Proximity Sensors vs Magnetic Sensors: Reliability in Vibration Analysis

SEP 24, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Sensor Technology Background and Objectives

Sensor technology has evolved significantly over the past decades, transforming from simple mechanical devices to sophisticated electronic systems capable of precise measurements in challenging environments. Proximity and magnetic sensors represent two distinct branches of this evolution, each with unique operating principles and applications. Proximity sensors detect objects without physical contact using electromagnetic fields, infrared, ultrasonic waves, or optical methods, while magnetic sensors measure magnetic field variations to determine position, direction, or presence of objects.

The historical development of these sensors traces back to the early 20th century with rudimentary magnetic compasses, evolving through the invention of Hall effect sensors in the 1950s, and accelerating with the miniaturization of electronics in the 1980s and 1990s. The integration of MEMS technology in the 2000s further revolutionized sensor capabilities, particularly for vibration analysis applications.

In industrial environments, vibration analysis serves as a critical component of predictive maintenance strategies, enabling early detection of mechanical failures and preventing costly downtime. The reliability of sensors in these applications directly impacts operational efficiency and safety across manufacturing, automotive, aerospace, and energy sectors. As Industry 4.0 initiatives gain momentum, the demand for robust sensors capable of continuous monitoring in high-vibration environments has increased exponentially.

The technical objectives of this research focus on comparing the reliability characteristics of proximity and magnetic sensors specifically in vibration analysis applications. Key parameters under investigation include measurement accuracy under varying vibration frequencies and amplitudes, long-term stability in continuous operation, resistance to environmental factors, signal-to-noise ratio in industrial settings, and power consumption considerations.

Current market trends indicate a growing preference for integrated sensor solutions that combine multiple sensing technologies with advanced signal processing capabilities. The global sensor market for industrial applications is projected to reach $35 billion by 2026, with vibration monitoring solutions representing approximately 18% of this market. This growth is driven by increasing automation, stricter regulatory requirements for equipment safety, and the expanding implementation of condition-based maintenance programs.

The technological trajectory suggests convergence toward hybrid sensing systems that leverage the complementary strengths of different sensor types. Future developments are likely to focus on enhancing sensor resilience through advanced materials, improving signal processing algorithms for noise reduction, and developing self-calibrating capabilities to maintain accuracy over extended operational periods in challenging vibration environments.

The historical development of these sensors traces back to the early 20th century with rudimentary magnetic compasses, evolving through the invention of Hall effect sensors in the 1950s, and accelerating with the miniaturization of electronics in the 1980s and 1990s. The integration of MEMS technology in the 2000s further revolutionized sensor capabilities, particularly for vibration analysis applications.

In industrial environments, vibration analysis serves as a critical component of predictive maintenance strategies, enabling early detection of mechanical failures and preventing costly downtime. The reliability of sensors in these applications directly impacts operational efficiency and safety across manufacturing, automotive, aerospace, and energy sectors. As Industry 4.0 initiatives gain momentum, the demand for robust sensors capable of continuous monitoring in high-vibration environments has increased exponentially.

The technical objectives of this research focus on comparing the reliability characteristics of proximity and magnetic sensors specifically in vibration analysis applications. Key parameters under investigation include measurement accuracy under varying vibration frequencies and amplitudes, long-term stability in continuous operation, resistance to environmental factors, signal-to-noise ratio in industrial settings, and power consumption considerations.

Current market trends indicate a growing preference for integrated sensor solutions that combine multiple sensing technologies with advanced signal processing capabilities. The global sensor market for industrial applications is projected to reach $35 billion by 2026, with vibration monitoring solutions representing approximately 18% of this market. This growth is driven by increasing automation, stricter regulatory requirements for equipment safety, and the expanding implementation of condition-based maintenance programs.

