Magnetron vs Traveling Wave Tube: Cost-Effectiveness

AUG 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Microwave Tube Technology Background and Objectives

Microwave tube technology has evolved significantly since its inception in the early 20th century, with magnetrons and traveling wave tubes (TWTs) emerging as two dominant technologies in the field. The magnetron was first developed in the 1920s but gained prominence during World War II as a critical component in radar systems. TWTs, meanwhile, were introduced in the late 1940s, offering different operational characteristics and applications. Both technologies have since undergone continuous refinement to meet evolving requirements across various sectors including defense, communications, and industrial applications.

The evolution of these microwave tube technologies has been driven by increasing demands for higher power, greater efficiency, improved reliability, and cost-effectiveness. Magnetrons have traditionally held advantages in terms of simplicity, robustness, and lower production costs, making them suitable for mass-market applications such as microwave ovens and certain radar systems. TWTs, while more complex and expensive to manufacture, offer superior bandwidth, gain, and linearity characteristics that make them indispensable for sophisticated communications and electronic warfare systems.

Recent technological trends indicate a growing interest in optimizing the cost-effectiveness ratio of both technologies. For magnetrons, this has manifested in efforts to improve efficiency and reliability while maintaining their cost advantage. For TWTs, research has focused on reducing manufacturing complexity and extending operational lifetimes to offset their higher initial costs. Additionally, the emergence of solid-state alternatives has created competitive pressure, pushing both technologies to demonstrate their continued relevance through enhanced performance-to-cost ratios.

The global market for microwave tube technologies continues to expand, with particular growth in satellite communications, defense systems, and scientific research applications. This expansion has been accompanied by increasing specialization, with magnetrons and TWTs each finding distinct niches based on their respective strengths. Understanding the cost-effectiveness of these technologies requires consideration not only of initial acquisition costs but also operational expenses, maintenance requirements, and service life.

The primary technical objective in comparing magnetrons and TWTs is to establish comprehensive cost-effectiveness metrics that account for the total lifecycle costs and performance characteristics of each technology. This includes quantifying factors such as power efficiency, reliability under various operating conditions, maintenance requirements, and adaptability to emerging applications. Secondary objectives include identifying potential hybrid approaches that might combine the strengths of both technologies, and exploring manufacturing innovations that could reduce production costs without compromising performance.

By thoroughly examining the historical development, current state, and future trajectories of magnetron and TWT technologies, this analysis aims to provide actionable insights for strategic decision-making regarding technology selection, investment priorities, and research directions in the microwave tube domain.

The evolution of these microwave tube technologies has been driven by increasing demands for higher power, greater efficiency, improved reliability, and cost-effectiveness. Magnetrons have traditionally held advantages in terms of simplicity, robustness, and lower production costs, making them suitable for mass-market applications such as microwave ovens and certain radar systems. TWTs, while more complex and expensive to manufacture, offer superior bandwidth, gain, and linearity characteristics that make them indispensable for sophisticated communications and electronic warfare systems.

Recent technological trends indicate a growing interest in optimizing the cost-effectiveness ratio of both technologies. For magnetrons, this has manifested in efforts to improve efficiency and reliability while maintaining their cost advantage. For TWTs, research has focused on reducing manufacturing complexity and extending operational lifetimes to offset their higher initial costs. Additionally, the emergence of solid-state alternatives has created competitive pressure, pushing both technologies to demonstrate their continued relevance through enhanced performance-to-cost ratios.

The global market for microwave tube technologies continues to expand, with particular growth in satellite communications, defense systems, and scientific research applications. This expansion has been accompanied by increasing specialization, with magnetrons and TWTs each finding distinct niches based on their respective strengths. Understanding the cost-effectiveness of these technologies requires consideration not only of initial acquisition costs but also operational expenses, maintenance requirements, and service life.

