How to Test Neuromorphic Algorithms for Fraud Detection

SEP 8, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Neuromorphic Fraud Detection Background and Objectives

Neuromorphic computing represents a paradigm shift in computational architecture, drawing inspiration from the structure and function of biological neural systems. This approach has gained significant traction in recent years as traditional computing architectures face increasing challenges in processing the massive volumes of data required for modern fraud detection systems. The evolution of neuromorphic technology traces back to the 1980s with Carver Mead's pioneering work, but has only recently matured to a point where practical applications in complex domains like fraud detection have become feasible.

The financial industry faces unprecedented challenges in fraud detection, with global fraud losses exceeding $30 billion annually and growing at approximately 15% year over year. Traditional rule-based and even conventional machine learning approaches struggle to adapt to the increasingly sophisticated and rapidly evolving fraud techniques. This technological gap creates an urgent need for more adaptive, efficient, and powerful computational methods.

Neuromorphic computing offers several compelling advantages for fraud detection applications. These systems excel at pattern recognition in noisy data environments, demonstrate exceptional energy efficiency compared to traditional computing architectures, and possess inherent capabilities for online learning and adaptation—critical features for responding to emerging fraud patterns. The spike-based information processing mimics the human brain's ability to rapidly identify anomalies while filtering out irrelevant information.

The primary objective of neuromorphic fraud detection research is to develop testing methodologies that can reliably evaluate the performance of these novel algorithms against established benchmarks. This includes assessing their accuracy in identifying fraudulent transactions, measuring their computational efficiency and energy consumption, evaluating their adaptability to new fraud patterns, and determining their scalability for enterprise-level deployment.

Current research trends indicate growing interest in hybrid systems that combine neuromorphic components with traditional computing architectures, allowing organizations to leverage existing infrastructure while gradually incorporating neuromorphic capabilities. Additionally, there is significant focus on developing specialized hardware accelerators optimized for neuromorphic fraud detection algorithms, potentially offering orders-of-magnitude improvements in processing efficiency.

The convergence of neuromorphic computing with other emerging technologies such as quantum computing and advanced AI presents intriguing possibilities for future fraud detection systems. These combined approaches may eventually enable predictive fraud prevention rather than merely reactive detection, fundamentally transforming how financial institutions approach security.

The financial industry faces unprecedented challenges in fraud detection, with global fraud losses exceeding $30 billion annually and growing at approximately 15% year over year. Traditional rule-based and even conventional machine learning approaches struggle to adapt to the increasingly sophisticated and rapidly evolving fraud techniques. This technological gap creates an urgent need for more adaptive, efficient, and powerful computational methods.

Neuromorphic computing offers several compelling advantages for fraud detection applications. These systems excel at pattern recognition in noisy data environments, demonstrate exceptional energy efficiency compared to traditional computing architectures, and possess inherent capabilities for online learning and adaptation—critical features for responding to emerging fraud patterns. The spike-based information processing mimics the human brain's ability to rapidly identify anomalies while filtering out irrelevant information.

The primary objective of neuromorphic fraud detection research is to develop testing methodologies that can reliably evaluate the performance of these novel algorithms against established benchmarks. This includes assessing their accuracy in identifying fraudulent transactions, measuring their computational efficiency and energy consumption, evaluating their adaptability to new fraud patterns, and determining their scalability for enterprise-level deployment.

Current research trends indicate growing interest in hybrid systems that combine neuromorphic components with traditional computing architectures, allowing organizations to leverage existing infrastructure while gradually incorporating neuromorphic capabilities. Additionally, there is significant focus on developing specialized hardware accelerators optimized for neuromorphic fraud detection algorithms, potentially offering orders-of-magnitude improvements in processing efficiency.

The convergence of neuromorphic computing with other emerging technologies such as quantum computing and advanced AI presents intriguing possibilities for future fraud detection systems. These combined approaches may eventually enable predictive fraud prevention rather than merely reactive detection, fundamentally transforming how financial institutions approach security.

Market Demand Analysis for Neuromorphic Fraud Detection

The global fraud detection market is experiencing unprecedented growth, driven by the increasing sophistication of financial crimes and the digital transformation of payment systems. Current market research indicates that the fraud detection and prevention market is projected to reach $65.8 billion by 2026, growing at a compound annual growth rate (CAGR) of approximately 22.5% from 2021. This substantial growth underscores the critical need for more advanced fraud detection technologies, particularly in financial services, e-commerce, and healthcare sectors.

Neuromorphic computing, which mimics the neural structure and operation of the human brain, represents a revolutionary approach to fraud detection. Traditional fraud detection systems often struggle with the volume, velocity, and variety of data in modern financial transactions. These systems typically rely on rule-based algorithms or conventional machine learning models that may not adapt quickly enough to evolving fraud patterns.

Financial institutions are increasingly seeking solutions that can process vast amounts of transaction data in real-time while maintaining high accuracy in fraud identification. A survey of banking executives revealed that 78% consider advanced fraud detection capabilities as a top priority for technology investment over the next three years. Additionally, 65% of these executives expressed interest in neuromorphic computing solutions specifically for fraud detection applications.

