Laser Proximity Sensors vs RFID Sensors: Evaluation in Tagging Systems

SEP 24, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Laser and RFID Sensing Technologies Background and Objectives

Laser proximity sensors and RFID sensors represent two distinct yet complementary technologies that have evolved significantly over the past few decades. Laser proximity sensing technology originated in the 1960s with the development of laser light sources, while RFID technology emerged in the 1970s from radio-frequency identification research. Both technologies have undergone substantial refinement, with laser sensors becoming more precise and compact, and RFID systems becoming more standardized and cost-effective.

The evolution of laser proximity sensors has been characterized by improvements in accuracy, range, and miniaturization. Early laser sensors were bulky and limited to industrial applications, but modern versions utilize advanced optoelectronics to achieve sub-millimeter precision in compact form factors. The technology has progressed from simple time-of-flight measurements to sophisticated phase-shift and triangulation methods, enabling greater versatility across various environments.

RFID technology has followed a different evolutionary path, moving from simple passive tags to complex active systems with extended read ranges and enhanced data storage capabilities. The standardization efforts of the 1990s and 2000s, particularly the development of EPC (Electronic Product Code) standards, have been crucial in driving widespread adoption across supply chains and inventory management systems.

The convergence of these technologies in tagging systems presents unique opportunities and challenges. While laser proximity sensors excel in precision measurement and can operate without physical tags, RFID systems offer advantages in identification, tracking multiple items simultaneously, and functioning without line-of-sight requirements. Understanding the complementary nature of these technologies is essential for developing integrated solutions that leverage the strengths of each.

The primary technical objectives of this research include: evaluating the performance characteristics of laser proximity and RFID sensors in various tagging system environments; identifying optimal deployment scenarios for each technology; assessing integration possibilities for hybrid systems; and projecting future technological developments that may influence selection criteria. Additionally, we aim to establish quantifiable metrics for comparing these technologies across different use cases.

Looking forward, both technologies are expected to benefit from advancements in miniaturization, energy efficiency, and data processing capabilities. Laser proximity sensors are trending toward higher resolution and multi-point scanning abilities, while RFID is moving toward enhanced security features and integration with IoT ecosystems. The intersection of these technological trajectories will likely yield innovative hybrid solutions that overcome the limitations of each individual technology.

The evolution of laser proximity sensors has been characterized by improvements in accuracy, range, and miniaturization. Early laser sensors were bulky and limited to industrial applications, but modern versions utilize advanced optoelectronics to achieve sub-millimeter precision in compact form factors. The technology has progressed from simple time-of-flight measurements to sophisticated phase-shift and triangulation methods, enabling greater versatility across various environments.

RFID technology has followed a different evolutionary path, moving from simple passive tags to complex active systems with extended read ranges and enhanced data storage capabilities. The standardization efforts of the 1990s and 2000s, particularly the development of EPC (Electronic Product Code) standards, have been crucial in driving widespread adoption across supply chains and inventory management systems.

The convergence of these technologies in tagging systems presents unique opportunities and challenges. While laser proximity sensors excel in precision measurement and can operate without physical tags, RFID systems offer advantages in identification, tracking multiple items simultaneously, and functioning without line-of-sight requirements. Understanding the complementary nature of these technologies is essential for developing integrated solutions that leverage the strengths of each.

The primary technical objectives of this research include: evaluating the performance characteristics of laser proximity and RFID sensors in various tagging system environments; identifying optimal deployment scenarios for each technology; assessing integration possibilities for hybrid systems; and projecting future technological developments that may influence selection criteria. Additionally, we aim to establish quantifiable metrics for comparing these technologies across different use cases.

Looking forward, both technologies are expected to benefit from advancements in miniaturization, energy efficiency, and data processing capabilities. Laser proximity sensors are trending toward higher resolution and multi-point scanning abilities, while RFID is moving toward enhanced security features and integration with IoT ecosystems. The intersection of these technological trajectories will likely yield innovative hybrid solutions that overcome the limitations of each individual technology.