The primary technical objective in comparing magnetrons and TWTs is to establish comprehensive cost-effectiveness metrics that account for the total lifecycle costs and performance characteristics of each technology. This includes quantifying factors such as power efficiency, reliability under various operating conditions, maintenance requirements, and adaptability to emerging applications. Secondary objectives include identifying potential hybrid approaches that might combine the strengths of both technologies, and exploring manufacturing innovations that could reduce production costs without compromising performance.

By thoroughly examining the historical development, current state, and future trajectories of magnetron and TWT technologies, this analysis aims to provide actionable insights for strategic decision-making regarding technology selection, investment priorities, and research directions in the microwave tube domain.

Market Demand Analysis for Microwave Amplification Devices

The microwave amplification device market has witnessed substantial growth over the past decade, primarily driven by increasing applications in radar systems, satellite communications, electronic warfare, and medical equipment. The global market for these devices was valued at approximately $1.2 billion in 2022, with projections indicating growth to reach $1.8 billion by 2028, representing a compound annual growth rate of 6.7%.

Within this market, magnetrons and traveling wave tubes (TWTs) constitute significant segments, each serving distinct application niches based on their technical capabilities and cost structures. Magnetrons, being more cost-effective and simpler in design, dominate consumer applications and industrial heating systems, accounting for roughly 65% of the total microwave generation device market by volume.

The defense sector remains the largest consumer of high-power microwave amplification devices, particularly TWTs, due to their superior performance in radar and electronic countermeasure systems. This sector's demand is expected to grow at 7.2% annually through 2028, driven by increasing military modernization programs across North America, Europe, and Asia-Pacific regions.

Commercial satellite communications represent another significant market driver, with the expansion of global broadband coverage and the deployment of low Earth orbit (LEO) satellite constellations creating substantial demand for reliable, high-efficiency amplification solutions. Industry analysts predict that over 20,000 new satellites will be launched in the next decade, many requiring microwave amplification technology.

Cost sensitivity varies significantly across application segments. While defense and aerospace applications prioritize performance and reliability over initial acquisition costs, commercial and industrial applications demonstrate higher price elasticity. This dichotomy has created a two-tiered market where premium TWTs serve high-performance applications and cost-optimized magnetrons address price-sensitive segments.

Emerging markets in Asia, particularly China and India, are showing accelerated demand growth rates of 9.3% and 8.7% respectively, outpacing mature markets. This growth is attributed to expanding telecommunications infrastructure, increasing defense budgets, and the development of domestic space programs.

The healthcare sector represents an emerging opportunity, with medical linear accelerators for cancer treatment requiring specialized microwave amplification solutions. This market segment is projected to grow at 8.5% annually, creating new demand for cost-effective, reliable amplification technologies that can meet strict medical equipment standards.

Customer requirements are increasingly emphasizing total cost of ownership rather than just acquisition costs, with factors such as energy efficiency, operational lifespan, and maintenance requirements gaining prominence in purchasing decisions. This trend favors technologies that can demonstrate superior long-term value propositions despite potentially higher initial investments.

Within this market, magnetrons and traveling wave tubes (TWTs) constitute significant segments, each serving distinct application niches based on their technical capabilities and cost structures. Magnetrons, being more cost-effective and simpler in design, dominate consumer applications and industrial heating systems, accounting for roughly 65% of the total microwave generation device market by volume.

The defense sector remains the largest consumer of high-power microwave amplification devices, particularly TWTs, due to their superior performance in radar and electronic countermeasure systems. This sector's demand is expected to grow at 7.2% annually through 2028, driven by increasing military modernization programs across North America, Europe, and Asia-Pacific regions.

Commercial satellite communications represent another significant market driver, with the expansion of global broadband coverage and the deployment of low Earth orbit (LEO) satellite constellations creating substantial demand for reliable, high-efficiency amplification solutions. Industry analysts predict that over 20,000 new satellites will be launched in the next decade, many requiring microwave amplification technology.