The e-commerce sector presents another significant market opportunity. With global e-commerce sales exceeding $4.9 trillion in 2021 and continuing to grow, merchants face mounting challenges in combating sophisticated fraud schemes. Research indicates that e-commerce fraud losses amount to approximately $20 billion annually, creating substantial demand for more effective detection technologies.

Insurance companies represent another key market segment, with insurance fraud estimated to cost the industry over $40 billion per year in the United States alone. The ability of neuromorphic algorithms to identify subtle patterns in claims data could significantly reduce these losses, making this sector particularly receptive to neuromorphic fraud detection solutions.

From a geographical perspective, North America currently dominates the fraud detection market, accounting for approximately 40% of global market share. However, the Asia-Pacific region is expected to witness the highest growth rate in the coming years due to rapid digitalization of financial services and increasing regulatory focus on fraud prevention.

Customer expectations are also evolving, with a growing demand for fraud detection systems that minimize false positives while maintaining high security standards. A recent consumer survey indicated that 72% of customers would consider switching service providers after experiencing a false decline of their legitimate transaction, highlighting the business imperative for more accurate fraud detection technologies.

Neuromorphic computing, which mimics the neural structure and operation of the human brain, represents a revolutionary approach to fraud detection. Traditional fraud detection systems often struggle with the volume, velocity, and variety of data in modern financial transactions. These systems typically rely on rule-based algorithms or conventional machine learning models that may not adapt quickly enough to evolving fraud patterns.

Financial institutions are increasingly seeking solutions that can process vast amounts of transaction data in real-time while maintaining high accuracy in fraud identification. A survey of banking executives revealed that 78% consider advanced fraud detection capabilities as a top priority for technology investment over the next three years. Additionally, 65% of these executives expressed interest in neuromorphic computing solutions specifically for fraud detection applications.

The e-commerce sector presents another significant market opportunity. With global e-commerce sales exceeding $4.9 trillion in 2021 and continuing to grow, merchants face mounting challenges in combating sophisticated fraud schemes. Research indicates that e-commerce fraud losses amount to approximately $20 billion annually, creating substantial demand for more effective detection technologies.

Insurance companies represent another key market segment, with insurance fraud estimated to cost the industry over $40 billion per year in the United States alone. The ability of neuromorphic algorithms to identify subtle patterns in claims data could significantly reduce these losses, making this sector particularly receptive to neuromorphic fraud detection solutions.

From a geographical perspective, North America currently dominates the fraud detection market, accounting for approximately 40% of global market share. However, the Asia-Pacific region is expected to witness the highest growth rate in the coming years due to rapid digitalization of financial services and increasing regulatory focus on fraud prevention.

Customer expectations are also evolving, with a growing demand for fraud detection systems that minimize false positives while maintaining high security standards. A recent consumer survey indicated that 72% of customers would consider switching service providers after experiencing a false decline of their legitimate transaction, highlighting the business imperative for more accurate fraud detection technologies.

Current State and Challenges in Neuromorphic Testing

Neuromorphic computing for fraud detection represents a promising frontier, yet testing these algorithms presents unique challenges compared to traditional computing paradigms. Currently, the field lacks standardized testing frameworks specifically designed for neuromorphic systems, with most practitioners adapting conventional machine learning evaluation methods that may not fully capture the temporal and event-driven nature of neuromorphic processing.

The global landscape shows varied development stages across regions. North America leads with advanced research institutions like IBM's TrueNorth project and Intel's Loihi chip providing testing environments for fraud detection applications. Europe follows with the Human Brain Project contributing significant neuromorphic testing infrastructure, while Asia is rapidly advancing with substantial investments from countries like China and Japan in neuromorphic hardware platforms.

A major technical challenge lies in the fundamental architectural differences between neuromorphic systems and traditional computing. Spike-based processing and temporal dynamics inherent to neuromorphic algorithms require specialized testing approaches that can evaluate performance across time dimensions rather than just static accuracy metrics. This necessitates new benchmarking methodologies that account for energy efficiency, temporal precision, and adaptability to concept drift—all critical factors in fraud detection scenarios.

Data availability presents another significant obstacle. While conventional fraud detection systems benefit from extensive labeled datasets, neuromorphic testing requires temporally encoded data that preserves the sequential nature of transactions. The scarcity of such specialized datasets hampers comprehensive evaluation of neuromorphic fraud detection algorithms, forcing researchers to either convert existing datasets (potentially losing temporal information) or generate synthetic data with uncertain real-world applicability.

Hardware-software integration challenges further complicate testing efforts. The tight coupling between neuromorphic algorithms and their hardware implementation means testing must often occur on specific neuromorphic chips, creating dependencies that limit reproducibility and standardization. Simulators like NEST and Brian provide alternatives but introduce fidelity concerns when translating results to physical neuromorphic systems.

