Case Study: Lithium Phosphate Impact on Energy Transition Efforts

AUG 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Lithium Phosphate Technology Evolution and Objectives

Lithium phosphate technology has undergone significant evolution since its initial development in the 1990s. Originally conceived as a cathode material for lithium-ion batteries, lithium iron phosphate (LiFePO4 or LFP) emerged as a promising alternative to cobalt-based cathodes due to its inherent stability, safety characteristics, and abundant raw material sources. The early development phase faced challenges related to low electrical conductivity and energy density, limiting its commercial viability despite its theoretical advantages.

The technology experienced a breakthrough in the early 2000s when researchers discovered that carbon coating and nanostructuring could significantly enhance the electrical conductivity of LFP materials. This innovation catalyzed the first wave of commercial applications, primarily in portable electronics and early electric vehicles. By 2010, manufacturing processes had matured sufficiently to enable mass production, coinciding with growing global interest in sustainable energy solutions.

Recent technological advancements have focused on addressing the energy density limitations through doping strategies, advanced synthesis methods, and novel composite structures. The introduction of silicon and graphene into LFP formulations has yielded promising results, with energy densities approaching those of nickel-based alternatives while maintaining the inherent safety advantages of phosphate chemistry.

The primary objective of current lithium phosphate technology development is to optimize performance-to-cost ratios to accelerate energy transition efforts globally. Specific technical goals include achieving energy densities exceeding 200 Wh/kg at the cell level while maintaining cycle life beyond 4,000 cycles and reducing production costs below $80/kWh. These targets are considered critical thresholds for enabling mass adoption of electric vehicles and grid-scale energy storage systems.

Another key objective is enhancing the sustainability profile of lithium phosphate technology through reduced energy consumption during manufacturing, development of water-based processing methods, and establishment of closed-loop recycling systems. These environmental considerations have gained prominence as the technology scales to gigawatt-hour production volumes.

Looking forward, the technology evolution trajectory suggests convergence toward solid-state electrolyte integration with lithium phosphate cathodes, potentially unlocking step-change improvements in energy density while maintaining the safety advantages that have defined this chemistry. Research initiatives are increasingly focused on this frontier, with preliminary results indicating potential for energy densities exceeding 300 Wh/kg within the next decade.

The evolution of lithium phosphate technology represents a critical enabler for global energy transition efforts, with objectives now extending beyond performance metrics to encompass sustainability, scalability, and integration capabilities across diverse energy applications.

The technology experienced a breakthrough in the early 2000s when researchers discovered that carbon coating and nanostructuring could significantly enhance the electrical conductivity of LFP materials. This innovation catalyzed the first wave of commercial applications, primarily in portable electronics and early electric vehicles. By 2010, manufacturing processes had matured sufficiently to enable mass production, coinciding with growing global interest in sustainable energy solutions.

Recent technological advancements have focused on addressing the energy density limitations through doping strategies, advanced synthesis methods, and novel composite structures. The introduction of silicon and graphene into LFP formulations has yielded promising results, with energy densities approaching those of nickel-based alternatives while maintaining the inherent safety advantages of phosphate chemistry.

The primary objective of current lithium phosphate technology development is to optimize performance-to-cost ratios to accelerate energy transition efforts globally. Specific technical goals include achieving energy densities exceeding 200 Wh/kg at the cell level while maintaining cycle life beyond 4,000 cycles and reducing production costs below $80/kWh. These targets are considered critical thresholds for enabling mass adoption of electric vehicles and grid-scale energy storage systems.

Another key objective is enhancing the sustainability profile of lithium phosphate technology through reduced energy consumption during manufacturing, development of water-based processing methods, and establishment of closed-loop recycling systems. These environmental considerations have gained prominence as the technology scales to gigawatt-hour production volumes.

Looking forward, the technology evolution trajectory suggests convergence toward solid-state electrolyte integration with lithium phosphate cathodes, potentially unlocking step-change improvements in energy density while maintaining the safety advantages that have defined this chemistry. Research initiatives are increasingly focused on this frontier, with preliminary results indicating potential for energy densities exceeding 300 Wh/kg within the next decade.

