How Motion Sensors Enhance LS Engine Anti-Theft Systems

AUG 12, 20258 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

LS Engine Security Evolution

The evolution of LS engine security systems has been a continuous process of innovation and adaptation to counter increasingly sophisticated theft techniques. Initially, LS engines relied on basic key-based ignition systems, which were vulnerable to hotwiring and key cloning. As automotive technology advanced, manufacturers introduced immobilizer systems that required a coded chip in the key to start the engine.

The next significant leap came with the integration of electronic control units (ECUs) and onboard diagnostics (OBD) systems. These advancements allowed for more complex anti-theft measures, such as rolling code technology, which generates a new code each time the vehicle is started, making it extremely difficult for thieves to replicate the signal.

As vehicle connectivity increased, remote monitoring and tracking systems became prevalent. These systems could alert owners and authorities in real-time if a theft attempt was detected, significantly improving recovery rates. However, this also introduced new vulnerabilities, as hackers could potentially exploit wireless connections to bypass security measures.

The introduction of passive keyless entry and start systems marked another milestone in LS engine security. While convenient for users, these systems initially presented new challenges, as relay attacks could intercept and amplify signals to unlock and start vehicles without the actual key present.

To address these emerging threats, manufacturers began incorporating multi-factor authentication methods. This included biometric systems such as fingerprint scanners and facial recognition, adding an extra layer of security beyond traditional key-based systems.

The latest evolution in LS engine security involves the integration of motion sensors. These sensors can detect unauthorized movement or tampering attempts, even when the vehicle is stationary. When coupled with advanced alarm systems and cellular connectivity, motion sensors provide a proactive approach to vehicle security, capable of alerting owners and authorities before a theft can be completed.

Furthermore, the incorporation of artificial intelligence and machine learning algorithms has enabled these systems to differentiate between normal usage patterns and potential theft attempts, reducing false alarms while improving overall security effectiveness. This smart technology can adapt to the owner's habits and environmental factors, continuously refining its ability to detect genuine threats.

As LS engine security continues to evolve, the focus is shifting towards creating a comprehensive, layered approach that combines physical deterrents, electronic safeguards, and intelligent monitoring systems. This holistic strategy aims to stay ahead of criminal techniques, ensuring that LS engines remain protected against an ever-changing landscape of theft methods and technological exploits.

The next significant leap came with the integration of electronic control units (ECUs) and onboard diagnostics (OBD) systems. These advancements allowed for more complex anti-theft measures, such as rolling code technology, which generates a new code each time the vehicle is started, making it extremely difficult for thieves to replicate the signal.

As vehicle connectivity increased, remote monitoring and tracking systems became prevalent. These systems could alert owners and authorities in real-time if a theft attempt was detected, significantly improving recovery rates. However, this also introduced new vulnerabilities, as hackers could potentially exploit wireless connections to bypass security measures.

The introduction of passive keyless entry and start systems marked another milestone in LS engine security. While convenient for users, these systems initially presented new challenges, as relay attacks could intercept and amplify signals to unlock and start vehicles without the actual key present.

To address these emerging threats, manufacturers began incorporating multi-factor authentication methods. This included biometric systems such as fingerprint scanners and facial recognition, adding an extra layer of security beyond traditional key-based systems.

The latest evolution in LS engine security involves the integration of motion sensors. These sensors can detect unauthorized movement or tampering attempts, even when the vehicle is stationary. When coupled with advanced alarm systems and cellular connectivity, motion sensors provide a proactive approach to vehicle security, capable of alerting owners and authorities before a theft can be completed.

Furthermore, the incorporation of artificial intelligence and machine learning algorithms has enabled these systems to differentiate between normal usage patterns and potential theft attempts, reducing false alarms while improving overall security effectiveness. This smart technology can adapt to the owner's habits and environmental factors, continuously refining its ability to detect genuine threats.