Cost sensitivity varies significantly across application segments. While defense and aerospace applications prioritize performance and reliability over initial acquisition costs, commercial and industrial applications demonstrate higher price elasticity. This dichotomy has created a two-tiered market where premium TWTs serve high-performance applications and cost-optimized magnetrons address price-sensitive segments.

Emerging markets in Asia, particularly China and India, are showing accelerated demand growth rates of 9.3% and 8.7% respectively, outpacing mature markets. This growth is attributed to expanding telecommunications infrastructure, increasing defense budgets, and the development of domestic space programs.

The healthcare sector represents an emerging opportunity, with medical linear accelerators for cancer treatment requiring specialized microwave amplification solutions. This market segment is projected to grow at 8.5% annually, creating new demand for cost-effective, reliable amplification technologies that can meet strict medical equipment standards.

Customer requirements are increasingly emphasizing total cost of ownership rather than just acquisition costs, with factors such as energy efficiency, operational lifespan, and maintenance requirements gaining prominence in purchasing decisions. This trend favors technologies that can demonstrate superior long-term value propositions despite potentially higher initial investments.

Current State and Challenges in Magnetron and TWT Technologies

Magnetron and Traveling Wave Tube (TWT) technologies represent two distinct approaches to microwave generation, each with its own development trajectory and technical challenges. Currently, magnetrons dominate the commercial market due to their cost-effectiveness and reliability in applications like microwave ovens and certain radar systems. These devices typically achieve 60-70% efficiency and can generate power outputs ranging from hundreds of watts to several kilowatts at frequencies between 1-40 GHz, all at a relatively low production cost of $100-500 per unit for standard models.

In contrast, TWTs occupy the high-performance segment, primarily serving military, aerospace, and telecommunications industries. They offer superior bandwidth (up to 2 octaves compared to magnetrons' narrow band operation), higher frequency stability, and power outputs reaching tens of kilowatts. However, this performance comes at significantly higher costs, with typical TWTs priced between $5,000-50,000 depending on specifications.

The manufacturing complexity presents a major challenge for both technologies but affects them differently. Magnetrons benefit from decades of mass production optimization, resulting in streamlined manufacturing processes. TWT production remains largely specialized, involving precision engineering of complex helical structures and sophisticated electron beam focusing systems that have resisted similar cost reductions through scale.

Reliability issues persist as technical challenges for both technologies. Magnetrons typically offer 5,000-10,000 hours of operational life, with failure modes often related to cathode degradation and filament burnout. TWTs generally provide longer service lives (15,000-50,000 hours) but require more complex power supplies and cooling systems, increasing system-level complexity and maintenance requirements.

Energy efficiency represents another significant challenge. While both technologies have improved over decades, TWTs generally achieve higher efficiency (up to 70-80% for modern designs) compared to magnetrons (typically 60-70%). However, this efficiency advantage is often offset by the additional power required for TWT support systems.

Geographic distribution of technical expertise shows concentration of advanced magnetron research and production in Japan, China, and Eastern Europe, while TWT development remains centered in the United States, Western Europe, and increasingly in India. This distribution creates supply chain vulnerabilities for both technologies in different markets.

Recent technical innovations have focused on addressing specific limitations: for magnetrons, efforts center on improving frequency stability and extending operational lifetimes; for TWTs, research aims to reduce production costs through new manufacturing techniques and materials. Both technologies face increasing competition from solid-state alternatives, particularly in lower-power applications, creating pressure for continued innovation to maintain relevance in their respective market segments.

In contrast, TWTs occupy the high-performance segment, primarily serving military, aerospace, and telecommunications industries. They offer superior bandwidth (up to 2 octaves compared to magnetrons' narrow band operation), higher frequency stability, and power outputs reaching tens of kilowatts. However, this performance comes at significantly higher costs, with typical TWTs priced between $5,000-50,000 depending on specifications.