Market Demand Analysis for Tagging System Solutions

The global tagging systems market has experienced significant growth in recent years, driven by increasing demands for asset tracking, inventory management, and supply chain optimization across various industries. The market for tagging solutions is projected to reach $17.4 billion by 2026, growing at a CAGR of 9.8% from 2021. This growth trajectory reflects the expanding need for efficient identification and tracking technologies in an increasingly complex global supply chain environment.

Within this broader market, both Laser Proximity Sensors and RFID Sensors represent critical technological solutions addressing different segments of customer needs. The demand for Laser Proximity Sensors has been particularly strong in manufacturing environments where precision detection and measurement are paramount. These sensors have gained traction in automotive assembly, electronics manufacturing, and pharmaceutical production, where accurate positioning and object detection directly impact product quality and operational efficiency.

RFID Sensors, conversely, have seen robust demand growth in retail, logistics, and healthcare sectors. The retail industry alone accounts for approximately 32% of the global RFID market, with implementations focusing on inventory accuracy, loss prevention, and enhanced customer experiences through technologies like smart fitting rooms and automated checkouts. The logistics sector represents another significant market segment, with companies increasingly adopting RFID solutions to achieve real-time visibility across complex supply chains.

Market research indicates that end-users are increasingly prioritizing tagging solutions that offer enhanced data capture capabilities, longer read ranges, and improved durability in challenging environments. There is a growing preference for systems that can be seamlessly integrated with existing enterprise software platforms, particularly warehouse management systems (WMS) and enterprise resource planning (ERP) solutions.

Cost considerations remain a significant factor influencing market demand patterns. While RFID technology has seen substantial cost reductions over the past decade, with tag prices decreasing by over 80%, implementation costs still present barriers for small and medium enterprises. Laser proximity solutions often present lower initial implementation costs but may offer more limited functionality in certain applications requiring mass identification capabilities.

Regional analysis reveals varying adoption patterns, with North America and Europe leading in sophisticated tagging implementations, while Asia-Pacific represents the fastest-growing market with a particular focus on manufacturing applications. The demand in emerging economies is primarily driven by the expansion of organized retail and the growth of export-oriented manufacturing facilities requiring compliance with global supply chain standards.

Looking forward, market demand is increasingly shifting toward hybrid solutions that combine multiple sensing technologies to maximize operational benefits while minimizing the limitations inherent to any single technology approach. This trend suggests significant growth potential for integrated systems that leverage the complementary strengths of both laser proximity and RFID sensing technologies.

Within this broader market, both Laser Proximity Sensors and RFID Sensors represent critical technological solutions addressing different segments of customer needs. The demand for Laser Proximity Sensors has been particularly strong in manufacturing environments where precision detection and measurement are paramount. These sensors have gained traction in automotive assembly, electronics manufacturing, and pharmaceutical production, where accurate positioning and object detection directly impact product quality and operational efficiency.

RFID Sensors, conversely, have seen robust demand growth in retail, logistics, and healthcare sectors. The retail industry alone accounts for approximately 32% of the global RFID market, with implementations focusing on inventory accuracy, loss prevention, and enhanced customer experiences through technologies like smart fitting rooms and automated checkouts. The logistics sector represents another significant market segment, with companies increasingly adopting RFID solutions to achieve real-time visibility across complex supply chains.

Market research indicates that end-users are increasingly prioritizing tagging solutions that offer enhanced data capture capabilities, longer read ranges, and improved durability in challenging environments. There is a growing preference for systems that can be seamlessly integrated with existing enterprise software platforms, particularly warehouse management systems (WMS) and enterprise resource planning (ERP) solutions.

Cost considerations remain a significant factor influencing market demand patterns. While RFID technology has seen substantial cost reductions over the past decade, with tag prices decreasing by over 80%, implementation costs still present barriers for small and medium enterprises. Laser proximity solutions often present lower initial implementation costs but may offer more limited functionality in certain applications requiring mass identification capabilities.

Regional analysis reveals varying adoption patterns, with North America and Europe leading in sophisticated tagging implementations, while Asia-Pacific represents the fastest-growing market with a particular focus on manufacturing applications. The demand in emerging economies is primarily driven by the expansion of organized retail and the growth of export-oriented manufacturing facilities requiring compliance with global supply chain standards.