The technological trajectory suggests convergence toward hybrid sensing systems that leverage the complementary strengths of different sensor types. Future developments are likely to focus on enhancing sensor resilience through advanced materials, improving signal processing algorithms for noise reduction, and developing self-calibrating capabilities to maintain accuracy over extended operational periods in challenging vibration environments.

Market Demand for Vibration Analysis Sensors

The vibration analysis sensor market is experiencing robust growth driven by the increasing adoption of predictive maintenance strategies across various industries. According to recent market research, the global vibration monitoring market is projected to reach $2.5 billion by 2025, growing at a CAGR of approximately 7.1% from 2020. This growth is primarily fueled by the manufacturing sector's shift from reactive to predictive maintenance approaches, which has significantly reduced downtime costs and extended equipment lifespan.

Industrial sectors including manufacturing, oil and gas, energy and power, and automotive are the primary consumers of vibration analysis sensors. The manufacturing sector alone accounts for nearly 35% of the total market share, with automotive and aerospace industries following closely behind. These industries rely heavily on vibration analysis to detect early signs of mechanical failures in rotating equipment, bearings, and other critical components.

The demand for more reliable and accurate vibration analysis solutions has intensified the competition between proximity sensors and magnetic sensors. End-users increasingly require sensors that can perform consistently in harsh industrial environments characterized by extreme temperatures, dust, moisture, and electromagnetic interference. This has created a significant market segment specifically for ruggedized sensors with enhanced reliability features.

Regional analysis indicates that North America and Europe currently dominate the vibration analysis sensor market, collectively accounting for over 60% of global demand. However, the Asia-Pacific region is emerging as the fastest-growing market with an estimated growth rate of 9.2% annually, driven by rapid industrialization in countries like China, India, and South Korea.

The market is also witnessing a shift toward wireless and IoT-enabled vibration sensors, with demand for such solutions growing at twice the rate of traditional wired systems. This trend reflects the broader industrial movement toward connected systems and real-time monitoring capabilities, creating new opportunities for sensor manufacturers who can integrate their products into IoT ecosystems.

Customer requirements are evolving beyond basic vibration measurement to include comprehensive analysis capabilities, integration with existing systems, and lower total cost of ownership. According to industry surveys, 78% of maintenance professionals cite reliability in variable operating conditions as their top priority when selecting vibration analysis sensors, followed by accuracy (65%) and ease of integration (58%).

The market for specialized vibration analysis solutions in critical applications such as nuclear power plants, aerospace, and defense is growing at an above-average rate of 8.5% annually, creating premium segments where performance and reliability command significant price premiums over standard industrial solutions.

Industrial sectors including manufacturing, oil and gas, energy and power, and automotive are the primary consumers of vibration analysis sensors. The manufacturing sector alone accounts for nearly 35% of the total market share, with automotive and aerospace industries following closely behind. These industries rely heavily on vibration analysis to detect early signs of mechanical failures in rotating equipment, bearings, and other critical components.

The demand for more reliable and accurate vibration analysis solutions has intensified the competition between proximity sensors and magnetic sensors. End-users increasingly require sensors that can perform consistently in harsh industrial environments characterized by extreme temperatures, dust, moisture, and electromagnetic interference. This has created a significant market segment specifically for ruggedized sensors with enhanced reliability features.

Regional analysis indicates that North America and Europe currently dominate the vibration analysis sensor market, collectively accounting for over 60% of global demand. However, the Asia-Pacific region is emerging as the fastest-growing market with an estimated growth rate of 9.2% annually, driven by rapid industrialization in countries like China, India, and South Korea.

The market is also witnessing a shift toward wireless and IoT-enabled vibration sensors, with demand for such solutions growing at twice the rate of traditional wired systems. This trend reflects the broader industrial movement toward connected systems and real-time monitoring capabilities, creating new opportunities for sensor manufacturers who can integrate their products into IoT ecosystems.