The manufacturing complexity presents a major challenge for both technologies but affects them differently. Magnetrons benefit from decades of mass production optimization, resulting in streamlined manufacturing processes. TWT production remains largely specialized, involving precision engineering of complex helical structures and sophisticated electron beam focusing systems that have resisted similar cost reductions through scale.

Reliability issues persist as technical challenges for both technologies. Magnetrons typically offer 5,000-10,000 hours of operational life, with failure modes often related to cathode degradation and filament burnout. TWTs generally provide longer service lives (15,000-50,000 hours) but require more complex power supplies and cooling systems, increasing system-level complexity and maintenance requirements.

Energy efficiency represents another significant challenge. While both technologies have improved over decades, TWTs generally achieve higher efficiency (up to 70-80% for modern designs) compared to magnetrons (typically 60-70%). However, this efficiency advantage is often offset by the additional power required for TWT support systems.

Geographic distribution of technical expertise shows concentration of advanced magnetron research and production in Japan, China, and Eastern Europe, while TWT development remains centered in the United States, Western Europe, and increasingly in India. This distribution creates supply chain vulnerabilities for both technologies in different markets.

Recent technical innovations have focused on addressing specific limitations: for magnetrons, efforts center on improving frequency stability and extending operational lifetimes; for TWTs, research aims to reduce production costs through new manufacturing techniques and materials. Both technologies face increasing competition from solid-state alternatives, particularly in lower-power applications, creating pressure for continued innovation to maintain relevance in their respective market segments.

Comparative Cost Analysis of Magnetron and TWT Solutions

01 Manufacturing cost comparison between magnetrons and traveling wave tubes

The manufacturing costs of magnetrons and traveling wave tubes (TWTs) differ significantly due to their structural complexity and materials used. Magnetrons generally have lower production costs due to their simpler design and fewer components. In contrast, TWTs require more precise manufacturing techniques and specialized materials, resulting in higher production costs. However, the cost-effectiveness must be evaluated considering the specific application requirements and performance characteristics needed.- Cost-effective manufacturing techniques for magnetrons: Various manufacturing techniques have been developed to reduce the production costs of magnetrons while maintaining performance. These include simplified assembly methods, use of less expensive materials, and optimized production processes. These innovations help make magnetrons more cost-effective for various applications, particularly in consumer electronics and industrial heating systems.

- Efficiency improvements in traveling wave tubes: Advancements in traveling wave tube (TWT) design have focused on improving energy efficiency to reduce operational costs. These improvements include enhanced electron beam focusing, better collector designs for energy recovery, and optimized RF circuit structures. Such developments have significantly increased the cost-effectiveness of TWTs in high-power applications like satellite communications and radar systems.

- Comparative performance analysis between magnetrons and TWTs: Studies comparing magnetrons and traveling wave tubes reveal different cost-effectiveness profiles depending on the application. Magnetrons generally offer lower initial costs and simpler design, while TWTs provide better frequency stability, bandwidth, and longevity. The choice between these technologies often depends on specific requirements such as power level, frequency range, and operational lifetime considerations.

- Hybrid and combined systems for cost optimization: Innovative approaches combining elements of both magnetron and traveling wave tube technologies have been developed to optimize cost-effectiveness. These hybrid systems leverage the advantages of each technology while mitigating their respective limitations. Such combinations can provide more economical solutions for specific applications in communications, radar, and industrial processing.

- Lifetime and maintenance cost considerations: The total cost of ownership for both magnetrons and traveling wave tubes is significantly affected by their operational lifetime and maintenance requirements. Design innovations focused on extending service life, reducing failure rates, and simplifying maintenance procedures have improved the long-term cost-effectiveness of these devices. Factors such as cathode design, cooling systems, and protective circuits play important roles in determining the overall economic value of these microwave devices.