Looking forward, market demand is increasingly shifting toward hybrid solutions that combine multiple sensing technologies to maximize operational benefits while minimizing the limitations inherent to any single technology approach. This trend suggests significant growth potential for integrated systems that leverage the complementary strengths of both laser proximity and RFID sensing technologies.

Current State and Challenges in Proximity Sensing Technologies

The proximity sensing technology landscape has evolved significantly over the past decade, with laser proximity sensors and RFID sensors emerging as dominant technologies in tagging systems. Currently, laser proximity sensors utilize time-of-flight or triangulation principles to detect objects with high precision, achieving accuracy levels of 0.01-0.5mm depending on the specific implementation. These systems have seen widespread adoption in industrial automation, robotics, and high-precision manufacturing environments where exact distance measurements are critical.

RFID sensing technology, meanwhile, has matured into a robust ecosystem with multiple frequency bands (LF, HF, UHF) serving different application requirements. The global RFID market reached approximately $11.6 billion in 2022, with projections suggesting growth to $17.4 billion by 2026. Passive RFID systems dominate the market share at roughly 70%, while active RFID systems account for the remaining 30%, primarily in high-value asset tracking applications.

Despite their widespread implementation, both technologies face significant challenges. Laser proximity sensors struggle with environmental interference factors including ambient light variations, reflective surfaces, and atmospheric conditions like dust or fog that can scatter the laser beam. These limitations reduce reliability in outdoor or harsh industrial environments. Additionally, laser systems typically operate on line-of-sight principles, limiting their effectiveness in complex spatial arrangements or when objects are obscured.

RFID technology confronts different obstacles, primarily related to signal interference and range limitations. Metal surfaces and liquids can significantly attenuate or reflect RF signals, creating dead zones or unreliable reading areas. Reader collision (when multiple readers attempt to interrogate the same tag) and tag collision (when multiple tags respond simultaneously) remain persistent technical challenges, particularly in dense deployment scenarios.

Geographically, North America and Europe lead in laser proximity sensor innovation and implementation, while Asia-Pacific dominates RFID manufacturing with China accounting for approximately 45% of global RFID tag production. Japan maintains leadership in high-precision laser sensing technologies, particularly for industrial applications.

Energy consumption presents another significant challenge, especially for battery-powered active RFID systems where operational longevity is critical. Current active RFID tags typically offer 3-5 years of battery life under normal usage conditions, though this varies significantly based on reading frequency and environmental factors.

Standardization efforts continue to evolve, with ISO/IEC 18000 series providing frameworks for RFID implementations, while laser proximity sensing still lacks comprehensive cross-manufacturer standards, creating interoperability challenges in complex systems integrating multiple sensor types.

RFID sensing technology, meanwhile, has matured into a robust ecosystem with multiple frequency bands (LF, HF, UHF) serving different application requirements. The global RFID market reached approximately $11.6 billion in 2022, with projections suggesting growth to $17.4 billion by 2026. Passive RFID systems dominate the market share at roughly 70%, while active RFID systems account for the remaining 30%, primarily in high-value asset tracking applications.

Despite their widespread implementation, both technologies face significant challenges. Laser proximity sensors struggle with environmental interference factors including ambient light variations, reflective surfaces, and atmospheric conditions like dust or fog that can scatter the laser beam. These limitations reduce reliability in outdoor or harsh industrial environments. Additionally, laser systems typically operate on line-of-sight principles, limiting their effectiveness in complex spatial arrangements or when objects are obscured.

RFID technology confronts different obstacles, primarily related to signal interference and range limitations. Metal surfaces and liquids can significantly attenuate or reflect RF signals, creating dead zones or unreliable reading areas. Reader collision (when multiple readers attempt to interrogate the same tag) and tag collision (when multiple tags respond simultaneously) remain persistent technical challenges, particularly in dense deployment scenarios.

Geographically, North America and Europe lead in laser proximity sensor innovation and implementation, while Asia-Pacific dominates RFID manufacturing with China accounting for approximately 45% of global RFID tag production. Japan maintains leadership in high-precision laser sensing technologies, particularly for industrial applications.

