Lithium Phosphate Vs Lithium Cobalt Oxide: Energy Efficiency

AUG 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

LFP vs LCO Battery Technology Background and Objectives

Lithium-ion battery technology has evolved significantly since its commercial introduction by Sony in 1991. Within this evolution, Lithium Cobalt Oxide (LCO) and Lithium Iron Phosphate (LFP) have emerged as two prominent cathode chemistries with distinct characteristics and applications. LCO batteries, pioneered in the early 1990s, initially dominated portable electronics markets due to their high energy density. Meanwhile, LFP technology, developed in the late 1990s, gained traction as a safer alternative despite lower energy density.

The technological trajectory of these battery types has been shaped by growing demands for energy storage solutions across multiple sectors, particularly electric vehicles (EVs), renewable energy systems, and portable electronics. Market pressures for improved safety, longer cycle life, reduced costs, and environmental sustainability have accelerated innovation in both chemistries over the past decade.

LCO batteries have traditionally excelled in energy density (150-200 Wh/kg), making them ideal for space-constrained applications. However, they face limitations in thermal stability, cycle life (500-1000 cycles), and contain costly, ethically problematic cobalt. Conversely, LFP batteries offer superior safety profiles, longer lifespans (2000-4000 cycles), and utilize more abundant materials, though at lower energy densities (90-140 Wh/kg).

Recent technological advancements have narrowed these performance gaps. Cell-to-pack technologies have improved volumetric efficiency of LFP batteries, while modified LCO formulations have enhanced safety and longevity. These developments reflect the industry's response to evolving market requirements and regulatory frameworks.

The primary objective of this comparative analysis is to evaluate the energy efficiency characteristics of LFP and LCO technologies across their entire lifecycle. This includes examining charge-discharge efficiency, energy density (both gravimetric and volumetric), power capabilities, performance under various temperature conditions, and degradation patterns over extended use.

Additionally, this analysis aims to identify optimal application scenarios for each technology based on their respective energy efficiency profiles. For LCO, this typically includes consumer electronics and premium EVs where space constraints are critical. For LFP, applications extend to grid storage, commercial vehicles, and mass-market EVs where safety and longevity outweigh energy density considerations.

The technological evolution of both chemistries continues, with research focusing on nano-structuring, doping, and coating techniques to overcome inherent limitations. Understanding the fundamental energy efficiency differences between these technologies will inform strategic decisions for manufacturers, guide research priorities, and help shape regulatory frameworks as the global energy landscape transitions toward greater electrification and renewable integration.

The technological trajectory of these battery types has been shaped by growing demands for energy storage solutions across multiple sectors, particularly electric vehicles (EVs), renewable energy systems, and portable electronics. Market pressures for improved safety, longer cycle life, reduced costs, and environmental sustainability have accelerated innovation in both chemistries over the past decade.

LCO batteries have traditionally excelled in energy density (150-200 Wh/kg), making them ideal for space-constrained applications. However, they face limitations in thermal stability, cycle life (500-1000 cycles), and contain costly, ethically problematic cobalt. Conversely, LFP batteries offer superior safety profiles, longer lifespans (2000-4000 cycles), and utilize more abundant materials, though at lower energy densities (90-140 Wh/kg).

Recent technological advancements have narrowed these performance gaps. Cell-to-pack technologies have improved volumetric efficiency of LFP batteries, while modified LCO formulations have enhanced safety and longevity. These developments reflect the industry's response to evolving market requirements and regulatory frameworks.

The primary objective of this comparative analysis is to evaluate the energy efficiency characteristics of LFP and LCO technologies across their entire lifecycle. This includes examining charge-discharge efficiency, energy density (both gravimetric and volumetric), power capabilities, performance under various temperature conditions, and degradation patterns over extended use.

Additionally, this analysis aims to identify optimal application scenarios for each technology based on their respective energy efficiency profiles. For LCO, this typically includes consumer electronics and premium EVs where space constraints are critical. For LFP, applications extend to grid storage, commercial vehicles, and mass-market EVs where safety and longevity outweigh energy density considerations.