The evolution of lithium phosphate technology represents a critical enabler for global energy transition efforts, with objectives now extending beyond performance metrics to encompass sustainability, scalability, and integration capabilities across diverse energy applications.

Energy Transition Market Demand Analysis

The global energy transition market is experiencing unprecedented growth, driven by increasing environmental concerns, policy support, and technological advancements. The demand for sustainable energy solutions has created a substantial market for lithium phosphate batteries, which are becoming central to energy transition efforts worldwide.

Market analysis indicates that the global energy storage market is projected to grow at a compound annual growth rate of 20-25% through 2030, with lithium phosphate batteries capturing an increasing share due to their safety profile and cost advantages. This growth is particularly evident in utility-scale storage applications, where lithium phosphate technology is displacing traditional lead-acid batteries and competing effectively with other lithium-ion chemistries.

Consumer demand for electric vehicles represents another significant market driver for lithium phosphate batteries. The EV market has expanded rapidly, with global sales increasing by over 40% annually in recent years. Within this sector, lithium phosphate batteries are gaining market share, especially in mass-market vehicles where cost considerations outweigh energy density requirements.

Geographically, China currently dominates the lithium phosphate market, accounting for approximately 70% of global production capacity. However, significant investments are being made in North America and Europe to develop regional supply chains, driven by energy security concerns and government incentives for domestic manufacturing.

The renewable energy integration sector presents perhaps the most promising growth opportunity for lithium phosphate technology. As wind and solar deployment accelerates globally, the need for grid-scale storage solutions has become critical. Lithium phosphate batteries are increasingly the technology of choice for these applications due to their longer cycle life, improved safety characteristics, and declining costs.

Industrial and commercial energy users represent another expanding market segment, with businesses increasingly deploying behind-the-meter storage to reduce peak demand charges, improve resilience, and meet sustainability goals. This sector is expected to grow at 30% annually through 2025, with lithium phosphate capturing a significant portion of new installations.

Market forecasts suggest that raw material constraints may impact the broader lithium battery industry, potentially creating supply bottlenecks. However, lithium phosphate chemistry requires less cobalt and nickel than competing technologies, potentially giving it a competitive advantage as these materials face supply constraints and price volatility.

Market analysis indicates that the global energy storage market is projected to grow at a compound annual growth rate of 20-25% through 2030, with lithium phosphate batteries capturing an increasing share due to their safety profile and cost advantages. This growth is particularly evident in utility-scale storage applications, where lithium phosphate technology is displacing traditional lead-acid batteries and competing effectively with other lithium-ion chemistries.

Consumer demand for electric vehicles represents another significant market driver for lithium phosphate batteries. The EV market has expanded rapidly, with global sales increasing by over 40% annually in recent years. Within this sector, lithium phosphate batteries are gaining market share, especially in mass-market vehicles where cost considerations outweigh energy density requirements.

Geographically, China currently dominates the lithium phosphate market, accounting for approximately 70% of global production capacity. However, significant investments are being made in North America and Europe to develop regional supply chains, driven by energy security concerns and government incentives for domestic manufacturing.

The renewable energy integration sector presents perhaps the most promising growth opportunity for lithium phosphate technology. As wind and solar deployment accelerates globally, the need for grid-scale storage solutions has become critical. Lithium phosphate batteries are increasingly the technology of choice for these applications due to their longer cycle life, improved safety characteristics, and declining costs.

Industrial and commercial energy users represent another expanding market segment, with businesses increasingly deploying behind-the-meter storage to reduce peak demand charges, improve resilience, and meet sustainability goals. This sector is expected to grow at 30% annually through 2025, with lithium phosphate capturing a significant portion of new installations.

Market forecasts suggest that raw material constraints may impact the broader lithium battery industry, potentially creating supply bottlenecks. However, lithium phosphate chemistry requires less cobalt and nickel than competing technologies, potentially giving it a competitive advantage as these materials face supply constraints and price volatility.

Global Lithium Phosphate Development Status and Barriers

Lithium phosphate technology has evolved significantly over the past decade, becoming a cornerstone in global energy transition efforts. Currently, the global development of lithium phosphate faces a complex landscape characterized by uneven resource distribution, technological maturity variations, and regulatory disparities across regions. China dominates the market with approximately 70% of global lithium phosphate production capacity, followed by significant but smaller contributions from North America, Europe, and emerging markets in South America and Australia.