02 Operational efficiency and power consumption considerations

The operational efficiency of magnetrons and traveling wave tubes significantly impacts their cost-effectiveness. Magnetrons typically offer higher efficiency at lower power levels and consume less energy during operation, making them more economical for certain applications. TWTs, while generally less efficient at lower power levels, provide better efficiency at higher frequencies and power outputs. The selection between these technologies often involves balancing initial costs against long-term operational expenses based on power consumption requirements.Expand Specific Solutions03 Lifespan and maintenance cost analysis

The lifespan and associated maintenance costs significantly affect the overall cost-effectiveness of magnetrons versus traveling wave tubes. Magnetrons typically have shorter operational lifespans but are less expensive to replace. TWTs generally offer longer service life under proper operating conditions, reducing the frequency of replacements. When calculating total ownership costs, the maintenance requirements, downtime costs, and replacement intervals must be considered alongside the initial acquisition expenses.Expand Specific Solutions04 Performance characteristics and application-specific cost benefits

The cost-effectiveness of magnetrons versus traveling wave tubes varies significantly depending on the specific application requirements. Magnetrons provide cost advantages in applications requiring high power at fixed frequencies, such as consumer microwave ovens and certain radar systems. TWTs offer superior performance in applications requiring wide bandwidth, frequency agility, and high linearity, such as satellite communications and electronic warfare systems, where their higher cost may be justified by their performance benefits.Expand Specific Solutions05 Technological advancements improving cost-effectiveness

Recent technological innovations have improved the cost-effectiveness of both magnetrons and traveling wave tubes. Advanced manufacturing techniques have reduced production costs while enhancing performance characteristics. Developments in materials science have extended operational lifespans and improved efficiency. Additionally, hybrid systems combining elements of both technologies are emerging to optimize cost-performance ratios for specific applications, potentially offering the benefits of both technologies while mitigating their individual limitations.Expand Specific Solutions

Key Industry Players in Microwave Tube Manufacturing

The magnetron vs traveling wave tube (TWT) cost-effectiveness landscape is currently in a mature market phase with established technologies, though innovation continues. The global market for these microwave vacuum electron devices is estimated at $1-1.5 billion annually, with magnetrons dominating commercial applications due to their lower cost and simpler design. Leading companies like LG Electronics, Galanz, and Midea leverage magnetrons for consumer microwave ovens, while aerospace and defense players such as Boeing, Thales, and Teledyne UK focus on TWTs for their superior performance in radar and communications systems despite higher costs. Academic institutions including Tsinghua University and University of Electronic Science & Technology of China are researching efficiency improvements, while Huawei and Samsung are exploring applications in next-generation communications infrastructure where the performance-to-cost ratio is increasingly critical.

The Boeing Co.

Technical Solution: Boeing has developed specialized high-power microwave systems utilizing both magnetron and TWT technologies for aerospace and defense applications. Their approach focuses on application-specific optimization rather than favoring one technology exclusively. For satellite communications systems, Boeing employs TWTs operating in Ka and Ku bands that deliver up to 200W of RF power with efficiency rates of 65-70%. These systems incorporate advanced thermal management solutions to dissipate heat in space environments. For radar applications requiring high peak power, Boeing has implemented hybrid solutions where magnetrons provide cost-effective power generation for certain operational modes, while TWTs handle more sophisticated signal processing requirements. Boeing's cost-effectiveness analysis framework evaluates total lifecycle costs including initial procurement, operational power consumption, maintenance requirements, and expected service life to determine optimal technology selection for each application. Their research indicates that while magnetrons offer 60-80% lower initial costs, the extended lifetime and superior performance of TWTs often justify their higher acquisition costs in mission-critical systems.

Strengths: Application-specific optimization approach maximizes cost-effectiveness for each use case; extensive experience in aerospace environments where reliability is paramount; sophisticated lifecycle cost modeling. Weaknesses: Custom solutions may limit economies of scale; higher initial investment required for TWT-based systems; more complex integration requirements for hybrid systems.

