Efficient Solvent Recovery Techniques For Organic Synthesis Plants

AUG 22, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Solvent Recovery Background and Objectives

Solvent recovery has been a critical aspect of organic synthesis plants since the early 20th century, evolving from simple distillation methods to sophisticated integrated systems. The historical trajectory shows a clear shift from disposal-oriented approaches to recovery-focused methodologies, driven by environmental regulations, economic pressures, and sustainability initiatives. This evolution reflects the industry's growing recognition of solvents as valuable resources rather than mere waste products.

The global chemical industry consumes approximately 30 million tons of solvents annually, with organic synthesis plants accounting for roughly 35% of this usage. Recovery rates have improved from below 40% in the 1980s to over 75% in advanced facilities today, demonstrating significant technological progress. However, efficiency plateaus and energy consumption remain persistent challenges across the sector.

Current solvent recovery objectives center on maximizing recovery efficiency while minimizing energy consumption and capital investment. The industry aims to achieve recovery rates exceeding 95% with energy requirements below 0.3 kWh per kilogram of recovered solvent. These targets represent a delicate balance between economic viability and environmental responsibility, particularly as regulatory frameworks become increasingly stringent worldwide.

Technical objectives for next-generation solvent recovery systems include developing membrane technologies capable of selective separation at molecular levels, implementing advanced adsorption materials with regeneration capabilities, and creating hybrid systems that combine multiple recovery mechanisms. These innovations seek to address the limitations of conventional distillation and extraction methods, particularly for azeotropic mixtures and thermally sensitive compounds.

The environmental dimension of solvent recovery has gained prominence with global climate initiatives and circular economy principles. Modern recovery objectives extend beyond simple reuse to include solvent purification that enables closed-loop manufacturing systems. This approach aligns with broader sustainability goals while offering significant operational cost advantages through reduced procurement needs.

Safety considerations have also evolved substantially, with current objectives emphasizing inherently safer design principles that minimize explosion risks and operator exposure. This represents a shift from earlier approaches that relied heavily on engineering controls and personal protective equipment to manage hazards associated with solvent handling and recovery operations.

The technological roadmap for solvent recovery reflects a convergence of chemical engineering innovations, digital monitoring capabilities, and process intensification strategies. Future objectives include developing autonomous recovery systems capable of real-time optimization and adaptation to changing process conditions, potentially revolutionizing efficiency parameters across the organic synthesis landscape.

The global chemical industry consumes approximately 30 million tons of solvents annually, with organic synthesis plants accounting for roughly 35% of this usage. Recovery rates have improved from below 40% in the 1980s to over 75% in advanced facilities today, demonstrating significant technological progress. However, efficiency plateaus and energy consumption remain persistent challenges across the sector.

Current solvent recovery objectives center on maximizing recovery efficiency while minimizing energy consumption and capital investment. The industry aims to achieve recovery rates exceeding 95% with energy requirements below 0.3 kWh per kilogram of recovered solvent. These targets represent a delicate balance between economic viability and environmental responsibility, particularly as regulatory frameworks become increasingly stringent worldwide.

Technical objectives for next-generation solvent recovery systems include developing membrane technologies capable of selective separation at molecular levels, implementing advanced adsorption materials with regeneration capabilities, and creating hybrid systems that combine multiple recovery mechanisms. These innovations seek to address the limitations of conventional distillation and extraction methods, particularly for azeotropic mixtures and thermally sensitive compounds.

The environmental dimension of solvent recovery has gained prominence with global climate initiatives and circular economy principles. Modern recovery objectives extend beyond simple reuse to include solvent purification that enables closed-loop manufacturing systems. This approach aligns with broader sustainability goals while offering significant operational cost advantages through reduced procurement needs.

Safety considerations have also evolved substantially, with current objectives emphasizing inherently safer design principles that minimize explosion risks and operator exposure. This represents a shift from earlier approaches that relied heavily on engineering controls and personal protective equipment to manage hazards associated with solvent handling and recovery operations.

The technological roadmap for solvent recovery reflects a convergence of chemical engineering innovations, digital monitoring capabilities, and process intensification strategies. Future objectives include developing autonomous recovery systems capable of real-time optimization and adaptation to changing process conditions, potentially revolutionizing efficiency parameters across the organic synthesis landscape.