Regulatory and compliance requirements add another layer of complexity. Financial fraud detection systems must meet stringent regulatory standards, yet current compliance frameworks have not evolved to accommodate the unique characteristics of neuromorphic systems. This regulatory uncertainty creates hesitation among financial institutions to adopt these technologies despite their potential advantages in detecting sophisticated fraud patterns.

The interdisciplinary nature of the field compounds these challenges, requiring collaboration between neuroscientists, computer engineers, and financial security experts to develop comprehensive testing methodologies that can adequately evaluate neuromorphic fraud detection systems across multiple dimensions of performance.

The global landscape shows varied development stages across regions. North America leads with advanced research institutions like IBM's TrueNorth project and Intel's Loihi chip providing testing environments for fraud detection applications. Europe follows with the Human Brain Project contributing significant neuromorphic testing infrastructure, while Asia is rapidly advancing with substantial investments from countries like China and Japan in neuromorphic hardware platforms.

A major technical challenge lies in the fundamental architectural differences between neuromorphic systems and traditional computing. Spike-based processing and temporal dynamics inherent to neuromorphic algorithms require specialized testing approaches that can evaluate performance across time dimensions rather than just static accuracy metrics. This necessitates new benchmarking methodologies that account for energy efficiency, temporal precision, and adaptability to concept drift—all critical factors in fraud detection scenarios.

Data availability presents another significant obstacle. While conventional fraud detection systems benefit from extensive labeled datasets, neuromorphic testing requires temporally encoded data that preserves the sequential nature of transactions. The scarcity of such specialized datasets hampers comprehensive evaluation of neuromorphic fraud detection algorithms, forcing researchers to either convert existing datasets (potentially losing temporal information) or generate synthetic data with uncertain real-world applicability.

Hardware-software integration challenges further complicate testing efforts. The tight coupling between neuromorphic algorithms and their hardware implementation means testing must often occur on specific neuromorphic chips, creating dependencies that limit reproducibility and standardization. Simulators like NEST and Brian provide alternatives but introduce fidelity concerns when translating results to physical neuromorphic systems.

Regulatory and compliance requirements add another layer of complexity. Financial fraud detection systems must meet stringent regulatory standards, yet current compliance frameworks have not evolved to accommodate the unique characteristics of neuromorphic systems. This regulatory uncertainty creates hesitation among financial institutions to adopt these technologies despite their potential advantages in detecting sophisticated fraud patterns.

The interdisciplinary nature of the field compounds these challenges, requiring collaboration between neuroscientists, computer engineers, and financial security experts to develop comprehensive testing methodologies that can adequately evaluate neuromorphic fraud detection systems across multiple dimensions of performance.

Current Testing Methodologies for Neuromorphic Algorithms

01 Spiking Neural Networks (SNNs) for Neuromorphic Computing

Spiking Neural Networks mimic the brain's neural activity by processing information through discrete spikes rather than continuous signals. These networks are fundamental to neuromorphic computing, offering energy efficiency and temporal information processing capabilities. SNNs implement various learning algorithms including spike-timing-dependent plasticity (STDP) and can be used for pattern recognition, classification, and temporal data processing tasks.- Spiking Neural Networks and Neuromorphic Computing: Neuromorphic algorithms based on spiking neural networks (SNNs) mimic the brain's information processing mechanisms. These algorithms use discrete spikes for communication between artificial neurons, enabling energy-efficient computing and temporal information processing. SNNs can be implemented in specialized neuromorphic hardware to achieve significant power efficiency advantages over traditional computing architectures while maintaining biological plausibility.

- Learning and Training Methods for Neuromorphic Systems: Various learning algorithms have been developed specifically for neuromorphic computing, including spike-timing-dependent plasticity (STDP), reinforcement learning, and supervised learning approaches adapted for spiking neural networks. These methods enable neuromorphic systems to adapt and learn from data, allowing for online learning capabilities and improved performance in pattern recognition, classification, and prediction tasks.

- Hardware Implementation of Neuromorphic Algorithms: Neuromorphic algorithms can be implemented in specialized hardware architectures designed to efficiently execute brain-inspired computations. These implementations include memristor-based systems, analog/digital hybrid circuits, and specialized neuromorphic processors. The hardware designs focus on parallel processing, low power consumption, and efficient handling of sparse, event-driven computations typical of neuromorphic approaches.

- Applications of Neuromorphic Algorithms: Neuromorphic algorithms find applications across various domains including computer vision, pattern recognition, autonomous systems, robotics, and sensory processing. These algorithms excel in real-time processing of sensory data, anomaly detection, and adaptive control systems. Their energy efficiency and ability to process temporal information make them particularly suitable for edge computing and IoT applications where power constraints are significant.

- Novel Neuromorphic Computing Paradigms: Emerging approaches in neuromorphic algorithms include quantum neuromorphic computing, reservoir computing, and hybrid systems that combine traditional deep learning with neuromorphic principles. These novel paradigms aim to overcome limitations of current neuromorphic systems by incorporating quantum effects, utilizing the dynamics of physical systems for computation, or combining the strengths of different computational approaches to achieve improved performance and efficiency.