Thales SA

Technical Solution: Thales has developed advanced Traveling Wave Tube (TWT) technology for satellite communications and radar systems. Their TWT solutions utilize helical slow-wave structures and innovative cathode designs to achieve higher power efficiency (up to 70%) and broader bandwidth operation (several GHz). Thales implements proprietary thermal management techniques that extend TWT operational lifetimes to over 15 years in space applications. Their TWTs feature multi-stage collectors that recover energy from spent electron beams, significantly improving overall efficiency compared to magnetrons. For military and aerospace applications, Thales has engineered TWTs with enhanced resistance to electromagnetic pulse effects and radiation hardening techniques that ensure reliable operation in harsh environments. Their manufacturing process incorporates precision automated assembly and rigorous testing protocols to maintain consistent performance across production units.

Strengths: Superior bandwidth capabilities allowing for complex signal modulation; excellent power efficiency at high frequencies; longer operational lifetime; better phase and frequency stability for sensitive applications. Weaknesses: Significantly higher production costs compared to magnetrons; requires more complex power supply systems; larger size and weight; longer warm-up times before reaching optimal performance.

Technical Innovations in Microwave Tube Design

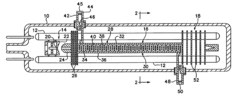

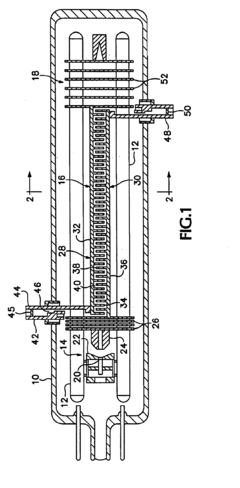

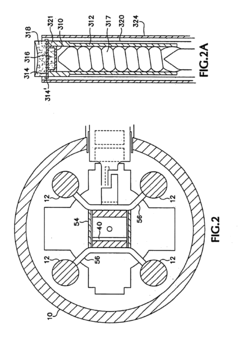

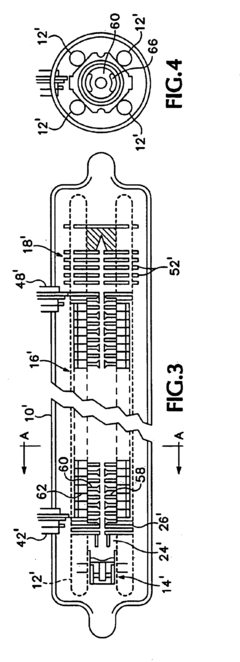

Traveling wave tube, electron gun, and power amplification system

PatentPendingEP4510166A1

Innovation

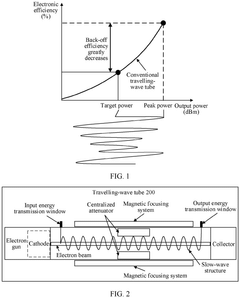

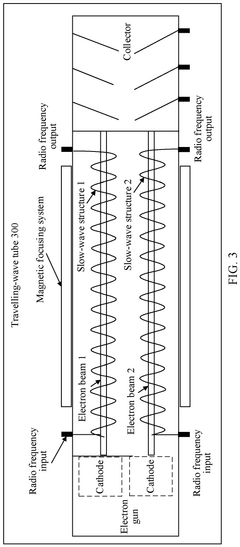

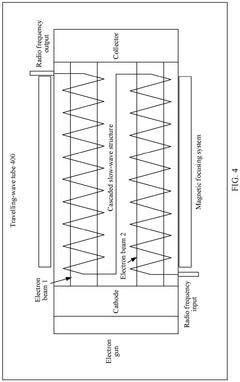

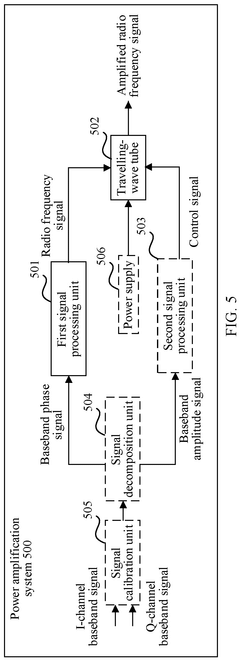

- A travelling-wave tube system is developed, incorporating an input apparatus, control circuit, electron gun, slow-wave circuit, and output apparatus. The control circuit determines the number and currents of electron beams to optimize electronic efficiency, allowing the slow-wave circuit to operate in a saturation region for linear amplification.