Energy consumption presents another significant challenge, especially for battery-powered active RFID systems where operational longevity is critical. Current active RFID tags typically offer 3-5 years of battery life under normal usage conditions, though this varies significantly based on reading frequency and environmental factors.

Standardization efforts continue to evolve, with ISO/IEC 18000 series providing frameworks for RFID implementations, while laser proximity sensing still lacks comprehensive cross-manufacturer standards, creating interoperability challenges in complex systems integrating multiple sensor types.

Comparative Analysis of Laser and RFID Tagging Implementations

01 Integration of laser proximity sensors with RFID for enhanced detection

Systems that combine laser proximity sensors with RFID technology to provide more accurate and reliable detection capabilities. The laser sensors detect physical presence while RFID provides identification information, creating a dual-verification system. This integration enhances security applications by reducing false positives and enabling precise tracking of objects or individuals in controlled environments.- Integration of laser proximity sensors with RFID for enhanced detection: Systems that combine laser proximity sensors with RFID technology to provide more accurate and reliable detection capabilities. The laser sensors detect physical presence while RFID provides identification information, creating a dual-verification system. This integration enhances security applications by reducing false positives and enabling precise tracking of objects or individuals in controlled environments.

- RFID-based proximity detection systems for access control: Access control systems utilizing RFID sensors to detect and authenticate users in proximity to secured areas. These systems can automatically grant or deny access based on the identification data stored in RFID tags, without requiring physical contact. The technology includes various read ranges and security protocols to prevent unauthorized access while maintaining convenience for authorized users.

- Multi-sensor fusion techniques for proximity detection and identification: Advanced systems that combine multiple sensor technologies including laser, RFID, and other sensing methods to create comprehensive detection solutions. These systems use sensor fusion algorithms to process data from different sources, improving accuracy and reliability in complex environments. Applications include industrial automation, robotics, and advanced security systems where both precise distance measurement and object identification are required.

- Mobile device integration with proximity sensing technologies: Solutions that integrate smartphone or mobile device capabilities with proximity sensing technologies. These systems leverage the processing power and connectivity of mobile devices to enhance the functionality of proximity sensors. Applications include consumer electronics, retail experiences, and location-based services where users can receive contextual information based on their proximity to tagged objects or locations.

- Industrial and automotive applications of proximity detection systems: Specialized proximity detection and identification systems designed for industrial environments and automotive applications. These systems are engineered to withstand harsh conditions while providing reliable detection capabilities for safety, automation, and inventory management. Features include extended detection ranges, resistance to interference, and integration with industrial control systems to prevent accidents and optimize workflows.

02 RFID-based proximity detection systems for access control

Access control systems utilizing RFID sensors to detect and authenticate users or objects in proximity. These systems can automatically grant or deny access based on the identification data received from RFID tags. The proximity detection capabilities allow for contactless authentication, improving security while maintaining convenience for authorized users in various applications including building entry, secure areas, and vehicle access.Expand Specific Solutions03 Multi-sensor fusion techniques for proximity detection and identification

Advanced systems that combine multiple sensor technologies including laser, RFID, and other sensing methods to create comprehensive detection solutions. These multi-sensor approaches improve accuracy by compensating for the limitations of individual sensors. The fusion of data from different sensor types enables more robust object tracking, identification, and classification across varying environmental conditions and use cases.Expand Specific Solutions04 Mobile device integration with proximity sensing technologies

Systems that incorporate proximity sensors and RFID technology into mobile devices or integrate with them for various applications. These solutions enable smartphones and tablets to interact with nearby objects or locations through proximity detection. Applications include contactless payments, location-based services, inventory management, and personalized user experiences based on proximity to identified objects or zones.Expand Specific Solutions05 Industrial and logistics applications of proximity and identification sensors

Implementation of laser proximity sensors and RFID technology in industrial environments and logistics operations. These systems enable automated inventory tracking, asset management, and process optimization through accurate detection and identification of materials, products, and equipment. The combination of precise proximity detection with identification capabilities improves efficiency in manufacturing, warehousing, and supply chain operations.Expand Specific Solutions