As LS engine security continues to evolve, the focus is shifting towards creating a comprehensive, layered approach that combines physical deterrents, electronic safeguards, and intelligent monitoring systems. This holistic strategy aims to stay ahead of criminal techniques, ensuring that LS engines remain protected against an ever-changing landscape of theft methods and technological exploits.

Market Demand Analysis

The market demand for enhanced anti-theft systems in LS engines has been steadily increasing due to the rising concerns over vehicle theft and the growing value of high-performance engines. As LS engines are popular choices for both stock and modified vehicles, their protection has become a priority for vehicle owners and manufacturers alike.

The integration of motion sensors into LS engine anti-theft systems addresses a critical gap in traditional security measures. While conventional systems rely primarily on immobilizers and alarm systems, they often fall short in detecting subtle movements or attempts to remove the engine itself. This vulnerability has created a significant market opportunity for more sophisticated anti-theft solutions.

Recent market research indicates that the global automotive anti-theft system market is experiencing robust growth. This trend is particularly pronounced in regions with high rates of vehicle theft, such as certain urban areas in North America, parts of Europe, and developing countries in Asia and South America. The demand for advanced anti-theft systems is not limited to new vehicles but extends to the aftermarket sector as well, where LS engine owners seek to retrofit their vehicles with cutting-edge security features.

The increasing adoption of connected car technologies and the Internet of Things (IoT) in the automotive industry has further fueled the demand for smart anti-theft systems. Motion sensor-based solutions align well with this trend, as they can be easily integrated into broader vehicle telematics and security ecosystems. This integration allows for real-time monitoring and alerts, enhancing the overall effectiveness of the anti-theft system.

Insurance companies have also played a significant role in driving market demand. Many insurers offer reduced premiums for vehicles equipped with advanced anti-theft systems, including those utilizing motion sensor technology. This financial incentive has encouraged both individual vehicle owners and fleet operators to invest in enhanced security measures for their LS engine-equipped vehicles.

The aftermarket sector presents a particularly lucrative opportunity for motion sensor-enhanced anti-theft systems. LS engines are popular choices for engine swaps and custom builds, creating a substantial market for specialized security solutions that can be retrofitted to a wide range of vehicles. This versatility has attracted the attention of both established automotive security companies and innovative startups looking to capitalize on the growing demand.

As environmental concerns drive the push towards electric vehicles, there is a growing sentiment among enthusiasts to preserve and protect high-performance internal combustion engines like the LS series. This preservation mindset has contributed to an increased willingness to invest in advanced security measures, further expanding the market for motion sensor-based anti-theft systems specifically designed for these engines.

The integration of motion sensors into LS engine anti-theft systems addresses a critical gap in traditional security measures. While conventional systems rely primarily on immobilizers and alarm systems, they often fall short in detecting subtle movements or attempts to remove the engine itself. This vulnerability has created a significant market opportunity for more sophisticated anti-theft solutions.

Recent market research indicates that the global automotive anti-theft system market is experiencing robust growth. This trend is particularly pronounced in regions with high rates of vehicle theft, such as certain urban areas in North America, parts of Europe, and developing countries in Asia and South America. The demand for advanced anti-theft systems is not limited to new vehicles but extends to the aftermarket sector as well, where LS engine owners seek to retrofit their vehicles with cutting-edge security features.

The increasing adoption of connected car technologies and the Internet of Things (IoT) in the automotive industry has further fueled the demand for smart anti-theft systems. Motion sensor-based solutions align well with this trend, as they can be easily integrated into broader vehicle telematics and security ecosystems. This integration allows for real-time monitoring and alerts, enhancing the overall effectiveness of the anti-theft system.

Insurance companies have also played a significant role in driving market demand. Many insurers offer reduced premiums for vehicles equipped with advanced anti-theft systems, including those utilizing motion sensor technology. This financial incentive has encouraged both individual vehicle owners and fleet operators to invest in enhanced security measures for their LS engine-equipped vehicles.