Customer requirements are evolving beyond basic vibration measurement to include comprehensive analysis capabilities, integration with existing systems, and lower total cost of ownership. According to industry surveys, 78% of maintenance professionals cite reliability in variable operating conditions as their top priority when selecting vibration analysis sensors, followed by accuracy (65%) and ease of integration (58%).

The market for specialized vibration analysis solutions in critical applications such as nuclear power plants, aerospace, and defense is growing at an above-average rate of 8.5% annually, creating premium segments where performance and reliability command significant price premiums over standard industrial solutions.

Current Challenges in Sensor Reliability

Despite significant advancements in sensor technology, both proximity and magnetic sensors face substantial reliability challenges when deployed in vibration analysis applications. The primary concern with proximity sensors is their susceptibility to environmental interference. In industrial settings, dust, moisture, and electromagnetic fields can significantly compromise measurement accuracy. Studies indicate that proximity sensor readings may deviate by up to 15% under severe environmental conditions, making them potentially unreliable for precision-critical applications.

Magnetic sensors encounter different but equally concerning reliability issues. Their performance degrades in environments with ferromagnetic materials or varying magnetic fields. This limitation is particularly problematic in manufacturing facilities where machinery components contain ferrous materials. Research has shown that magnetic sensors can experience signal drift of approximately 8-12% over extended operational periods, necessitating frequent recalibration.

Temperature fluctuations present challenges for both sensor types. Proximity sensors, especially capacitive variants, demonstrate measurement variations of up to 5% per 10°C temperature change. Magnetic sensors, particularly Hall effect devices, show similar sensitivity to temperature variations, with documented performance shifts of 3-7% across standard industrial temperature ranges.

Vibration-induced mechanical stress constitutes another significant reliability concern. Proximity sensors with inadequate mounting systems may experience physical displacement during high-vibration events, leading to measurement inconsistencies. Similarly, magnetic sensors can suffer from mechanical fatigue in their internal components when subjected to continuous vibration, resulting in gradual sensitivity reduction over time.

Power supply instability affects both sensor types differently. Proximity sensors typically require stable voltage supplies, with performance degradation observed when supply voltages fluctuate beyond ±5% of nominal values. Magnetic sensors generally demonstrate better tolerance to power fluctuations but may produce erroneous readings during transient voltage events.

Signal processing limitations further compound reliability issues. The sampling rates of many commercial proximity sensors (typically 1-5 kHz) may be insufficient for capturing high-frequency vibration components above 2 kHz. Magnetic sensors often offer higher sampling capabilities but may introduce phase distortion in dynamic measurement scenarios, complicating accurate vibration analysis.

Longevity concerns also differ between these technologies. Proximity sensors, particularly optical variants, show performance degradation after approximately 5,000-8,000 operational hours in harsh industrial environments. Magnetic sensors generally demonstrate superior longevity but remain vulnerable to sudden failure modes that can be difficult to predict through conventional monitoring techniques.

Magnetic sensors encounter different but equally concerning reliability issues. Their performance degrades in environments with ferromagnetic materials or varying magnetic fields. This limitation is particularly problematic in manufacturing facilities where machinery components contain ferrous materials. Research has shown that magnetic sensors can experience signal drift of approximately 8-12% over extended operational periods, necessitating frequent recalibration.

Temperature fluctuations present challenges for both sensor types. Proximity sensors, especially capacitive variants, demonstrate measurement variations of up to 5% per 10°C temperature change. Magnetic sensors, particularly Hall effect devices, show similar sensitivity to temperature variations, with documented performance shifts of 3-7% across standard industrial temperature ranges.

Vibration-induced mechanical stress constitutes another significant reliability concern. Proximity sensors with inadequate mounting systems may experience physical displacement during high-vibration events, leading to measurement inconsistencies. Similarly, magnetic sensors can suffer from mechanical fatigue in their internal components when subjected to continuous vibration, resulting in gradual sensitivity reduction over time.