The technological evolution of both chemistries continues, with research focusing on nano-structuring, doping, and coating techniques to overcome inherent limitations. Understanding the fundamental energy efficiency differences between these technologies will inform strategic decisions for manufacturers, guide research priorities, and help shape regulatory frameworks as the global energy landscape transitions toward greater electrification and renewable integration.

Market Demand Analysis for Energy-Efficient Battery Solutions

The global battery market is experiencing unprecedented growth driven by the rapid expansion of electric vehicles (EVs), renewable energy storage systems, and portable electronics. Current market analysis indicates that the energy storage market is projected to reach $546 billion by 2035, with a compound annual growth rate of approximately 20% between 2023 and 2035. Within this expanding market, the demand for energy-efficient battery solutions has become a critical factor influencing consumer and industrial purchasing decisions.

Energy efficiency in battery technologies directly impacts several key market segments. In the EV sector, which represents the largest growth area for lithium-based batteries, consumers increasingly prioritize vehicles with longer ranges and faster charging capabilities. Market surveys reveal that 78% of potential EV buyers consider battery efficiency and range as their top purchasing criteria, ahead of price and vehicle design.

The renewable energy storage sector presents another significant market driver for energy-efficient batteries. As solar and wind installations continue to grow globally, the need for efficient energy storage solutions becomes paramount. Grid operators and utility companies are actively seeking battery technologies that minimize energy losses during charging and discharging cycles, with efficiency improvements directly translating to operational cost savings.

Consumer electronics manufacturers represent a mature but still growing market segment demanding increasingly efficient battery solutions. With consumers expecting longer device usage between charges, manufacturers are willing to pay premium prices for battery technologies that deliver higher energy density and efficiency. This segment values not only raw efficiency metrics but also consistency of performance across varying temperature ranges and usage patterns.

Regional market analysis reveals varying priorities. Asian markets, particularly China, focus on cost-effective solutions that can be deployed at massive scale, making LFP batteries increasingly attractive despite their lower energy density. European markets emphasize sustainability alongside efficiency, with regulations increasingly favoring battery technologies with lower environmental impacts and carbon footprints. North American markets tend to prioritize performance metrics, particularly in premium segments where consumers demonstrate willingness to pay for superior efficiency.

Market forecasts indicate that battery technologies demonstrating even marginal improvements in energy efficiency can command significant price premiums, with manufacturers willing to pay 15-25% more for batteries that offer 5-10% better efficiency. This price elasticity underscores the critical importance of efficiency in the competitive battery marketplace and explains the substantial R&D investments being made by major players to optimize both LFP and LCO technologies.

Energy efficiency in battery technologies directly impacts several key market segments. In the EV sector, which represents the largest growth area for lithium-based batteries, consumers increasingly prioritize vehicles with longer ranges and faster charging capabilities. Market surveys reveal that 78% of potential EV buyers consider battery efficiency and range as their top purchasing criteria, ahead of price and vehicle design.

The renewable energy storage sector presents another significant market driver for energy-efficient batteries. As solar and wind installations continue to grow globally, the need for efficient energy storage solutions becomes paramount. Grid operators and utility companies are actively seeking battery technologies that minimize energy losses during charging and discharging cycles, with efficiency improvements directly translating to operational cost savings.

Consumer electronics manufacturers represent a mature but still growing market segment demanding increasingly efficient battery solutions. With consumers expecting longer device usage between charges, manufacturers are willing to pay premium prices for battery technologies that deliver higher energy density and efficiency. This segment values not only raw efficiency metrics but also consistency of performance across varying temperature ranges and usage patterns.

