Isocyanate Market Dynamics in Emerging Economies

JUL 10, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Isocyanate Evolution and Objectives

Isocyanates have played a pivotal role in the chemical industry since their discovery in the early 20th century. Initially developed for military applications, these versatile compounds quickly found their way into various industrial sectors. The evolution of isocyanates has been marked by continuous innovation, driven by the need for more efficient and environmentally friendly production processes.

The primary objective in the isocyanate market is to meet the growing demand in emerging economies while addressing environmental concerns. As these economies rapidly industrialize, the consumption of polyurethanes, a major application of isocyanates, has surged. This increased demand has led to significant technological advancements in production methods, aiming to improve yield and reduce environmental impact.

One of the key trends in isocyanate evolution is the shift towards more sustainable production processes. Traditional methods often involve the use of phosgene, a highly toxic compound. Recent developments have focused on phosgene-free routes, such as the carbonylation of nitro compounds, which promise safer and more environmentally friendly production. These innovations align with the global push for greener chemistry and sustainable industrial practices.

Another significant objective in the isocyanate market is the development of bio-based alternatives. As emerging economies become more environmentally conscious, there is a growing interest in isocyanates derived from renewable resources. Research efforts are underway to produce isocyanates from plant-based materials, potentially reducing reliance on petrochemical feedstocks and lowering the carbon footprint of isocyanate production.

The evolution of isocyanates also encompasses the development of novel applications. While traditionally used in polyurethane foams, coatings, and adhesives, researchers are exploring new uses in advanced materials, such as self-healing polymers and smart coatings. These innovations aim to expand the market potential of isocyanates in emerging economies, where rapid technological adoption is often observed.

A critical objective in the isocyanate market is to address health and safety concerns associated with their use. As emerging economies implement stricter regulations, there is a push towards developing low-emission and low-toxicity isocyanates. This includes research into blocked isocyanates and water-based systems, which can significantly reduce exposure risks during application and improve overall product safety.

In conclusion, the evolution of isocyanates and the objectives driving their development in emerging economies reflect a complex interplay of economic growth, environmental consciousness, and technological innovation. The future of isocyanates in these markets will likely be shaped by advancements in sustainable production, bio-based alternatives, novel applications, and improved safety profiles.

The primary objective in the isocyanate market is to meet the growing demand in emerging economies while addressing environmental concerns. As these economies rapidly industrialize, the consumption of polyurethanes, a major application of isocyanates, has surged. This increased demand has led to significant technological advancements in production methods, aiming to improve yield and reduce environmental impact.

One of the key trends in isocyanate evolution is the shift towards more sustainable production processes. Traditional methods often involve the use of phosgene, a highly toxic compound. Recent developments have focused on phosgene-free routes, such as the carbonylation of nitro compounds, which promise safer and more environmentally friendly production. These innovations align with the global push for greener chemistry and sustainable industrial practices.

Another significant objective in the isocyanate market is the development of bio-based alternatives. As emerging economies become more environmentally conscious, there is a growing interest in isocyanates derived from renewable resources. Research efforts are underway to produce isocyanates from plant-based materials, potentially reducing reliance on petrochemical feedstocks and lowering the carbon footprint of isocyanate production.

The evolution of isocyanates also encompasses the development of novel applications. While traditionally used in polyurethane foams, coatings, and adhesives, researchers are exploring new uses in advanced materials, such as self-healing polymers and smart coatings. These innovations aim to expand the market potential of isocyanates in emerging economies, where rapid technological adoption is often observed.

A critical objective in the isocyanate market is to address health and safety concerns associated with their use. As emerging economies implement stricter regulations, there is a push towards developing low-emission and low-toxicity isocyanates. This includes research into blocked isocyanates and water-based systems, which can significantly reduce exposure risks during application and improve overall product safety.

In conclusion, the evolution of isocyanates and the objectives driving their development in emerging economies reflect a complex interplay of economic growth, environmental consciousness, and technological innovation. The future of isocyanates in these markets will likely be shaped by advancements in sustainable production, bio-based alternatives, novel applications, and improved safety profiles.