Power supply instability affects both sensor types differently. Proximity sensors typically require stable voltage supplies, with performance degradation observed when supply voltages fluctuate beyond ±5% of nominal values. Magnetic sensors generally demonstrate better tolerance to power fluctuations but may produce erroneous readings during transient voltage events.

Signal processing limitations further compound reliability issues. The sampling rates of many commercial proximity sensors (typically 1-5 kHz) may be insufficient for capturing high-frequency vibration components above 2 kHz. Magnetic sensors often offer higher sampling capabilities but may introduce phase distortion in dynamic measurement scenarios, complicating accurate vibration analysis.

Longevity concerns also differ between these technologies. Proximity sensors, particularly optical variants, show performance degradation after approximately 5,000-8,000 operational hours in harsh industrial environments. Magnetic sensors generally demonstrate superior longevity but remain vulnerable to sudden failure modes that can be difficult to predict through conventional monitoring techniques.

Technical Comparison of Sensor Solutions

01 Environmental factors affecting sensor reliability

Environmental conditions significantly impact the reliability of proximity and magnetic sensors. Factors such as temperature variations, humidity, electromagnetic interference, and vibration can degrade sensor performance over time. Proper shielding, calibration techniques, and environmental compensation algorithms can be implemented to maintain sensor accuracy and reliability under challenging conditions. Designing sensors with robust housings and protective coatings also helps to mitigate environmental effects.- Environmental factors affecting sensor reliability: Environmental conditions significantly impact the reliability of proximity and magnetic sensors. Factors such as temperature variations, humidity, electromagnetic interference, and vibration can degrade sensor performance over time. Proper shielding, calibration techniques, and environmental compensation algorithms can be implemented to enhance sensor reliability in harsh operating conditions. Designing sensors with robust housings and protective coatings also helps maintain consistent performance across varying environmental conditions.

- Calibration and error compensation techniques: Advanced calibration methods and error compensation algorithms significantly improve the reliability of proximity and magnetic sensors. These techniques include auto-calibration routines, drift compensation, temperature compensation, and adaptive filtering to minimize measurement errors. Regular recalibration procedures and built-in self-test capabilities ensure long-term stability and accuracy. Implementing digital signal processing algorithms can further enhance sensor reliability by reducing noise and compensating for systematic errors in real-time applications.

- Redundancy and fault tolerance systems: Implementing redundancy and fault tolerance mechanisms significantly enhances the reliability of proximity and magnetic sensing systems. This approach involves using multiple sensors in parallel configurations, sensor fusion techniques combining different sensing technologies, and implementing voting algorithms to detect and mitigate sensor failures. Fault detection circuits can continuously monitor sensor performance and automatically switch to backup sensors when anomalies are detected. These redundancy strategies are particularly important in safety-critical applications where sensor failure could have severe consequences.

- Material selection and manufacturing processes: The choice of materials and manufacturing processes significantly impacts the reliability of proximity and magnetic sensors. Using high-quality magnetic materials with stable properties, corrosion-resistant components, and proper encapsulation techniques enhances sensor longevity. Advanced manufacturing processes such as precision deposition of sensing elements, controlled annealing of magnetic materials, and automated assembly reduce variability between sensor units. Quality control procedures including burn-in testing and accelerated aging help identify potential reliability issues before sensors are deployed in the field.

- Diagnostic and predictive maintenance features: Incorporating diagnostic capabilities and predictive maintenance features into proximity and magnetic sensors improves their operational reliability. These features include built-in self-test routines, continuous performance monitoring, wear indicators, and communication interfaces for reporting sensor health status. Advanced sensors may implement machine learning algorithms to detect gradual performance degradation and predict potential failures before they occur. Remote monitoring capabilities allow for timely maintenance interventions, reducing unexpected downtime and extending the effective service life of sensing systems.