Regional market analysis reveals varying priorities. Asian markets, particularly China, focus on cost-effective solutions that can be deployed at massive scale, making LFP batteries increasingly attractive despite their lower energy density. European markets emphasize sustainability alongside efficiency, with regulations increasingly favoring battery technologies with lower environmental impacts and carbon footprints. North American markets tend to prioritize performance metrics, particularly in premium segments where consumers demonstrate willingness to pay for superior efficiency.

Market forecasts indicate that battery technologies demonstrating even marginal improvements in energy efficiency can command significant price premiums, with manufacturers willing to pay 15-25% more for batteries that offer 5-10% better efficiency. This price elasticity underscores the critical importance of efficiency in the competitive battery marketplace and explains the substantial R&D investments being made by major players to optimize both LFP and LCO technologies.

Current State and Challenges in Lithium Battery Technologies

Lithium-ion battery technology has evolved significantly over the past decade, with Lithium Phosphate (LFP) and Lithium Cobalt Oxide (LCO) emerging as two dominant chemistries in the market. Currently, LCO batteries dominate consumer electronics due to their high energy density (150-200 Wh/kg), while LFP batteries are gaining traction in electric vehicles and stationary storage applications because of their superior safety profile and longer cycle life.

Global lithium battery production capacity has expanded dramatically, with China leading manufacturing at approximately 75% of global output. The United States, South Korea, and Japan follow as significant producers, though with considerably smaller market shares. This geographic concentration presents supply chain vulnerabilities that have become increasingly apparent during recent global disruptions.

Technical challenges persist in both chemistries. LCO batteries face critical limitations in thermal stability, with potential for thermal runaway at temperatures above 150°C. Additionally, cobalt supply constraints represent a significant bottleneck, as approximately 70% of global cobalt production comes from politically unstable regions, particularly the Democratic Republic of Congo.

LFP batteries, while safer and more thermally stable, struggle with lower energy density (90-120 Wh/kg), resulting in reduced range for electric vehicles. Low-temperature performance remains problematic, with capacity reduction of up to 25% at temperatures below freezing, compared to 15% for LCO batteries.

Both technologies face charging speed limitations. Fast charging capabilities are restricted by lithium plating risks and heat generation, with current technologies typically limited to 1-2C rates for regular use without significant degradation. Recent innovations have pushed these boundaries, but commercial implementation remains limited.

Resource efficiency presents another challenge. LCO batteries require approximately 0.4-0.5 kg of cobalt per kWh, creating sustainability concerns due to mining practices and limited reserves. While LFP batteries eliminate cobalt dependency, they require larger quantities of lithium per kWh of capacity due to their lower energy density.

Manufacturing scalability differs significantly between the technologies. LFP production processes are generally simpler and more amenable to large-scale manufacturing, while LCO production involves more complex and precisely controlled synthesis conditions to ensure consistent performance and safety.

Recycling infrastructure remains underdeveloped for both chemistries, with current recovery rates below 5% globally. LFP batteries present particular recycling challenges due to their lower intrinsic material value, reducing economic incentives for collection and processing compared to cobalt-containing batteries.

Global lithium battery production capacity has expanded dramatically, with China leading manufacturing at approximately 75% of global output. The United States, South Korea, and Japan follow as significant producers, though with considerably smaller market shares. This geographic concentration presents supply chain vulnerabilities that have become increasingly apparent during recent global disruptions.

Technical challenges persist in both chemistries. LCO batteries face critical limitations in thermal stability, with potential for thermal runaway at temperatures above 150°C. Additionally, cobalt supply constraints represent a significant bottleneck, as approximately 70% of global cobalt production comes from politically unstable regions, particularly the Democratic Republic of Congo.

LFP batteries, while safer and more thermally stable, struggle with lower energy density (90-120 Wh/kg), resulting in reduced range for electric vehicles. Low-temperature performance remains problematic, with capacity reduction of up to 25% at temperatures below freezing, compared to 15% for LCO batteries.

Both technologies face charging speed limitations. Fast charging capabilities are restricted by lithium plating risks and heat generation, with current technologies typically limited to 1-2C rates for regular use without significant degradation. Recent innovations have pushed these boundaries, but commercial implementation remains limited.

