Optimize Recovery Techniques for Lithium Phosphate Scrap

AUG 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Lithium Phosphate Recovery Background and Objectives

Lithium phosphate compounds have emerged as critical materials in the global energy transition, primarily due to their extensive use in lithium iron phosphate (LFP) batteries. The evolution of lithium phosphate technology dates back to the 1990s when researchers first identified its potential as a cathode material. Over the past two decades, this technology has undergone significant refinement, transitioning from laboratory curiosity to commercial dominance, particularly in electric vehicle and energy storage applications.

The recovery of lithium phosphate from manufacturing scrap and end-of-life products represents an increasingly urgent technological challenge. Current global lithium phosphate production generates approximately 5-8% scrap during manufacturing processes, translating to thousands of tons of valuable material being potentially lost annually. This wastage occurs at various stages, including synthesis, electrode preparation, and cell assembly.

The technological trajectory indicates a clear shift toward closed-loop systems where materials are continuously recovered and reintroduced into the supply chain. This circular approach is gaining momentum as manufacturers face mounting pressure from regulatory frameworks, resource constraints, and sustainability commitments. The European Union's Battery Directive and similar legislation worldwide are accelerating this transition by mandating specific recovery rates for battery materials.

Our technical objectives for lithium phosphate recovery optimization encompass several dimensions. First, we aim to develop processes that can achieve recovery rates exceeding 95% from manufacturing scrap, significantly improving upon current industry standards of 60-80%. Second, we seek to design recovery methods that maintain the electrochemical performance of recovered materials, ensuring they meet specifications for reuse in battery production without downgrading.

Additionally, we intend to reduce the energy intensity of recovery processes by at least 30% compared to conventional hydrometallurgical approaches, while simultaneously minimizing the use of harsh chemicals and generation of secondary waste streams. The economic viability threshold has been established at a recovery cost not exceeding 70% of the virgin material production cost.

The technical evolution in this field is expected to progress from current batch processing methods toward continuous recovery systems integrated directly into manufacturing lines. This integration represents the ultimate goal: transforming what is currently a waste management challenge into a seamless component of the production process, thereby creating a truly circular material economy for lithium phosphate compounds.

The recovery of lithium phosphate from manufacturing scrap and end-of-life products represents an increasingly urgent technological challenge. Current global lithium phosphate production generates approximately 5-8% scrap during manufacturing processes, translating to thousands of tons of valuable material being potentially lost annually. This wastage occurs at various stages, including synthesis, electrode preparation, and cell assembly.

The technological trajectory indicates a clear shift toward closed-loop systems where materials are continuously recovered and reintroduced into the supply chain. This circular approach is gaining momentum as manufacturers face mounting pressure from regulatory frameworks, resource constraints, and sustainability commitments. The European Union's Battery Directive and similar legislation worldwide are accelerating this transition by mandating specific recovery rates for battery materials.

Our technical objectives for lithium phosphate recovery optimization encompass several dimensions. First, we aim to develop processes that can achieve recovery rates exceeding 95% from manufacturing scrap, significantly improving upon current industry standards of 60-80%. Second, we seek to design recovery methods that maintain the electrochemical performance of recovered materials, ensuring they meet specifications for reuse in battery production without downgrading.

Additionally, we intend to reduce the energy intensity of recovery processes by at least 30% compared to conventional hydrometallurgical approaches, while simultaneously minimizing the use of harsh chemicals and generation of secondary waste streams. The economic viability threshold has been established at a recovery cost not exceeding 70% of the virgin material production cost.

The technical evolution in this field is expected to progress from current batch processing methods toward continuous recovery systems integrated directly into manufacturing lines. This integration represents the ultimate goal: transforming what is currently a waste management challenge into a seamless component of the production process, thereby creating a truly circular material economy for lithium phosphate compounds.

Market Analysis for Recycled Lithium Materials

The global market for recycled lithium materials has experienced significant growth in recent years, driven by the expanding electric vehicle (EV) industry and increasing environmental regulations. The market value reached approximately $2.1 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 8.3% through 2030, potentially reaching $4.2 billion by the end of the decade.