The primary technical barriers in lithium phosphate development include energy density limitations, which remain 20-30% lower than nickel-based alternatives, restricting their application in high-performance sectors. Cycling stability at extreme temperatures continues to challenge researchers, with performance degradation observed below -10°C and above 55°C. Manufacturing scalability presents another significant hurdle, as current production processes involve complex synthesis routes requiring precise control of reaction parameters.

Resource constraints represent a critical barrier, with lithium supply chains facing volatility and phosphate rock reserves concentrated in specific geographical regions. This concentration creates geopolitical dependencies and supply vulnerabilities. Additionally, recycling infrastructure remains underdeveloped, with current recovery rates for lithium from spent batteries hovering around 50-60%, significantly lower than the theoretical maximum.

Regulatory frameworks across different regions create a fragmented compliance landscape. While the European Union has implemented stringent battery passport regulations and carbon footprint requirements, the United States focuses on domestic supply chain development through the Inflation Reduction Act. Meanwhile, China's policies emphasize production scale and vertical integration, creating different development trajectories in each region.

Investment disparities also impact global development, with venture capital and corporate R&D funding heavily concentrated in established markets. Emerging economies face significant capital access challenges despite often possessing substantial raw material reserves. This creates an innovation gap that slows global technology diffusion and adoption.

Standardization issues further complicate the landscape, with competing battery management systems, charging protocols, and safety standards creating market fragmentation. The lack of unified global standards increases manufacturing complexity and raises barriers to entry for new market participants, ultimately slowing the pace of innovation and commercial deployment of lithium phosphate technologies in energy transition applications.

The primary technical barriers in lithium phosphate development include energy density limitations, which remain 20-30% lower than nickel-based alternatives, restricting their application in high-performance sectors. Cycling stability at extreme temperatures continues to challenge researchers, with performance degradation observed below -10°C and above 55°C. Manufacturing scalability presents another significant hurdle, as current production processes involve complex synthesis routes requiring precise control of reaction parameters.

Resource constraints represent a critical barrier, with lithium supply chains facing volatility and phosphate rock reserves concentrated in specific geographical regions. This concentration creates geopolitical dependencies and supply vulnerabilities. Additionally, recycling infrastructure remains underdeveloped, with current recovery rates for lithium from spent batteries hovering around 50-60%, significantly lower than the theoretical maximum.

Regulatory frameworks across different regions create a fragmented compliance landscape. While the European Union has implemented stringent battery passport regulations and carbon footprint requirements, the United States focuses on domestic supply chain development through the Inflation Reduction Act. Meanwhile, China's policies emphasize production scale and vertical integration, creating different development trajectories in each region.

Investment disparities also impact global development, with venture capital and corporate R&D funding heavily concentrated in established markets. Emerging economies face significant capital access challenges despite often possessing substantial raw material reserves. This creates an innovation gap that slows global technology diffusion and adoption.

Standardization issues further complicate the landscape, with competing battery management systems, charging protocols, and safety standards creating market fragmentation. The lack of unified global standards increases manufacturing complexity and raises barriers to entry for new market participants, ultimately slowing the pace of innovation and commercial deployment of lithium phosphate technologies in energy transition applications.

Current Lithium Phosphate Battery Solutions

01 Lithium iron phosphate battery manufacturing methods

Various manufacturing methods for lithium iron phosphate (LiFePO4) batteries that improve performance characteristics such as energy density, cycle life, and charging efficiency. These methods include specific synthesis techniques, coating processes, and material modifications that enhance the electrochemical properties of the cathode material. The manufacturing processes focus on optimizing particle size, crystallinity, and uniformity to achieve better battery performance.- Lithium iron phosphate battery manufacturing methods: Various manufacturing methods for lithium iron phosphate (LiFePO4) batteries that improve performance characteristics such as energy density, cycle life, and charging efficiency. These methods include specialized coating techniques, doping processes, and novel synthesis approaches that enhance the electrochemical properties of the cathode material. The manufacturing innovations address common challenges like low electronic conductivity and slow lithium-ion diffusion in LiFePO4 materials.