02 Hardware Implementation of Neuromorphic Algorithms

Neuromorphic algorithms are implemented in specialized hardware architectures designed to mimic neural processing. These implementations include memristor-based systems, FPGA configurations, and dedicated neuromorphic chips that enable parallel processing and low power consumption. The hardware designs focus on efficiently executing spike-based computations and learning mechanisms while overcoming traditional von Neumann bottlenecks.Expand Specific Solutions03 Learning and Adaptation in Neuromorphic Systems

Neuromorphic algorithms incorporate various learning mechanisms that allow systems to adapt to new data and environments. These include unsupervised learning approaches, reinforcement learning techniques adapted for spiking networks, and online learning methods that enable continuous adaptation. The learning algorithms are designed to work within the constraints of neuromorphic hardware while maintaining biological plausibility.Expand Specific Solutions04 Applications of Neuromorphic Algorithms

Neuromorphic algorithms are applied across various domains including computer vision, autonomous systems, robotics, and signal processing. These applications leverage the energy efficiency and real-time processing capabilities of neuromorphic systems. Specific implementations include object recognition, anomaly detection, sensory processing, and control systems that require adaptive behavior and low latency responses.Expand Specific Solutions05 Novel Architectures for Neuromorphic Computing

Research in neuromorphic computing has led to the development of novel architectures that go beyond traditional neural network designs. These include hierarchical structures, reservoir computing approaches, and hybrid systems that combine different neural processing paradigms. These architectures aim to address specific computational challenges while maintaining the core principles of brain-inspired computing such as parallelism, sparsity, and event-driven processing.Expand Specific Solutions