Lithium phosphate materials, particularly those recovered from lithium iron phosphate (LFP) batteries, represent a growing segment within this market. With LFP batteries gaining market share due to their lower cost and improved safety profiles compared to nickel-based alternatives, the volume of lithium phosphate scrap requiring recycling is expected to increase substantially in the coming years.

Regional analysis shows China dominating the recycled lithium materials market with over 45% market share, followed by Europe (25%) and North America (18%). This distribution largely mirrors the manufacturing centers for lithium batteries and EVs. However, emerging markets in South America and Southeast Asia are showing accelerated growth rates as local recycling infrastructure develops.

The demand-side dynamics reveal multiple end-use sectors competing for recycled lithium materials. The battery manufacturing sector remains the primary consumer, absorbing approximately 78% of recycled lithium. Secondary markets include ceramics, glass, and lubricants, which collectively account for about 15% of demand. The remaining 7% serves various niche applications including pharmaceuticals and metallurgy.

Price trends for recycled lithium phosphate materials have shown volatility, with prices ranging from $7,000 to $12,000 per ton depending on purity levels and market conditions. The price differential between virgin and recycled lithium phosphate materials has narrowed from 30% to approximately 15% over the past three years, making recycling increasingly economically viable.

Market barriers include technological limitations in achieving high-purity recovery, regulatory inconsistencies across regions, and competition from newly mined lithium sources. However, these barriers are gradually diminishing as recovery technologies improve and environmental regulations tighten globally.

Future market projections indicate that by 2025, recycled lithium could potentially supply up to 25% of the global lithium demand, compared to less than 10% today. This growth is contingent upon continued technological advancements in recovery techniques, particularly those focused on lithium phosphate scrap, which currently has lower recovery rates compared to other lithium compounds.

Lithium phosphate materials, particularly those recovered from lithium iron phosphate (LFP) batteries, represent a growing segment within this market. With LFP batteries gaining market share due to their lower cost and improved safety profiles compared to nickel-based alternatives, the volume of lithium phosphate scrap requiring recycling is expected to increase substantially in the coming years.

Regional analysis shows China dominating the recycled lithium materials market with over 45% market share, followed by Europe (25%) and North America (18%). This distribution largely mirrors the manufacturing centers for lithium batteries and EVs. However, emerging markets in South America and Southeast Asia are showing accelerated growth rates as local recycling infrastructure develops.

The demand-side dynamics reveal multiple end-use sectors competing for recycled lithium materials. The battery manufacturing sector remains the primary consumer, absorbing approximately 78% of recycled lithium. Secondary markets include ceramics, glass, and lubricants, which collectively account for about 15% of demand. The remaining 7% serves various niche applications including pharmaceuticals and metallurgy.

Price trends for recycled lithium phosphate materials have shown volatility, with prices ranging from $7,000 to $12,000 per ton depending on purity levels and market conditions. The price differential between virgin and recycled lithium phosphate materials has narrowed from 30% to approximately 15% over the past three years, making recycling increasingly economically viable.

Market barriers include technological limitations in achieving high-purity recovery, regulatory inconsistencies across regions, and competition from newly mined lithium sources. However, these barriers are gradually diminishing as recovery technologies improve and environmental regulations tighten globally.

Future market projections indicate that by 2025, recycled lithium could potentially supply up to 25% of the global lithium demand, compared to less than 10% today. This growth is contingent upon continued technological advancements in recovery techniques, particularly those focused on lithium phosphate scrap, which currently has lower recovery rates compared to other lithium compounds.

Current Recovery Challenges and Technical Limitations

The recovery of lithium phosphate from scrap materials faces significant technical challenges that limit efficiency and economic viability. Current hydrometallurgical processes, while effective for certain lithium compounds, struggle with the complex matrices found in lithium phosphate scrap. The low solubility of lithium phosphate compounds in conventional leaching solutions necessitates harsh conditions including high temperatures and concentrated acids, leading to increased energy consumption and equipment corrosion.

Selective recovery presents another major obstacle, as lithium phosphate scrap typically contains multiple valuable elements including lithium, phosphorus, and various transition metals. Achieving high separation factors between these elements remains difficult with conventional techniques. Cross-contamination frequently occurs during precipitation and extraction stages, resulting in lower purity recovered materials that require additional purification steps.