- Lithium phosphate electrolyte compositions: Development of advanced electrolyte formulations containing lithium phosphate compounds that improve battery safety and performance. These electrolyte compositions enhance ionic conductivity, form stable solid-electrolyte interfaces, and provide better thermal stability. The formulations may include various lithium phosphate salts, additives, and solvents designed to optimize the electrochemical performance while reducing flammability and improving the overall safety profile of lithium-ion batteries.

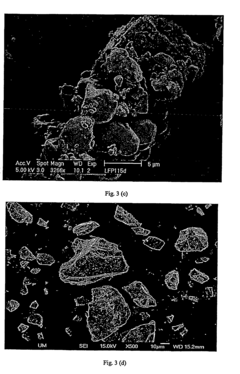

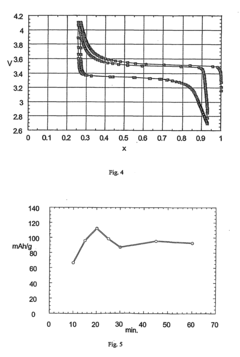

- Lithium phosphate synthesis and material processing: Methods for synthesizing and processing lithium phosphate materials with controlled morphology, particle size, and crystallinity. These processes include hydrothermal synthesis, solid-state reactions, sol-gel methods, and various post-synthesis treatments. The techniques focus on producing high-purity lithium phosphate compounds with specific physical and chemical properties tailored for battery applications, including improved capacity, rate capability, and cycling stability.

- Lithium phosphate composite materials and coatings: Development of composite materials and coating technologies incorporating lithium phosphate compounds to enhance battery performance. These include carbon-coated lithium phosphate particles, core-shell structures, and hybrid materials combining lithium phosphate with other active materials. The composite approach addresses limitations of pure lithium phosphate materials by improving electronic conductivity, structural stability, and rate capability while maintaining the inherent safety advantages of lithium phosphate chemistry.

- Lithium phosphate applications in solid-state batteries: Utilization of lithium phosphate materials in solid-state battery technologies as solid electrolytes, electrode materials, or interface modifiers. These applications leverage the ionic conductivity and electrochemical stability of lithium phosphate compounds to develop safer, higher-energy-density batteries without liquid electrolytes. The research focuses on overcoming interface resistance issues, improving manufacturing processes, and enhancing the overall performance of solid-state batteries using lithium phosphate-based components.

02 Lithium phosphate electrolyte compositions

Development of specialized electrolyte compositions containing lithium phosphate compounds that improve battery safety, stability, and performance. These electrolytes may include additives, solvents, and lithium salts formulated to enhance ionic conductivity, reduce interface resistance, and prevent unwanted side reactions. The electrolyte compositions are designed to work effectively across a wide temperature range and extend battery lifespan.Expand Specific Solutions03 Lithium phosphate material synthesis and modification

Innovative methods for synthesizing and modifying lithium phosphate materials with specific properties for energy storage applications. These techniques include hydrothermal synthesis, solid-state reactions, sol-gel methods, and various doping strategies to enhance conductivity and structural stability. The modifications aim to overcome inherent limitations of lithium phosphate materials such as low electronic conductivity while maintaining their thermal stability advantages.Expand Specific Solutions04 Advanced lithium phosphate composite cathode materials

Development of composite cathode materials incorporating lithium phosphate compounds with other materials such as carbon, conductive polymers, or metal oxides to enhance performance. These composite structures improve electron transport, structural integrity, and electrochemical activity. The composite approach addresses limitations of pure lithium phosphate materials while maintaining their inherent safety advantages and environmental benefits.Expand Specific Solutions05 Lithium phosphate applications in solid-state batteries

Utilization of lithium phosphate materials in solid-state battery technologies as solid electrolytes, electrode materials, or interface layers. These applications leverage the stability and safety of lithium phosphate compounds to enable next-generation battery designs with higher energy density and improved safety profiles. The solid-state configurations eliminate flammable liquid electrolytes while potentially offering faster charging capabilities and longer cycle life.Expand Specific Solutions

Leading Companies in Lithium Phosphate Industry

The lithium phosphate market is experiencing rapid growth within the energy transition sector, currently in an expansion phase with increasing market adoption. The global market size is projected to reach significant scale due to rising demand for electric vehicles and energy storage systems. Technologically, the field shows varying maturity levels across players. Industry leaders like A123 Systems, CATL (Ningde Amperex), and Guoxuan High-Tech have established advanced manufacturing capabilities for LFP batteries, while companies such as BASF, Johnson Matthey, and Saft are advancing material innovations. Research institutions including CNRS and Rutgers University contribute fundamental breakthroughs, creating a competitive landscape balanced between established manufacturers and emerging technology developers focused on improving energy density and cycle life.