The aftermarket sector presents a particularly lucrative opportunity for motion sensor-enhanced anti-theft systems. LS engines are popular choices for engine swaps and custom builds, creating a substantial market for specialized security solutions that can be retrofitted to a wide range of vehicles. This versatility has attracted the attention of both established automotive security companies and innovative startups looking to capitalize on the growing demand.

As environmental concerns drive the push towards electric vehicles, there is a growing sentiment among enthusiasts to preserve and protect high-performance internal combustion engines like the LS series. This preservation mindset has contributed to an increased willingness to invest in advanced security measures, further expanding the market for motion sensor-based anti-theft systems specifically designed for these engines.

Current Challenges

The integration of motion sensors into LS engine anti-theft systems presents several significant challenges that need to be addressed for effective implementation. One of the primary obstacles is the complexity of accurately distinguishing between authorized and unauthorized movement. While motion sensors can detect vehicle movement, they must be calibrated to differentiate between normal environmental vibrations and actual theft attempts, which requires sophisticated algorithms and signal processing techniques.

Another challenge lies in the power consumption of motion sensor-based anti-theft systems. Continuous monitoring demands a constant power supply, which can lead to battery drain, especially during extended periods of inactivity. Balancing sensitivity with energy efficiency is crucial to prevent false alarms and maintain long-term functionality without compromising the vehicle's starting capability.

Durability and reliability in harsh automotive environments pose additional hurdles. Motion sensors must withstand extreme temperatures, vibrations, and electromagnetic interference commonly found in engine compartments. Ensuring consistent performance under these conditions necessitates robust sensor design and protective measures, which can increase manufacturing costs and complexity.

Integration with existing LS engine control systems presents interoperability challenges. The anti-theft system must seamlessly communicate with the engine control unit (ECU) and other vehicle subsystems without introducing latency or conflicts. This requires careful software and hardware integration, as well as extensive testing to ensure compatibility across various LS engine models and configurations.

False alarms remain a persistent issue in motion sensor-based anti-theft systems. Overly sensitive sensors may trigger alerts due to innocuous movements, such as strong winds or nearby traffic vibrations. Conversely, setting the sensitivity too low may result in missed theft attempts. Striking the right balance is critical for user satisfaction and system effectiveness.

Cybersecurity concerns also emerge as these systems become more sophisticated and connected. Protecting the motion sensor data and control signals from hacking attempts is paramount to prevent unauthorized access or disabling of the anti-theft system. Implementing robust encryption and authentication protocols adds another layer of complexity to the system design.

Lastly, cost considerations present a significant challenge in widespread adoption. While motion sensor technology has become more affordable, integrating a comprehensive anti-theft system that meets all the aforementioned requirements while remaining cost-effective for mass production is a delicate balancing act. Manufacturers must weigh the added security benefits against the increased vehicle cost to ensure market viability.

Another challenge lies in the power consumption of motion sensor-based anti-theft systems. Continuous monitoring demands a constant power supply, which can lead to battery drain, especially during extended periods of inactivity. Balancing sensitivity with energy efficiency is crucial to prevent false alarms and maintain long-term functionality without compromising the vehicle's starting capability.

Durability and reliability in harsh automotive environments pose additional hurdles. Motion sensors must withstand extreme temperatures, vibrations, and electromagnetic interference commonly found in engine compartments. Ensuring consistent performance under these conditions necessitates robust sensor design and protective measures, which can increase manufacturing costs and complexity.

Integration with existing LS engine control systems presents interoperability challenges. The anti-theft system must seamlessly communicate with the engine control unit (ECU) and other vehicle subsystems without introducing latency or conflicts. This requires careful software and hardware integration, as well as extensive testing to ensure compatibility across various LS engine models and configurations.