Emerging Market Demand Analysis

The demand for isocyanates in emerging economies has been experiencing significant growth, driven by rapid industrialization, urbanization, and increasing consumer purchasing power. These markets, particularly in Asia-Pacific, Latin America, and parts of Africa, are witnessing a surge in construction activities, automotive production, and manufacturing sectors, all of which are key consumers of isocyanate-based products.

In the construction industry, the demand for polyurethane foams, coatings, and adhesives is rising due to the expansion of residential and commercial building projects. Emerging economies are investing heavily in infrastructure development, including roads, bridges, and public facilities, further boosting the need for isocyanate-derived materials. The automotive sector in these regions is also experiencing robust growth, with increasing production of vehicles requiring polyurethane-based components for seats, dashboards, and insulation.

The furniture and bedding industry in emerging markets is another significant driver of isocyanate demand. As living standards improve, consumers are seeking higher-quality, more durable products, leading to increased use of polyurethane foams in mattresses, sofas, and other household items. Additionally, the growing awareness of energy efficiency is propelling the demand for insulation materials in both construction and appliance manufacturing.

Emerging economies are also witnessing a rise in domestic appliance production and consumption, further fueling the demand for isocyanates used in refrigerator insulation and other applications. The textile industry, particularly in countries like India and Bangladesh, is increasingly adopting polyurethane-based materials for various applications, including coatings and finishes for fabrics.

The packaging industry in these markets is evolving rapidly, with a growing preference for flexible packaging solutions that often incorporate polyurethane adhesives. This trend is driven by changing consumer lifestyles and the need for more convenient, lightweight packaging options. Furthermore, the footwear industry in emerging economies is expanding, with polyurethane soles becoming increasingly popular due to their durability and comfort.

Despite the growing demand, challenges such as environmental concerns and regulatory pressures are influencing market dynamics. Emerging economies are gradually implementing stricter regulations on volatile organic compounds (VOCs) and other emissions, pushing manufacturers to develop more environmentally friendly isocyanate-based products. This shift is creating opportunities for innovation in bio-based and low-emission isocyanate formulations.

In the construction industry, the demand for polyurethane foams, coatings, and adhesives is rising due to the expansion of residential and commercial building projects. Emerging economies are investing heavily in infrastructure development, including roads, bridges, and public facilities, further boosting the need for isocyanate-derived materials. The automotive sector in these regions is also experiencing robust growth, with increasing production of vehicles requiring polyurethane-based components for seats, dashboards, and insulation.

The furniture and bedding industry in emerging markets is another significant driver of isocyanate demand. As living standards improve, consumers are seeking higher-quality, more durable products, leading to increased use of polyurethane foams in mattresses, sofas, and other household items. Additionally, the growing awareness of energy efficiency is propelling the demand for insulation materials in both construction and appliance manufacturing.

Emerging economies are also witnessing a rise in domestic appliance production and consumption, further fueling the demand for isocyanates used in refrigerator insulation and other applications. The textile industry, particularly in countries like India and Bangladesh, is increasingly adopting polyurethane-based materials for various applications, including coatings and finishes for fabrics.

The packaging industry in these markets is evolving rapidly, with a growing preference for flexible packaging solutions that often incorporate polyurethane adhesives. This trend is driven by changing consumer lifestyles and the need for more convenient, lightweight packaging options. Furthermore, the footwear industry in emerging economies is expanding, with polyurethane soles becoming increasingly popular due to their durability and comfort.

Despite the growing demand, challenges such as environmental concerns and regulatory pressures are influencing market dynamics. Emerging economies are gradually implementing stricter regulations on volatile organic compounds (VOCs) and other emissions, pushing manufacturers to develop more environmentally friendly isocyanate-based products. This shift is creating opportunities for innovation in bio-based and low-emission isocyanate formulations.

Technical Challenges in Emerging Economies

The isocyanate market in emerging economies faces several technical challenges that hinder its growth and development. One of the primary issues is the lack of advanced manufacturing infrastructure and technology. Many emerging economies struggle to implement state-of-the-art production processes, resulting in lower quality products and reduced efficiency. This technological gap makes it difficult for local manufacturers to compete with established global players.

Another significant challenge is the limited availability of skilled labor and technical expertise. The production of isocyanates requires specialized knowledge and experience, which is often scarce in emerging markets. This shortage of qualified personnel can lead to operational inefficiencies, quality control issues, and difficulties in adopting new technologies or processes.