Market Analysis for Solvent Recovery Systems

The global solvent recovery systems market is experiencing robust growth, valued at approximately $1.2 billion in 2022 and projected to reach $1.8 billion by 2027, representing a compound annual growth rate of 8.5%. This growth is primarily driven by increasing environmental regulations, rising solvent costs, and growing awareness of sustainable manufacturing practices across the chemical and pharmaceutical industries.

The pharmaceutical sector currently holds the largest market share at 35%, followed by the chemical industry at 28%, and paint and coating manufacturers at 18%. Geographically, North America leads with 32% market share, followed closely by Europe at 30%, while Asia-Pacific represents the fastest-growing region with a 10.2% CAGR, largely due to rapid industrialization in China and India.

Environmental regulations are significantly influencing market dynamics. The European Union's VOC Solvents Emissions Directive and the U.S. EPA's Clean Air Act amendments have established strict emission limits, compelling manufacturers to implement efficient solvent recovery systems. These regulatory pressures are expected to intensify, particularly in developing economies adopting similar environmental standards.

Cost considerations remain a primary market driver, with solvent recovery systems offering return on investment periods typically ranging from 12 to 36 months depending on installation scale and solvent types. The average cost savings reported by manufacturing facilities implementing modern recovery systems ranges from 40% to 60% on solvent procurement expenses.

Market segmentation reveals distinct preferences based on recovery efficiency and capital investment capabilities. Large pharmaceutical and chemical manufacturers favor advanced distillation and membrane separation technologies despite higher initial costs, while small to medium enterprises typically opt for adsorption-based systems with lower capital requirements but potentially higher operational costs.

Customer demand is increasingly focused on automated systems with reduced energy consumption and higher recovery rates. Systems offering recovery efficiencies above 95% command premium pricing, with market data indicating customers' willingness to pay 15-25% more for each percentage point of efficiency gained above industry standards.

Emerging market trends include integration with Industry 4.0 technologies, with IoT-enabled solvent recovery systems experiencing 22% higher adoption rates compared to conventional systems. Additionally, modular and scalable solutions are gaining traction, particularly among contract manufacturing organizations seeking flexibility in production capacity.

The pharmaceutical sector currently holds the largest market share at 35%, followed by the chemical industry at 28%, and paint and coating manufacturers at 18%. Geographically, North America leads with 32% market share, followed closely by Europe at 30%, while Asia-Pacific represents the fastest-growing region with a 10.2% CAGR, largely due to rapid industrialization in China and India.

Environmental regulations are significantly influencing market dynamics. The European Union's VOC Solvents Emissions Directive and the U.S. EPA's Clean Air Act amendments have established strict emission limits, compelling manufacturers to implement efficient solvent recovery systems. These regulatory pressures are expected to intensify, particularly in developing economies adopting similar environmental standards.

Cost considerations remain a primary market driver, with solvent recovery systems offering return on investment periods typically ranging from 12 to 36 months depending on installation scale and solvent types. The average cost savings reported by manufacturing facilities implementing modern recovery systems ranges from 40% to 60% on solvent procurement expenses.

Market segmentation reveals distinct preferences based on recovery efficiency and capital investment capabilities. Large pharmaceutical and chemical manufacturers favor advanced distillation and membrane separation technologies despite higher initial costs, while small to medium enterprises typically opt for adsorption-based systems with lower capital requirements but potentially higher operational costs.

Customer demand is increasingly focused on automated systems with reduced energy consumption and higher recovery rates. Systems offering recovery efficiencies above 95% command premium pricing, with market data indicating customers' willingness to pay 15-25% more for each percentage point of efficiency gained above industry standards.

Emerging market trends include integration with Industry 4.0 technologies, with IoT-enabled solvent recovery systems experiencing 22% higher adoption rates compared to conventional systems. Additionally, modular and scalable solutions are gaining traction, particularly among contract manufacturing organizations seeking flexibility in production capacity.

