Isocyanate Supply Chain Innovations for Industry Competitiveness

JUL 10, 20258 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Isocyanate Industry Evolution and Objectives

The isocyanate industry has undergone significant evolution since its inception in the early 20th century. Initially developed for military applications, isocyanates quickly found their way into various industrial sectors due to their versatile chemical properties. The industry's growth has been closely tied to the expansion of polyurethane applications, which remain the primary end-use for isocyanates.

In the 1950s and 1960s, the industry saw rapid technological advancements, leading to more efficient production processes and a wider range of isocyanate types. This period marked the beginning of large-scale commercial production, with major chemical companies investing heavily in research and development. The 1970s and 1980s witnessed a global expansion of isocyanate manufacturing, with new production facilities established in emerging economies.

The 1990s and early 2000s brought increased focus on environmental and health concerns related to isocyanate production and use. This led to the development of safer handling practices, improved emission control technologies, and the exploration of bio-based alternatives. In recent years, the industry has been driven by sustainability goals, with efforts to reduce carbon footprint and enhance energy efficiency in production processes.

Currently, the isocyanate industry faces several challenges and opportunities. The volatility of raw material prices, particularly for key feedstocks like benzene and toluene, has a significant impact on production costs and market dynamics. Additionally, stringent environmental regulations and growing consumer awareness of sustainability issues are pushing manufacturers to innovate in terms of both products and processes.

The primary objective for the isocyanate industry is to maintain competitiveness while addressing these challenges. This involves several key goals: First, improving supply chain resilience through diversification of raw material sources and optimization of logistics networks. Second, enhancing production efficiency to reduce costs and environmental impact. Third, developing new isocyanate formulations that meet evolving market demands, particularly in high-growth sectors like automotive, construction, and electronics.

Furthermore, the industry aims to explore and implement circular economy principles, focusing on recycling and upcycling of isocyanate-based products. Research into bio-based isocyanates and other sustainable alternatives is also a priority, aligning with global efforts to reduce dependence on fossil fuels. Lastly, the industry is working towards improving its public image by emphasizing the critical role of isocyanates in energy-efficient and durable products, while simultaneously addressing health and safety concerns through advanced handling and application technologies.

In the 1950s and 1960s, the industry saw rapid technological advancements, leading to more efficient production processes and a wider range of isocyanate types. This period marked the beginning of large-scale commercial production, with major chemical companies investing heavily in research and development. The 1970s and 1980s witnessed a global expansion of isocyanate manufacturing, with new production facilities established in emerging economies.

The 1990s and early 2000s brought increased focus on environmental and health concerns related to isocyanate production and use. This led to the development of safer handling practices, improved emission control technologies, and the exploration of bio-based alternatives. In recent years, the industry has been driven by sustainability goals, with efforts to reduce carbon footprint and enhance energy efficiency in production processes.

Currently, the isocyanate industry faces several challenges and opportunities. The volatility of raw material prices, particularly for key feedstocks like benzene and toluene, has a significant impact on production costs and market dynamics. Additionally, stringent environmental regulations and growing consumer awareness of sustainability issues are pushing manufacturers to innovate in terms of both products and processes.

The primary objective for the isocyanate industry is to maintain competitiveness while addressing these challenges. This involves several key goals: First, improving supply chain resilience through diversification of raw material sources and optimization of logistics networks. Second, enhancing production efficiency to reduce costs and environmental impact. Third, developing new isocyanate formulations that meet evolving market demands, particularly in high-growth sectors like automotive, construction, and electronics.

Furthermore, the industry aims to explore and implement circular economy principles, focusing on recycling and upcycling of isocyanate-based products. Research into bio-based isocyanates and other sustainable alternatives is also a priority, aligning with global efforts to reduce dependence on fossil fuels. Lastly, the industry is working towards improving its public image by emphasizing the critical role of isocyanates in energy-efficient and durable products, while simultaneously addressing health and safety concerns through advanced handling and application technologies.

Market Demand Analysis for Isocyanates

The global isocyanate market has been experiencing steady growth, driven by increasing demand from various end-use industries such as automotive, construction, furniture, and electronics. Isocyanates, particularly methylene diphenyl diisocyanate (MDI) and toluene diisocyanate (TDI), are crucial raw materials for polyurethane production, which finds extensive applications in insulation, coatings, adhesives, and elastomers.