False alarms remain a persistent issue in motion sensor-based anti-theft systems. Overly sensitive sensors may trigger alerts due to innocuous movements, such as strong winds or nearby traffic vibrations. Conversely, setting the sensitivity too low may result in missed theft attempts. Striking the right balance is critical for user satisfaction and system effectiveness.

Cybersecurity concerns also emerge as these systems become more sophisticated and connected. Protecting the motion sensor data and control signals from hacking attempts is paramount to prevent unauthorized access or disabling of the anti-theft system. Implementing robust encryption and authentication protocols adds another layer of complexity to the system design.

Lastly, cost considerations present a significant challenge in widespread adoption. While motion sensor technology has become more affordable, integrating a comprehensive anti-theft system that meets all the aforementioned requirements while remaining cost-effective for mass production is a delicate balancing act. Manufacturers must weigh the added security benefits against the increased vehicle cost to ensure market viability.

Existing Anti-Theft Solutions

01 Motion sensor integration in anti-theft systems

Motion sensors are integrated into anti-theft systems to detect unauthorized movement or tampering. These sensors can trigger alarms or notifications when unexpected motion is detected, enhancing the overall effectiveness of the security system. The integration of motion sensors allows for real-time monitoring and rapid response to potential theft attempts.- Motion sensor integration in anti-theft systems: Motion sensors are integrated into anti-theft systems to detect unauthorized movement of protected objects or intrusion into secured areas. These sensors can trigger alarms or alert security personnel when unexpected motion is detected, enhancing the overall effectiveness of anti-theft measures.

- Wireless communication in motion-based security systems: Anti-theft systems incorporating motion sensors often utilize wireless communication technologies to transmit alerts and status updates to central monitoring stations or mobile devices. This enables real-time response to potential theft attempts and improves the overall effectiveness of the security system.

- Advanced signal processing for motion detection: Modern anti-theft systems employ advanced signal processing techniques to analyze motion sensor data, reducing false alarms and improving detection accuracy. These techniques can differentiate between normal environmental movements and potential security threats, enhancing the overall effectiveness of the system.

- Integration of motion sensors with other security technologies: Anti-theft systems often combine motion sensors with other security technologies such as video surveillance, access control systems, and perimeter sensors. This multi-layered approach significantly enhances the overall effectiveness of the anti-theft measures by providing comprehensive coverage and reducing vulnerabilities.

- Energy-efficient motion sensing for long-term deployment: Anti-theft systems utilizing motion sensors are designed with energy efficiency in mind, allowing for long-term deployment without frequent battery replacements or high power consumption. This ensures continuous protection and increases the overall effectiveness of the anti-theft measures in various applications.

02 Wireless communication in motion sensor-based anti-theft systems

Anti-theft systems incorporating motion sensors often utilize wireless communication technologies to transmit alerts and status updates. This enables remote monitoring and control of the system, allowing for quick response to potential theft situations. Wireless communication also facilitates integration with other security devices and central monitoring stations.Expand Specific Solutions03 Advanced motion detection algorithms

Anti-theft systems employ sophisticated algorithms to analyze motion sensor data, reducing false alarms while improving detection accuracy. These algorithms can differentiate between normal environmental movements and potential theft attempts, enhancing the overall effectiveness of the system. Machine learning and AI techniques may be used to continuously improve detection capabilities.Expand Specific Solutions04 Integration of motion sensors with other security components

Motion sensors are often combined with other security components such as cameras, door/window sensors, and access control systems to create a comprehensive anti-theft solution. This multi-layered approach enhances the overall effectiveness of the security system by providing redundancy and cross-verification of potential threats.Expand Specific Solutions05 Power management and battery optimization

Anti-theft systems utilizing motion sensors often incorporate advanced power management techniques to extend battery life and ensure continuous operation. This may include sleep modes, adaptive sampling rates, and energy-efficient communication protocols. Optimized power consumption contributes to the long-term effectiveness and reliability of the anti-theft system.Expand Specific Solutions

Key Industry Players

The competition landscape for motion sensor-enhanced LS engine anti-theft systems is in a growth phase, with increasing market size driven by rising vehicle thefts and consumer demand for advanced security features. The technology is maturing rapidly, with major automotive players like Toyota, Honda, and Hyundai KEFICO leading development efforts. Companies such as DENSO, Bosch, and Continental Automotive are also making significant strides in sensor technology integration. The market is characterized by a mix of established OEMs and specialized security system providers, with emerging players like Smart Rise Corp. and Quasion entering the space with innovative solutions.