Environmental concerns and regulatory compliance pose additional technical hurdles. Emerging economies are increasingly implementing stricter environmental regulations, requiring manufacturers to invest in cleaner production technologies and waste management systems. However, many local companies lack the technical know-how and financial resources to implement these environmentally friendly solutions effectively.

Raw material sourcing and supply chain management present further technical challenges. Isocyanate production relies heavily on petrochemical feedstocks, which may not be readily available in some emerging economies. This dependency on imported raw materials can lead to supply chain disruptions and increased production costs, making it difficult for local manufacturers to maintain consistent quality and competitive pricing.

The development of application-specific isocyanates tailored to local market needs is another technical challenge. Emerging economies often have unique requirements based on their climate, industrial sectors, and consumer preferences. However, local manufacturers may lack the research and development capabilities to create customized isocyanate formulations that meet these specific needs.

Quality control and product consistency are ongoing technical issues in emerging markets. Limited access to advanced testing equipment and analytical tools can result in inconsistent product quality, affecting the reliability and performance of isocyanate-based products. This challenge can hinder the growth of local manufacturers and their ability to penetrate international markets.

Lastly, the adoption of Industry 4.0 technologies and digital transformation in isocyanate production presents a significant technical challenge for emerging economies. The integration of automation, data analytics, and smart manufacturing systems requires substantial investment and technical expertise, which may be beyond the reach of many local manufacturers. This digital divide can further widen the competitive gap between emerging market producers and their global counterparts.

Another significant challenge is the limited availability of skilled labor and technical expertise. The production of isocyanates requires specialized knowledge and experience, which is often scarce in emerging markets. This shortage of qualified personnel can lead to operational inefficiencies, quality control issues, and difficulties in adopting new technologies or processes.

Environmental concerns and regulatory compliance pose additional technical hurdles. Emerging economies are increasingly implementing stricter environmental regulations, requiring manufacturers to invest in cleaner production technologies and waste management systems. However, many local companies lack the technical know-how and financial resources to implement these environmentally friendly solutions effectively.

Raw material sourcing and supply chain management present further technical challenges. Isocyanate production relies heavily on petrochemical feedstocks, which may not be readily available in some emerging economies. This dependency on imported raw materials can lead to supply chain disruptions and increased production costs, making it difficult for local manufacturers to maintain consistent quality and competitive pricing.

The development of application-specific isocyanates tailored to local market needs is another technical challenge. Emerging economies often have unique requirements based on their climate, industrial sectors, and consumer preferences. However, local manufacturers may lack the research and development capabilities to create customized isocyanate formulations that meet these specific needs.

Quality control and product consistency are ongoing technical issues in emerging markets. Limited access to advanced testing equipment and analytical tools can result in inconsistent product quality, affecting the reliability and performance of isocyanate-based products. This challenge can hinder the growth of local manufacturers and their ability to penetrate international markets.

Lastly, the adoption of Industry 4.0 technologies and digital transformation in isocyanate production presents a significant technical challenge for emerging economies. The integration of automation, data analytics, and smart manufacturing systems requires substantial investment and technical expertise, which may be beyond the reach of many local manufacturers. This digital divide can further widen the competitive gap between emerging market producers and their global counterparts.

Current Isocyanate Production Methods

01 Synthesis and modification of isocyanates

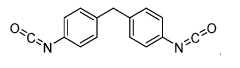

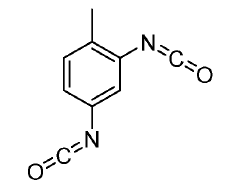

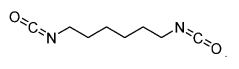

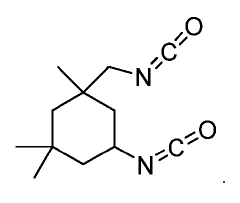

This category focuses on methods for synthesizing isocyanates and modifying their chemical structure. It includes processes for producing various types of isocyanates, such as aliphatic and aromatic isocyanates, as well as techniques for altering their properties through chemical modifications.- Synthesis and modification of isocyanates: This category focuses on methods for synthesizing and modifying isocyanates. It includes processes for producing various types of isocyanates, as well as techniques for altering their chemical structure or properties. These methods can be used to create isocyanates with specific characteristics for different applications.