The construction sector remains a significant consumer of isocyanates, with the growing need for energy-efficient buildings driving the demand for polyurethane-based insulation materials. The automotive industry also contributes substantially to the market growth, as lightweight polyurethane components are increasingly used to improve fuel efficiency and reduce emissions.

In recent years, there has been a notable shift towards more sustainable and eco-friendly isocyanate alternatives, driven by stringent environmental regulations and growing consumer awareness. This trend has led to increased research and development efforts in bio-based isocyanates and non-isocyanate polyurethanes, presenting both challenges and opportunities for market players.

The Asia-Pacific region, particularly China and India, has emerged as the fastest-growing market for isocyanates, fueled by rapid industrialization, urbanization, and infrastructure development. North America and Europe continue to be significant markets, with a focus on high-performance and specialty applications.

Supply chain disruptions and raw material price volatility have been key challenges for the isocyanate industry, highlighting the need for innovative supply chain solutions. The COVID-19 pandemic further emphasized the importance of resilient and flexible supply chains, prompting companies to explore digital technologies and alternative sourcing strategies.

The market is characterized by intense competition among major players, driving innovation in product development and manufacturing processes. Collaborations and partnerships across the value chain have become increasingly important for ensuring a stable supply of raw materials and meeting evolving customer demands.

As the industry moves towards greater sustainability, there is a growing emphasis on circular economy principles, with efforts to improve recycling and reuse of polyurethane products. This shift is expected to influence future demand patterns and supply chain strategies in the isocyanate market.

The construction sector remains a significant consumer of isocyanates, with the growing need for energy-efficient buildings driving the demand for polyurethane-based insulation materials. The automotive industry also contributes substantially to the market growth, as lightweight polyurethane components are increasingly used to improve fuel efficiency and reduce emissions.

In recent years, there has been a notable shift towards more sustainable and eco-friendly isocyanate alternatives, driven by stringent environmental regulations and growing consumer awareness. This trend has led to increased research and development efforts in bio-based isocyanates and non-isocyanate polyurethanes, presenting both challenges and opportunities for market players.

The Asia-Pacific region, particularly China and India, has emerged as the fastest-growing market for isocyanates, fueled by rapid industrialization, urbanization, and infrastructure development. North America and Europe continue to be significant markets, with a focus on high-performance and specialty applications.

Supply chain disruptions and raw material price volatility have been key challenges for the isocyanate industry, highlighting the need for innovative supply chain solutions. The COVID-19 pandemic further emphasized the importance of resilient and flexible supply chains, prompting companies to explore digital technologies and alternative sourcing strategies.

The market is characterized by intense competition among major players, driving innovation in product development and manufacturing processes. Collaborations and partnerships across the value chain have become increasingly important for ensuring a stable supply of raw materials and meeting evolving customer demands.

As the industry moves towards greater sustainability, there is a growing emphasis on circular economy principles, with efforts to improve recycling and reuse of polyurethane products. This shift is expected to influence future demand patterns and supply chain strategies in the isocyanate market.

Current Challenges in Isocyanate Supply Chain

The isocyanate supply chain faces several significant challenges that impact industry competitiveness. One of the primary issues is the volatility of raw material prices, particularly for key feedstocks like benzene and toluene. These fluctuations can lead to unpredictable production costs and affect profit margins throughout the supply chain.

Environmental and safety regulations pose another major challenge. Isocyanates are known for their potential health hazards and environmental impact, leading to stringent regulations on their production, transportation, and use. Compliance with these regulations often requires substantial investments in safety equipment and procedures, adding to operational costs.

Supply chain disruptions have become increasingly prevalent, as highlighted by recent global events such as the COVID-19 pandemic and geopolitical tensions. These disruptions can lead to shortages of raw materials, production delays, and increased logistics costs, affecting the entire isocyanate value chain.

The energy-intensive nature of isocyanate production presents challenges in terms of sustainability and cost management. As energy prices rise and pressure to reduce carbon footprints increases, manufacturers are struggling to balance production efficiency with environmental responsibility.