Key Industry Players in Sensing and Tagging Solutions

The RFID and laser proximity sensor market for tagging systems is in a growth phase, with increasing adoption across retail, logistics, and manufacturing sectors. The market size is expanding rapidly, driven by supply chain optimization and inventory management needs. Technologically, RFID solutions are more mature, with established players like NXP, Zebra Technologies, and Impinj leading innovation in passive and active RFID systems. Laser proximity sensors, championed by companies like Honeywell and Omron, offer complementary advantages in precision detection. IBM, Intel, and Amazon Technologies are advancing integrated solutions combining both technologies with cloud and AI capabilities, while specialized manufacturers like PragmatIC Semiconductor are developing flexible electronics to expand application possibilities in consumer goods and healthcare.

NXP USA, Inc.

Technical Solution: NXP has developed a comprehensive portfolio addressing both RFID and proximity sensing technologies for tagging systems. Their UCODE product line represents advanced RFID solutions optimized for supply chain and retail applications, while their NTAG series integrates NFC capabilities with proximity detection. NXP's approach includes specialized semiconductor solutions that enable hybrid sensing capabilities, such as their MIFARE DESFire products that combine contactless RFID with secure authentication. For proximity detection, NXP offers laser-based time-of-flight (ToF) sensors that provide accurate distance measurement with lower power consumption than traditional approaches. Their integrated circuits enable fusion of data from multiple sensor types, allowing systems to dynamically switch between laser proximity sensing for precise location determination and RFID for identification. NXP's solutions emphasize security, with encrypted communication protocols protecting data across both sensing modalities.

Strengths: Industry-leading semiconductor technology enabling miniaturization and power efficiency; strong security features across both technologies; extensive ecosystem of development tools and partners. Weaknesses: Requires integration with third-party hardware for complete solutions; higher component costs for advanced security features; more complex implementation compared to turnkey solutions.

Zebra Technologies Corp.

Technical Solution: Zebra Technologies has developed a dual-technology approach that integrates both laser proximity sensors and RFID in their tagging systems. Their FX9600 Fixed RFID Reader works alongside their DS9900 Series hybrid imager, creating a comprehensive solution that leverages the strengths of both technologies. The laser-based systems provide immediate, line-of-sight identification with high accuracy for barcode scanning, while their RFID technology offers non-line-of-sight capabilities for bulk reading. Zebra's platform includes edge computing capabilities that process data from both sensor types, allowing real-time decision making based on proximity detection (laser) and identification (RFID). Their Enterprise Asset Intelligence vision combines these technologies with cloud-based data analytics to provide end-to-end visibility across supply chains and retail environments.

Strengths: Comprehensive integration of both technologies allows flexibility across various use cases; superior read range and accuracy in challenging environments; mature ecosystem with software support. Weaknesses: Higher implementation costs compared to single-technology solutions; complexity in deployment requiring specialized expertise; potential interference issues in dense deployment scenarios.

Technical Deep Dive: Core Patents and Innovations

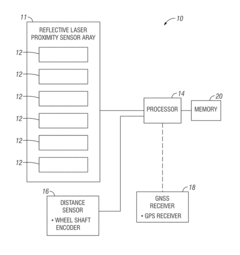

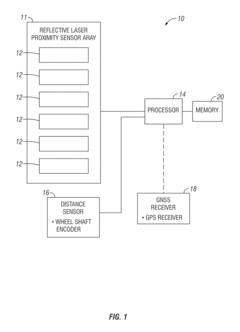

Crop stand analyzer using reflective laser proximity sensors

PatentActiveUS9804097B1

Innovation

- A system utilizing reflective laser proximity sensors with background suppression and adjustable cutoff range, vertically aligned sensor banks, and a processor to generate side-view profiles and extract plant stand information, capable of being mounted on mobile platforms for real-time data collection.