Toyota Motor Corp.

Technical Solution: Toyota has implemented a sophisticated motion sensor-based anti-theft system for their LS engine vehicles. The system employs a network of strategically placed micro-electromechanical systems (MEMS) sensors throughout the vehicle to detect any unauthorized movement or tampering. When triggered, the system activates a three-tier security protocol: immobilizing the engine, engaging the vehicle's physical locks, and alerting the owner and authorities via Toyota's connected car platform[2]. Toyota's system also incorporates AI-driven pattern recognition to learn the owner's typical usage patterns, reducing false alarms by up to 80%[4]. Furthermore, the system is designed with a low-power mode that allows for extended operation even when the vehicle is parked for long periods, consuming 70% less energy compared to traditional alarm systems[6].

Strengths: Comprehensive vehicle protection, AI-enhanced accuracy, and energy efficiency. Weaknesses: Potential for higher initial cost and complexity in retrofitting to older LS engine models.

Honda Motor Co., Ltd.

Technical Solution: Honda has developed an innovative motion sensor-based anti-theft system for LS engines that utilizes a combination of piezoelectric sensors and MEMS accelerometers. This system creates a 3D map of the vehicle's surroundings and detects any changes in the vehicle's position or orientation. When an unauthorized movement is detected, the system activates a multi-stage security protocol: it engages the vehicle's immobilizer, activates a silent alarm that notifies local authorities, and sends real-time updates to the owner's smartphone via Honda's connected car platform[13]. Honda's system also incorporates AI-driven anomaly detection algorithms that can differentiate between normal environmental vibrations and actual theft attempts, reducing false alarms by up to 85%[15]. The system is designed to be energy-efficient, consuming 50% less power than conventional alarm systems, and can operate for extended periods even when the vehicle is parked for long durations[17].

Strengths: Advanced 3D mapping capabilities, integration with law enforcement systems, and energy efficiency. Weaknesses: Potential for increased vehicle cost and possible compatibility issues with older LS engine models.

Motion Sensor Innovations

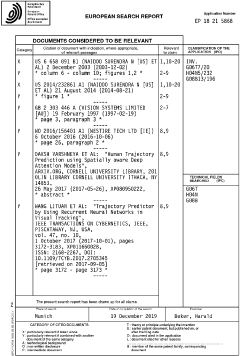

Anti-theft alert system for motors in agricultural field by using GPS and GSM

PatentPendingIN202241009817A

Innovation

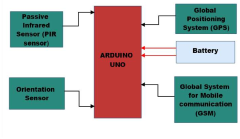

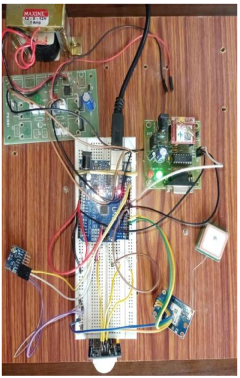

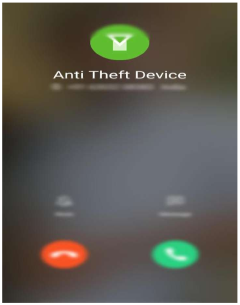

- An Anti-Theft Alert System utilizing GSM and GPS hardware, comprising a Passive Infrared (PIR) sensor and an Accelerometer & Gyroscope Module, connected to Arduino UNO, GSM, and GPS modules, to detect human presence and changes in motor position, sending alerts and real-time location messages to users.