Technological limitations in current production processes also hinder competitiveness. Many existing plants use older technologies that are less efficient and more resource-intensive compared to newer, more advanced processes. Upgrading these facilities requires significant capital investment, which can be challenging for smaller players in the market.

Market concentration is another issue affecting the isocyanate supply chain. A small number of large producers dominate the market, potentially leading to reduced competition and innovation. This concentration can also make the supply chain more vulnerable to disruptions if a major producer faces operational issues.

Lastly, the cyclical nature of demand in key end-use industries, such as construction and automotive, creates challenges in capacity planning and inventory management. Balancing production levels with fluctuating demand requires careful forecasting and agile supply chain strategies, which can be difficult to implement effectively.

Environmental and safety regulations pose another major challenge. Isocyanates are known for their potential health hazards and environmental impact, leading to stringent regulations on their production, transportation, and use. Compliance with these regulations often requires substantial investments in safety equipment and procedures, adding to operational costs.

Supply chain disruptions have become increasingly prevalent, as highlighted by recent global events such as the COVID-19 pandemic and geopolitical tensions. These disruptions can lead to shortages of raw materials, production delays, and increased logistics costs, affecting the entire isocyanate value chain.

The energy-intensive nature of isocyanate production presents challenges in terms of sustainability and cost management. As energy prices rise and pressure to reduce carbon footprints increases, manufacturers are struggling to balance production efficiency with environmental responsibility.

Technological limitations in current production processes also hinder competitiveness. Many existing plants use older technologies that are less efficient and more resource-intensive compared to newer, more advanced processes. Upgrading these facilities requires significant capital investment, which can be challenging for smaller players in the market.

Market concentration is another issue affecting the isocyanate supply chain. A small number of large producers dominate the market, potentially leading to reduced competition and innovation. This concentration can also make the supply chain more vulnerable to disruptions if a major producer faces operational issues.

Lastly, the cyclical nature of demand in key end-use industries, such as construction and automotive, creates challenges in capacity planning and inventory management. Balancing production levels with fluctuating demand requires careful forecasting and agile supply chain strategies, which can be difficult to implement effectively.

Existing Supply Chain Optimization Strategies

01 Supply chain optimization for isocyanate production

Optimizing the supply chain for isocyanate production involves improving logistics, inventory management, and production processes. This can include implementing advanced forecasting techniques, just-in-time inventory systems, and streamlining transportation networks to reduce costs and increase efficiency. By optimizing the supply chain, companies can enhance their competitiveness in the isocyanate market.- Supply chain optimization for isocyanate production: Optimizing the supply chain for isocyanate production involves implementing advanced logistics management systems, streamlining production processes, and improving inventory control. These strategies can help reduce costs, increase efficiency, and enhance overall competitiveness in the isocyanate market.

- Innovation in isocyanate manufacturing processes: Developing innovative manufacturing processes for isocyanates can significantly improve competitiveness. This includes exploring new catalysts, reaction pathways, and production techniques that can increase yield, reduce energy consumption, and minimize waste generation.

- Market analysis and demand forecasting for isocyanates: Conducting comprehensive market analysis and implementing accurate demand forecasting techniques are crucial for maintaining competitiveness in the isocyanate supply chain. This involves using advanced analytics tools to predict market trends, customer needs, and potential disruptions.

- Sustainable and eco-friendly isocyanate production: Developing sustainable and eco-friendly methods for isocyanate production can provide a competitive edge in the market. This includes exploring bio-based raw materials, implementing green chemistry principles, and reducing the environmental impact of manufacturing processes.

- Strategic partnerships and vertical integration: Forming strategic partnerships and pursuing vertical integration within the isocyanate supply chain can enhance competitiveness. This approach can help secure raw material supplies, improve cost-effectiveness, and create a more resilient supply chain structure.