Traveling wave tube and method of manufacture

PatentInactiveUS6747412B2

Innovation

- A traveling wave tube design utilizing a unitary structure supported by parallel glass rods with electrostatic focusing, eliminating the need for ceramic-metal brazing and permanent magnets, and incorporating a slow wave structure such as a ladder circuit, double helix, or double ring loop for amplification, which allows for economical construction and precise alignment.

Manufacturing Process Optimization Opportunities

Manufacturing processes for both magnetrons and traveling wave tubes (TWTs) present significant opportunities for cost optimization. The magnetron's relatively simpler structure allows for more streamlined production methods, including automated assembly lines that have been refined over decades of mass production. These established processes have contributed to the magnetron's cost advantage, with production costs typically 5-10 times lower than comparable TWTs.

For magnetrons, key optimization areas include cathode fabrication techniques, where precision automation has reduced manual labor requirements by approximately 40% in modern facilities. Advanced sintering processes for permanent magnets have also improved yield rates by 15-20% over the past decade, directly impacting unit economics.

TWT manufacturing, conversely, remains more complex due to the precision required for helix structures and beam focusing components. The intricate slow-wave structures demand specialized fabrication techniques that are difficult to fully automate. Recent innovations in computer-controlled precision machining have reduced TWT production times by approximately 25%, but significant manual assembly steps remain.

Material selection presents another optimization frontier. For magnetrons, research into alternative cathode materials has shown potential to extend operational lifetimes by 30-40% without significant cost increases. For TWTs, advances in vacuum-compatible materials and joining technologies could reduce manufacturing defect rates, which currently account for 15-20% of production costs.

Testing procedures represent a substantial cost factor for both technologies. Magnetron testing has been largely standardized and automated, while TWT testing remains more time-intensive due to the broader range of operational parameters that must be verified. Implementation of AI-assisted testing protocols has demonstrated potential to reduce TWT testing time by up to 35% in pilot programs.

Supply chain optimization offers additional cost-reduction potential. Vertical integration strategies have proven effective for high-volume magnetron producers, while TWT manufacturers might benefit more from specialized supplier partnerships that leverage external expertise in complex component fabrication. Recent industry analyses suggest potential cost reductions of 10-15% through optimized supply chain management for both technologies.

For magnetrons, key optimization areas include cathode fabrication techniques, where precision automation has reduced manual labor requirements by approximately 40% in modern facilities. Advanced sintering processes for permanent magnets have also improved yield rates by 15-20% over the past decade, directly impacting unit economics.

TWT manufacturing, conversely, remains more complex due to the precision required for helix structures and beam focusing components. The intricate slow-wave structures demand specialized fabrication techniques that are difficult to fully automate. Recent innovations in computer-controlled precision machining have reduced TWT production times by approximately 25%, but significant manual assembly steps remain.

Material selection presents another optimization frontier. For magnetrons, research into alternative cathode materials has shown potential to extend operational lifetimes by 30-40% without significant cost increases. For TWTs, advances in vacuum-compatible materials and joining technologies could reduce manufacturing defect rates, which currently account for 15-20% of production costs.

Testing procedures represent a substantial cost factor for both technologies. Magnetron testing has been largely standardized and automated, while TWT testing remains more time-intensive due to the broader range of operational parameters that must be verified. Implementation of AI-assisted testing protocols has demonstrated potential to reduce TWT testing time by up to 35% in pilot programs.