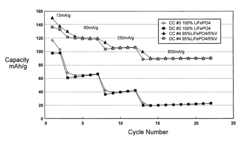

A123 Systems LLC

Technical Solution: A123 Systems pioneered commercial-scale lithium iron phosphate (LFP) battery technology with their proprietary Nanophosphate® technology. Their approach involves nano-scale engineering of lithium phosphate materials to create cathodes with higher power density and improved thermal stability. The company's LFP cells feature a unique doped nanoscale phosphate cathode material that enables faster lithium ion transport and higher electrical conductivity compared to conventional LFP materials. Their cylindrical and prismatic cell designs incorporate advanced safety features including specialized current collectors and separator technologies that prevent thermal runaway even under extreme conditions. A123's energy storage systems have been deployed in grid stabilization projects across multiple continents, demonstrating the scalability of their LFP technology for renewable energy integration.

Strengths: Superior safety profile with virtually no thermal runaway risk; exceptional cycle life (>7,000 cycles at 100% DOD); excellent power capability and fast-charging performance; stable supply chain with reduced cobalt dependency. Weaknesses: Lower energy density compared to NMC/NCA chemistries (approximately 140-160 Wh/kg vs. 200+ Wh/kg); higher initial manufacturing costs; temperature-sensitive performance requiring thermal management systems.

Hefei Guoxuan High-Tech Power Energy Co., Ltd.

Technical Solution: Guoxuan High-Tech has developed a comprehensive LFP technology platform centered around their Semi-Solid State Battery (SSSB) architecture. This innovative approach incorporates high-viscosity gel electrolytes that improve energy density while maintaining LFP's inherent safety advantages. Their manufacturing process employs precision-controlled co-precipitation techniques that yield highly uniform LFP particles with optimized morphology and surface characteristics. Guoxuan's cell design features a unique "sandwich" electrode structure that maximizes active material loading while maintaining excellent rate capability. Their proprietary surface coating technology creates a nanoscale protective layer on LFP particles that significantly improves cycling stability and calendar life. Guoxuan has also pioneered large-format prismatic cells specifically designed for commercial vehicles and stationary storage applications, with capacities exceeding 300Ah per cell. Their integrated thermal management systems employ phase-change materials that maintain optimal operating temperatures with minimal energy consumption.

Strengths: Cost-effective manufacturing with production costs below $70/kWh; specialized expertise in large-format cells for commercial vehicles; strong domestic supply chain integration; government support enabling rapid capacity expansion. Weaknesses: Limited international presence and brand recognition; potential intellectual property challenges in global markets; less extensive validation history compared to industry leaders.

Key Patents and Innovations in Lithium Phosphate Chemistry

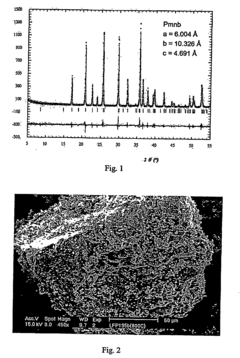

Lithium transition-metal phosphate powder for rechargeable batteries

PatentInactiveUS20040175614A1

Innovation

- A new synthesis technique involving an equimolar aqueous solution of Li+ and M+ ions with PO43- that decomposes below 500°C, followed by annealing under inert or reducing atmospheres at temperatures below 800°C, allowing for the production of LiMPO4 powders with controlled particle sizes and improved homogeneity, using cost-effective FeIII sources like Fe(NO3)9H2O, and optimizing the LiFePO4 particle size to less than 1 μm for enhanced performance.