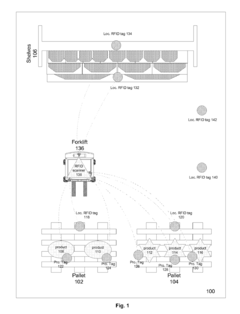

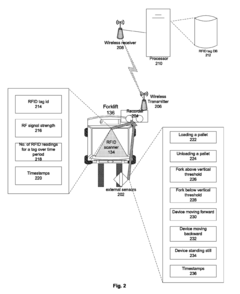

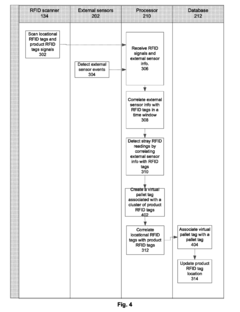

System and method of enhanced RFID transport device sensor network

PatentActiveUS8120482B2

Innovation

- Equipping transport devices like forklifts with RFID scanners and additional external sensors such as proximity sensors, laser sensors, and accelerometers to filter out unwanted RFID signals by correlating load information, movement data, and signal strengths, and assigning a 'virtual' pallet tag to groups of product RFID tags for accurate location tracking.

Cost-Benefit Analysis of Competing Sensing Technologies

When evaluating laser proximity sensors versus RFID sensors for tagging systems, a comprehensive cost-benefit analysis reveals significant differences in both initial investment and long-term operational expenses. Laser proximity sensors typically require a higher upfront capital expenditure, with average unit costs ranging from $500 to $2,500 depending on precision requirements and detection range capabilities. In contrast, RFID systems present a more distributed cost structure, with readers priced between $300 and $1,500, while individual tags cost between $0.10 and $5 depending on their functionality and durability specifications.

Operational expenses also differ substantially between these technologies. Laser proximity systems generally consume more power, increasing energy costs by approximately 15-25% compared to RFID alternatives. However, RFID systems often incur higher maintenance costs due to the need for tag replacement and reader calibration, particularly in harsh industrial environments where tag damage is common.

The total cost of ownership calculation must account for installation complexity as well. Laser proximity sensors typically require precise alignment and calibration, increasing installation labor costs by 30-40% compared to RFID systems. However, RFID infrastructure may necessitate more extensive network integration, potentially adding $5,000-$10,000 in IT infrastructure costs depending on the scale of implementation.

Return on investment timelines vary significantly based on application context. In high-throughput manufacturing environments, laser proximity sensors often achieve ROI within 12-18 months due to their superior accuracy and reduced error rates. RFID systems typically require 18-24 months to reach ROI but offer greater scalability advantages for growing operations.

Scalability economics particularly favor RFID when considering large-scale deployments. The marginal cost of adding additional RFID tags decreases substantially at volume, while expanding laser proximity coverage requires proportional sensor additions with minimal economy of scale. For installations tracking more than 10,000 items, RFID systems demonstrate a 30-40% cost advantage over comparable laser proximity implementations.

Risk assessment must also factor into the cost-benefit equation. Laser proximity sensors face fewer cybersecurity vulnerabilities, reducing potential costs associated with data breaches. Conversely, RFID systems may require additional security infrastructure costing $3,000-$7,000 annually to mitigate potential vulnerabilities in data transmission and storage.

Operational expenses also differ substantially between these technologies. Laser proximity systems generally consume more power, increasing energy costs by approximately 15-25% compared to RFID alternatives. However, RFID systems often incur higher maintenance costs due to the need for tag replacement and reader calibration, particularly in harsh industrial environments where tag damage is common.

The total cost of ownership calculation must account for installation complexity as well. Laser proximity sensors typically require precise alignment and calibration, increasing installation labor costs by 30-40% compared to RFID systems. However, RFID infrastructure may necessitate more extensive network integration, potentially adding $5,000-$10,000 in IT infrastructure costs depending on the scale of implementation.

Return on investment timelines vary significantly based on application context. In high-throughput manufacturing environments, laser proximity sensors often achieve ROI within 12-18 months due to their superior accuracy and reduced error rates. RFID systems typically require 18-24 months to reach ROI but offer greater scalability advantages for growing operations.

Scalability economics particularly favor RFID when considering large-scale deployments. The marginal cost of adding additional RFID tags decreases substantially at volume, while expanding laser proximity coverage requires proportional sensor additions with minimal economy of scale. For installations tracking more than 10,000 items, RFID systems demonstrate a 30-40% cost advantage over comparable laser proximity implementations.