Key Industry Players in Neuromorphic Computing

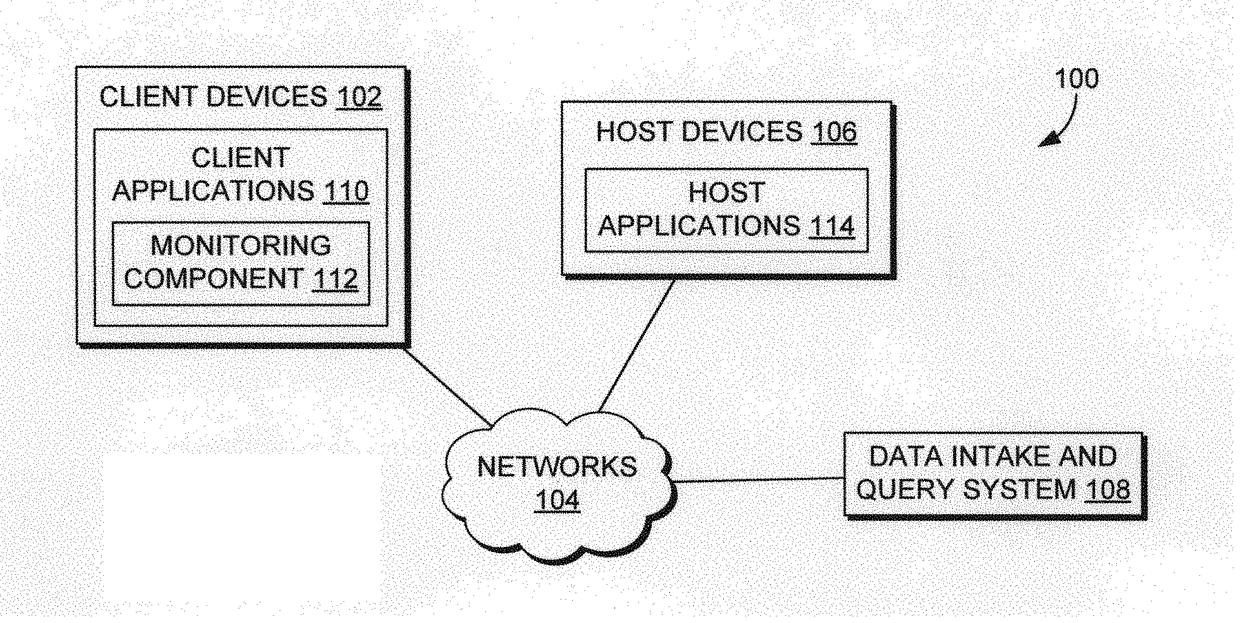

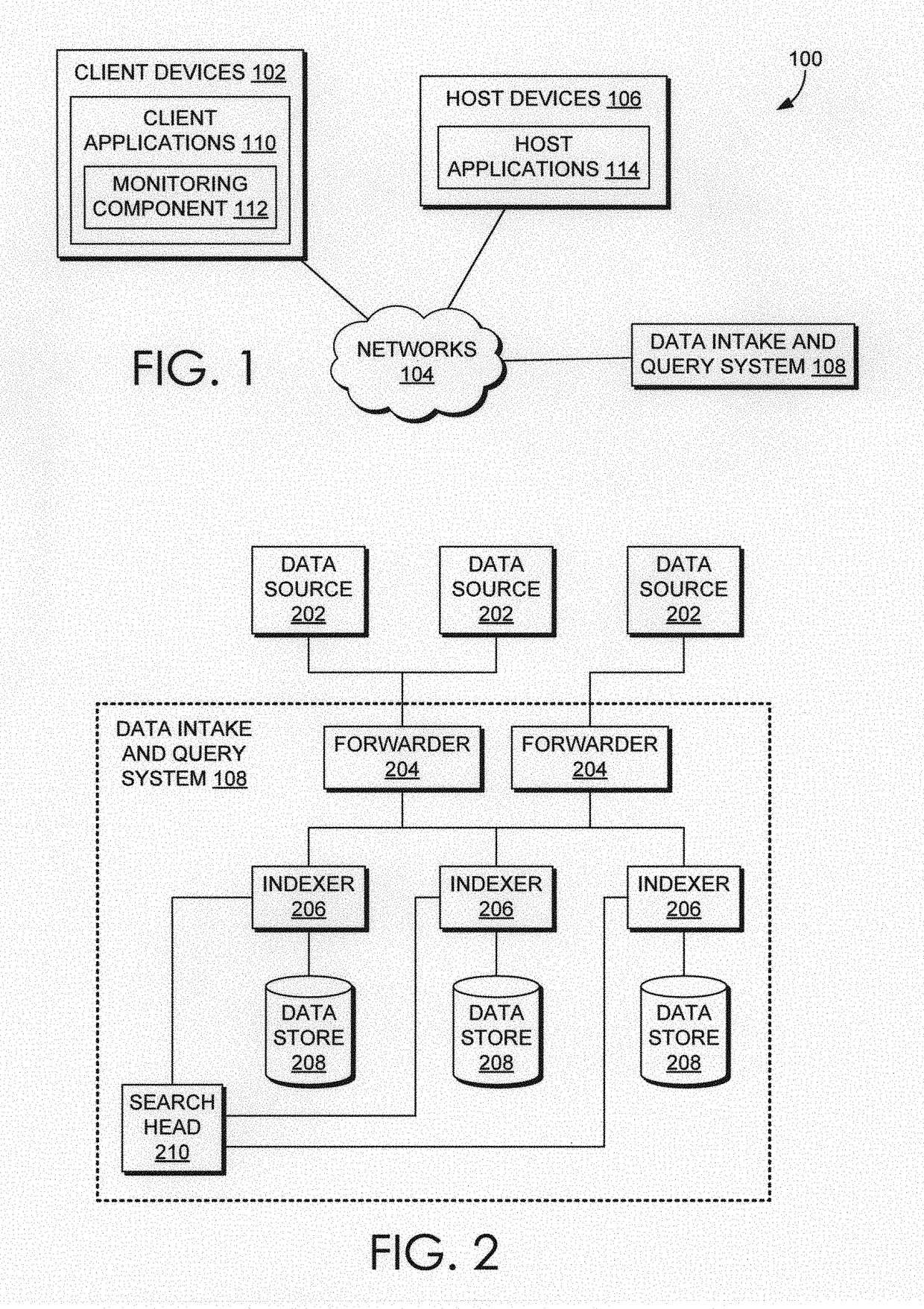

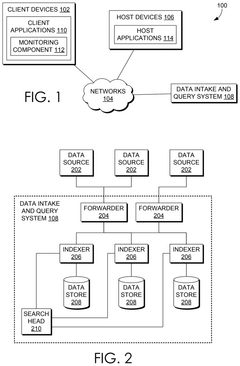

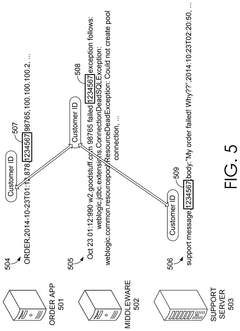

The neuromorphic algorithm fraud detection market is in its early growth phase, characterized by increasing adoption as financial institutions seek more sophisticated defense mechanisms against evolving fraud threats. The market size is expanding rapidly, driven by the rising costs of financial fraud globally, with projections suggesting significant growth over the next five years. Technologically, this field remains in development with varying maturity levels across implementations. Leading players include established financial technology companies like Visa and Mastercard who are investing heavily in neuromorphic computing for fraud detection, alongside specialized security firms such as Jumio and Splunk. Technology giants including IBM, NVIDIA, and Tencent are leveraging their AI expertise to develop neuromorphic solutions, while financial institutions like China Merchants Bank and JP Morgan Chase are implementing these technologies to protect their vast transaction networks.