Current Challenges in Industrial Solvent Recovery

Despite significant advancements in solvent recovery technologies, the industrial sector continues to face substantial challenges in implementing efficient recovery systems. The primary obstacle remains the high energy consumption associated with conventional distillation processes, which account for approximately 40-60% of operational costs in typical organic synthesis plants. This energy-intensive nature not only impacts economic viability but also contradicts growing sustainability imperatives across the chemical manufacturing industry.

Material compatibility presents another significant challenge, as recovery systems must withstand continuous exposure to diverse and often corrosive solvents. Equipment degradation accelerates maintenance cycles and introduces contamination risks that can compromise product quality in high-purity synthesis operations. Many facilities report replacement of critical components at intervals 30-40% shorter than manufacturer specifications due to these compatibility issues.

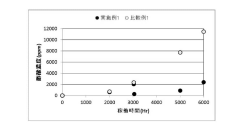

Cross-contamination between different production batches remains problematic, particularly in multi-purpose synthesis facilities where production lines handle various products. Current separation technologies struggle to achieve complete solvent segregation, with trace contaminants often persisting at levels between 10-100 ppm, which exceeds acceptable thresholds for pharmaceutical and electronics applications.

The handling of azeotropic mixtures continues to challenge conventional recovery methods. Approximately 35% of common industrial solvent combinations form azeotropes that resist standard separation techniques, necessitating specialized approaches that add complexity and cost to recovery operations. This is particularly evident in processes involving water-organic solvent systems common in pharmaceutical synthesis.

Regulatory compliance adds another layer of complexity, with increasingly stringent emission standards limiting volatile organic compound (VOC) releases. Current recovery systems typically achieve 85-95% efficiency, leaving a gap that often requires supplementary abatement technologies to meet regulatory thresholds below 20 mg/Nm³ in many jurisdictions.

Scale flexibility represents a growing challenge as manufacturing trends shift toward modular and flexible production. Traditional recovery systems designed for continuous, large-scale operations often perform sub-optimally in batch processes or when scaled down, with efficiency losses of 15-25% commonly observed in flexible manufacturing settings.

Finally, real-time monitoring and control systems for solvent recovery operations remain underdeveloped compared to other process technologies. The inability to precisely track recovery efficiency, purity levels, and energy consumption in real-time limits optimization opportunities and contributes to operational inefficiencies estimated at 10-15% across the industry.

Material compatibility presents another significant challenge, as recovery systems must withstand continuous exposure to diverse and often corrosive solvents. Equipment degradation accelerates maintenance cycles and introduces contamination risks that can compromise product quality in high-purity synthesis operations. Many facilities report replacement of critical components at intervals 30-40% shorter than manufacturer specifications due to these compatibility issues.

Cross-contamination between different production batches remains problematic, particularly in multi-purpose synthesis facilities where production lines handle various products. Current separation technologies struggle to achieve complete solvent segregation, with trace contaminants often persisting at levels between 10-100 ppm, which exceeds acceptable thresholds for pharmaceutical and electronics applications.

The handling of azeotropic mixtures continues to challenge conventional recovery methods. Approximately 35% of common industrial solvent combinations form azeotropes that resist standard separation techniques, necessitating specialized approaches that add complexity and cost to recovery operations. This is particularly evident in processes involving water-organic solvent systems common in pharmaceutical synthesis.

Regulatory compliance adds another layer of complexity, with increasingly stringent emission standards limiting volatile organic compound (VOC) releases. Current recovery systems typically achieve 85-95% efficiency, leaving a gap that often requires supplementary abatement technologies to meet regulatory thresholds below 20 mg/Nm³ in many jurisdictions.

Scale flexibility represents a growing challenge as manufacturing trends shift toward modular and flexible production. Traditional recovery systems designed for continuous, large-scale operations often perform sub-optimally in batch processes or when scaled down, with efficiency losses of 15-25% commonly observed in flexible manufacturing settings.

Finally, real-time monitoring and control systems for solvent recovery operations remain underdeveloped compared to other process technologies. The inability to precisely track recovery efficiency, purity levels, and energy consumption in real-time limits optimization opportunities and contributes to operational inefficiencies estimated at 10-15% across the industry.