02 Innovation in isocyanate manufacturing processes

Developing innovative manufacturing processes for isocyanates can significantly improve competitiveness. This may include new catalysts, reaction conditions, or production methods that increase yield, reduce energy consumption, or improve product quality. Continuous improvement in manufacturing processes can lead to cost reductions and enhanced product performance, giving companies a competitive edge.Expand Specific Solutions03 Market analysis and strategic planning for isocyanate industry

Conducting comprehensive market analysis and developing strategic plans are crucial for maintaining competitiveness in the isocyanate supply chain. This involves analyzing market trends, customer needs, and competitor strategies to inform decision-making. Companies can use this information to identify new opportunities, adjust pricing strategies, and optimize their product portfolios to stay ahead in the market.Expand Specific Solutions04 Sustainable and eco-friendly isocyanate production

Developing sustainable and eco-friendly methods for isocyanate production can provide a competitive advantage. This may include using renewable raw materials, implementing green chemistry principles, or developing processes with reduced environmental impact. Companies that focus on sustainability can appeal to environmentally conscious customers and potentially benefit from regulatory incentives.Expand Specific Solutions05 Digitalization and Industry 4.0 in isocyanate supply chain

Implementing digital technologies and Industry 4.0 concepts in the isocyanate supply chain can enhance competitiveness. This includes using artificial intelligence for demand forecasting, blockchain for supply chain transparency, and Internet of Things (IoT) devices for real-time monitoring of production and logistics. Digitalization can lead to improved efficiency, reduced costs, and better decision-making throughout the supply chain.Expand Specific Solutions

Key Players in Isocyanate Production and Distribution

The isocyanate supply chain innovation landscape is characterized by a mature market with established players and ongoing technological advancements. The industry is in a consolidation phase, with major companies like Wanhua Chemical, Covestro, and BASF dominating the market. These firms are investing heavily in R&D to improve production efficiency and develop eco-friendly alternatives. The global isocyanate market size is substantial, driven by growing demand in construction, automotive, and electronics sectors. While the core technology is well-established, companies are focusing on incremental innovations to enhance product performance, reduce environmental impact, and optimize manufacturing processes. This competitive environment is spurring collaborations between industry leaders and research institutions to drive future breakthroughs in isocyanate technology.

Wanhua Chemical Group Co., Ltd.

Technical Solution: Wanhua Chemical has developed innovative isocyanate production processes, including a proprietary gas-phase phosgenation technology for MDI production. This technology offers improved efficiency and reduced environmental impact compared to traditional liquid-phase processes[1]. The company has also invested in integrated production facilities, allowing for better control over the entire isocyanate supply chain. Wanhua's continuous innovation in catalyst systems and reaction engineering has led to higher yields and improved product quality[2]. Additionally, they have implemented advanced process control systems and predictive maintenance technologies to optimize production and reduce downtime[3].

Strengths: Proprietary technology, vertical integration, and continuous innovation. Weaknesses: Potential over-reliance on MDI market, exposure to raw material price fluctuations.

Covestro Deutschland AG

Technical Solution: Covestro has developed a novel gas-phase technology for the production of TDI (toluene diisocyanate), which significantly reduces energy consumption and CO2 emissions compared to conventional processes[4]. The company has also invested in bio-based raw materials for isocyanate production, aiming to reduce dependency on fossil resources. Covestro's "Dream Production" project utilizes CO2 as a raw material for polyol production, which is then used in isocyanate-based polyurethanes[5]. Furthermore, they have implemented digital twin technology in their production facilities, enabling real-time optimization and predictive maintenance[6].

Strengths: Sustainable production methods, innovative use of CO2 as feedstock. Weaknesses: Higher initial investment costs for new technologies, market acceptance of bio-based products.

Innovative Technologies in Isocyanate Logistics

Blocked isocyanates and their use in coating compositions

PatentActiveEP1789466A1

Innovation

- A thermally dissociative blocked polyisocyanate composition containing isocyanurate moieties derived from bis(isocyanatomethyl)cyclohexane, specifically comprising a mixture of cis- and trans-1,3- and cis- and trans-1,4-isomers with at least 5 weight percent of the 1,4-isomer, reacted with a blocking agent and trimerization catalyst to achieve high reactivity and optimal isocyanate group distribution, enhancing the coating's properties.