Visa International Service Association

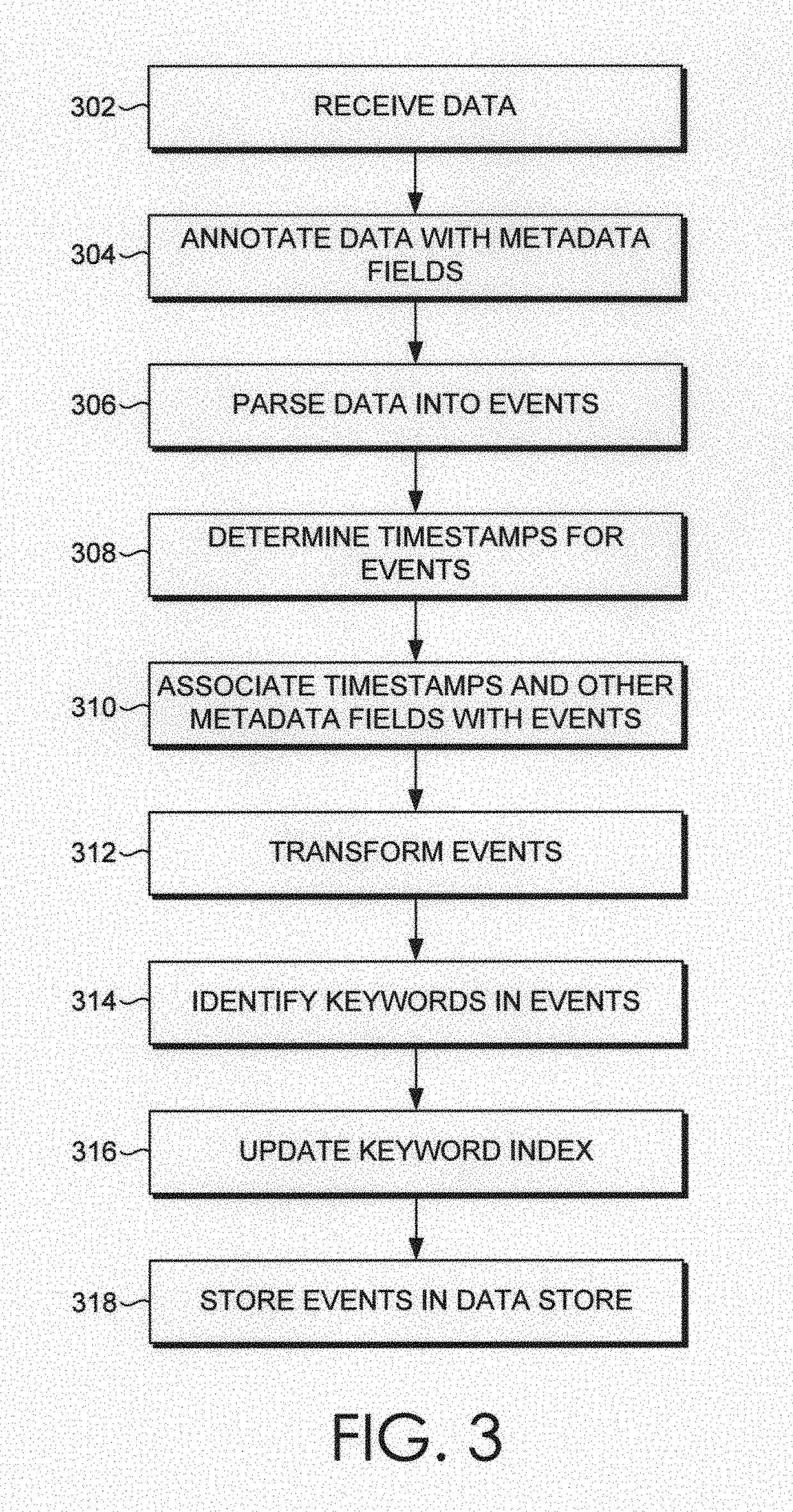

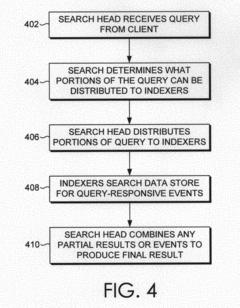

Technical Solution: Visa has developed a sophisticated testing framework for neuromorphic fraud detection algorithms that operates across their global payment network. Their approach integrates neuromorphic computing principles with their existing fraud detection infrastructure, focusing on the temporal aspects of transaction patterns. Visa's testing methodology employs a multi-stage validation process that begins with controlled laboratory testing using anonymized historical data, followed by regional shadow deployments before full-scale implementation. Their neuromorphic algorithms are specifically designed to detect time-based anomalies in transaction sequences that traditional systems might miss. Visa has created specialized benchmark datasets that incorporate various fraud typologies across different merchant categories and geographical regions to ensure comprehensive testing[3]. Their testing framework includes performance metrics specifically designed for neuromorphic systems, measuring not only accuracy but also energy efficiency, processing latency, and adaptability to emerging fraud patterns. Visa implements continuous learning protocols that evaluate how well neuromorphic algorithms adapt to evolving fraud tactics without requiring complete retraining.

Strengths: Access to massive real-world transaction datasets enables exceptionally robust testing and validation of neuromorphic algorithms. Their global infrastructure allows for testing across diverse markets and fraud patterns, ensuring broad applicability. Weaknesses: Highly regulated environment may limit innovation speed and flexibility in testing novel approaches. Their testing frameworks may be overly optimized for their specific payment ecosystem rather than general-purpose fraud detection.