State-of-the-Art Solvent Recovery Solutions

01 Distillation and Condensation Systems

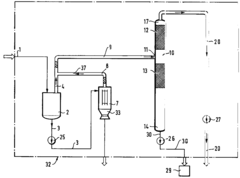

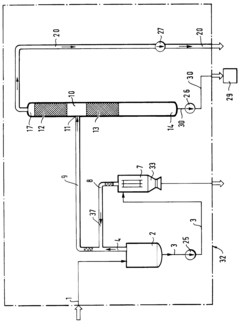

Advanced distillation and condensation systems are employed for efficient solvent recovery. These systems utilize temperature and pressure differentials to separate solvents from mixtures, followed by condensation to recover the purified solvent. Improvements in heat exchange technology and multi-stage distillation processes have significantly enhanced recovery rates and energy efficiency in these systems.- Distillation and thermal recovery techniques: Distillation is a widely used solvent recovery technique that separates solvents based on their different boiling points. Thermal recovery methods utilize heat to evaporate solvents from mixtures, which are then condensed and collected. These techniques can be optimized for energy efficiency through heat integration and advanced column designs. Modern distillation systems often incorporate vacuum operation to lower the boiling point of solvents and reduce energy consumption.

- Membrane-based solvent recovery: Membrane technology offers an energy-efficient alternative to traditional solvent recovery methods. These systems use selective membranes that allow certain molecules to pass through while blocking others, enabling effective separation of solvents from mixtures. Pervaporation, vapor permeation, and membrane distillation are common techniques that can achieve high recovery rates with lower energy requirements compared to conventional distillation. Recent advances in membrane materials have significantly improved separation efficiency and membrane durability.

- Adsorption and absorption recovery systems: Adsorption techniques utilize materials like activated carbon, zeolites, or silica gel to selectively capture solvent molecules from gas or liquid streams. These systems can be regenerated through temperature or pressure swings to release the captured solvents. Absorption processes use liquid absorbents to dissolve target solvents from mixtures. Both methods offer high efficiency for specific applications and can be designed as continuous processes with multiple stages to maximize recovery rates while minimizing energy consumption.

- Condensation and cryogenic recovery techniques: Condensation techniques recover solvents by cooling vapor streams until the solvents condense into liquid form. Cryogenic recovery extends this approach by using extremely low temperatures to condense solvents with low boiling points. These methods are particularly effective for volatile organic compounds and can achieve high recovery rates. Modern systems incorporate heat exchangers and refrigeration cycles optimized for energy efficiency, often using staged cooling to minimize energy consumption while maximizing solvent recovery.

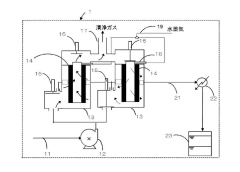

- Integrated and hybrid solvent recovery systems: Hybrid systems combine multiple recovery techniques to maximize efficiency and overcome limitations of individual methods. These integrated approaches often pair complementary technologies such as membrane separation followed by distillation, or adsorption with condensation. Such combinations can significantly reduce energy consumption while achieving higher recovery rates and purity levels. Advanced control systems and process optimization further enhance the efficiency of these integrated solutions, adapting operation parameters based on feed composition and desired product specifications.

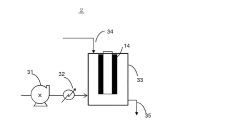

02 Membrane-Based Recovery Technologies

Membrane-based technologies offer selective separation of solvents based on molecular size and properties. These systems utilize semipermeable membranes that allow certain molecules to pass through while blocking others. Recent advancements include composite membranes with enhanced selectivity and durability, as well as integrated membrane systems that combine different separation mechanisms to improve overall recovery efficiency.Expand Specific Solutions03 Adsorption and Absorption Recovery Methods

These techniques utilize specialized materials to capture solvent molecules through surface adsorption or bulk absorption processes. Activated carbon, zeolites, and polymeric adsorbents are commonly employed materials. Innovations in this area include pressure swing adsorption systems, temperature-responsive adsorbents, and regenerable absorption media that can be reused multiple times, significantly improving the economic viability of solvent recovery operations.Expand Specific Solutions04 Cryogenic Recovery Systems