Physical separation methods show limited effectiveness for fine particles and intimately mixed components typical in end-of-life lithium phosphate materials. Mechanical processing often fails to achieve complete liberation of target compounds, while flotation techniques struggle with the hydrophilic nature of many phosphate compounds. This results in significant material losses during preliminary treatment stages.

Energy intensity represents a critical limitation in current recovery systems. Thermal treatment methods commonly employed for phosphate conversion require temperatures exceeding 800°C, contributing substantially to the carbon footprint and operational costs of recovery operations. The high energy demand undermines the sustainability benefits of lithium recycling efforts.

Scale-up challenges persist throughout the industry, with most efficient recovery techniques remaining at laboratory or pilot scale. The heterogeneous nature of lithium phosphate waste streams complicates the development of standardized industrial processes. Batch-to-batch variations in feed composition necessitate frequent process adjustments, reducing operational efficiency and increasing labor costs.

Economic barriers further constrain technology adoption, as capital expenditure for specialized equipment often outweighs short-term returns. The fluctuating market prices of recovered materials create uncertainty in investment planning. Additionally, the relatively low concentration of lithium in many waste streams results in high processing costs per unit of recovered material, challenging the economic case for recovery operations.

Regulatory compliance adds complexity to recovery operations, with increasingly stringent environmental standards limiting the use of certain reagents and requiring comprehensive waste management strategies. The classification of process residues as hazardous materials in many jurisdictions imposes additional handling and disposal costs that further strain economic feasibility.

Selective recovery presents another major obstacle, as lithium phosphate scrap typically contains multiple valuable elements including lithium, phosphorus, and various transition metals. Achieving high separation factors between these elements remains difficult with conventional techniques. Cross-contamination frequently occurs during precipitation and extraction stages, resulting in lower purity recovered materials that require additional purification steps.

Physical separation methods show limited effectiveness for fine particles and intimately mixed components typical in end-of-life lithium phosphate materials. Mechanical processing often fails to achieve complete liberation of target compounds, while flotation techniques struggle with the hydrophilic nature of many phosphate compounds. This results in significant material losses during preliminary treatment stages.

Energy intensity represents a critical limitation in current recovery systems. Thermal treatment methods commonly employed for phosphate conversion require temperatures exceeding 800°C, contributing substantially to the carbon footprint and operational costs of recovery operations. The high energy demand undermines the sustainability benefits of lithium recycling efforts.

Scale-up challenges persist throughout the industry, with most efficient recovery techniques remaining at laboratory or pilot scale. The heterogeneous nature of lithium phosphate waste streams complicates the development of standardized industrial processes. Batch-to-batch variations in feed composition necessitate frequent process adjustments, reducing operational efficiency and increasing labor costs.

Economic barriers further constrain technology adoption, as capital expenditure for specialized equipment often outweighs short-term returns. The fluctuating market prices of recovered materials create uncertainty in investment planning. Additionally, the relatively low concentration of lithium in many waste streams results in high processing costs per unit of recovered material, challenging the economic case for recovery operations.

Regulatory compliance adds complexity to recovery operations, with increasingly stringent environmental standards limiting the use of certain reagents and requiring comprehensive waste management strategies. The classification of process residues as hazardous materials in many jurisdictions imposes additional handling and disposal costs that further strain economic feasibility.

Current Recovery Methods and Process Optimization

01 Hydrometallurgical processes for lithium phosphate recovery

Hydrometallurgical techniques involve using aqueous solutions to extract lithium from phosphate scrap materials. These processes typically include leaching with acids or bases, followed by precipitation, crystallization, or solvent extraction to separate and recover lithium compounds. The methods are effective for processing various types of lithium phosphate waste, including spent batteries and industrial byproducts, with high recovery rates and relatively low environmental impact compared to pyrometallurgical approaches.- Hydrometallurgical processes for lithium phosphate recovery: Hydrometallurgical techniques involve the use of aqueous solutions to extract lithium from phosphate scrap materials. These processes typically include leaching with acids or bases, followed by precipitation, crystallization, or solvent extraction to separate and recover lithium compounds. The methods are effective for processing various types of lithium phosphate waste, including spent batteries and industrial byproducts, with high recovery rates and relatively low environmental impact compared to pyrometallurgical approaches.