Mastercard International, Inc.

Technical Solution: Mastercard has developed an advanced testing framework for neuromorphic fraud detection algorithms that leverages their global transaction network. Their approach combines traditional fraud detection methods with neuromorphic computing principles to create hybrid systems that benefit from both paradigms. Mastercard's testing methodology employs a staged validation process that begins with offline testing using anonymized historical data, followed by limited live testing in controlled environments before broader deployment. Their neuromorphic algorithms focus particularly on detecting temporal patterns and anomalies in transaction sequences across multiple channels. Mastercard has established specialized testing environments that simulate their payment processing infrastructure while allowing for controlled experimentation with neuromorphic algorithms[4]. Their testing protocols include performance benchmarks specifically designed for neuromorphic systems, measuring detection accuracy, false positive rates, processing efficiency, and adaptability to new fraud patterns. Mastercard implements continuous monitoring systems that evaluate how well neuromorphic algorithms perform against evolving fraud tactics in real-time operational environments.

Strengths: Extensive global transaction data provides diverse testing scenarios across different markets, payment methods, and fraud types. Their hybrid approach combines the benefits of traditional and neuromorphic methods for more robust detection. Weaknesses: Complex integration requirements with existing fraud systems may limit deployment flexibility. Their testing frameworks may be overly tailored to card payment fraud rather than broader financial fraud detection applications.

Core Patents and Research in Neuromorphic Testing

Neural networks for detecting fraud based on user behavior biometrics

PatentActiveUS20180300625A1

Innovation

- A method using a neural network to analyze user behavior biometric data, such as cursor movement, generating images from this data, and training a model to predict fraud, which cannot be easily emulated by attackers, and correlating results with log data for improved accuracy.

Multiple input neural networks for detecting fraud

PatentPendingUS20250209144A1

Innovation

- A method using multiple input neural networks that analyze user behavior biometric data, such as cursor movements, in conjunction with parameters like screen resolution and IP address, to predict fraudulent activity by comparing against a known group of users, enhancing detection accuracy through machine learning models.

Benchmark Datasets and Performance Metrics

Evaluating neuromorphic algorithms for fraud detection requires robust benchmark datasets and standardized performance metrics to ensure reliable assessment and comparison. The financial fraud detection domain presents unique challenges due to the highly imbalanced nature of datasets, where fraudulent transactions typically represent less than 1% of all transactions. Several benchmark datasets have emerged as industry standards, including the IEEE-CIS Fraud Detection dataset, containing over 590,000 transactions with anonymized features, and the Credit Card Fraud Detection dataset from ULB, which offers 284,807 transactions with 30 principal components derived from PCA transformation.

For synthetic data generation, researchers commonly employ techniques such as SMOTE (Synthetic Minority Over-sampling Technique) and GANs (Generative Adversarial Networks) to address class imbalance issues. The PaySim simulator has gained popularity for generating synthetic mobile money transactions that closely mimic real-world patterns while preserving privacy concerns inherent in financial data.

Performance evaluation of neuromorphic fraud detection algorithms requires metrics beyond traditional accuracy, which can be misleading in imbalanced datasets. Precision, recall, and F1-score provide more nuanced evaluation, with recall being particularly critical as it measures the algorithm's ability to detect fraudulent transactions. The Area Under the Receiver Operating Characteristic curve (AUC-ROC) and Area Under the Precision-Recall curve (AUC-PR) offer comprehensive assessments of model performance across different threshold settings.

Time-based metrics are especially relevant for neuromorphic computing, including inference latency, energy efficiency (operations per watt), and throughput (transactions processed per second). These metrics highlight the advantages of neuromorphic hardware in real-time fraud detection scenarios. Additionally, adaptability metrics measure how quickly algorithms can adjust to emerging fraud patterns, a critical consideration given the evolving nature of financial fraud.

Cross-validation techniques, particularly time-series cross-validation, are essential for robust evaluation, as they account for the temporal dynamics of fraud patterns. Industry standards recommend using at least 5-fold cross-validation with stratified sampling to maintain class distribution across folds. For neuromorphic implementations specifically, hardware-in-the-loop testing provides the most accurate assessment of real-world performance by evaluating algorithms directly on neuromorphic processors rather than through simulation alone.

For synthetic data generation, researchers commonly employ techniques such as SMOTE (Synthetic Minority Over-sampling Technique) and GANs (Generative Adversarial Networks) to address class imbalance issues. The PaySim simulator has gained popularity for generating synthetic mobile money transactions that closely mimic real-world patterns while preserving privacy concerns inherent in financial data.

Performance evaluation of neuromorphic fraud detection algorithms requires metrics beyond traditional accuracy, which can be misleading in imbalanced datasets. Precision, recall, and F1-score provide more nuanced evaluation, with recall being particularly critical as it measures the algorithm's ability to detect fraudulent transactions. The Area Under the Receiver Operating Characteristic curve (AUC-ROC) and Area Under the Precision-Recall curve (AUC-PR) offer comprehensive assessments of model performance across different threshold settings.