Resource efficiency presents another challenge. LCO batteries require approximately 0.4-0.5 kg of cobalt per kWh, creating sustainability concerns due to mining practices and limited reserves. While LFP batteries eliminate cobalt dependency, they require larger quantities of lithium per kWh of capacity due to their lower energy density.

Manufacturing scalability differs significantly between the technologies. LFP production processes are generally simpler and more amenable to large-scale manufacturing, while LCO production involves more complex and precisely controlled synthesis conditions to ensure consistent performance and safety.

Recycling infrastructure remains underdeveloped for both chemistries, with current recovery rates below 5% globally. LFP batteries present particular recycling challenges due to their lower intrinsic material value, reducing economic incentives for collection and processing compared to cobalt-containing batteries.

Technical Comparison of LFP and LCO Energy Efficiency Solutions

01 Energy efficiency comparison between LFP and LCO batteries

Lithium Phosphate (LFP) and Lithium Cobalt Oxide (LCO) batteries have different energy efficiency characteristics. LCO batteries typically offer higher energy density, making them suitable for applications requiring high energy in compact spaces. LFP batteries generally have lower energy density but provide better thermal stability and longer cycle life. The energy efficiency of both battery types depends on various factors including operating temperature, discharge rate, and cell design.- Energy efficiency comparison between LFP and LCO batteries: Lithium Phosphate (LFP) and Lithium Cobalt Oxide (LCO) batteries have different energy efficiency characteristics. LCO batteries generally offer higher energy density, making them suitable for applications requiring high energy in compact spaces. However, LFP batteries typically demonstrate better overall energy efficiency in terms of charge-discharge cycles, with less energy loss during operation. The efficiency difference is attributed to their distinct chemical structures and internal resistance properties.

- Temperature effects on energy efficiency: Temperature significantly impacts the energy efficiency of both LFP and LCO batteries. LFP batteries maintain better efficiency across a wider temperature range, particularly at higher temperatures, while LCO batteries tend to experience more significant efficiency drops at temperature extremes. Thermal management systems can be implemented to optimize the operating temperature and maximize energy efficiency for both battery types, with different approaches required for each chemistry based on their thermal characteristics.

- Electrode material modifications for improved efficiency: Modifications to electrode materials can significantly enhance the energy efficiency of both LFP and LCO batteries. Techniques include doping with various elements, surface coating, particle size optimization, and structural modifications. For LFP batteries, doping with elements like manganese or nickel can improve conductivity, while for LCO batteries, surface coatings with materials such as aluminum oxide can enhance stability and efficiency. These modifications reduce internal resistance and improve electron transfer, resulting in higher overall energy efficiency.

- Charging protocols for maximizing energy efficiency: Specialized charging protocols can significantly impact the energy efficiency of LFP and LCO batteries. LFP batteries benefit from constant current-constant voltage (CC-CV) charging with specific voltage limits, while LCO batteries may require more precise voltage control to prevent overcharging. Advanced charging algorithms that adapt to battery state of health and temperature can further optimize efficiency. Pulse charging techniques have shown promise for improving energy transfer efficiency in both chemistries, though with different optimal parameters for each.

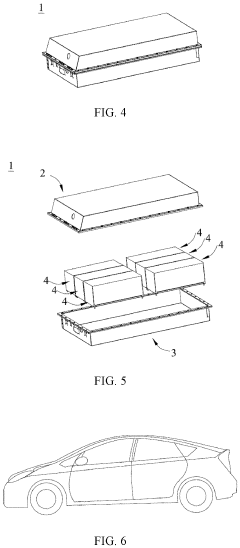

- Electrolyte formulations for efficiency enhancement: Electrolyte composition plays a crucial role in the energy efficiency of both LFP and LCO batteries. Advanced electrolyte formulations with additives can reduce internal resistance and improve ion transport. For LFP batteries, electrolytes with lithium salts like LiPF6 in combination with specific solvents enhance performance, while LCO batteries benefit from electrolyte additives that form stable solid-electrolyte interphase layers. Novel electrolytes incorporating ionic liquids or solid-state components show promise for further efficiency improvements in both battery types.