Cryogenic techniques involve cooling solvent-containing gas streams to temperatures where the solvents condense or freeze out. These systems are particularly effective for recovering volatile organic compounds and can achieve very high recovery rates. Recent developments include energy-efficient cooling cycles, improved heat exchangers, and integrated systems that combine cryogenic recovery with other techniques to optimize overall efficiency.Expand Specific Solutions05 Automated and Integrated Recovery Systems

Modern solvent recovery systems increasingly incorporate automation, sensors, and integrated process control to optimize recovery efficiency. These systems continuously monitor operating parameters and adjust conditions in real-time to maintain optimal recovery rates. Advanced designs include modular units that can be tailored to specific applications, hybrid systems combining multiple recovery technologies, and energy recovery subsystems that capture and reuse waste heat from the recovery process.Expand Specific Solutions

Leading Companies in Solvent Recovery Equipment

The solvent recovery technology market for organic synthesis plants is currently in a growth phase, characterized by increasing demand for sustainable and cost-effective solutions. The global market size is expanding steadily, driven by stricter environmental regulations and rising operational costs. Technologically, the field shows varying maturity levels, with established players like Sinopec Research Institute and China Petroleum & Chemical Corp. offering conventional recovery systems, while companies such as Toyobo Co., Kimura Chemical Plants, and Daicel Corp. are advancing membrane-based technologies. Academic institutions including Tohoku University and South China University of Technology are contributing breakthrough research. Fraunhofer-Gesellschaft and specialized firms like Aquatech International are developing hybrid systems combining multiple recovery techniques, indicating a trend toward integrated solutions that balance efficiency, cost, and environmental impact.

China Petroleum & Chemical Corp.

Technical Solution: China Petroleum & Chemical Corp. (Sinopec) has developed advanced membrane separation technology for solvent recovery in organic synthesis plants. Their system employs composite membranes with selective permeability that can separate specific solvents from complex mixtures with high efficiency. The technology incorporates a multi-stage pervaporation process that operates at lower temperatures (40-60°C) compared to conventional distillation, reducing energy consumption by approximately 30-40%. Sinopec's approach includes specialized membrane modules with optimized flow patterns to minimize concentration polarization and fouling, extending membrane life by up to 200% compared to conventional designs. Their integrated control systems continuously monitor separation performance and automatically adjust operating parameters to maintain optimal recovery rates even when feed compositions fluctuate.

Strengths: Lower energy consumption compared to thermal methods; can separate azeotropic mixtures effectively; modular design allows for scalability. Weaknesses: Membrane fouling can occur with certain solvent mixtures; higher initial capital investment compared to conventional distillation; requires specialized maintenance expertise.

Sinopec Research Institute of Petroleum Processing

Technical Solution: Sinopec Research Institute has pioneered adsorption-based solvent recovery systems utilizing novel molecular sieves and activated carbon materials specifically engineered for organic synthesis applications. Their proprietary pressure swing adsorption (PSA) technology achieves recovery rates exceeding 98% for common organic solvents while maintaining solvent purity above 99.5%. The system incorporates a multi-bed configuration with staggered regeneration cycles to ensure continuous operation. Their advanced adsorbent materials feature tailored pore structures that maximize selectivity for target solvents while minimizing co-adsorption of impurities. The institute has also developed thermal swing adsorption variants that utilize waste heat from other plant processes, further improving overall energy efficiency by approximately 25% compared to standalone systems.

Strengths: Extremely high recovery rates and purity levels; can handle complex solvent mixtures; relatively low operating costs after installation. Weaknesses: Requires significant floor space for multiple adsorption beds; periodic replacement of adsorbent materials adds to maintenance costs; less effective for high-boiling solvents.

Key Patents and Innovations in Solvent Recovery

Organic solvent recovery method and organic solvent recovery system

PatentActiveJP2021013879A

Innovation

- An adsorption-desorption process combined with an adhesion amount control step, including periodic washing of the adsorbent with water, to manage the amount of decomposition-active substances on activated carbon fiber, ensuring high-quality solvent recovery.

