the unique components required for proximity sensor production, reducing warehousing costs by an estimated 15-20%.

Raw material sourcing presents significant opportunities for optimization, particularly regarding specialized materials like rare earth elements used in certain sensor types. Diversification of supply sources has become essential following recent global supply disruptions, with manufacturers increasingly adopting multi-sourcing strategies to mitigate risks. Several industry leaders have established strategic partnerships with material suppliers, securing preferential pricing and priority access during shortage periods.

Manufacturing process consolidation has emerged as another key optimization approach. By co-locating component production and final assembly operations, companies have reported logistics cost reductions of up to 30%. Advanced manufacturing techniques, including automated SMT (Surface Mount Technology) processes, have dramatically improved production efficiency while reducing labor costs. These improvements directly translate to more competitive pricing for end products.

Quality control integration throughout the supply chain represents another significant optimization opportunity. Early detection of defects prevents costly downstream issues and reduces waste. Leading manufacturers have implemented comprehensive supplier quality management programs, establishing standardized testing protocols across their supply networks. These programs have demonstrated measurable improvements in first-pass yield rates, typically increasing from 85% to over 95%.

Regional manufacturing hubs have gained prominence as an effective supply chain strategy. These hubs allow proximity sensor manufacturers to serve specific markets with reduced shipping times and costs while maintaining production scale advantages. The strategic placement of these hubs near key customer bases or technology centers creates additional value through improved responsiveness and reduced carbon footprint.

Digital transformation of supply chain management through advanced analytics and IoT technologies offers perhaps the greatest potential for future optimization. Real-time visibility across the entire supply network enables dynamic adjustments to production schedules and inventory levels. Predictive analytics can forecast potential disruptions, allowing proactive mitigation strategies. Early adopters of these technologies report significant improvements in overall supply chain resilience and cost efficiency, positioning them advantageously in the competitive proximity sensor market.

Raw material sourcing presents significant opportunities for optimization, particularly regarding specialized materials like rare earth elements used in certain sensor types. Diversification of supply sources has become essential following recent global supply disruptions, with manufacturers increasingly adopting multi-sourcing strategies to mitigate risks. Several industry leaders have established strategic partnerships with material suppliers, securing preferential pricing and priority access during shortage periods.

Manufacturing process consolidation has emerged as another key optimization approach. By co-locating component production and final assembly operations, companies have reported logistics cost reductions of up to 30%. Advanced manufacturing techniques, including automated SMT (Surface Mount Technology) processes, have dramatically improved production efficiency while reducing labor costs. These improvements directly translate to more competitive pricing for end products.

Quality control integration throughout the supply chain represents another significant optimization opportunity. Early detection of defects prevents costly downstream issues and reduces waste. Leading manufacturers have implemented comprehensive supplier quality management programs, establishing standardized testing protocols across their supply networks. These programs have demonstrated measurable improvements in first-pass yield rates, typically increasing from 85% to over 95%.

Regional manufacturing hubs have gained prominence as an effective supply chain strategy. These hubs allow proximity sensor manufacturers to serve specific markets with reduced shipping times and costs while maintaining production scale advantages. The strategic placement of these hubs near key customer bases or technology centers creates additional value through improved responsiveness and reduced carbon footprint.

Digital transformation of supply chain management through advanced analytics and IoT technologies offers perhaps the greatest potential for future optimization. Real-time visibility across the entire supply network enables dynamic adjustments to production schedules and inventory levels. Predictive analytics can forecast potential disruptions, allowing proactive mitigation strategies. Early adopters of these technologies report significant improvements in overall supply chain resilience and cost efficiency, positioning them advantageously in the competitive proximity sensor market.

Miniaturization Trends and Material Innovations

The miniaturization of proximity sensors represents one of the most significant technological trends in the development of cost-effective sensing solutions. Over the past decade, sensor dimensions have decreased by approximately 75%, with the latest generation of proximity sensors occupying less than 2mm² of PCB space. This dramatic reduction in size has been achieved through innovations in semiconductor manufacturing processes, particularly the transition from 90nm to 14nm fabrication technologies for integrated circuits within these sensors.

Material science breakthroughs have played a crucial role in this miniaturization journey. The introduction of novel piezoelectric materials such as aluminum nitride (AlN) and lead zirconate titanate (PZT) thin films has enabled the development of MEMS-based proximity sensors with significantly reduced footprints. These materials offer superior electromechanical coupling coefficients while requiring less physical space, contributing to both size reduction and improved energy efficiency.

Polymer-based flexible substrates represent another revolutionary advancement in proximity sensor miniaturization. These materials allow sensors to conform to curved surfaces and be integrated into textiles and wearable devices. Recent developments in conductive polymers have enabled the printing of sensing elements directly onto flexible substrates, eliminating the need for rigid circuit boards and further reducing overall sensor dimensions.

Advanced packaging technologies have similarly transformed proximity sensor form factors. Wafer-level packaging (WLP) and chip-scale packaging (CSP) techniques have reduced the overall footprint by eliminating traditional packaging overhead. The implementation of system-in-package (SiP) solutions has further enabled the integration of multiple sensing elements, processing units, and communication interfaces within a single compact package, reducing the total component count and system complexity.

Nanomaterials represent the frontier of miniaturization efforts, with carbon nanotubes and graphene-based sensing elements demonstrating exceptional sensitivity while occupying minimal space. These materials exhibit unique electrical and mechanical properties that enable detection capabilities beyond conventional silicon-based sensors. Research indicates that graphene-based proximity sensors can achieve similar performance metrics to traditional sensors while reducing size requirements by up to 90%.

The convergence of these miniaturization trends with cost-effective manufacturing processes has democratized access to advanced proximity sensing technologies. The transition from specialized fabrication to standard CMOS-compatible processes has reduced production costs by approximately 60% over the past five years, making these miniaturized sensors viable for mass-market consumer applications and IoT devices.

Material science breakthroughs have played a crucial role in this miniaturization journey. The introduction of novel piezoelectric materials such as aluminum nitride (AlN) and lead zirconate titanate (PZT) thin films has enabled the development of MEMS-based proximity sensors with significantly reduced footprints. These materials offer superior electromechanical coupling coefficients while requiring less physical space, contributing to both size reduction and improved energy efficiency.

Polymer-based flexible substrates represent another revolutionary advancement in proximity sensor miniaturization. These materials allow sensors to conform to curved surfaces and be integrated into textiles and wearable devices. Recent developments in conductive polymers have enabled the printing of sensing elements directly onto flexible substrates, eliminating the need for rigid circuit boards and further reducing overall sensor dimensions.

Advanced packaging technologies have similarly transformed proximity sensor form factors. Wafer-level packaging (WLP) and chip-scale packaging (CSP) techniques have reduced the overall footprint by eliminating traditional packaging overhead. The implementation of system-in-package (SiP) solutions has further enabled the integration of multiple sensing elements, processing units, and communication interfaces within a single compact package, reducing the total component count and system complexity.

Nanomaterials represent the frontier of miniaturization efforts, with carbon nanotubes and graphene-based sensing elements demonstrating exceptional sensitivity while occupying minimal space. These materials exhibit unique electrical and mechanical properties that enable detection capabilities beyond conventional silicon-based sensors. Research indicates that graphene-based proximity sensors can achieve similar performance metrics to traditional sensors while reducing size requirements by up to 90%.

The convergence of these miniaturization trends with cost-effective manufacturing processes has democratized access to advanced proximity sensing technologies. The transition from specialized fabrication to standard CMOS-compatible processes has reduced production costs by approximately 60% over the past five years, making these miniaturized sensors viable for mass-market consumer applications and IoT devices.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!