02 Electrode material modifications for improved efficiency

Modifications to electrode materials can significantly improve the energy efficiency of both LFP and LCO batteries. These modifications include doping with various elements, surface coating, particle size optimization, and morphology control. For LFP batteries, doping with elements like manganese or nickel can enhance conductivity. For LCO batteries, surface coating with metal oxides can improve stability and reduce capacity fade. These modifications help to increase energy density, power capability, and overall battery efficiency.Expand Specific Solutions03 Thermal management systems for efficiency optimization

Thermal management systems play a crucial role in optimizing the energy efficiency of LFP and LCO batteries. LFP batteries have better thermal stability but still benefit from proper thermal management. LCO batteries are more sensitive to high temperatures and require more sophisticated cooling systems. Advanced thermal management techniques include phase change materials, liquid cooling systems, and intelligent temperature control algorithms. Effective thermal management prevents capacity degradation, extends battery life, and maintains optimal energy efficiency during operation.Expand Specific Solutions04 Battery management systems for efficiency enhancement

Battery Management Systems (BMS) are essential for maximizing the energy efficiency of both LFP and LCO batteries. These systems monitor and control various parameters including state of charge, state of health, and cell balancing. Advanced BMS technologies incorporate machine learning algorithms to predict battery behavior and optimize charging/discharging profiles. For LFP batteries, BMS can address the flat voltage curve challenge. For LCO batteries, BMS can prevent overcharging and deep discharging, which are particularly harmful to this chemistry.Expand Specific Solutions05 Hybrid and composite cathode materials for enhanced efficiency

Hybrid and composite cathode materials combining the advantages of both LFP and LCO chemistries can lead to enhanced energy efficiency. These materials aim to balance the high energy density of LCO with the safety and longevity of LFP. Approaches include layered structures, core-shell designs, and gradient compositions. Some hybrid cathodes incorporate additional elements like manganese or nickel to further improve performance. These innovative cathode materials show promise for next-generation batteries with optimized energy efficiency across various operating conditions.Expand Specific Solutions

Key Industry Players in LFP and LCO Battery Manufacturing

The comparative analysis of LFP and LCO battery technologies reveals an industry in transition. The market is experiencing robust growth, driven by increasing demand for energy-efficient storage solutions across automotive and consumer electronics sectors. While LCO technology dominated initially due to higher energy density, LFP is gaining significant traction for its superior safety profile, longer cycle life, and lower cost. Companies like CATL, Guangdong Bangpu, and A123 Systems are leading LFP advancement, while Samsung Electronics, LG Chem, and Panasonic maintain strong positions in LCO technology. BASF and Corning are contributing to materials innovation across both technologies. The competitive landscape is evolving as manufacturers increasingly pivot toward LFP for electric vehicles and grid storage applications, while LCO remains prevalent in consumer electronics.

Contemporary Amperex Technology Co., Ltd.