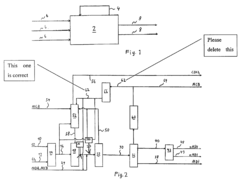

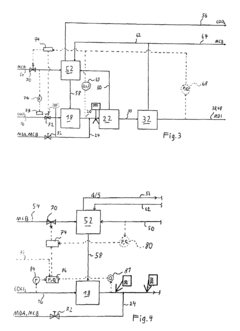

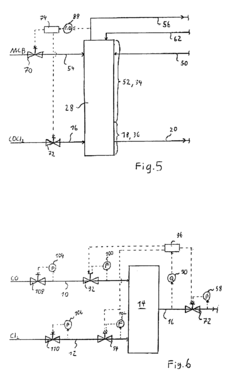

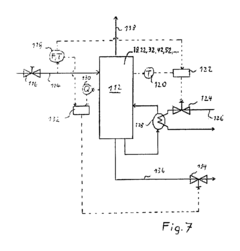

Process for controlling a production process

PatentInactiveEP1932828A2

Innovation

- The process controls the phosgene and solvent feed streams as primary variables, allowing for independent control of subsystems and optimization of the isocyanate production process, enabling the recovery of unused reactants and reducing unwanted substances, thereby stabilizing and automating the process while minimizing production costs.

Environmental Impact of Isocyanate Production

The production of isocyanates, a key component in polyurethane manufacturing, has significant environmental implications that warrant careful consideration. The primary environmental concerns associated with isocyanate production stem from the energy-intensive processes and the potential release of hazardous substances.

Isocyanate production typically involves the reaction of amines with phosgene, a highly toxic gas. This process requires substantial energy inputs, contributing to greenhouse gas emissions and climate change. The energy consumption is primarily due to the high temperatures and pressures required for the reactions, as well as the need for extensive cooling and separation processes.

Air pollution is another major environmental impact of isocyanate production. The release of volatile organic compounds (VOCs) and other air pollutants during manufacturing can contribute to smog formation and negatively affect air quality. Additionally, the potential for accidental releases of toxic substances, including phosgene and isocyanates themselves, poses risks to both human health and the environment.

Water pollution is also a concern in isocyanate production. Wastewater from manufacturing processes may contain organic compounds, heavy metals, and other contaminants that can harm aquatic ecosystems if not properly treated. Ensuring adequate wastewater treatment and implementing closed-loop systems are crucial steps in mitigating this impact.

The production of raw materials for isocyanates, such as toluene and nitric acid, also contributes to the overall environmental footprint. These upstream processes often involve fossil fuel-based feedstocks and energy-intensive operations, further exacerbating the environmental impact of the isocyanate supply chain.

To address these environmental challenges, the industry has been exploring various innovations. These include the development of bio-based isocyanates, which aim to reduce reliance on fossil fuels and decrease the carbon footprint of production. Additionally, process improvements focusing on energy efficiency, waste reduction, and the implementation of cleaner technologies are being pursued to minimize environmental impacts.

Regulatory pressures and growing consumer awareness of environmental issues are driving the industry towards more sustainable practices. This includes the adoption of life cycle assessment approaches to comprehensively evaluate and improve the environmental performance of isocyanate production and use throughout the supply chain.

Isocyanate production typically involves the reaction of amines with phosgene, a highly toxic gas. This process requires substantial energy inputs, contributing to greenhouse gas emissions and climate change. The energy consumption is primarily due to the high temperatures and pressures required for the reactions, as well as the need for extensive cooling and separation processes.

Air pollution is another major environmental impact of isocyanate production. The release of volatile organic compounds (VOCs) and other air pollutants during manufacturing can contribute to smog formation and negatively affect air quality. Additionally, the potential for accidental releases of toxic substances, including phosgene and isocyanates themselves, poses risks to both human health and the environment.

Water pollution is also a concern in isocyanate production. Wastewater from manufacturing processes may contain organic compounds, heavy metals, and other contaminants that can harm aquatic ecosystems if not properly treated. Ensuring adequate wastewater treatment and implementing closed-loop systems are crucial steps in mitigating this impact.

The production of raw materials for isocyanates, such as toluene and nitric acid, also contributes to the overall environmental footprint. These upstream processes often involve fossil fuel-based feedstocks and energy-intensive operations, further exacerbating the environmental impact of the isocyanate supply chain.

To address these environmental challenges, the industry has been exploring various innovations. These include the development of bio-based isocyanates, which aim to reduce reliance on fossil fuels and decrease the carbon footprint of production. Additionally, process improvements focusing on energy efficiency, waste reduction, and the implementation of cleaner technologies are being pursued to minimize environmental impacts.