- Direct recycling methods for lithium iron phosphate batteries: Direct recycling approaches focus on recovering lithium phosphate materials from spent batteries with minimal chemical transformation, preserving the original structure and composition. These techniques often involve mechanical processing steps such as crushing, grinding, and separation, followed by purification processes to remove contaminants. The recovered materials can be directly reused in new battery production, reducing energy consumption and processing costs compared to methods that completely break down the chemical structure.

- Chemical precipitation techniques for lithium phosphate recovery: Chemical precipitation methods involve the selective precipitation of lithium compounds from solution by adding specific reagents that form insoluble lithium salts. These techniques often utilize pH adjustment, temperature control, and the addition of phosphate sources to recover lithium as lithium phosphate compounds. The precipitated materials can be further processed to obtain high-purity lithium phosphate suitable for reuse in battery manufacturing or other applications, with recovery rates typically exceeding 90% under optimized conditions.

- Electrochemical recovery processes for lithium phosphate: Electrochemical recovery methods utilize electrical current to selectively extract lithium from waste materials or solutions containing lithium phosphate compounds. These processes often involve electrolysis, electrodeposition, or electrochemical ion exchange to separate lithium from other elements. The techniques offer advantages such as high selectivity, reduced chemical consumption, and the ability to process complex waste streams. Electrochemical approaches can be particularly effective for recovering lithium from dilute solutions where other methods may be less economical.

- Thermal treatment and pyrometallurgical recovery methods: Thermal treatment and pyrometallurgical approaches involve high-temperature processes to recover lithium from phosphate-containing materials. These methods include calcination, roasting, smelting, and thermal decomposition, often followed by water leaching to extract the lithium compounds. The high temperatures facilitate phase transformations that make lithium more accessible for recovery. While energy-intensive, these techniques can effectively process complex or contaminated scrap materials and are sometimes combined with hydrometallurgical steps in integrated recovery systems.

02 Direct recycling methods for lithium iron phosphate batteries

Direct recycling approaches focus on recovering lithium phosphate materials with minimal chemical transformation, preserving the original structure and properties of the cathode materials. These techniques often involve mechanical separation, thermal treatment, and rejuvenation processes that allow the recovered materials to be directly reused in new battery production. This approach reduces energy consumption and processing costs while maintaining the value of the original materials.Expand Specific Solutions03 Electrochemical recovery techniques

Electrochemical methods utilize electrical current to selectively recover lithium from phosphate-containing waste streams. These processes include electrodeposition, electrodialysis, and electrochemical leaching, which can achieve high purity lithium recovery with reduced chemical consumption. The techniques are particularly effective for processing complex mixed waste streams and can be integrated with other recovery methods to create comprehensive recycling systems.Expand Specific Solutions04 Pyrometallurgical and thermal treatment processes

Pyrometallurgical approaches involve high-temperature treatment of lithium phosphate scrap to facilitate recovery. These methods include smelting, calcination, and roasting processes that transform the phosphate compounds into more easily recoverable forms. The thermal treatments can break down complex structures, volatilize impurities, and create concentrated lithium-containing phases that can be further processed using hydrometallurgical techniques, enabling efficient recovery from difficult-to-process materials.Expand Specific Solutions05 Biological and green recovery methods

Environmentally friendly approaches utilize biological agents or green chemistry principles for lithium phosphate recovery. These methods include bioleaching using microorganisms, bio-sorption processes, and environmentally benign solvents or reagents. The techniques aim to minimize environmental impact while achieving effective lithium recovery, often operating at ambient temperatures and pressures with reduced energy requirements and toxic chemical usage compared to conventional methods.Expand Specific Solutions

Key Industry Players in Battery Material Recovery

The lithium phosphate scrap recovery technology landscape is currently in a growth phase, with the market expanding rapidly due to increasing demand for sustainable battery materials. The global market size for lithium recycling is projected to reach significant scale as electric vehicle adoption accelerates. Among key players, Chinese companies like Guangdong Brunp Recycling (CATL subsidiary) and Hunan Bangpu lead with advanced hydrometallurgical processes, while Korean firms such as POSCO Holdings and Korea Zinc focus on integrated recovery systems. Academic institutions including Central South University and IIT Bombay are driving innovation through novel extraction techniques. Western companies like Attero Recycling and Green Li-Ion are developing modular solutions for on-site recycling. The technology is approaching commercial maturity, with most processes achieving 80-95% recovery efficiency, though economic viability remains challenging at smaller scales.