Process for working up solvent mixtures containing high boiling components and appropriate device

PatentInactiveEP0629420A1

Innovation

- A thermally gentle process involving a solvent recovery plant with a concentration device for evaporating a volatile fraction, a separation device for separating high-boiling components, and a separation column for separating organic solvents, which minimizes energy consumption and emissions by using conventional components and operating under reduced pressure.

Environmental Regulations Impact Assessment

Environmental regulations governing solvent use and recovery in organic synthesis plants have become increasingly stringent worldwide, significantly impacting operational strategies and technology adoption. The European Union's Industrial Emissions Directive (IED) and the Solvent Emissions Directive (SED) establish strict limits on volatile organic compound (VOC) emissions, requiring facilities to implement best available techniques (BAT) for solvent management. These regulations mandate recovery efficiencies exceeding 99% for certain solvents, driving substantial investments in advanced recovery systems.

In the United States, the Environmental Protection Agency's Clean Air Act regulations impose similar constraints through National Emission Standards for Hazardous Air Pollutants (NESHAP) and Maximum Achievable Control Technology (MACT) standards. These frameworks establish industry-specific emission limits and control requirements, with pharmaceutical and fine chemical manufacturing facing particularly rigorous oversight. Compliance costs for medium-sized facilities typically range from $500,000 to $2 million for comprehensive solvent recovery system upgrades.

Asian markets present a complex regulatory landscape, with China's recent environmental protection law amendments introducing stricter VOC emission standards and Japan maintaining comprehensive chemical substance control regulations. This regulatory convergence across major manufacturing regions has eliminated previous "regulatory arbitrage" opportunities, creating uniform pressure for improved solvent recovery technologies globally.

Financial implications extend beyond equipment investments to include increased operational costs, with regulatory compliance monitoring representing 3-5% of total operational expenditure for typical organic synthesis facilities. However, analysis indicates that advanced solvent recovery systems with 95%+ efficiency typically achieve return on investment within 2-4 years through reduced solvent purchasing costs and waste disposal fees.

Regulatory trends indicate further tightening of emission standards, with particular focus on halogenated solvents and those with high global warming potential. The EU's Chemical Strategy for Sustainability and similar initiatives worldwide signal continued regulatory pressure, with potential bans on certain solvents driving innovation in green chemistry alternatives and recovery technologies.

Compliance strategies increasingly require integrated approaches combining multiple recovery technologies to address diverse solvent streams. Facilities implementing comprehensive solvent management systems report 30-40% lower compliance costs compared to piecemeal approaches. This regulatory landscape ultimately serves as both constraint and catalyst, driving technological innovation while establishing minimum performance thresholds for commercially viable solvent recovery solutions in organic synthesis applications.

In the United States, the Environmental Protection Agency's Clean Air Act regulations impose similar constraints through National Emission Standards for Hazardous Air Pollutants (NESHAP) and Maximum Achievable Control Technology (MACT) standards. These frameworks establish industry-specific emission limits and control requirements, with pharmaceutical and fine chemical manufacturing facing particularly rigorous oversight. Compliance costs for medium-sized facilities typically range from $500,000 to $2 million for comprehensive solvent recovery system upgrades.

Asian markets present a complex regulatory landscape, with China's recent environmental protection law amendments introducing stricter VOC emission standards and Japan maintaining comprehensive chemical substance control regulations. This regulatory convergence across major manufacturing regions has eliminated previous "regulatory arbitrage" opportunities, creating uniform pressure for improved solvent recovery technologies globally.

Financial implications extend beyond equipment investments to include increased operational costs, with regulatory compliance monitoring representing 3-5% of total operational expenditure for typical organic synthesis facilities. However, analysis indicates that advanced solvent recovery systems with 95%+ efficiency typically achieve return on investment within 2-4 years through reduced solvent purchasing costs and waste disposal fees.

Regulatory trends indicate further tightening of emission standards, with particular focus on halogenated solvents and those with high global warming potential. The EU's Chemical Strategy for Sustainability and similar initiatives worldwide signal continued regulatory pressure, with potential bans on certain solvents driving innovation in green chemistry alternatives and recovery technologies.