Risk assessment must also factor into the cost-benefit equation. Laser proximity sensors face fewer cybersecurity vulnerabilities, reducing potential costs associated with data breaches. Conversely, RFID systems may require additional security infrastructure costing $3,000-$7,000 annually to mitigate potential vulnerabilities in data transmission and storage.

Integration Strategies for Enterprise Tagging Ecosystems

Effective integration of tagging technologies into enterprise ecosystems requires a strategic approach that considers both technical compatibility and business process alignment. When evaluating laser proximity sensors versus RFID sensors, organizations must develop comprehensive integration frameworks that accommodate the strengths and limitations of each technology.

The integration strategy should begin with a thorough assessment of existing enterprise systems, including inventory management, asset tracking, and security protocols. This evaluation provides the foundation for determining appropriate connection points and data flow pathways between tagging systems and core business applications.

For laser proximity sensor integration, enterprises should focus on developing robust APIs that can process high-frequency spatial data and translate it into actionable business intelligence. These sensors typically require line-of-sight positioning and may necessitate modifications to physical infrastructure to ensure optimal coverage throughout facilities.

RFID integration strategies, by contrast, must address radio frequency management, tag collision protocols, and data encryption standards. Enterprise architects should implement middleware solutions capable of filtering and aggregating the substantial data volumes generated by RFID systems, particularly in high-density deployment scenarios.

Cross-platform compatibility represents a critical consideration, as tagging ecosystems must function seamlessly across diverse operating environments. Organizations should adopt standardized data formats and communication protocols to facilitate interoperability between sensor networks and enterprise applications such as ERP, CRM, and supply chain management systems.

Security integration demands particular attention, with encryption requirements differing significantly between laser and RFID implementations. A comprehensive security framework should include authentication mechanisms, access controls, and audit trails specifically designed for the chosen tagging technology.

Scalability planning must account for the divergent growth patterns of laser and RFID deployments. While laser systems typically scale through additional sensor units, RFID ecosystems may require expanded reader networks, enhanced database capacity, and more sophisticated signal management as tag populations increase.

Finally, integration strategies should incorporate feedback mechanisms that enable continuous optimization of the tagging ecosystem. Real-time performance monitoring, exception handling protocols, and automated calibration processes ensure that the integrated system maintains accuracy and reliability throughout its operational lifecycle.

The integration strategy should begin with a thorough assessment of existing enterprise systems, including inventory management, asset tracking, and security protocols. This evaluation provides the foundation for determining appropriate connection points and data flow pathways between tagging systems and core business applications.

For laser proximity sensor integration, enterprises should focus on developing robust APIs that can process high-frequency spatial data and translate it into actionable business intelligence. These sensors typically require line-of-sight positioning and may necessitate modifications to physical infrastructure to ensure optimal coverage throughout facilities.

RFID integration strategies, by contrast, must address radio frequency management, tag collision protocols, and data encryption standards. Enterprise architects should implement middleware solutions capable of filtering and aggregating the substantial data volumes generated by RFID systems, particularly in high-density deployment scenarios.

Cross-platform compatibility represents a critical consideration, as tagging ecosystems must function seamlessly across diverse operating environments. Organizations should adopt standardized data formats and communication protocols to facilitate interoperability between sensor networks and enterprise applications such as ERP, CRM, and supply chain management systems.

Security integration demands particular attention, with encryption requirements differing significantly between laser and RFID implementations. A comprehensive security framework should include authentication mechanisms, access controls, and audit trails specifically designed for the chosen tagging technology.

Scalability planning must account for the divergent growth patterns of laser and RFID deployments. While laser systems typically scale through additional sensor units, RFID ecosystems may require expanded reader networks, enhanced database capacity, and more sophisticated signal management as tag populations increase.

Finally, integration strategies should incorporate feedback mechanisms that enable continuous optimization of the tagging ecosystem. Real-time performance monitoring, exception handling protocols, and automated calibration processes ensure that the integrated system maintains accuracy and reliability throughout its operational lifecycle.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!