Hunan Bangpu Recycling Technology Co., Ltd.

Technical Solution: Hunan Bangpu has developed a comprehensive lithium phosphate scrap recovery system utilizing a hydrometallurgical process combined with selective precipitation. Their technology involves a multi-stage leaching process using dilute sulfuric acid under controlled temperature conditions (50-80°C), followed by impurity removal through pH adjustment and selective precipitation. The recovered materials undergo crystallization to form high-purity lithium phosphate compounds with recovery rates exceeding 95%. Their process is particularly effective for handling mixed cathode materials from end-of-life batteries, employing mechanical pre-treatment including crushing, screening, and magnetic separation to prepare the scrap for chemical processing. The company has implemented this technology at industrial scale with processing capacity exceeding 100,000 tons of lithium-ion battery waste annually.

Strengths: High recovery efficiency (>95%), scalable industrial implementation, and effective handling of mixed cathode materials. Weaknesses: Energy-intensive process requiring precise pH and temperature control, and potential generation of secondary waste streams requiring additional treatment.

Central South University

Technical Solution: Central South University has developed a groundbreaking "Integrated Hydrometallurgical Recovery" (IHR) technology for lithium phosphate scrap. Their approach combines advanced leaching techniques with membrane separation technology. The process begins with ultrasonic-assisted leaching using dilute acids (typically citric or malic acid) at moderate temperatures (60-70°C), which enhances dissolution kinetics while minimizing reagent consumption. Following leaching, their innovation incorporates nanofiltration membrane technology to separate lithium and phosphate ions from impurities with high selectivity. The final recovery stage employs electrochemical deposition to produce high-purity lithium phosphate compounds with recovery efficiencies of 94-97%. A distinctive feature of their technology is the integration of real-time monitoring systems using spectroscopic techniques to optimize process parameters continuously. The university has successfully demonstrated this technology at pilot scale (processing 500kg/day) and has established partnerships with several battery manufacturers for technology transfer.

Strengths: Combination of green chemistry principles with advanced separation technologies, high recovery efficiency, and reduced environmental impact through reagent recycling. Weaknesses: Complex process control requirements and higher initial investment costs for membrane and electrochemical systems compared to conventional methods.

Critical Patents and Innovations in Lithium Recycling

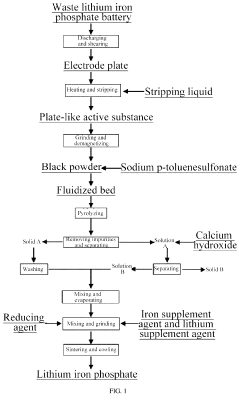

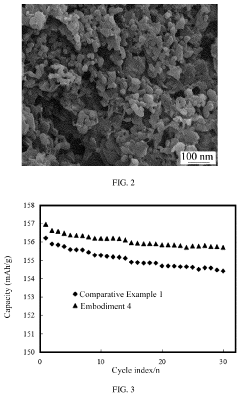

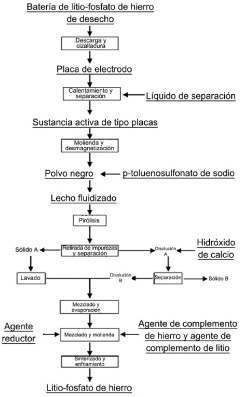

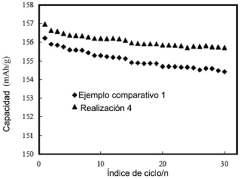

Method for recycling and preparing positive electrode material from waste lithium iron phosphate batteries

PatentActiveUS12009492B2

Innovation

- A method involving discharging, drying, and crushing waste lithium iron phosphate batteries, followed by a fluidized bed reaction with benzene sulfonate to remove carbon and fluorine, and subsequent acid and alkali treatments to separate impurities, with the addition of lithium and iron supplements for sintering, effectively reducing aluminum and copper content and improving cathode material purity.