Time-based metrics are especially relevant for neuromorphic computing, including inference latency, energy efficiency (operations per watt), and throughput (transactions processed per second). These metrics highlight the advantages of neuromorphic hardware in real-time fraud detection scenarios. Additionally, adaptability metrics measure how quickly algorithms can adjust to emerging fraud patterns, a critical consideration given the evolving nature of financial fraud.

Cross-validation techniques, particularly time-series cross-validation, are essential for robust evaluation, as they account for the temporal dynamics of fraud patterns. Industry standards recommend using at least 5-fold cross-validation with stratified sampling to maintain class distribution across folds. For neuromorphic implementations specifically, hardware-in-the-loop testing provides the most accurate assessment of real-world performance by evaluating algorithms directly on neuromorphic processors rather than through simulation alone.

Regulatory Compliance and Security Considerations

The implementation of neuromorphic algorithms for fraud detection necessitates careful consideration of regulatory compliance and security frameworks. Financial institutions must adhere to regulations such as the General Data Protection Regulation (GDPR), Payment Card Industry Data Security Standard (PCI DSS), and Anti-Money Laundering (AML) directives when deploying these advanced detection systems. Testing protocols must verify that neuromorphic algorithms maintain compliance with these regulations while effectively identifying fraudulent activities.

Data privacy represents a critical concern when testing neuromorphic fraud detection systems. Organizations must ensure that personal financial information used during algorithm training and testing is properly anonymized and protected. This includes implementing robust data masking techniques and establishing secure testing environments that prevent unauthorized access to sensitive information. Furthermore, testing procedures should validate that the neuromorphic system's data handling practices align with jurisdictional privacy requirements.

Explainability and transparency pose unique challenges for neuromorphic algorithms. Unlike traditional rule-based systems, these brain-inspired algorithms often function as "black boxes," making their decision-making processes difficult to interpret. Regulatory bodies increasingly demand that financial institutions provide clear explanations for algorithmic decisions, particularly when they result in adverse actions against customers. Testing frameworks must therefore incorporate methods to evaluate and enhance the explainability of neuromorphic fraud detection systems.

Security vulnerabilities present another critical testing dimension. Neuromorphic algorithms may be susceptible to adversarial attacks designed to manipulate their detection capabilities. Comprehensive testing should include penetration testing and adversarial scenarios to identify potential weaknesses. This includes evaluating the algorithm's resilience against data poisoning attempts, where malicious actors introduce corrupted training data to compromise detection accuracy.

Audit trails and documentation requirements must also be addressed during testing. Regulatory compliance often necessitates maintaining detailed records of algorithm performance, training data sources, and decision rationales. Testing protocols should verify that the neuromorphic system generates appropriate logs and documentation to satisfy regulatory audits and internal governance requirements.

Cross-border considerations add complexity when testing neuromorphic fraud detection systems intended for global deployment. Different jurisdictions maintain varying regulatory standards regarding algorithmic decision-making and data protection. Testing frameworks must account for these regional variations and ensure that the system can adapt to diverse compliance requirements while maintaining consistent fraud detection capabilities across markets.

Data privacy represents a critical concern when testing neuromorphic fraud detection systems. Organizations must ensure that personal financial information used during algorithm training and testing is properly anonymized and protected. This includes implementing robust data masking techniques and establishing secure testing environments that prevent unauthorized access to sensitive information. Furthermore, testing procedures should validate that the neuromorphic system's data handling practices align with jurisdictional privacy requirements.

Explainability and transparency pose unique challenges for neuromorphic algorithms. Unlike traditional rule-based systems, these brain-inspired algorithms often function as "black boxes," making their decision-making processes difficult to interpret. Regulatory bodies increasingly demand that financial institutions provide clear explanations for algorithmic decisions, particularly when they result in adverse actions against customers. Testing frameworks must therefore incorporate methods to evaluate and enhance the explainability of neuromorphic fraud detection systems.

Security vulnerabilities present another critical testing dimension. Neuromorphic algorithms may be susceptible to adversarial attacks designed to manipulate their detection capabilities. Comprehensive testing should include penetration testing and adversarial scenarios to identify potential weaknesses. This includes evaluating the algorithm's resilience against data poisoning attempts, where malicious actors introduce corrupted training data to compromise detection accuracy.

Audit trails and documentation requirements must also be addressed during testing. Regulatory compliance often necessitates maintaining detailed records of algorithm performance, training data sources, and decision rationales. Testing protocols should verify that the neuromorphic system generates appropriate logs and documentation to satisfy regulatory audits and internal governance requirements.

Cross-border considerations add complexity when testing neuromorphic fraud detection systems intended for global deployment. Different jurisdictions maintain varying regulatory standards regarding algorithmic decision-making and data protection. Testing frameworks must account for these regional variations and ensure that the system can adapt to diverse compliance requirements while maintaining consistent fraud detection capabilities across markets.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!