Regulatory pressures and growing consumer awareness of environmental issues are driving the industry towards more sustainable practices. This includes the adoption of life cycle assessment approaches to comprehensively evaluate and improve the environmental performance of isocyanate production and use throughout the supply chain.

Regulatory Framework for Isocyanate Industry

The regulatory framework for the isocyanate industry plays a crucial role in shaping the supply chain and ensuring industry competitiveness. Globally, regulations governing isocyanates are primarily focused on worker safety, environmental protection, and product quality standards.

In the United States, the Occupational Safety and Health Administration (OSHA) has established stringent guidelines for isocyanate handling and exposure limits. These regulations mandate the use of personal protective equipment, proper ventilation systems, and regular health monitoring for workers in isocyanate-related industries. The Environmental Protection Agency (EPA) also enforces strict emission controls and waste management practices for isocyanate production facilities.

The European Union has implemented the REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulation, which requires manufacturers and importers to register isocyanates and provide detailed safety information. Additionally, the EU has set specific exposure limits for isocyanates in workplace environments through the Carcinogens and Mutagens Directive.

In Asia, countries like China and Japan have been strengthening their regulatory frameworks for isocyanates. China's Ministry of Ecology and Environment has introduced stricter environmental protection measures for chemical industries, including those producing isocyanates. Japan's Industrial Safety and Health Law sets guidelines for isocyanate handling and storage.

The regulatory landscape also extends to transportation and storage of isocyanates. The International Maritime Dangerous Goods (IMDG) Code and the International Air Transport Association (IATA) Dangerous Goods Regulations provide guidelines for the safe transport of isocyanates by sea and air, respectively.

Product quality standards for isocyanates are often governed by industry-specific regulations. For instance, in the automotive sector, regulations like the Global Automotive Declarable Substance List (GADSL) impact the use of isocyanates in vehicle components.

Recent regulatory trends indicate a move towards more sustainable and environmentally friendly practices in the isocyanate industry. This includes incentives for developing bio-based isocyanates and stricter controls on volatile organic compound (VOC) emissions.

The complex and evolving regulatory framework presents both challenges and opportunities for innovation in the isocyanate supply chain. Companies are increasingly investing in research and development to create compliant and sustainable isocyanate products. This regulatory-driven innovation is reshaping the competitive landscape of the industry, favoring those who can adapt quickly to new requirements while maintaining cost-effectiveness.

In the United States, the Occupational Safety and Health Administration (OSHA) has established stringent guidelines for isocyanate handling and exposure limits. These regulations mandate the use of personal protective equipment, proper ventilation systems, and regular health monitoring for workers in isocyanate-related industries. The Environmental Protection Agency (EPA) also enforces strict emission controls and waste management practices for isocyanate production facilities.

The European Union has implemented the REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulation, which requires manufacturers and importers to register isocyanates and provide detailed safety information. Additionally, the EU has set specific exposure limits for isocyanates in workplace environments through the Carcinogens and Mutagens Directive.

In Asia, countries like China and Japan have been strengthening their regulatory frameworks for isocyanates. China's Ministry of Ecology and Environment has introduced stricter environmental protection measures for chemical industries, including those producing isocyanates. Japan's Industrial Safety and Health Law sets guidelines for isocyanate handling and storage.

The regulatory landscape also extends to transportation and storage of isocyanates. The International Maritime Dangerous Goods (IMDG) Code and the International Air Transport Association (IATA) Dangerous Goods Regulations provide guidelines for the safe transport of isocyanates by sea and air, respectively.

Product quality standards for isocyanates are often governed by industry-specific regulations. For instance, in the automotive sector, regulations like the Global Automotive Declarable Substance List (GADSL) impact the use of isocyanates in vehicle components.

Recent regulatory trends indicate a move towards more sustainable and environmentally friendly practices in the isocyanate industry. This includes incentives for developing bio-based isocyanates and stricter controls on volatile organic compound (VOC) emissions.

The complex and evolving regulatory framework presents both challenges and opportunities for innovation in the isocyanate supply chain. Companies are increasingly investing in research and development to create compliant and sustainable isocyanate products. This regulatory-driven innovation is reshaping the competitive landscape of the industry, favoring those who can adapt quickly to new requirements while maintaining cost-effectiveness.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!