Method for recycling and preparing positive electrode material from waste lithium iron phosphate batteries

PatentUndeterminedES2963369A2

Innovation

- The use of benzenesulfonate in a fluidized bed reaction to effectively remove carbon and fluorine impurities from waste lithium iron phosphate battery black powder.

- Controlled and optimized crushing, stripping, and impurity removal processes that enable high-purity positive electrode material recovery while maintaining cost-effectiveness.

- Selective supplementation approach where only iron or lithium needs to be added during the regeneration process, combined with carbothermic reduction to restore electrode performance.

Environmental Impact and Sustainability Assessment

The recovery of lithium phosphate from scrap materials presents significant environmental implications that must be thoroughly assessed. Current conventional recovery methods often involve energy-intensive processes, hazardous chemicals, and substantial water consumption, resulting in considerable carbon emissions and potential contamination of soil and water resources. Life cycle assessments indicate that traditional lithium phosphate recovery techniques can generate up to 15-20 kg CO2 equivalent per kilogram of recovered material, primarily due to high-temperature processing and chemical leaching operations.

Water usage represents another critical environmental concern, with conventional recovery methods consuming approximately 50-100 liters of water per kilogram of processed material. This places substantial pressure on local water resources, particularly in regions already experiencing water scarcity. Additionally, the acidic solutions commonly employed in hydrometallurgical processes pose risks of groundwater contamination if not properly managed.

Optimized recovery techniques demonstrate promising sustainability improvements. Advanced hydrometallurgical processes incorporating selective precipitation methods have shown potential to reduce energy consumption by 30-40% compared to traditional approaches. Similarly, emerging bioleaching technologies utilizing specialized microorganisms can operate at ambient temperatures, potentially decreasing carbon emissions by up to 50% while minimizing the need for harsh chemicals.

Circular economy principles applied to lithium phosphate recovery create substantial environmental benefits. Research indicates that each kilogram of lithium phosphate recovered from scrap rather than extracted from virgin sources prevents approximately 25-30 kg of mining waste generation. This reduction in primary resource extraction significantly decreases landscape disruption, habitat destruction, and the associated biodiversity impacts of mining operations.

Regulatory frameworks increasingly emphasize environmental performance metrics for recovery processes. The European Union's Battery Directive and similar regulations in North America and Asia are establishing progressively stringent requirements for recovery efficiency and environmental impact mitigation. Companies developing optimized recovery techniques must consider these evolving standards to ensure long-term compliance and market access.

Future sustainability improvements will likely emerge from integration of renewable energy sources into recovery processes, development of closed-loop water systems, and implementation of zero-waste approaches that valorize all by-products. These advancements could potentially transform lithium phosphate recovery from an environmental liability into a cornerstone of sustainable material management within the growing battery ecosystem.

Water usage represents another critical environmental concern, with conventional recovery methods consuming approximately 50-100 liters of water per kilogram of processed material. This places substantial pressure on local water resources, particularly in regions already experiencing water scarcity. Additionally, the acidic solutions commonly employed in hydrometallurgical processes pose risks of groundwater contamination if not properly managed.

Optimized recovery techniques demonstrate promising sustainability improvements. Advanced hydrometallurgical processes incorporating selective precipitation methods have shown potential to reduce energy consumption by 30-40% compared to traditional approaches. Similarly, emerging bioleaching technologies utilizing specialized microorganisms can operate at ambient temperatures, potentially decreasing carbon emissions by up to 50% while minimizing the need for harsh chemicals.

Circular economy principles applied to lithium phosphate recovery create substantial environmental benefits. Research indicates that each kilogram of lithium phosphate recovered from scrap rather than extracted from virgin sources prevents approximately 25-30 kg of mining waste generation. This reduction in primary resource extraction significantly decreases landscape disruption, habitat destruction, and the associated biodiversity impacts of mining operations.