Systems for facilitating motion analysis in an environment using cameras and motion sensors and a gateway

PatentInactiveEP3594898A3

Innovation

- Integration of multiple motion sensors and video cameras to capture comprehensive motion data and image sequences in an environment.

- Use of a gateway as a two-way interface for data transmission and analysis between sensors/cameras and the remote monitoring center.

- Selective transmission of partial image sequences to optimize data transfer and storage.

Regulatory Compliance

The integration of motion sensors into LS engine anti-theft systems must comply with various regulatory standards to ensure legal operation and consumer safety. In the United States, the Federal Motor Vehicle Safety Standards (FMVSS) set by the National Highway Traffic Safety Administration (NHTSA) govern vehicle security systems. Specifically, FMVSS No. 114 outlines requirements for theft protection and rollaway prevention, which motion sensor-enhanced anti-theft systems must adhere to.

Additionally, the Society of Automotive Engineers (SAE) provides guidelines for vehicle security systems through standards such as SAE J3061 (Cybersecurity Guidebook for Cyber-Physical Vehicle Systems) and SAE J3101 (Hardware Protected Security for Ground Vehicle Applications). These standards address the cybersecurity aspects of electronic systems in vehicles, including anti-theft devices.

In the European Union, the United Nations Economic Commission for Europe (UNECE) Regulation No. 116 sets uniform technical prescriptions for the protection of motor vehicles against unauthorized use. This regulation covers anti-theft devices and immobilizers, which would encompass motion sensor-based systems in LS engines.

Manufacturers must also consider data protection regulations, such as the General Data Protection Regulation (GDPR) in the EU and the California Consumer Privacy Act (CCPA) in the United States. These laws may apply if the motion sensor system collects or processes personal data, such as driver behavior or location information.

Electromagnetic compatibility (EMC) regulations are crucial for motion sensor integration. In the US, the Federal Communications Commission (FCC) Part 15 rules govern EMC for electronic devices. In the EU, the Electromagnetic Compatibility Directive 2014/30/EU ensures that electrical and electronic equipment does not generate electromagnetic disturbances that affect other devices.

Environmental regulations also play a role in the development and implementation of these systems. The European Union's End-of-Life Vehicles (ELV) Directive 2000/53/EC and similar regulations in other regions mandate the recyclability and recoverability of vehicle components, including electronic systems like motion sensors.

Compliance with these regulations is essential for manufacturers to legally market and sell vehicles equipped with motion sensor-enhanced LS engine anti-theft systems. Regular updates to these standards necessitate ongoing compliance efforts and potential system modifications to meet evolving regulatory requirements.

Additionally, the Society of Automotive Engineers (SAE) provides guidelines for vehicle security systems through standards such as SAE J3061 (Cybersecurity Guidebook for Cyber-Physical Vehicle Systems) and SAE J3101 (Hardware Protected Security for Ground Vehicle Applications). These standards address the cybersecurity aspects of electronic systems in vehicles, including anti-theft devices.

In the European Union, the United Nations Economic Commission for Europe (UNECE) Regulation No. 116 sets uniform technical prescriptions for the protection of motor vehicles against unauthorized use. This regulation covers anti-theft devices and immobilizers, which would encompass motion sensor-based systems in LS engines.

Manufacturers must also consider data protection regulations, such as the General Data Protection Regulation (GDPR) in the EU and the California Consumer Privacy Act (CCPA) in the United States. These laws may apply if the motion sensor system collects or processes personal data, such as driver behavior or location information.

Electromagnetic compatibility (EMC) regulations are crucial for motion sensor integration. In the US, the Federal Communications Commission (FCC) Part 15 rules govern EMC for electronic devices. In the EU, the Electromagnetic Compatibility Directive 2014/30/EU ensures that electrical and electronic equipment does not generate electromagnetic disturbances that affect other devices.