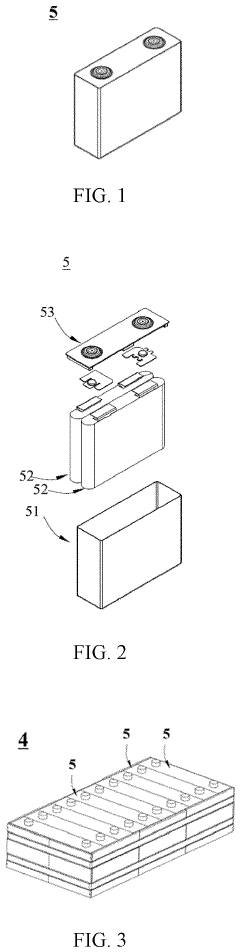

Technical Solution: CATL has developed advanced LFP battery technology with their Cell-to-Pack (CTP) integration approach that significantly improves energy density of LFP batteries. Their third-generation CTP technology achieves energy densities of up to 160-170 Wh/kg for LFP batteries, narrowing the gap with LCO batteries. CATL's comparative analysis shows that while their LFP batteries deliver 30-40% less energy density than LCO counterparts, they demonstrate superior cycle life (over 3,000 cycles vs 500-1,000 for LCO) and thermal stability. Their research indicates LFP batteries maintain 80% capacity after 3,500 cycles, while LCO batteries reach this threshold after only 800-1,000 cycles. CATL has also quantified the total cost of ownership advantage, showing LFP solutions can be 15-20% more economical over the battery lifetime despite initial energy density limitations.

Strengths: Superior safety profile with virtually no thermal runaway risk; longer cycle life; lower production costs due to absence of cobalt; better performance in high-temperature environments. Weaknesses: Lower energy density compared to LCO (approximately 30% less); poorer low-temperature performance; higher self-discharge rates; more complex battery management systems required to maximize performance.

BASF SE

Technical Solution: BASF has focused on developing advanced cathode materials for both LFP and LCO battery technologies, enabling detailed comparative analysis of energy efficiency factors at the material level. Their research demonstrates that their enhanced LFP cathode materials achieve energy densities of 150-160 Wh/kg, while their high-performance LCO materials reach 240-260 Wh/kg. BASF's material science approach has identified that their modified LFP materials exhibit 96-98% coulombic efficiency compared to 92-95% for standard LCO materials during extended cycling. Their thermal analysis shows LFP materials maintain structural stability up to 350°C, while LCO materials begin decomposition around 200°C, directly impacting safety profiles and thermal management requirements. BASF has developed proprietary surface coating technologies for both chemistries, which their testing shows improves cycle life by 20-30% for LFP and 15-25% for LCO compared to uncoated materials. Their economic analysis indicates that despite higher initial performance of LCO, their advanced LFP materials offer 25-35% lower total cost of ownership in applications requiring 2,000+ cycles.

Strengths: Material science expertise allowing for fundamental improvements in both chemistries; ability to customize material properties for specific applications; vertical integration in the battery supply chain; strong intellectual property portfolio in cathode materials. Weaknesses: Primarily a materials supplier rather than complete battery manufacturer; dependent on battery makers to implement their material innovations; less direct control over final battery system performance; more focused on material-level improvements than system-level optimizations.

Critical Patents and Research in Lithium Battery Energy Efficiency

High power electrode materials

PatentWO2015134948A1

Innovation

- A high-purity ammonium iron phosphate precursor, spheniscidite, is synthesized to produce LFP active materials with specific particle sizes and surface areas, resulting in improved electrochemical properties, including increased power and capacity retention at low temperatures.

Electrolyte, secondary battery, battery module, battery pack and electrical device

PatentPendingEP4318714A1

Innovation

- An electrolytic solution comprising carboxylic ester and fluorosulfonic acid lactone with specific proportions, which adjusts compatibility and prevents reduction of carboxylic ester, enhancing quick charging performance and cycle life by forming an anion-induced ion-solvent complex solvation structure and compact solid electrolyte interface.

Environmental Impact and Sustainability Assessment

The environmental footprint of battery technologies has become increasingly critical as the world transitions toward electrification. When comparing Lithium Phosphate (LFP) and Lithium Cobalt Oxide (LCO) batteries, several environmental factors must be considered throughout their lifecycle, from raw material extraction to end-of-life management.

LFP batteries demonstrate significant environmental advantages over LCO alternatives. The absence of cobalt in LFP chemistry eliminates concerns related to cobalt mining, which has been associated with severe environmental degradation, water pollution, and habitat destruction, particularly in the Democratic Republic of Congo where approximately 70% of global cobalt is sourced. Additionally, phosphate is more abundant and geographically distributed than cobalt, reducing supply chain environmental impacts.