02 Calibration and error compensation techniques

Advanced calibration methods and error compensation algorithms are essential for ensuring the reliability of proximity and magnetic sensors. These techniques include self-calibration routines, offset compensation, temperature drift correction, and cross-axis sensitivity reduction. Regular recalibration procedures and adaptive compensation mechanisms can significantly improve sensor accuracy and long-term stability. Implementing digital signal processing techniques helps to filter noise and correct systematic errors in sensor measurements.Expand Specific Solutions03 Redundancy and fault detection systems

Implementing redundancy and fault detection mechanisms greatly enhances the reliability of proximity and magnetic sensor systems. This includes using multiple sensors in parallel configurations, continuous self-diagnostic routines, and watchdog circuits that monitor sensor performance. Cross-validation between different sensor types can provide more robust detection capabilities. Fault-tolerant designs with graceful degradation modes ensure system functionality even when individual sensors fail, which is particularly important in safety-critical applications.Expand Specific Solutions04 Material selection and manufacturing processes

The choice of materials and manufacturing processes significantly impacts sensor reliability. High-quality magnetic materials with stable properties, corrosion-resistant components, and proper encapsulation techniques contribute to longer sensor lifespans. Advanced manufacturing methods such as precision deposition of sensing elements, careful control of material properties, and rigorous quality control during production help minimize variations between sensors. Proper stress relief and aging processes can also improve long-term stability of sensor components.Expand Specific Solutions05 Integration with signal processing and communication systems

Effective integration of proximity and magnetic sensors with signal processing and communication systems enhances overall reliability. This includes implementing noise filtering algorithms, data fusion techniques, and secure communication protocols. Advanced signal conditioning circuits can improve signal-to-noise ratios and measurement accuracy. Intelligent power management systems extend battery life in wireless sensor applications. Additionally, implementing proper isolation between sensing and processing components prevents interference and improves system robustness.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The proximity and magnetic sensor market for vibration analysis is in a growth phase, with increasing demand driven by industrial automation and IoT applications. The market is projected to expand significantly as predictive maintenance becomes standard across industries. Technologically, magnetic sensors offered by Allegro MicroSystems and Melexis Technologies demonstrate higher reliability in high-vibration environments, while proximity sensors from Balluff and Micro-Epsilon provide superior detection versatility. Major players like Robert Bosch, Honeywell, and Siemens are investing heavily in hybrid sensing technologies that combine both approaches. The competitive landscape shows established industrial automation companies competing with specialized sensor manufacturers, with automotive applications representing a particularly contested segment where CTS Corp. and BCS Automotive Interface Solutions are gaining market share.

Robert Bosch GmbH

Technical Solution: Bosch has developed advanced vibration analysis systems that utilize both proximity and magnetic sensors in complementary configurations. Their technology employs eddy current-based proximity sensors with high-frequency response (up to 20kHz) for direct surface displacement measurements without contact, particularly valuable in high-temperature environments. These sensors maintain accuracy within ±1% across a wide temperature range (-40°C to +180°C). Bosch's magnetic sensor solutions incorporate Hall effect and magnetoresistive technologies with integrated temperature compensation algorithms that automatically adjust for thermal drift. Their proprietary signal processing algorithms combine data from both sensor types to filter mechanical noise and provide more reliable vibration signatures, especially in automotive and industrial applications where environmental conditions fluctuate significantly.

Strengths: Superior noise immunity in electromagnetically challenging environments; excellent temperature stability; high sampling rates enabling detection of high-frequency vibrations; robust design for harsh industrial environments. Weaknesses: Higher implementation cost compared to single-sensor solutions; more complex calibration requirements; increased power consumption; larger physical footprint requiring more installation space.

Honeywell International Technologies Ltd.