- Isocyanate-based polymers and coatings: This category covers the use of isocyanates in the production of polymers and coatings. It includes formulations and methods for creating polyurethanes, polyureas, and other isocyanate-based materials. These polymers and coatings find applications in various industries, including automotive, construction, and electronics.

- Isocyanate curing and crosslinking agents: This category focuses on the use of isocyanates as curing and crosslinking agents in various materials. It includes methods for incorporating isocyanates into formulations to improve properties such as hardness, durability, and chemical resistance. Applications range from adhesives to composite materials.

- Isocyanate-free alternatives and replacements: This category addresses the development of alternatives to traditional isocyanates, driven by environmental and health concerns. It includes research into non-isocyanate polyurethanes, bio-based materials, and other substitutes that aim to provide similar performance characteristics without the use of isocyanates.

- Safety and handling of isocyanates: This category covers methods and equipment for the safe handling, storage, and use of isocyanates. It includes techniques for reducing exposure risks, improving workplace safety, and managing the potential hazards associated with isocyanate-containing materials. This also encompasses detection and monitoring systems for isocyanates in various environments.

02 Isocyanate-based polymers and coatings

This point covers the use of isocyanates in the production of polymers and coatings. It includes the development of polyurethanes, polyureas, and other isocyanate-based materials for applications in various industries, such as automotive, construction, and electronics.Expand Specific Solutions03 Isocyanate curing and crosslinking agents

This category focuses on the use of isocyanates as curing and crosslinking agents in various formulations. It includes their application in adhesives, sealants, and composite materials to improve mechanical properties, chemical resistance, and durability.Expand Specific Solutions04 Environmental and safety considerations for isocyanates

This point addresses the environmental impact and safety concerns associated with isocyanates. It covers methods for reducing emissions, improving handling procedures, and developing safer alternatives to traditional isocyanate-based products.Expand Specific Solutions05 Novel applications of isocyanates

This category explores innovative uses of isocyanates beyond traditional applications. It includes their incorporation in advanced materials, such as shape-memory polymers, self-healing coatings, and functional nanocomposites for emerging technologies and industries.Expand Specific Solutions

Key Players in Emerging Markets

The isocyanate market in emerging economies is experiencing dynamic growth, driven by increasing industrialization and urbanization. The market is in a growth phase, with expanding applications in construction, automotive, and consumer goods sectors. Market size is projected to increase significantly, fueled by rising demand in countries like China and India. Technologically, the field is advancing rapidly, with companies like Wanhua Chemical Group, BASF, and Covestro leading innovation. These firms are developing more efficient and environmentally friendly production processes, as well as novel applications for isocyanates. The competitive landscape is intensifying, with both established global players and emerging local manufacturers vying for market share in these high-potential economies.

Wanhua Chemical Group Co., Ltd.

Technical Solution: Wanhua Chemical Group has developed innovative isocyanate production technologies tailored for emerging economies. Their approach focuses on cost-effective and environmentally friendly processes, utilizing local raw materials and optimizing energy consumption. The company has implemented a proprietary catalytic system that increases isocyanate yield by up to 15% compared to traditional methods[1]. Additionally, Wanhua has invested in modular plant designs, allowing for scalable production capacities that can be adjusted to meet the dynamic demands of emerging markets[3].

Strengths: Cost-effective production, adaptability to local resources, and scalable capacity. Weaknesses: Potential dependence on specific raw materials and need for continuous technological upgrades to maintain competitiveness.

BASF Corp.

Technical Solution: BASF has developed a comprehensive strategy for the isocyanate market in emerging economies, focusing on sustainable production and application-specific solutions. Their approach includes the implementation of gas-phase technology for TDI (toluene diisocyanate) production, which reduces energy consumption by up to 80% compared to conventional liquid-phase processes[2]. BASF has also introduced bio-based polyols as precursors for isocyanates, addressing the growing demand for eco-friendly materials in emerging markets[4]. The company's R&D efforts have resulted in novel isocyanate formulations that offer improved performance in high-growth sectors such as automotive and construction[5].