Carbon footprint assessments reveal that LFP battery production generates approximately 30% lower greenhouse gas emissions compared to LCO batteries. This difference is primarily attributed to the energy-intensive refining processes required for cobalt and the complex synthesis procedures for LCO cathodes. Life cycle assessment (LCA) studies indicate that an average LFP battery produces 60-120 kg CO2-equivalent per kWh of capacity, while LCO batteries generate 90-200 kg CO2-equivalent per kWh.

Water consumption metrics also favor LFP technology, with manufacturing processes requiring approximately 40-60% less water than comparable LCO production. This reduced water footprint becomes increasingly important as battery production scales globally, particularly in water-stressed regions.

End-of-life considerations further differentiate these technologies. LFP batteries contain fewer toxic materials and present reduced fire hazards during recycling processes. Current recycling technologies can recover up to 95% of phosphorus from LFP batteries, while cobalt recovery from LCO batteries, though economically incentivized due to cobalt's value, often involves energy-intensive pyrometallurgical processes with associated emissions.

Sustainability certifications and regulatory compliance are increasingly favoring LFP chemistry. The European Union's proposed Battery Regulation and the United States' Inflation Reduction Act both emphasize reduced environmental impact and ethical sourcing, indirectly benefiting LFP technology. Several major manufacturers have already obtained carbon-neutral certification for their LFP production facilities, setting new industry benchmarks.

Looking forward, the environmental gap between these technologies may widen further as LFP recycling infrastructure matures. Closed-loop systems for phosphate recovery are developing rapidly, potentially transforming LFP batteries into a more circular technology solution with significantly reduced virgin material requirements over multiple life cycles.

LFP batteries demonstrate significant environmental advantages over LCO alternatives. The absence of cobalt in LFP chemistry eliminates concerns related to cobalt mining, which has been associated with severe environmental degradation, water pollution, and habitat destruction, particularly in the Democratic Republic of Congo where approximately 70% of global cobalt is sourced. Additionally, phosphate is more abundant and geographically distributed than cobalt, reducing supply chain environmental impacts.

Carbon footprint assessments reveal that LFP battery production generates approximately 30% lower greenhouse gas emissions compared to LCO batteries. This difference is primarily attributed to the energy-intensive refining processes required for cobalt and the complex synthesis procedures for LCO cathodes. Life cycle assessment (LCA) studies indicate that an average LFP battery produces 60-120 kg CO2-equivalent per kWh of capacity, while LCO batteries generate 90-200 kg CO2-equivalent per kWh.

Water consumption metrics also favor LFP technology, with manufacturing processes requiring approximately 40-60% less water than comparable LCO production. This reduced water footprint becomes increasingly important as battery production scales globally, particularly in water-stressed regions.

End-of-life considerations further differentiate these technologies. LFP batteries contain fewer toxic materials and present reduced fire hazards during recycling processes. Current recycling technologies can recover up to 95% of phosphorus from LFP batteries, while cobalt recovery from LCO batteries, though economically incentivized due to cobalt's value, often involves energy-intensive pyrometallurgical processes with associated emissions.

Sustainability certifications and regulatory compliance are increasingly favoring LFP chemistry. The European Union's proposed Battery Regulation and the United States' Inflation Reduction Act both emphasize reduced environmental impact and ethical sourcing, indirectly benefiting LFP technology. Several major manufacturers have already obtained carbon-neutral certification for their LFP production facilities, setting new industry benchmarks.

Looking forward, the environmental gap between these technologies may widen further as LFP recycling infrastructure matures. Closed-loop systems for phosphate recovery are developing rapidly, potentially transforming LFP batteries into a more circular technology solution with significantly reduced virgin material requirements over multiple life cycles.