Regulatory frameworks increasingly emphasize environmental performance metrics for recovery processes. The European Union's Battery Directive and similar regulations in North America and Asia are establishing progressively stringent requirements for recovery efficiency and environmental impact mitigation. Companies developing optimized recovery techniques must consider these evolving standards to ensure long-term compliance and market access.

Future sustainability improvements will likely emerge from integration of renewable energy sources into recovery processes, development of closed-loop water systems, and implementation of zero-waste approaches that valorize all by-products. These advancements could potentially transform lithium phosphate recovery from an environmental liability into a cornerstone of sustainable material management within the growing battery ecosystem.

Economic Feasibility and Scaling Considerations

The economic viability of lithium phosphate scrap recovery represents a critical factor in determining the widespread adoption of recycling technologies. Current cost analyses indicate that recovery processes range from $3,500 to $9,000 per ton of processed material, with hydrometallurgical methods typically offering lower operational costs compared to pyrometallurgical approaches. However, these figures vary significantly based on regional energy prices, labor costs, and regulatory requirements.

Scale-up considerations reveal that many promising laboratory techniques face substantial challenges when implemented at industrial levels. Pilot plants operating at 100-500 kg/day capacity have demonstrated efficiency losses of 15-22% compared to laboratory results, primarily due to increased impurity accumulation and reduced reaction control. These scaling inefficiencies must be addressed through process optimization and equipment redesign to maintain economic viability.

Capital expenditure requirements for establishing commercial-scale recovery facilities (processing >1,000 tons annually) typically range from $8-15 million, with return on investment periods of 4-7 years depending on market conditions and recovery efficiency. Notably, facilities integrating multiple recovery streams (not limited to lithium phosphate alone) demonstrate improved economic resilience through diversified revenue streams.

Energy consumption represents a significant operational cost factor, with current best practices requiring 2.3-3.8 MWh per ton of processed material. Implementing energy recovery systems and process optimization can potentially reduce this requirement by 25-30%, substantially improving long-term economic viability. Water usage and treatment costs similarly impact operational economics, particularly in water-stressed regions.

Market volatility presents another critical economic consideration. Historical lithium price fluctuations of ±40% within 18-month periods create significant uncertainty for recovery operations. Successful facilities typically incorporate flexible processing capabilities that can adapt to changing market conditions and material compositions, though this adaptability often requires additional capital investment.

Government incentives, including tax benefits, subsidies, and regulatory frameworks promoting circular economy principles, increasingly influence economic feasibility. Regions with strong environmental regulations and producer responsibility frameworks generally provide more favorable economic conditions for recovery operations, effectively offsetting higher operational costs through regulatory advantages and market access benefits.

Scale-up considerations reveal that many promising laboratory techniques face substantial challenges when implemented at industrial levels. Pilot plants operating at 100-500 kg/day capacity have demonstrated efficiency losses of 15-22% compared to laboratory results, primarily due to increased impurity accumulation and reduced reaction control. These scaling inefficiencies must be addressed through process optimization and equipment redesign to maintain economic viability.

Capital expenditure requirements for establishing commercial-scale recovery facilities (processing >1,000 tons annually) typically range from $8-15 million, with return on investment periods of 4-7 years depending on market conditions and recovery efficiency. Notably, facilities integrating multiple recovery streams (not limited to lithium phosphate alone) demonstrate improved economic resilience through diversified revenue streams.

Energy consumption represents a significant operational cost factor, with current best practices requiring 2.3-3.8 MWh per ton of processed material. Implementing energy recovery systems and process optimization can potentially reduce this requirement by 25-30%, substantially improving long-term economic viability. Water usage and treatment costs similarly impact operational economics, particularly in water-stressed regions.

Market volatility presents another critical economic consideration. Historical lithium price fluctuations of ±40% within 18-month periods create significant uncertainty for recovery operations. Successful facilities typically incorporate flexible processing capabilities that can adapt to changing market conditions and material compositions, though this adaptability often requires additional capital investment.

Government incentives, including tax benefits, subsidies, and regulatory frameworks promoting circular economy principles, increasingly influence economic feasibility. Regions with strong environmental regulations and producer responsibility frameworks generally provide more favorable economic conditions for recovery operations, effectively offsetting higher operational costs through regulatory advantages and market access benefits.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!