Technical Solution: Honeywell has pioneered hybrid sensing technology that integrates proximity and magnetic sensing principles for vibration analysis. Their SmartLine series employs eddy current proximity sensors with sub-micron resolution (typically 0.1μm) for high-precision displacement measurements in critical rotating equipment. These are complemented by their proprietary magnetoresistive sensor arrays that can detect subtle magnetic field variations caused by material stress and structural changes. Honeywell's differential measurement approach uses algorithmic fusion of both sensor outputs to eliminate common-mode noise and environmental interference. Their technology implements adaptive filtering techniques that automatically adjust sensitivity based on operating conditions, maintaining measurement integrity even when vibration characteristics change unexpectedly. The system features self-diagnostic capabilities that continuously monitor sensor health and can predict potential failures before they impact measurement accuracy.

Strengths: Exceptional measurement stability in fluctuating environmental conditions; industry-leading temperature compensation; self-calibration capabilities reducing maintenance requirements; comprehensive diagnostic features. Weaknesses: Premium pricing positioning limits adoption in cost-sensitive applications; complex installation requiring specialized expertise; higher power requirements than simpler sensing solutions; proprietary interfaces limiting integration with third-party systems.

Critical Patents and Research in Vibration Sensing

Magnetic proximity sensor

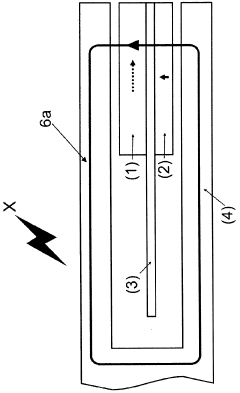

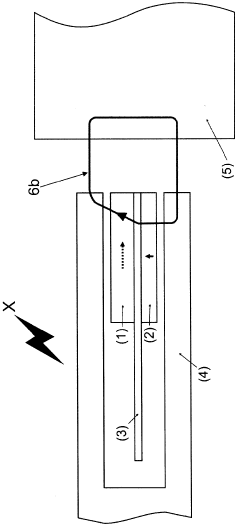

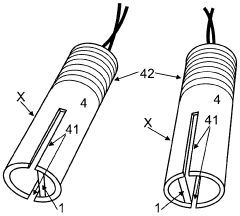

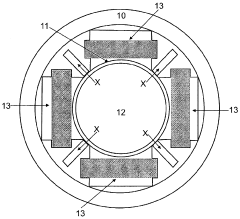

PatentWO2009100697A1

Innovation

- A magnetic proximity sensor design featuring a magnetic field sensor with a preferred axis and a magnetic field source generating a field component perpendicular to it, minimizing magnetic forces and utilizing a shielded configuration to reduce hysteresis influence and enhance sensitivity, with a GMR sensor and a permanent magnet for improved accuracy and distance measurement.

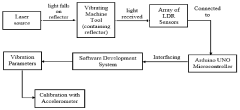

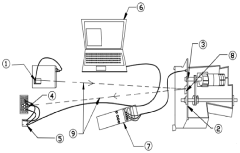

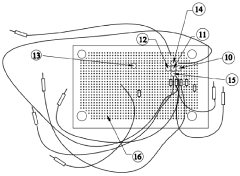

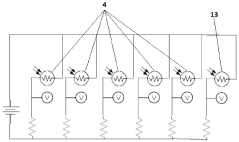

Real time non-contact vibration measuring system for structural health monitoring

PatentInactiveIN3567DEL2015A

Innovation

- A real-time non-contact vibration measuring system using a laser beam reflected from the machine tool surface, detected by an array of Light-Dependent Resistors (LDR) sensors, which send signals to a microcontroller and software for analysis, eliminating the need for sensor mounting and reducing costs.

Environmental Factors Affecting Sensor Performance

Environmental conditions significantly impact the performance and reliability of both proximity and magnetic sensors in vibration analysis applications. Temperature variations represent one of the most critical factors affecting sensor accuracy. Proximity sensors, particularly those utilizing capacitive or inductive principles, often experience sensitivity drift when operating outside their optimal temperature range. Magnetic sensors similarly suffer from temperature-dependent magnetic permeability changes, which can alter their detection thresholds and response characteristics.