Compliance strategies increasingly require integrated approaches combining multiple recovery technologies to address diverse solvent streams. Facilities implementing comprehensive solvent management systems report 30-40% lower compliance costs compared to piecemeal approaches. This regulatory landscape ultimately serves as both constraint and catalyst, driving technological innovation while establishing minimum performance thresholds for commercially viable solvent recovery solutions in organic synthesis applications.

Economic Feasibility and ROI Analysis

The economic feasibility of implementing efficient solvent recovery techniques in organic synthesis plants represents a critical consideration for industry stakeholders. Initial capital expenditure for comprehensive solvent recovery systems typically ranges from $500,000 to $3 million, depending on plant size, solvent types, and recovery efficiency targets. This investment encompasses distillation columns, condensers, storage tanks, and associated control systems. While substantial, these costs must be evaluated against the significant ongoing operational savings.

Analysis of operational cost reduction reveals that efficient solvent recovery can decrease raw material expenses by 60-80%. For medium-sized pharmaceutical manufacturing facilities utilizing common solvents like acetone, methanol, and toluene, this translates to annual savings of $300,000-$700,000. Additionally, waste disposal costs, which average $2-5 per gallon for hazardous solvents, can be reduced by 70-90%, yielding further savings of $100,000-$250,000 annually.

Return on investment calculations demonstrate compelling economic justification. Most state-of-the-art solvent recovery systems achieve payback periods of 1.5-3 years, with ROI rates of 30-65% depending on implementation scale and solvent costs. Facilities processing high-value solvents or operating in regions with stringent environmental regulations typically experience faster returns, sometimes under 12 months.

Sensitivity analysis indicates that ROI is most heavily influenced by solvent prices, recovery efficiency rates, and energy costs. Each percentage point improvement in recovery efficiency typically yields 2-4% better ROI. Modern systems achieving 95%+ recovery rates significantly outperform older technologies limited to 70-80% recovery.

Long-term economic benefits extend beyond direct cost savings. Reduced environmental compliance costs, lower insurance premiums due to decreased hazardous material handling, and enhanced corporate sustainability profiles contribute additional value. Companies implementing advanced solvent recovery systems report 15-25% reductions in regulatory compliance costs and improved relationships with regulatory authorities.

Financing options further enhance economic feasibility. Equipment leasing arrangements, green technology incentives, and pollution prevention grants available in many jurisdictions can reduce initial capital requirements by 20-40%. Several case studies demonstrate successful implementation models where third-party financing enabled positive cash flow from the first month of operation through operational savings exceeding financing costs.

Analysis of operational cost reduction reveals that efficient solvent recovery can decrease raw material expenses by 60-80%. For medium-sized pharmaceutical manufacturing facilities utilizing common solvents like acetone, methanol, and toluene, this translates to annual savings of $300,000-$700,000. Additionally, waste disposal costs, which average $2-5 per gallon for hazardous solvents, can be reduced by 70-90%, yielding further savings of $100,000-$250,000 annually.

Return on investment calculations demonstrate compelling economic justification. Most state-of-the-art solvent recovery systems achieve payback periods of 1.5-3 years, with ROI rates of 30-65% depending on implementation scale and solvent costs. Facilities processing high-value solvents or operating in regions with stringent environmental regulations typically experience faster returns, sometimes under 12 months.

Sensitivity analysis indicates that ROI is most heavily influenced by solvent prices, recovery efficiency rates, and energy costs. Each percentage point improvement in recovery efficiency typically yields 2-4% better ROI. Modern systems achieving 95%+ recovery rates significantly outperform older technologies limited to 70-80% recovery.

Long-term economic benefits extend beyond direct cost savings. Reduced environmental compliance costs, lower insurance premiums due to decreased hazardous material handling, and enhanced corporate sustainability profiles contribute additional value. Companies implementing advanced solvent recovery systems report 15-25% reductions in regulatory compliance costs and improved relationships with regulatory authorities.

Financing options further enhance economic feasibility. Equipment leasing arrangements, green technology incentives, and pollution prevention grants available in many jurisdictions can reduce initial capital requirements by 20-40%. Several case studies demonstrate successful implementation models where third-party financing enabled positive cash flow from the first month of operation through operational savings exceeding financing costs.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!