Supply chain optimization offers additional cost-reduction potential. Vertical integration strategies have proven effective for high-volume magnetron producers, while TWT manufacturers might benefit more from specialized supplier partnerships that leverage external expertise in complex component fabrication. Recent industry analyses suggest potential cost reductions of 10-15% through optimized supply chain management for both technologies.

Supply Chain Considerations for Microwave Tube Production

The supply chain for microwave tube production represents a critical factor in the cost-effectiveness comparison between magnetrons and traveling wave tubes (TWTs). Magnetrons benefit from a more mature and streamlined supply chain, having been in mass production since World War II. Their relatively simpler construction requires fewer specialized materials and components, resulting in more abundant supplier options and competitive pricing structures. This supply chain maturity translates directly to lower production costs and shorter lead times, typically 4-8 weeks for standard magnetrons compared to 12-20 weeks for comparable TWTs.

In contrast, TWT production involves a more complex supply chain with several critical vulnerabilities. The specialized materials required for TWT manufacturing, particularly high-purity ceramics and rare earth elements for focusing magnets, often face availability constraints and price volatility. These materials frequently originate from geographically concentrated sources, creating potential supply disruptions during geopolitical tensions. For instance, certain rare earth elements crucial for high-performance TWTs are sourced predominantly from regions with unstable trade relationships with Western manufacturing centers.

Manufacturing infrastructure represents another significant supply chain consideration. Magnetron production facilities benefit from decades of process optimization and economies of scale, with multiple qualified manufacturers across various regions globally. TWT production, however, requires more specialized equipment and technical expertise, resulting in fewer qualified manufacturers and increased vulnerability to production bottlenecks. This concentration of manufacturing capability creates potential single points of failure in the supply chain.

Component standardization also differs significantly between the two technologies. Magnetrons have achieved greater standardization across manufacturers, facilitating interchangeability and reducing dependency on specific suppliers. TWTs, with their more complex designs and application-specific optimizations, typically exhibit less standardization, complicating inventory management and increasing supply chain risks. This standardization gap directly impacts maintenance logistics and lifetime operational costs.

Regulatory considerations further complicate the supply chain landscape. Export controls on certain high-performance microwave tubes, particularly advanced TWTs with dual-use applications, can restrict supplier options and increase procurement complexity for international organizations. These regulatory hurdles add administrative overhead and potential delays to the supply chain, factors that must be considered in total cost of ownership calculations when comparing magnetron and TWT implementations.

In contrast, TWT production involves a more complex supply chain with several critical vulnerabilities. The specialized materials required for TWT manufacturing, particularly high-purity ceramics and rare earth elements for focusing magnets, often face availability constraints and price volatility. These materials frequently originate from geographically concentrated sources, creating potential supply disruptions during geopolitical tensions. For instance, certain rare earth elements crucial for high-performance TWTs are sourced predominantly from regions with unstable trade relationships with Western manufacturing centers.

Manufacturing infrastructure represents another significant supply chain consideration. Magnetron production facilities benefit from decades of process optimization and economies of scale, with multiple qualified manufacturers across various regions globally. TWT production, however, requires more specialized equipment and technical expertise, resulting in fewer qualified manufacturers and increased vulnerability to production bottlenecks. This concentration of manufacturing capability creates potential single points of failure in the supply chain.

Component standardization also differs significantly between the two technologies. Magnetrons have achieved greater standardization across manufacturers, facilitating interchangeability and reducing dependency on specific suppliers. TWTs, with their more complex designs and application-specific optimizations, typically exhibit less standardization, complicating inventory management and increasing supply chain risks. This standardization gap directly impacts maintenance logistics and lifetime operational costs.

Regulatory considerations further complicate the supply chain landscape. Export controls on certain high-performance microwave tubes, particularly advanced TWTs with dual-use applications, can restrict supplier options and increase procurement complexity for international organizations. These regulatory hurdles add administrative overhead and potential delays to the supply chain, factors that must be considered in total cost of ownership calculations when comparing magnetron and TWT implementations.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!