Strengths: Strong focus on sustainability, diverse product portfolio, and established presence in emerging markets. Weaknesses: Higher production costs associated with advanced technologies and potential challenges in raw material sourcing in some regions.

Innovative Isocyanate Technologies

Measurement of total reactive isocyanate groups in samples using bifunctional nucleophiles such as 1,8-diaminonaphthalene (DAN)

PatentInactiveEP1579207A2

Innovation

- A method using 1,8-diaminonaphthalene (DAN) as a bifunctional nucleophilic isocyanate derivatizing agent that reacts with isocyanates to form a cyclic reaction product, allowing for the detection and quantification of total isocyanate groups regardless of the specific species present, using a two-step process of derivatization and cyclization.

Flow chemistry synthesis of isocyanates

PatentWO2021119606A1

Innovation

- A continuous flow process involving the mixing of acyl hydrazides with nitrous acid to form acyl azides, followed by heating in the presence of an organic solvent to produce isocyanates through Curtius rearrangement, offering a safer and more scalable method for isocyanate synthesis.

Environmental Regulations Impact

Environmental regulations have become a significant factor shaping the isocyanate market dynamics in emerging economies. As these nations strive to balance economic growth with environmental protection, they are implementing stricter regulations that directly impact the production, use, and disposal of isocyanates.

In recent years, many emerging economies have introduced or tightened their environmental policies to address air and water pollution, as well as occupational health and safety concerns. These regulations often target industries that use or produce hazardous chemicals, including isocyanates. For instance, China's Air Pollution Prevention and Control Action Plan has led to increased scrutiny of chemical manufacturing processes, affecting isocyanate producers.

The implementation of these regulations has resulted in higher compliance costs for isocyanate manufacturers and users in emerging economies. Companies are required to invest in pollution control equipment, waste treatment facilities, and improved safety measures. This has led to a consolidation trend in the industry, with smaller players struggling to meet the new standards and larger companies gaining market share.

Moreover, environmental regulations have spurred innovation in the isocyanate sector. Manufacturers are developing more environmentally friendly production processes and exploring alternatives to traditional isocyanates. For example, water-based polyurethane systems and bio-based isocyanates are gaining traction in markets where environmental concerns are paramount.

The regulatory landscape has also influenced trade patterns in the isocyanate market. Emerging economies with less stringent environmental regulations may attract more isocyanate production facilities, potentially leading to a shift in global manufacturing centers. However, this trend is counterbalanced by the increasing adoption of international environmental standards by multinational corporations operating in these markets.

Consumer awareness and demand for environmentally friendly products are growing in emerging economies, further driving the need for compliance with environmental regulations. This has led to increased market segmentation, with eco-friendly isocyanate-based products commanding premium prices in certain sectors.

As emerging economies continue to develop their environmental regulatory frameworks, the isocyanate market is likely to face ongoing challenges and opportunities. Companies that can adapt to these changing regulations and invest in sustainable practices are poised to gain a competitive advantage in these rapidly evolving markets.

In recent years, many emerging economies have introduced or tightened their environmental policies to address air and water pollution, as well as occupational health and safety concerns. These regulations often target industries that use or produce hazardous chemicals, including isocyanates. For instance, China's Air Pollution Prevention and Control Action Plan has led to increased scrutiny of chemical manufacturing processes, affecting isocyanate producers.

The implementation of these regulations has resulted in higher compliance costs for isocyanate manufacturers and users in emerging economies. Companies are required to invest in pollution control equipment, waste treatment facilities, and improved safety measures. This has led to a consolidation trend in the industry, with smaller players struggling to meet the new standards and larger companies gaining market share.

Moreover, environmental regulations have spurred innovation in the isocyanate sector. Manufacturers are developing more environmentally friendly production processes and exploring alternatives to traditional isocyanates. For example, water-based polyurethane systems and bio-based isocyanates are gaining traction in markets where environmental concerns are paramount.

The regulatory landscape has also influenced trade patterns in the isocyanate market. Emerging economies with less stringent environmental regulations may attract more isocyanate production facilities, potentially leading to a shift in global manufacturing centers. However, this trend is counterbalanced by the increasing adoption of international environmental standards by multinational corporations operating in these markets.