Supply Chain and Raw Material Considerations

The supply chain dynamics and raw material availability significantly impact the commercial viability and sustainability of both LFP and LCO battery technologies. LFP batteries utilize iron and phosphate as primary components, both of which are abundant and widely distributed globally. Iron is the fourth most common element in Earth's crust, while phosphate reserves are substantial across multiple regions including Morocco, China, and the United States. This abundance translates to more stable pricing and reduced geopolitical supply risks compared to cobalt-dependent technologies.

In contrast, LCO batteries rely heavily on cobalt, a material with significant supply chain vulnerabilities. Approximately 70% of global cobalt production occurs in the Democratic Republic of Congo, a region frequently associated with political instability, ethical mining concerns, and human rights issues. This geographic concentration creates substantial supply security risks and price volatility. Historical data shows cobalt prices have fluctuated dramatically, with spikes exceeding 300% during supply disruptions.

The extraction and processing infrastructure for LFP materials is generally more established and less environmentally damaging. Iron mining has centuries of industrial development behind it, with mature extraction and processing technologies. Phosphate mining, while having environmental considerations, typically generates fewer toxic byproducts than cobalt extraction. The manufacturing supply chain for LFP is increasingly diversified across multiple countries, reducing single-point failure risks.

LCO supply chains face additional challenges regarding ethical sourcing certification and compliance with emerging regulations like the EU Battery Directive and the US Inflation Reduction Act, which increasingly demand transparency in material origins. The premium pricing of cobalt also necessitates more sophisticated inventory management and hedging strategies for manufacturers, adding operational complexity.

From a recycling perspective, LFP batteries present greater challenges due to the lower intrinsic value of recovered materials, whereas cobalt recovery from LCO batteries offers stronger economic incentives for end-of-life processing. However, the environmental footprint of the complete supply chain typically favors LFP, with studies indicating 30-40% lower carbon emissions across the full material lifecycle compared to cobalt-based chemistries.

Recent market trends show accelerating investment in alternative cobalt-free cathode technologies, suggesting industry recognition of these supply chain vulnerabilities. Major automotive manufacturers have increasingly pivoted toward LFP technology for mass-market applications, particularly for vehicles where extreme energy density is less critical than supply chain resilience and cost stability.

In contrast, LCO batteries rely heavily on cobalt, a material with significant supply chain vulnerabilities. Approximately 70% of global cobalt production occurs in the Democratic Republic of Congo, a region frequently associated with political instability, ethical mining concerns, and human rights issues. This geographic concentration creates substantial supply security risks and price volatility. Historical data shows cobalt prices have fluctuated dramatically, with spikes exceeding 300% during supply disruptions.

The extraction and processing infrastructure for LFP materials is generally more established and less environmentally damaging. Iron mining has centuries of industrial development behind it, with mature extraction and processing technologies. Phosphate mining, while having environmental considerations, typically generates fewer toxic byproducts than cobalt extraction. The manufacturing supply chain for LFP is increasingly diversified across multiple countries, reducing single-point failure risks.

LCO supply chains face additional challenges regarding ethical sourcing certification and compliance with emerging regulations like the EU Battery Directive and the US Inflation Reduction Act, which increasingly demand transparency in material origins. The premium pricing of cobalt also necessitates more sophisticated inventory management and hedging strategies for manufacturers, adding operational complexity.

From a recycling perspective, LFP batteries present greater challenges due to the lower intrinsic value of recovered materials, whereas cobalt recovery from LCO batteries offers stronger economic incentives for end-of-life processing. However, the environmental footprint of the complete supply chain typically favors LFP, with studies indicating 30-40% lower carbon emissions across the full material lifecycle compared to cobalt-based chemistries.

Recent market trends show accelerating investment in alternative cobalt-free cathode technologies, suggesting industry recognition of these supply chain vulnerabilities. Major automotive manufacturers have increasingly pivoted toward LFP technology for mass-market applications, particularly for vehicles where extreme energy density is less critical than supply chain resilience and cost stability.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!