Electrode material with enhanced ionic transport properties

PatentActiveUS7842420B2

Innovation

- A method for synthesizing a metal phosphate material with enhanced lithium ion conductivity by incorporating an additive such as V, Nb, or C into a starting mixture of lithium, a metal, and phosphate, and heating it in a reducing environment to produce a two-phase material with improved electronic and ionic conductivities.

Supply Chain Resilience and Raw Material Considerations

The global lithium phosphate supply chain represents a critical component in the energy transition landscape, with significant implications for the resilience and sustainability of renewable energy technologies. Current supply chains exhibit notable vulnerabilities, particularly due to geographic concentration of raw materials. China dominates the lithium phosphate processing sector, controlling approximately 60% of global production capacity, while Australia, Chile, and Argentina collectively account for over 75% of lithium extraction. This concentration creates inherent geopolitical risks and potential bottlenecks during periods of high demand.

Material availability presents another significant challenge, with projections indicating that lithium demand could increase by 400-500% by 2030 as electric vehicle adoption accelerates. Phosphate resources, while more geographically distributed than lithium, face competing demands from agricultural sectors, potentially creating cross-industry supply tensions. These factors contribute to price volatility, as evidenced by lithium carbonate price fluctuations exceeding 300% between 2020 and 2022.

Environmental and social considerations further complicate supply chain resilience. Conventional lithium extraction methods consume substantial water resources—approximately 500,000 gallons per ton of lithium—creating sustainability challenges in water-stressed regions. Additionally, mining operations often impact local communities, raising ethical sourcing concerns that increasingly influence corporate procurement strategies and regulatory frameworks.

Industry leaders are implementing several strategies to enhance supply chain resilience. Vertical integration has emerged as a prominent approach, with companies like Tesla and CATL investing directly in mining operations to secure material access. Material diversification represents another key strategy, with research into sodium-ion and solid-state technologies offering potential pathways to reduce lithium dependency. Recycling initiatives are also gaining momentum, with advanced recovery processes now capable of reclaiming up to 95% of lithium and phosphate materials from end-of-life batteries.

Regulatory frameworks increasingly shape supply chain development, with the EU Battery Directive and US Inflation Reduction Act establishing incentives for domestic production and sustainable sourcing. These policies aim to reduce dependency on concentrated supply regions while promoting environmental standards throughout the value chain. The implementation of blockchain-based traceability systems further supports these objectives by enhancing transparency regarding material origins and processing conditions.

Material availability presents another significant challenge, with projections indicating that lithium demand could increase by 400-500% by 2030 as electric vehicle adoption accelerates. Phosphate resources, while more geographically distributed than lithium, face competing demands from agricultural sectors, potentially creating cross-industry supply tensions. These factors contribute to price volatility, as evidenced by lithium carbonate price fluctuations exceeding 300% between 2020 and 2022.

Environmental and social considerations further complicate supply chain resilience. Conventional lithium extraction methods consume substantial water resources—approximately 500,000 gallons per ton of lithium—creating sustainability challenges in water-stressed regions. Additionally, mining operations often impact local communities, raising ethical sourcing concerns that increasingly influence corporate procurement strategies and regulatory frameworks.

Industry leaders are implementing several strategies to enhance supply chain resilience. Vertical integration has emerged as a prominent approach, with companies like Tesla and CATL investing directly in mining operations to secure material access. Material diversification represents another key strategy, with research into sodium-ion and solid-state technologies offering potential pathways to reduce lithium dependency. Recycling initiatives are also gaining momentum, with advanced recovery processes now capable of reclaiming up to 95% of lithium and phosphate materials from end-of-life batteries.

Regulatory frameworks increasingly shape supply chain development, with the EU Battery Directive and US Inflation Reduction Act establishing incentives for domestic production and sustainable sourcing. These policies aim to reduce dependency on concentrated supply regions while promoting environmental standards throughout the value chain. The implementation of blockchain-based traceability systems further supports these objectives by enhancing transparency regarding material origins and processing conditions.

Environmental Impact Assessment of Lithium Phosphate Technologies

The environmental impact of lithium phosphate technologies represents a critical consideration in the broader context of energy transition efforts. Lithium iron phosphate (LFP) batteries, while offering significant advantages for sustainable energy storage, present complex environmental trade-offs that warrant comprehensive assessment.