Humidity and moisture exposure present distinct challenges for sensor reliability. Proximity sensors with exposed electronic components may experience signal degradation or complete failure when subjected to high humidity environments. Conversely, magnetic sensors typically offer superior moisture resistance due to their hermetically sealed designs, making them preferable for applications in condensing environments or locations with frequent wash-down requirements.

Electromagnetic interference (EMI) constitutes another crucial environmental consideration. Proximity sensors, especially capacitive variants, demonstrate heightened susceptibility to EMI from nearby power lines, motors, or wireless communication devices. Magnetic sensors also experience interference from external magnetic fields, though modern shielding techniques and differential sensing arrangements have significantly mitigated these effects in contemporary designs.

Dust, particulate matter, and chemical exposure represent significant environmental challenges in industrial settings. Proximity sensors with optical components (such as infrared or photoelectric types) suffer performance degradation when their sensing surfaces become contaminated. Magnetic sensors maintain functionality even in dirty environments since magnetic fields penetrate non-ferromagnetic contaminants, though accumulated ferrous particles can potentially disrupt their operation over time.

Mechanical shock and extreme vibration conditions can affect sensor mounting integrity and internal components. Proximity sensors with complex electronic assemblies may experience connection failures or component damage under severe mechanical stress. Magnetic sensors, particularly those utilizing solid-state Hall effect technology, demonstrate superior resilience to mechanical shock due to their simpler construction and fewer moving parts.

Atmospheric pressure variations impact sensor performance in specialized applications. Proximity sensors utilizing ultrasonic principles experience significant measurement errors with pressure changes due to altered sound wave propagation characteristics. Magnetic sensors remain largely unaffected by pressure variations, maintaining consistent performance across diverse pressure environments, from vacuum conditions to high-pressure industrial processes.

Humidity and moisture exposure present distinct challenges for sensor reliability. Proximity sensors with exposed electronic components may experience signal degradation or complete failure when subjected to high humidity environments. Conversely, magnetic sensors typically offer superior moisture resistance due to their hermetically sealed designs, making them preferable for applications in condensing environments or locations with frequent wash-down requirements.

Electromagnetic interference (EMI) constitutes another crucial environmental consideration. Proximity sensors, especially capacitive variants, demonstrate heightened susceptibility to EMI from nearby power lines, motors, or wireless communication devices. Magnetic sensors also experience interference from external magnetic fields, though modern shielding techniques and differential sensing arrangements have significantly mitigated these effects in contemporary designs.

Dust, particulate matter, and chemical exposure represent significant environmental challenges in industrial settings. Proximity sensors with optical components (such as infrared or photoelectric types) suffer performance degradation when their sensing surfaces become contaminated. Magnetic sensors maintain functionality even in dirty environments since magnetic fields penetrate non-ferromagnetic contaminants, though accumulated ferrous particles can potentially disrupt their operation over time.

Mechanical shock and extreme vibration conditions can affect sensor mounting integrity and internal components. Proximity sensors with complex electronic assemblies may experience connection failures or component damage under severe mechanical stress. Magnetic sensors, particularly those utilizing solid-state Hall effect technology, demonstrate superior resilience to mechanical shock due to their simpler construction and fewer moving parts.

Atmospheric pressure variations impact sensor performance in specialized applications. Proximity sensors utilizing ultrasonic principles experience significant measurement errors with pressure changes due to altered sound wave propagation characteristics. Magnetic sensors remain largely unaffected by pressure variations, maintaining consistent performance across diverse pressure environments, from vacuum conditions to high-pressure industrial processes.

Cost-Benefit Analysis of Sensor Implementation

When evaluating the implementation of proximity sensors versus magnetic sensors for vibration analysis, a comprehensive cost-benefit analysis reveals significant economic considerations that influence decision-making processes across industries.

Initial acquisition costs present a notable difference between these sensor types. Proximity sensors typically require a higher upfront investment, with average costs ranging from $150 to $500 per unit for industrial-grade models. Magnetic sensors generally offer a more economical entry point, with costs between $80 and $300 per unit. However, this initial price differential must be considered within the broader context of total ownership costs.