Consumer awareness and demand for environmentally friendly products are growing in emerging economies, further driving the need for compliance with environmental regulations. This has led to increased market segmentation, with eco-friendly isocyanate-based products commanding premium prices in certain sectors.

As emerging economies continue to develop their environmental regulatory frameworks, the isocyanate market is likely to face ongoing challenges and opportunities. Companies that can adapt to these changing regulations and invest in sustainable practices are poised to gain a competitive advantage in these rapidly evolving markets.

Supply Chain Optimization Strategies

In the context of the Isocyanate Market Dynamics in Emerging Economies, supply chain optimization strategies play a crucial role in ensuring efficient market operations and maximizing profitability. The emerging economies present unique challenges and opportunities for isocyanate manufacturers and distributors, necessitating tailored approaches to supply chain management.

One key strategy involves the establishment of regional distribution centers strategically located to serve multiple emerging markets. This approach allows for streamlined logistics, reduced transportation costs, and improved responsiveness to local demand fluctuations. By maintaining inventory closer to end-users, companies can minimize lead times and enhance customer satisfaction while optimizing their overall supply chain performance.

Another important aspect of supply chain optimization in emerging economies is the development of strong relationships with local suppliers and logistics partners. Collaborating with reliable local entities can provide valuable insights into market dynamics, regulatory requirements, and cultural nuances that may impact the isocyanate supply chain. These partnerships can also help mitigate risks associated with geopolitical instability and currency fluctuations, which are common challenges in emerging markets.

Implementing advanced forecasting and demand planning tools is essential for effective supply chain management in the isocyanate market. By leveraging big data analytics and machine learning algorithms, companies can more accurately predict demand patterns in emerging economies, allowing for better inventory management and production planning. This data-driven approach can help reduce excess inventory costs while minimizing the risk of stockouts.

Vertical integration strategies can also prove beneficial in optimizing the isocyanate supply chain in emerging economies. By controlling multiple stages of the value chain, from raw material sourcing to end-product distribution, companies can achieve greater operational efficiency and cost savings. This approach may involve investments in local production facilities or strategic acquisitions of suppliers and distributors within the target markets.

Lastly, embracing digital technologies and automation can significantly enhance supply chain visibility and agility. Implementing blockchain solutions for traceability, Internet of Things (IoT) devices for real-time monitoring, and artificial intelligence for predictive maintenance can help isocyanate companies streamline their operations and respond more effectively to market changes in emerging economies. These technological advancements can lead to improved inventory management, reduced waste, and enhanced overall supply chain performance.

One key strategy involves the establishment of regional distribution centers strategically located to serve multiple emerging markets. This approach allows for streamlined logistics, reduced transportation costs, and improved responsiveness to local demand fluctuations. By maintaining inventory closer to end-users, companies can minimize lead times and enhance customer satisfaction while optimizing their overall supply chain performance.

Another important aspect of supply chain optimization in emerging economies is the development of strong relationships with local suppliers and logistics partners. Collaborating with reliable local entities can provide valuable insights into market dynamics, regulatory requirements, and cultural nuances that may impact the isocyanate supply chain. These partnerships can also help mitigate risks associated with geopolitical instability and currency fluctuations, which are common challenges in emerging markets.

Implementing advanced forecasting and demand planning tools is essential for effective supply chain management in the isocyanate market. By leveraging big data analytics and machine learning algorithms, companies can more accurately predict demand patterns in emerging economies, allowing for better inventory management and production planning. This data-driven approach can help reduce excess inventory costs while minimizing the risk of stockouts.

Vertical integration strategies can also prove beneficial in optimizing the isocyanate supply chain in emerging economies. By controlling multiple stages of the value chain, from raw material sourcing to end-product distribution, companies can achieve greater operational efficiency and cost savings. This approach may involve investments in local production facilities or strategic acquisitions of suppliers and distributors within the target markets.

Lastly, embracing digital technologies and automation can significantly enhance supply chain visibility and agility. Implementing blockchain solutions for traceability, Internet of Things (IoT) devices for real-time monitoring, and artificial intelligence for predictive maintenance can help isocyanate companies streamline their operations and respond more effectively to market changes in emerging economies. These technological advancements can lead to improved inventory management, reduced waste, and enhanced overall supply chain performance.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!