Mining operations for lithium and phosphate raw materials create substantial ecological footprints. Open-pit mining for lithium disrupts landscapes, while phosphate extraction can lead to habitat destruction and water contamination. Recent studies indicate that lithium mining consumes approximately 2,000 liters of water per kilogram of lithium produced in water-scarce regions, creating significant hydrological stress in extraction areas such as the South American "Lithium Triangle."

Processing these materials involves energy-intensive procedures that generate considerable carbon emissions. The refining of lithium phosphate compounds typically requires temperatures exceeding 800°C, contributing to the carbon footprint of battery production. However, comparative lifecycle analyses demonstrate that LFP batteries generally produce 30-40% lower greenhouse gas emissions than conventional nickel-manganese-cobalt (NMC) alternatives when considering full production cycles.

Waste management presents another significant environmental challenge. While LFP batteries contain fewer toxic heavy metals than other lithium-ion variants, their disposal and recycling infrastructure remains underdeveloped. Current recycling rates for lithium phosphate batteries hover around 5% globally, substantially lower than the technical potential of 90%+ recovery rates demonstrated in laboratory settings.

Water usage throughout the LFP battery lifecycle represents a particular concern. Beyond mining impacts, manufacturing processes require substantial water inputs for cooling, cleaning, and chemical processing. Recent industrial data suggests production facilities consume between 7-15 cubic meters of water per MWh of battery capacity produced, though advanced facilities implementing closed-loop systems have demonstrated potential reductions of up to 60%.

Land use changes associated with lithium phosphate supply chains also merit consideration. Satellite imagery analysis from major production regions indicates conversion of approximately 2,000 hectares of natural landscapes annually to support expanding extraction operations. These changes affect biodiversity, carbon sequestration capacity, and ecosystem services in production regions.

Despite these challenges, technological innovations are improving the environmental profile of lithium phosphate technologies. Advancements in hydrometallurgical processing, direct lithium extraction techniques, and water-efficient manufacturing processes promise to reduce environmental impacts by 40-60% over the next decade, according to industry projections and research initiatives.

Mining operations for lithium and phosphate raw materials create substantial ecological footprints. Open-pit mining for lithium disrupts landscapes, while phosphate extraction can lead to habitat destruction and water contamination. Recent studies indicate that lithium mining consumes approximately 2,000 liters of water per kilogram of lithium produced in water-scarce regions, creating significant hydrological stress in extraction areas such as the South American "Lithium Triangle."

Processing these materials involves energy-intensive procedures that generate considerable carbon emissions. The refining of lithium phosphate compounds typically requires temperatures exceeding 800°C, contributing to the carbon footprint of battery production. However, comparative lifecycle analyses demonstrate that LFP batteries generally produce 30-40% lower greenhouse gas emissions than conventional nickel-manganese-cobalt (NMC) alternatives when considering full production cycles.

Waste management presents another significant environmental challenge. While LFP batteries contain fewer toxic heavy metals than other lithium-ion variants, their disposal and recycling infrastructure remains underdeveloped. Current recycling rates for lithium phosphate batteries hover around 5% globally, substantially lower than the technical potential of 90%+ recovery rates demonstrated in laboratory settings.

Water usage throughout the LFP battery lifecycle represents a particular concern. Beyond mining impacts, manufacturing processes require substantial water inputs for cooling, cleaning, and chemical processing. Recent industrial data suggests production facilities consume between 7-15 cubic meters of water per MWh of battery capacity produced, though advanced facilities implementing closed-loop systems have demonstrated potential reductions of up to 60%.

Land use changes associated with lithium phosphate supply chains also merit consideration. Satellite imagery analysis from major production regions indicates conversion of approximately 2,000 hectares of natural landscapes annually to support expanding extraction operations. These changes affect biodiversity, carbon sequestration capacity, and ecosystem services in production regions.

Despite these challenges, technological innovations are improving the environmental profile of lithium phosphate technologies. Advancements in hydrometallurgical processing, direct lithium extraction techniques, and water-efficient manufacturing processes promise to reduce environmental impacts by 40-60% over the next decade, according to industry projections and research initiatives.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!