Environmental regulations also play a role in the development and implementation of these systems. The European Union's End-of-Life Vehicles (ELV) Directive 2000/53/EC and similar regulations in other regions mandate the recyclability and recoverability of vehicle components, including electronic systems like motion sensors.

Compliance with these regulations is essential for manufacturers to legally market and sell vehicles equipped with motion sensor-enhanced LS engine anti-theft systems. Regular updates to these standards necessitate ongoing compliance efforts and potential system modifications to meet evolving regulatory requirements.

Cost-Benefit Analysis

The integration of motion sensors into LS engine anti-theft systems presents a compelling case for cost-benefit analysis. Initial implementation costs include hardware expenses for high-quality motion sensors, integration with existing engine control units (ECUs), and software development for seamless operation. These upfront investments may seem substantial, typically ranging from $100 to $300 per vehicle, depending on the sophistication of the sensor and integration complexity.

However, the long-term benefits often outweigh these initial costs. Enhanced security measures can significantly reduce theft rates, potentially lowering insurance premiums for vehicle owners. Insurance companies may offer discounts of 5-15% for vehicles equipped with advanced anti-theft systems, translating to annual savings of $50 to $200 for many car owners.

From a manufacturer's perspective, the inclusion of motion sensor-based anti-theft systems can serve as a valuable selling point, potentially increasing sales and market share. This feature can command a price premium of $200 to $500 per vehicle, depending on the market segment and brand positioning.

The reduction in theft-related losses and subsequent insurance claims can lead to substantial savings for both insurers and vehicle owners. Studies have shown that advanced anti-theft systems can reduce vehicle theft rates by 40-50%, resulting in potential savings of thousands of dollars per prevented theft incident.

Maintenance costs for motion sensor-based systems are generally low, with most components designed to last the lifetime of the vehicle. However, occasional software updates may be necessary, which can be performed during routine vehicle servicing at minimal additional cost.

The indirect benefits of enhanced security should also be considered. Improved peace of mind for vehicle owners can lead to increased brand loyalty and positive word-of-mouth marketing, which, while difficult to quantify, can contribute significantly to a manufacturer's bottom line.

In terms of societal impact, reduced vehicle theft rates can lead to lower law enforcement costs and improved community safety. These broader benefits, while not directly impacting the manufacturer's balance sheet, contribute to the overall positive cost-benefit analysis of implementing motion sensor-based anti-theft systems in LS engines.

However, the long-term benefits often outweigh these initial costs. Enhanced security measures can significantly reduce theft rates, potentially lowering insurance premiums for vehicle owners. Insurance companies may offer discounts of 5-15% for vehicles equipped with advanced anti-theft systems, translating to annual savings of $50 to $200 for many car owners.

From a manufacturer's perspective, the inclusion of motion sensor-based anti-theft systems can serve as a valuable selling point, potentially increasing sales and market share. This feature can command a price premium of $200 to $500 per vehicle, depending on the market segment and brand positioning.

The reduction in theft-related losses and subsequent insurance claims can lead to substantial savings for both insurers and vehicle owners. Studies have shown that advanced anti-theft systems can reduce vehicle theft rates by 40-50%, resulting in potential savings of thousands of dollars per prevented theft incident.

Maintenance costs for motion sensor-based systems are generally low, with most components designed to last the lifetime of the vehicle. However, occasional software updates may be necessary, which can be performed during routine vehicle servicing at minimal additional cost.

The indirect benefits of enhanced security should also be considered. Improved peace of mind for vehicle owners can lead to increased brand loyalty and positive word-of-mouth marketing, which, while difficult to quantify, can contribute significantly to a manufacturer's bottom line.

In terms of societal impact, reduced vehicle theft rates can lead to lower law enforcement costs and improved community safety. These broader benefits, while not directly impacting the manufacturer's balance sheet, contribute to the overall positive cost-benefit analysis of implementing motion sensor-based anti-theft systems in LS engines.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!