Installation expenses vary considerably between these technologies. Proximity sensors often demand more precise positioning and may require specialized mounting hardware, increasing installation labor costs by approximately 15-25% compared to magnetic sensors. Conversely, magnetic sensors benefit from simpler installation requirements, though they may necessitate additional shielding in electromagnetically noisy environments.

Operational lifetime and maintenance requirements significantly impact long-term economics. Proximity sensors demonstrate superior durability in high-vibration environments, with typical replacement cycles of 3-5 years. Magnetic sensors may require replacement every 2-3 years under similar conditions, creating higher cumulative replacement costs despite lower initial investment.

Energy consumption presents another economic consideration. Proximity sensors typically consume 20-30% more power than their magnetic counterparts, translating to increased operational expenses in large-scale deployments or battery-powered applications where energy efficiency is paramount.

Reliability costs manifest in both direct and indirect forms. Direct costs include maintenance, calibration, and replacement expenses. Indirect costs encompass production downtime, quality control issues, and potential safety incidents resulting from sensor failure. Studies indicate that proximity sensors offer 12-18% lower failure rates in high-vibration environments, potentially justifying their higher acquisition costs through reduced downtime and maintenance expenses.

Return on investment calculations reveal that proximity sensors typically achieve cost parity with magnetic sensors within 18-24 months of operation in high-vibration applications. This breakeven point varies based on application specifics, with more demanding environments favoring proximity sensors despite higher initial costs.

Scalability considerations also influence the cost-benefit equation. Proximity sensor networks often require more complex infrastructure but deliver superior data quality and reliability. Magnetic sensor networks offer more economical scaling but may necessitate more frequent maintenance interventions, creating hidden costs in large-scale deployments.

Initial acquisition costs present a notable difference between these sensor types. Proximity sensors typically require a higher upfront investment, with average costs ranging from $150 to $500 per unit for industrial-grade models. Magnetic sensors generally offer a more economical entry point, with costs between $80 and $300 per unit. However, this initial price differential must be considered within the broader context of total ownership costs.

Installation expenses vary considerably between these technologies. Proximity sensors often demand more precise positioning and may require specialized mounting hardware, increasing installation labor costs by approximately 15-25% compared to magnetic sensors. Conversely, magnetic sensors benefit from simpler installation requirements, though they may necessitate additional shielding in electromagnetically noisy environments.

Operational lifetime and maintenance requirements significantly impact long-term economics. Proximity sensors demonstrate superior durability in high-vibration environments, with typical replacement cycles of 3-5 years. Magnetic sensors may require replacement every 2-3 years under similar conditions, creating higher cumulative replacement costs despite lower initial investment.

Energy consumption presents another economic consideration. Proximity sensors typically consume 20-30% more power than their magnetic counterparts, translating to increased operational expenses in large-scale deployments or battery-powered applications where energy efficiency is paramount.

Reliability costs manifest in both direct and indirect forms. Direct costs include maintenance, calibration, and replacement expenses. Indirect costs encompass production downtime, quality control issues, and potential safety incidents resulting from sensor failure. Studies indicate that proximity sensors offer 12-18% lower failure rates in high-vibration environments, potentially justifying their higher acquisition costs through reduced downtime and maintenance expenses.

Return on investment calculations reveal that proximity sensors typically achieve cost parity with magnetic sensors within 18-24 months of operation in high-vibration applications. This breakeven point varies based on application specifics, with more demanding environments favoring proximity sensors despite higher initial costs.

Scalability considerations also influence the cost-benefit equation. Proximity sensor networks often require more complex infrastructure but deliver superior data quality and reliability. Magnetic sensor networks offer more economical scaling but may necessitate more frequent maintenance interventions, creating hidden costs in large-scale deployments.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!